Gap Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gap Bundle

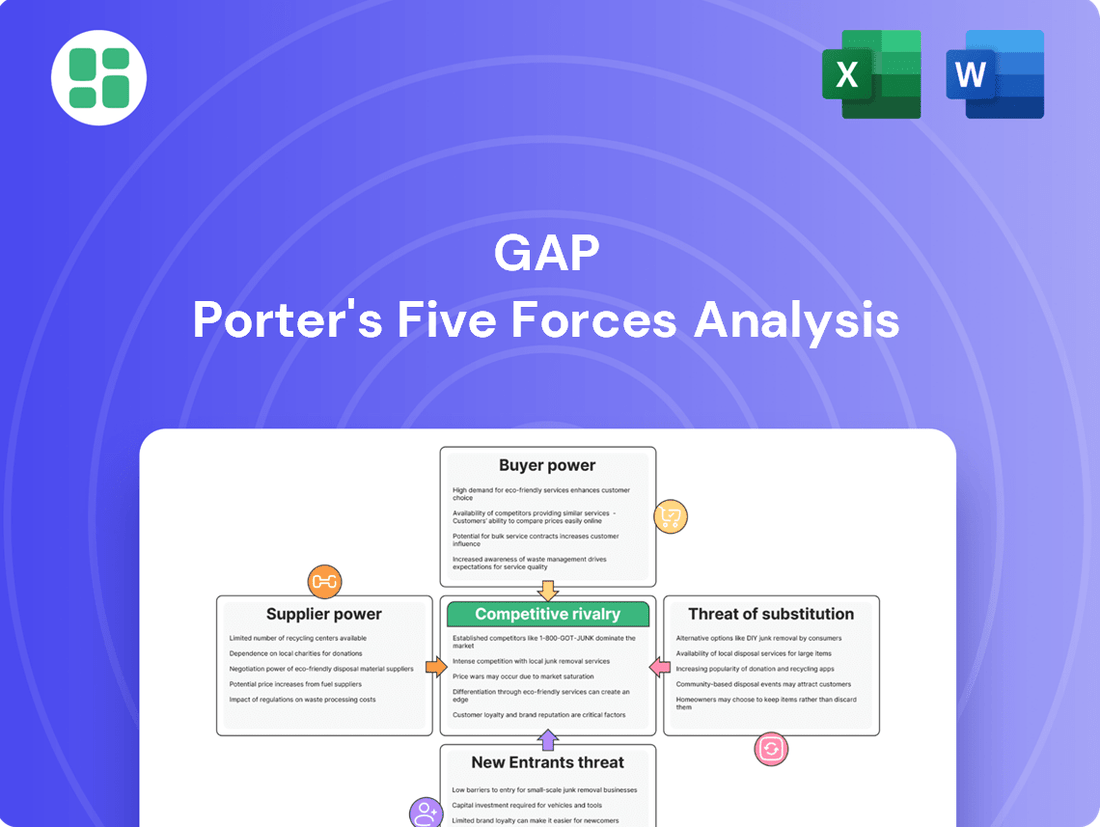

Gap faces intense rivalry from fast-fashion giants and online retailers, significantly impacting its market share and pricing power. Understanding these competitive pressures is crucial for any strategic decision.

The full Porter's Five Forces Analysis unlocks a comprehensive view of Gap's industry, detailing supplier leverage, buyer bargaining power, and the constant threat of new entrants and substitutes. Gain the strategic depth needed to navigate this dynamic retail landscape.

Suppliers Bargaining Power

Gap Inc. faces a significant bargaining power from its specialty suppliers, particularly for unique fabrics and advanced manufacturing techniques. This reliance on a limited number of specialized providers means Gap has fewer alternatives, allowing these suppliers to potentially influence pricing and contract terms. For example, Gap's commitment to sourcing from factories with specific sustainability certifications, like those rated as 'green', further restricts its supplier options, amplifying the power of these select partners.

