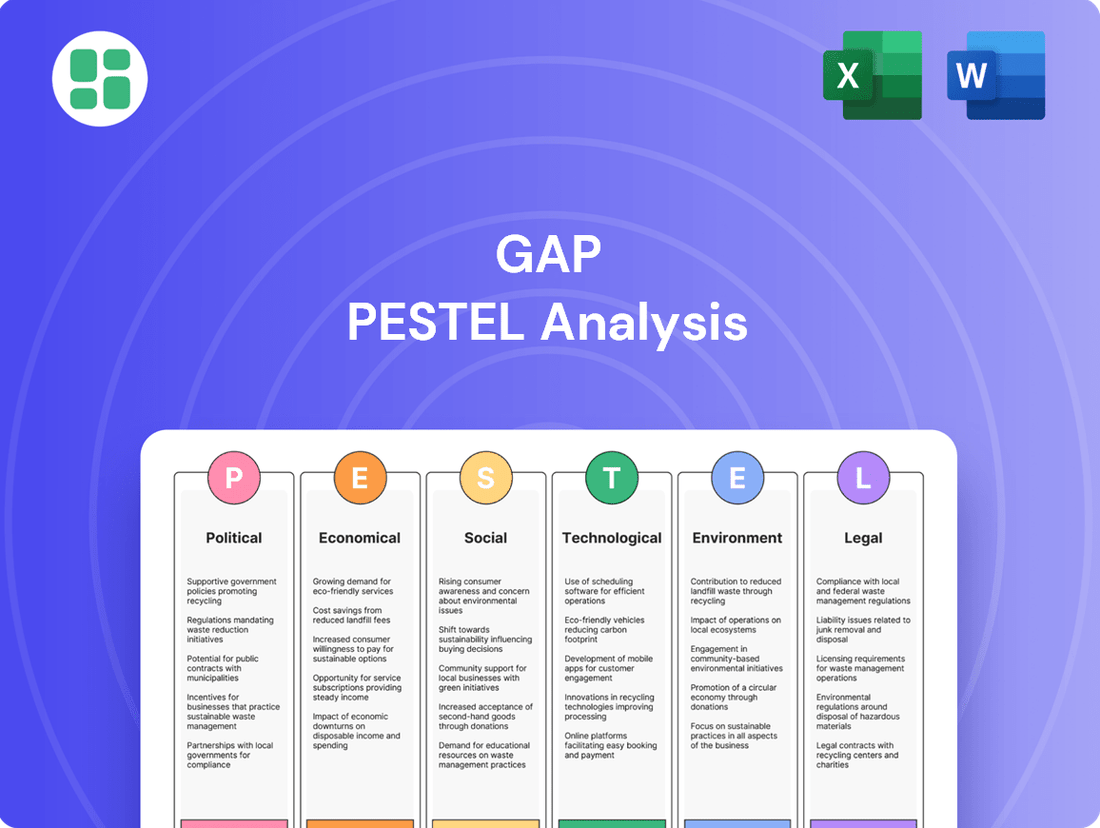

Gap PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gap Bundle

Gain an edge with our in-depth PESTEL Analysis for Gap. Discover how political stability, economic shifts, and evolving social trends are shaping the company’s future, and leverage these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Changes in international trade policies and tariffs directly affect Gap Inc.'s supply chain costs and overall profitability. For example, new tariffs on textiles from key manufacturing hubs like Vietnam could raise operational expenses significantly.

Gap Inc. is proactively seeking sourcing from nations with advantageous trade agreements to lessen these potential cost increases. A potential second Trump administration in the U.S. might introduce further tariff uncertainties, influencing Gap's sourcing decisions.

Gap Inc.'s extensive global supply chain, spanning numerous countries, makes it inherently vulnerable to shifts in political stability. For instance, geopolitical tensions in regions crucial for textile manufacturing, such as parts of Southeast Asia or South Asia, can directly impact production timelines and costs. A significant political event in a key sourcing country in 2024 could easily trigger supply chain disruptions, potentially adding 5-10% to logistics expenses.

Furthermore, political unrest can erode consumer confidence, leading to reduced discretionary spending on apparel, a core product for Gap. In 2024, markets experiencing heightened political instability saw an average decline of 3-5% in retail sales for non-essential goods. This directly translates to lower revenue for Gap in those affected regions.

