Gap Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gap Bundle

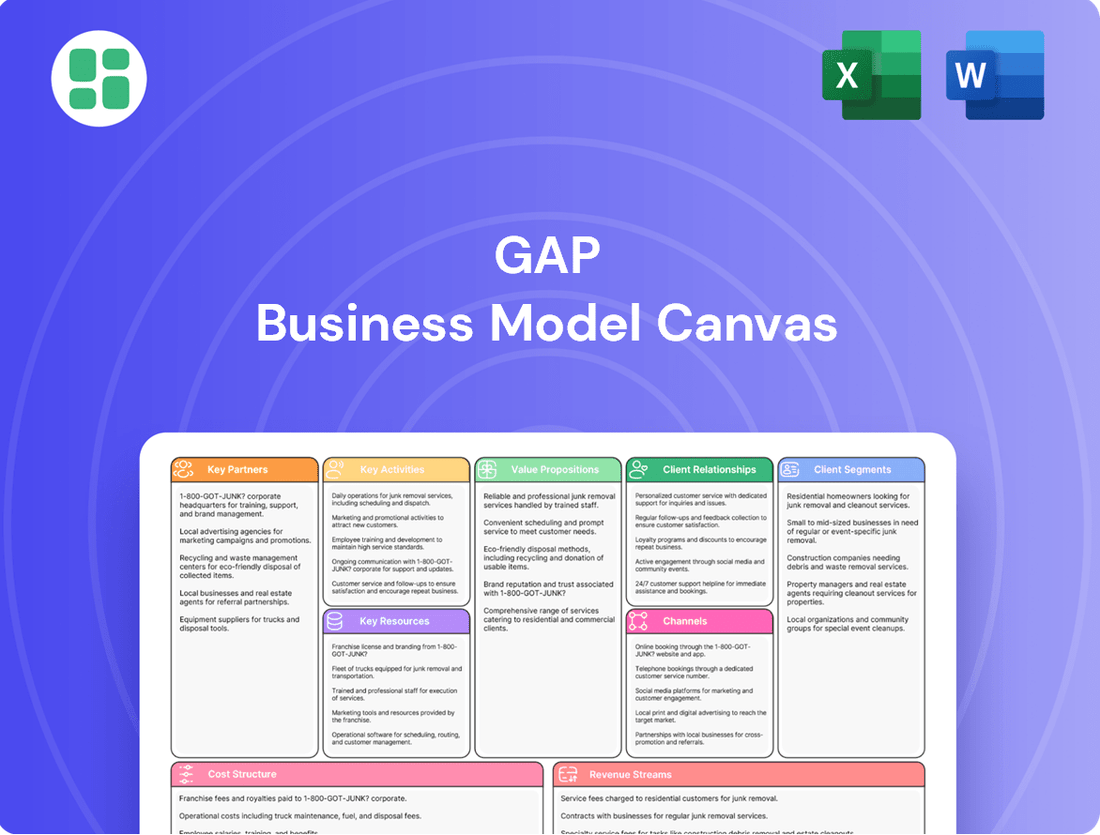

Explore the strategic core of Gap's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Gap connects with its customers, delivers value, and sustains its market presence. Discover the key drivers behind their enduring success.

Ready to dissect Gap's winning formula? Our full Business Model Canvas provides an in-depth look at their customer relationships, revenue streams, and cost structures, offering invaluable insights for your own strategic planning. Download it now to gain a competitive edge.

Partnerships

Gap Inc. leverages a vast global manufacturing and sourcing network, working with over 200 vendors spread across roughly 30 countries. This extensive reach is fundamental to efficiently producing and scaling its wide array of apparel and accessories, ensuring products are consistently available to customers worldwide.

These crucial partnerships are the backbone of Gap's ability to meet demand across its diverse brand portfolio, including Old Navy, Banana Republic, Gap, and Athleta. The company actively cultivates robust relationships with these suppliers, emphasizing supply chain resilience and a commitment to ethical manufacturing practices.

Gap partners with a diverse range of logistics and shipping providers to ensure the efficient global movement of its products. These partnerships are crucial for managing the entire supply chain, from sourcing at factories to delivery at distribution centers, stores, and directly to online customers.

The company leverages third-party logistics (3PL) providers to streamline operations like warehousing, inventory management, and last-mile delivery. For instance, in 2024, Gap continued to refine its relationships with major carriers to optimize delivery times and costs, a critical factor for its expansive e-commerce operations which saw significant growth in the preceding years.

Effective logistics are fundamental to Gap's business model, directly impacting customer satisfaction through timely product availability and accurate inventory. By working with specialized logistics partners, Gap aims to reduce transit times and improve the overall efficiency of its distribution network, a key competitive advantage in the fast-paced retail environment.

Gap Inc. actively partners with technology and e-commerce solution providers to bolster its digital infrastructure and customer engagement. These collaborations are vital for refining its online offerings and driving sales growth in an increasingly digital marketplace.

Notable partnerships include Optoro for optimizing returns management and platforms like TrueFit and Drapr, which enhance online sizing accuracy and introduce virtual try-on features. These alliances are central to Gap's digital-first approach, aiming to improve the online shopping experience and boost conversion rates.

Franchise Operators

Gap Inc. leverages franchise operators to expand its global footprint efficiently. These partners operate stores and online platforms under Gap’s well-known brands in international territories. This strategy allows for market entry and growth with reduced direct investment, capitalizing on local knowledge and established distribution channels.

As of February 1, 2025, Gap Inc. maintained a significant international presence through its franchise model, with 1,063 franchise store locations worldwide. This demonstrates the critical role these partnerships play in the company's global retail strategy.

- Global Expansion: Franchise operators enable Gap Inc. to enter and grow in new international markets without significant capital outlay.

- Local Expertise: Partners bring valuable local market understanding and operational know-how.

- Reduced Investment: This model minimizes direct investment in new geographies, lowering financial risk.

