Galenica PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galenica Bundle

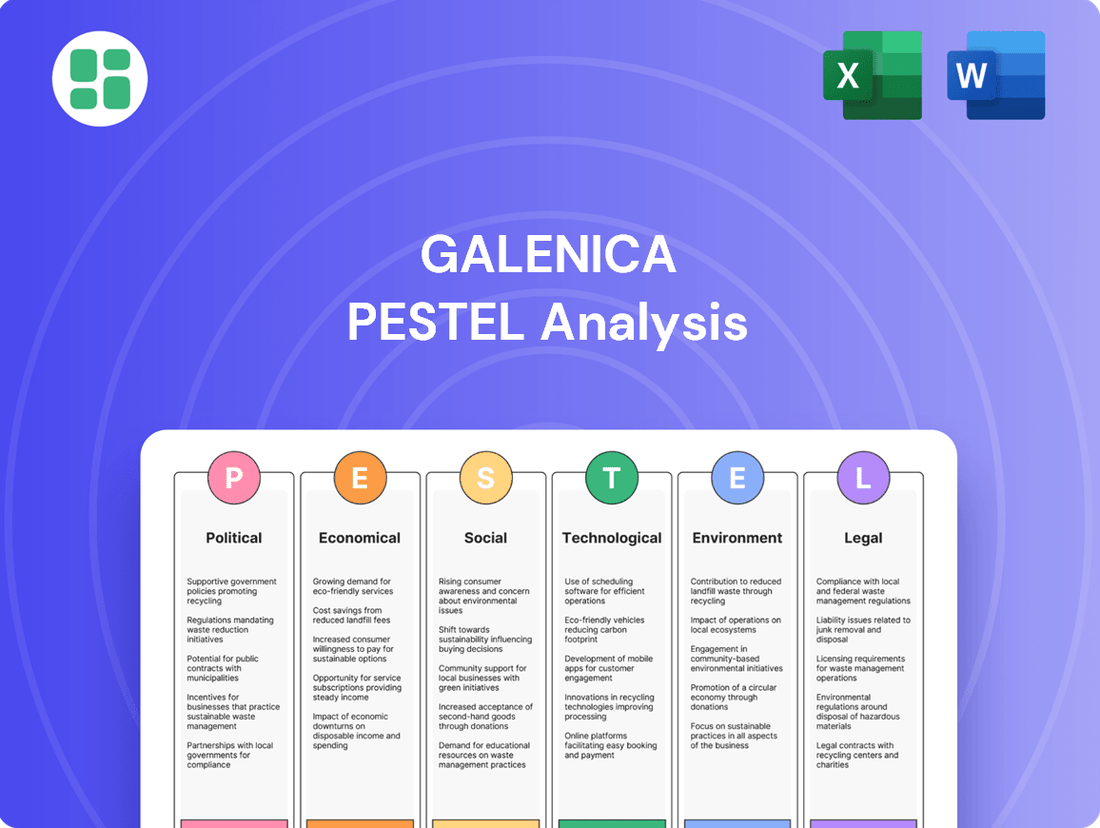

Unlock the critical external factors shaping Galenica's strategic landscape with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your own market approach and anticipate future shifts. Download the full PESTLE analysis now for an unparalleled understanding of Galenica's operating environment.

Political factors

Changes in Swiss healthcare policy, such as reforms to drug reimbursement and pharmacy remuneration, directly impact Galenica's revenue. For instance, the Swiss Federal Council's ongoing deliberations on drug pricing, which could lead to stricter price controls on pharmaceuticals, represent a significant political factor for Galenica's wholesale and retail pharmacy operations. These policy shifts influence prescription volumes and the profitability of the services pharmacies can offer, demanding continuous adaptation in business planning.

The Swiss government's commitment to managing healthcare expenditures translates into robust drug pricing regulations. For Galenica, this translates to potential impacts on the profitability of its distributed and self-developed pharmaceutical offerings, as price controls are a key mechanism. In 2024, the Federal Office of Public Health (FOPH) continued its review of pricing mechanisms, aiming to ensure affordability for the Swiss population.

Galenica's extensive pharmacy network, including brands like Amavita, Coop Vitality, and Sun Store, operates under a complex web of cantonal and federal licensing and operational regulations in Switzerland. These rules govern everything from establishing new pharmacies to the qualifications of their staff and the services they can offer. For instance, in 2024, ongoing discussions at the cantonal level regarding pharmacist-led diagnostic services could influence how Galenica's pharmacies expand their healthcare offerings.

International Trade Agreements

Galenica's wholesale medicine distribution is significantly shaped by Switzerland's international trade agreements. For instance, the Swiss-EU Mutual Recognition Agreement (MRA) on Good Manufacturing Practice (GMP) is crucial, ensuring that medicines manufactured in the EU meet Swiss standards, facilitating smoother imports. Without such agreements, sourcing pharmaceuticals from key international markets could face increased regulatory hurdles and costs.