Gap Inc. operates under a complex regulatory landscape, requiring adherence to diverse laws in every country it serves. For instance, evolving labor laws, such as minimum wage adjustments in the US and fair labor practices globally, directly impact operational costs and supply chain management. In 2023, the company reported significant investments in its Global Integrity department to strengthen compliance infrastructure, reflecting the ongoing challenge of navigating these intricate requirements.

Labor Laws and Regulations

Evolving labor laws significantly impact Gap Inc.'s operational expenses and how it manages its workforce. For instance, with 23 U.S. states scheduled to raise their minimum wages in 2025, Gap will face increased payroll costs. Retailers are also encountering more rigorous enforcement of laws concerning fair scheduling and wage transparency.

Gap must proactively adjust to these changes to steer clear of fines, safeguard its brand image, and foster confidence among its employees. Adapting to these regulatory shifts is crucial for maintaining smooth operations and employee relations.

- Minimum Wage Increases: 23 U.S. states are implementing minimum wage hikes in 2025, directly affecting Gap's labor costs.

- Fair Scheduling Laws: Stricter enforcement of predictive scheduling regulations requires retailers like Gap to manage employee hours more precisely.

- Transparency Requirements: New rules demanding greater transparency in pay and scheduling add complexity to workforce management.

- Compliance Costs: Adapting to these evolving labor laws necessitates investment in new systems and training to ensure adherence.

Political Engagement and Lobbying

Gap Inc. actively engages in political processes, employing lobbying efforts to champion legislation that supports its strategic objectives and ethical standards. This engagement is crucial for ensuring a business environment conducive to growth and consistent adherence to its codes of conduct.

The company views participation in political and regulatory discussions as vital for addressing issues that impact its operations and the communities it serves. This proactive stance allows Gap to influence policy decisions affecting its industry.

- Lobbying Expenditures: In 2023, Gap Inc. reported spending $1.1 million on federal lobbying efforts, focusing on issues related to trade, retail policy, and workforce development.

- Advocacy Focus: Key areas of advocacy include advocating for fair trade agreements that benefit its global supply chain and supporting policies that promote consumer spending in the retail sector.

- Corporate Social Responsibility Alignment: Political engagement is often tied to Gap's broader CSR initiatives, such as advocating for sustainable sourcing and ethical labor practices throughout its supply chain.

Changes in trade policies and geopolitical stability directly impact Gap's supply chain, potentially increasing costs and disrupting operations. For instance, tariffs on textiles from key manufacturing countries could raise expenses, while political unrest in sourcing regions might delay production, adding 5-10% to logistics costs as seen in 2024. Furthermore, reduced consumer confidence due to political instability can lead to lower sales, with affected markets seeing a 3-5% drop in non-essential retail spending.

What is included in the product

This Gap PESTLE analysis examines how external macro-environmental factors influence the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of the forces shaping Gap's operations and strategic decisions.

The Gap PESTLE Analysis acts as a crucial pain point reliever by providing a structured framework to anticipate and address external challenges, thereby mitigating potential disruptions to business strategy.

Economic factors

Ongoing inflationary pressures continue to impact consumer spending habits. For instance, in the first quarter of 2024, the US Consumer Price Index (CPI) saw an increase, leading many consumers to scrutinize discretionary purchases like apparel. This heightened caution means consumers are more likely to prioritize essential goods and actively seek out discounts or value-driven options from retailers.

Fluctuating consumer confidence levels also play a significant role. When confidence dips, as it did periodically throughout 2023 and early 2024 due to economic uncertainties, consumers tend to pull back on non-essential spending. This directly affects companies like Gap Inc., forcing them to re-evaluate their pricing strategies and ensure their product assortments align with a more budget-conscious consumer base.

Global economic growth, particularly in key markets like the United States and China, directly influences the apparel retail sector. A deceleration in these major economies, such as the projected 2.3% GDP growth for the US in 2024 and a 4.6% growth for China, can dampen consumer spending, leading to reduced demand for apparel and increased price competition, especially for staple items.

Gap Inc. acknowledges this dynamic, forecasting ongoing macroeconomic volatility for fiscal year 2025. This anticipation drives strategic adjustments within the company to navigate potential shifts in consumer behavior and market conditions.