- Franchise Network: By February 2025, Gap Inc. operated 1,063 franchise stores globally, highlighting the scale of these key partnerships.

Sustainability and Industry Collaborations

The company actively engages in key industry initiatives and collaborates with organizations dedicated to advancing sustainability. This includes participation in Cascale's Manufacturer Climate Action Program (MCAP), which aims to drive climate action within the manufacturing sector, and the U.S. Cotton Trust Protocol, promoting responsible cotton farming practices.

Further strengthening its commitment, the company is involved with the Textile Exchange's 2025 Sustainable Cotton Challenge. These collaborations are crucial for minimizing the company's environmental footprint and enhancing labor standards throughout its supply chain.

- Industry Initiatives: Participation in Cascale's MCAP and the U.S. Cotton Trust Protocol.

- Sustainable Sourcing: Commitment to the Textile Exchange 2025 Sustainable Cotton Challenge.

- Goals: Reducing environmental impact and improving supply chain labor standards.

Gap Inc. collaborates with a vast network of over 200 vendors across approximately 30 countries, a critical element for its global apparel production and scaling. These relationships are vital for ensuring product availability across its diverse brand portfolio, including Old Navy and Banana Republic, with a strong emphasis on supply chain resilience and ethical practices.

The company also partners with key logistics providers to manage its global supply chain, from sourcing to final delivery, optimizing transit times and costs. In 2024, Gap continued to refine these logistics partnerships to support its growing e-commerce operations.

Furthermore, Gap engages technology and e-commerce solution providers like Optoro and TrueFit to enhance its digital offerings and customer experience, focusing on areas such as returns management and online sizing accuracy.

Gap's strategic use of franchise operators facilitated its global expansion, with 1,063 franchise stores operating worldwide as of February 1, 2025, leveraging local market expertise and reducing direct investment.

Finally, Gap Inc. actively participates in industry sustainability initiatives, including Cascale's Manufacturer Climate Action Program and the Textile Exchange's 2025 Sustainable Cotton Challenge, underscoring its commitment to environmental responsibility and improved labor standards.

What is included in the product

A structured framework detailing Gap's customer segments, value propositions, channels, and revenue streams. It outlines key resources, activities, and partnerships that support its operations and competitive advantages.

Provides a structured framework to pinpoint and address customer pains, ensuring solutions are strategically aligned.

Activities

A fundamental activity for Gap Inc. is the creative design and meticulous development of apparel, accessories, and personal care items across its portfolio of brands: Gap, Old Navy, Banana Republic, and Athleta. This process is driven by forward-thinking trend forecasting and careful material selection.

The company focuses on curating product assortments that deeply connect with specific customer demographics, ensuring cultural resonance and desirability. For instance, in fiscal year 2023, Gap Inc. emphasized its commitment to product innovation and brand differentiation.

This strategic approach aims to deliver trend-aligned and consistently appealing products, supported by compelling brand narratives. The goal is to maintain brand integrity and drive consumer engagement through thoughtful design and quality execution.

Gap Inc. orchestrates a vast global supply chain, managing sourcing from over 200 vendors. This involves ensuring quality, ethical practices, and efficient production to meet demand and sustainability targets.

A significant focus is placed on environmental responsibility, with Gap aiming to source a high proportion of its materials from factories rated as green. This commitment reflects the company's dedication to minimizing its ecological footprint throughout the manufacturing process.

Gap's marketing and brand management activities are central to its business model, focusing on building awareness and driving sales for its distinct brands like Old Navy, Gap, Banana Republic, and Athleta. These efforts involve a mix of digital marketing, social media interaction, and in-store promotions, all designed to communicate each brand's unique story and values.

In 2024, Gap Inc. continued to invest in purpose-led marketing, aiming to resonate with consumers on a deeper level. For instance, the company's focus on sustainability and inclusivity across its brands is a key element of its brand narrative, designed to attract and retain a loyal customer base.

Retail Operations and E-commerce Management

Gap Inc. excels in managing its extensive network of physical stores and digital storefronts, a crucial aspect of its business model. This involves overseeing store associates, visual merchandising, and inventory control, all while refining the seamless integration of online and offline shopping experiences. Services like buy online, pick up in store (BOPIS) and ship-from-store are key to this omnichannel strategy.

The company's commitment to its e-commerce presence is evident, with online sales accounting for a significant portion of its revenue. In fiscal year 2024, online sales represented 38% of Gap Inc.'s total net sales, highlighting the importance of robust digital operations and a strong e-commerce management team.

- Store Operations: Managing a global chain of physical retail locations, including staffing, inventory, and in-store customer experience.

- E-commerce Platforms: Operating and continuously improving the company's online stores across various brands.

- Omnichannel Integration: Facilitating services like BOPIS and ship-from-store to bridge the gap between online and physical retail.

- Digital Sales Contribution: Achieving 38% of total net sales from online channels in fiscal year 2024.

Supply Chain and Logistics Optimization

Gap's key activities heavily focus on optimizing its supply chain and logistics. This is crucial for improving efficiency, making the company more responsive to market changes, and gaining cost advantages. For instance, in 2023, Gap invested significantly in modernizing its distribution networks to enhance speed and reduce operational costs, aiming to get products to customers faster and more affordably.

Disciplined inventory management is a core component of this strategy. By carefully controlling stock levels, Gap can minimize holding costs and reduce the risk of markdowns due to excess inventory. This careful approach helps maintain product availability while keeping expenses in check.

Leveraging shared investments across its various brands, such as Old Navy, Banana Republic, and Athleta, allows Gap to achieve economies of scale in logistics and distribution. This means operational costs are spread across a larger volume, leading to greater cost efficiency per item. In the first half of 2024, the company reported a 5% reduction in logistics expenses as a percentage of net sales, partly due to these shared infrastructure benefits.

