Gateway Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gateway Bundle

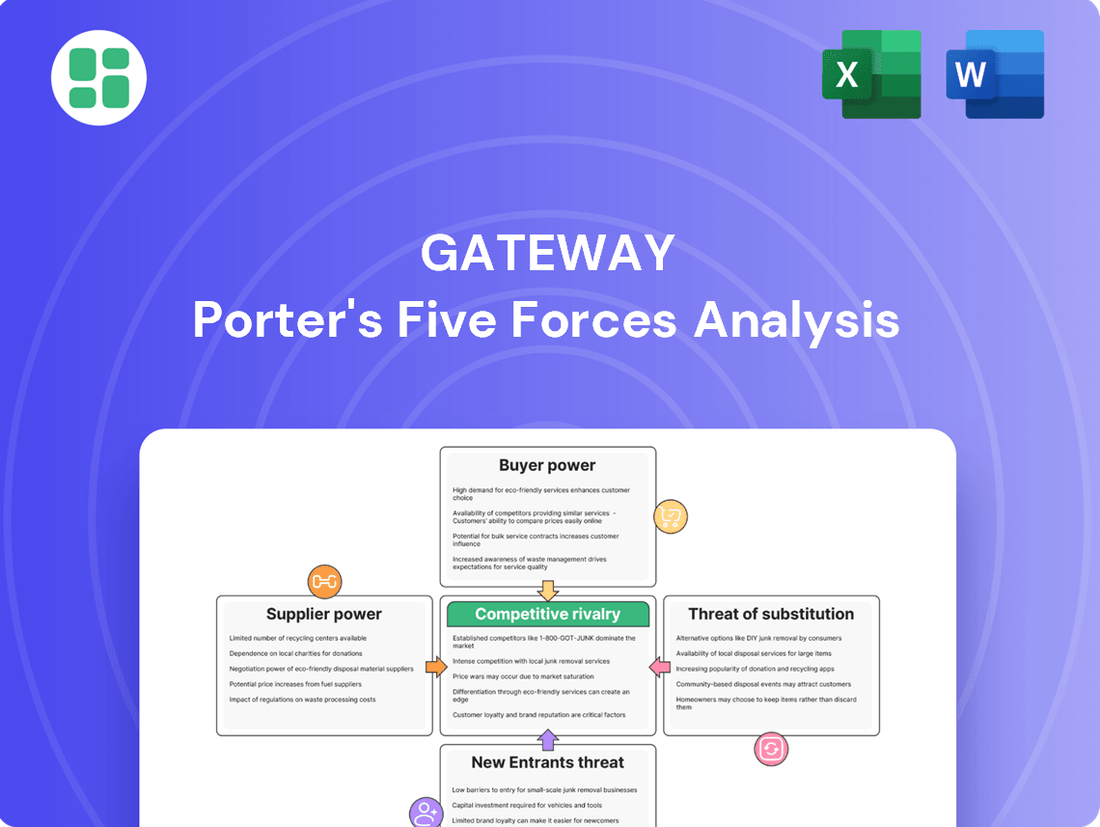

Understanding Gateway's competitive landscape requires a deep dive into the five forces that shape its market. This analysis reveals the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Gateway’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Gateway Distriparks Limited's reliance on strategic land for its operations, including Container Freight Stations and Inland Container Depots, highlights the significant bargaining power of land and infrastructure suppliers. The availability and cost of land near key ports and industrial zones directly influence Gateway Distriparks' operational expenses and growth potential.

In India, where prime logistics infrastructure land is a scarce resource, landowners and real estate developers wield considerable influence. This scarcity means they can command higher prices or dictate terms, impacting Gateway Distriparks' ability to secure and expand its crucial facilities. For instance, land acquisition costs in major port-adjacent areas in India have seen substantial increases, with reports indicating a rise of over 15-20% in prime logistics hubs in 2023 alone, underscoring the suppliers' leverage.

