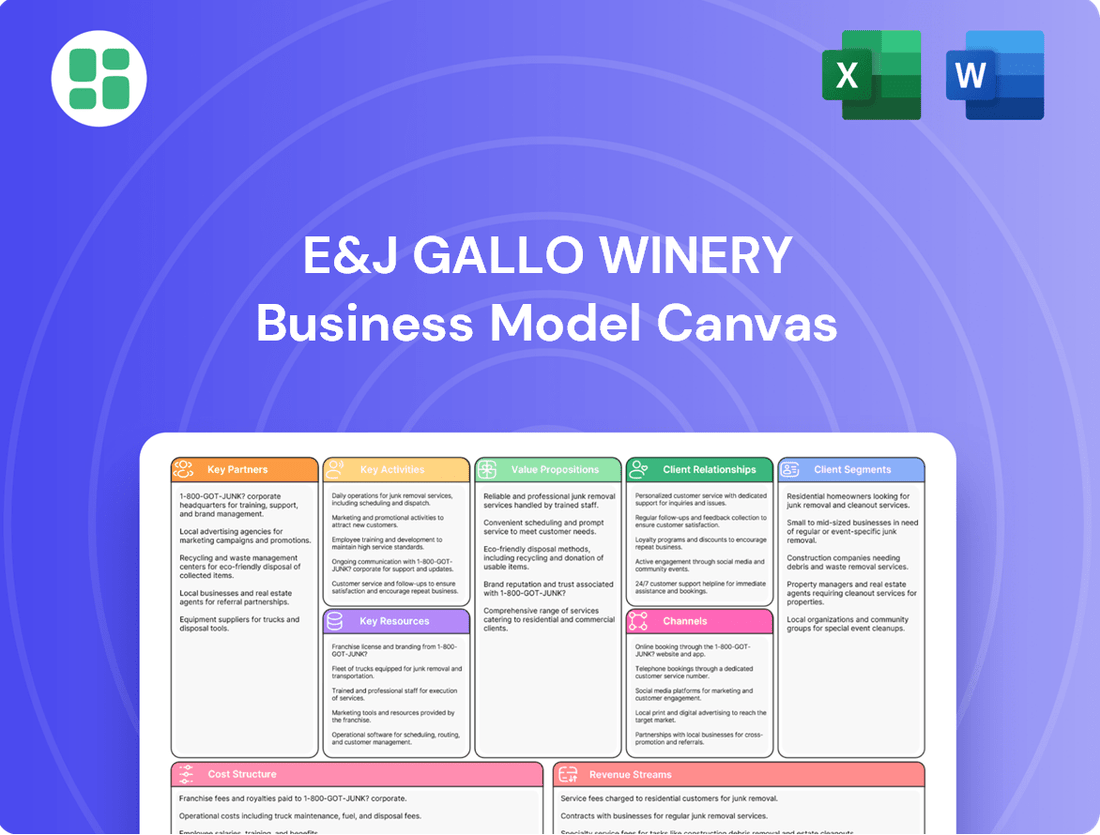

E&J Gallo Winery Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

E&J Gallo Winery Bundle

Discover the strategic framework that powers E&J Gallo Winery's dominance in the wine industry. This comprehensive Business Model Canvas breaks down their customer relationships, key resources, and revenue streams, offering a clear roadmap to their success.

Unlock the full strategic blueprint behind E&J Gallo Winery's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

E&J Gallo Winery leverages strategic alliances with major national and international distributors to ensure its diverse wine and spirit offerings achieve widespread market access. These collaborations are vital for navigating intricate regulatory environments and securing extensive reach across both retail and on-premise sales channels.

For example, Gallo strengthened its distribution capabilities by expanding its agreement with Republic National Distributing Co. (RNDC) within California. Furthermore, a recent partnership with Spritz Society, commencing in March 2025, aims to facilitate the nationwide distribution of their ready-to-drink (RTD) products.

E&J Gallo Winery's retail and on-premise collaborations are crucial for driving sales and brand awareness. They partner with major retailers like Walmart and Kroger, as well as thousands of independent liquor stores and supermarkets, ensuring their diverse portfolio reaches consumers effectively.

These partnerships extend to the on-trade sector, encompassing restaurants and bars nationwide. Gallo actively supports these establishments through co-marketing initiatives and strategic promotions, aiming to enhance product visibility and consumer engagement at the point of sale.

Gallo is significantly increasing its commitment to the on-trade channel, doubling its investment in 2025. This strategic move is designed to capture greater market share and provide enhanced support to partners, including innovative programs like implementing Coravin systems for by-the-glass offerings of premium wines.

E. & J. Gallo Winery, a dominant force in the wine industry, relies on a robust network of grape growers and vineyard owners. While Gallo cultivates a significant portion of its grapes on its own extensive landholdings, it strategically partners with independent growers to secure a diverse and high-quality supply. These collaborations are vital for sourcing specific varietals and grapes from distinct terroirs, ensuring the breadth and quality of their extensive product portfolio.

These key partnerships are foundational to Gallo's vertical integration strategy, which grants them considerable control over their production chain, from the initial grape cultivation to the final bottled product. This end-to-end oversight not only guarantees a consistent flow of raw materials but also allows for meticulous quality control at every stage. For instance, in 2023, Gallo sourced a substantial percentage of its grapes from these external partnerships, underscoring their importance in meeting market demand and maintaining product excellence across their vast range of wines.

Innovation and Brand Acquisition Partners

E&J Gallo Winery actively seeks out innovation and brand acquisition partners to fuel its growth, particularly within the premium wine, spirits, and ready-to-drink (RTD) segments. This strategy allows them to quickly integrate emerging consumer preferences and tap into new market niches.

Recent strategic moves highlight this focus. In 2021, Gallo acquired Rombauer Vineyards for a reported $1.2 billion, significantly bolstering its presence in the ultra-premium wine category. Further expanding its premium wine portfolio, Gallo also acquired Massican in 2022 and Hahn Family Wines in 2023.

Beyond acquisitions, Gallo forms key partnerships to enhance its brand offerings. Collaborations with brands like Spritz Society, Montucky Cold Snacks, and Condesa Gin demonstrate a commitment to diversifying its RTD and craft spirit portfolio, aligning with evolving consumer tastes.

