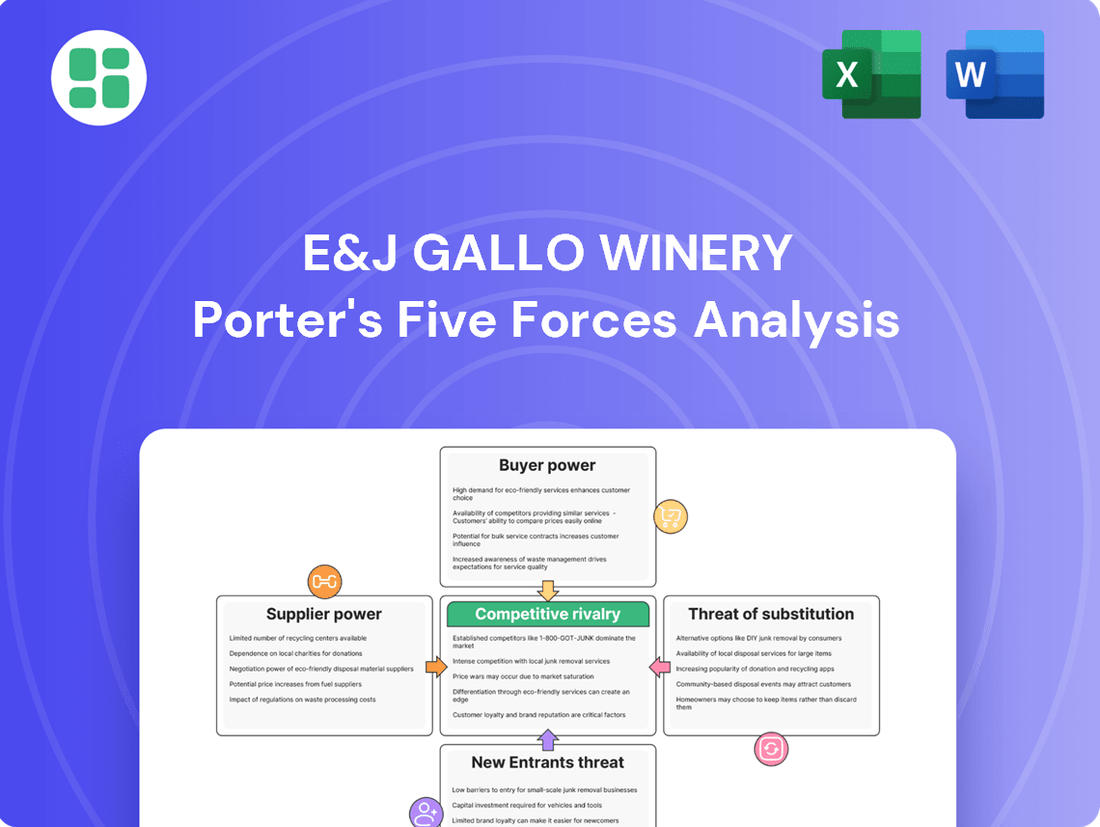

E&J Gallo Winery Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

E&J Gallo Winery Bundle

E&J Gallo Winery navigates a complex landscape shaped by intense rivalry, significant buyer power, and the ever-present threat of substitutes. Understanding these dynamics is crucial for any player in the wine industry.

The complete report reveals the real forces shaping E&J Gallo Winery’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The wine industry, especially in California, is currently grappling with a significant oversupply of grapes. This abundance means growers are receiving lower prices, and some fruit isn't even being picked. This trend is projected to persist through 2025, with wineries likely to hold off on substantial grape purchases until the 2026 harvest.

For a major player like E&J Gallo Winery, this oversupply translates into a considerable advantage. With their own vast vineyard operations and substantial buying capacity, Gallo can leverage this market dynamic to secure grapes at more favorable terms, effectively reducing the bargaining power of individual grape suppliers. This situation provides them with greater flexibility and cost control in their procurement strategies.

While E&J Gallo Winery might benefit from a grape oversupply, the bargaining power of suppliers for other essential inputs like energy, chemicals, and packaging remains a moderate concern. Global supply chain disruptions and persistent inflation in 2024 have driven up the costs of these crucial materials, directly impacting Gallo's operational expenses.

The rising cost of everyday necessities and agricultural inputs, a trend continuing into 2024, further squeezes profit margins for wine producers. This broad inflationary pressure means suppliers of even seemingly minor components can leverage increased market prices.

