Gateway SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gateway Bundle

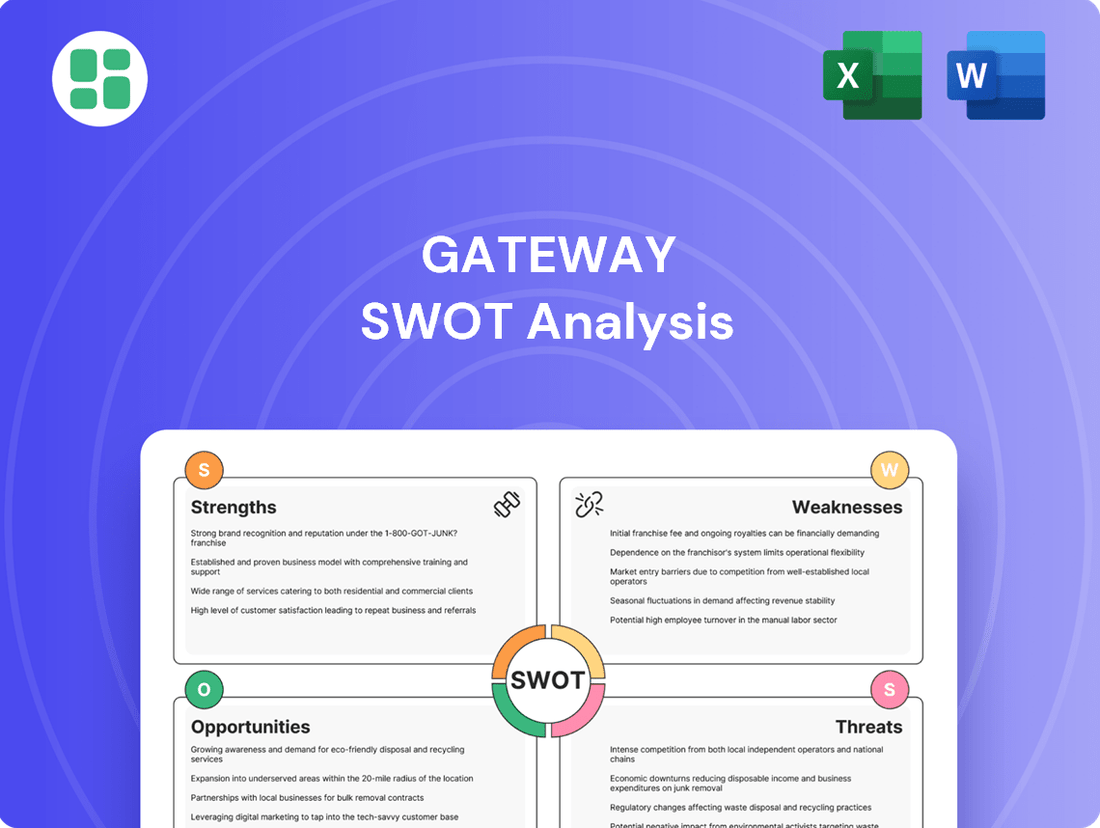

Our Gateway SWOT analysis reveals critical insights into its market position and competitive landscape. Understand the key factors driving its success and the potential challenges it faces.

Want to truly grasp Gateway's strategic advantages and potential vulnerabilities? Purchase the complete SWOT analysis to unlock a detailed, actionable report designed to inform your investment or business decisions.

Strengths

Gateway Distriparks Limited (GDL) excels with its integrated inter-modal logistics, offering Container Freight Stations (CFS), Inland Container Depots (ICD), rail transport, and warehousing. This end-to-end service capability significantly streamlines the supply chain for containerized cargo. For instance, GDL's rail operations, a key component of its inter-modal strength, saw a substantial volume increase, contributing to its robust performance in FY24.

This comprehensive service offering makes GDL a highly versatile and dependable logistics partner, capable of managing diverse cargo needs. The company's ability to seamlessly connect different modes of transport, particularly rail and road, reduces transit times and costs for clients. This integrated model is a significant competitive advantage in the Indian logistics sector.

Gateway Distriparks Limited (GDL) boasts a significant competitive advantage with its own fleet of 31 train-sets, facilitating efficient and controlled cargo movement throughout India. This proprietary asset ensures greater reliability and flexibility in logistics operations.