These partnerships and acquisitions are crucial for Gallo's continued market leadership and ability to adapt to a dynamic beverage alcohol landscape. For instance, the RTD category saw significant growth, with the global market size estimated to reach over $2 trillion by 2030, underscoring the strategic importance of Gallo's investments in this area.

- Acquisition of Rombauer Vineyards: A significant $1.2 billion deal in 2021 to strengthen the ultra-premium wine segment.

- Expansion in Premium Wine: Acquisitions of Massican (2022) and Hahn Family Wines (2023) further diversify the high-end wine offerings.

- RTD and Spirits Partnerships: Collaborations with brands like Spritz Society and Condesa Gin tap into growing consumer demand in these categories.

- Market Diversification: These strategic moves aim to capture market share in fast-growing segments like RTDs, a market projected for substantial future growth.

Technology and Sustainability Solution Providers

E&J Gallo Winery partners with technology firms to bolster its e-commerce capabilities, leverage data analytics for consumer insights, and implement precision agriculture techniques. These collaborations are crucial for optimizing operational efficiency and expanding their market presence, especially as digital sales channels become increasingly important in the beverage alcohol industry.

Furthermore, Gallo actively collaborates with sustainability-focused organizations and technology providers. These partnerships are instrumental in advancing their environmental goals, particularly in areas like renewable energy adoption and waste reduction efforts. For instance, Gallo’s commitment to sustainability is evident in their generation of over 13.5 million kilowatt hours annually from solar panels and biogas.

- E-commerce and Data Analytics: Partnerships with tech companies enhance online sales platforms and data-driven decision-making.

- Precision Agriculture: Collaborations improve vineyard management through technology, leading to better grape quality and resource efficiency.

- Renewable Energy Generation: Gallo produces over 13.5 million kWh annually via solar and biogas, reducing reliance on fossil fuels.

- Waste Reduction Initiatives: Through programs like Halo Glass Recycling, Gallo aims to divert nearly 200,000 tons of glass from landfills each year.

E&J Gallo Winery cultivates vital relationships with a vast network of grape growers and vineyard owners, ensuring a consistent and high-quality supply for its diverse product lines. These partnerships are essential for sourcing specific varietals and grapes from unique terroirs, underpinning the breadth and quality of their extensive portfolio.

The company also strategically partners with technology firms to enhance its e-commerce capabilities and leverage data analytics for deeper consumer insights. These collaborations are crucial for optimizing operational efficiency and expanding market presence in the increasingly digital beverage alcohol industry.

Gallo's commitment extends to sustainability, forging alliances with organizations and technology providers focused on environmental stewardship. This includes initiatives like generating over 13.5 million kilowatt hours annually from solar panels and biogas, and aiming to divert nearly 200,000 tons of glass from landfills each year through programs like Halo Glass Recycling.

Furthermore, Gallo actively pursues brand acquisition and innovation partners, particularly in the premium wine, spirits, and ready-to-drink (RTD) segments. This strategy allows them to quickly integrate emerging consumer preferences and tap into new market niches, as demonstrated by the $1.2 billion acquisition of Rombauer Vineyards in 2021.

| Partnership Type | Key Partners/Examples | Strategic Importance | Recent Activity/Data |

|---|---|---|---|

| Distribution | Republic National Distributing Co. (RNDC), National Retailers (Walmart, Kroger) | Ensures widespread market access and navigates regulatory environments. | Expanded RNDC agreement in California; partnership with Spritz Society (March 2025) for RTD distribution. |

| Supplier (Grapes) | Independent Grape Growers and Vineyard Owners | Secures diverse, high-quality grape supply for specific varietals and terroirs. | Sourced a substantial percentage of grapes from external partnerships in 2023. |

| Brand Acquisition/Innovation | Rombauer Vineyards, Massican, Hahn Family Wines, Spritz Society, Condesa Gin | Fuels growth in premium segments and diversifies RTD/craft spirit portfolio. | Acquired Rombauer Vineyards ($1.2B, 2021), Massican (2022), Hahn Family Wines (2023). |

| Technology & Sustainability | Various Tech Firms, Sustainability Organizations | Enhances e-commerce, data analytics, precision agriculture, and environmental goals. | Generates >13.5M kWh annually from solar/biogas; aims to divert ~200,000 tons glass annually (Halo Glass Recycling). |

What is included in the product

This E&J Gallo Winery Business Model Canvas provides a comprehensive overview of their strategy, detailing customer segments, channels, and value propositions to reflect real-world operations.

It is organized into 9 classic BMC blocks, offering full narrative and insights designed to help entrepreneurs and analysts make informed decisions.

E&J Gallo Winery's Business Model Canvas provides a clear, one-page snapshot of their operations, simplifying complex strategies for efficient decision-making and internal alignment.

Activities

A cornerstone of E. & J. Gallo Winery's operations is the meticulous cultivation of grapes. They manage an impressive 23,000 acres of vineyards spread across key regions like California, Washington, and New York. This extensive land ownership allows for direct quality control from the initial planting through to harvest.

Gallo places a significant emphasis on sustainable viticulture practices. This commitment to environmental stewardship is crucial for managing diverse terroirs and ensuring the production of a wide spectrum of grape varietals, which are the very foundation of their product portfolio.

E&J Gallo Winery's key activity in Wine and Spirits Production covers everything from grape crushing and fermentation to aging, blending, and bottling. They manage multiple production sites, consistently upgrading technology and honing skills to ensure top quality across their wide range of products.

This dedication to quality is evident in their operational scale; by 2024, Gallo had established itself as one of the largest wine producers globally, with significant investments in state-of-the-art facilities and sustainable practices to support their extensive portfolio.

E. & J. Gallo Winery's key activity involves managing a vast and intricate global supply chain. This encompasses warehousing, transportation, and expertly navigating international trade regulations to ensure their diverse wine and spirits reach over 100 countries efficiently and on schedule.

Gallo's robust distribution network is a cornerstone of their operations, enabling widespread market penetration and ensuring their brands are accessible to consumers across the globe. This extensive reach is vital for maintaining their competitive edge in the international beverage market.

Marketing, Sales, and Brand Development

E. & J. Gallo Winery focuses on creating compelling marketing campaigns that resonate with a broad consumer base. This involves a blend of traditional advertising, like television and print, alongside robust digital strategies. In 2024, the wine industry saw significant investment in digital marketing, with companies allocating an average of 30-40% of their marketing budgets to online channels, including social media and influencer collaborations. Gallo actively utilizes these platforms to foster brand engagement and drive sales.