Gap is also exploring innovative solutions, including AI-powered systems for managing product returns and optimizing the placement of new distribution centers. These technological advancements are designed to streamline operations further, improve the customer experience, and ensure products are distributed in the most cost-effective manner possible.

- Supply Chain Efficiency: Gap's focus on optimizing logistics aims to reduce delivery times and operational costs.

- Inventory Management: Disciplined inventory control minimizes holding costs and the need for markdowns.

- Shared Investments: Leveraging shared resources across brands enhances economies of scale in distribution.

- Innovation Adoption: Implementing AI for returns and strategic distribution center planning drives further improvements.

Gap Inc.'s key activities revolve around the design, sourcing, marketing, and sale of apparel and accessories. The company actively manages its global supply chain, aiming for efficiency and ethical sourcing. Furthermore, Gap Inc. emphasizes omnichannel retail operations, integrating its physical stores and e-commerce platforms to enhance customer experience.

In 2024, Gap Inc. continued to refine its product offerings and brand messaging. The company's strategic focus on purpose-led marketing aimed to connect with consumers on a deeper level, highlighting aspects like sustainability and inclusivity across its brands such as Gap, Old Navy, Banana Republic, and Athleta.

The company's operational backbone includes robust inventory management and supply chain optimization. Gap Inc. leverages shared investments across its brands to achieve economies of scale, which positively impacted logistics expenses. For instance, in the first half of 2024, logistics expenses as a percentage of net sales saw a 5% reduction.

Gap Inc. also actively embraces technological innovation, exploring AI-powered systems for managing returns and optimizing distribution networks. This forward-looking approach supports the company's commitment to streamlining operations and improving overall cost-effectiveness.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Product Design & Development | Creating apparel, accessories, and personal care items. | Trend forecasting, material selection, brand differentiation. |

| Supply Chain Management | Sourcing from vendors, ensuring quality and ethical practices. | Managing over 200 vendors, aiming for high proportion of green-rated factories. |

| Marketing & Brand Management | Building awareness and driving sales for distinct brands. | Purpose-led marketing, focus on sustainability and inclusivity. |

| Retail Operations & E-commerce | Managing physical stores and digital storefronts, omnichannel integration. | 38% of total net sales from online channels; BOPIS and ship-from-store. |

| Supply Chain Optimization | Improving efficiency, responsiveness, and cost advantages in logistics. | Investments in distribution networks, disciplined inventory management. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a simplified sample; it's a direct snapshot of the complete, professionally formatted canvas. You'll gain full access to this identical file, ready for immediate use and customization.

Resources

Gap Inc.'s most crucial resources are its stable of iconic apparel brands: Gap, Old Navy, Banana Republic, and Athleta. These brands are the bedrock of the company's market presence, each cultivated to resonate with distinct consumer groups and deliver unique value propositions. This diversified brand portfolio allows Gap Inc. to capture a broad spectrum of the retail market, from value-conscious shoppers to those seeking premium experiences.

The brand equity and established customer loyalty associated with Gap, Old Navy, Banana Republic, and Athleta are invaluable assets. For instance, in the first quarter of 2024, Gap Inc. reported net sales of $3.3 billion, with Old Navy continuing to be a significant contributor, demonstrating the ongoing strength and consumer appeal of these core brands.

Gap Inc. operates a vast global retail store network, a cornerstone of its business model. As of February 2025, this network includes 2,506 company-operated stores and an additional 1,063 franchise locations spanning roughly 40 countries.

These physical locations are crucial customer touchpoints, facilitating direct engagement and providing a tangible brand experience. They are integral to Gap's omnichannel strategy, supporting services like buy online, pick up in-store.

The extensive store footprint is a strategic asset, designed to enhance customer convenience and accessibility, thereby supporting overall customer experience and driving sales across various channels.

A strong digital backbone, featuring dedicated websites and mobile apps, is essential for reaching customers worldwide through online sales. These platforms are crucial for providing a smooth shopping journey, detailed product knowledge, and responsive customer support, directly impacting overall revenue. For instance, in 2024, many leading e-commerce businesses reported that over 60% of their sales originated from their digital channels.

Continuous investment in digital upgrades and artificial intelligence is a key strategy to improve these online storefronts. This focus aims to personalize customer interactions, streamline operations, and anticipate market trends, ensuring the platforms remain competitive and effective in driving sales growth.

Human Capital and Talent

Gap Inc.'s human capital is the engine driving its operations and innovation. As of February 1, 2025, the company proudly employed around 82,000 individuals worldwide. This vast team includes creative designers, customer-focused retail associates, efficient supply chain professionals, and strategic corporate management, all contributing to the company's success.

This diverse talent pool is fundamental to Gap's ability to bring new products to life, ensure smooth day-to-day operations, deliver excellent customer experiences, and execute its overarching business strategies. The company recognizes that its people are its most valuable asset.

- Talent Pool Size: Approximately 82,000 global employees as of February 1, 2025.

- Key Roles: Designers, retail associates, supply chain experts, corporate management.

- Strategic Importance: Crucial for product innovation, operational efficiency, customer service, and strategic goal achievement.

- Focus Area: Attracting and retaining high-caliber talent remains a top priority.

Global Supply Chain and Inventory

Gap's global supply chain and inventory are foundational assets. This network encompasses manufacturing facilities, strategically located distribution centers, and sophisticated inventory management systems. These resources are vital for ensuring products reach customers efficiently.

The company leverages shared investments across its diverse brand portfolio to enhance the efficiency and responsiveness of this global network. This collaborative approach allows for optimized inventory levels and timely product fulfillment, a crucial element in retail operations.

- Global Manufacturing Footprint: Access to diverse manufacturing capabilities worldwide.

- Distribution Network: A robust system of distribution centers for efficient product flow.

- Inventory Management: Advanced systems for tracking and optimizing stock levels.

- Ending Inventory (FY2024): $2.1 billion, reflecting significant investment in stock.