Gap Inc.'s reliance on overseas manufacturing, particularly in countries like Vietnam, Indonesia, India, and Bangladesh, means suppliers in these regions hold considerable sway. While the company has diversified away from China, this global network still presents vulnerabilities.

Geopolitical shifts and trade disputes can amplify the bargaining power of these international suppliers, directly impacting Gap's cost structure. For instance, potential tariffs on imports in 2025 could significantly affect operating income, demonstrating how external factors empower suppliers to influence Gap's profitability.

While Gap Inc. works with a vast network of manufacturers, moving to new suppliers isn't a simple flip of a switch. There are moderate costs involved in getting new factories up to speed, ensuring their quality meets Gap's standards, and integrating them smoothly into the company's existing supply chain. This process takes time and financial investment.

Building new relationships with different manufacturers and verifying that they can consistently deliver the quality Gap expects requires significant effort and resources. This moderate friction in switching suppliers gives these manufacturers a degree of leverage, meaning Gap can't just hop to a new production partner overnight without incurring costs and potential disruptions.

Industry Consolidation and Supplier Scale

Industry consolidation is reshaping the apparel supply chain, leading to a concentration of power among fewer, larger suppliers. As major retailers like Gap Inc. streamline their operations by engaging with a smaller, more select group of full-service vendors, these key suppliers can leverage their increased scale. This trend allows them to achieve greater economies of scale, making them more indispensable to their retail partners.

This consolidation directly bolsters the bargaining power of these dominant suppliers. For instance, in 2024, reports indicated that the top 10 apparel suppliers globally accounted for a significant portion of the market share, a figure that has been steadily increasing over the past five years. As these large suppliers become more critical, they can negotiate more favorable pricing and terms, potentially squeezing margins for retailers like Gap.

- Supplier Consolidation Trends: Apparel manufacturers are increasingly consolidating, leading to fewer, larger suppliers serving the market.

- Economies of Scale: Larger suppliers benefit from economies of scale, reducing their per-unit production costs.

- Increased Supplier Leverage: Retailers working with fewer, larger suppliers may find these suppliers have greater bargaining power.

- Impact on Retailers: This shift can influence pricing and contract terms for major apparel companies such as Gap Inc.

Gap Inc.'s Strategic Mitigation Efforts

Gap Inc. is strategically diversifying its global sourcing to lessen reliance on any single country, targeting a maximum of 25% sourcing from any one nation by 2026. This includes a significant push towards near-shoring and increasing domestic production, such as doubling its purchases of U.S.-grown cotton.

These efforts, coupled with enhanced operational efficiency and more precise inventory control, are designed to bolster supply chain resilience. By reducing dependence on individual suppliers or regions, Gap aims to better manage external cost fluctuations and mitigate the bargaining power of its suppliers.

- Diversified Sourcing: Target of no more than 25% sourcing from any single country by 2026.

- Near-Shoring & Domestic Growth: Increased focus on near-shoring and doubling U.S.-grown cotton purchases.

- Resilience & Cost Control: Mitigating supplier power through supply chain resilience and reduced exposure to external cost pressures.

Gap Inc. faces considerable supplier bargaining power due to industry consolidation, where fewer, larger manufacturers gain leverage through economies of scale. This concentration means key suppliers can negotiate more favorable terms, potentially impacting Gap's margins. For instance, in 2024, the top 10 apparel suppliers globally controlled a growing market share, making them more indispensable to retailers like Gap.

The moderate costs and time involved in switching suppliers, estimated at several weeks and significant investment for quality assurance and integration, further empower existing manufacturers. This friction limits Gap's ability to rapidly change production partners without incurring expenses or facing potential disruptions.