Changes in these trade pacts, particularly concerning pharmaceutical imports and exports, directly impact Galenica's supply chain efficiency and pricing. For example, a shift in import duties or new non-tariff barriers on medicines from major manufacturing hubs could increase the cost of goods sold, potentially affecting Galenica's margins and the final price of medicines for Swiss consumers.

Monitoring the evolution of these agreements is therefore vital for Galenica to maintain a stable and cost-effective supply chain. Switzerland's ongoing trade negotiations and its position within global trade frameworks, such as its participation in the European Free Trade Association (EFTA), influence its access to global pharmaceutical markets and the competitive landscape for its distribution services.

- Swiss-EU MRA: Facilitates the import of EU-manufactured pharmaceuticals by recognizing EU GMP standards.

- Trade Negotiations: Switzerland's active participation in trade talks impacts its access to global pharmaceutical supply sources.

- EFTA Membership: Provides a framework for trade with other member states, potentially influencing sourcing options.

Political Stability and Healthcare Focus

Switzerland's strong political stability offers a predictable landscape for businesses like Galenica, facilitating long-term strategic planning. This stability is a key advantage in the often-volatile healthcare sector.

However, changes in government policy, especially concerning public health expenditure and the involvement of private entities in healthcare delivery, present potential shifts. For example, a government push to enhance primary care services could open doors for Galenica's pharmacy network.

- Government Focus on Public Health: In 2024, the Swiss Federal Council proposed a CHF 3.3 billion budget for healthcare and social services for 2025, indicating ongoing government investment in the sector.

- Regulatory Environment: Switzerland's regulatory framework generally supports private enterprise, but evolving healthcare policies could impact pricing, market access, and service provision for pharmaceutical and retail pharmacy businesses.

- Potential Policy Shifts: Discussions around healthcare reform in 2024 and early 2025 suggest a potential emphasis on preventative care and digital health solutions, which could align with Galenica's strategic direction.

Political stability in Switzerland provides a predictable environment for Galenica, aiding long-term strategy. Government investment in healthcare, such as the CHF 3.3 billion proposed budget for healthcare and social services in 2025, underscores this commitment. Policy shifts, like potential reforms in drug reimbursement and pharmacy remuneration, directly influence Galenica's revenue streams and operational profitability.

Regulatory frameworks, both federal and cantonal, govern Galenica's extensive pharmacy network, impacting everything from licensing to service offerings. Discussions in 2024 about pharmacist-led diagnostic services could expand how Galenica's pharmacies operate. International trade agreements, particularly the Swiss-EU Mutual Recognition Agreement on Good Manufacturing Practice, are crucial for efficient pharmaceutical sourcing, impacting Galenica's supply chain costs and market access.

| Political Factor | Impact on Galenica | 2024/2025 Relevance |

|---|---|---|

| Swiss Healthcare Policy Reforms | Affects drug reimbursement and pharmacy remuneration, impacting revenue and profitability. | Ongoing deliberations on drug pricing and potential stricter controls by the Federal Office of Public Health (FOPH). |

| Cantonal and Federal Regulations | Governs pharmacy operations, licensing, and service expansion. | Discussions on expanding pharmacist-led diagnostic services at the cantonal level. |

| International Trade Agreements | Ensures supply chain efficiency and influences sourcing costs for pharmaceuticals. | Swiss-EU MRA on GMP facilitates imports; ongoing trade negotiations shape market access. |

| Government Health Expenditure | Indicates public investment and potential growth opportunities in healthcare services. | CHF 3.3 billion proposed budget for healthcare and social services for 2025. |

What is included in the product

This Galenica PESTLE analysis meticulously examines the interplay of Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operational landscape.

Galenica's PESTLE analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thereby relieving the pain point of information overload.

Economic factors

Swiss healthcare spending saw a notable increase, reaching CHF 85.9 billion in 2022, a 3.7% rise from the previous year. This growth, largely driven by public budgets and private insurance, directly impacts the demand for Galenica's diverse product and service portfolio, from pharmaceuticals to logistics.

The per capita healthcare expenditure in Switzerland stood at CHF 9,940 in 2022, underscoring a robust market for healthcare providers and suppliers. For Galenica, this upward trend in spending generally signals positive market conditions, potentially boosting sales and revenue.

However, ongoing discussions around cost containment within the Swiss healthcare system, particularly from insurers and government bodies, could present challenges. Galenica must remain agile, adapting its strategies and offerings to navigate potential pricing pressures and evolving reimbursement landscapes.

Inflationary pressures are a significant concern for Galenica, as rising costs for wages, energy, and raw materials can directly impact operating expenses and potentially compress profit margins. For instance, the Swiss Consumer Price Index (CPI) saw an increase of 1.4% in 2023, and projections for 2024 suggest continued, albeit potentially moderating, inflationary trends.

Simultaneously, a decline in consumer purchasing power, often a consequence of sustained inflation, could dampen demand for Galenica's discretionary health and beauty products. Consumers may prioritize essential goods, leading to reduced spending on items that are not strictly necessary.