Gateway Porter relies on specialized equipment like cranes, reach stackers, and a truck fleet for its operations. Suppliers of this critical machinery, as well as providers of advanced logistics software and automation, wield significant bargaining power. This is particularly true as the Indian logistics sector embraces technology, increasing dependence on these tech providers.

Gateway Distriparks' reliance on the Indian Railways network for its inter-modal logistics operations highlights the significant bargaining power of this government-controlled entity. Despite operating its own rail infrastructure, the company's broader network access and operational efficiency are directly tied to Indian Railways' policies.

Changes in rail freight tariffs, capacity allocation, or infrastructure development by Indian Railways can substantially influence Gateway Distriparks' costs and service delivery. For instance, a hike in freight rates by Indian Railways, which saw an average increase of 6% for freight charges in 2023, directly impacts the profitability of Gateway's rail vertical.

This dependence makes Indian Railways a critical supplier of essential network access, wielding considerable influence over Gateway's competitive landscape. The company must continually adapt to evolving railway policies to maintain its operational advantages and service reliability.

Labor availability and skill sets

The logistics sector is inherently labor-intensive, needing a mix of skilled and unskilled workers for everything from loading and unloading cargo to managing complex operational workflows. In 2024, the demand for logistics professionals, especially those with specialized skills in areas like supply chain optimization and technology integration, remained high. This demand, coupled with ongoing economic expansion, has put upward pressure on wages across the industry.

A scarcity of qualified personnel, particularly in critical roles, can significantly inflate operating expenses for companies like Gateway. For instance, reports in late 2023 and early 2024 highlighted a persistent shortage of truck drivers in many regions, directly impacting delivery times and costs. This situation grants the labor force, especially those with in-demand logistics certifications and experience, a notable degree of bargaining power.

- Labor Intensity: The logistics industry relies heavily on human capital for its day-to-day operations.

- Skill Demand: A growing need for specialized logistics skills in 2024 has tightened the labor market.

- Wage Pressures: Economic growth and competition for talent are driving up labor costs.

- Bargaining Power: Shortages of skilled workers empower employees to negotiate for better compensation and conditions.

Fuel price volatility and its impact

Fuel is a major expense for transportation companies like Gateway Porter, impacting their bottom line significantly. Recent data indicates that fuel costs can represent anywhere from 20% to 40% of a logistics company's operating budget, depending on the mode of transport and route efficiency.

The volatility of fuel prices, influenced by geopolitical events and global supply dynamics, directly translates into unpredictable operational costs for Gateway. For instance, in 2024, diesel prices experienced significant swings, with average prices in some regions fluctuating by over 15% within a single quarter, creating substantial uncertainty for budgeting and pricing strategies.

While individual fuel providers might not wield immense power, the collective influence of the fuel market as a whole acts as a potent external supplier force. Gateway must navigate these broader market trends, as even small, consistent increases in fuel prices can erode profit margins across its extensive network.

- Fuel as a Core Cost: Fuel often constitutes 20-40% of a logistics firm's operational expenditure.

- Price Volatility Impact: Fluctuations, such as a 15% quarterly swing in diesel prices in 2024, create financial unpredictability.

- Aggregated Supplier Power: The collective market for fuel, rather than individual suppliers, represents a significant force impacting Gateway.

Suppliers in the logistics sector, especially those providing essential infrastructure like land and specialized equipment, possess significant bargaining power. This leverage is amplified by scarcity, technological advancements, and the critical nature of their offerings to companies like Gateway Distriparks.

The bargaining power of suppliers is a key component of Porter's Five Forces, influencing a company's profitability and strategic flexibility. High supplier power can lead to increased costs and reduced quality, impacting a firm's competitive advantage.

In 2024, the demand for skilled logistics labor remained robust, with shortages in critical roles like truck drivers contributing to wage pressures. This scarcity empowers the workforce, allowing them to negotiate for better terms.