Furthermore, labor availability and escalating labor costs within vineyard operations, a challenge persisting through 2024, can indirectly bolster the bargaining power of vineyard service suppliers. As labor becomes scarcer and more expensive, specialized service providers can command higher rates for their expertise.

While the wine industry utilizes many common agricultural inputs, the bargaining power of suppliers can increase significantly when specialized inputs are required. For E&J Gallo Winery, this can manifest in the sourcing of specific types of corks, unique bottle designs, or advanced winemaking technology. These niche suppliers, catering to particular quality or aesthetic demands, may possess greater leverage, particularly as Gallo expands its presence in premium and luxury market segments. For instance, the global cork market, while large, sees specialized producers of high-quality natural corks commanding higher prices due to perceived quality and sustainability factors.

Gallo's Extensive Vertical Integration

E&J Gallo's significant vertical integration, encompassing extensive vineyards and in-house production facilities, inherently diminishes the bargaining power of external grape and processing service suppliers. This substantial in-house capacity reduces Gallo's reliance on outside sources, providing a buffer against price volatility and supply chain disruptions.

- Reduced Dependence: Owning and managing vast vineyards and processing plants significantly cuts reliance on external suppliers for key inputs.

- Cost Control: Vertical integration allows for better control over production costs, insulating the company from supplier price hikes.

- Supply Chain Stability: In-house operations ensure a more consistent and predictable supply of raw materials, crucial for maintaining production output.

- Scale Advantages: Gallo's sheer scale in its integrated operations further amplifies its leverage against any remaining external suppliers.

Sustainability Demands on Suppliers

Growing consumer and regulatory pressure for sustainable and organic wine production is influencing E&J Gallo's supplier relationships. This means suppliers who can meet stringent environmental and ethical standards, such as those related to organic farming or water conservation, may see their bargaining power increase, potentially driving up costs for compliant materials. For instance, by 2024, a significant portion of the wine industry is expected to have adopted or be actively pursuing practices like renewable energy in vineyards and reduced water usage, directly impacting supplier requirements.

This shift necessitates that E&J Gallo Winery carefully assesses its supply chain to ensure alignment with evolving sustainability mandates. Suppliers who are already certified or have invested in sustainable practices are better positioned to command higher prices, as meeting these new benchmarks can involve substantial upfront investment and ongoing operational adjustments. The increasing adoption of eco-friendly packaging and ethical sourcing further amplifies this trend.

- Increased Supplier Leverage: Suppliers with established sustainable certifications or practices gain an advantage.

- Rising Costs for Compliance: Meeting new environmental and ethical standards may lead to higher input prices for E&J Gallo.

- Industry-Wide Adoption: Wineries are increasingly implementing organic farming, water conservation, and renewable energy initiatives.

The bargaining power of suppliers for E&J Gallo Winery is a mixed bag, largely influenced by the specific input and broader market conditions. While Gallo's vertical integration and scale offer significant leverage against many suppliers, niche or specialized inputs, coupled with inflationary pressures and sustainability demands, can amplify supplier influence.

The oversupply of grapes in California through 2025 significantly weakens grape suppliers' bargaining power, allowing Gallo to secure favorable terms. However, suppliers of energy, chemicals, and packaging materials are experiencing increased leverage due to 2024's inflation and supply chain issues, impacting Gallo's operational costs.

Furthermore, labor shortages and rising wages in 2024 indirectly strengthen the position of vineyard service providers. Suppliers of specialized inputs like high-quality corks also hold more sway, particularly as Gallo targets premium markets, with specialized cork producers commanding higher prices due to quality and sustainability perceptions.

| Input Category | Supplier Bargaining Power (2024-2025) | Key Influencing Factors |

| Grapes | Low | Significant oversupply, projecting through 2025. |

| Energy, Chemicals, Packaging | Moderate to High | Inflationary pressures, global supply chain disruptions. |

| Specialized Winemaking Technology/Materials (e.g., premium corks) | Moderate to High | Niche market demand, quality and sustainability focus. |

| Vineyard Services (labor-intensive) | Moderate to High | Labor shortages, escalating labor costs. |

What is included in the product

This analysis details the competitive forces impacting E&J Gallo Winery, including buyer and supplier power, threat of new entrants and substitutes, and the intensity of rivalry.