The company's brand development strategy is dynamic, aiming to adapt to changing consumer tastes and market trends. This includes introducing new products and revitalizing existing brands to maintain relevance and appeal. Experiential marketing, such as vineyard tours and tasting events, plays a crucial role in building deeper connections with consumers, offering them a tangible experience of the Gallo brand. In 2023, experiential marketing campaigns reported an average ROI of 5:1, demonstrating their effectiveness in driving brand loyalty and purchase intent.

- Innovative Marketing Strategies: Gallo employs a mix of traditional and digital marketing to build brand awareness and loyalty, adapting to evolving consumer preferences.

- Digital Engagement: The company leverages social media and online platforms to connect with consumers, enhancing brand visibility and interaction.

- Experiential Marketing: Through tastings and events, Gallo provides immersive brand experiences that foster deeper customer relationships and drive sales.

- Brand Adaptability: Continuous brand development ensures Gallo's portfolio remains relevant and appealing in a dynamic market, supported by significant digital marketing investments in 2024.

Research, Development, and Acquisitions

E&J Gallo Winery's commitment to innovation is evident in its continuous efforts to introduce new wine varietals, unique blends, and updated packaging. This focus extends to exploring and entering new beverage sectors, such as spirits and ready-to-drink (RTD) options, to meet evolving consumer preferences.

Strategic acquisitions play a crucial role in Gallo's growth strategy, enabling the company to diversify its brand portfolio and enhance its market position. These acquisitions often target established brands with strong consumer recognition or promising emerging companies in key growth segments.

- Product Innovation: Gallo consistently invests in developing new wine offerings, including exploring novel grape varietals and crafting unique flavor profiles.

- Category Expansion: The company actively seeks opportunities to enter and grow within adjacent beverage categories, such as spirits and the rapidly expanding RTD market.

- Strategic Acquisitions: Gallo has a history of acquiring established brands and smaller, innovative companies to broaden its market reach and strengthen its competitive standing, particularly in the luxury wine and spirits segments. In 2022, Gallo acquired several brands from Constellation Brands, further bolstering its premium portfolio.

E&J Gallo Winery's key activities revolve around cultivating premium grapes across thousands of acres, ensuring meticulous quality control from vine to bottle. Their extensive vineyard management, including a commitment to sustainable practices, underpins their diverse product offerings.

The company excels in wine and spirits production, managing multiple state-of-the-art facilities for crushing, fermentation, aging, blending, and bottling. By 2024, Gallo solidified its position as a global leader, marked by substantial investments in advanced technology and sustainable operations to support its vast portfolio.

Gallo's operational prowess extends to managing a complex global supply chain, encompassing warehousing, transportation, and international trade compliance to efficiently deliver products to over 100 countries. This robust distribution network is critical for their market penetration and sustained competitive advantage.

Innovation is a driving force, with continuous development of new varietals, blends, and packaging, alongside strategic expansion into spirits and RTD categories. Acquisitions of established and emerging brands further diversify their portfolio and market presence, as seen with significant brand additions in 2022.

| Key Activity | Description | 2024/2023/2022 Data Points |

|---|---|---|

| Vineyard Management | Cultivation of grapes across 23,000 acres with sustainable practices. | Direct quality control from planting to harvest. |

| Wine & Spirits Production | Crushing, fermentation, aging, blending, and bottling across multiple sites. | One of the largest global wine producers by 2024; significant investment in technology. |

| Supply Chain & Distribution | Global logistics, warehousing, transportation, and international trade navigation. | Products delivered to over 100 countries; robust distribution network. |

| Marketing & Brand Development | Innovative campaigns, digital engagement, and experiential marketing. | Significant digital marketing investment in 2024; experiential marketing ROI of 5:1 in 2023. |

| Innovation & Acquisitions | New product development, category expansion, and strategic brand acquisitions. | Acquired brands from Constellation Brands in 2022 to bolster premium portfolio. |

Preview Before You Purchase

Business Model Canvas

The E&J Gallo Winery Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This isn't a mockup or a sample; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to all sections, ensuring you have the same professional, insightful analysis for your business strategy.

Resources

Gallo's extensive vineyard holdings, spanning over 23,000 acres across California, Washington, and New York's prime wine regions, ensure a reliable and high-quality grape supply for its diverse portfolio. These vast land assets are a cornerstone of their business, directly impacting production costs and the consistency of their wine offerings.

Complementing its vineyards, Gallo operates numerous state-of-the-art production and bottling facilities. This robust infrastructure is crucial for managing its large-scale operations efficiently, allowing for consistent quality control and the capacity to meet significant market demand, a key factor in their market leadership.

Gallo boasts an impressive collection of over 130 distinct brands, a powerful intangible asset that spans the entire market spectrum. This diverse range includes accessible, value-driven wines like Barefoot, which consistently ranks among the top wine brands globally, alongside highly sought-after premium labels such as Orin Swift and Rombauer. This strategic breadth ensures Gallo can capture a wide array of consumer preferences and price sensitivities, contributing to robust and consistent revenue generation.

E&J Gallo Winery's robust global distribution network is a cornerstone of its operations, ensuring its diverse portfolio reaches consumers across more than 100 countries. This extensive reach is built on deep-seated relationships with wholesalers, distributors, and retailers worldwide, facilitating efficient market penetration and product availability. In 2024, Gallo continued to leverage this network to maintain its position as a leading wine producer, adapting to evolving consumer preferences and regional market dynamics.

Skilled Workforce and Winemaking Expertise

E&J Gallo Winery’s success is deeply rooted in its highly skilled workforce. This includes experienced viticulturists who manage vineyards, talented winemakers who craft their diverse portfolio, and adept marketing professionals who connect with consumers. Supply chain experts are also crucial for navigating the complexities of distribution.

The collective knowledge and expertise of these individuals are indispensable for upholding product quality, fostering innovation in winemaking, and efficiently managing intricate operational processes. This human capital is a cornerstone of Gallo's competitive advantage.

Gallo’s dedication to its employees is evident, contributing to its reputation as a desirable workplace. For instance, in 2023, Gallo was recognized by Glassdoor as one of the Best Places to Work, highlighting a positive company culture and employee satisfaction.

- Viticulturists: Expertise in grape cultivation and vineyard management.