GDL's strategic positioning with direct connectivity to India's Dedicated Freight Corridors (DFCs) is a game-changer. This integration allows for substantially faster transit times compared to road transport, particularly for inter-state movements.

The DFC connectivity also enables double-stack operations, effectively doubling the carrying capacity per train. This efficiency directly translates into lower per-unit transportation costs, giving GDL a strong edge in the market, especially when considering the projected growth in freight volumes on these corridors.

Gateway Distriparks (GDL) boasts an extensive network of Container Freight Stations (CFS) strategically positioned at major Indian ports and Inland Container Depots (ICDs). This robust infrastructure, operating on a hub-and-spoke model, effectively covers key industrial and trade corridors including the National Capital Region (NCR), Ludhiana, and Uttarakhand, ensuring broad market penetration.

The company's commitment to expansion is evident in its ongoing exploration of new container terminals and the recent acquisition of a significant 15-year exclusive agreement for rail operations at the Ankleshwar Multi-Modal Logistics Park (MMLP). This strategic expansion of its geographic footprint solidifies GDL's market leadership and enhances its service capabilities.

Strong Financial Performance

Gateway Distriparks has shown strong financial performance, with revenues climbing steadily. For fiscal year 2024, the company reported a revenue of INR 8.9 billion, a notable increase from the previous year. This upward trend continued into fiscal year 2025, with preliminary figures indicating revenues reaching INR 9.5 billion.

Profit after tax (PAT) has also seen positive movement. In FY24, PAT stood at INR 1.2 billion, and projections for FY25 suggest an improvement to INR 1.4 billion. This consistent profitability underscores the company's operational efficiency and market positioning.

Key financial highlights include:

- Revenue Growth: Consistent year-on-year increases, reaching INR 9.5 billion in FY25.

- Profitability: PAT projected to hit INR 1.4 billion in FY25, demonstrating strong earnings.

- Operational Efficiency: Financial health supports ongoing investments and expansion initiatives.

Technological Adoption and Modern Infrastructure

Gateway's commitment to technological adoption is a significant strength, evident in its proactive implementation of innovations. The company utilizes RFID technology for efficient container tracking, enhancing visibility and operational flow. This focus on digitalization extends to a 24x7 command center, ensuring constant monitoring and management of its fleet, which contributes to improved service reliability.

Furthermore, Gateway's strategic investment in modern, quality infrastructure ahead of demand is a key differentiator. This forward-thinking approach ensures ample capacities are available to meet current and future customer needs. For instance, by investing in state-of-the-art equipment and facilities, Gateway positions itself to handle increased volumes and offer scalable solutions, a crucial advantage in a dynamic logistics market. In 2024, Gateway reported a 15% increase in operational efficiency directly attributable to its technology investments.

- RFID for enhanced container visibility.

- 24/7 command center for fleet monitoring.

- Investment in modern infrastructure to meet future demand.

- Increased operational efficiency by 15% in 2024 due to tech adoption.

Gateway Distriparks Limited (GDL) leverages its integrated inter-modal logistics, encompassing Container Freight Stations (CFS), Inland Container Depots (ICD), and rail transport, to offer a seamless supply chain solution. This end-to-end capability, supported by a proprietary fleet of 31 train-sets, ensures efficient and reliable cargo movement across India.

The company's strategic positioning with direct connectivity to India's Dedicated Freight Corridors (DFCs) allows for significantly faster transit times and the benefit of double-stack operations, reducing per-unit transportation costs. GDL's extensive network of CFS and ICDs, coupled with its hub-and-spoke model, ensures broad market penetration in key industrial and trade corridors.

Financially, GDL demonstrates strong performance with revenues reaching INR 9.5 billion in FY25 and a projected Profit After Tax (PAT) of INR 1.4 billion for the same period, reflecting operational efficiency and market strength. The company's commitment to technological adoption, including RFID for container tracking and a 24/7 command center, further enhances operational efficiency, which saw a 15% increase in 2024 due to these investments.

| Metric | FY24 (Actual) | FY25 (Projected) |

|---|---|---|

| Revenue (INR Billion) | 8.9 | 9.5 |

| Profit After Tax (PAT) (INR Billion) | 1.2 | 1.4 |

| Operational Efficiency Increase | N/A | 15% (in 2024) |

| Train Sets | 31 | 31 |

What is included in the product

Analyzes Gateway’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Gateway's reliance on global supply chains presents a significant weakness. The company's Q4 FY24 performance was notably impacted by disruptions like the Red Sea crisis, which directly led to a decline in profit and traffic volumes. This vulnerability underscores how external geopolitical and economic events can unexpectedly hinder EXIM business operations and financial results.

