E&J Gallo Winery Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

E&J Gallo Winery Bundle

Curious about E&J Gallo Winery's market position? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up, identifying potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on unlocking the full strategic picture.

Purchase the complete E&J Gallo Winery BCG Matrix to gain a comprehensive understanding of each product's market share and growth potential, empowering you to make informed investment decisions and optimize your strategy.

Ready to transform your understanding of E&J Gallo's product landscape? Get the full report for detailed quadrant analysis and actionable insights that will guide your next strategic move.

Stars

High Noon Hard Seltzer, launched in 2019, has experienced explosive growth, becoming the top-selling spirit brand by volume in the U.S. by 2023. This remarkable market penetration in the burgeoning ready-to-drink (RTD) segment positions it as a star in E&J Gallo Winery's portfolio.

Its success is driven by a premium positioning, utilizing real spirits and fruit juice, which resonates with consumers seeking higher quality options. Gallo's strategic expansion into variations like tequila-based seltzers and vodka iced teas further solidifies High Noon's market leadership and growth potential.

E&J Gallo Winery's premium/luxury wine segment, featuring brands like Rombauer and Orin Swift, represents a significant strategic focus. These acquisitions, Rombauer in 2023 and Orin Swift in 2016, highlight Gallo's commitment to high-growth, high-margin categories. The luxury wine market is expanding, driven by consumer demand for premium experiences, with Rombauer, for instance, holding a strong position in its segment.

Gallo's investment strategy in 2025 aims to bolster this luxury portfolio, further capturing market share and supporting distribution partners. This push is part of a broader effort to make fine wine more accessible, aligning with the company's goal to democratize the premium wine experience. The success of brands like Orin Swift, known for its innovative blends and strong consumer following, underscores the viability of this strategy.

Gallo's 'Spirit of Gallo' division, encompassing premium tequilas and whiskeys, is strategically positioned within a booming U.S. spirits market. Brands like Camarena Tequila are experiencing significant growth, tapping into the increasing consumer demand for premium spirits.

The U.S. spirits market is a high-growth area, with projections indicating continued expansion, particularly in categories like whiskey and premium tequila. This trend directly benefits Gallo's portfolio, as consumers increasingly seek out higher-quality, differentiated spirits.

Emerging RTD Cocktails (e.g., Spritz Society, VMC)

E&J Gallo Winery is strategically expanding its presence in the booming ready-to-drink (RTD) cocktail market. This includes a distribution partnership with Spritz Society, set to commence in 2025, and the ongoing distribution of VMC tequila-based canned cocktails.

The RTD segment is a significant growth driver for the beverage industry. In fact, spirits-based RTDs saw a remarkable 26.8% increase, making it the fastest-growing spirits category by revenue. This surge highlights a strong consumer preference for convenient, flavorful beverage options.

- Market Growth: The RTD cocktail market is experiencing substantial expansion, driven by consumer demand for convenience and variety.

- Gallo's Strategy: E&J Gallo's distribution agreements with brands like Spritz Society and VMC demonstrate a clear focus on capturing market share in this high-growth category.

- Category Performance: Spirits-based RTDs are outperforming other spirits segments, with revenue growth of 26.8%, underscoring their appeal.

- Consumer Trends: These products align with evolving consumer preferences for ready-to-consume, portable, and diverse flavor profiles in alcoholic beverages.

Innovations in Premium Wine Varietals (e.g., Massican)

E. & J. Gallo Winery's acquisition of Massican in 2023 marks a significant play in the premium wine market, particularly for unique white varietals. Massican, known for its Italian-inspired white wines, fits perfectly into Gallo's strategy to capture the increasing consumer appetite for high-quality, distinctive wine experiences. This move is particularly relevant as the premium wine segment continues to expand, with consumers actively seeking out new and artisanal offerings.