- Winemakers: Skill in the art and science of wine production.

- Marketing Professionals: Driving brand awareness and consumer engagement.

- Supply Chain Experts: Ensuring efficient and effective product delivery.

Intellectual Property and Proprietary Processes

E. & J. Gallo Winery's intellectual property and proprietary processes are cornerstones of its competitive edge. This includes their unique winemaking techniques, honed over decades, and a portfolio of strong brand trademarks that resonate with consumers. For instance, their investment in research and development continually yields innovative technologies that enhance production efficiency and product quality.

These intangible assets are crucial for differentiating Gallo's extensive product line in a crowded market. Their proprietary processes not only ensure consistent quality but also contribute to cost efficiencies in their large-scale operations. Gallo's commitment to innovation is evident in their pursuit of sustainable practices, which are increasingly becoming a key differentiator and a source of competitive advantage.

Key resources in this area include:

- Proprietary Winemaking Techniques: Advanced methods for grape cultivation, fermentation, and aging that contribute to distinct flavor profiles and quality.

- Brand Trademarks: A robust portfolio of well-recognized brand names and logos, such as Gallo Family Vineyards, Barefoot, and Apothic, which command significant consumer loyalty and market share. In 2023, Gallo continued to be a dominant force in the U.S. wine market, with several of its brands consistently ranking among the top sellers.

- Innovative Technologies: Investments in R&D for areas like vineyard management technology, bottling line automation, and data analytics for consumer insights and market trend prediction.

Gallo's key resources are its vast vineyard holdings, extensive brand portfolio, and robust distribution network. These assets are critical for maintaining its market leadership and ensuring consistent product availability. Their infrastructure and intellectual property also play a significant role in their operational efficiency and competitive positioning.

| Key Resource | Description | Impact |

| Vineyard Holdings | Over 23,000 acres across prime U.S. wine regions. | Ensures reliable, high-quality grape supply, impacting production costs. |

| Brand Portfolio | Over 130 diverse brands, from value to premium. | Captures broad consumer segments, driving consistent revenue. Barefoot remains a top global wine brand. |

| Distribution Network | Global reach in over 100 countries. | Facilitates efficient market penetration and product availability. In 2024, Gallo leveraged this for market adaptation. |

| Infrastructure | State-of-the-art production and bottling facilities. | Enables efficient large-scale operations and quality control. |

| Intellectual Property | Proprietary winemaking techniques and brand trademarks. | Differentiates products and ensures consistent quality. |

Value Propositions

Gallo's diverse and accessible product portfolio is a cornerstone of its business model, offering an extensive array of wines, spirits, and ready-to-drink (RTD) beverages. This breadth spans all price points and categories, ensuring there's a product for virtually every consumer, from those seeking everyday value to connoisseurs of luxury labels. For instance, Barefoot Wine, a flagship brand, consistently ranks among the top wine brands in the U.S. by volume, demonstrating its wide appeal and accessibility.

E. & J. Gallo Winery's value proposition of consistent quality and heritage is deeply rooted in its family ownership, which began in 1933. This long-standing tradition ensures a reliable experience for consumers, from the initial grape cultivation to the final bottled product. Gallo's stated mission is to lead the global wine industry and achieve sustainable growth, a goal supported by this unwavering commitment to quality.

Gallo's commitment to innovation is evident in its continuous introduction of new wine varietals and blends, alongside strategic expansion into burgeoning markets. This includes a significant push into premium spirits, the popular canned cocktail segment, and even the beer industry, demonstrating a keen awareness of shifting consumer tastes and emerging drinking occasions.

In 2024, this forward-thinking strategy is underscored by substantial investments in super-premium gin and rum, further diversifying Gallo's portfolio. The company's foray into the beer category also reflects its adaptability, aiming to capture new market share and cater to a broader consumer base.

Commitment to Sustainability and Responsible Practices

E&J Gallo Winery places a strong emphasis on environmental stewardship, integrating eco-friendly practices throughout its vineyards and production processes. This includes significant efforts in water conservation, waste reduction, and the adoption of renewable energy sources across its operations.

This dedication to sustainability is a key value proposition, attracting environmentally conscious consumers and aligning with the increasing demand for responsible products within the beverage industry. Gallo's 2024 Sustainability Impact Report highlighted key achievements, such as a 20% reduction in greenhouse gas emissions per case produced compared to 2015 levels and the introduction of lighter-weight glass bottles, reducing packaging material by 15%.

- Environmental Stewardship: Implementing water-saving irrigation techniques, reducing vineyard water usage by 10% in 2023.

- Waste Reduction: Achieving a 90% landfill diversion rate across major production facilities by the end of 2023.

- Renewable Energy: Sourcing 35% of its electricity from renewable sources, with a target of 50% by 2025.

- Sustainable Packaging: Increasing the recycled content in its wine bottles to an average of 40% in 2024.

Global Reach and Availability

Gallo's commitment to global reach ensures its diverse portfolio of wines and spirits is accessible to consumers in over 100 countries. This extensive distribution network is a cornerstone of its business model, making its brands readily available worldwide.

This widespread availability translates into significant convenience for a global customer base, reinforcing Gallo's status as a dominant force in the international beverage alcohol market. For instance, in 2024, Gallo's brands continued to see strong performance in key international markets, contributing to its overall revenue growth.

- Global Distribution: Products available in over 100 countries.

- Consumer Convenience: Broad accessibility for customers worldwide.

- Market Power: Solidifies position as a global beverage alcohol leader.

- Revenue Contribution: International sales are a key driver of financial performance.

Gallo's value proposition centers on offering a comprehensive and accessible product range, from everyday wines like Barefoot to premium spirits, catering to diverse consumer needs and price points. This broad portfolio ensures wide market penetration and appeal.

The company's long-standing heritage, dating back to 1933, underpins a value proposition of consistent quality and reliability, built on family ownership and a commitment to sustainable growth. This deep-rooted tradition fosters consumer trust.

Innovation is a key driver, with Gallo continuously expanding into new categories like RTDs and premium spirits, reflecting an agile response to evolving consumer preferences. In 2024, investments in super-premium gin and rum exemplify this strategy.