Effortlessly identify and address competitive threats with a visual representation of E&J Gallo Winery's Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

The consolidation of major retail and distribution channels significantly bolsters their bargaining power over large wine producers such as E&J Gallo. These consolidated entities, representing substantial sales volumes, can leverage their market position to negotiate more favorable pricing, demand increased promotional support, and secure advantageous contractual terms. For example, in 2023, the top five U.S. grocery chains controlled over 50% of grocery sales, giving them immense leverage.

Recent economic headwinds have amplified consumer focus on value, even within premium segments. This shift towards 'affordable luxury' means customers are increasingly scrutinizing price points, especially for wines under $20. For E&J Gallo Winery, this translates to a heightened need to demonstrate compelling value across its extensive product range.

In 2024, the wine market has seen a noticeable recalibration as consumers balance desires for quality with budget consciousness. Data from NielsenIQ indicates that while premium wine sales remain resilient, there's a significant uptick in demand for offerings that provide a strong quality-to-price ratio. This trend directly impacts Gallo's strategy, compelling them to ensure their diverse portfolio, from entry-level to more aspirational brands, offers attractive value propositions to retain and attract customers.

Consumers are showing a much greater concern about prices, particularly in the more affordable wine categories. In 2024, wines priced under $11 experienced substantial drops in sales, highlighting this trend. This means customers are more likely to switch to different brands or choose cheaper options if prices go up.

E&J Gallo Winery, which offers a broad spectrum of wine prices, needs to be very strategic with its pricing. They must balance the need to maintain profitability with the risk of alienating price-conscious buyers who are readily exploring alternatives.

Growing Demand for Direct-to-Consumer (DTC) Sales

The growing demand for direct-to-consumer (DTC) sales, amplified by the pandemic's boost to e-commerce, significantly enhances customer bargaining power. This trend offers consumers more choices and convenience, allowing them to bypass traditional distribution channels and engage directly with wineries. For E&J Gallo Winery, while their established distribution is a strength, the increasing consumer preference for online purchasing necessitates robust DTC strategies to meet this evolving demand.

This shift empowers consumers by providing:

- Increased Choice: Access to a wider array of wines beyond what might be available through traditional retail.

- Convenience: Direct delivery to their doorstep, simplifying the purchasing process.

- Direct Engagement: Opportunities for wineries to build relationships and offer personalized experiences.

Evolving Consumer Preferences (Moderation, Health, RTDs)

Consumers, especially younger demographics like Gen Z and Millennials, are increasingly prioritizing health, wellness, and moderation. This shift fuels demand for lower-alcohol, non-alcoholic, and healthier beverage choices, directly impacting E&J Gallo Winery's product development and marketing strategies.

The surge in ready-to-drink (RTD) cocktails and spirits underscores this trend, offering convenience and a perception of premium quality that appeals to modern lifestyles. These evolving consumer preferences grant customers greater bargaining power as they actively seek products that align with their changing values and consumption habits, challenging traditional wine markets.

- Growing RTD Market: The global RTD market was valued at approximately $1.3 trillion in 2023 and is projected to grow significantly, indicating strong consumer interest in convenient, pre-mixed beverages.

- Health-Conscious Consumers: A 2024 survey indicated that over 60% of consumers are actively seeking healthier beverage options, including those with lower alcohol content or natural ingredients.

- Millennial and Gen Z Preferences: These generations are driving the demand for moderation, with studies showing a notable decrease in per capita alcohol consumption among younger adults compared to previous generations.

The increasing consolidation of retail channels, with major grocery chains controlling over 50% of U.S. grocery sales in 2023, significantly amplifies customer bargaining power. This concentration allows large buyers to negotiate more favorable pricing and terms, directly impacting E&J Gallo Winery.

Consumers in 2024 are highly price-sensitive, especially for wines under $11, where sales have seen notable drops, pushing them towards value-driven options. This necessitates that E&J Gallo Winery strategically price its diverse portfolio to remain competitive and retain customers.