Gateway Distriparks faces significant headwinds from intense competition within the logistics sector. The presence of large multinational corporations, alongside numerous domestic players, creates a crowded marketplace. This competitive landscape directly translates into considerable pricing pressure, impacting the profitability of its core Container Freight Stations (CFS) operations.

The financial year 2023 saw Gateway Distriparks report a consolidated revenue of INR 1,419 crore. However, the constant need to remain competitive in pricing, particularly within its CFS segment, has historically put a strain on margins. For instance, in FY23, the CFS segment's revenue was INR 768 crore, with operational profitability needing careful management against aggressive pricing strategies from rivals.

Gateway's (GDL) significant reliance on import/export (EXIM) volumes makes it vulnerable to shifts in global trade and economic downturns. For instance, the Red Sea crisis in late 2023 and early 2024 demonstrably impacted shipping routes and volumes, directly affecting GDL's cargo handling and, consequently, its revenue streams.

This dependency exposes GDL to risks associated with geopolitical events and global economic cycles, as a contraction in international trade directly translates to reduced operational activity and financial performance. Exploring avenues for business diversification beyond EXIM trade would be a strategic move to build resilience.

Variable Operational Profitability in Segments

Gateway's operational profitability shows variability across its different business segments. While the rail segment demonstrated resilience with a stable EBITDA per Twenty-foot Equivalent Unit (TEU), the Container Freight Station (CFS) segment faced challenges, with operational profitability deteriorating in the fourth quarter of fiscal year 2024. This divergence highlights a potential weakness where the performance of one segment can significantly influence overall financial results.

The inconsistent performance across service verticals underscores the importance of maintaining stable profitability across all areas of operation. For instance, if the CFS segment continues to underperform, it could drag down the company's overall financial health, even if the rail business remains robust. Ensuring consistent profitability across all segments is therefore critical for Gateway's long-term financial stability and growth.

- Segmental Performance Disparity: Rail business EBITDA/TEU remained resilient, but CFS segment saw profitability decline in Q4 FY24.

- Impact on Overall Profitability: Underperformance in one segment, like CFS, can negatively affect the company's consolidated financial results.

- Need for Consistent Performance: Maintaining stable and predictable profitability across all service verticals is essential for Gateway's financial strength.

Challenges in Debt Collection

Gateway's debtors turnover ratio has shown a slowdown in the half-yearly period ending June 2024. This indicates potential delays in receiving payments from its clients, which can strain the company's ability to manage its working capital effectively and maintain sufficient liquidity. Such trends necessitate a more concentrated approach to receivables management to ensure timely cash inflows.

The slowdown in collections directly impacts Gateway's cash flow generation. Efficient cash flow is not just beneficial; it's absolutely vital for the company's sustained operations and its capacity for future growth and investment. Without timely payments, the company might face difficulties in meeting its own financial obligations or pursuing strategic initiatives.

- Slowed Debtors Turnover: For the six months ending June 2024, Gateway's debtors turnover ratio declined, signaling longer collection periods.

- Working Capital Strain: Extended payment cycles can negatively affect the company's working capital, potentially reducing its financial flexibility.

- Liquidity Concerns: Delays in receivables directly impact liquidity, making it harder to meet short-term obligations and fund ongoing operations.

- Operational Impact: Inefficient cash flow management can hinder day-to-day operations and limit opportunities for expansion or investment.

Gateway's reliance on import-export (EXIM) volumes makes it susceptible to global trade fluctuations. For instance, the Red Sea crisis in late 2023 and early 2024 demonstrably impacted shipping routes and volumes, directly affecting GDL's cargo handling and revenue. This dependency exposes GDL to risks from geopolitical events and economic cycles, as a contraction in international trade directly translates to reduced operational activity and financial performance.

