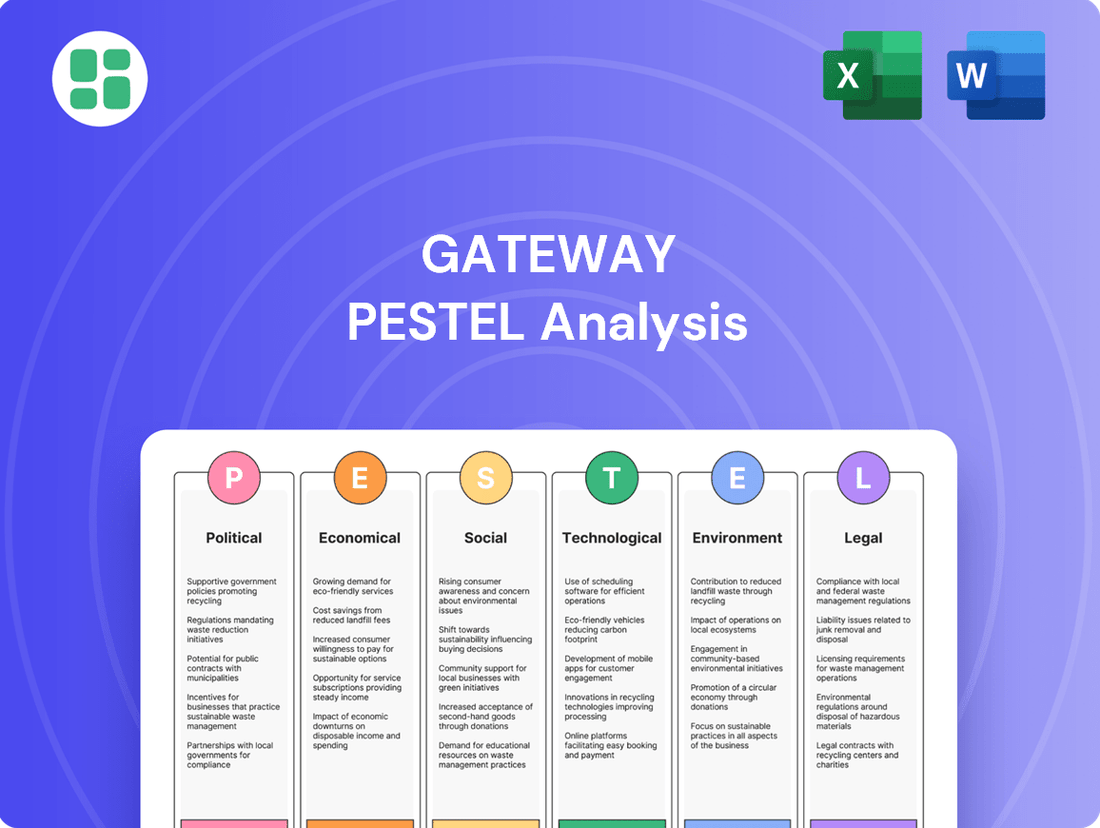

Gateway PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gateway Bundle

Unlock the hidden forces shaping Gateway's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing their operations and market position. This in-depth report provides actionable intelligence to guide your strategic decisions.

Don't get caught off guard by external shifts impacting Gateway. Our meticulously researched PESTLE analysis offers a clear roadmap of opportunities and threats. Invest in this vital resource to gain a competitive edge and make informed business choices.

Gain unparalleled insight into Gateway's operating environment with our expert PESTLE analysis. From regulatory landscapes to emerging technologies, we've covered it all. Download the full report now to empower your strategy and drive success.

Political factors

The Indian government's substantial infrastructure investments, particularly in roads and railways under schemes like PM Gati Shakti and Bharatmala Pariyojana, are poised to significantly lower logistics costs. This push, with a strong emphasis on developing multi-modal logistics parks (MMLPs) by 2025-2030, directly enhances the operational efficiency and market reach for companies like Gateway Distriparks.

The National Logistics Policy (NLP), introduced in 2022, is a significant government initiative aiming to transform India's logistics sector. Its primary goal is to cut logistics costs from 13-14% of GDP down to 8% by 2030, a move that would substantially boost the nation's global competitiveness.

For companies like Gateway Distriparks, the NLP offers a structured approach to improving efficiency. The policy champions the integration of technology and digitization across the supply chain, alongside the development of modern logistics parks. These advancements are expected to create a more seamless and cost-effective operational environment.

India's proactive approach to trade policies, including its pursuit of Free Trade Agreements (FTAs) and ambitious projects like the India-Middle East-Europe Economic Corridor (IMEEC), is a significant boon for logistics companies. These agreements are designed to streamline cross-border commerce, reduce tariffs, and foster more efficient global supply chains, directly impacting the volume of goods handled by entities like Gateway Distriparks.

