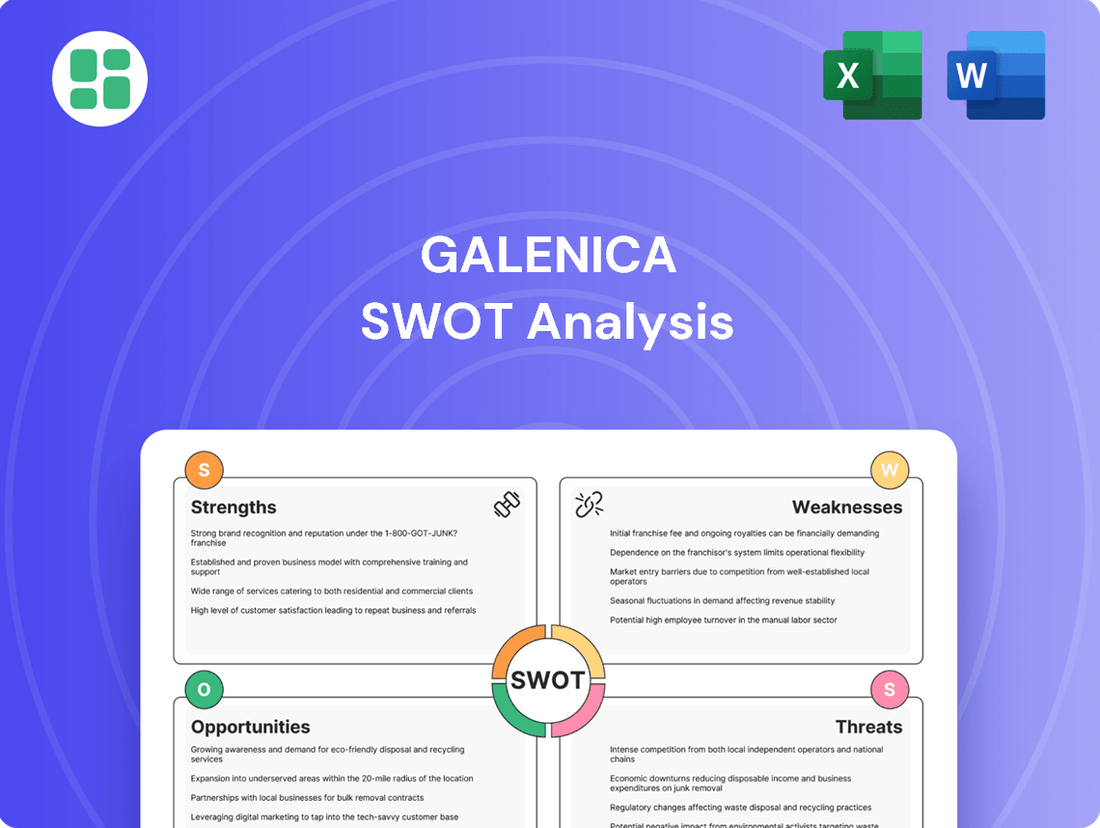

Galenica SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galenica Bundle

Galenica's market position is strong, but are you aware of the specific threats and opportunities that lie just beneath the surface? Our comprehensive SWOT analysis dives deep into their internal capabilities and external environment.

Want to truly understand Galenica's competitive edge and potential growth areas? Purchase the full SWOT analysis to unlock actionable insights and strategic planning tools, perfect for investors and market analysts.

Strengths

Galenica boasts Switzerland's most extensive branded pharmacy network, encompassing well-known names like Amavita, Coop Vitality, and Sun Store. This vast local presence, strategically situated in high-traffic areas, ensures direct access to a broad customer base for pharmaceutical products and vital healthcare services. The network's growth is evident, with new acquisitions and openings continuing through 2024, reinforcing its dominant market standing.