While Massican's current production volume is modest, Gallo's strategic intent is clear: to scale its market presence and leverage the growing demand for premium white wines. The global premium wine market is projected to grow, with sources indicating a compound annual growth rate (CAGR) of around 5-7% in the coming years leading up to 2025 and beyond. This acquisition positions Gallo to benefit directly from this trend, tapping into a niche that appeals to discerning consumers.

- Acquisition Date: 2023

- Massican's Focus: Premium white wines from Italian grape varietals.

- Market Trend Alignment: Capitalizes on premiumization and demand for unique wine offerings.

- Projected Market Growth: Premium wine segment expected to see continued expansion.

High Noon Hard Seltzer is a clear star in E&J Gallo Winery's portfolio, having become the top-selling spirit brand by volume in the U.S. by 2023. Its premium positioning, using real spirits and fruit juice, appeals strongly to consumers, and Gallo's continued expansion into variations like tequila-based seltzers ensures its future growth potential.

The brand's success is a testament to Gallo's ability to identify and capitalize on high-growth market segments. Its rapid ascent in the competitive RTD space, driven by quality ingredients and strategic product development, firmly establishes it as a leading performer.

High Noon's market dominance is further solidified by its appeal to a broad consumer base seeking convenient, high-quality alcoholic beverages. The brand's impressive sales figures and market penetration underscore its status as a key growth driver for E&J Gallo Winery.

The company's focus on premiumization within the RTD category, exemplified by High Noon, aligns with broader consumer trends favoring quality and convenience. This strategic alignment positions High Noon for continued success and market leadership.