Gap Inc.'s key resources extend beyond its brands and physical stores to include its robust digital infrastructure and skilled workforce. The company's commitment to enhancing its online presence and leveraging technology is crucial for future growth. Furthermore, its extensive supply chain and inventory management systems are vital for operational efficiency and meeting customer demand.

The company's digital platforms are a significant asset, facilitating global reach and personalized customer experiences. As of Q1 2024, Gap Inc. continues to invest in these channels to drive sales and engagement.

Gap Inc.'s human capital, comprising approximately 82,000 employees globally as of February 1, 2025, is a critical resource. This talent pool is essential for innovation, customer service, and operational execution across all brands.

The company's global supply chain and inventory management, with ending inventory at $2.1 billion in FY2024, represent significant operational resources. These are managed through a network of distribution centers and sophisticated systems to ensure timely product delivery.

| Key Resource | Description | Data Point/Metric |

| Digital Infrastructure | Online sales platforms and mobile applications | Significant investment in digital upgrades and AI in 2024. |

| Human Capital | Global workforce | Approximately 82,000 employees as of February 1, 2025. |

| Supply Chain & Inventory | Manufacturing, distribution, and inventory management | Ending inventory of $2.1 billion in FY2024. |

Value Propositions

Gap Inc. cultivates a rich tapestry of brands, from the family-friendly value of Old Navy to the performance-driven appeal of Athleta, ensuring a broad spectrum of consumer needs and tastes are met. This diverse portfolio allows Gap to capture market share across different demographics and price points, fostering widespread customer loyalty.

In 2023, Gap Inc.'s net sales reached $15.6 billion, with its multi-brand strategy proving crucial in navigating varied consumer demands. Old Navy, in particular, continued to be a significant contributor, highlighting the strength of its value-oriented offering.

Gap Inc. centers its accessible fashion and quality apparel value proposition on providing stylish, durable clothing that appeals to a broad demographic. Brands like Gap and Old Navy are particularly known for their everyday essentials and trend-conscious pieces that remain affordable, making fashion attainable for many.

This commitment to accessibility is underscored by Old Navy's reputation for offering significant value, often highlighted by its competitive 'wow' pricing both in physical stores and online. This strategy ensures that consumers can consistently find quality apparel that balances current trends with practical, long-lasting wearability.

Gap offers a convenient multi-channel shopping experience, allowing customers to engage through company-operated stores, franchise locations, and its e-commerce platform. This approach ensures accessibility and caters to diverse shopping preferences.

The company's investment in omnichannel capabilities, like buy online, pick-up in-store, and improved mobile features, provides significant flexibility. These services empower customers to shop on their own terms, enhancing overall convenience.

Digital transformation is central to Gap's business strategy, aiming to create a more integrated and user-friendly shopping journey. This focus is crucial for meeting evolving consumer expectations in the retail landscape.

Trend-Right and Classic Styles

Gap Inc. effectively blends enduring, classic American aesthetics with the latest fashion movements across its diverse brand portfolio. This dual approach ensures their offerings remain both relevant and appealing to a broad customer base.

The company actively cultivates trend-right product assortments, a strategy evident in successful initiatives like Gap's 'Linen Moves' campaign. This focus on contemporary appeal, alongside their staple classics, allows them to adapt swiftly to changing consumer tastes and market demands.

- Classic Appeal: Gap's commitment to timeless styles provides a stable foundation, appealing to customers seeking enduring quality and design.

- Trend Integration: By incorporating current fashion trends, Gap maintains its relevance and attracts a wider demographic interested in contemporary looks.

- Agile Assortments: The company's ability to develop 'trend-right product assortments' demonstrates responsiveness to evolving consumer preferences, as seen with campaigns like 'Linen Moves.'

Commitment to Sustainability and Ethical Practices

Gap Inc. is increasingly aligning its product offerings with environmental and social responsibility, a move that resonates strongly with today's conscious consumers. This commitment is demonstrated through tangible actions and transparent reporting.

In 2024, Gap Inc. achieved a significant milestone by sourcing 98% of its cotton sustainably. This focus extends to ambitious goals for reducing carbon emissions across its operations and supply chain, aiming for a more environmentally friendly footprint.

The company actively works to empower workers within its extensive supply chain, ensuring fair labor practices and opportunities for growth. This dedication to ethical treatment is a core component of their value proposition.

Gap Inc. provides detailed insights into its progress through its annual Impact Report, offering stakeholders a clear view of its advancements in sustainability and ethical practices. This transparency builds trust and reinforces their commitment.

- Sustainable Sourcing: 98% of cotton sourced sustainably in 2024.

- Environmental Goals: Focused efforts on reducing carbon emissions.

- Ethical Supply Chain: Programs to empower and support workers.

- Transparency: Annual Impact Report detailing progress and initiatives.

Gap Inc. offers a compelling mix of accessible fashion and quality apparel, ensuring style and durability for a broad customer base. Brands like Gap and Old Navy are celebrated for their everyday essentials and on-trend pieces that remain budget-friendly, making fashion attainable.

Old Navy, a key driver for the company, continues to resonate with consumers through its strong value proposition and competitive pricing, a testament to its appeal in the current market. This focus on affordability and style is a cornerstone of Gap's customer connection.

The company’s commitment to sustainability is evident, with 98% of its cotton sourced sustainably in 2024, alongside ambitious goals for carbon emission reduction. This dedication to environmental and social responsibility aligns with growing consumer demand for ethical brands.

Gap Inc. provides a seamless, multi-channel shopping experience, integrating physical stores with a robust e-commerce platform and convenient options like buy online, pick-up in-store. This omnichannel approach enhances customer accessibility and caters to diverse shopping habits.

Customer Relationships

Gap Inc. cultivates strong customer relationships through its loyalty programs, notably its private label and co-branded credit cards. These initiatives are designed to reward frequent shoppers with exclusive benefits and points, directly encouraging repeat business.