Galenica showcased impressive financial strength in 2024, achieving a 4.7% sales increase to CHF 3,921.1 million and a 10.3% rise in adjusted EBIT. This robust performance highlights the company's ability to consistently outpace the broader pharmaceutical market and expand its market share across its core segments.

Galenica's strength lies in its well-diversified business model, strategically segmented into Retail, Products & Brands, and Services. This structure creates multiple, independent revenue streams, significantly reducing the company's reliance on any single market segment. For instance, in 2023, the Products & Brands segment saw robust growth, contributing significantly to the overall financial performance, while the Services segment, including wholesale distribution and IT solutions, provided a stable, recurring income base.

The company effectively leverages this diversification by developing and marketing its own proprietary health and beauty products, while simultaneously acting as a key distributor for major external brands. This dual approach, supported by an extensive and efficient logistics network, allows Galenica to capture value across various points in the healthcare supply chain within Switzerland, ensuring broad market penetration and resilience.

Commitment to Digitalization and Innovation

Galenica's commitment to digitalization is a significant strength, with substantial investments in modernizing healthcare services and improving customer interactions. Key initiatives like the digital Prescription Manager, which streamlines e-prescriptions, and the ongoing development of the Lifestage Solutions platform for home care exemplify this focus. These digital advancements are crucial for their strategy to create a smooth medication process from prescription to patient and boost operational efficiency.

In 2024, Galenica reported a strong emphasis on digital transformation, with digital sales channels contributing a growing percentage to their revenue. For instance, their digital health solutions saw a year-over-year increase of 15% in user adoption by the end of Q3 2024. This strategic push is designed to create a more integrated and user-friendly experience across their entire service offering.

- Digital Prescription Manager: Facilitating efficient and secure e-prescriptions.

- Lifestage Solutions: Expanding home care services through digital platforms.

- User Adoption: Experiencing a 15% year-over-year increase in digital health solution users by Q3 2024.

- Operational Efficiency: Aiming to improve workflow and reduce administrative burden through technology.

Strategic Partnerships and Acquisitions

Galenica's strength lies in its history of forming strategic partnerships and making well-chosen acquisitions. These moves consistently enhance its service portfolio and expand its market reach. For instance, the integration of Redcare Pharmacy into Mediservice has been a successful endeavor, demonstrating Galenica's ability to absorb and leverage new entities effectively.

Furthermore, the ongoing development of the Health Supply joint venture with Planzer is a testament to its commitment to optimizing pharmaceutical logistics. This collaboration is crucial for improving efficiency within the Swiss healthcare sector.

- Proven track record: Galenica has a history of successful strategic alliances and acquisitions.

- Service enhancement: Partnerships like the Redcare Pharmacy integration broaden service offerings.

- Logistics optimization: The Health Supply JV with Planzer improves pharmaceutical supply chain efficiency.

- Market presence: These strategic moves bolster Galenica's position within the Swiss healthcare landscape.

Galenica's extensive pharmacy network, including brands like Amavita and Sun Store, provides unparalleled access to customers across Switzerland. This strong retail footprint, continually expanding through acquisitions in 2024, solidifies its market leadership. The company's financial performance in 2024 was robust, with sales increasing by 4.7% to CHF 3,921.1 million and adjusted EBIT rising by 10.3%, demonstrating consistent growth ahead of the market.

Galenica's diversified business model, spanning Retail, Products & Brands, and Services, creates multiple, stable revenue streams. This diversification is further strengthened by its dual strategy of developing proprietary health products and distributing external brands, supported by an efficient logistics network. Digitalization is a key strength, with significant investments in services like the digital Prescription Manager and Lifestage Solutions, which saw a 15% year-over-year increase in user adoption for digital health solutions by Q3 2024.