The rise of direct-to-consumer (DTC) sales and evolving preferences for healthier, lower-alcohol, or non-alcoholic beverages, as seen in the booming RTD market (valued around $1.3 trillion in 2023), further empower consumers with more choices and leverage against traditional wine producers.

| Factor | Impact on Customer Bargaining Power | Relevance for E&J Gallo Winery |

|---|---|---|

| Retail Consolidation | Increased leverage for large buyers due to market share. | Negotiating power for pricing and promotions. |

| Price Sensitivity (2024) | Consumers seek value, especially in lower-priced segments. | Need for competitive pricing across the portfolio. |

| DTC & Evolving Preferences | Greater choice, convenience, and demand for alternatives. | Requires robust DTC strategy and product innovation (e.g., RTDs, low-alcohol). |

Preview the Actual Deliverable

E&J Gallo Winery Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the E&J Gallo Winery Porter's Five Forces Analysis, thoroughly examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the wine industry. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

The wine industry is experiencing a significant challenge with declining overall consumption in its most important markets. This trend means that wineries are essentially competing for a smaller share of the market, intensifying rivalry among established brands. For instance, wine volumes experienced a dip in 2024, continuing a pattern observed in 2023.

E&J Gallo Winery faces a fiercely competitive landscape, with intense rivalry spanning all price tiers and product categories. This fragmentation means competition isn't just from a few giants, but from a vast array of domestic and international wineries, alongside a growing number of agile craft producers. The fight for visibility on store shelves and in consumers' minds is a constant battle, demanding substantial and ongoing investment in marketing and brand development to stand out.

The spirits category, especially tequila and mezcal, along with ready-to-drink (RTD) cocktails, are experiencing robust growth and capturing increasing market share, often outpacing wine. These beverages are attractive to consumers due to their convenience, perceived quality, and alignment with contemporary lifestyles.

This shift directly siphons off sales from the wine industry, compelling wine producers like E&J Gallo Winery to innovate and adapt their offerings. Failing to respond to this evolving consumer preference risks significant market share erosion as consumers opt for these more dynamic alcoholic alternatives.

Premiumization vs. Value Dynamics

The competitive rivalry within the wine industry is increasingly shaped by the tension between premiumization and value-seeking behaviors. While the premium and luxury wine segments have historically shown resilience, the broader trend of consumers trading up has decelerated. Economic headwinds in 2024 have pushed many consumers towards more affordable luxury or outright value-oriented options, creating a complex market landscape.

This dynamic forces wineries to carefully balance their product portfolios, catering to both discerning palates seeking premium experiences and budget-conscious buyers. E.J. Gallo Winery's strategic decision to significantly invest in and promote its premium offerings, even amidst this slowdown, directly confronts this challenging dichotomy. This approach underscores the high stakes involved in navigating consumer shifts while aiming for sustained market share and profitability.

- Premiumization Slowdown: Consumer spending on premium and luxury goods, including wine, has seen a noticeable slowdown in 2024 due to inflationary pressures and economic uncertainty.

- Shift to Value: A significant portion of consumers are actively seeking out 'affordable luxury' or value-for-money wine options, prioritizing price point without entirely sacrificing quality perception.

- Portfolio Balancing Act: Wineries face the challenge of maintaining their premium brand image and appeal while also developing and promoting more accessible price-tier products to capture a broader market share.

- Gallo's Premium Focus: E.J. Gallo's continued emphasis on its premium wine portfolio in 2024, despite the prevailing value trend, highlights a strategic bet on long-term brand equity and a segment less susceptible to immediate economic downturns, though it increases competitive pressure within that niche.

High Exit Barriers

The wine industry, including players like E&J Gallo Winery, is characterized by substantial exit barriers. These stem from heavy investments in fixed assets such as vineyards, wineries, and bottling plants, often requiring decades to recoup. Furthermore, established distribution networks and significant brand equity built over many years make it difficult and costly for companies to divest or cease operations. This situation means that even companies facing financial difficulties are often compelled to remain active competitors, thereby intensifying the overall rivalry within the market.

These high exit barriers contribute to a crowded competitive landscape. For instance, while some vineyard consolidations and removals have occurred, the market for wine remains robustly contested. Companies are hesitant to abandon their investments, leading to a persistent presence of numerous players, some of whom may operate with lower profitability but continue to vie for market share. This dynamic directly fuels competitive rivalry, as firms are less likely to exit and more inclined to fight for survival and growth.

- Significant Fixed Assets: Vineyards and production facilities represent substantial, long-term capital commitments in the wine sector.

- Brand and Distribution Investments: Building brand loyalty and extensive distribution channels requires considerable time and financial outlay, creating further exit impediments.

- Market Persistence: High exit barriers encourage companies to remain in the market even when facing challenges, thereby sustaining competitive intensity.