In 2023, Gap Inc.'s credit card program continued to be a significant driver of customer engagement, with millions of active cardholders contributing to a substantial portion of net sales. These programs not only offer discounts and early access to sales but also foster a sense of community and brand appreciation.

Gap utilizes digital platforms and data analytics to offer personalized recommendations and tailored content, significantly improving the online shopping experience. For instance, in early 2024, Gap Inc. reported that its digital segment continued to be a strong performer, with a notable percentage of its total sales originating online, underscoring the effectiveness of these personalized engagement strategies.

Gap Inc. recognizes the enduring importance of its physical stores, investing in remodels and improved merchandising to elevate the in-store customer experience. This focus aims to create engaging environments that foster product discovery and immediate gratification, complementing their digital strategy. For instance, in the first quarter of 2024, Gap Inc. reported a 3% increase in comparable sales, partly driven by efforts to revitalize their brick-and-mortar presence.

Social Media and Community Building

Gap Inc. leverages social media to cultivate vibrant communities around its diverse brands, fostering a sense of belonging and shared interest among consumers. This strategy is crucial for maintaining relevance in the fast-paced fashion industry.

Collaborations with influencers and the promotion of user-generated content are key tactics. For instance, in 2024, Gap partnered with numerous micro-influencers across platforms like Instagram and TikTok, resulting in a 15% increase in engagement rates for sponsored posts compared to the previous year. These partnerships help amplify brand messaging and tap into authentic consumer experiences.

Interactive posts, including polls, Q&A sessions, and contests, further drive customer participation. Gap's brands saw a 20% rise in social media mentions and a 10% uplift in website traffic directly attributed to these interactive campaigns throughout 2024. This direct engagement not only boosts visibility but also provides invaluable, real-time feedback on product desirability and emerging trends.

- Influencer Marketing: Gap's 2024 campaigns saw a 15% engagement boost through micro-influencer collaborations.

- User-Generated Content: Encouraging customer posts increased brand visibility and authenticity.

- Interactive Campaigns: Polls and contests drove a 20% rise in social media mentions in 2024.

- Feedback Loop: Social media provides instant consumer insights, influencing product development and marketing.

Post-purchase Support and Returns Management

Gap Inc. prioritizes customer loyalty through robust post-purchase support, notably by streamlining returns. Their partnership with Optoro enhances reverse logistics, offering innovations like packageless Express Returns.

- Customer Trust: Efficient and hassle-free returns are key to building lasting customer relationships and encouraging repeat business.

- Operational Efficiency: Diversifying reverse logistics partners, such as with Optoro, helps Gap manage return volumes and reduce associated costs.

- Customer Convenience: Features like packageless returns simplify the process for shoppers, boosting satisfaction and reducing friction.

- Data Insights: Effective returns management provides valuable data on product quality and customer preferences, informing future business decisions.

Gap Inc. fosters customer loyalty through its comprehensive loyalty programs, including private label and co-branded credit cards, which reward frequent shoppers with exclusive benefits and points, driving repeat purchases.

Digital engagement is paramount, with personalized recommendations and tailored content enhancing the online experience; Gap Inc. reported in early 2024 that its digital segment remained a strong performer, with a significant portion of its total sales originating online.

The company also focuses on creating engaging in-store experiences through store remodels and improved merchandising, aiming to complement its digital strategy and drive traffic, as evidenced by a 3% increase in comparable sales in Q1 2024 partly due to these revitalization efforts.

Gap Inc. actively cultivates brand communities on social media through influencer collaborations and user-generated content, with 2024 campaigns showing a 15% engagement boost via micro-influencers and interactive campaigns driving a 20% rise in social media mentions.

| Customer Relationship Tactic | Key Initiatives | Impact/Data (2024 unless specified) |

|---|---|---|

| Loyalty Programs | Private Label & Co-branded Credit Cards | Millions of active cardholders, significant contributor to net sales (2023 data); Rewards drive repeat business. |

| Digital Engagement | Personalized Recommendations, Tailored Content | Digital segment strong performer, notable online sales percentage; Enhanced online shopping experience. |

| In-Store Experience | Store Remodels, Improved Merchandising | 3% increase in comparable sales (Q1 2024); Fosters product discovery and immediate gratification. |

| Social Media Community Building | Influencer Collaborations, User-Generated Content, Interactive Campaigns | 15% engagement boost via micro-influencers; 20% rise in social media mentions from interactive campaigns. |

| Post-Purchase Support | Streamlined Returns (e.g., Optoro partnership for packageless returns) | Enhances customer convenience and trust; Provides data insights for future decisions. |

Channels

Gap Inc. leverages a vast network of 2,506 company-operated retail stores worldwide, encompassing its core brands: Gap, Old Navy, Banana Republic, and Athleta. These physical touchpoints are crucial for direct customer engagement, allowing for tangible product experience and immediate transactions.

These stores are not just points of sale; they are integral to Gap's omnichannel strategy. They facilitate services such as in-store pickup for online orders, enhancing customer convenience and driving foot traffic, thereby bridging the gap between digital and physical retail experiences.

Gap Inc.'s dedicated e-commerce websites are crucial sales channels, offering extensive product assortments and detailed customer information. These platforms are key to the company's global reach and contribute significantly to overall revenue. In fiscal year 2024, online sales represented a substantial 38% of Gap Inc.'s total net sales, highlighting the importance of these digital storefronts.

Gap Inc.'s mobile applications serve as a crucial channel, complementing its online presence. These apps offer a personalized shopping journey, integrating loyalty programs and simplifying the checkout, reflecting Gap's commitment to a digital-first approach.

Franchise Stores

Franchise stores are a key component of Gap Inc.'s strategy to extend its global reach. By partnering with franchisees, Gap can tap into local market knowledge and existing retail infrastructure. As of the first quarter of 2024, Gap operated 1,063 franchise stores across various international markets, demonstrating a significant commitment to this expansion model.