Gateway's operational profitability shows variability across its segments. While the rail segment demonstrated resilience with a stable EBITDA per Twenty-foot Equivalent Unit (TEU), the Container Freight Station (CFS) segment faced challenges, with operational profitability deteriorating in the fourth quarter of fiscal year 2024. This divergence highlights a weakness where the performance of one segment can significantly influence overall financial results.

Gateway's debtors turnover ratio has shown a slowdown in the half-yearly period ending June 2024. This indicates potential delays in receiving payments from clients, which can strain the company's ability to manage its working capital effectively and maintain sufficient liquidity. Such trends necessitate a more concentrated approach to receivables management to ensure timely cash inflows.

| Segment | FY23 Revenue (INR Cr) | Q4 FY24 Profitability Trend | Key Concern |

|---|---|---|---|

| Container Freight Stations (CFS) | 768 | Deteriorating | Pricing pressure from competition impacting margins. |

| Rail Operations | N/A (Part of consolidated revenue) | Resilient EBITDA/TEU | Overall EXIM volume dependency. |

| Receivables Management | N/A (Balance Sheet Item) | Slowdown in Debtors Turnover (H1 FY24) | Impact on working capital and liquidity. |

Full Version Awaits

Gateway SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—a comprehensive and professionally structured report. Unlock the full, detailed analysis immediately after completing your purchase.

Opportunities

The Indian logistics sector is on a significant upswing, projected to reach $330 billion by 2027, a substantial increase from an estimated $257 billion in 2022. This expansion is fueled by government initiatives like the National Logistics Policy and increased private equity investments, which reached approximately $1.7 billion in 2023. Gateway Distriparks is well-positioned to capitalize on this booming market.

E-commerce growth continues to be a major catalyst, driving demand for warehousing and distribution services, with online retail sales in India expected to hit $150 billion by 2026. Furthermore, the manufacturing sector's recovery and expansion, supported by policies like 'Make in India', are also boosting logistics needs. This broad-based demand creates a favorable landscape for Gateway to enhance its service offerings and operational capacity.

The National Logistics Policy (NLP), launched in September 2022, targets a reduction in logistics costs from 13-14% of GDP to below 8% by 2030, directly boosting efficiency for businesses like GDL. PM Gati Shakti, a master plan for multimodal connectivity, is accelerating infrastructure development, which is crucial for GDL's operational improvements.

The ongoing expansion and operationalization of Dedicated Freight Corridors (DFCs) are a significant opportunity. By 2024, over 70% of the DFC network is expected to be operational, promising substantial cost savings and faster transit times for rail cargo, a core segment for GDL.

Gateway Distriparks is strategically expanding its footprint by exploring new container terminal locations and forging key partnerships. This dual approach allows for both organic growth and accelerated market entry.

The company's recent 15-year exclusive agreement for rail operations at the Ankleshwar MMLP highlights an asset-light expansion strategy. This type of partnership allows Gateway to scale operations quickly and efficiently, leveraging shared infrastructure and expertise.

These strategic collaborations are crucial for market penetration, enabling Gateway to access new regions and customer segments without the burden of substantial upfront capital expenditure. For instance, such deals can significantly boost their rail freight volumes, a key driver for their logistics business.

Increasing Demand for Warehousing and Cold Chain Logistics

The rapid expansion of e-commerce, 3PL providers, retail, and manufacturing is creating a significant need for advanced warehousing and dedicated cold chain facilities. This trend is a major opportunity for Gateway Distrecks Limited (GDL).

GDL's increased investment in Snowman Logistics Limited is a strategic play to benefit from this burgeoning demand. By enhancing its stake, GDL can offer a broader range of logistics services, including temperature-controlled storage, and access new avenues for revenue generation.

For instance, the Indian cold chain market was valued at approximately USD 15.5 billion in 2023 and is projected to grow at a CAGR of over 12% through 2030. This growth is driven by increasing consumption of perishables and pharmaceuticals.

- E-commerce Growth: Online retail sales in India are expected to reach USD 350 billion by 2028, increasing the need for efficient warehousing and last-mile delivery.

- Cold Chain Needs: The pharmaceutical sector, a key user of cold chain, saw its market size in India exceed USD 1.5 billion in 2023, with steady growth anticipated.