What is included in the product

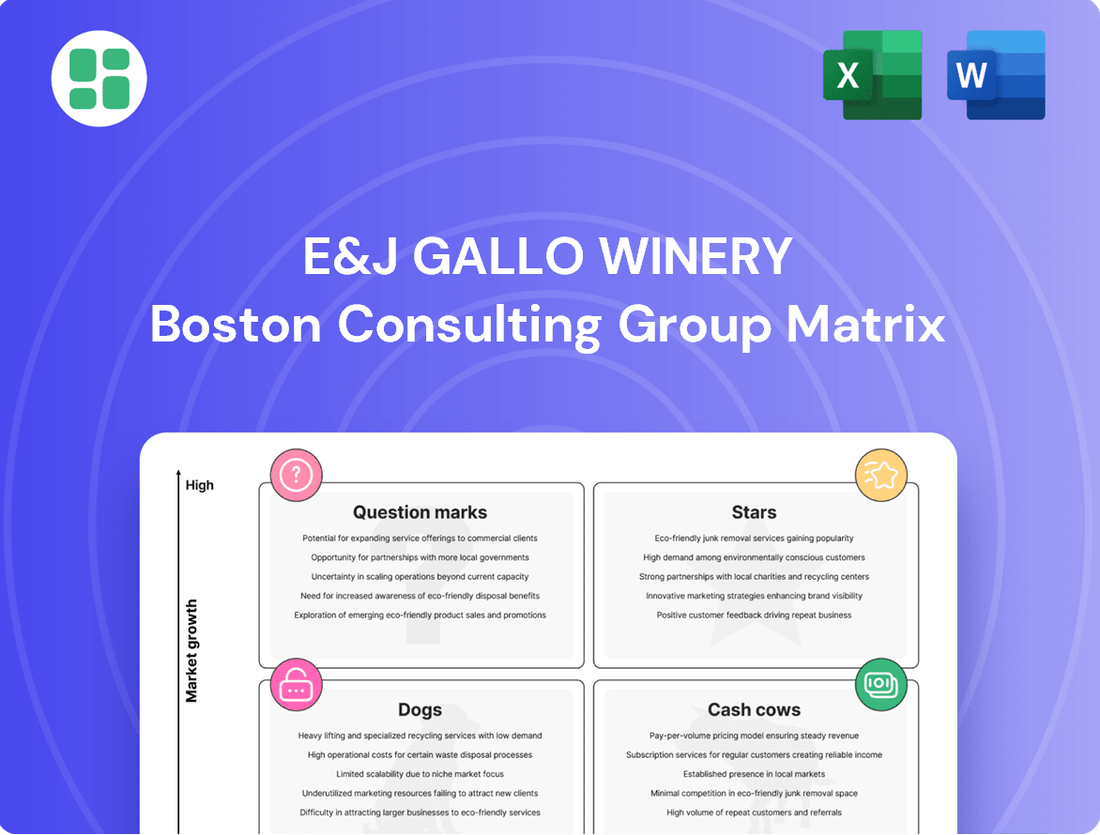

The E&J Gallo Winery BCG Matrix offers a tailored analysis of its product portfolio, categorizing brands into Stars, Cash Cows, Question Marks, and Dogs.

This framework highlights which units to invest in, hold, or divest for strategic growth and resource allocation.

A clear E&J Gallo Winery BCG Matrix provides a visual roadmap, alleviating the pain of strategic uncertainty by highlighting growth opportunities and underperforming assets.

Cash Cows

Barefoot Cellars, a flagship brand under E&J Gallo Winery, is a prime example of a cash cow within the BCG matrix. Its global recognition and strong presence in the value-for-money wine segment contribute to consistent, substantial cash flow generation.

Despite a mature market, Barefoot’s extensive distribution and broad consumer appeal, evidenced by its consistent sales volumes, allow it to maintain a dominant market share with minimal marketing expenditure. This brand is a reliable generator of profits for Gallo.

Gallo Family Vineyards stands as E&J Gallo Winery's quintessential cash cow. As the flagship brand, it commands a significant market share within the established wine sector, a testament to its enduring consumer recognition and extensive distribution network. This brand's longevity translates into a predictable and substantial revenue stream, underpinning the company's financial stability.

The brand's mature market presence allows for optimized operational efficiencies, contributing to robust profit margins. In 2024, E&J Gallo Winery reported overall net sales of approximately $5.1 billion, with brands like Gallo Family Vineyards being instrumental in achieving this figure through their consistent performance and high profitability.

E&J Brandy, a stalwart since 1975, holds the distinction of being the world's top-selling American brandy. This leadership position within a mature spirits market signifies a substantial market share for Gallo Winery.

The brand's consistent performance translates into robust cash flow, supported by well-established production and distribution networks. Its enduring consumer loyalty and market presence allow for sustained profitability without requiring significant new investment.

Black Box Wines

Black Box Wines, now under E&J Gallo Winery, is a prime example of a cash cow. Acquired in 2020, it commands a significant share in the expanding premium box wine market. This segment is attractive to consumers who prioritize both convenience and value, especially in a market that has matured.

The brand's success stems from its ability to deliver consistent sales and healthy profit margins. This is largely due to its efficient packaging and distribution strategies, which minimize costs. In 2023, the US wine market saw box wine sales reach approximately $1.5 billion, with premium segments showing particular strength.

- Market Position: Strong market share in the premium box wine segment.

- Consumer Appeal: Attracts consumers seeking convenience and value.

- Financial Contribution: Generates consistent sales and high-profit margins.

- Operational Efficiency: Benefits from cost-effective packaging and distribution.

Mass-Market Still Wines (e.g., Carlo Rossi, Peter Vella)

E&J Gallo Winery's mass-market still wines, exemplified by brands like Carlo Rossi and Peter Vella, are classic Cash Cows. These brands dominate a mature segment of the wine market, leveraging high volume and affordability to maintain substantial market share. In 2024, the U.S. wine market saw continued strength in value segments, with brands like Carlo Rossi consistently ranking among the top-selling wine brands by volume, often exceeding 10 million cases annually.

These offerings generate significant and reliable cash flow for Gallo, driven by efficient production processes and widespread distribution networks. Despite the low growth in the overall mass-market wine category, their consistent sales volume ensures a steady revenue stream. This allows Gallo to fund investments in other areas of its portfolio.

- Dominant Market Share: Brands like Carlo Rossi consistently hold top positions in U.S. wine sales by volume, often shipping over 10 million cases annually.