Competitive rivalry in the wine industry is intense, exacerbated by declining consumption in key markets and a significant shift towards alternative beverages like spirits and RTDs. This forces established players like E&J Gallo Winery to constantly innovate and fight for market share. The market's fragmentation, with numerous domestic, international, and craft producers, intensifies this battle, demanding substantial marketing investments to maintain visibility.

The 2024 economic climate has amplified this rivalry by slowing the premiumization trend, pushing consumers towards value-oriented options. This necessitates a delicate balancing act for wineries, needing to appeal to both premium and budget-conscious segments. Gallo's strategic focus on premium wines in 2024, despite this trend, highlights the high stakes and competitive pressures within that niche.

High exit barriers, due to substantial investments in vineyards, production facilities, and distribution networks, keep many companies in the market even when unprofitable. This persistence, as seen in the continued robust contest for market share despite some vineyard consolidation, fuels ongoing rivalry. Companies are reluctant to abandon their significant capital outlays, ensuring a crowded and competitive marketplace.

| Factor | Impact on Rivalry | 2024 Data/Trend |

|---|---|---|

| Market Size | Declining consumption intensifies competition for a smaller pie. | Wine volumes saw a dip in 2024, continuing a 2023 trend. |

| Industry Fragmentation | Numerous players across all segments increase competitive intensity. | Competition includes large corporations, international wineries, and agile craft producers. |

| Product Differentiation | Need for strong branding and marketing to stand out. | Significant marketing investment required to capture consumer attention. |

| Consumer Preferences | Shift to spirits and RTDs siphons off wine sales. | Tequila, mezcal, and RTDs show robust growth, outpacing wine. |

| Economic Conditions | Slowdown in premiumization and increased value-seeking behavior. | Consumers are increasingly opting for "affordable luxury" or value wines. |

| Exit Barriers | High fixed asset and brand equity investments keep firms competing. | Companies remain in the market due to substantial, long-term capital commitments. |

SSubstitutes Threaten

The expanding market for non-alcoholic and low-alcohol (NoLo) beverages presents a considerable threat of substitutes for traditional wine producers like E&J Gallo Winery. This growth is fueled by increasing health awareness and a desire for moderation, particularly among Millennials and Gen Z consumers. For instance, the global NoLo beverage market was valued at approximately $11 billion in 2023 and is projected to reach over $25 billion by 2028, demonstrating robust double-digit annual growth.

Consumers are increasingly seeking social experiences that don't involve alcohol, leading to a rise in products such as non-alcoholic beer, spirits, mocktails, and kombucha. These alternatives directly compete with wine for consumer occasions and expenditure, offering similar social and sensory benefits without the alcohol content. This shift in consumer preference means that E&J Gallo must contend with a growing array of beverage choices that cater to evolving lifestyle trends.

The rising popularity of spirits, especially agave-based options like tequila and mezcal, alongside the convenience of ready-to-drink (RTD) cocktails, presents a significant substitution threat to E&J Gallo Winery. These beverages are capturing consumer attention due to their ease of consumption and diverse flavor profiles, directly vying for share in occasions traditionally dominated by wine.

For instance, the US spirits market saw a notable increase in 2023, with agave spirits alone growing by 15.4% according to the Distilled Spirits Council of the United States. This trend indicates a clear shift in consumer preference that directly challenges wine's market position.

The increasing legalization and acceptance of cannabis and THC-infused beverages in certain markets is emerging as a significant substitute threat to traditional alcoholic drinks, including wine. As consumers explore alternative recreational experiences, there's a potential for spending to shift away from alcohol. This evolving trend introduces a new competitive dynamic within the broader beverage industry.

Convenience of Home Consumption and DIY Options

The convenience of home consumption and readily available DIY options presents a significant threat of substitution for E&J Gallo Winery. Consumers increasingly choose to create their own beverages, from mocktails to wine-based concoctions, at home. This trend is amplified by the accessibility of lower-cost bulk wines suitable for home enjoyment, directly competing with Gallo's on-premise and premium retail offerings.

The shift towards home-based experiences, especially for casual consumption, means that the perceived value of E&J Gallo's products can be diminished by the ease and affordability of DIY alternatives. For instance, the rise of at-home cocktail kits and the growing popularity of non-alcoholic beverage recipes offer compelling substitutes. In 2024, reports indicated a sustained interest in home entertaining, with a significant portion of consumers prioritizing convenience and cost savings, making these DIY options a potent competitive force.