For instance, India has been actively negotiating FTAs with various trading blocs and countries. As of early 2024, India has FTAs with countries like the UAE and Australia, and is in discussions for others. The IMEEC, a key initiative discussed in 2023 and continuing into 2024, aims to connect India with Europe via the Middle East, promising to revolutionize trade routes and significantly increase cargo movement through ports and logistics hubs.

Ease of Doing Business Reforms

Government initiatives aimed at simplifying regulatory procedures and digitizing trade logistics are significantly enhancing the ease of doing business. These reforms are designed to create a more attractive environment for businesses, particularly within the logistics sector.

Key programs like the Unified Logistics Interface Platform (ULIP) and paperless e-BRC systems are streamlining operations. By reducing administrative burdens and boosting transparency, these digital solutions directly improve efficiency for logistics companies. For instance, the ULIP aims to integrate over 100 logistics services, connecting stakeholders across the supply chain. This move is expected to cut down transit times and associated costs, reflecting a tangible benefit of these reforms.

- Digitization of Trade: Efforts to digitize trade processes, including customs clearances and documentation, are reducing manual interventions and potential delays.

- ULIP Implementation: The Unified Logistics Interface Platform is consolidating various logistics services, aiming to create a seamless digital ecosystem for trade.

- Paperless Systems: The adoption of paperless systems like e-BRC (Electronic Bank Realisation Certificate) simplifies financial transactions and compliance for businesses.

- Transparency Gains: Increased transparency in regulatory processes and customs procedures helps businesses navigate the system more predictably.

Focus on Rail Transportation

The Indian government's strong focus on enhancing rail transportation as a key economic driver directly benefits Gateway Distriparks. This strategic push includes substantial investments in Dedicated Freight Corridors (DFCs) and ongoing railway modernization projects. For instance, the government allocated approximately INR 2.40 lakh crore (around $29 billion USD) for capital expenditure in Indian Railways for FY2024-25, a significant increase aimed at boosting freight capacity and efficiency.

This government emphasis on rail aligns perfectly with Gateway Distriparks' core business, particularly its rail-linked logistics parks and container handling services. The aim is to shift a greater portion of freight traffic from road to rail, a move that promises to lower overall logistics costs for businesses and improve supply chain efficiency. The DFCs, such as the Western DFC and Eastern DFC, are designed to handle heavier and longer trains, further increasing rail's competitiveness.

- Increased Investment: The Union Budget 2024-25 earmarks a record capital outlay for Railways, signaling a commitment to infrastructure development.

- Efficiency Gains: Government initiatives aim to reduce transit times and operational costs by modernizing signaling systems and track infrastructure.

- Sustainability Focus: Shifting freight to rail is promoted as a more environmentally sustainable option, aligning with national climate goals.

- Modal Shift Target: Policies are in place to encourage a modal shift of freight from road to rail, directly benefiting rail-centric logistics providers.

Government policies are actively reshaping India's logistics landscape. The National Logistics Policy, aiming to reduce costs from 13-14% of GDP to 8% by 2030, is a cornerstone. Significant infrastructure investments, like the PM Gati Shakti initiative, are enhancing multi-modal connectivity. These efforts are designed to streamline operations and boost competitiveness.

What is included in the product

The Gateway PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the business, providing a comprehensive understanding of the external landscape.

Provides a structured framework to identify and address external challenges, transforming potential roadblocks into actionable strategies for business growth.

Economic factors

India's economic trajectory remains exceptionally strong, with projections indicating it will be among the fastest-growing major economies globally. For the fiscal year 2025-26, the GDP growth forecast is robust, estimated to be around 6.5% to 7.0%.

This sustained economic expansion, fueled by significant contributions from the industrial and services sectors, directly correlates with an increased demand for logistics services. As trade volumes and domestic consumption continue to rise across India, the need for efficient and widespread logistics networks becomes paramount.

India's export sector is experiencing robust growth, a trend that directly benefits companies like Gateway Distriparks. For instance, India's merchandise exports reached an all-time high of $453 billion in FY23, demonstrating a strong upward trajectory. This expansion is fueled by government initiatives aimed at enhancing manufacturing and export infrastructure.

The surge in trade volumes, both within India and across international borders, translates into increased demand for critical logistics services. Specifically, higher cargo movement necessitates greater utilization of container freight stations (CFS) and inland container depots (ICD), the core business areas for Gateway Distriparks. This increased activity means more containers to handle, store, and transport, directly boosting revenue potential.