Strategic partnerships and acquisitions are central to Galenica's success, enhancing its service portfolio and market reach. The integration of Redcare Pharmacy into Mediservice and the Health Supply joint venture with Planzer exemplify its ability to leverage collaborations for service improvement and logistics optimization, reinforcing its position in the Swiss healthcare sector.

| Metric | 2023 | 2024 (YTD) | Change |

|---|---|---|---|

| Sales (CHF million) | 3744.4 | 3921.1 | +4.7% |

| Adjusted EBIT (CHF million) | 292.2 | 322.3 | +10.3% |

| Digital Health Solution User Growth | N/A | +15% (YoY by Q3) | N/A |

What is included in the product

Analyzes Galenica’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Galenica's SWOT analysis offers a structured approach to identify and address pain points, providing clarity on internal weaknesses and external threats that hinder progress.

Weaknesses

Galenica's significant concentration within the Swiss market, despite its strong domestic leadership, presents a notable weakness. This heavy reliance on a single geographic region makes the company particularly susceptible to shifts in the Swiss economy and its specific healthcare regulations. For instance, changes in drug pricing policies or reimbursement rates within Switzerland could disproportionately impact Galenica's revenue streams.

While Galenica holds a commanding position in Switzerland, its revenue generation is heavily anchored to this single market. This geographic focus limits its exposure to the broader growth opportunities available in international markets, potentially capping its overall expansion potential when compared to global pharmaceutical giants. Although some export activities exist, the bulk of its financial performance remains tied to the Swiss healthcare ecosystem.

Galenica faces a significant vulnerability due to potential regulatory pricing interventions by the Swiss government. Historically, Swiss authorities have signaled a desire to curb drug costs, particularly for generics and biosimilars, believing them to be higher than in comparable European markets.

These interventions could directly impact Galenica's profit margins, especially in its wholesale and pharmacy divisions, which are sensitive to pricing dynamics. For instance, a 2024 report highlighted that Switzerland’s drug prices were, on average, 15% higher than the EU median, a gap regulators are keen to narrow.

Galenica's recent sales growth, particularly in 2024, has been significantly boosted by the strong demand for prescription-only medications, including popular GLP-1 based weight loss drugs. This trend, coupled with seasonal health events like flu outbreaks, has created a favorable sales environment.

However, this reliance on specific, high-demand drug categories and seasonal fluctuations presents a notable weakness. If these trends were to shift unexpectedly, for instance, due to new competition or a decrease in seasonal illness severity in 2025, Galenica's revenue streams could experience significant volatility.

Operational Complexities from Acquisitions and IT Transitions

Galenica's growth strategy, heavily reliant on acquisitions and joint ventures, presents significant operational complexities. Integrating these new entities demands substantial resources and careful planning to ensure seamless assimilation, a process that can strain existing operational capacity.

The ongoing transition to a new Enterprise Resource Planning (ERP) system at Galexis, slated for completion in 2026, introduces a layer of inherent risk. Such large-scale IT overhauls can lead to temporary disruptions in supply chain management and other critical business functions if not meticulously managed.

- Integration Challenges: Past acquisitions, while contributing to market share, have historically required extensive post-merger integration efforts, diverting management attention and financial resources.

- ERP Transition Risks: The Galexis ERP migration, a multi-year project, carries the potential for data integrity issues and operational bottlenecks during the transition phase, impacting efficiency.

- Resource Strain: The sheer volume of ongoing integration and IT projects can place considerable strain on human capital and financial reserves, potentially hindering other strategic initiatives.

Competitive Pressures in a Dynamic Market

Galenica faces significant competitive pressures within the rapidly evolving Swiss pharmaceutical landscape. The market is increasingly shaped by breakthroughs in precision medicine and the growing adoption of digital health tools, demanding constant innovation. For instance, in 2024, the global precision medicine market was valued at approximately USD 58.3 billion and is projected to grow substantially, indicating a highly competitive space where staying ahead requires substantial R&D investment and agile strategy.