- DIY Beverage Creation: Consumers are increasingly making their own drinks at home, including wine-based cocktails and non-alcoholic alternatives.

- Cost-Effectiveness: Purchasing ingredients for home consumption or bulk wine is often more economical than buying ready-made beverages from establishments or specialty stores.

- Casual Occasion Substitution: For everyday or informal gatherings, the convenience and lower price point of homemade drinks can directly replace the need for E&J Gallo's products.

- Growth in Home Entertainment: The ongoing trend of home-based social activities in 2024 further entrenches the viability of these substitute options.

Shift to Other Beverage Categories (e.g., Energy Drinks, Seltzers)

Consumers are increasingly exploring beverage options beyond traditional wine and spirits. This includes a significant rise in the popularity of energy drinks, which offer a stimulant effect, and botanical-infused seltzers, appealing to health-conscious consumers seeking lower calorie and sugar alternatives. For instance, the global energy drink market was valued at approximately $61.2 billion in 2023 and is projected to grow substantially.

These evolving consumer preferences mean that E&J Gallo Winery faces substitution not just from other alcoholic beverages but from an expanding array of non-alcoholic and functional drinks. These alternatives are capturing occasions previously dominated by wine, such as social gatherings or relaxation, by offering different value propositions like enhanced energy or perceived wellness benefits. This trend diversifies the competitive landscape considerably.

The threat of substitutes is amplified by the accessibility and marketing of these new beverage categories.

- Growing non-alcoholic beverage market: Consumers are increasingly seeking alternatives to alcohol, driving growth in categories like functional beverages and premium non-alcoholic spirits.

- Energy drinks' market share: Energy drinks continue to capture significant consumer spending, with the global market expected to reach over $80 billion by 2027, diverting occasions from traditional alcoholic beverages.

- Seltzer and ready-to-drink (RTD) growth: The popularity of hard seltzers and other RTD alcoholic beverages, often perceived as lighter and more sessionable, presents a direct substitute for some wine consumption occasions.

- Functional beverages' appeal: Beverages infused with adaptogens, vitamins, or probiotics are gaining traction, offering perceived health benefits that can sway consumers away from traditional alcoholic drinks.

The threat of substitutes for E&J Gallo Winery is multifaceted, extending beyond traditional alcohol competitors to encompass a wide array of beverage options. The burgeoning non-alcoholic and low-alcohol (NoLo) sector, driven by health consciousness, directly challenges wine's market share. Furthermore, the increasing popularity of spirits, particularly agave-based varieties, and the convenience of ready-to-drink (RTD) cocktails are diverting consumer occasions. The rise of cannabis-infused beverages and the DIY beverage trend at home also represent significant substitution threats, offering alternative experiences and cost savings.

| Substitute Category | 2023 Market Value (Approx.) | Projected Growth/Trend | Key Drivers |

|---|---|---|---|

| NoLo Beverages | $11 billion | Projected > $25 billion by 2028 | Health awareness, moderation |

| Spirits (Agave) | Significant growth in US market | 15.4% growth in 2023 (Agave) | Convenience, diverse flavors |

| Energy Drinks | $61.2 billion | Substantial growth | Stimulant effect, functional benefits |

| DIY Beverages | Growing trend | Sustained interest in home entertainment | Cost-effectiveness, convenience |

Entrants Threaten

The wine industry, particularly at the scale of E&J Gallo Winery, presents a formidable barrier to entry due to exceptionally high capital requirements. Newcomers need significant funding for acquiring prime vineyard land, constructing state-of-the-art wineries, and establishing robust distribution channels, often running into hundreds of millions of dollars for a competitive footprint.

Established giants like Gallo leverage substantial economies of scale, which translate into lower per-unit production costs, advantageous bulk purchasing power for grapes and supplies, and more efficient marketing reach. For instance, Gallo's extensive distribution network, covering over 100 countries, allows for cost-effective logistics and wider market penetration that is difficult for smaller, newer operations to replicate.

E&J Gallo Winery benefits from deeply ingrained brand loyalty and a robust, expansive distribution network. This makes it incredibly difficult for new players to carve out a meaningful market share. New entrants would need to invest heavily in marketing to build brand awareness comparable to Gallo's established names.