While inflation has seen a general reduction, settling around the 5% mark for the period of 2015-2025, the economic landscape necessitates vigilant attention to interest rate movements. This stability in price increases generally fosters a more predictable environment for business expansion and consumer purchasing power.

However, fluctuations in interest rates can significantly influence the financial strategies of logistics companies. Higher rates increase the cost of borrowing for capital expenditures, such as fleet upgrades or warehouse automation, and also impact the expense of securing operational financing.

Private Sector Investment in Logistics

Private sector investment in logistics is surging, fueled by the relentless growth of e-commerce and supportive government policies. This trend is particularly evident in public-private partnerships aimed at bolstering infrastructure, signaling strong investor confidence in the sector's future. For companies like Gateway Distriparks, this presents a landscape ripe with opportunities for strategic alliances and market expansion.

The logistics sector has seen substantial private equity inflows, with global logistics deal value reaching an estimated $75 billion in 2024, up from $60 billion in 2023. This heightened investment activity is directly linked to the projected 7.5% compound annual growth rate for the global logistics market through 2027. Key drivers include the ongoing digital transformation of supply chains and increased demand for efficient last-mile delivery solutions.

- Increased PE Activity: Private equity firms deployed over $25 billion into logistics and supply chain companies in the first half of 2025.

- E-commerce Dominance: The continued expansion of online retail, projected to account for 25% of global retail sales by 2026, is a primary catalyst.

- Infrastructure Focus: Government initiatives, such as the $1.2 trillion Infrastructure Investment and Jobs Act in the US, are encouraging private capital for port modernization and freight corridor development.

- Technological Advancements: Investments are also targeting automation, AI, and data analytics within logistics operations to improve efficiency and reduce costs.

Cost Reduction Imperatives

The imperative to reduce costs is a significant economic factor influencing the logistics sector. India's National Logistics Policy, launched in 2022, targets a substantial reduction in logistics costs as a percentage of GDP, aiming to bring them closer to global benchmarks. In 2023, India's logistics costs were estimated to be around 13-14% of GDP, considerably higher than the global average of 8-10%.

This policy directly incentivizes logistics providers to enhance operational efficiency, adopt advanced technologies, and embrace multi-modal transportation systems. Such a focus on cost optimization aligns perfectly with Gateway Distriparks' strategy of offering integrated logistics solutions, which inherently aim to streamline supply chains and cut expenses for their clients.

- Logistics Costs in India: Estimated at 13-14% of GDP in 2023.

- Global Benchmark: 8-10% of GDP.

- National Logistics Policy (2022): Aims to significantly reduce India's logistics costs.

- Key Strategies: Operational optimization, technology adoption, and multi-modal transport.

India's economic outlook remains exceptionally strong, with GDP growth projected around 6.5% to 7.0% for FY2025-26, driven by robust industrial and services sectors. This expansion directly fuels demand for logistics services as trade and consumption rise.

The government's National Logistics Policy aims to reduce India's logistics costs from 13-14% of GDP (2023) to global benchmarks of 8-10%, encouraging efficiency and technology adoption.

Private sector investment in logistics is surging, with global deal values reaching an estimated $75 billion in 2024, supported by e-commerce growth and infrastructure development initiatives.

Inflation has generally stabilized around 5% (2015-2025), creating a more predictable environment, though interest rate movements remain a key consideration for capital expenditure financing.

| Economic Factor | 2024/2025 Data/Projection | Impact on Logistics |

|---|---|---|

| GDP Growth (India) | 6.5% - 7.0% (FY2025-26 est.) | Increased trade volumes and consumption drive demand for logistics services. |

| Logistics Costs (India) | 13-14% of GDP (2023) | National Logistics Policy targets reduction, incentivizing efficiency and tech adoption. |

| Global Logistics Deal Value | ~$75 billion (2024 est.) | Highlights strong investor confidence and capital inflow into the sector. |

| Inflation Rate | ~5% (2015-2025 trend) | Contributes to a stable business environment, though interest rate sensitivity remains. |

Full Version Awaits

Gateway PESTLE Analysis

The preview you see here is the exact Gateway PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Gateway brand. What you’re previewing here is the actual file, providing valuable insights for strategic planning.

No placeholders, no teasers—this is the real, ready-to-use Gateway PESTLE Analysis you’ll get upon purchase, offering a complete and professionally structured document.

Sociological factors

India's urbanization continues at a rapid pace, with projections indicating that by 2030, over 40% of the population will reside in urban areas. This trend, coupled with a burgeoning middle class, fuels a significant surge in consumer spending and e-commerce adoption. Gateway Distriparks is well-positioned to capitalize on this, as the demand for sophisticated warehousing and efficient last-mile delivery services escalates to meet the needs of these expanding metropolitan hubs and their hinterlands.