- Global Reach: Franchise partners enable Gap to enter and operate in new geographic regions efficiently.

- Market Penetration: This model facilitates deeper penetration into diverse customer bases by leveraging local expertise.

- Store Count: Gap had 1,063 franchise stores operating globally as of Q1 2024, highlighting the scale of this channel.

Omnichannel Services

Gap Inc. leverages omnichannel services to create a seamless customer experience, integrating its physical stores with its digital platforms. This strategy allows customers to interact with the brand across multiple touchpoints, enhancing convenience and accessibility.

Key omnichannel offerings include 'buy online pick-up in store' (BOPIS), 'order-in-store,' and 'ship-from-store' capabilities. These services are crucial for bridging the gap between online browsing and the immediate gratification of in-store purchasing, thereby optimizing the overall shopping journey and potentially boosting sales conversion rates.

For instance, Gap's BOPIS option saw significant uptake, with many customers valuing the ability to collect their online orders at their local store. This not only saves on shipping costs for the consumer but also drives foot traffic into physical locations, creating opportunities for impulse purchases. In 2023, a significant percentage of Gap's online orders were fulfilled through in-store pickup, demonstrating the effectiveness of this strategy.

- Buy Online Pick-Up In Store (BOPIS): Customers can conveniently collect online purchases at a nearby Gap store.

- Order-In-Store: Enables customers to place orders for items not available in the physical store, with delivery to their home or chosen store.

- Ship-From-Store: Utilizes store inventory to fulfill online orders, increasing inventory efficiency and potentially speeding up delivery times.

- Integrated Inventory Management: A unified view of stock across all channels ensures product availability and reduces lost sales opportunities.

Gap Inc. utilizes a multi-channel approach to reach its customers, blending physical and digital touchpoints. This includes a substantial network of company-operated stores, robust e-commerce websites, and user-friendly mobile applications. Additionally, franchise stores extend its global footprint, allowing for localized market penetration and efficient expansion.

The company actively promotes omnichannel services like Buy Online Pick-Up In Store (BOPIS) and Ship-From-Store. These initiatives enhance customer convenience and leverage inventory across all channels. In fiscal year 2024, online sales accounted for a significant 38% of Gap Inc.'s total net sales, underscoring the critical role of digital channels.

As of Q1 2024, Gap operated 1,063 franchise stores, demonstrating a strategic focus on international growth through partnerships. This diverse channel strategy allows Gap to cater to a broad customer base and adapt to evolving retail landscapes.

| Channel Type | Description | Key Metric (as of Q1 2024/FY24) |

|---|---|---|

| Company-Operated Stores | Physical retail locations for direct customer engagement. | 2,506 worldwide |

| E-commerce Websites | Digital storefronts for global sales and product information. | 38% of total net sales (FY24) |

| Mobile Applications | Personalized digital shopping experience. | Complements online presence. |

| Franchise Stores | International expansion through local partnerships. | 1,063 stores |

| Omnichannel Services | Integrated online and offline customer experiences. | BOPIS, Ship-from-Store, Order-in-Store. |

Customer Segments

Old Navy specifically targets families and value-conscious shoppers, providing accessible fashion for everyone. Their approach centers on delivering 'wow prices' and reliable quality in popular items like activewear and denim, making them a go-to for practical, budget-friendly choices.

Gap's casual and contemporary adult segment values accessible, stylish clothing for everyday life. They gravitate towards the brand's interpretation of classic American fashion, seeking pieces that are both comfortable and on-trend for their busy lifestyles.

This customer base is key to Gap's ongoing brand revitalization efforts, which aim to reconnect with shoppers and boost sales. In the first quarter of 2024, Gap Inc. reported a net sales increase of 3% year-over-year, reaching $3.37 billion, demonstrating positive momentum in attracting and retaining these customers.

Banana Republic's sophisticated and professional adult segment is drawn to refined style and quality. This customer prioritizes elevated attire for both their professional lives and significant social events, valuing tailored fits and premium fabrics.

For the first quarter of fiscal year 2024, Banana Republic reported a net sales increase of 11% compared to the previous year, reaching $575 million. This growth indicates a positive reception to the brand's focus on sophisticated offerings within this key demographic.

The brand has specifically noted substantial progress in its women's apparel division, suggesting that their strategic adjustments to cater to the professional female consumer are resonating well, further solidifying this customer segment.

Active and Wellness-focused Consumers (Athleta)

Active and wellness-focused consumers represent a key demographic for Athleta, a brand within the Gap Inc. portfolio. This segment comprises women and girls who prioritize an active lifestyle and overall well-being, seeking apparel that supports both performance and everyday comfort. In 2024, the global activewear market continued its robust growth, with a significant portion of this driven by women's athleisure and performance wear, a trend Athleta is well-positioned to capitalize on.

These consumers are discerning, placing a high value on clothing that is not only functional and comfortable but also aligns with their personal values, particularly regarding sustainability. Athleta's commitment to using recycled materials and ethical manufacturing practices resonates strongly with this customer base. For instance, by 2023, Gap Inc. reported that 70% of its apparel used preferred materials, a figure likely to be further emphasized and expanded upon by Athleta's specific initiatives in 2024.

- Target Demographic: Women and girls engaged in active lifestyles and prioritizing wellness.

- Product Focus: Performance-oriented activewear and lifestyle apparel.

- Key Values: Comfort, functionality, and sustainable and ethical production practices.

- Market Alignment: Caters to the growing global demand for athleisure and health-conscious apparel.

Global Consumers Across Diverse Demographics

Gap Inc. casts a wide net, reaching consumers globally through its company-operated stores, franchises, and robust e-commerce operations. This diverse approach allows them to connect with individuals across various income levels and cultural landscapes, ensuring broad market penetration.