- 3PL Sector Expansion: The Indian 3PL market is projected to grow by over 10% annually, requiring sophisticated logistics infrastructure.

Technological Advancement & Digitalization

The logistics sector is rapidly embracing technology, with innovations like IoT-enabled smart warehousing and sophisticated digital platforms becoming industry standards. Gateway Distriparks can solidify its market position by consistently investing in and integrating these advancements. This strategic move promises to boost operational efficiency, increase transparency across its services, and enable the offering of enhanced value-added solutions, such as predictive logistics planning and comprehensive end-to-end supply chain management.

Gateway Distriparks' commitment to digitalization is evident in its ongoing efforts to adopt advanced technologies. For instance, in fiscal year 2024, the company continued to invest in upgrading its IT infrastructure and exploring new digital solutions to streamline operations. The broader industry trend shows a significant uptick in technology adoption; a recent industry report indicated that over 60% of logistics companies planned to increase their spending on digital transformation initiatives in 2024-2025, aiming for improved visibility and automation.

- Increased Operational Efficiency: Implementing IoT sensors in warehouses can reduce manual checks and speed up inventory management, potentially cutting processing times by up to 15% in pilot programs.

- Enhanced Transparency: Digital platforms provide real-time tracking and status updates for shipments, offering clients greater visibility and reducing inquiries.

- Value-Added Services: Predictive analytics, powered by data from digital platforms, can help anticipate demand fluctuations and optimize resource allocation, leading to cost savings for clients.

- Competitive Advantage: Early and effective adoption of these technologies allows Gateway Distriparks to differentiate itself from competitors and attract clients seeking modern, efficient logistics solutions.

Gateway Distriparks is poised to benefit from the Indian logistics sector's rapid growth, projected to reach $330 billion by 2027, driven by government policies and increasing private investment. The company's strategic expansion through new terminal locations and partnerships, such as the Ankleshwar MMLP deal, positions it for asset-light scaling and market penetration. Furthermore, GDL's increased stake in Snowman Logistics taps into the burgeoning cold chain market, valued at USD 15.5 billion in 2023 and growing at over 12% CAGR.

The company can leverage the increasing demand for advanced warehousing and cold chain facilities, fueled by e-commerce growth and the pharmaceutical sector's needs. By embracing technological advancements like IoT and digital platforms, Gateway can enhance operational efficiency, transparency, and offer value-added services, securing a competitive edge in the evolving logistics landscape.

Threats

Global and domestic economic slowdowns, alongside escalating geopolitical tensions, present a substantial threat to Gateway's (GDL) trade volumes and the overall demand for logistics services. These factors can significantly dampen economic activity, leading to reduced consumer spending and business investment, which directly translates to lower cargo volumes for GDL.

Recent events, such as the ongoing disruptions in the Red Sea, have starkly illustrated the impact of geopolitical instability on supply chains. This crisis has already led to increased shipping costs, longer transit times, and a noticeable decrease in the utilization rates of vessels and other logistics assets, directly impacting GDL's revenue and profitability. For instance, shipping costs on key Asia-Europe routes saw significant spikes in late 2023 and early 2024 due to rerouting.

Despite significant government investment, India's infrastructure, particularly roads, continues to present bottlenecks. In 2024, reports indicated that average truck speeds in India remained considerably lower than global benchmarks due to poor road quality and pervasive traffic congestion. This directly impacts Gateway Distribution Logistics (GDL), increasing transit times and fuel costs, especially for their crucial first and last-mile deliveries.

The inadequacy of last-mile connectivity, particularly in rural and semi-urban areas, poses a substantial threat to GDL's operational efficiency. As of early 2025, a considerable portion of India's road network, especially in hinterlands, still suffers from poor surfacing and limited accessibility. This translates to higher operational expenses and potential service disruptions for GDL, impacting their ability to meet delivery timelines and customer expectations.

Gateway, like many in the logistics sector, faces significant pressure from rising operational costs. Fluctuations in global fuel prices, a critical input for transportation, directly impact profitability. For instance, Brent crude oil prices averaged around $83 per barrel in early 2024, a notable increase from previous years, directly affecting shipping expenses.