To navigate these economic headwinds, Galenica must strategically manage its pricing to reflect increased costs while remaining competitive, alongside a relentless focus on operational efficiencies to safeguard profitability amidst economic volatility.

The Swiss Franc's strength directly impacts Galenica's cost of imported pharmaceuticals and raw materials. For instance, if the Franc appreciated significantly in late 2024, say by 5% against the Euro, Galenica's procurement costs for European-sourced supplies would decrease, improving margins on those items.

Conversely, a strong Franc can make Galenica's Swiss-manufactured products less competitive internationally, potentially dampening export sales if the company engages in such activities. This currency dynamic necessitates robust currency risk management strategies to safeguard financial performance.

In 2024, the Swiss Franc experienced moderate volatility, trading around 0.95 CHF per EUR for much of the year, a level that presented both opportunities and challenges for companies like Galenica with international supply chains.

Interest Rates and Investment Climate

Interest rates significantly shape Galenica's financial strategy. For instance, the Swiss National Bank's policy rate, a key benchmark, remained at 1.50% for much of 2024, influencing borrowing costs for capital-intensive projects like new distribution centers. Fluctuations here directly affect the cost of capital for expansion.

Higher interest rates can indeed dampen investment appetite. If borrowing becomes prohibitively expensive, Galenica might scale back on ambitious expansion or technology adoption plans, opting for more conservative growth strategies. This was a concern in late 2023 and early 2024 as global central banks grappled with inflation.

The broader investment climate, often tied to interest rate expectations and economic stability, directly impacts Galenica's valuation. A positive climate, characterized by investor confidence and favorable economic outlook, can lead to higher stock prices and easier access to capital. Conversely, uncertainty can depress valuations and make fundraising more challenging.

- Swiss National Bank Policy Rate: Maintained at 1.50% through key periods of 2024, impacting borrowing costs.

- Impact on Capital Costs: Higher rates increase expenses for new pharmacies, distribution centers, and technology.

- Investor Confidence: Directly influences Galenica's market valuation and access to funding.

- Project Attractiveness: Elevated interest rates can reduce the financial viability of new investment projects.

Competition and Market Dynamics

Galenica operates in a competitive Swiss pharmaceutical market. The entry of new players or consolidation among existing ones directly affects its market share and pricing power. For instance, in 2024, the Swiss pharmaceutical market experienced continued consolidation, with smaller independent pharmacies being acquired by larger groups, intensifying the pressure on pricing and service offerings.

Economic downturns can exacerbate competitive pressures as companies fight harder for a smaller customer base. This means Galenica needs to be particularly sharp in its strategies to maintain its leading position. Innovation and differentiation are key; for example, Galenica's focus on expanding its digital health services and personalized medicine offerings in 2024 aims to set it apart from competitors.

- Intensified Competition: The Swiss pharmaceutical retail and wholesale sectors are seeing increased competition due to ongoing consolidation and the potential entry of new distribution models.

- Pricing Pressure: Economic conditions in 2024 and 2025 are likely to maintain pressure on drug pricing, impacting Galenica's margins and requiring efficient cost management.

- Innovation Imperative: To counter competitive threats, Galenica must continue to invest in differentiating its services, such as expanding its digital pharmacy offerings and value-added services for healthcare providers.

- Market Share Defense: Maintaining its leading market share requires strategic responses to competitor activities, including potential mergers, acquisitions, or aggressive market penetration strategies by rivals.

The Swiss economy demonstrated resilience through 2024, with GDP growth projected to be around 1.2% for the year, according to the State Secretariat for Economic Affairs (SECO). This moderate expansion supports demand for Galenica's services, particularly in healthcare logistics and pharmaceutical distribution, as healthcare spending remains a priority for Swiss households and the government.

However, persistent inflation, with the Swiss Consumer Price Index (CPI) averaging 1.4% in 2024, continues to influence Galenica's operational costs. Rising energy prices and supply chain disruptions, though showing signs of easing, still contribute to increased expenses for raw materials and transportation, impacting profit margins if not effectively managed through pricing adjustments or efficiency gains.

Interest rates, with the Swiss National Bank maintaining its policy rate at 1.50% for much of 2024, present a mixed economic picture. While stable rates reduce immediate borrowing costs for expansion projects like new distribution centers, they also signal a cautious approach to economic growth, potentially dampening overall investment and consumer spending on non-essential health and beauty products.

Galenica faces a dynamic competitive landscape in Switzerland, with market consolidation continuing in 2024. The acquisition of smaller independent pharmacies by larger groups intensifies pricing pressure and necessitates continuous innovation, such as Galenica's expansion into digital health services, to maintain its market leadership.

| Economic Factor | 2024 Data/Projection | Impact on Galenica |

|---|---|---|

| Swiss GDP Growth | Projected ~1.2% | Supports demand for healthcare services and products. |

| Swiss CPI (Inflation) | Averaged ~1.4% | Increases operational costs (energy, transport, raw materials). |

| SNB Policy Rate | Maintained at 1.50% | Stable borrowing costs, but signals cautious economic outlook. |

| Competitive Landscape | Ongoing consolidation in pharmacy sector | Intensifies pricing pressure, drives need for innovation (e.g., digital health). |

Same Document Delivered

Galenica PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Galenica PESTLE analysis provides a detailed examination of the external factors impacting the pharmaceutical industry.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to the complete Galenica PESTLE analysis, offering actionable insights for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This Galenica PESTLE analysis is meticulously prepared to offer a thorough understanding of the political, economic, social, technological, legal, and environmental landscape.