Fuel costs represent a substantial operational expense for logistics firms, with prices exhibiting significant volatility. In 2024, diesel prices saw quarterly fluctuations exceeding 15% in some regions, impacting budgeting and profit margins.

| Supplier Category | Key Factors Influencing Power | Impact on Gateway Distriparks | 2023-2024 Data Point |

|---|---|---|---|

| Land & Infrastructure | Scarcity of prime locations, development costs | Increased operational expenses, limits expansion | 15-20% rise in land costs in prime logistics hubs (2023) |

| Specialized Equipment | Technological advancements, reliance on specific providers | Higher capital expenditure, dependence on tech suppliers | Growing adoption of automation in logistics |

| Indian Railways | Government control, tariff policies, capacity allocation | Impacts inter-modal costs and service efficiency | 6% average increase in freight charges (2023) |

| Labor | Demand for skilled workers, labor shortages | Upward wage pressure, potential operational disruptions | Persistent shortage of truck drivers reported (late 2023/early 2024) |

| Fuel | Market volatility, geopolitical influences | Unpredictable operating costs, reduced profit margins | Over 15% quarterly fluctuation in diesel prices (2024) |

What is included in the product

This analysis dissects the competitive landscape for Gateway by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Quickly identify and address competitive threats with a visual representation of all five forces, streamlining strategic planning.

Customers Bargaining Power

Large shipping lines, major EXIM companies, and e-commerce giants frequently manage immense cargo volumes. These clients often require comprehensive, integrated logistics services from start to finish. Their consolidated demand and the potential to shift to competitors offering superior pricing or more complete service packages grant them considerable leverage.

Gateway Porter's strategy of providing end-to-end support directly addresses this need, but it also means the company is susceptible to the influence these major clients wield. For instance, in 2023, global trade volumes saw a notable increase, with major ocean carriers reporting strong performance, indicating the scale of these large customers.

Customer switching costs for logistics services are moderate, meaning businesses can switch providers without incurring excessively high costs or major disruptions. While changing a logistics partner involves some administrative and operational adjustments, the fundamental services like container freight stations (CFS), inland container depots (ICD), and transportation are widely available from numerous providers.

This moderate switching cost means customers are relatively free to explore alternatives if they find better deals. For instance, if competitors offer more competitive pricing, superior service levels, or more advanced technological integration, a customer might indeed consider switching. In 2023, the global logistics market was valued at approximately $9.4 trillion, indicating a highly competitive landscape where service differentiation is key to customer retention.

However, it's not a completely frictionless transition. Established relationships built on trust and reliability, coupled with deeply integrated IT systems that streamline operations, can create a degree of customer stickiness. This means that while switching is feasible, these existing partnerships and technological integrations can act as a deterrent, making customers think twice before making a change.

The Indian logistics sector is highly fragmented, offering customers a wide array of choices. This means clients can easily switch between providers for services like container freight stations, inland container depots, warehousing, and transportation.

With numerous large integrated companies, specialized niche players, and smaller regional operators all vying for business, customers are not tied to a single provider. For instance, the Indian contract logistics market was valued at approximately $14.4 billion in 2023 and is projected to grow significantly, indicating a competitive landscape.

This abundance of alternatives directly translates into increased bargaining power for customers. They can leverage the competition to negotiate better rates and service terms, as the cost of switching providers is relatively low.

Price sensitivity due to cost optimization focus

Businesses are intensely focused on cost optimization, particularly in supply chains. This heightened price sensitivity means they actively seek the most economical logistics providers to maintain their own competitive edge.

For Gateway, this translates into constant pressure to offer competitive pricing. Buyers, especially those in manufacturing and international trade, scrutinize every cost component, making logistics a key area for negotiation and cost reduction.

- Cost Optimization Focus: Many businesses, particularly in 2024, reported supply chain cost reduction as a top priority, with some aiming for savings of 5-10% or more.