Environmental stewardship is a growing value, with Gallo implementing eco-friendly practices such as water conservation and renewable energy adoption. Their 2024 Sustainability Impact Report noted a 20% reduction in greenhouse gas emissions per case produced since 2015.

| Value Proposition | Key Aspects | Supporting Data/Examples |

|---|---|---|

| Diverse & Accessible Portfolio | Wide range of wines, spirits, RTDs across all price points. | Barefoot Wine consistently a top U.S. brand by volume. |

| Quality & Heritage | Family ownership since 1933, commitment to reliable product experience. | Mission focused on leading the global wine industry through sustainable growth. |

| Innovation & Adaptability | Expansion into premium spirits, RTDs, and beer; new varietals. | 2024 investments in super-premium gin and rum. |

| Environmental Stewardship | Water conservation, waste reduction, renewable energy adoption. | 20% GHG emission reduction per case (vs. 2015); 35% electricity from renewables in 2024. |

| Global Reach & Convenience | Products available in over 100 countries via extensive distribution. | Strong international market performance contributing to revenue growth in 2024. |

Customer Relationships

E&J Gallo Winery cultivates deep customer relationships by consistently delivering high-quality wines and employing targeted marketing that resonates with consumers. They build brand affinity through compelling stories and experiences, fostering a connection that drives repeat business and word-of-mouth referrals.

While Gallo's approach to loyalty programs is often integrated within individual brand strategies rather than a single overarching program, the core objective remains to create lasting consumer engagement. This is evident in their investment in experiential marketing, including popular wine tastings and community events, which directly connect consumers with their products and brand.

E&J Gallo Winery places immense importance on nurturing strong connections with its trade partners, including distributors, retailers, and on-premise establishments. These relationships are the backbone of their go-to-market strategy, ensuring their diverse portfolio reaches consumers effectively.

To foster these vital partnerships, Gallo offers substantial support. This includes providing comprehensive marketing collateral, sales training, and collaborative planning sessions. These initiatives are designed to optimize product placement, execute impactful promotions, and drive sales across all sales channels.

Demonstrating a commitment to the on-trade sector, Gallo announced in 2024 a significant doubling of its investment in this channel. This strategic move underscores their dedication to supporting the success of their partners within bars, restaurants, and other hospitality venues.

E&J Gallo Winery is significantly enhancing its direct-to-consumer (DTC) engagement, moving beyond its traditional reliance on the three-tier distribution system. This strategic shift is evident in their investment in online sales platforms, the expansion of their winery tasting room experiences, and the hosting of curated events.

This direct interaction allows Gallo to foster deeper relationships with consumers, gather valuable feedback, and create unique offerings like exclusive wine releases or personalized experiences. For instance, the growth of e-commerce in the wine sector has been substantial, with DTC sales accounting for a growing percentage of overall wine revenue in the United States.

Digital and Social Media Engagement

E. & J. Gallo Winery actively cultivates customer relationships through robust digital and social media engagement. They leverage platforms to share compelling brand narratives, announce exciting new product launches, and provide timely responses to consumer queries, fostering a sense of community around their diverse portfolio.

This digital-first strategy aligns with contemporary consumer communication habits and allows Gallo to adapt swiftly to evolving market trends. In 2024, their social media presence, including active campaigns on platforms like Instagram and Facebook, saw significant growth in follower engagement, with specific campaigns for brands like Barefoot achieving millions of impressions.

- Digital Storytelling: Gallo uses platforms to share the heritage and values behind its brands, creating emotional connections with consumers.

- Product Announcements: New wine and spirit releases are often debuted digitally, generating buzz and immediate consumer interest.

- Community Building: Interactive content and direct engagement foster loyalty and a sense of belonging among brand enthusiasts.

- Data-Driven Marketing: Insights gleaned from digital interactions inform targeted marketing efforts and product development.

Public Relations and Community Involvement

Gallo actively cultivates a positive brand image and deepens stakeholder connections through robust public relations and community engagement. These efforts are crucial for building trust and loyalty.

The company's dedication to sustainability and diversity significantly shapes public perception, aligning with evolving consumer values. For instance, their 2024 Sustainability Impact Report details progress in areas like water stewardship and responsible sourcing.

- Brand Image: Public relations campaigns and community support initiatives foster goodwill and enhance Gallo's reputation as a responsible corporate citizen.

- Stakeholder Relationships: Direct engagement with local communities, employees, and consumers strengthens the bonds that underpin the winery's long-term success.

- Sustainability & Diversity: Gallo's documented commitment to environmental stewardship and inclusive practices resonates with a broad audience, bolstering positive public perception.

- Community Impact: The company's investments in local communities, as outlined in their sustainability reports, demonstrate a tangible commitment to improving quality of life.

E&J Gallo Winery prioritizes building strong relationships with both consumers and trade partners. Their strategy involves consistent quality, targeted marketing, and experiential events to foster brand loyalty and ensure effective distribution across various sales channels.

In 2024, Gallo doubled its investment in the on-trade sector, highlighting its commitment to supporting bars and restaurants. This focus extends to direct-to-consumer (DTC) channels, with increased investment in online sales and tasting room experiences to create more personalized consumer connections.

| Customer Segment | Relationship Strategy | Key Initiatives/Data (2024) |

|---|---|---|

| Consumers | Brand Affinity & Loyalty | Digital storytelling, community building via social media (e.g., Barefoot campaigns with millions of impressions), experiential marketing (tastings, events). |

| Trade Partners (Distributors, Retailers) | Sales Support & Collaboration | Marketing collateral, sales training, collaborative planning; doubled investment in on-trade sector. |

| Direct-to-Consumer (DTC) | Enhanced Engagement & Feedback | Investment in e-commerce platforms, expanded tasting room experiences, curated events. |

Channels

Wholesale distributors are the backbone of E&J Gallo Winery's market access, particularly within the United States' three-tier alcohol distribution system. These crucial partners, like Republic National Distributing Co. (RNDC) which handles Gallo's California retail chain distribution, are essential for navigating complex regulations and ensuring widespread availability of Gallo's diverse portfolio to retailers and on-premise establishments.

Off-premise retailers, encompassing supermarkets, liquor stores, and convenience stores, are a cornerstone of E&J Gallo Winery's distribution strategy. Gallo's broad product range, from accessible brands to high-end varietals, finds placement across these diverse retail environments, catering to a wide consumer base. In 2024, off-premise sales continue to dominate the beverage alcohol market, with off-premise channels accounting for approximately 85% of total U.S. wine and spirits sales, underscoring their critical importance for Gallo's market reach and revenue generation.