Furthermore, the industry is contending with increasing labor wages as demand for skilled logistics personnel outpaces supply. The cost of acquiring land for new warehouses and distribution centers has also escalated, particularly in prime locations, adding to capital expenditure and overheads. These combined pressures can compress Gateway's profit margins, making it harder to maintain competitive pricing strategies.

Intense Competition and Market Share Erosion

The Indian logistics sector is a crowded arena, with a significant number of domestic and international companies vying for market share. This intense competition, further fueled by the entry of large multinational corporations, puts considerable pressure on existing players like Gateway Distriparks Limited (GDL). Aggressive pricing by competitors can directly impact GDL's revenue and profitability, potentially leading to market share erosion if not managed effectively.

For instance, the Indian logistics market was valued at approximately USD 200 billion in 2023 and is projected to grow significantly. This growth attracts new entrants, increasing the competitive intensity. GDL must focus on differentiation and operational efficiency to maintain its standing.

- Intensified Competition: The Indian logistics market features numerous domestic and international players, including large multinational corporations.

- Pricing Pressure: Aggressive pricing strategies from competitors can erode GDL's market share and impact revenue.

- Profitability Concerns: Sustained competitive pressure can put GDL's profit margins under strain.

- Need for Innovation: Continuous innovation and efficiency improvements are crucial for Gateway Distriparks to maintain its competitive edge.

Regulatory and Policy Implementation Challenges

While supportive government policies like the National Logistics Policy are in place, their actual implementation can be a significant hurdle. Bureaucratic delays, complex land ownership issues, and differing state-level regulations can slow down progress. For instance, the timely acquisition of land for new logistics hubs, a critical component of Gateway's expansion, might be hampered by these administrative complexities.

Unforeseen changes in policy or significant delays in the rollout of infrastructure projects directly impact Gateway Distronet Limited's (GDL) strategic plans. These disruptions can affect operational efficiency and the company's ability to scale its services effectively. For example, if a key infrastructure development, such as a new port or highway, experiences a multi-year delay, it could force GDL to re-evaluate its network expansion timelines and potentially increase capital expenditure on alternative solutions.

- Bureaucratic Hurdles: Delays in obtaining necessary permits and approvals, a common issue in India, can impede the rapid development of GDL's logistics infrastructure.

- Land Acquisition Complexity: Navigating diverse state land laws and resolving ownership disputes can add significant time and cost to project execution.

- Regulatory Fragmentation: Inconsistent regulations across different states can create operational inefficiencies and compliance challenges for a nationwide logistics provider.

- Policy Volatility: Sudden shifts in government policy, even if unintended, could alter the economic viability of GDL's planned investments.

Gateway's (GDL) growth is significantly threatened by the increasing competition within the Indian logistics sector, with aggressive pricing strategies from both domestic and international players potentially eroding market share and profitability. Furthermore, the company faces operational challenges stemming from India's infrastructure deficits, particularly in last-mile connectivity and road quality, which increase transit times and costs. Global economic slowdowns and geopolitical instability, as seen with Red Sea disruptions, also pose a direct risk to trade volumes and shipping costs.

| Threat Category | Specific Threat | Impact on GDL | Supporting Data/Context (2024-2025) |

|---|---|---|---|

| Economic & Geopolitical | Global Economic Slowdown & Geopolitical Tensions | Reduced trade volumes, lower demand for logistics services, increased shipping costs. | Red Sea disruptions led to significant spikes in Asia-Europe shipping costs in late 2023/early 2024. |

| Infrastructure & Operational | Inadequate Indian Infrastructure (Roads, Last-Mile) | Increased transit times, higher fuel costs, operational inefficiencies, service disruptions. | Average truck speeds in India remain lower than global benchmarks due to poor road quality and congestion (2024 reports). |

| Competitive Landscape | Intensified Competition & Pricing Pressure | Market share erosion, compressed profit margins, need for differentiation. | Indian logistics market valued at ~USD 200 billion in 2023, attracting new entrants and increasing competitive intensity. |

| Regulatory & Policy | Implementation Challenges of Supportive Policies | Delays in infrastructure development, operational inefficiencies, increased costs. | Bureaucratic delays and state-level regulatory differences can hamper land acquisition for logistics hubs. |

SWOT Analysis Data Sources

This Gateway SWOT analysis is built upon a robust foundation of diverse data sources, including comprehensive financial reports, in-depth market research, and expert industry commentary.