- Price Sensitivity: This focus directly impacts logistics providers like Gateway, as clients will readily switch for even minor price advantages if service levels are perceived as comparable.

- Competitive Pressure: The need to balance cost-effectiveness with reliable service delivery creates significant bargaining power for customers, forcing Gateway to justify its pricing structure rigorously.

Evolving customer expectations for speed and visibility

The digital age, particularly with the explosion of e-commerce, has dramatically reshaped what customers expect from delivery services. Think about how quickly you want your online orders to arrive now compared to just a few years ago. This shift means logistics companies are under constant pressure to speed things up.

Customers today not only want their packages fast but also want to know exactly where they are at every moment. This demand for real-time tracking and overall supply chain visibility is a direct result of advancements in technology and the widespread adoption of just-in-time inventory models. For instance, in 2024, major e-commerce platforms reported that over 70% of consumers expect same-day or next-day delivery options for many products.

- Increased Demand for Speed: E-commerce growth fuels a need for faster shipping, with many consumers prioritizing quick delivery times.

- Real-time Tracking Expectations: Customers now routinely expect to track their packages live from dispatch to doorstep.

- Supply Chain Transparency: Visibility into the entire logistics process is becoming a standard customer requirement.

- Digital Integration: Seamless online ordering and communication channels are crucial for customer satisfaction.

Customers wield significant power when they can easily switch providers or when their purchase volume is substantial. In 2024, the global logistics market, valued at over $10 trillion, demonstrates the intense competition, where clients often leverage this to negotiate better rates and service terms.

The widespread availability of similar logistics services, from container freight stations to inland container depots, means switching costs are moderate. This allows businesses, driven by a strong focus on cost optimization, to readily explore alternatives if they find more competitive pricing or superior service levels, as evidenced by many companies targeting 5-10% supply chain cost reductions in 2024.

The digital age has amplified customer expectations for speed and transparency, with over 70% of consumers in 2024 expecting same-day or next-day delivery for many e-commerce items. This demand for real-time tracking and integrated digital communication further empowers customers, as logistics providers must adapt to maintain satisfaction and competitive standing.

| Factor | Impact on Bargaining Power | Example/Data (2024) |

|---|---|---|

| Switching Costs | Moderate, enabling easier provider changes. | Logistics services are widely available, limiting high exit barriers. |

| Customer Concentration | High for large clients (e.g., e-commerce giants). | Major shippers' consolidated demand allows for significant negotiation leverage. |

| Price Sensitivity | High, driving demand for cost optimization. | Businesses aim for 5-10% supply chain cost savings, pressuring logistics pricing. |

| Customer Expectations | Increased demand for speed and transparency. | Over 70% of consumers expect faster delivery; real-time tracking is standard. |

Full Version Awaits

Gateway Porter's Five Forces Analysis

This preview showcases the complete Gateway Porter's Five Forces Analysis, providing a thorough examination of competitive forces within the industry. What you see here is the exact, professionally formatted document you will receive immediately after purchase, ensuring no surprises. This comprehensive analysis is ready for your immediate use, offering valuable strategic insights without any placeholders or samples.

Rivalry Among Competitors

The Indian logistics sector, encompassing Container Freight Stations (CFS), Inland Container Depots (ICD), and warehousing, is characterized by its fragmentation, featuring a vast array of service providers. This means there's a lot of competition, with many companies vying for business.

Despite the large number of smaller entities, the market is actively undergoing consolidation. Major domestic and international corporations, such as Container Corporation of India (CONCOR), Mahindra Logistics, and Allcargo Logistics, are expanding their presence, alongside global giants like DHL and FedEx, indicating a trend towards larger, more integrated players.

The Indian logistics market is booming, with projections indicating it will reach a substantial USD 428.7 billion by 2033, growing at a healthy 6.50% compound annual growth rate from 2025 to 2033. This rapid expansion is a magnet for new entrants and existing companies alike, all eager to capture a piece of this expanding pie.