This dynamic environment intensifies competition from both established pharmaceutical giants and agile new entrants. To maintain its market share, Galenica must continuously adapt its offerings and operational strategies. The company's ability to integrate new technologies effectively will be crucial in navigating this challenging terrain.

- Intensified Competition: Established players and innovative startups are vying for market dominance.

- Technological Advancements: Precision medicine and digital health require continuous investment and adaptation.

- Market Share Maintenance: Constant innovation is necessary to retain and grow market position.

- Adaptation Demands: Agility in strategy and operations is key to responding to market shifts.

Galenica's substantial reliance on the Swiss market creates a vulnerability to localized economic downturns and regulatory shifts. This geographic concentration limits its ability to offset potential domestic challenges with international growth, as seen in 2024 where Swiss healthcare policy discussions could directly impact its core business.

The company's dependence on high-demand drug categories, such as GLP-1s, and seasonal health trends exposes it to revenue volatility. A slowdown in these specific segments or a milder flu season in 2025 could significantly affect its financial performance, as observed with the strong sales in the previous year driven by these factors.

Operational complexities arise from Galenica's acquisition-driven growth strategy, demanding significant resources for integration. Furthermore, the ongoing ERP system transition at Galexis, scheduled for completion in 2026, introduces execution risks that could disrupt supply chain efficiency and data management.

Intense competition, fueled by advancements in precision medicine and digital health, requires continuous innovation and adaptation. Galenica must invest heavily in R&D and technology to maintain its market share against both established players and agile startups, a challenge highlighted by the global precision medicine market's significant growth projections for 2024 and beyond.

Preview the Actual Deliverable

Galenica SWOT Analysis

This preview reflects the real Galenica SWOT analysis document you'll receive. It's professionally structured and ready for your strategic planning needs. Purchase now to unlock the complete, in-depth report.

Opportunities

Galenica has a prime opportunity to broaden its healthcare service offerings within its pharmacies, capitalizing on the growing demand for services like vaccinations and basic health consultations. This expansion aligns perfectly with consumer trends favoring accessible, local healthcare solutions.

The company can leverage its widespread pharmacy footprint to become a more central hub for primary health needs, offering a wider array of services beyond traditional dispensing. For instance, in 2024, the global market for pharmacy-based clinical services was estimated to be worth billions, with significant growth projected as healthcare systems increasingly rely on community pharmacies for accessible care.

The increasing shift towards outpatient and home-based care presents a significant growth avenue for Galenica. This trend allows the company to broaden its services within the home care and residential care segments, tapping into a market that prioritizes convenience and personalized health solutions.

Galenica's strategic focus on digital integration, exemplified by platforms like Lifestage Solutions, is well-positioned to capitalize on this demand. By connecting diverse home care services, Galenica aims to offer comprehensive, digitally-enabled solutions that meet the evolving needs of patients and healthcare providers in this expanding sector.

Galenica can capitalize on further digital transformation by continuing to invest in its digital platforms. This includes expanding e-prescription capabilities and enhancing the online presence of its pharmacies, which directly addresses customer convenience and operational efficiency. For instance, in 2023, a significant portion of Galenica's revenue was already being influenced by its digital channels, demonstrating a clear trend towards online engagement.

Developing a comprehensive digital medication journey is a key opportunity. This means creating a seamless experience from the doctor's prescription to the patient's doorstep, incorporating online ordering and robust prescription management. Such integration strengthens Galenica's competitive position by meeting evolving consumer demands for accessible and efficient healthcare solutions.

Strategic Partnerships and Targeted Acquisitions for Market Expansion

Galenica's strategy to enhance its market position and service offerings hinges on continuing its pursuit of strategic partnerships and targeted acquisitions. This approach allows for synergistic growth and deeper integration within the healthcare ecosystem.

Recent moves, like the acquisition of Labor Team W AG in 2024, demonstrate this commitment. These actions are designed to broaden Galenica's product portfolio and facilitate entry into new, promising service areas, bolstering its competitive edge.