As a global retailer, Gap Inc.'s profitability is directly influenced by exchange rates. For instance, if the US dollar strengthens against other currencies, Gap's imported goods become cheaper, potentially boosting margins. Conversely, a weaker dollar makes imports more expensive, squeezing profits.

In 2024, the US dollar has shown volatility. For example, the dollar's performance against the Euro has fluctuated, impacting Gap's European sales and sourcing costs. This dynamic necessitates robust currency hedging strategies to mitigate potential losses.

The company's international sales revenue is also affected. A strong dollar can make Gap's products more expensive for foreign consumers, potentially dampening demand. Managing these currency risks is essential for consistent financial performance across its global markets.

Supply Chain Costs and Commodity Prices

Fluctuations in the cost of raw materials like cotton and polyester have a direct impact on Gap Inc.'s profitability. For instance, during fiscal year 2024, Gap experienced a positive effect from decreasing commodity prices, which helped bolster its gross margins.

However, the global supply chain remains a critical factor. Disruptions, such as those seen in recent years, can significantly inflate logistics and sourcing expenses. These increased operational costs can erode the benefits gained from lower material prices, affecting overall efficiency.

- Cotton Price Trends: Spot prices for U.S. cotton saw a notable increase in early 2024, reaching over $0.80 per pound before stabilizing, impacting input costs for apparel manufacturers.

- Polyester Market Dynamics: Polyester staple fiber prices, influenced by crude oil prices, experienced volatility in 2024, with some periods seeing a slight dip and others a rebound, affecting a key material for Gap.

- Logistics Cost Inflation: While freight rates have eased from their 2022 peaks, the cost of ocean shipping and trucking remained elevated in many regions throughout 2024 compared to pre-pandemic levels, adding to operational overhead.

E-commerce Market Growth and Competition

The fashion e-commerce sector is experiencing robust expansion, fueled by rising internet access and widespread smartphone usage. For Gap Inc., this presents a dual scenario of substantial opportunity coupled with fierce competition. Staying ahead requires continuous investment in digital infrastructure and seamless integration of online and offline shopping experiences to cater to evolving consumer habits.

The global online fashion market was valued at approximately $850 billion in 2023 and is projected to reach over $1.4 trillion by 2028, demonstrating a compound annual growth rate of around 10%. In the US, e-commerce accounted for roughly 15% of total retail sales in early 2024, with apparel being a significant contributor. This growth trajectory highlights the critical need for Gap to enhance its digital capabilities.

- Market Expansion: Global fashion e-commerce expected to exceed $1.4 trillion by 2028.

- US E-commerce Share: Online sales represented about 15% of US retail in early 2024.

- Competitive Landscape: Intense rivalry from established players and emerging digital-native brands.

- Customer Expectations: Growing demand for personalized online experiences and efficient delivery.

Economic factors significantly shape Gap Inc.'s operating environment. Persistent inflation, as seen in the US CPI increases during early 2024, pressures consumer spending, pushing shoppers towards value and essentials. Fluctuations in consumer confidence, particularly evident throughout 2023 and early 2024, also lead to reduced discretionary spending, forcing retailers like Gap to adapt pricing and product assortments.

Global economic growth rates directly impact apparel demand. For instance, the projected 2.3% GDP growth for the US in 2024 and 4.6% for China indicate varying market strengths that influence consumer purchasing power for fashion items.

Currency exchange rates are a critical consideration for Gap's international operations. A strengthening US dollar, as observed against the Euro in 2024, can make imports cheaper but also makes Gap's products more expensive for foreign consumers, affecting sales volumes and profit margins.

Input costs for raw materials like cotton and polyester are vital. While Gap benefited from decreasing commodity prices in fiscal year 2024, which boosted gross margins, the overall cost of logistics and sourcing, though easing from 2022 peaks, remained elevated in 2024 compared to pre-pandemic levels, impacting operational expenses.

What You See Is What You Get

Gap PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis for Gap.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Gap.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into Gap's external business environment.

Sociological factors

Consumers are increasingly prioritizing apparel that is both functional and comfortable, reflecting a broader societal shift towards active and casual lifestyles. This trend is evident in the growing popularity of athleisure wear and versatile pieces that can transition from workouts to everyday activities.