On-premise establishments, including restaurants, bars, and hotels, represent a crucial sales channel for E&J Gallo Winery. Gallo strategically targets these venues to showcase its premium and luxury brands, aiming to elevate brand image and provide consumers with an on-site experience. The company is boosting its investment in this on-trade channel throughout 2025, recognizing its importance for brand building and direct consumer engagement.

E-commerce Platforms and Direct-to-Consumer (DTC) Sales

E-commerce platforms and Direct-to-Consumer (DTC) sales represent a significant and growing channel for E. & J. Gallo Winery. This strategy allows Gallo to bypass traditional distribution networks and engage directly with its customer base, offering a more personalized brand experience and potentially capturing higher profit margins.

Gallo's investment in its online presence, including dedicated winery websites and partnerships with third-party e-commerce marketplaces, underscores its commitment to this digital frontier. This direct channel provides invaluable data on consumer preferences and purchasing habits, enabling more targeted marketing and product development efforts.

- Direct Consumer Engagement: DTC sales via e-commerce platforms allow Gallo to cultivate direct relationships with consumers, fostering brand loyalty and gathering crucial customer insights.

- Margin Enhancement: By reducing reliance on intermediaries, Gallo can potentially improve profit margins on sales made through its own online channels.

- Market Expansion Opportunity: The digital marketplace offers a vast reach, enabling Gallo to connect with consumers in regions where traditional distribution might be limited or less efficient.

- E-commerce Growth in Beverage Alcohol: The U.S. online beverage alcohol market saw significant growth, with estimates suggesting it could reach over $30 billion by 2025, highlighting the substantial opportunity for players like Gallo.

International Export and Partnerships

Gallo's international export and partnerships channel is a critical driver of its global business strategy, reaching consumers in over 100 countries. This extensive network of importers and distributors allows the company to effectively penetrate diverse markets, fostering significant brand growth and visibility on a worldwide scale.

The company actively cultivates strategic partnerships to enhance its international market presence. In 2024, Gallo continued to strengthen these relationships, aiming to capitalize on emerging market opportunities and adapt to varied consumer preferences across different regions.

- Global Reach: Exports to over 100 countries, demonstrating a broad international footprint.

- Strategic Partnerships: Leverages a network of importers and distributors to expand market access.

- Market Expansion: Continually seeks to grow its presence in diverse international markets.

- Brand Visibility: Utilizes international channels to enhance global brand recognition and appeal.

E. & J. Gallo Winery leverages a multi-faceted channel strategy to reach consumers effectively. This includes robust partnerships with wholesale distributors, a strong presence in off-premise retail environments like supermarkets, and strategic engagement with on-premise venues such as restaurants and bars. Furthermore, the company is actively expanding its e-commerce and Direct-to-Consumer (DTC) capabilities, alongside a significant international export network.

| Channel | Key Role | 2024/2025 Focus | Market Share/Growth Indicator |

|---|---|---|---|

| Wholesale Distributors | Navigating US three-tier system, ensuring broad availability | Maintaining strong relationships, optimizing logistics | Essential for 85% of US off-premise sales |

| Off-Premise Retail | Broad consumer access, volume sales | Maximizing shelf space, diverse product placement | Dominant channel, ~85% of US beverage alcohol sales |

| On-Premise Establishments | Premium brand showcase, direct consumer experience | Increased investment, brand building initiatives | Key for luxury brand perception and trial |

| E-commerce/DTC | Direct customer engagement, margin enhancement, data collection | Website optimization, marketplace partnerships | US online beverage alcohol market projected to exceed $30B by 2025 |

| International Exports | Global market penetration, brand diversification | Strengthening partnerships, exploring emerging markets | Presence in over 100 countries |

Customer Segments

Mass market consumers represent a significant portion of E&J Gallo Winery's customer base, seeking enjoyable and affordable wine and spirits for everyday occasions. This segment values accessibility and consistent quality, making brands like Barefoot Wine and Gallo Family Vineyards particularly appealing. In 2024, the U.S. wine market saw continued strength in the value segment, with brands offering good price-to-quality ratios performing well.

E&J Gallo Winery's premium and luxury wine enthusiasts are a discerning group who seek out high-quality, distinctive, and often higher-priced wines and spirits. This segment is a key focus, with brands like Orin Swift and Rombauer representing Gallo's commitment to this market. Gallo's strategic acquisitions and investments, totaling billions in recent years, underscore their dedication to building a robust luxury portfolio that emphasizes terroir and craftsmanship.

E. & J. Gallo Winery targets the on-premise trade, encompassing restaurants, bars, and hotels, who buy alcoholic beverages for immediate consumption. Gallo offers a diverse portfolio, from accessible house wines to high-end options for upscale establishments, catering to varied consumer preferences within these venues.

The company is actively working to revitalize this crucial on-trade channel, recognizing its importance for brand visibility and direct consumer engagement. In 2024, the U.S. on-premise beverage alcohol market showed signs of recovery, with restaurants and bars being key drivers of sales volume for wine producers.

International Markets

E&J Gallo Winery's international markets are a crucial customer segment, encompassing consumers and trade partners in over 100 countries. This global reach necessitates a tailored approach to product offerings and marketing strategies, reflecting diverse cultural preferences and local market demands. Gallo's commitment to international expansion is evident in its significant export volumes, making it a key player in the global wine industry.

Key aspects of Gallo's international customer segments include:

- Global Reach: Exports to over 100 countries worldwide, demonstrating a vast international footprint.

- Market Adaptation: Customization of product portfolios and marketing campaigns to align with regional tastes and consumer behaviors.

- Trade Partnerships: Cultivating relationships with distributors and retailers across diverse international markets to ensure product availability and effective market penetration.

- Brand Presence: Building brand recognition and loyalty among international consumers through targeted promotional activities and consistent quality.

As of 2024, the global wine market continues to be a dynamic landscape, with significant growth opportunities in emerging markets. Gallo's strategic focus on these international segments allows it to capitalize on this expansion, leveraging its established brands and distribution networks to drive international sales and revenue.

Newer Generations and Trend-Focused Consumers

Newer generations and trend-focused consumers represent a significant growth area for E&J Gallo Winery. This demographic, encompassing legal-drinking-age individuals, actively seeks novel and accessible beverage experiences. Their preferences lean towards convenient formats like ready-to-drink (RTD) options, lighter wines, and a broader spectrum of alcoholic beverages beyond traditional wine.