- Market Expansion: Acquisitions and partnerships are key to entering new geographical markets and service segments.

- Portfolio Enhancement: Integrating new products and services through these strategic alliances diversifies revenue streams.

- Synergistic Growth: Collaborations leverage existing strengths, creating value beyond individual entity performance.

- Healthcare Ecosystem Integration: These moves strengthen Galenica's role within the broader healthcare landscape.

Leveraging Demographic Trends and Chronic Disease Prevalence

Switzerland's demographic landscape, marked by an aging population, presents a significant opportunity for Galenica. By 2024, it's estimated that over 20% of the Swiss population will be aged 65 and above, a trend that directly correlates with increased healthcare needs.

The rising prevalence of chronic diseases, such as cardiovascular conditions and diabetes, further fuels demand for pharmaceutical products and continuous healthcare support. For instance, the incidence of diabetes in Switzerland has seen a steady increase, impacting a substantial portion of the population requiring ongoing medication and management.

Galenica is strategically positioned to address these evolving market dynamics. Its comprehensive offerings, including essential medicines, specialized patient care programs, and expert advisory services, are precisely what this growing demographic requires. This alignment allows Galenica to not only meet but anticipate the needs of an aging society with increasing chronic health challenges.

- Aging Population: Over 20% of Switzerland's population projected to be 65+ by 2024.

- Chronic Disease Growth: Increasing incidence of conditions like diabetes and cardiovascular diseases.

- Demand Driver: These demographic and health trends naturally boost demand for pharmaceuticals and healthcare services.

- Galenica's Advantage: Well-positioned to provide tailored medicines, patient care, and advisory services.

Galenica can expand its pharmacy services to include more health consultations and vaccinations, tapping into the growing demand for accessible, local healthcare. This strategy aligns with consumer preferences for convenient health solutions.

The company can leverage its extensive pharmacy network to become a primary health hub, offering a broader range of services beyond prescription dispensing. In 2024, the global market for pharmacy clinical services was valued in the billions, with strong growth anticipated as healthcare systems increasingly rely on community pharmacies.

Galenica has a significant opportunity to grow within the outpatient and home-based care sectors, catering to market trends that prioritize convenience and personalized health solutions. Its digital platforms, such as Lifestage Solutions, are designed to integrate various home care services, offering comprehensive, digitally-enabled care.

Continued investment in digital transformation, including enhanced e-prescription capabilities and online pharmacy presence, presents a clear path for growth. In 2023, digital channels already influenced a substantial portion of Galenica's revenue, highlighting a strong shift towards online engagement.

Threats

The Swiss healthcare market is a hotbed of competition, with biopharmaceutical breakthroughs and digital health innovations drawing in new companies and intensifying rivalry. Galenica feels this pressure from established pharmacy chains and newer digital health platforms, making ongoing innovation crucial for staying ahead.

In 2024, the global biopharmaceutical market was valued at an estimated $290 billion, a figure projected to grow significantly, indicating the increasing importance and competitive nature of this segment. Galenica's market share is challenged not only by traditional players but also by agile digital health startups that are rapidly capturing consumer attention and market penetration.

Galenica faces considerable threats from an evolving regulatory landscape, particularly concerning government efforts to control drug pricing. Ongoing interventions aimed at reducing costs for generics and biosimilars directly impact revenue streams and profit margins. For instance, in 2024, many European countries continued to implement stricter price negotiation frameworks and tender systems for pharmaceuticals, potentially squeezing Galenica's pricing power.

Global and local supply chain vulnerabilities, exacerbated by geopolitical tensions and manufacturing challenges, pose a significant threat to Galenica. For instance, the pharmaceutical sector experienced widespread disruptions in 2024 due to increased raw material costs and shipping delays, impacting product availability worldwide.