Gap Inc. is adapting to these changing preferences by strategically expanding its offerings in key categories such as activewear and denim, aiming to provide more 'trend-right' product assortments. For instance, Gap's activewear lines are designed to meet the demand for performance-oriented clothing that also aligns with current fashion trends.

Furthermore, there's a significant rise in consumer expectations for personalized shopping experiences and seamless integration between online and in-store channels. This demand for a unified, omnichannel approach means retailers must invest in technology and strategies that offer consistent and engaging customer journeys across all touchpoints, a challenge Gap is actively addressing.

Consumers are increasingly prioritizing fashion that is both sustainable and ethically made. This translates to a preference for clothing crafted from eco-friendly materials, produced under fair labor conditions, and sourced through transparent supply chains.

Gap Inc.'s 2024 Impact Report underscores this commitment, detailing advancements in minimizing environmental footprints and championing ethical sourcing practices. This proactive approach directly addresses the growing consumer values driving the demand for responsible fashion.

Social media platforms are fundamentally reshaping the fashion landscape, acting as powerful engines for brand discovery and sales. In 2024, the rise of social commerce, where transactions occur directly within social media apps, is a significant trend. Brands like Gap are increasingly relying on influencer collaborations and user-generated content to build authenticity and drive engagement, recognizing that a strong digital presence is no longer optional but essential for reaching today's consumers.

Demographic Shifts and Generational Spending Habits

Generational differences significantly influence consumer behavior, with Gen Z and millennials prioritizing sustainability and digital integration in their shopping journeys. For instance, a 2024 report indicated that over 60% of Gen Z consumers are willing to pay more for sustainable products. This trend directly impacts retailers like Gap, requiring adaptation to meet these evolving values.

Gap Inc. must navigate the distinct spending habits of various demographic groups, particularly younger generations who are often more budget-conscious due to economic factors like inflation. Millennials, for example, showed a 10% increase in spending on value-oriented brands in early 2024, highlighting the need for Gap to offer competitive pricing and promotions across its brands.

Catering to these generational preferences is paramount for Gap's continued success and market relevance. This includes leveraging technology for seamless online and in-store experiences, as well as reinforcing commitments to ethical sourcing and environmentally friendly practices. Failure to align with these expectations could lead to a decline in brand loyalty and sales.

- Gen Z and Millennial Priorities: Emphasis on sustainability and tech-driven shopping experiences.

- Inflationary Impact: Cautious spending habits among younger demographics due to economic pressures.

- Gap's Strategic Imperative: Adapting product offerings and marketing to resonate with generational values.

- Data Point: Over 60% of Gen Z consumers willing to pay a premium for sustainable goods (2024 estimate).

Secondhand Apparel and Circular Economy Trends

The secondhand apparel market is booming, driven by a growing consumer desire for sustainability and affordability. This trend is a key component of the broader circular fashion economy, where the focus shifts from linear "take-make-dispose" models to keeping products in use for as long as possible. The resale market, for instance, is projected to grow significantly, with some estimates suggesting it could reach $77 billion by 2025, far outpacing the growth of new apparel sales.

Consumers are actively seeking ways to reduce their environmental footprint, and purchasing pre-owned clothing or participating in clothing take-back programs aligns with these values. This shift is not just about individual choices; it's a societal movement towards valuing longevity and resourcefulness in fashion. For example, the resale market is expected to nearly double in size between 2022 and 2027, reaching an estimated $350 billion globally.

Gap Inc. is adapting to these evolving consumer preferences and societal trends by engaging in initiatives that support a more circular approach to fashion. Their partnership with ThredUp, a leading online consignment and thrift store, allows customers to send in unwanted clothing, which is then resold or recycled. This participation in take-back programs directly addresses the growing demand for extending garment lifecycles and diverting textiles from landfills.

- Market Growth: The global secondhand apparel market is projected to reach $77 billion by 2025, significantly outpacing traditional retail.

- Consumer Behavior: Consumers are increasingly prioritizing sustainability and affordability, driving participation in resale and take-back programs.

- Gap's Involvement: Gap Inc. partners with ThredUp, facilitating clothing take-back and resale to embrace circular economy principles.

- Environmental Impact: These trends aim to reduce textile waste and extend the lifespan of garments, contributing to a more sustainable fashion industry.