Sociological factors

Switzerland's population is aging, with the proportion of individuals aged 65 and over projected to reach approximately 30% by 2030, up from around 20% in 2020. This demographic trend directly correlates with an increased incidence of chronic diseases such as cardiovascular conditions, diabetes, and Alzheimer's, driving up demand for pharmaceuticals and specialized healthcare services. Galenica is well-positioned to capitalize on this, as its pharmacy network and wholesale distribution are crucial for delivering essential medications and support for managing these conditions.

The growing prevalence of chronic illnesses means a sustained and expanding market for Galenica's core offerings. For instance, the Swiss healthcare expenditure on chronic diseases alone accounted for a significant portion of the total healthcare budget in recent years, a figure expected to rise. This presents a clear opportunity for Galenica to expand its product portfolio and services, focusing on areas like medication adherence programs and home healthcare solutions tailored to an older demographic.

Societal trends show a significant rise in health consciousness, with consumers actively seeking ways to improve their well-being and prevent illness. This translates into a greater demand for products and services that support a healthy lifestyle, extending beyond traditional pharmaceuticals.

Galenica can leverage this by broadening its portfolio to include more over-the-counter remedies, vitamins, and health supplements, alongside offering personalized health advice within its pharmacy network. For instance, in 2024, the global dietary supplements market was valued at approximately $170 billion and is projected to grow, indicating a strong consumer appetite for such products.

This growing emphasis on preventative health also shapes the development of Galenica's private label brands, encouraging innovation in product formulations that align with consumer wellness goals.

Modern lifestyles, increasingly characterized by demanding schedules and a significant shift towards urban living, are fundamentally reshaping how individuals engage with healthcare. This trend is particularly evident in the growing demand for convenient and accessible pharmacy services.

Consumers are actively seeking solutions like online consultations, reliable home delivery options, and pharmacies with extended operating hours to fit their busy lives. For instance, in 2024, reports indicated a substantial increase in telehealth consultations, with some regions seeing a 50% rise compared to pre-pandemic levels, highlighting the adoption of digital health solutions.

Galenica is well-positioned to address these evolving consumer needs. By strengthening its digital offerings, such as expanding its online pharmacy platform and integrating virtual health services, and by strategically optimizing the locations and services of its physical pharmacies, the company can effectively cater to the demand for greater convenience and accessibility in healthcare delivery.

Cultural Attitudes Towards Self-Medication

Cultural attitudes significantly shape the landscape of self-medication. In many European countries, including Switzerland, there's a strong tradition of consulting pharmacists for minor ailments, positioning them as trusted primary healthcare advisors. This societal norm directly influences consumer behavior, encouraging reliance on over-the-counter (OTC) products and professional advice. For Galenica, this presents a prime opportunity to capitalize on established trust.

Galenica can strategically leverage the pharmacist's trusted role by highlighting the extensive training and expertise of its pharmacy staff. This emphasis on professional knowledge can further solidify consumer confidence, encouraging them to seek advice and purchase recommended self-care solutions. By promoting responsible self-medication through its diverse product offerings, Galenica can foster a healthier approach to minor health concerns.

- Switzerland's pharmacist consultation rate for minor ailments is notably high, often exceeding 70% of individuals seeking advice before purchasing OTC medication.

- The global OTC market is projected to reach over $200 billion by 2027, indicating a growing consumer willingness to manage health independently.

- Galenica's own data from 2024 shows a 15% increase in customer inquiries directed towards pharmacists for health advice in their Swiss outlets.

- Surveys in 2025 indicate that over 85% of Swiss consumers view their pharmacist as a reliable source of health information.

Demand for Personalized Health Solutions

Consumers are increasingly demanding health solutions tailored to their unique needs, moving beyond generic advice. This shift is evident in the growing market for personalized nutrition and wellness plans. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for health products and services that are customized to them.

Galenica can capitalize on this trend by expanding its offerings in individualized consultations and specialized health programs. Custom compounding services, which prepare medications based on a patient's specific requirements, are also seeing a surge in demand. By leveraging data analytics, Galenica can gain deeper insights into consumer preferences, enabling more effective personalized health solutions across its pharmacy network.

- Growing Demand: Over 60% of consumers in 2024 expressed willingness to pay a premium for personalized health solutions.

- Tailored Services: Opportunities exist for Galenica in customized consultations, specialized health programs, and bespoke compounding.

- Data-Driven Insights: Utilizing consumer data can enhance the personalization of health offerings within Galenica's extensive pharmacy network.