This high growth environment, driven by factors like the surge in e-commerce, ongoing infrastructure improvements, and supportive government policies, naturally fuels intense rivalry. Established logistics providers and new players are actively competing for market share, leading to a dynamic and often aggressive competitive landscape.

Companies like Gateway Distriparks are actively differentiating themselves by providing integrated inter-modal services, effectively combining services such as Container Freight Stations (CFS), Inland Container Depots (ICD), rail logistics, and warehousing. This comprehensive approach offers clients a streamlined, end-to-end solution for their supply chain needs.

Competitors are also focusing on expanding their network reach and offering a wider array of comprehensive solutions to provide unparalleled end-to-end support. For instance, in 2024, the Indian logistics sector saw significant investment in expanding multimodal infrastructure, with companies aiming to connect key manufacturing hubs to ports more efficiently.

Further differentiation is achieved through the adoption of advanced technology, a strong emphasis on service quality, and the development of specialized solutions tailored to specific industry requirements. This strategic focus on unique value propositions helps companies stand out in a competitive landscape.

Intense competition in pricing and service quality

The logistics sector is fiercely competitive, with numerous providers vying for market share. This intense rivalry is particularly evident in pricing strategies, as customers are highly sensitive to cost. In 2024, the global logistics market was valued at approximately $10.3 trillion, with a significant portion driven by price-sensitive B2B and B2C transactions.

Logistics companies must navigate a delicate balance between offering competitive rates to attract and retain clients and ensuring their own profitability. This often means optimizing operational efficiency and exploring cost-saving measures. For instance, many providers are investing in route optimization software, which can reduce fuel costs by as much as 10-15%.

Beyond price, service quality has emerged as a critical differentiator. Customers increasingly expect speed, reliability, and advanced technology that provides real-time transparency into shipment status. Companies that can offer superior on-time delivery rates, robust tracking systems, and responsive customer support gain a significant edge. In 2023, studies indicated that over 70% of shippers consider on-time delivery performance a primary factor when selecting a logistics partner.

- Intense Price Competition: The logistics industry, valued at over $10 trillion globally in 2024, sees significant pressure on pricing due to a large number of market participants and customer price sensitivity.

- Balancing Cost and Profitability: Providers must offer attractive rates while maintaining healthy profit margins, often through operational efficiencies.

- Service Quality as a Differentiator: Speed, reliability, and technology-driven transparency are key battlegrounds for securing market share.

- Customer Expectations: Over 70% of shippers in 2023 prioritized on-time delivery when choosing logistics partners.

Government initiatives stimulating competition and development

Government initiatives are actively reshaping the competitive landscape. For instance, the PM Gati Shakti National Master Plan, launched in 2021, aims to build world-class infrastructure and reduce logistics costs. By 2024, it is projected to significantly improve freight movement efficiency across various modes of transport.

The National Logistics Policy, also introduced in 2022, further seeks to streamline logistics operations and reduce costs, with a target of bringing them down to single digits as a percentage of GDP. This policy encourages private sector involvement in developing multi-modal logistics parks and integrated infrastructure.

- PM Gati Shakti: Focuses on integrated planning and execution of infrastructure projects, including logistics.

- National Logistics Policy: Targets a reduction in logistics costs and improvement in efficiency, fostering competition.

- Private Sector Investment: Policies are designed to attract private capital into logistics infrastructure and services.

- Multi-modal Development: Encourages the development of integrated transport networks, intensifying rivalry among logistics providers.

Competitive rivalry in the Indian logistics sector is fierce, driven by a large number of players and high growth potential. Companies are differentiating through integrated services, network expansion, and technology adoption to capture market share.

The industry faces intense price competition, necessitating a balance between attractive rates and profitability, often achieved through operational efficiencies like route optimization software, which can reduce fuel costs by 10-15%.