- High Volume, Low Margin: These wines thrive on accessibility and competitive pricing, generating substantial revenue through sheer sales volume rather than high per-unit profit.

- Mature Market: Operating in a low-growth segment, their success relies on maintaining brand loyalty and efficient operations rather than aggressive market expansion.

- Cash Flow Generation: Their established presence and consistent demand make them reliable generators of cash, supporting other business ventures.

E&J Gallo Winery's mass-market still wines, including brands like Carlo Rossi and Peter Vella, are quintessential cash cows. These brands dominate a mature segment, leveraging high volume and affordability to maintain substantial market share. In 2024, Carlo Rossi consistently ranked among the top-selling wine brands by volume in the U.S., frequently exceeding 10 million cases annually, underscoring their reliable cash generation for the company.

These offerings generate significant and dependable cash flow for Gallo, driven by efficient production and widespread distribution. Despite low growth in the mass-market wine category, their consistent sales volume ensures a steady revenue stream, enabling Gallo to fund investments in other parts of its portfolio.

The enduring popularity and operational efficiencies of these brands make them vital contributors to Gallo's financial stability. Their established presence and consistent demand solidify their role as reliable cash generators, supporting the winery's broader strategic initiatives and investments in emerging market segments.

| Brand Example | Market Segment | BCG Category | 2024 Volume (Est. Cases) | Financial Contribution |

|---|---|---|---|---|

| Carlo Rossi | Mass-market Still Wine | Cash Cow | 10,000,000+ | High volume, consistent revenue |

| Peter Vella | Mass-market Bag-in-Box | Cash Cow | Significant | Reliable cash flow, operational efficiency |

| Gallo Family Vineyards | Established Wine Sector | Cash Cow | High | Predictable revenue, financial stability |

Full Transparency, Always

E&J Gallo Winery BCG Matrix

The E&J Gallo Winery BCG Matrix preview you're seeing is the definitive, fully formatted document you'll receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report ready for your strategic planning.

What you see here is the exact E&J Gallo Winery BCG Matrix report that will be delivered to you upon completion of your purchase. It's meticulously crafted to offer clear strategic insights, providing you with a comprehensive tool for evaluating Gallo's product portfolio without any need for further revisions.

This preview accurately represents the E&J Gallo Winery BCG Matrix file you will download after your purchase. Once acquired, you'll gain access to the complete, editable version, perfectly suited for immediate integration into your business strategy discussions or presentations.

The E&J Gallo Winery BCG Matrix document you are currently reviewing is the identical, final version you will obtain after purchasing. This professionally designed, data-driven analysis is instantly downloadable, allowing you to leverage its strategic insights without delay.

Dogs

E&J Gallo Winery’s divestment of legacy dessert wine brands like Fairbanks and Sheffield in 2020 signals their classification as Dogs within the BCG Matrix. These brands likely operated in a shrinking market segment, characterized by low market share and minimal growth potential.

Brands like Fairbanks and Sheffield, often requiring significant marketing and distribution investment for meager returns, represent cash traps. Gallo’s strategic decision to divest these brands in 2020 freed up capital that could be reinvested into more promising, higher-growth segments of their portfolio.

Some of the brands Gallo acquired from Constellation Brands in 2020, particularly those priced at $11 or less, may be underperforming. These brands, acquired in a large deal involving over 30 labels, could represent low-growth, low-market-share components within Gallo's expanded portfolio.

If specific acquired brands haven't gained significant market traction or integrated smoothly, they could be classified as underperforming assets. These brands might face difficulties in a crowded wine market, potentially yielding minimal profits and requiring careful management or divestment.

Certain niche wine styles, like some traditional sherry or port varieties, are experiencing a shrinking consumer base. These older, more complex styles often struggle to connect with today's consumers who increasingly favor lighter, fruit-forward, or ready-to-drink options.