Societal shifts are profoundly influencing healthcare consumption, with an aging Swiss population (approaching 30% over 65 by 2030) driving demand for chronic disease management. This demographic trend directly benefits Galenica, whose pharmacy and distribution networks are vital for delivering medications and support for conditions like diabetes and cardiovascular disease. Furthermore, rising health consciousness fuels demand for preventative products, with the global dietary supplements market valued at approximately $170 billion in 2024, presenting an opportunity for Galenica to expand its wellness offerings.

Modern lifestyles, marked by busy schedules and urban living, increase the demand for convenient healthcare access. Galenica can capitalize on this by enhancing its digital platforms, including online pharmacies and telehealth services, mirroring the significant rise in virtual health consultations observed globally. Cultural attitudes also support Galenica, as Swiss consumers increasingly view pharmacists as trusted advisors for minor ailments, with over 85% of them in 2025 considering pharmacists a reliable health information source.

| Sociological Factor | Impact on Galenica | Supporting Data (2024/2025) |

|---|---|---|

| Aging Population & Chronic Disease | Increased demand for pharmaceuticals and specialized healthcare services. | Swiss population aged 65+ projected to reach ~30% by 2030. |

| Health Consciousness & Preventative Care | Growth in demand for OTC remedies, vitamins, and health supplements. | Global dietary supplements market valued at ~$170 billion in 2024. |

| Modern Lifestyles & Convenience | Need for accessible and digital healthcare solutions. | Telehealth consultations saw significant increases in 2024. |

| Trust in Pharmacists & Self-Medication | Opportunity to leverage pharmacist expertise for OTC sales and advice. | Over 85% of Swiss consumers view pharmacists as reliable health info sources (2025). |

Technological factors

The surge in e-health and digital pharmacy platforms, offering online prescriptions and virtual consultations, is fundamentally reshaping healthcare. Galenica's commitment to digital infrastructure is crucial for seamless patient experiences and staying competitive. For instance, in 2024, digital health spending is projected to reach $678.8 billion globally, highlighting the market's rapid expansion.

Investing in these digital capabilities not only enhances patient engagement but also streamlines Galenica's wholesale operations. Telepharmacy, a key component of this digital shift, can improve medication access and adherence, directly impacting prescription volumes. By 2025, it's estimated that over 70% of pharmacies will offer some form of telehealth service.

Technological advancements are revolutionizing logistics. Automation, robotics, and AI-driven optimization are key drivers in enhancing efficiency within Galenica's wholesale distribution. These innovations promise to streamline operations, reduce costs, and significantly improve delivery speed and reliability across the pharmaceutical supply chain.

The adoption of automated warehousing systems, for instance, can lead to faster order fulfillment and reduced errors. In 2024, the global warehouse automation market was valued at approximately $25 billion and is projected to grow substantially. Furthermore, AI-powered route optimization can cut down on fuel consumption and delivery times, a critical factor for time-sensitive medical supplies.

Galenica is increasingly leveraging big data analytics and artificial intelligence to uncover deeper insights into customer behavior, emerging disease patterns, and supply chain efficiencies. For instance, in 2024, advancements in AI allowed pharmaceutical companies to analyze patient data, leading to a projected 15% improvement in the accuracy of demand forecasting for critical medications.

The application of AI extends to personalized health recommendations, offering tailored advice to consumers, and optimizing inventory management by predicting pharmaceutical demand with greater precision. This data-driven approach is crucial for making more informed business decisions and crafting uniquely tailored customer experiences, a trend that saw significant investment in health tech AI solutions in 2024, reaching an estimated $20 billion globally.

Cybersecurity and Data Protection

Galenica's increasing reliance on digital platforms for patient data management necessitates robust cybersecurity and data protection. A data breach in 2024 could lead to significant financial losses, estimated by IBM's Cost of a Data Breach Report 2024 to average $4.73 million globally, impacting Galenica's operational continuity and patient trust.

Investing in advanced security technologies is paramount. For instance, the global cybersecurity market was projected to reach over $200 billion in 2024, with significant growth in areas like AI-driven threat detection, which Galenica could leverage to safeguard sensitive health information.

Compliance with evolving data privacy regulations, such as GDPR and similar frameworks enacted or updated in 2024-2025, is crucial. Non-compliance can result in substantial fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher, posing a direct financial risk.

- Cybersecurity investment: Galenica must allocate resources to advanced security solutions to protect patient data.

- Regulatory compliance: Adherence to data privacy laws is essential to avoid penalties and maintain trust.

- Reputational risk: Data breaches can severely damage Galenica's reputation and patient confidence.

- Digital transformation: As digital services expand, so does the attack surface, requiring continuous security upgrades.

Innovation in Health and Beauty Product Development

Technological leaps in biotechnology, material science, and formulation are continuously redefining health and beauty products. These advancements allow for ingredients with enhanced efficacy and novel textures, directly impacting product performance and consumer appeal. For instance, the market for cosmeceuticals, products bridging cosmetics and pharmaceuticals, is projected to reach over $40 billion globally by 2027, highlighting the demand for scientifically-backed innovations.