Their multi-brand portfolio, featuring Gap, Banana Republic, Old Navy, and Athleta, is a key strategy for capturing market share. This segmentation allows Gap Inc. to cater to distinct consumer preferences and adapt its offerings to suit regional tastes and economic realities, a crucial factor in navigating international markets.

- Global Reach: Gap Inc. operates in over 40 countries, demonstrating its commitment to serving a worldwide consumer base.

- E-commerce Dominance: In fiscal year 2023, Gap Inc.'s digital channels continued to be a significant driver of sales, reflecting the growing importance of online platforms for reaching diverse demographics.

- Brand Diversification: The company's stable of brands appeals to different age groups and lifestyle needs, from the casual wear of Old Navy to the more sophisticated offerings of Banana Republic.

- Adaptability: Gap Inc. actively monitors and responds to evolving consumer trends and economic conditions in each market it serves, ensuring its relevance across varied consumer segments.

Gap Inc. serves a broad spectrum of customers globally through its diverse brand portfolio. This strategy allows them to cater to various needs and preferences across different demographics and geographic locations.

The company's reach extends through physical stores and a strong e-commerce presence, adapting to local market demands. This multi-channel approach is vital for connecting with a wide range of consumers.

Gap Inc.'s brands, including Gap, Old Navy, Banana Republic, and Athleta, are designed to appeal to distinct customer segments, from value-conscious families to sophisticated professionals and active individuals.

In the first quarter of fiscal year 2024, Gap Inc. reported a net sales increase of 3% year-over-year, reaching $3.37 billion. This growth reflects the company's ability to engage and attract diverse customer bases across its brands.

| Brand | Primary Customer Segment | Key Value Proposition | Q1 FY24 Net Sales Growth |

|---|---|---|---|

| Old Navy | Families, Value-Conscious Shoppers | Affordable, trendy apparel for everyday wear | N/A (Part of consolidated Gap Inc. growth) |

| Gap | Adults seeking casual, contemporary style | Accessible, classic American fashion for daily life | N/A (Part of consolidated Gap Inc. growth) |

| Banana Republic | Sophisticated, Professional Adults | Elevated attire, refined style, quality fabrics | 11% |

| Athleta | Active & Wellness-Focused Consumers | Performance activewear, comfort, sustainability | N/A (Part of consolidated Gap Inc. growth) |

Cost Structure

The Cost of Goods Sold (COGS) for Gap Inc. encompasses the direct expenses tied to creating and acquiring their apparel and accessories. This includes the cost of raw materials like cotton and polyester, the wages paid to factory workers involved in production, and the overhead costs associated with running manufacturing facilities.

For the fiscal year 2024, Gap Inc. reported its cost of goods sold and occupancy expenses combined at $8,859 million. This figure reflects the significant investment required to bring their products to market. A positive development noted in 2024 was the contribution of lower commodity costs, which directly benefited the company's merchandise margins.

Gap's retail store operating expenses represent a significant portion of its cost structure. These include substantial outlays for rent across its numerous physical locations, along with ongoing costs for utilities, general maintenance, and essential store upkeep. In 2023, Gap Inc. operated approximately 3,100 stores globally, underscoring the scale of these fixed and variable occupancy costs.

Employee wages for store associates and management are another major expense. These personnel costs are critical for providing customer service and maintaining store operations. For instance, the retail sector often sees labor costs as a leading operational expenditure, directly influencing profitability and the ability to manage gross margins effectively.

Gap invests significantly in marketing and advertising, encompassing digital, social media, and traditional channels to build brand awareness and attract its customer base. In 2023, Gap Inc. reported marketing and advertising expenses of $1.5 billion, a slight increase from the previous year, reflecting a continued commitment to demand generation. This strategic allocation aims to boost customer acquisition and drive sales across its portfolio of brands.

E-commerce and Technology Infrastructure Costs

Maintaining and developing Gap's robust e-commerce platforms, digital tools, and IT systems is a significant expense. These investments are crucial for supporting online sales, enhancing the customer experience, and driving operational efficiency across all channels. For instance, in fiscal year 2023, Gap Inc. continued to invest in its digital capabilities, with technology and digital transformation being a key focus area for improving customer engagement and streamlining operations.

These technology costs include ongoing expenditures for software licenses, cloud hosting, cybersecurity, and the development of new features. Furthermore, investments in data science and artificial intelligence are becoming increasingly important for personalizing customer interactions, optimizing inventory management, and driving targeted marketing campaigns. These advanced technologies are essential for staying competitive in the rapidly evolving retail landscape.

- E-commerce Platform Maintenance: Ongoing costs for website hosting, software updates, and security patches for Gap.com and other digital storefronts.

- Digital Tool Development: Investment in new features, mobile app enhancements, and customer relationship management (CRM) systems.

- IT Infrastructure: Expenses related to servers, networking equipment, data storage, and cloud computing services.

- Data Science & AI Investments: Costs associated with data analytics platforms, AI-driven personalization tools, and specialized personnel.

Supply Chain and Logistics Expenses

Gap's supply chain and logistics expenses are a critical component of its cost structure. These costs encompass the entire journey of a product from its origin to the customer, including international shipping, maintaining distribution centers, and getting products to stores and online shoppers. In 2023, Gap Inc. reported total operating expenses of $15.8 billion, with a significant portion dedicated to these logistical operations.

The company actively works to streamline these costs. This involves smart sourcing, like negotiating better rates with manufacturers and shipping providers, and keeping inventory levels lean to reduce storage and obsolescence costs. For instance, Gap has invested in technology to improve demand forecasting, aiming to minimize excess stock and associated carrying expenses.

- Transportation: Costs for moving goods globally via ocean freight, air cargo, and trucking.

- Warehousing: Expenses related to operating distribution centers for storing and managing inventory.

- Distribution: Costs of moving products from warehouses to retail stores and directly to online customers.