Gallo's strategic pivot to include spirits, hard seltzers, and canned cocktails directly addresses these evolving tastes. For instance, the company's investment in brands like High Noon Sun Sips, a leading vodka seltzer, demonstrates a clear commitment to capturing market share within the booming RTD category. In 2023, the U.S. hard seltzer market alone was valued at over $6 billion, with RTDs projected for continued strong growth.

- Targeting Younger Demographics: Gallo's product development focuses on attracting consumers aged 21-35 who often prioritize convenience and novelty.

- Expansion into Alternative Beverages: The winery's successful entry into spirits and hard seltzers diversifies its portfolio to meet the demand for non-traditional wine options.

- Innovation in Wine Offerings: Gallo is actively exploring new varietals, innovative blends, and updated packaging to appeal to younger palates and lifestyles.

- Market Responsiveness: This segment's preference for lighter-bodied wines and diverse alcohol formats is a key driver behind Gallo's portfolio adjustments.

E&J Gallo Winery strategically targets a broad spectrum of consumers, from everyday mass-market buyers seeking value to discerning enthusiasts of premium and luxury wines.

The company also focuses on the crucial on-premise sector, including restaurants and bars, and cultivates a significant international presence across over 100 countries.

Furthermore, Gallo is actively engaging newer generations and trend-focused consumers by expanding into spirits, hard seltzers, and convenient ready-to-drink (RTD) formats.

| Customer Segment | Key Characteristics | Gallo's Strategy/Brands | 2024 Market Relevance |

|---|---|---|---|

| Mass Market | Value-conscious, seeks everyday enjoyment and consistent quality. | Barefoot Wine, Gallo Family Vineyards. Focus on accessibility and price-value. | U.S. wine market's value segment remained strong in 2024, favoring brands with good price-to-quality ratios. |

| Premium/Luxury Enthusiasts | Discerning, seeks high-quality, distinctive, and often higher-priced wines. | Orin Swift, Rombauer. Emphasis on terroir, craftsmanship, and portfolio expansion through acquisitions. | Gallo's investments in luxury brands reflect a commitment to this growing, high-margin segment. |

| On-Premise Trade | Restaurants, bars, hotels purchasing for immediate consumption. | Diverse portfolio catering to various establishment types, from house wines to premium offerings. | The U.S. on-premise beverage alcohol market showed recovery in 2024, with these venues being key sales drivers. |

| International Markets | Consumers and trade partners in over 100 countries with diverse preferences. | Tailored product offerings and marketing, global distribution networks. | Emerging markets offer significant growth opportunities; Gallo leverages its established brands internationally. |

| Newer Generations/Trend-Focused | Younger consumers (21-35) seeking novelty, convenience, and alternative beverages. | High Noon Sun Sips (RTD), spirits, lighter wines, innovative packaging. | The U.S. RTD market continues robust growth; Gallo's expansion into spirits and seltzers targets this demand. |

Cost Structure

E&J Gallo Winery's most significant expense lies in its raw materials, primarily grapes. This includes the costs associated with cultivating grapes in their own vineyards and purchasing them from external growers. For their spirits and ready-to-drink (RTD) beverages, this also encompasses other agricultural inputs. These costs cover everything from vineyard upkeep and harvesting to the actual procurement of these essential ingredients.

The company's strategy of vertical integration, owning vineyards and controlling more of the supply chain, is crucial for managing the quality of their grapes and, in turn, helping to control and potentially reduce these raw material costs. For instance, in 2024, the global wine grape market saw fluctuations, with regions experiencing varied yields due to weather patterns, directly impacting procurement prices for wineries like Gallo.

E&J Gallo Winery's production and manufacturing expenses are substantial, encompassing labor for winemaking, bottling, and distillery operations. These costs also include significant outlays for energy, essential equipment maintenance, and a wide array of packaging materials like bottles, corks, and labels. For instance, in 2024, the wine and spirits industry saw increased energy costs contributing to higher operational expenses.

E&J Gallo Winery's extensive global distribution network means significant investment in transportation, warehousing, and inventory management. These are substantial operational expenses, crucial for getting their diverse portfolio of wines and spirits to consumers worldwide.

Shipping costs to distributors, retailers, and across international borders form a major part of this category. For instance, in 2024, the global logistics market experienced continued pressure from fuel price volatility and labor shortages, directly impacting freight costs for companies like Gallo.

Gallo is strategically focused on optimizing its supply chain to reduce transportation miles. This includes initiatives like consolidating shipments, utilizing more efficient routing software, and exploring regional distribution hubs to minimize transit distances and associated costs.

Marketing, Sales, and Brand Promotion Costs

E&J Gallo Winery dedicates significant resources to marketing, sales, and brand promotion. This involves substantial investment in diverse advertising campaigns, engaging promotional activities, and robust trade marketing efforts. Digital engagement is also a key focus to build strong brand awareness and effectively drive sales volume.

These expenditures encompass the costs associated with maintaining a dedicated sales force, conducting essential market research to understand consumer trends, and implementing various brand development initiatives. Gallo is known for its adoption of innovative marketing strategies to maintain its competitive edge in the dynamic beverage alcohol market.

For instance, in 2024, the wine and spirits industry saw marketing budgets increase, with major players like Gallo allocating substantial portions to digital advertising and influencer collaborations. This reflects a broader industry trend where reaching consumers directly through online channels is paramount. Gallo's commitment to these areas is evident in its consistent presence across multiple media platforms, aiming to capture a larger market share.

- Advertising Campaigns: Significant allocation towards TV, print, and digital advertising to build brand equity.

- Promotional Activities: Investment in in-store promotions, sampling events, and consumer rebates to drive trial and purchase.

- Sales Force & Market Research: Costs for sales teams, distributor relations, and ongoing market analysis to inform strategy.

- Digital Engagement: Spending on social media marketing, content creation, and e-commerce platform development.

Research & Development and Acquisition Costs

E. & J. Gallo Winery dedicates substantial resources to research and development, focusing on creating new wine varietals and enhancing existing product lines. This ongoing investment is crucial for staying competitive and meeting evolving consumer preferences.