For E&J Gallo, these declining segments represent potential 'Dogs' in their BCG Matrix. For instance, while specific figures for these niche styles within Gallo's portfolio aren't publicly disclosed, the broader trend shows a decline in consumption for many fortified wines. In 2023, the global fortified wine market was valued at approximately $10 billion, but its growth rate was notably slower than other wine categories.

Brands from Divested Wineries (e.g., Columbia and Hogue)

E&J Gallo Winery's 2024 divestment of Columbia and Hogue wineries in Washington State signifies a strategic shift. These brands, despite their historical presence, likely held a low market share within Gallo's extensive portfolio and were not contributing to key growth objectives.

This exit from Washington State indicates a deliberate move away from assets that were not meeting performance expectations. The decision suggests that these brands were not generating adequate returns to warrant further investment.

- Low Market Share: Columbia and Hogue likely had a minimal share of the overall wine market compared to Gallo's leading brands, impacting their strategic importance.

- Strategic Misalignment: The divested wineries may not have fit with Gallo's evolving focus on premium or high-growth segments.

- Financial Performance: Insufficient profitability or return on investment was a probable driver for the divestment.

Certain Lower-Priced, High-Volume Wine Segments Facing Volume Decline

Certain lower-priced, high-volume wine segments within E&J Gallo Winery's portfolio are likely facing challenges, potentially categorizing them as Dogs in a BCG Matrix analysis. The broader wine market has experienced volume contractions, with projections indicating a notable 5% decrease in overall wine volumes for 2024.

Despite E&J Gallo Winery's significant market share as the largest producer by volume, some of its offerings in the high-volume, lower-priced tiers may be encountering reduced consumer demand and minimal growth prospects. These products are contending with intense competition and a discernible shift in consumer tastes, moving away from the consumption of high-volume, lower-tier wines.

- Market Trend: Overall wine market volume decline, estimated at 5% for 2024.

- Product Category: Lower-priced, high-volume wine segments.

- Challenges: Declining demand and low growth due to competitive pressures and shifting consumer preferences.

- BCG Classification: Potential classification as "Dogs" within the portfolio.

E&J Gallo Winery's divestment of brands like Columbia and Hogue wineries in 2024 highlights their classification as Dogs. These operations likely had low market share and minimal growth potential within the competitive Washington State wine market. This strategic exit suggests these assets were not generating sufficient returns to justify continued investment.

Within Gallo's portfolio, certain lower-priced, high-volume wine segments are also likely classified as Dogs. With overall wine volumes projected to decrease by 5% in 2024, these offerings face declining consumer demand and intense competition, leading to low growth prospects.

| Brand/Category | BCG Classification | Rationale | Market Trend Context |

|---|---|---|---|

| Fairbanks & Sheffield (Dessert Wines) | Dogs | Shrinking market segment, low growth potential, divested in 2020. | Fortified wine market growth slower than other categories. |

| Columbia & Hogue Wineries | Dogs | Divested in 2024, likely low market share and performance. | Strategic exit from underperforming assets. |

| Lower-priced, high-volume wines | Potential Dogs | Facing declining demand and low growth prospects. | Overall wine volume projected to decrease by 5% in 2024. |

Question Marks

E&J Gallo Winery's acquisition of Montucky Cold Snacks in 2024 signifies a strategic pivot into the burgeoning beer market, a category where Gallo has historically had a minimal presence. This move positions Montucky Cold Snacks as a Question Mark within Gallo's portfolio. The craft beer segment, while experiencing robust growth, is highly competitive, and Gallo's current market share in this niche is nascent.

The company will need to channel substantial resources into marketing and distribution to elevate Montucky Cold Snacks' visibility and capture a more significant share of the beer market. This investment is crucial for establishing a competitive edge and building brand loyalty in a dynamic and crowded landscape.

Gallo's 2023 partnership with Lotte Chilsung Beverage to introduce Soju into its spirits portfolio positions it within a high-growth category, particularly appealing to younger, diverse consumer groups. This strategic move taps into the burgeoning demand for flavored spirits and international beverages.