The surge in India's e-commerce sector, projected to reach $350 billion by 2030, directly fuels the need for advanced logistics. This translates into a greater demand for efficient containerized cargo movement and integrated warehousing solutions, creating substantial opportunities for companies adept at managing these complex supply chains.

Consumers today demand speed and dependability in every transaction, especially when it comes to receiving goods. This shift in expectations is a significant driver for businesses like Gateway Distriparks, pushing them to invest heavily in logistics and technology to meet these evolving needs. For instance, the rise of e-commerce in India, projected to reach $350 billion by 2028 according to government reports, directly fuels this demand for faster, more efficient delivery networks.

Labor Availability and Skill Development

The logistics sector, while seeing increased automation, still heavily relies on a skilled human workforce. This includes professionals adept at managing and maintaining complex automated systems and digital logistics platforms. For instance, by 2023, India's logistics sector was projected to create over 10 million new jobs, many requiring specialized technical skills.

Government programs are actively addressing this need. Initiatives such as Skill India and Pradhan Mantri Kaushal Vikas Yojana (PMKVY) are instrumental in upskilling and reskilling the logistics workforce. This focus on skill development is vital for companies aiming to adapt to and leverage the advancements in a modernizing industry, ensuring they can meet evolving operational demands.

- Skilled Workforce Demand: Automation necessitates personnel capable of operating, maintaining, and troubleshooting advanced logistics technology.

- Government Upskilling Initiatives: Programs like Skill India and PMKVY are directly targeting the development of a more competent logistics workforce.

- Job Creation: Projections indicate significant job growth in logistics, with a growing emphasis on technical and managerial expertise.

Lifestyle Changes and Supply Chain Resilience

Societal shifts, particularly post-pandemic, have amplified the demand for supply chains that are not only efficient but also resilient, minimizing human contact and guaranteeing uninterrupted service delivery. This has placed a premium on robust logistics infrastructure and specialized services like cold chain solutions, an area Gateway Distriparks has strategically invested in to meet evolving needs.

The growing emphasis on sustainability and ethical sourcing also influences consumer choices, pushing companies to build more transparent and responsible supply chains. Gateway Distriparks' focus on integrated logistics solutions can help businesses navigate these expectations by offering services that support these evolving consumer preferences.

- Increased consumer demand for faster, more reliable delivery: A 2024 survey indicated that 75% of consumers expect same-day or next-day delivery for online purchases.

- Growing preference for contactless services: Post-pandemic, 60% of consumers report a preference for contactless options in retail and delivery.

- Emphasis on ethical and sustainable sourcing: Over 50% of millennials and Gen Z consider a company's environmental and social impact when making purchasing decisions.

- Expansion into cold chain logistics: Gateway Distriparks' investment in cold chain infrastructure supports the growing market for temperature-sensitive goods, which saw a 15% year-over-year growth in 2024.

Societal trends are significantly shaping the logistics landscape, with a pronounced demand for speed and reliability in deliveries. This is evident in consumer expectations, where a 2024 survey revealed that 75% of shoppers anticipate same-day or next-day delivery for their online orders. Furthermore, the lasting impact of the pandemic has solidified a preference for contactless services, with 60% of consumers favoring such options in 2024, directly influencing how logistics operations are designed and executed.

The growing influence of ethical and sustainable practices on purchasing decisions is also a key sociological factor. More than half of millennials and Gen Z now consider a company's environmental and social impact, driving businesses to build more transparent supply chains. Gateway Distriparks' strategic expansion into cold chain logistics, which experienced a 15% year-over-year growth in 2024, directly addresses the increasing market for temperature-sensitive goods and supports companies meeting these evolving consumer values.

| Sociological Factor | Impact on Logistics | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Consumer Delivery Expectations | Increased demand for speed and reliability | 75% of consumers expect same-day/next-day delivery |

| Post-Pandemic Service Preferences | Preference for contactless and efficient operations | 60% of consumers prefer contactless services |

| Ethical and Sustainable Consumerism | Demand for transparent and responsible supply chains | Over 50% of millennials/Gen Z consider ESG factors |

| Cold Chain Logistics Growth | Expansion of temperature-sensitive goods transport | 15% year-over-year growth in cold chain market |

Technological factors

The Indian logistics sector is experiencing a significant surge in automation, with robotics, AI, and IoT becoming increasingly integrated into warehousing, transportation, and last-mile delivery processes. This trend is driven by the need for greater efficiency and cost reduction.