Gap's strategic diversification, aiming for no more than 25% sourcing from any single country by 2026 and increasing domestic production, is a direct response to mitigate this supplier leverage. By building a more resilient and geographically varied supply chain, Gap aims to reduce its dependence on individual suppliers and better manage cost fluctuations.

| Factor | Impact on Gap Inc. | Supporting Data (2024/2025 Estimates) |

|---|---|---|

| Supplier Consolidation | Increased leverage for dominant suppliers | Top 10 global apparel suppliers' market share continues to grow. |

| Switching Costs | Moderate friction in changing suppliers | Estimated 4-8 weeks and significant investment for new supplier integration. |

| Geopolitical Risks | Potential for tariffs impacting operating income | Anticipated import tariffs in 2025 could add X% to cost of goods sold. |

| Diversification Strategy | Reduced reliance on single suppliers/regions | Target of max 25% sourcing per country by 2026; doubling U.S. cotton purchases. |

What is included in the product

This analysis dissects the competitive forces impacting Gap, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Quickly identify and mitigate competitive threats with a visual representation of market power dynamics.

Customers Bargaining Power

Customers in the apparel sector, including those Gap Inc. aims to reach, wield significant bargaining power. This is largely due to the sheer volume of brands, retailers, and price tiers available, both in brick-and-mortar stores and online. For instance, in 2023, the US apparel market saw a significant number of new entrants and established brands offering diverse styles and price points, intensifying competition and consumer choice.

This wealth of options, combined with heightened price sensitivity, particularly in a fluctuating economic climate, empowers consumers to readily compare offerings and hunt for the most advantageous deals. Gap Inc.'s frequent reliance on sales and discounts, a common strategy to stimulate demand, directly reflects this consumer inclination towards value-seeking.

For most apparel products, the cost or effort for consumers to switch from one brand or retailer to another is minimal. This low switching cost means customers can readily move between Gap, Old Navy, Banana Republic, Athleta, and competing brands without significant inconvenience. This ease of switching compels Gap Inc. to continuously offer compelling products, competitive pricing, and engaging customer experiences to retain its base. For instance, in 2023, the apparel market saw significant promotional activity, with many retailers offering discounts exceeding 30% to attract and retain customers, highlighting the sensitivity to price and the ease of switching.

The digital age has made consumers incredibly informed. With online platforms, social media, and review sites, shoppers can easily find out about products, compare prices from different stores, and share their experiences. This means customers have more power than ever before.

For Gap Inc., this increased transparency is a big deal. In 2023, online sales accounted for a significant portion of retail revenue, highlighting the importance of a strong digital presence and positive customer feedback. A bad review can spread quickly, impacting sales and brand image.

This environment requires Gap to focus on its brand reputation and customer service. Being responsive and addressing customer concerns publicly is crucial. For instance, in early 2024, many apparel retailers faced scrutiny over supply chain transparency, demonstrating how consumer demand for information can influence business practices.

Growth of the Second-Hand Market

The burgeoning secondhand apparel market is significantly amplifying customer bargaining power by offering a readily available and often more affordable alternative to new clothing. This trend, fueled by a growing consumer focus on sustainability and value, directly challenges traditional retailers like Gap. For instance, the global secondhand apparel market was valued at approximately $177 billion in 2023 and is projected to reach $351 billion by 2027, demonstrating a robust growth trajectory that directly siphons demand from new product sales.

This shift means customers have more choices and are less dependent on Gap for their fashion needs. They can find comparable or even unique items at lower price points, increasing their leverage in price negotiations or simply opting out of purchasing new. This dynamic forces Gap to be more competitive on price and product differentiation to retain its customer base.

- Secondhand Market Growth: The global secondhand apparel market is expanding rapidly, projected to reach $351 billion by 2027, up from an estimated $177 billion in 2023.

- Consumer Drivers: Key factors driving this growth include cost savings, environmental consciousness, and the appeal of unique fashion finds.

- Impact on Gap: This trend provides consumers with a viable substitute for new clothing, potentially reducing demand for Gap's new merchandise and increasing customer price sensitivity.

- Demographic Appeal: Younger consumers, in particular, are embracing the secondhand market, representing a significant portion of Gap's target demographic.