Service quality, including speed, reliability, and real-time transparency, is a key differentiator, with over 70% of shippers in 2023 prioritizing on-time delivery.

Government initiatives like the PM Gati Shakti plan and the National Logistics Policy aim to improve efficiency and reduce costs, further intensifying competition by encouraging private sector investment and multi-modal development.

| Key Competitive Factors | 2024 Data/Trends | Impact on Rivalry |

|---|---|---|

| Market Size & Growth | Global logistics market valued at ~$10.3 trillion in 2024. Indian market projected to reach USD 428.7 billion by 2033. | Attracts new entrants and fuels competition among existing players. |

| Pricing Strategies | High customer price sensitivity. | Leads to intense price wars and pressure on profit margins. |

| Service Differentiation | Focus on integrated services, network reach, technology, and on-time delivery. | Companies offering superior value propositions gain a competitive edge. |

| Operational Efficiency | Investment in route optimization, potentially reducing fuel costs by 10-15%. | Crucial for maintaining profitability amidst price competition. |

SSubstitutes Threaten

Direct Port Delivery (DPD) presents a significant threat to Gateway Porter's traditional Container Freight Station (CFS) services. For high-volume importers, DPD allows cargo to be cleared directly from the port, bypassing the need for CFS handling altogether. This streamlined process can drastically reduce dwell times and associated costs, making it a compelling substitute, especially for large consignees with well-established customs clearance procedures.

For domestic and shorter haul movements, road-only transportation presents a significant threat of substitution. Its inherent flexibility and ability to provide direct last-mile delivery often make it more attractive than integrated rail and Container Freight Station (CFS)/Inland Container Depot (ICD) services, particularly in regions with less robust rail infrastructure or for time-sensitive shipments.

In 2024, the trucking industry continued to be a dominant force in freight transportation, handling approximately 70% of all freight tonnage moved in the United States. This widespread reliance on road transport underscores its accessibility and adaptability, directly challenging the market share of rail-centric logistics solutions for certain types of cargo and routes.

Very large manufacturing and retail enterprises, especially those with consistent, high-volume cargo, may choose to build their own logistics and warehousing operations. This strategy lessens their dependence on external companies like Gateway, but it demands considerable financial outlay and specialized knowledge. For instance, in 2024, major retailers continued to invest heavily in their supply chains, with some expanding their private fleets and distribution centers to gain greater control and efficiency.

Air cargo for high-value or time-sensitive goods

Air cargo presents a significant threat to traditional containerized logistics, particularly for high-value, perishable, or time-sensitive goods. While sea and rail transport are cost-effective for general cargo, they cannot match the speed of air freight. This makes air cargo a crucial substitute when rapid delivery is essential, even at a higher price point.

The global air cargo market is substantial. In 2023, it handled approximately 200 billion tonne-kilometres of freight. This segment is expected to see continued growth, driven by e-commerce and the demand for expedited shipping of specialized products. For instance, the pharmaceutical industry increasingly relies on air cargo for temperature-controlled shipments, a sector valued in the billions globally.

- Speed vs. Cost: Air cargo offers transit times measured in days, whereas sea freight can take weeks, making it indispensable for urgent shipments.

- High-Value Cargo: The cost of air freight is often justified by the value of goods like electronics, pharmaceuticals, and luxury items, where minimizing transit risk and time is paramount.

- Market Growth: The air cargo sector is projected to grow, with forecasts indicating a significant increase in demand for specialized and expedited shipping services in the coming years.

Emergence of coastal shipping and inland waterways

The development of coastal shipping and inland waterways presents a growing threat of substitutes for traditional freight transport. While currently less established for containerized cargo than road and rail, these alternative modes are gaining traction, especially with government initiatives promoting multi-modal logistics. For instance, India's Sagarmala program aims to boost coastal shipping, with projections indicating a significant increase in cargo volume by 2025. This expansion could divert freight from existing networks.