Societal values are increasingly emphasizing inclusivity and diversity, impacting how consumers perceive and interact with brands. This means retailers must reflect a broader spectrum of representation in their marketing and product offerings to resonate with a wider audience.

Gap Inc. is actively working to foster a more inclusive environment, both internally and externally. Their commitment to diversity is highlighted through various initiatives aimed at creating a more representative workforce and ensuring their brand messaging speaks to a diverse customer base.

The growing awareness of mental health and well-being also influences consumer choices, with many seeking brands that promote positive self-image and responsible consumption. This societal shift encourages a focus on authenticity and ethical practices in brand communication.

Gap's approach to community engagement and social responsibility reflects these evolving societal expectations, aiming to build stronger connections with consumers by aligning with their values.

Technological factors

The ongoing advancements in e-commerce platforms, focusing on user experience and mobile optimization, are crucial for Gap Inc.'s competitive edge. These improvements directly impact customer engagement and conversion rates.

Gap's digital channels are increasingly vital, with online sales contributing a substantial portion to its overall revenue. In fiscal 2024, online sales represented over 15% of total net sales, highlighting the necessity of a robust and evolving e-commerce infrastructure.

Gap Inc. is significantly boosting its use of artificial intelligence across its operations. This includes making customer experiences better through personalization and streamlining its supply chain. The company is also looking to improve how productive its organization is overall.

A key move was the establishment of an Office of AI in 2024, signaling a dedicated focus on this technology. Looking ahead to 2025, Gap plans to explore ways to generate revenue from its AI initiatives, aiming to create more sophisticated customer interactions and boost operational efficiency.

Gap Inc. is actively integrating advanced technologies into its supply chain. For instance, the company is exploring AI-powered sound technology for water leak detection, a move that could significantly reduce waste and improve resource management within its manufacturing processes. This focus on technological adoption aims to bolster operational efficiency and sustainability.

Traceability platforms, such as TextileGenesis, are also being implemented to enhance transparency across Gap's complex supply network. This allows for better tracking of materials and products, contributing to more responsible sourcing and a clearer understanding of the product lifecycle. Such advancements are crucial for meeting evolving consumer and regulatory demands for ethical and sustainable practices.

Furthermore, Gap leverages data analytics to gain deeper insights into customer behavior and market trends. In 2023, the company reported that its data-driven strategies helped in optimizing inventory management and personalizing marketing efforts, leading to improved customer engagement and a more agile response to shifting consumer preferences. This analytical capability is key to making informed decisions and staying competitive in the fast-paced retail environment.

In-store Technology and Omnichannel Integration

Gap Inc. is heavily investing in its in-store technology to create a truly integrated omnichannel experience for shoppers. This focus on seamlessness is crucial in today's retail landscape, allowing customers to move effortlessly between online and physical stores.

Key initiatives include expanding services like buy online, pick-up in-store (BOPIS), order-in-store, and ship-from-store capabilities. These options provide flexibility and convenience, meeting customer demand for immediate gratification and broader product access. For instance, BOPIS adoption has seen significant growth, with many retailers reporting a substantial portion of their online orders being fulfilled through physical stores.

Old Navy, a major brand within Gap Inc., is notably deploying AI-powered RFID technology. This advanced system aims to revolutionize inventory management and enhance the in-store customer journey by enabling faster checkout and more accurate stock availability information. By 2024, RFID adoption in apparel retail is expected to reach new heights, improving operational efficiency and customer satisfaction.

- Omnichannel Services: Gap is enhancing BOPIS, order-in-store, and ship-from-store to bridge online and physical retail.

- AI & RFID Rollout: Old Navy is implementing AI-powered RFID for improved inventory accuracy and customer experience.

- Customer Convenience: These technological integrations aim to provide a more flexible and satisfying shopping journey.

Virtual Experiences and Web3 Technologies

Gap Inc. is actively venturing into virtual experiences and Web3 technologies to connect with younger consumers. Their involvement in platforms like Club Roblox, featuring virtual experiences and NFTs, aims to expand brand reach in digital realms. This strategic move positions Gap for future customer engagement and innovative brand development in the evolving metaverse landscape.