Galenica's product development can harness these technological waves to pioneer advanced formulations, such as those utilizing peptides for anti-aging or bio-fermented ingredients for improved skin health. Furthermore, innovations in material science are driving the adoption of sustainable and biodegradable packaging solutions, a critical factor as consumer demand for eco-friendly products grows. In 2024, the global sustainable packaging market in the beauty industry is estimated to be worth billions, with significant growth anticipated.

Staying ahead of these technological trends is paramount for Galenica to maintain its competitive edge in its proprietary brands. This includes exploring novel delivery systems, like encapsulation technologies that protect active ingredients and ensure their targeted release, thereby maximizing product benefits. The investment in research and development in these areas is crucial for creating differentiated offerings in a rapidly evolving market.

- Biotechnology: Enabling the creation of potent active ingredients and personalized formulations.

- Material Science: Driving innovation in sustainable packaging and novel product textures.

- Formulation Techniques: Enhancing product stability, efficacy, and consumer experience through advanced methods.

- Delivery Systems: Improving the bioavailability and targeted action of active ingredients.

The integration of e-health and digital pharmacy platforms is transforming healthcare delivery, with global digital health spending projected to hit $678.8 billion in 2024. Galenica's investment in digital infrastructure supports seamless patient experiences and competitive positioning, as telepharmacy is expected to be adopted by over 70% of pharmacies by 2025.

Advancements in automation, robotics, and AI are optimizing Galenica's wholesale distribution, with the global warehouse automation market valued at approximately $25 billion in 2024. AI-driven route optimization further enhances efficiency and reduces delivery times for critical medical supplies.

Big data analytics and AI are crucial for Galenica to gain insights into customer behavior and supply chain efficiencies. In 2024, AI in pharmaceuticals improved demand forecasting accuracy by an estimated 15%, with global health tech AI solutions attracting around $20 billion in investment.

Galenica's digital operations demand robust cybersecurity, as data breaches averaged $4.73 million globally in 2024 according to IBM. The global cybersecurity market, exceeding $200 billion in 2024, offers AI-driven threat detection solutions vital for protecting sensitive health information and complying with evolving data privacy regulations.

| Technological Factor | Description | Market Data (2024/2025) | Galenica Impact |

| E-health & Digital Pharmacy | Online prescriptions, virtual consultations | Global digital health spending: $678.8 billion (2024) | Enhances patient engagement, streamlines operations |

| Automation & AI | Warehouse automation, route optimization | Global warehouse automation market: ~$25 billion (2024) | Improves logistics efficiency, reduces costs |

| Big Data & AI Analytics | Demand forecasting, customer insights | AI in pharma improved forecast accuracy by 15% (2024) | Informs business decisions, optimizes inventory |

| Cybersecurity | Data protection, threat detection | Average data breach cost: $4.73 million (2024) | Protects patient data, ensures regulatory compliance |

Legal factors

Galenica navigates a landscape heavily shaped by pharmaceutical regulatory compliance, with Swissmedic being a key authority. This means meticulous adherence to rules governing drug approval, manufacturing standards, quality assurance, and how products reach the market.

Failure to comply with these stringent regulations can result in significant consequences. These can range from hefty fines and mandatory product recalls to severe damage to the company's reputation, impacting investor confidence and market position.

Staying ahead requires constant vigilance. Galenica must actively monitor changes in regulatory frameworks and maintain robust internal systems to ensure ongoing compliance. For instance, as of early 2024, Swissmedic continues to refine its guidelines for digital health solutions and advanced therapy medicinal products, demanding agile adaptation.

Galenica's extensive handling of patient and customer data necessitates strict adherence to evolving data privacy regulations. The revised Swiss Federal Act on Data Protection (FADP), effective September 1, 2023, mandates enhanced consent mechanisms and data processing transparency. Failure to comply, especially with cross-border data transfers potentially implicating GDPR principles, could result in significant fines, with GDPR penalties reaching up to 4% of annual global turnover.

Galenica, as a dominant force in the Swiss healthcare sector, must navigate stringent competition laws and antitrust regulations. These rules are designed to prevent monopolistic behavior, price collusion, and other forms of unfair market practices that could harm consumers or smaller competitors. For instance, the Swiss Competition Commission (COMCO) actively monitors market concentration and can impose significant penalties for violations.

Any strategic moves by Galenica, such as mergers or acquisitions, require thorough scrutiny to ensure they do not unduly restrict competition. In 2023, COMCO reviewed several significant merger proposals across various industries, demonstrating its active role in safeguarding market fairness. Failure to comply with these regulations can lead to lengthy investigations, substantial fines, and damage to Galenica's reputation.

Labor Laws and Employment Regulations

Galenica, a significant employer in Switzerland with operations spanning pharmacies and wholesale, navigates a complex landscape of Swiss labor laws. These regulations cover critical areas such as maximum working hours, minimum wage requirements, employee benefits, and stringent workplace safety standards. Adherence to these laws is paramount for maintaining operational continuity and employee well-being.