As a nascent player in the Soju market, Gallo currently commands a low market share. This necessitates significant investment in marketing and consumer education to build brand awareness and drive trial, aiming to elevate Soju from a Question Mark to a Star within the BCG matrix.

E&J Gallo Winery's strategic re-entry into super-premium gin with Condesa Gin and rum with Ron del Barrilito in 2024 positions these brands as potential Stars within the BCG Matrix. These categories are experiencing robust growth, with the global premium spirits market projected to reach $131.7 billion by 2027, growing at a CAGR of 6.2%. Gallo's investment aims to capitalize on this trend, targeting consumers willing to pay a premium for quality and unique brand stories.

Despite the high growth potential, Condesa Gin and Ron del Barrilito likely start with a relatively low market share, characteristic of Stars. For instance, the craft gin market, while expanding rapidly, is still fragmented, and Ron del Barrilito, though established, faces intense competition from other premium aged rums. Gallo's success hinges on significant marketing spend to build brand awareness and secure prime shelf space, mirroring the investment required to nurture a Star into a Cash Cow.

Non-Alcoholic Beverage Ventures

E&J Gallo Winery's ventures into the non-alcoholic beverage segment can be viewed as Stars within the BCG matrix. This category is experiencing robust growth, with projections indicating a 7.4% compound annual growth rate through 2030, largely fueled by the expanding sober curious movement.

While this market presents a significant opportunity, Gallo's specific non-alcoholic product lines are likely in their nascent stages, possessing a relatively low market share. This positions them as Stars, requiring substantial investment and innovative marketing strategies to capture consumer attention and achieve greater market penetration.

- Market Growth: The non-alcoholic beverage market is forecast to grow at a 7.4% CAGR until 2030.

- Key Driver: The sober curious movement is a primary catalyst for this expansion.

- Gallo's Position: Non-alcoholic ventures are likely Stars, characterized by high growth and low market share.

- Strategic Needs: These ventures demand significant investment and creative marketing for success.

Experimental/Artisan Wine Projects (e.g., The Language of Yes, Denner Vineyards)

E&J Gallo Winery's acquisition of Denner Vineyards in 2022 and its portfolio including The Language of Yes exemplify investments in experimental wine projects. These ventures are designed to capture niche, high-growth consumer segments. While these artisan brands offer premium quality, their production volumes are intentionally kept lower, resulting in a smaller market share within the broader wine landscape.

These projects require substantial strategic investment and careful brand positioning to foster growth and achieve wider recognition. The aim is to cultivate them into potential Stars within Gallo's luxury wine portfolio, targeting discerning palates.

- Denner Vineyards Acquisition: Acquired in 2022, signaling a move into ultra-premium, terroir-driven wines.

- The Language of Yes: Represents a focus on artisanal production and unique winemaking philosophies.

- Market Position: These brands target niche segments with high-growth potential, characterized by discerning consumers.

- Strategic Goal: To nurture these lower-volume, high-quality brands into potential Stars in the luxury wine market.

Montucky Cold Snacks, acquired in 2024, and the Soju venture represent E&J Gallo Winery's strategic forays into new, high-growth beverage categories. Both operate with low current market share in dynamic, competitive landscapes. Significant investment in marketing and distribution is essential for these brands to gain traction and transition from Question Marks to potential Stars.

| Brand/Venture | Category | BCG Matrix Position | Strategic Rationale | Investment Focus |

|---|---|---|---|---|

| Montucky Cold Snacks | Beer | Question Mark | Entry into a growing but competitive market. | Marketing, Distribution, Brand Building |

| Soju Venture | Spirits (Soju) | Question Mark | Tapping into demand for flavored and international spirits. | Consumer Education, Brand Awareness, Trial |

BCG Matrix Data Sources

Our E&J Gallo Winery BCG Matrix is built on a foundation of robust market intelligence, integrating internal sales data, industry growth rates, and competitor performance metrics.