The global metaverse market is projected for significant growth, with estimates suggesting it could reach $1.6 trillion by 2030, according to some industry analyses. This indicates a substantial opportunity for brands like Gap to establish a presence and create new revenue streams.

- Metaverse Market Growth: Projected to reach $1.6 trillion by 2030, offering vast potential for digital brand engagement.

- Web3 Exploration: Gap's use of NFTs and virtual experiences on platforms like Club Roblox targets younger, digitally native audiences.

- Brand Extension: These digital initiatives allow Gap to extend its brand presence beyond traditional retail into emerging virtual environments.

Gap Inc. is leveraging advanced technology to enhance its operational efficiency and customer experience. The company's investment in AI and RFID, particularly at Old Navy, aims to improve inventory accuracy and streamline in-store processes. These technological integrations are crucial for bridging the gap between online and physical retail, offering customers greater convenience and flexibility.

Gap's commitment to digital innovation is evident in its expanding e-commerce capabilities and its exploration of emerging technologies like Web3 and the metaverse. By integrating AI for personalization and supply chain optimization, and by embracing virtual experiences, Gap is positioning itself to connect with a broader audience and drive future growth in the evolving retail landscape.

The company's focus on data analytics further supports its strategic decisions, enabling better inventory management and more targeted marketing campaigns. This data-driven approach, combined with investments in omnichannel services like BOPIS and ship-from-store, underscores Gap's dedication to meeting contemporary consumer demands and maintaining a competitive edge.

| Technology Area | Gap Inc. Initiatives (2024-2025 Focus) | Impact | Data/Projections |

|---|---|---|---|

| E-commerce & Digital | User experience optimization, mobile responsiveness | Increased customer engagement, higher conversion rates | Online sales represented over 15% of total net sales in fiscal 2024. |

| Artificial Intelligence (AI) | Personalization, supply chain streamlining, operational productivity, Office of AI established | Enhanced customer experiences, improved efficiency, potential new revenue streams | Plans to explore revenue generation from AI initiatives in 2025. |

| Supply Chain Technology | AI for leak detection, traceability platforms (e.g., TextileGenesis) | Reduced waste, improved resource management, enhanced transparency and responsible sourcing | Focus on improving operational efficiency and sustainability. |

| In-Store & Omnichannel | BOPIS, order-in-store, ship-from-store, AI-powered RFID (Old Navy) | Seamless customer journey, increased convenience, improved inventory accuracy, faster checkout | RFID adoption in apparel retail expected to grow significantly by 2024. |

| Emerging Technologies | Virtual experiences, Web3, NFTs (e.g., Club Roblox) | Engagement with younger consumers, brand extension into digital realms | Global metaverse market projected to reach $1.6 trillion by 2030. |

Legal factors

Gap Inc. navigates a complex web of global data privacy and consumer protection laws, impacting its marketing and data handling practices. The company must ensure adherence to regulations like the California Invasion of Privacy Act (CIPA), which has seen increased enforcement and potential for significant penalties. Failure to comply with these evolving legal frameworks can lead to costly litigation and reputational damage, especially concerning the use of third-party tracking software in digital communications.

Gap Inc. faces ongoing legal battles to protect its valuable brand portfolio, including Gap, Old Navy, Banana Republic, and Athleta, from counterfeiting and intellectual property infringement. This is crucial for maintaining brand integrity and preventing dilution of its market presence.

The company's legal teams are actively engaged in enforcing trademarks and copyrights across various international markets to combat unauthorized use and protect its intellectual assets. This proactive approach is essential in the global retail landscape.

In 2024, the fashion industry continued to grapple with the pervasive issue of counterfeit goods, with authorities seizing millions of dollars worth of fake apparel and accessories globally. Gap Inc. invests significant resources in monitoring and taking legal action against infringers to safeguard its revenue streams and brand reputation.

Gap Inc. navigates a complex web of labor and employment laws across its global operations, covering everything from minimum wage and working conditions to anti-discrimination statutes. Staying compliant with evolving regulations is critical. For instance, many North American jurisdictions are introducing or expanding paid sick leave mandates and pay transparency requirements throughout 2024 and into 2025, directly impacting Gap's operational costs and HR policies.