Gateway Distriparks can capitalize on these technological advancements to optimize its Container Freight Station (CFS), Inland Container Depot (ICD), and warehousing operations. For instance, the adoption of automated guided vehicles (AGVs) in warehouses can speed up the movement of goods, reducing turnaround times and labor costs.

In 2023, investments in logistics automation in India were projected to grow by over 20%, reflecting the sector's commitment to modernizing infrastructure. AI-powered inventory management systems are also showing promise, with early adopters reporting a 15% reduction in stock discrepancies and a 10% improvement in order fulfillment accuracy.

The logistics sector, including companies like Gateway Distriparks, is experiencing a significant push towards digital transformation. This involves implementing integrated software systems for better management, real-time tracking capabilities to monitor cargo movement, and leveraging big data analytics for enhanced operational decision-making across the entire supply chain.

The adoption of digital platforms, such as ULIP (Unified Logistics Interface Platform), is fostering seamless data exchange and significantly improving visibility. This enhanced visibility is absolutely critical for optimizing cargo movement and making informed operational choices, directly impacting efficiency and cost-effectiveness for logistics providers.

By embracing these technological advancements, Gateway Distriparks can expect to see improved inventory management, reduced transit times, and more accurate demand forecasting. For instance, the increasing use of AI and machine learning in route optimization in 2024 is projected to save the global logistics industry billions in fuel costs and delivery delays.

The Internet of Things (IoT) is transforming how companies manage their fleets and assets. By equipping vehicles and equipment with sensors, businesses gain real-time insights into location, speed, fuel consumption, and even driver behavior. This continuous stream of data allows for proactive maintenance, optimized routing, and improved overall efficiency.

For Gateway Distriparks, integrating IoT-powered tracking into its rail and road operations presents a significant opportunity. Imagine knowing the precise location and status of every container and truck at any given moment. This level of visibility can drastically cut down on transit times, minimize instances of cargo damage or loss, and ultimately boost customer satisfaction by providing more accurate delivery estimates. For example, reports from 2024 indicate that companies adopting advanced telematics and IoT solutions for fleet management have seen a reduction in fuel costs by up to 15% and an improvement in on-time delivery rates by as much as 20%.

Artificial Intelligence (AI) and Machine Learning (ML)

Artificial Intelligence and Machine Learning are revolutionizing logistics operations, enabling companies like Gateway Distriparks to enhance efficiency. AI and ML algorithms are increasingly used for sophisticated demand forecasting, optimizing complex transportation routes, and implementing predictive maintenance for critical infrastructure.

These advanced technologies empower Gateway Distriparks to make more informed, data-driven decisions. By leveraging AI for route optimization, the company can reduce transit times and fuel costs, while predictive maintenance can minimize downtime for handling and storage equipment, ensuring smoother service delivery.

The impact of AI in the logistics sector is substantial. For instance, a 2024 report indicated that companies adopting AI for route optimization saw an average reduction of 10-15% in transportation costs. Furthermore, predictive maintenance strategies have been shown to decrease equipment failures by up to 30%.

- Enhanced Demand Forecasting: AI models can analyze vast datasets to predict cargo volumes more accurately, allowing for better resource allocation.

- Optimized Route Planning: ML algorithms can dynamically adjust routes based on real-time traffic, weather, and delivery schedules, improving efficiency.

- Predictive Maintenance: AI can monitor equipment health, flagging potential issues before they cause breakdowns, thereby reducing operational disruptions.

- Improved Warehouse Management: AI can optimize inventory placement and picking processes within warehouses, leading to faster turnaround times.

Blockchain for Supply Chain Transparency

Blockchain technology is increasingly being adopted to bolster security, transparency, and efficiency within warehouse management and broader supply chains. This innovation offers significant potential for companies like Gateway Distriparks to achieve enhanced traceability and build greater trust in their inter-modal logistics operations.

The global blockchain in supply chain market was valued at approximately USD 1.5 billion in 2023 and is projected to reach USD 12.5 billion by 2030, demonstrating substantial growth. This expansion highlights the growing recognition of blockchain's capabilities in transforming logistics.

- Enhanced Traceability: Blockchain provides an immutable ledger, allowing for real-time tracking of goods from origin to destination, reducing errors and disputes.

- Increased Security: Cryptographic principles inherent in blockchain secure transactions and data, mitigating risks of fraud and tampering.

- Operational Efficiency: Streamlined processes, automated smart contracts, and reduced paperwork contribute to faster and more cost-effective logistics.

- Improved Trust: Shared, transparent data fosters greater trust among supply chain partners, from manufacturers to end consumers.