These disruptions could directly affect Galenica's capacity to ensure a steady supply of medications to pharmacies and healthcare providers. A study in late 2024 revealed that over 30% of pharmacies reported experiencing stockouts of essential drugs, a situation Galenica must actively mitigate to maintain its market position and customer trust.

Such shortages can lead to decreased customer satisfaction and a direct impact on revenue streams as sales opportunities are missed. Galenica's proactive inventory management and diversified sourcing strategies are crucial to navigating these potential product availability issues throughout 2025.

Economic Headwinds and Healthcare Expenditure Constraints

Broader economic downturns present a significant threat, potentially impacting Galenica's revenue streams. For instance, a projected 2.5% global GDP slowdown in 2025, as forecasted by the IMF, could translate to reduced consumer spending on healthcare services and products. This economic pressure might force governments and insurers to implement stricter cost-containment measures, directly affecting reimbursement rates for Galenica's offerings.

Sustained pressure on healthcare expenditure, exacerbated by an aging global population and the escalating costs of novel treatments, poses another considerable challenge. By 2030, the number of people aged 65 and over is expected to reach 1.6 billion globally, driving up demand for healthcare services while simultaneously straining budgets. This scenario could lead to increased scrutiny on pricing and a potential reduction in market access for Galenica's innovative therapies, impacting overall financial performance.

- Economic Slowdown Impact: A projected 2.5% global GDP slowdown in 2025 could reduce healthcare spending.

- Aging Population Strain: The global population aged 65+ is projected to hit 1.6 billion by 2030, increasing healthcare demand and costs.

- Reimbursement Pressure: Cost-containment measures by governments and insurers may lower reimbursement rates for Galenica's products and services.

- Innovation Cost Challenge: The high cost of innovative therapies may lead to pricing scrutiny and market access limitations.

Cybersecurity Risks and Data Privacy Concerns

Galenica's growing dependence on digital systems for customer engagement, supply chain management, and data handling exposes it to significant cybersecurity threats. A successful cyberattack could compromise sensitive patient data, leading to severe breaches of privacy.

The company must invest heavily in IT security to safeguard its operations and customer trust. For instance, the healthcare sector globally saw a 50% increase in cyberattacks in 2023 compared to 2022, with data breaches costing an average of $4.45 million according to IBM's 2023 Cost of a Data Breach Report.

- Heightened risk of cyberattacks: As digital platforms become central to Galenica's operations, the attack surface expands.

- Data privacy breaches: Protecting sensitive patient information is paramount; breaches can lead to significant legal and financial repercussions.

- Reputational damage: A loss of trust due to security failures can severely impact customer loyalty and market position.

- Regulatory penalties: Non-compliance with data protection regulations, such as GDPR or similar frameworks, can result in substantial fines.

Galenica faces intense competition from both established players and nimble digital health startups, a trend underscored by the biopharmaceutical market's estimated $290 billion valuation in 2024. Evolving regulations, particularly government efforts to control drug pricing through stricter frameworks and tender systems, directly threaten revenue streams and profit margins. Furthermore, global supply chain vulnerabilities, highlighted by widespread disruptions and raw material cost increases in 2024, pose a risk to product availability, with over 30% of pharmacies reporting stockouts of essential drugs late that year.

| Threat Category | Specific Threat | 2024/2025 Data/Projection |

|---|---|---|

| Competition | Intensified rivalry from biopharma and digital health | Biopharma market valued at $290 billion in 2024 |

| Regulatory Environment | Government drug pricing controls | Stricter price negotiation frameworks in Europe in 2024 |

| Supply Chain | Disruptions and increased costs | Over 30% of pharmacies reported stockouts of essential drugs in late 2024 |

SWOT Analysis Data Sources

This Galenica SWOT analysis is built upon a robust foundation of diverse data sources, including comprehensive financial reports, detailed market research, and expert industry opinions. These inputs are further augmented by official company disclosures and verified performance metrics, ensuring a thorough and reliable strategic evaluation.