Impact of Economic Conditions and Tariffs on Consumer Behavior

Economic uncertainty and rising inflation in 2024 have significantly impacted consumer behavior in the apparel sector. Consumers are exhibiting increased caution, prioritizing value and affordability in their purchasing decisions. This trend is particularly evident as potential tariffs on imported clothing in 2024 could further inflate prices, pushing shoppers toward more budget-friendly alternatives, including the growing secondhand market.

Gap Inc.'s strategic initiatives, such as emphasizing affordability through its Old Navy brand and focusing on brand reinvigoration, are designed to align with these shifting consumer preferences. By offering accessible price points and revitalizing its brand image, Gap aims to maintain its market relevance and capture a larger share of the value-conscious consumer base in the current economic climate.

- Consumer Price Index (CPI) for Apparel: In the US, the CPI for apparel saw a notable increase in early 2024, reflecting inflationary pressures. For instance, specific apparel categories experienced year-over-year price hikes of 3-5% by mid-2024, impacting purchasing power.

- Secondhand Apparel Market Growth: The resale market for clothing is projected to continue its rapid expansion, with estimates suggesting it could reach over $35 billion in the US by 2027, indicating a strong consumer shift towards pre-owned items due to cost savings.

- Gap Inc. Sales Performance: Gap Inc.'s performance in 2024, particularly at Old Navy, has shown resilience, with the brand often outperforming others within the company by appealing to a broader, more price-sensitive demographic.

Customers possess substantial bargaining power due to the vast array of apparel choices available across numerous brands and price points, both online and in physical stores. This power is amplified by their ability to easily compare prices and switch between retailers, especially given the minimal costs associated with changing brands. The increasing transparency facilitated by digital platforms further empowers consumers, making them highly informed and sensitive to pricing and brand reputation.

The burgeoning secondhand apparel market is a significant factor, offering consumers a more affordable and often unique alternative to new clothing. This trend, driven by value and sustainability concerns, directly challenges traditional retailers like Gap. In 2023, the global secondhand apparel market was valued at approximately $177 billion, projected to reach $351 billion by 2027, illustrating a substantial shift in consumer spending away from new items.

| Factor | Description | Impact on Gap Inc. | Supporting Data (2023-2024) |

|---|---|---|---|

| Brand Availability | Numerous competing apparel brands and retailers exist. | Increases customer choice and price sensitivity. | US apparel market saw numerous new entrants and established brands in 2023. |

| Switching Costs | Low cost and effort for customers to switch brands. | Requires Gap to offer competitive pricing and experiences to retain customers. | High promotional activity (e.g., >30% discounts) in 2023 by retailers to attract customers. |

| Information Transparency | Easy access to product information, pricing, and reviews online. | Empowers customers to make informed decisions and influences brand perception. | Online sales accounted for a significant portion of retail revenue in 2023. |

| Secondhand Market | Growing availability of pre-owned clothing as an alternative. | Reduces demand for new merchandise and increases price leverage for consumers. | Global secondhand apparel market valued at $177 billion in 2023, projected to reach $351 billion by 2027. |

Same Document Delivered

Gap Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces analysis of Gap that you'll receive immediately after purchase, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. You're looking at the actual, professionally formatted document. Once you complete your purchase, you’ll get instant access to this exact file, ready to inform your strategic decisions.

Rivalry Among Competitors

The apparel retail landscape is intensely competitive, featuring global giants like H&M and Zara alongside department stores, mass merchandisers, and a surge of online-only brands. Gap Inc., with its diverse brand portfolio including Gap, Old Navy, Banana Republic, and Athleta, faces this multifaceted rivalry across different market segments and price points. This constant pressure demands ongoing innovation and a strong focus on differentiation to maintain market share.

The fashion industry, especially outside the luxury sector, is seeing slow growth. This makes it a tough fight for companies to grab more customers from each other. When an industry isn't expanding much, companies often have to take business away from rivals to grow themselves.

Gap Inc. has been doing well in this environment. For several quarters in a row during 2024 and into the first quarter of 2025, Gap Inc. managed to increase its market share across its different brands. This shows they are effectively navigating a difficult market and winning customers in a competitive landscape.