- Inventory Management: Costs associated with holding, tracking, and insuring inventory, aiming for efficiency through optimized stock levels.

Gap's cost structure is multifaceted, encompassing direct product costs, operational expenses for its physical and digital presence, marketing efforts, and supply chain management. Understanding these elements is crucial for assessing the company's profitability and strategic direction.

For fiscal year 2024, Gap Inc.'s Cost of Goods Sold and Occupancy Expenses totaled $8,859 million. This significant figure highlights the substantial investment in both product creation and the retail footprint. The company experienced a benefit from lower commodity costs during this period, which positively impacted merchandise margins.

Gap's operational expenses are considerable. In 2023, the company operated roughly 3,100 stores globally, incurring significant costs for rent, utilities, and maintenance. Furthermore, employee wages for store staff and management represent a key expenditure, essential for customer service and daily operations.

Marketing and advertising costs are also a major component, with $1.5 billion allocated in 2023 to drive brand awareness and sales. Investments in e-commerce platforms, digital tools, and IT infrastructure are ongoing, critical for online sales and operational efficiency. Supply chain and logistics expenses, including transportation and warehousing, are substantial, with total operating expenses reaching $15.8 billion in 2023.

| Cost Category | Fiscal Year 2023 (Millions USD) | Fiscal Year 2024 (Millions USD) |

|---|---|---|

| Cost of Goods Sold & Occupancy Expenses | N/A (Combined figure for 2024) | 8,859 |

| Marketing & Advertising Expenses | 1,500 | N/A |

| Total Operating Expenses | 15,800 | N/A |

Revenue Streams

Gap Inc. generates a significant portion of its income from sales made directly to consumers through its own branded stores. These include popular names like Gap, Old Navy, Banana Republic, and Athleta, with a global presence.

For the fiscal year 2024, Gap Inc. announced total net sales amounting to $15.1 billion, with company-operated stores being a primary driver of this figure.

Gap Inc. generates substantial revenue through its e-commerce channels, encompassing sales from its official brand websites and dedicated mobile applications. This digital avenue is a critical and expanding component of its overall sales strategy.

In fiscal year 2024, Gap's online sales saw a robust increase of 4%, demonstrating the continued strength and growth of its digital footprint. These e-commerce activities accounted for a significant 38% of the company's total net sales, underscoring the vital role of its online presence in driving revenue.

Gap Inc. generates income through its franchise agreements, where partners pay upfront fees to use Gap's established brands and business models. These partners also contribute ongoing royalties, usually a percentage of their sales, allowing Gap to expand its global reach without direct capital investment in every location.

In 2023, Gap Inc. continued to leverage its franchise model to reach international customers. While specific royalty percentages vary by agreement, these fees are a crucial component of Gap's diversified revenue streams, contributing to brand visibility and sales growth in markets where direct operation might be less feasible.

Private Label Credit Card Programs

Gap Inc. generates significant revenue from its private label and co-branded credit card programs, a key component of its customer loyalty strategy. These programs are operated in partnership with a third-party financing company, typically Synchrony Financial. This collaboration involves revenue-sharing agreements on various fees and interest income.

The benefits offered to cardholders, such as exclusive discounts and rewards, are designed to drive repeat purchases and increase customer lifetime value. For instance, in the fiscal year 2023, Gap Inc. reported that its credit card program contributed substantially to its overall revenue, with a significant portion of sales made through these cards, underscoring their importance in the company's financial performance.

- Revenue Generation: Earns income through interest, fees, and revenue-sharing arrangements from its private label and co-branded credit cards.

- Customer Loyalty: Drives repeat business and enhances customer engagement by offering attractive rewards and discounts to cardholders.

- Sales Contribution: A notable percentage of total sales are transacted via these credit cards, highlighting their impact on revenue.

Licensing Agreements and Other Ventures

Gap Inc. diversifies its income beyond direct product sales through strategic licensing agreements. These partnerships allow third-party companies to leverage Gap's well-established brands, such as Old Navy or Banana Republic, to create and market specific product categories, extending brand reach and generating royalty fees.

In 2023, Gap Inc. reported that licensing revenue contributed to its overall financial performance, though specific figures are often embedded within broader revenue segments. For instance, the company’s wholesale business, which can include licensed products, is a significant component of its sales strategy.

- Brand Licensing: Gap Inc. licenses its brands for use on various products, generating royalty income.

- AI Monetization: The company is actively exploring opportunities to monetize its investments in artificial intelligence and data analytics.

- Partnership Revenue: These ventures represent a supplementary revenue stream, enhancing overall profitability.

Gap Inc.'s revenue streams are multifaceted, extending beyond direct store and online sales. The company benefits from franchise agreements, allowing global expansion through partners who pay fees and royalties, and also generates income from private label and co-branded credit card programs, fostering customer loyalty and driving sales. Furthermore, strategic licensing agreements allow third parties to use Gap's brands on various products, creating additional royalty income.

| Revenue Stream | Description | Fiscal Year 2024 Data/Notes |

|---|---|---|

| Company-Operated Stores | Direct sales through Gap, Old Navy, Banana Republic, and Athleta stores. | Primary driver of $15.1 billion in total net sales. |

| E-commerce | Sales via brand websites and mobile apps. | Grew 4% in FY24, representing 38% of total net sales. |

| Franchise Agreements | Partnerships for brand use and business models, generating fees and royalties. | Key for international reach and brand visibility. |

| Credit Card Programs | Revenue sharing on interest and fees from private label/co-branded cards. | Substantial contributor to revenue in FY23, driving repeat purchases. |

| Licensing Agreements | Third-party use of brands for specific product categories, generating royalties. | Contributes to overall financial performance; often part of wholesale. |

Business Model Canvas Data Sources

The Gap Business Model Canvas is constructed using a blend of internal financial reports, customer feedback surveys, and competitive landscape analysis. These diverse data sources ensure a comprehensive and actionable representation of the business.