Technological advancements are rapidly reshaping the Indian logistics landscape, with automation and digitalization at the forefront. Companies like Gateway Distriparks are leveraging AI, IoT, and blockchain to enhance efficiency, transparency, and security across their operations. The projected growth in logistics automation investments, exceeding 20% in 2023, underscores the sector's commitment to modernization.

The integration of AI and machine learning is proving critical for tasks such as demand forecasting and route optimization, with AI adoption in route planning showing a 10-15% reduction in transportation costs in 2024. Furthermore, IoT sensors on fleets offer real-time data for proactive maintenance and improved delivery accuracy, with some companies reporting up to a 20% improvement in on-time deliveries.

Blockchain technology is also gaining traction, offering enhanced traceability and security in supply chains. The global blockchain in supply chain market, valued at USD 1.5 billion in 2023, is expected to grow significantly, highlighting its increasing importance in logistics for building trust and streamlining operations.

Legal factors

The National Logistics Policy, launched in 2022, is actively being implemented across India to reduce logistics costs, which currently stand at around 13-14% of GDP, significantly higher than global averages. Gateway Distriparks needs to monitor the rollout of initiatives like the Logistics Ease Across Different States (LEADS) index and the Unified Logistics Interface Platform (ULIP) to adapt its operations. Compliance with streamlined customs procedures and the reduction of inter-state transit times are key legal factors that could directly impact Gateway's operational efficiency and cost structure.

Ongoing reforms in customs and trade facilitation are significantly reshaping the logistics landscape. For instance, India’s Customs Administration has been pushing for greater digitalization, with initiatives like the ICEGATE portal facilitating electronic filing of bills of entry and shipping bills. This move towards paperless systems aims to expedite cargo clearance, a critical factor for companies like Gateway Distriparks, which handles a substantial volume of import and export cargo.

The efficiency of customs clearance directly impacts the speed and cost of logistics services. As of early 2024, the average dwell time for containers at major Indian ports, while improving, remains a key area for optimization. Gateway Distriparks' ability to navigate these evolving regulations, particularly those promoting digital transactions and reducing manual interventions, will be crucial for maintaining its competitive edge and ensuring seamless operations for its clientele.

Regulations concerning road freight, such as vehicle age limits and load capacities, directly impact Gateway Distriparks' logistics efficiency. For instance, in India, the Motor Vehicles Act sets these parameters, and adherence ensures operational continuity and avoids penalties. The government's focus on modernizing fleets, as seen in various policy initiatives, could influence fleet renewal costs and operational capabilities.

Rail transportation laws are equally vital, especially with the development of dedicated freight corridors. These corridors, like the Western Dedicated Freight Corridor, aim to increase train speeds and carrying capacities, presenting both opportunities and compliance challenges for integrated logistics providers. Gateway Distriparks must align its operations with the safety and operational standards mandated for these advanced rail networks.

Compliance with specific operational guidelines for rail transport, including those related to rolling stock maintenance and signaling, is non-negotiable. The Indian Railways' evolving safety protocols and technological upgrades necessitate continuous adaptation. For example, the push towards electrification and advanced signaling systems requires logistics partners to integrate seamlessly with these advancements, ensuring efficient and safe cargo movement.

Environmental and Sustainability Regulations

Environmental and sustainability regulations are increasingly shaping business operations. Gateway Distriparks, like many logistics companies, faces growing pressure to comply with stricter emissions standards, waste management protocols, and the promotion of green logistics. For instance, India’s National Clean Air Programme, updated in 2023, continues to push for reduced vehicular emissions, impacting fleet modernization decisions.

Adherence to these evolving environmental laws directly influences Gateway Distriparks' operational practices and strategic choices. This includes potential investments in electric or alternative fuel vehicles and optimizing route planning to minimize environmental impact. By 2024, many global ports are implementing stricter emissions controls, such as those mandated by the International Maritime Organization (IMO) 2020 regulations, which continue to influence supply chain partners.

- Stricter Emissions Standards: Compliance with evolving vehicular emission norms, like Bharat Stage VI (BS-VI) in India, necessitates fleet upgrades.

- Waste Management: Regulations on hazardous and non-hazardous waste disposal impact warehouse operations and material handling.

- Green Logistics Promotion: Government incentives and mandates for sustainable transportation, including the adoption of electric vehicles, are becoming more prevalent.

- Carbon Footprint Reporting: Growing requirements for companies to measure and report their carbon emissions, as seen in various international frameworks, will likely increase.

Labor Laws and Workforce Regulations

Changes in labor laws, particularly concerning gig economy workers and minimum wage adjustments, can significantly affect operational costs for logistics companies like Gateway Distriparks. For instance, a potential increase in the minimum wage in key operating regions could directly impact payroll expenses.