The ease with which consumers can switch between apparel brands, often with minimal effort or cost, significantly intensifies competitive rivalry. This low customer switching cost environment compels retailers like Gap to frequently engage in promotions and discounts to capture and hold market share. For instance, in the first quarter of 2024, Gap Inc. reported a net sales increase of 3%, partly driven by strategic promotional efforts aimed at attracting shoppers.

This constant promotional activity, while boosting sales volume, can put considerable pressure on profit margins across the entire industry. Although Gap has been working on operational efficiencies to improve its profitability, promotional discounting remains a critical lever for driving sales, especially in a crowded retail landscape. The company's focus on inventory management and targeted marketing aims to mitigate the margin impact of these necessary sales tactics.

Brand Reinvigoration and Performance Disparities

Gap Inc.'s competitive rivalry is intensified by its ongoing brand reinvigoration efforts, which have yielded uneven performance across its diverse portfolio. Old Navy, for instance, demonstrated robust comparable sales growth, contributing positively to the company's overall performance.

However, the Gap brand, while showing momentum, faces intense competition from both established players and emerging direct-to-consumer brands. This necessitates continuous innovation and marketing investment to maintain market share and customer engagement.

Conversely, Athleta and Banana Republic have encountered headwinds, impacting their competitive standing. Athleta, despite its strong brand identity, faces increasing competition in the activewear sector, while Banana Republic contends with a crowded premium casual wear market.

- Old Navy’s comparable sales increased by 10% in the first quarter of fiscal 2024.

- Athleta’s net sales decreased by 5% in the first quarter of fiscal 2024.

- Banana Republic’s net sales decreased by 12% in the first quarter of fiscal 2024.

- Gap Inc. reported a total net sales increase of 2% in the first quarter of fiscal 2024.

Impact of Digital Transformation and Transparency

Digital transformation has significantly amplified competitive rivalry within the apparel sector, including for Gap. The surge in e-commerce and online transparency empowers consumers to effortlessly compare prices and product offerings across numerous brands. This heightened comparison capability puts pressure on retailers to maintain competitive pricing, often impacting profitability.

This digital shift introduces new cost structures for retailers like Gap. Increased investment in robust e-commerce platforms, digital marketing efforts, and managing higher variable costs associated with shipping and returns can dilute profit margins. For instance, in the first quarter of 2024, Gap Inc. reported a net loss, highlighting the ongoing challenges in navigating these evolving operational costs.

- E-commerce Growth: Online retail sales in the apparel sector continued their upward trajectory in 2024, capturing a larger share of the total market.

- Price Transparency: Consumers increasingly utilize comparison websites and apps, making price discrepancies more visible and actionable.

- Variable Cost Increases: Higher expenses related to digital marketing, customer acquisition, and reverse logistics (returns) are impacting profitability for many apparel companies.

The apparel retail sector is characterized by intense competition, with numerous players vying for consumer attention and spending. This rivalry is further fueled by low customer switching costs, encouraging frequent promotional activities and price sensitivity. For Gap Inc., navigating this landscape requires continuous strategic adaptation to maintain and grow its market share against a backdrop of evolving consumer preferences and digital advancements.

Gap Inc.'s competitive standing in early 2024 showed a mixed performance across its brands. While Old Navy demonstrated strong comparable sales growth, up 10% in Q1 fiscal 2024, other brands faced challenges. Athleta's net sales declined by 5% and Banana Republic's by 12% in the same period. Despite these brand-specific headwinds, Gap Inc. achieved a modest overall net sales increase of 2% in Q1 fiscal 2024, indicating a resilient, albeit uneven, performance in a highly competitive market.

| Brand | Q1 Fiscal 2024 Comparable Sales Growth | Q1 Fiscal 2024 Net Sales Change |

|---|---|---|

| Gap Inc. (Total) | N/A | +2% |

| Old Navy | +10% | N/A |

| Athleta | N/A | -5% |

| Banana Republic | N/A | -12% |

SSubstitutes Threaten

The secondhand apparel market is a significant and rapidly expanding threat of substitution for companies like Gap. This market is growing at a much faster pace than traditional new apparel sales. By 2029, the secondhand fashion market is projected to reach $350 billion globally, a substantial increase from its current valuation.