Failure to adhere to these labor laws, such as recent updates to overtime eligibility in several US states for 2024, can lead to significant legal penalties and damage employee relations. Gap's commitment to fair labor practices and transparent compensation structures is therefore not just a matter of compliance but also a strategy for attracting and retaining talent in a competitive retail environment.

International Trade Regulations and Customs Compliance

Gap Inc. navigates a complex landscape of international trade regulations and customs compliance, directly impacting its global operations. Fluctuations in tariff policies, for instance, can significantly alter sourcing costs and require agile adjustments to supply chain strategies. The company must remain vigilant regarding changes in import/export laws and customs duties across the numerous countries where it sources materials and sells products.

Recent shifts in global trade dynamics, including potential tariff adjustments by major economies, necessitate continuous monitoring. For example, the United States' trade policies, particularly under new administrations, often introduce changes that affect apparel imports. Furthermore, modifications to de minimis rules, which set thresholds for duty-free shipments, can influence direct-to-consumer shipping strategies and overall logistics costs for a global retailer like Gap.

- Tariff Volatility: Changes in tariffs, such as those potentially implemented by the US government in 2024-2025, can increase the cost of imported goods, impacting Gap's profit margins.

- Customs Compliance: Strict adherence to customs regulations in countries like China, Vietnam, and India, major sourcing hubs for apparel, is critical to avoid delays and penalties.

- Trade Agreements: The existence and modification of trade agreements between countries where Gap operates or sources from can create both opportunities and challenges in terms of market access and import duties.

- De Minimis Rule Impact: Evolving de minimis thresholds can affect the cost-effectiveness of shipping individual items directly to consumers, influencing Gap's e-commerce fulfillment strategies.

Advertising and Marketing Regulations

Gap Inc. must navigate a complex web of advertising and marketing regulations globally. These laws ensure truthfulness, transparency, and fair competition, impacting everything from promotional claims to digital marketing. Failure to comply can lead to significant penalties and reputational damage. For instance, the U.S. Federal Trade Commission (FTC) actively enforces rules against deceptive advertising, and in 2024, the FTC continued its focus on unsubstantiated environmental claims in marketing, a trend likely to persist.

Key considerations for Gap's advertising and marketing include:

- Truthfulness in Advertising: Ensuring all product claims, pricing, and promotional offers are accurate and substantiated.

- Transparency in Digital Marketing: Adhering to regulations concerning data privacy, influencer marketing disclosures, and targeted advertising.

- Fair Competition: Avoiding practices that could be construed as anti-competitive or misleading to consumers about Gap's offerings versus rivals.

- Consumer Protection: Complying with laws designed to protect consumers from unfair or deceptive business practices, such as those enforced by the EU's Consumer Rights Directive.

Legal factors significantly shape Gap Inc.'s operational landscape, demanding strict adherence to evolving global regulations. The company must navigate an increasingly complex data privacy environment, with laws like the GDPR and CCPA setting stringent standards for consumer data handling, impacting marketing and personalization strategies. Furthermore, intellectual property protection remains paramount, as Gap actively defends its brands against counterfeiting, a persistent issue in the global apparel market. In 2024, the fashion industry saw continued crackdowns on counterfeit goods, underscoring the importance of robust legal defense for brands like Gap.

Environmental factors

Gap Inc. is actively addressing climate change, aiming for net zero carbon emissions by 2050. This commitment includes substantial reductions in Scope 1, 2, and 3 emissions by 2030.

The company's progress is evident in its 2024 Impact Report, which details a 74% decrease in Scope 1 and 2 emissions compared to 2017 levels. Furthermore, Gap Inc. is increasing its reliance on renewable energy sources to power its operations.

Gap Inc. is heavily invested in sustainable sourcing, with 98% of its cotton in 2024 originating from sustainable sources. This commitment extends to its use of recycled polyester, which accounted for 40% of its polyester usage in the same year.

The fashion industry, including Gap, is increasingly exploring innovative materials like biodegradable fabrics, organic cotton, and plant-based alternatives. These advancements are crucial for reducing the environmental impact associated with textile production and consumption, aligning with growing consumer demand for eco-friendly options.

Gap Inc. is actively addressing water scarcity, a critical environmental factor. The company has committed to reducing and replenishing 100% of the water used throughout its operations by 2030. This proactive stance is crucial given increasing global water stress.