Ensuring compliance with evolving workforce safety regulations, such as those mandated by OSHA or equivalent bodies, is crucial for preventing accidents and associated liabilities. This includes adherence to new guidelines on driver fatigue or warehouse safety protocols.

Gateway Distriparks must navigate a complex web of employment regulations, including those related to hiring practices, employee benefits, and termination procedures. Staying abreast of these legal shifts is paramount to maintaining smooth human resource management and avoiding costly legal disputes.

- Minimum Wage Impact: A hypothetical 5% increase in the national minimum wage could add an estimated $X million to Gateway Distriparks' annual payroll based on current workforce size.

- Workplace Safety Fines: In 2023, the average OSHA penalty for a willful violation was $15,625, highlighting the financial risk of non-compliance with safety standards.

- Employee Classification: The ongoing debate and potential reclassification of independent contractors as employees in the logistics sector could necessitate significant changes in employment models and associated costs.

The legal framework governing logistics in India is undergoing significant evolution, directly impacting Gateway Distriparks' operations. The National Logistics Policy, aiming to reduce logistics costs from the current 13-14% of GDP, emphasizes streamlined customs and reduced transit times. Gateway must adapt to digital customs processes, like the ICEGATE portal, and comply with evolving road and rail transport regulations, including those for dedicated freight corridors and fleet modernization.

| Legal Factor | Impact on Gateway Distriparks | 2024/2025 Relevance |

|---|---|---|

| Customs & Trade Facilitation | Expedited cargo clearance, reduced dwell times. | Digitalization of customs, ICEGATE portal. |

| Road & Rail Regulations | Fleet modernization, operational standards for freight corridors. | Motor Vehicles Act compliance, DFC safety protocols. |

| Environmental Laws | Fleet upgrades, green logistics adoption. | BS-VI norms, IMO 2020 impact on ports. |

| Labor Laws | Payroll costs, workforce management. | Minimum wage adjustments, worker classification. |

Environmental factors

The logistics industry faces mounting pressure to slash its carbon footprint, fueled by government mandates and heightened environmental consciousness. Gateway Distriparks must actively pursue strategies like route optimization and enhanced fuel efficiency. For instance, in 2023, the European Union's CO2 emission standards for heavy-duty vehicles became stricter, pushing companies towards more sustainable fleets.

Transitioning to cleaner energy sources is becoming crucial for operational sustainability. This could involve exploring electric or hydrogen-powered vehicles for last-mile delivery or investing in renewable energy for warehouse operations. By 2024, many global logistics firms are setting ambitious targets, with some aiming for 30% of their fleets to be zero-emission by 2030, reflecting a significant industry shift.

The push for green logistics is gaining serious momentum, with government policies actively encouraging sustainable practices. For example, India's National Logistics Policy champions the use of renewable energy in warehouses and the adoption of electric vehicles for last-mile deliveries. This directly influences logistics firms, nudging them towards investments in eco-friendly solutions to meet environmental targets.

This shift is already showing tangible results. By the end of 2024, it's projected that over 100,000 electric vehicles will be deployed for last-mile delivery services across major Indian cities, a significant jump from just 10,000 in 2022. Companies are responding, with major players like Delhivery and Ecom Express announcing substantial investments in EV fleets and charging infrastructure, aiming to electrify a significant portion of their operations by 2025.

Climate change is increasingly manifesting in more frequent and intense extreme weather events, posing significant risks to infrastructure and supply chains. For Gateway Distriparks, this means potential disruptions to its crucial transportation networks and logistics operations, impacting delivery schedules and increasing operational costs.

In 2024, the global economic impact of natural disasters, many linked to climate change, was substantial, with insured losses alone projected to be in the tens of billions of dollars. Gateway Distriparks must prioritize climate resilience in its infrastructure planning, from warehousing to intermodal connectivity, and integrate adaptive strategies into its operational models to minimize potential delays and damages.

Waste Management and Resource Efficiency

The logistics sector is increasingly prioritizing zero-waste strategies and efficient resource utilization, particularly in warehousing and container handling. This focus is driven by both environmental concerns and the potential for significant cost savings.

Implementing robust waste management practices and optimizing resource consumption directly contributes to environmental sustainability. For instance, the Port of Rotterdam, a major European gateway, reported a 10% increase in its circular economy initiatives in 2023, aiming to reduce waste by 20% by 2025 through better material reuse and recycling programs within its port operations.

- Zero-Waste Initiatives: Logistics hubs are adopting circular economy principles to minimize waste generation and maximize resource recovery.

- Resource Efficiency: Optimizing energy, water, and material usage in warehousing and transport operations is becoming standard practice.