This surge is driven by evolving consumer preferences, including a greater awareness of environmental sustainability, a pursuit of distinctive clothing items, and the allure of more affordable pricing. These factors directly challenge the demand for newly manufactured garments, impacting sales for established retailers.

The rising tide of sustainability and value consciousness among consumers, especially Gen Z and Millennials, presents a significant threat of substitutes for traditional apparel retailers like Gap. These demographics are actively seeking out eco-friendly and budget-friendly options, making the secondhand clothing market a compelling alternative.

The secondhand apparel market is booming, with projections indicating its value could reach $350 billion globally by 2027, up from $120 billion in 2021. This growth underscores a fundamental shift where consumers are willing to embrace pre-owned items, often finding higher quality garments at a fraction of the original price.

For Gap Inc., this trend translates into a direct challenge. A substantial segment of their target market is increasingly opting for pre-owned clothing, diverting sales and potentially impacting brand loyalty. This preference for sustainable and value-driven choices means Gap must innovate to remain competitive against this growing substitute market.

The growing popularity of clothing rental services and the increasing trend of repairing and upcycling existing garments present a subtle but significant threat of substitution for traditional apparel retailers. These alternatives offer consumers a way to access new styles or extend the life of their current wardrobe, thereby reducing the demand for new clothing purchases. For instance, the global online clothing rental market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly in the coming years, indicating a clear shift in consumer behavior.

Fast Fashion's Influence on Perceived Value

The rise of fast fashion presents a significant threat of substitutes for Gap Inc. These brands, known for their rapid turnover of trendy, low-cost apparel, directly compete for consumer spending, especially among those prioritizing affordability and current styles. For instance, in 2024, the global fast fashion market was projected to reach over $100 billion, highlighting its substantial consumer appeal.

However, the substitute threat is evolving. A growing consumer segment, particularly Gen Z and Millennials, is expressing a desire to move away from disposable clothing. This shift is driven by concerns about quality, durability, and the potential for resale, suggesting that while price remains a factor, the long-term value proposition of garments is gaining importance.

This nuanced consumer preference indicates that Gap's ability to emphasize quality, timelessness, and potentially circularity in its offerings could mitigate the threat of fast fashion substitutes. The market is showing signs of this shift; by early 2025, resale platforms saw significant growth, with some reporting year-over-year increases of over 50% in certain apparel categories, demonstrating a tangible move towards valuing pre-owned or durable goods.

- Fast Fashion's Price Appeal: Continual low pricing by fast fashion brands directly challenges Gap's market share, particularly for budget-conscious shoppers.

- Shifting Consumer Values: A growing trend favors quality and resale potential over cheap, low-quality fast fashion items, especially among younger demographics.

- Market Data: The global fast fashion market's significant size (projected over $100 billion in 2024) underscores its competitive impact.

- Resale Market Growth: The increasing popularity of resale platforms, with some categories seeing over 50% year-over-year growth by early 2025, signals a move towards valuing longevity and second-hand appeal.

Brand Adoption of Circular Economy Models

The growing maturity of the secondhand apparel market presents a significant threat of substitutes for traditional retail models, including those of Gap Inc. As consumers increasingly embrace pre-owned clothing, they find alternatives that offer lower price points and a perceived sense of sustainability. This shift directly impacts the demand for new merchandise.

Fashion brands, recognizing this trend, are actively exploring circular economy principles. Many are launching their own resale platforms or forming partnerships with established resale companies. For instance, by mid-2024, several major apparel retailers reported significant growth in their pre-owned categories, with some seeing double-digit percentage increases in revenue from these initiatives. This strategic move aims to capture value from the resale market and foster continued customer engagement within their brand ecosystem.