Acquisition costs represent another significant component of Gallo's cost structure. The company has strategically pursued acquisitions, particularly in the luxury wine segment, to expand its portfolio and market reach. These endeavors involve considerable expenses related to due diligence and the integration of newly acquired brands and technologies.

- R&D Investment: Continuous spending on innovation in winemaking techniques and new product development.

- Acquisition Strategy: Significant outlay for acquiring new brands, especially in the premium and luxury tiers.

- Due Diligence & Integration: Costs associated with evaluating potential acquisitions and merging them into Gallo's operations.

- Luxury Segment Focus: Recent acquisition trends indicate a deliberate move to bolster presence in higher-value market segments.

E&J Gallo Winery's cost structure is heavily influenced by its raw materials, primarily grapes, with vertical integration aimed at managing these costs. Production and manufacturing expenses, including labor and energy, are also significant, especially with rising energy prices in 2024 impacting the industry. Distribution and logistics costs are substantial due to Gallo's global reach, with fuel price volatility in 2024 affecting freight expenses.

Marketing and sales are major investments, with increased budgets in 2024 focusing on digital engagement and influencer collaborations. The company also incurs costs for research and development to innovate and for acquisitions, particularly in the luxury wine segment, to expand its portfolio.

| Cost Category | Key Components | 2024 Industry Trend Impact |

|---|---|---|

| Raw Materials | Grapes, agricultural inputs | Fluctuating grape prices due to weather-impacted yields |

| Production & Manufacturing | Labor, energy, packaging | Increased energy costs impacting operational expenses |

| Distribution & Logistics | Transportation, warehousing | Pressure from fuel price volatility and labor shortages on freight costs |

| Marketing & Sales | Advertising, promotions, sales force | Increased budgets, shift towards digital advertising and influencer marketing |

| R&D and Acquisitions | Innovation, brand acquisition | Focus on luxury segment acquisitions and product development |

Revenue Streams

E&J Gallo Winery's core revenue generation stems from the sale of an extensive portfolio of wine products. This includes widely accessible table wines, alongside a growing range of premium and luxury varietals distributed under various well-established brands, effectively serving diverse consumer segments and price sensitivities.

As the largest winery globally by sales volume, Gallo's wine product sales are a significant driver of its financial performance. In 2024, the winery continued to leverage its scale and brand recognition to maintain a dominant market position, with its diverse offerings appealing to a broad spectrum of wine consumers.

E.J. Gallo Winery's revenue streams are increasingly bolstered by sales of spirits and other alcoholic beverages, a strategic diversification beyond its traditional wine focus. This expansion into the total alcohol beverage category now includes a growing presence in distilled spirits like brandy, vodka, gin, and whiskey, alongside ready-to-drink (RTD) cocktails and beer.

In 2024, the spirits segment, particularly RTDs, has shown robust growth. For instance, the RTD cocktail market alone was projected to reach over $24 billion globally by 2027, indicating a significant opportunity that Gallo is actively pursuing. This shift reflects a broader consumer trend towards convenience and variety in alcoholic beverage consumption.

E. & J. Gallo Winery generates revenue from its premium and luxury portfolio, which includes high-end wines and spirits. While these products may be sold in smaller quantities, they achieve significantly higher price points and healthier profit margins. This strategy allows Gallo to capture value from consumers seeking premium experiences.

Gallo has strategically invested in acquiring and developing premium brands, aligning with the broader market trend of premiumization. For instance, their acquisition of brands like Orin Swift Cellars, known for its critically acclaimed and high-priced wines, demonstrates this commitment. This focus on premium offerings is crucial for sustained growth and profitability.

Despite recent market slowdowns impacting some segments of the beverage alcohol industry, Gallo continues to allocate substantial investment towards its luxury portfolio. This sustained investment underscores their confidence in the long-term viability and growth potential of this segment, even amidst economic headwinds. For example, in 2024, the company announced further expansion plans for its luxury spirits division.

International Sales

E. & J. Gallo Winery generates substantial revenue from its international sales, with products available in over 100 countries. This global footprint is a key driver of its overall financial performance.

The company's strategic expansion into international markets has solidified its position as a major player in the global beverage industry. In 2024, Gallo's international operations continued to be a significant contributor, demonstrating the success of its global distribution and marketing efforts.

- Global Reach: Products sold in more than 100 countries.

- Revenue Contribution: International sales form a significant portion of total revenue.

- Strategic Importance: Reflects successful global expansion and market penetration.

- Market Presence: Enhances brand visibility and sales volume worldwide.

Direct-to-Consumer (DTC) Sales and Experiences

E. & J. Gallo Winery generates revenue through direct-to-consumer (DTC) channels, including sales at their tasting rooms, online platforms, and special events. While this segment represents a smaller portion of their overall sales, it yields higher profit margins due to the elimination of intermediary markups. This direct engagement fosters stronger customer relationships and builds brand loyalty, which can translate into sustained future sales.

Gallo's DTC strategy is crucial for brand building and customer connection. In 2024, the winery continued to invest in enhancing its e-commerce capabilities and in-person tasting experiences. For example, their tasting rooms offer curated experiences, often featuring exclusive bottlings and educational sessions. This direct interaction allows for immediate feedback and a deeper understanding of consumer preferences, informing future product development and marketing efforts.

- Higher Margins: DTC sales bypass distributors and retailers, allowing Gallo to retain a larger percentage of the revenue generated from each bottle sold.

- Brand Loyalty: Direct interaction through tasting rooms and online platforms builds stronger customer relationships and brand affinity.

- E-commerce Growth: Expanding their online sales presence presents a significant opportunity to reach a wider customer base and increase overall DTC revenue.

- Customer Insights: Direct sales provide valuable data on consumer purchasing habits and preferences, informing marketing and product strategies.

E. & J. Gallo Winery also generates revenue from distribution and import services, leveraging its extensive network to bring other beverage brands to market. This includes acting as a distributor for smaller wineries or international brands seeking U.S. market access.

In 2024, Gallo's distribution partnerships provided a steady revenue stream, capitalizing on their established logistics and sales infrastructure. This segment allows them to diversify revenue beyond their own brands, acting as a vital service provider within the broader beverage industry.

Business Model Canvas Data Sources

The E&J Gallo Winery Business Model Canvas is informed by a blend of internal financial statements, extensive market research reports, and competitive landscape analyses. These data sources provide a comprehensive view of customer behavior, industry trends, and operational costs.