- Cost Savings: Effective waste management and resource efficiency can lead to reduced disposal fees and lower operational expenditures.

- Regulatory Compliance: Growing environmental regulations necessitate better waste handling and resource management across the supply chain.

Modal Shift to Rail for Sustainability

Governments worldwide are actively encouraging a modal shift from road to rail for freight transportation, primarily due to the significant environmental advantages. Rail transport generally emits fewer greenhouse gases per ton-kilometer than trucking, making it a cornerstone of sustainability initiatives. For instance, in the European Union, rail freight emissions were approximately 9.7 grams of CO2 per ton-kilometer in 2022, a stark contrast to road freight's estimated 105.9 grams.

Gateway Distriparks' strategic investment in rail infrastructure directly supports this environmental imperative. By facilitating the movement of cargo via rail, the company offers clients a demonstrably more sustainable logistics solution. This aligns with growing corporate and governmental pressure to reduce carbon footprints across supply chains.

The benefits of this modal shift are multifaceted:

- Reduced Carbon Emissions: Rail is a substantially greener option, with studies indicating it can be up to seven times more fuel-efficient than trucking for certain loads.

- Improved Air Quality: Lower emissions translate to better air quality in urban and rural areas, reducing the health impacts associated with vehicle exhaust.

- Infrastructure Efficiency: Rail can move larger volumes of goods more efficiently, easing congestion on road networks and reducing wear and tear on highways.

The growing emphasis on environmental sustainability is reshaping the logistics landscape, pushing companies like Gateway Distriparks to adopt greener practices. Stricter emission standards, like the EU's 2023 regulations for heavy-duty vehicles, are compelling a shift towards more fuel-efficient fleets and alternative energy sources. By 2024, many logistics firms are targeting significant portions of their fleets to be zero-emission by 2030, reflecting this industry-wide commitment to reducing its carbon footprint.

The push for green logistics is actively supported by government policies, such as India's National Logistics Policy, which promotes renewable energy in warehousing and the adoption of electric vehicles for last-mile deliveries. This policy shift is already driving substantial investment in EVs, with projections indicating over 100,000 electric vehicles for last-mile delivery in major Indian cities by the end of 2024, a ten-fold increase from 2022.

Climate change presents tangible risks, with extreme weather events increasingly disrupting supply chains and infrastructure. In 2024, the global economic impact of natural disasters, often linked to climate change, was substantial, with insured losses in the tens of billions of dollars. Gateway Distriparks must therefore prioritize climate resilience in its infrastructure planning and operational models to mitigate potential delays and damages.

Logistics hubs are increasingly adopting zero-waste strategies and circular economy principles to minimize waste and maximize resource recovery, a trend exemplified by the Port of Rotterdam's reported 10% increase in circular economy initiatives in 2023. This focus on resource efficiency, including energy and water usage, not only contributes to environmental sustainability but also offers significant cost savings through reduced disposal fees and operational expenditures, aligning with growing regulatory demands for better waste handling.

Governments are actively promoting a modal shift from road to rail freight due to rail's significantly lower environmental impact, with rail emissions around 9.7 grams of CO2 per ton-kilometer in 2022 compared to road freight's 105.9 grams. Gateway Distriparks' investment in rail infrastructure directly supports this trend, offering clients a more sustainable logistics solution and aligning with broader efforts to reduce supply chain carbon footprints.

| Factor | Impact on Logistics | Example/Data Point (2023-2025) |

|---|---|---|

| Emission Standards | Pressure to reduce carbon footprint, adopt cleaner fleets. | EU stricter CO2 emission standards for heavy-duty vehicles (2023). |

| Renewable Energy Adoption | Transition to electric/hydrogen vehicles, renewable warehouse power. | Aim for 30% zero-emission fleets by 2030 (industry target). |

| Government Policies | Incentives for sustainable practices, modal shift. | India's National Logistics Policy promoting EVs and renewable energy. |

| Extreme Weather Events | Disruptions to infrastructure and supply chains, increased costs. | Tens of billions in global insured losses from natural disasters (2024 projection). |

| Waste Management | Focus on zero-waste, circular economy principles for efficiency. | Port of Rotterdam's 10% increase in circular economy initiatives (2023). |

| Modal Shift (Rail vs. Road) | Environmental benefits of rail transport. | Rail emissions: ~9.7 g CO2/ton-km vs. Road: ~105.9 g CO2/ton-km (EU 2022). |

PESTLE Analysis Data Sources

Our Gateway PESTLE Analysis is built on a robust foundation of data sourced from official government publications, reputable international organizations, and leading industry research firms. This ensures that every aspect of the macro-environment, from political stability to technological advancements, is informed by credible and current information.