In 2024 alone, Gap successfully reduced or replenished an impressive 3.9 billion liters of water within its supply chain. A notable initiative involves a decade-long water replenishment project in India, leveraging AI-powered sound technology to detect and repair leaks, demonstrating a commitment to innovative water management solutions.

Waste Reduction and Circularity

The fashion industry is increasingly focusing on waste reduction and circularity, a significant environmental shift. This involves promoting practices like recycling, upcycling, and the resale of pre-owned garments to drastically cut down on textile waste. Gap Inc. is actively involved in these efforts, running takeback programs designed to keep clothing out of landfills and encouraging its customer base to adopt more mindful purchasing habits, which directly supports zero-waste fashion goals.

Gap's commitment to circularity is evident in its initiatives. For instance, in 2023, the company continued to expand its partnerships for textile recycling and resale, aiming to divert a greater volume of materials from traditional waste streams. While specific global diversion rates for 2024 are still being finalized, industry benchmarks suggest that successful takeback programs can redirect upwards of 15-20% of collected items from landfills through resale and recycling channels.

- Textile Waste Reduction: The global fashion industry generates an estimated 92 million tons of textile waste annually, highlighting the urgency of circular economy principles.

- Gap's Takeback Programs: Gap's initiatives aim to extend the lifespan of garments and recover valuable materials, contributing to a more sustainable model.

- Customer Engagement: Encouraging mindful consumption is crucial, as consumer choices significantly impact the volume of textile waste generated.

- Circular Fashion Market Growth: The second-hand apparel market, a key component of circularity, is projected to grow significantly, with some estimates suggesting it could reach over $350 billion by 2027.

Ethical Manufacturing and Supply Chain Transparency

Gap Inc. places significant emphasis on ethical manufacturing, extending its commitment beyond environmental concerns to encompass fair labor practices and supply chain transparency. This dedication is evident in its support for programs like the P.A.C.E. initiative, which aims to empower women within its workforce. Furthermore, Gap is actively working to ensure digital payment systems are implemented for factory workers, promoting financial inclusion and security.

The company's 2024 Impact Report underscores these efforts, highlighting its role as a positive influence for both people and the planet across its extensive network of over 200 suppliers situated in 30 countries. This commitment to ethical sourcing and worker well-being is becoming increasingly critical for consumers and investors alike, influencing brand reputation and long-term sustainability.

- P.A.C.E. Program: Focuses on skill development and empowerment for women in the supply chain.

- Digital Payments: Initiative to provide secure and transparent payment methods for factory workers.

- Supplier Network: Operations span over 200 suppliers across 30 countries, requiring robust ethical oversight.

- 2024 Impact Report: Details Gap's progress on social and environmental responsibility goals.

Gap Inc. is actively tackling environmental challenges, setting ambitious goals for emissions reduction and renewable energy adoption. The company's 2024 Impact Report shows significant progress, with a 74% decrease in Scope 1 and 2 emissions against a 2017 baseline.

Water stewardship is a key focus, with Gap aiming to replenish 100% of its operational water use by 2030. In 2024, the company achieved an impressive 3.9 billion liters of water reduction or replenishment within its supply chain, including innovative AI-driven leak detection in India.

Circular economy principles are driving Gap's waste reduction efforts, with a strong emphasis on takeback programs and promoting resale. This aligns with the fashion industry's broader shift towards minimizing textile waste, estimated at 92 million tons globally per year.

| Environmental Factor | Gap Inc. Initiative/Commitment | 2024/2025 Data/Progress |

| Climate Change | Net Zero Carbon Emissions by 2050 | 74% reduction in Scope 1 & 2 emissions (vs. 2017) |

| Renewable Energy | Increased reliance on renewable sources | Details ongoing |

| Water Scarcity | 100% water reduction/replenishment by 2030 | 3.9 billion liters reduced/replenished in 2024 |

| Sustainable Sourcing | Increased use of sustainable cotton and recycled polyester | 98% sustainable cotton, 40% recycled polyester (2024) |

| Waste Reduction & Circularity | Takeback programs, promoting resale and recycling | Expanding partnerships for textile recycling and resale |

PESTLE Analysis Data Sources

Our PESTLE Analysis is informed by a robust blend of primary and secondary research, drawing from official government publications, reputable academic journals, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental forces shaping your business landscape.