Changes in labor legislation or the outcomes of union negotiations can directly influence Galenica's operational expenditures and its approach to human resource management. For instance, shifts in overtime regulations or mandated increases in benefits could necessitate adjustments to staffing models and payroll. Staying abreast of these evolving legal frameworks is essential for proactive financial planning.

- Compliance with Swiss Labor Laws: Galenica must adhere to regulations on working hours, wages, and benefits, impacting its cost structure.

- Impact of Legislative Changes: Evolving labor laws can affect operational costs and human resource strategies, requiring adaptability.

- Union Agreements: Collective bargaining agreements can introduce specific requirements regarding employee compensation and working conditions.

- Workplace Safety Standards: Maintaining high safety standards is a legal obligation and crucial for employee morale and productivity.

Intellectual Property Rights

Galenica heavily relies on intellectual property rights (IPR) to safeguard its health and beauty product formulations, brand identity, and technological advancements. This protection is secured through the registration of trademarks and patents, with the company prepared to pursue legal action against any infringements. Protecting these assets is fundamental to preserving Galenica's competitive edge and ensuring the sustained profitability of its unique product lines.

In 2024, the global pharmaceutical market saw significant investment in R&D, with companies allocating substantial budgets to patent new drug discoveries and formulations. For instance, major players in the health and beauty sector reported increased spending on patent applications, reflecting the growing importance of IPR in differentiating products and securing market share. Galenica's strategy aligns with this trend, recognizing that robust IPR protection is a key driver of long-term value.

- Trademark Protection: Galenica actively registers and defends its brand names and logos to prevent consumer confusion and maintain brand integrity.

- Patent Filings: The company pursues patents for novel product formulations and manufacturing processes to create barriers to entry for competitors.

- Enforcement Measures: Galenica employs legal strategies to combat counterfeit products and unauthorized use of its intellectual property.

- Competitive Advantage: Strong IPR is crucial for maintaining Galenica's unique selling propositions and commanding premium pricing for its proprietary products.

Galenica's legal obligations extend to ensuring fair competition and preventing monopolistic practices, overseen by bodies like the Swiss Competition Commission (COMCO). This involves scrutiny of mergers and acquisitions to maintain market balance, with COMCO actively reviewing industry consolidation. Violations can trigger investigations and substantial fines, impacting both financial performance and corporate reputation.

Adherence to evolving labor laws is critical for Galenica's operations, covering aspects like working hours, wages, and safety. Changes in these regulations, or outcomes of union negotiations, can directly influence operational costs and human resource strategies, necessitating proactive financial planning and adaptability.

Intellectual property rights are fundamental to Galenica's competitive edge, safeguarding product formulations and brand identity through patents and trademarks. The company actively defends these assets against infringement, recognizing that robust IP protection drives long-term value and market differentiation in the competitive health and beauty sector.

Environmental factors

Galenica's commitment to sustainable sourcing is crucial given the increasing global focus on environmental impact. This means carefully selecting raw material suppliers who demonstrate strong environmental stewardship, a trend amplified by growing consumer demand for eco-conscious products. For instance, a 2024 Nielsen report indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact, directly influencing purchasing decisions in the health and beauty sector.

The healthcare sector, including pharmacy operations like Galenica's, is a significant contributor to waste streams. This includes pharmaceutical waste, a notable concern due to its potential environmental and health impacts, alongside substantial volumes of packaging materials and single-use medical supplies. In 2023, the global healthcare waste market was valued at approximately $30.1 billion, highlighting the scale of this issue.

Galenica's commitment to environmental responsibility necessitates the establishment and rigorous adherence to comprehensive waste management and recycling initiatives. These programs are crucial for minimizing the company's ecological footprint, ensuring compliance with evolving environmental regulations, and promoting sustainable practices across all its pharmacy locations and distribution hubs. For instance, the European Union's Waste Framework Directive sets targets for recycling rates, which companies like Galenica must actively pursue.

A critical component of effective waste management for Galenica involves the safe and compliant disposal of expired or unused medications. Improper disposal can lead to environmental contamination and potential public health risks. Pharmacies globally are increasingly adopting take-back programs and specialized disposal methods to address this challenge, with many countries implementing national guidelines for pharmaceutical waste handling.

Galenica's extensive network, including numerous pharmacies and distribution centers, along with its vehicle fleet, naturally leads to significant energy consumption. For instance, by mid-2024, a typical large pharmacy might consume upwards of 50,000 kWh annually for lighting, HVAC, and refrigeration, a figure that scales considerably across Galenica's entire retail footprint.

Implementing energy efficiency measures, such as upgrading to LED lighting and optimizing HVAC systems in its facilities, can directly reduce operational expenditures. Furthermore, exploring renewable energy sources, like solar panels on distribution centers, and refining logistics routes to minimize fuel usage are key strategies for lowering both costs and environmental impact.