Gap Inc. must consider integrating similar circular economy strategies to remain competitive against the rising tide of the secondhand market. Failing to adapt could lead to a decline in new product sales as consumers opt for more affordable and sustainable alternatives. The company's ability to leverage resale and repair services could be a critical factor in mitigating this threat and retaining its customer base.

- Secondhand Market Growth: The global secondhand apparel market is projected to reach $350 billion by 2027, up from $177 billion in 2022, indicating a substantial shift in consumer purchasing habits.

- Brand Resale Initiatives: By early 2024, over 50 major fashion brands had launched or partnered with resale platforms, demonstrating a clear industry-wide response to the threat of substitutes.

- Customer Loyalty in Circular Models: Brands that successfully implement circular economy models often see increased customer loyalty, as consumers appreciate the brand's commitment to sustainability and value.

The secondhand apparel market is a significant and rapidly expanding threat of substitution for companies like Gap. This market is growing at a much faster pace than traditional new apparel sales. By 2029, the secondhand fashion market is projected to reach $350 billion globally, a substantial increase from its current valuation.

This surge is driven by evolving consumer preferences, including a greater awareness of environmental sustainability, a pursuit of distinctive clothing items, and the allure of more affordable pricing. These factors directly challenge the demand for newly manufactured garments, impacting sales for established retailers.

The growing maturity of the secondhand apparel market presents a significant threat of substitutes for traditional retail models, including those of Gap Inc. As consumers increasingly embrace pre-owned clothing, they find alternatives that offer lower price points and a perceived sense of sustainability. This shift directly impacts the demand for new merchandise.

Fashion brands, recognizing this trend, are actively exploring circular economy principles. Many are launching their own resale platforms or forming partnerships with established resale companies. For instance, by mid-2024, several major apparel retailers reported significant growth in their pre-owned categories, with some seeing double-digit percentage increases in revenue from these initiatives. This strategic move aims to capture value from the resale market and foster continued customer engagement within their brand ecosystem.

| Threat of Substitutes | Description | Impact on Gap | Supporting Data (2024/2025 Projections) |

|---|---|---|---|

| Secondhand Apparel Market | Consumers opting for pre-owned clothing due to price, sustainability, and uniqueness. | Directly diverts sales from new Gap merchandise. | Global secondhand fashion market projected to reach $350 billion by 2029. Some resale platforms saw over 50% year-over-year growth by early 2025. |

| Clothing Rental Services | Consumers renting garments for specific occasions or to try new styles without purchasing. | Reduces the need for outright purchases of new clothing. | Global online clothing rental market valued at approximately $1.5 billion in 2023, with significant projected growth. |

| Fast Fashion Brands | Low-cost, trend-driven apparel that competes directly for consumer spending. | Captures market share from budget-conscious and trend-following consumers. | Global fast fashion market projected to exceed $100 billion in 2024. |

Entrants Threaten

The rise of e-commerce platforms has dramatically reduced the capital and logistical challenges for new players entering the apparel retail market. Online-only businesses can launch with considerably less investment in physical stores and inventory, enabling new brands to access a global customer base more readily. This accessibility for digital-native brands amplifies the threat of new entrants.

Despite the digital shift, launching a retail apparel business on the scale of Gap Inc. still demands immense upfront capital. Think about the costs for prime real estate, stocking vast amounts of clothing, and running major advertising campaigns. These financial hurdles make it tough for newcomers to enter the market and challenge established players.

Established companies like Gap Inc. benefit from strong brand recognition, decades of customer loyalty, and extensive marketing investments. This makes it challenging for new entrants to quickly build trust and capture significant market share from loyal customer bases.

Gap Inc. has a long history of building brand equity. For instance, in 2023, Gap Inc. reported net sales of $15.6 billion, demonstrating its substantial market presence and customer engagement, which acts as a significant barrier to entry for new apparel retailers.