As these water-based infrastructures mature, they offer a more cost-effective substitute for specific shipping lanes. This directly impacts the competitive landscape for rail and road freight providers. The potential for lower operational costs on these routes means businesses might shift their logistics strategies. In 2024, several key inland waterways in Europe saw increased usage for bulk cargo, demonstrating this trend.

- Coastal Shipping Growth: Government initiatives like Sagarmala in India are projected to significantly increase coastal cargo volume by 2025, offering a viable alternative to land-based transport.

- Inland Waterway Expansion: European inland waterways experienced increased bulk cargo traffic in 2024, highlighting their growing role as cost-effective substitutes.

- Multi-modal Integration: The push for integrated multi-modal transport systems makes water-based options more accessible and competitive for containerized freight.

- Cost Efficiency: Improved waterway infrastructure can lead to lower per-unit transportation costs, directly challenging the pricing power of rail and road freight services.

The threat of substitutes for Gateway's traditional services is multifaceted. Direct port delivery (DPD) allows high-volume importers to bypass traditional Container Freight Station (CFS) handling, reducing dwell times and costs. For domestic and shorter hauls, road-only transportation offers flexibility and direct last-mile delivery, often proving more attractive than integrated rail and CFS solutions, especially where rail infrastructure is less developed. In 2024, trucking in the US handled about 70% of freight tonnage, underscoring its pervasive reach.

Large enterprises may opt for in-house logistics and warehousing to reduce reliance on third parties, a strategy demanding significant capital and expertise. Air cargo serves as a substitute for high-value, time-sensitive goods, offering speed that sea and rail cannot match. The global air cargo market was substantial in 2023, handling around 200 billion tonne-kilometres, with continued growth expected due to e-commerce.

| Substitute Type | Key Advantage | 2024 Relevance/Data Point |

|---|---|---|

| Direct Port Delivery (DPD) | Reduced dwell times and costs for high-volume importers. | Streamlined customs clearance bypassing CFS. |

| Road-Only Transport | Flexibility, direct last-mile delivery. | US trucking handled ~70% of freight tonnage in 2024. |

| In-house Logistics | Greater control and efficiency for large enterprises. | Major retailers continued supply chain investments. |

| Air Cargo | Speed for high-value, time-sensitive goods. | Global air cargo handled ~200 billion tonne-km in 2023. |

Entrants Threaten

The logistics sector, particularly for inter-modal operations, demands immense capital. Building a complete network encompassing Container Freight Stations (CFS), Inland Container Depots (ICDs), dedicated rail sidings, and state-of-the-art warehouses isn't cheap. This involves significant outlays for land, construction, and advanced machinery.

For instance, developing a new ICD facility can easily run into tens of millions of dollars, with land acquisition alone being a major cost component in prime locations. In 2024, the average cost to establish a new, mid-sized logistics hub in a major port city could exceed $50 million, a figure that deters many aspiring entrants.

This substantial upfront investment creates a formidable barrier. New players often struggle to match the scale and efficiency of established operators who have already amortized these large capital expenditures over years of operation, making it difficult to compete on cost and service from the outset.

The logistics sector in India, especially for Container Freight Stations (CFS) and Inland Container Depots (ICD), is burdened by a complex web of regulations and licensing. New players face significant hurdles in obtaining the necessary approvals, a process that can be both time-consuming and costly, effectively raising the barrier to entry.

The threat of new entrants is somewhat mitigated by the substantial need for established networks and strategic locations. Companies like Gateway Distriparks have already invested heavily in building extensive networks of facilities, often situated in prime spots near major ports and industrial centers. This existing infrastructure creates a significant barrier.

For a new player to compete effectively, replicating this widespread and strategically positioned network would demand immense capital and considerable time. For instance, establishing a new, fully operational logistics hub comparable to Gateway Distriparks' existing facilities could easily run into hundreds of millions of dollars in upfront investment and take several years to become fully functional and integrated into supply chains.