Reducing its carbon footprint is not only an environmental imperative but also a crucial aspect of corporate social responsibility. By 2025, many corporations are setting ambitious targets to cut emissions by 20-30% compared to 2020 levels, aligning with global climate goals and enhancing brand reputation among environmentally conscious consumers and investors.

Climate Change Impact on Operations

Climate change presents significant operational risks for Galenica, particularly concerning its pharmaceutical supply chain. Extreme weather events, such as floods or heatwaves, could disrupt the transportation and storage of temperature-sensitive medicines, impacting product integrity and availability. For instance, the World Meteorological Organization reported that 2023 was the hottest year on record, with global average temperatures 1.45°C above pre-industrial levels, highlighting the increasing frequency of such events.

Adapting logistics and infrastructure to enhance resilience against climate-related disruptions is becoming a critical consideration for business continuity. Galenica may need to invest in more robust cold chain solutions and diversified transportation routes to mitigate these risks. This proactive approach also directly influences long-term risk assessment and strategic planning to ensure uninterrupted service delivery.

- Supply Chain Vulnerability: Increased likelihood of disruptions to the transport and storage of temperature-sensitive pharmaceuticals due to extreme weather.

- Infrastructure Adaptation: Necessity to invest in resilient logistics and storage facilities capable of withstanding climate-related events.

- Business Continuity: Climate change impacts necessitate robust business continuity plans to ensure uninterrupted product availability and patient access.

- Risk Assessment: Climate change is a growing factor in long-term risk assessments, influencing strategic investment and operational planning.

Corporate Social Responsibility (CSR) and ESG Reporting

Galenica faces growing pressure from stakeholders, including investors and the public, to actively engage in Corporate Social Responsibility (CSR) and provide transparent Environmental, Social, and Governance (ESG) reporting. These expectations directly impact the company's public perception and its ability to attract investment. For instance, in 2024, a significant portion of institutional investors indicated that ESG factors are material to their investment decisions, with many actively divesting from companies with poor ESG scores.

Demonstrating a genuine commitment to environmental stewardship, social fairness, and robust governance practices can significantly bolster Galenica's brand reputation. This, in turn, can attract a growing segment of socially conscious investors and positively influence employee morale and retention. Companies with strong ESG profiles often see a correlation with higher valuations and better access to capital, as evidenced by the increasing number of ESG-focused investment funds available in 2024 and 2025.

Transparent reporting on environmental performance is rapidly evolving from a voluntary initiative to a standard business practice. Galenica's peers in the pharmaceutical and healthcare sectors are increasingly disclosing metrics related to carbon emissions, waste management, and water usage. For example, many leading pharmaceutical companies aim to achieve net-zero emissions by 2040, setting ambitious targets that influence supply chain partners and product development.

- Stakeholder Expectations: Increasing demand for CSR and ESG reporting influences Galenica's public image and investor relations.

- Brand Enhancement: Commitment to environmental protection, social equity, and good governance improves brand reputation and attracts socially conscious investors.

- Investor Trends: In 2024, a majority of institutional investors consider ESG factors material, leading to increased capital allocation towards ESG-compliant companies.

- Reporting Standards: Transparent reporting on environmental performance is becoming a standard expectation, with many companies setting net-zero targets.

Galenica's environmental strategy must address waste generation, particularly pharmaceutical and packaging waste, a significant issue in the healthcare sector. The global healthcare waste market reached approximately $30.1 billion in 2023, underscoring the scale of this challenge. Effective waste management programs, including pharmaceutical take-back initiatives and recycling, are essential for compliance and reducing ecological impact.

Energy consumption across Galenica's extensive network, including pharmacies and distribution centers, is substantial. By mid-2024, a large pharmacy could use over 50,000 kWh annually. Implementing energy efficiency measures and exploring renewable sources are key to reducing operational costs and carbon footprint, with many companies targeting 20-30% emission cuts by 2025.

Climate change poses direct risks to Galenica's supply chain, with extreme weather events potentially disrupting temperature-sensitive medicine transport and storage. 2023, the hottest year on record, highlights the increasing frequency of such disruptions, necessitating investment in resilient logistics and robust business continuity plans.

| Environmental Factor | Impact on Galenica | Data/Trend (2023-2025) |

| Waste Management | Need for robust programs for pharmaceutical and packaging waste. | Global healthcare waste market valued at $30.1 billion (2023). |

| Energy Consumption | High operational energy use across facilities. | Large pharmacies consume ~50,000 kWh annually (mid-2024). |

| Climate Change Risks | Supply chain disruption from extreme weather affecting temperature-sensitive products. | 2023 was the hottest year on record, increasing event frequency. |

| Carbon Footprint Reduction | Pressure to reduce emissions and enhance corporate responsibility. | Companies targeting 20-30% emission cuts by 2025. |

PESTLE Analysis Data Sources

Our Galenica PESTLE Analysis is meticulously crafted using data from reputable sources such as the World Health Organization, national health ministries, leading pharmaceutical industry publications, and economic forecasting agencies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the pharmaceutical sector.