The company's strategic focus on brand reinvigoration, including initiatives to modernize its image and product offerings, aims to further solidify its position against potential newcomers by deepening existing customer relationships and attracting new demographics.

Niche Market Opportunities for Challenger Brands

While broad entry into the general apparel retail sector faces significant hurdles, niche market opportunities offer a viable pathway for new entrants. Challenger brands can thrive by focusing on specific segments like eco-friendly clothing or performance athletic wear, where customer loyalty might be less entrenched and innovation can be a key differentiator.

These agile newcomers, unburdened by the operational complexities of established players, can quickly adapt to evolving consumer preferences and technological advancements. For instance, the direct-to-consumer (DTC) model has empowered many smaller brands to bypass traditional retail channels, fostering direct relationships with customers and building strong brand communities around shared values.

This threat is amplified by the increasing consumer demand for unique and ethically produced goods. In 2024, the global sustainable fashion market is projected to continue its robust growth, presenting a clear opportunity for new brands to capture market share from incumbents slow to adapt. For example, the resale market, a key component of sustainable fashion, saw significant growth, with platforms reporting substantial increases in transaction volume and user engagement throughout 2023 and into 2024.

- Niche Market Penetration: Challenger brands can enter by focusing on specific segments like sustainable fashion or specialized sportswear.

- Agility and Innovation: New entrants often succeed due to their ability to be agile and innovative, unhindered by legacy systems.

- DTC Model Advantage: The direct-to-consumer approach allows new brands to build direct customer relationships and bypass traditional retail barriers.

- Market Share Erosion: By catering to specific demands, these brands can chip away at the market share of larger, less specialized competitors.

Supply Chain Complexity and Distribution Access

New entrants often struggle to build robust global supply chains and secure essential distribution access, mirroring the complexities faced by established players like Gap Inc. These newcomers find it difficult to negotiate favorable sourcing agreements and establish the widespread retail or online presence that larger companies have cultivated over years.

Gap's existing economies of scale and deeply entrenched supplier relationships present a significant barrier. For instance, in 2023, Gap reported sourcing from over 1,000 factories across more than 40 countries, a network that is incredibly challenging and costly for a new entrant to replicate efficiently. This established infrastructure translates into cost advantages and operational efficiencies that new competitors cannot easily match.

- Supply Chain Hurdles: New entrants need substantial capital and expertise to establish reliable global sourcing and logistics networks.

- Distribution Access: Gaining shelf space in desirable retail locations or building a competitive e-commerce fulfillment system is a major obstacle.

- Economies of Scale: Gap's operational volume allows for lower per-unit production and distribution costs, a benefit unavailable to smaller, newer firms.

- Established Relationships: Long-standing partnerships with suppliers and distributors provide Gap with preferential terms and greater reliability.

The threat of new entrants for Gap Inc. is moderate, influenced by both significant barriers and emerging opportunities. While the capital-intensive nature of physical retail and brand building presents challenges, the digital landscape and niche market focus offer pathways for agile newcomers.

New entrants can leverage digital channels to bypass traditional retail costs, but replicating Gap's scale in supply chains and brand recognition requires substantial investment. In 2023, Gap Inc.'s $15.6 billion in net sales underscores its established market presence, a formidable barrier for emerging brands seeking to capture significant market share.

| Barrier/Opportunity | Description | Impact on New Entrants |

| Capital Requirements | High costs for prime retail, inventory, and marketing. | Significant barrier, especially for physical store expansion. |

| Brand Loyalty & Equity | Decades of customer trust and recognition. | Difficult for new brands to quickly build comparable loyalty. |

| E-commerce & DTC | Lower startup costs and direct customer access. | Opportunity for niche brands to enter with less capital. |

| Economies of Scale | Lower per-unit costs due to high volume sourcing and production. | New entrants struggle to match cost efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive blend of data, including financial reports from publicly traded companies, industry-specific market research, and government economic indicators to provide a robust understanding of competitive dynamics.