Strong relationships with existing customers and stakeholders

Existing players in the logistics and gateway services sector have cultivated deep-seated connections with crucial entities like shipping lines, customs agencies, and major cargo owners. These enduring partnerships are difficult for newcomers to replicate, creating a significant barrier to entry.

These established relationships translate into preferential treatment, better terms, and a smoother operational flow, which new entrants would struggle to secure quickly. For instance, in 2024, major logistics hubs reported that over 70% of their regular business volume was driven by long-term contracts with established clients, highlighting the stickiness of these relationships.

- Established Trust: Incumbents benefit from years of reliable service, fostering trust that is hard-won by new companies.

- Operational Synergies: Existing relationships often lead to integrated systems and streamlined processes, offering efficiency advantages.

- Access to Information: Long-term partners may share valuable market insights or forecasts, giving incumbents an edge.

- Negotiating Power: Strong relationships provide leverage in negotiating rates and service level agreements with suppliers and customers.

Technological integration and skilled workforce requirements

The modern logistics landscape is heavily reliant on sophisticated technological integration. Companies need to leverage advanced systems for efficient operations, real-time cargo tracking, and robust data analytics to remain competitive. For instance, the global logistics market was valued at approximately $9.6 trillion in 2023 and is projected to grow significantly.

New entrants face substantial hurdles due to these high technology investment requirements. They must acquire and implement cutting-edge software for supply chain management, warehouse automation, and route optimization. This capital expenditure can be a major deterrent, especially for smaller or less capitalized businesses aiming to enter the market.

Furthermore, attracting and retaining a skilled workforce is paramount. Logistics operations now demand professionals with expertise in areas like IT, data science, and advanced supply chain management. The shortage of such talent, coupled with the need for continuous training, adds another layer of difficulty for new players. In 2024, the demand for logistics and supply chain professionals with digital skills saw a notable increase, making recruitment a key challenge.

- High Capital Investment: New entrants must invest heavily in advanced technologies like AI-powered route planning and IoT for real-time tracking, which can run into millions of dollars.

- Talent Acquisition: The need for specialized IT and data analytics skills in logistics creates a competitive talent market, driving up recruitment costs and making it harder for new firms to build a capable team.

- Operational Complexity: Integrating new technologies and training staff requires significant time and resources, creating a steep learning curve for market newcomers.

The threat of new entrants in the logistics sector is considerably low due to the immense capital required for establishing comprehensive infrastructure and networks. Building a complete system of Container Freight Stations (CFS), Inland Container Depots (ICDs), and warehouses demands substantial upfront investment, often in the tens of millions of dollars, as seen in 2024 figures for mid-sized hubs exceeding $50 million.

Furthermore, navigating a complex regulatory environment and securing necessary licenses presents a significant hurdle for newcomers. Established players also benefit from deep-rooted relationships with key industry stakeholders, such as shipping lines and customs agencies, which are difficult for new entrants to replicate quickly.

High technology investment for advanced tracking, data analytics, and automation, alongside the challenge of acquiring specialized talent, further deters new market participants. These factors collectively create substantial barriers, protecting incumbent operators from significant new competition.

| Barrier Type | Description | Estimated Cost/Challenge (2024) |

|---|---|---|

| Capital Investment | Establishing infrastructure (CFS, ICDs, warehouses) | $50M+ for a mid-sized hub |

| Regulatory Hurdles | Obtaining licenses and approvals | Time-consuming and costly process |

| Established Relationships | Partnerships with shipping lines, customs | 70%+ of business from long-term contracts |

| Technology & Talent | Advanced systems, skilled workforce | High investment in IT, competitive talent market |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the gateway industry is built upon a foundation of robust data, including industry-specific market research reports, financial disclosures from major gateway operators, and government regulatory filings. This ensures a comprehensive understanding of competitive intensity and strategic positioning.