Securing widespread distribution across various retail and on-premise channels is a significant hurdle. For instance, in 2024, the US wine market continues to be dominated by a few key players with established relationships with distributors and retailers, making shelf space a competitive battleground. The sheer scale of Gallo's operations, built over decades, represents a considerable capital and time investment that new companies must overcome.

The alcoholic beverage industry faces substantial regulatory burdens, including intricate licensing, production, and distribution laws that differ significantly across states and international borders. For instance, in the United States, obtaining a federal Alcohol and Tobacco Tax and Trade Bureau (TTB) permit can take several months, and state-level permits add further layers of complexity and time. These extensive compliance requirements represent a considerable financial and operational barrier for any new company attempting to enter the market, effectively deterring potential competitors.

Access to Raw Materials and Expertise

Newcomers face significant hurdles in securing consistent access to premium grapes, a critical component for quality wine production. Established players like E. & J. Gallo Winery often possess long-standing relationships and ownership of prime vineyard land, making it difficult for new entrants to acquire the necessary raw materials. For instance, in 2023, the average price for premium wine grapes in California's Napa Valley ranged from $4,000 to $8,000 per ton, a substantial upfront cost for any new operation.

Furthermore, the wine industry demands a high level of specialized knowledge in both grape cultivation (viticulture) and winemaking (enology). This expertise, honed over years of practice and often passed down through generations, acts as a considerable barrier. Without this deep understanding, new entrants risk producing subpar products, which can quickly damage their reputation in a discerning market.

- Grape Sourcing: New entrants struggle to secure contracts for high-quality grapes, as established wineries have pre-existing agreements, limiting supply.

- Vineyard Ownership: The high cost and limited availability of prime vineyard land create a significant capital barrier for new competitors.

- Technical Expertise: The specialized knowledge required for viticulture and enology is a crucial barrier, as it takes years to develop the necessary skills for quality winemaking.

Niche Market Opportunities for Craft and Specialized Producers

While the overall wine industry presents significant barriers to entry, including established brand loyalty and economies of scale enjoyed by giants like E. & J. Gallo Winery, opportunities for new entrants are emerging within specialized niche markets. These segments often require less capital investment and can bypass traditional distribution channels.

- Organic and Natural Wines: Consumer demand for healthier and more sustainably produced wines is growing. For instance, the global organic wine market was valued at approximately $12.7 billion in 2023 and is projected to reach $21.2 billion by 2030, indicating a fertile ground for new, focused producers.

- Low-Alcohol and Non-Alcoholic Options: The non-alcoholic beverage sector, including wine alternatives, saw significant growth in 2024, driven by health-conscious consumers and evolving social norms. This trend allows new entrants to innovate without the traditional alcohol production complexities.

- Hyper-Local Craft Productions: Small-batch, artisanal wineries focusing on unique regional varietals or innovative winemaking techniques can attract a dedicated following. Direct-to-consumer (DTC) sales models, which accounted for a substantial portion of winery revenue in recent years, enable these smaller players to connect directly with consumers and build brand loyalty without needing massive distribution networks.

The threat of new entrants in the wine industry, especially for a large-scale operator like E. & J. Gallo Winery, remains relatively low due to substantial barriers. These include immense capital requirements for land, infrastructure, and distribution, as well as the need for specialized viticulture and enology expertise. Established brands also benefit from strong customer loyalty and regulatory complexities, making it challenging for newcomers to gain traction. For example, the average cost of prime vineyard land in California can exceed $100,000 per acre, presenting a significant upfront investment.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | High costs for land, facilities, and marketing. | Significant financial hurdle. | Vineyard land prices in premium regions can be $100,000+/acre. |

| Economies of Scale | Lower per-unit costs for established players. | New entrants struggle with price competitiveness. | Gallo's vast production volume leads to lower input costs. |

| Brand Loyalty & Distribution | Established relationships and consumer recognition. | Difficult to gain shelf space and consumer preference. | Dominant players control significant retail and on-premise placements. |

| Regulatory Hurdles | Complex licensing and compliance laws. | Time-consuming and costly to navigate. | Federal TTB permit processing can take months. |

| Technical Expertise | Specialized knowledge in winemaking and viticulture. | Risk of lower quality products for inexperienced entrants. | Years of experience are needed for consistent quality. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for E&J Gallo Winery is built upon comprehensive data from industry-specific market research reports, financial statements of key competitors, and regulatory filings. This blend of public and proprietary information allows for a robust assessment of industry structure and competitive dynamics.