Galenica Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galenica Bundle

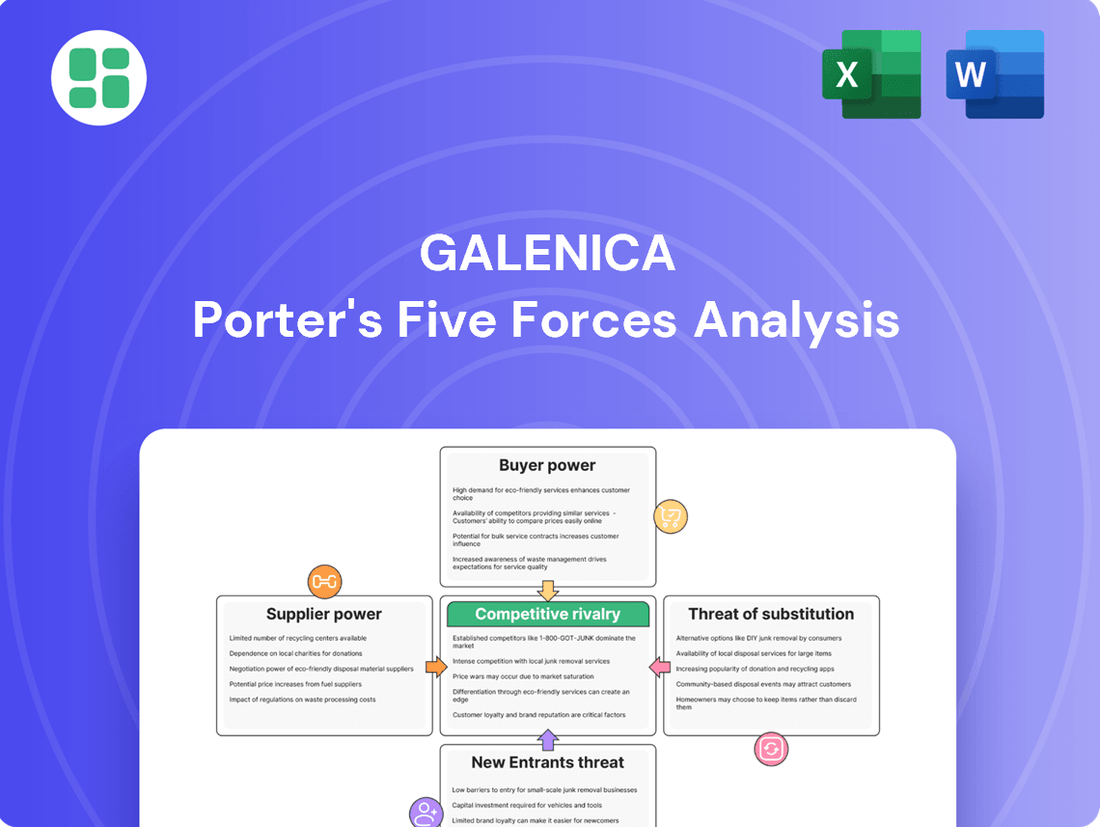

Galenica's competitive landscape is shaped by a complex interplay of forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for navigating the pharmaceutical and healthcare sectors.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Galenica’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Galenica, a key player in the Swiss pharmaceutical distribution and retail landscape, faces considerable bargaining power from its suppliers, the pharmaceutical manufacturers. This is particularly true for innovative, patented medications where Galenica has limited alternative sources, allowing manufacturers to dictate terms more effectively. In 2023, the global pharmaceutical market saw significant growth, with R&D spending reaching over $240 billion, underscoring the investment in unique product development by these suppliers.

Galenica's reliance on specialized logistics and IT service providers, particularly for its pre-wholesale, wholesale, and IT operations, means these suppliers can wield significant bargaining power. The intricate nature of pharmaceutical supply chains and the complexity of IT systems, such as the ongoing ERP implementation at Galexis, often translate into high switching costs for Galenica.

In 2024, the global logistics market was valued at approximately $10.7 trillion, with specialized segments like pharmaceutical logistics commanding premium pricing due to stringent regulatory and operational demands. For instance, providers of advanced warehousing solutions or critical IT infrastructure can dictate terms when their services are highly specialized and difficult to replace.

Galenica's strategic move to form Health Supply AG, a joint venture with Planzer, demonstrates an effort to consolidate and potentially gain more leverage over logistics suppliers. This initiative aims to streamline pharmaceutical distribution, which could reduce dependence on external providers and thereby diminish their individual bargaining power in the long run.

Galenica's own brand of health and beauty products relies on a variety of suppliers for essential components like raw materials, packaging, and manufacturing. The influence these suppliers hold can shift based on how easily Galenica can find replacements for ingredients, how standardized those ingredients are, and how much business Galenica represents to them. For instance, if a particular ingredient is highly specialized and difficult to source elsewhere, the supplier of that ingredient gains significant leverage.

Medical Equipment and Device Manufacturers

Galenica's pharmacies, while known for pharmaceuticals, also provide health services that may involve medical equipment. Suppliers of specialized devices for services like health screenings or vaccinations could wield moderate to high bargaining power. This is particularly true if the equipment is unique, patented, or necessitates specialized upkeep and operator training, limiting Galenica's alternatives.

The Swiss regulatory environment for medical devices, which largely mirrors EU standards, also plays a role. For instance, in 2024, the European Union's Medical Device Regulation (MDR) continued to shape market access and compliance requirements for new and existing devices. This can consolidate supplier influence by increasing the complexity and cost for alternative suppliers to enter the market or for Galenica to switch providers.

- Supplier Concentration: The number of manufacturers for specific, high-tech medical devices used in pharmacies can be limited, concentrating power among a few key players.

- Switching Costs: If Galenica invests in proprietary equipment or requires extensive staff retraining for new devices, the cost and effort to switch suppliers can be substantial, increasing supplier leverage.

- Regulatory Hurdles: Compliance with stringent medical device regulations, like the EU MDR which Switzerland follows, can create barriers to entry for new suppliers, thus strengthening the position of established ones.

- Input Differentiation: Highly specialized or technologically advanced equipment that offers unique diagnostic capabilities or efficiency gains can command higher prices and terms from suppliers.

Labor (Pharmacists and Healthcare Professionals)

The bargaining power of skilled labor, particularly pharmacists and healthcare professionals, is a significant factor for Galenica. The availability of these professionals directly influences Galenica's capacity to run its numerous pharmacies and deliver essential services. A scarcity of qualified individuals within the healthcare industry can amplify the leverage of employees, resulting in increased wage demands and difficulties in maintaining adequate staffing levels. This is a widespread challenge affecting traditional pharmacies.

In 2024, the healthcare sector, including pharmacy roles, continued to experience staffing pressures. For instance, reports indicated ongoing shortages of pharmacists in various regions, a trend exacerbated by an aging workforce and increasing demand for healthcare services. This dynamic directly translates to higher labor costs for companies like Galenica, as they compete for a limited pool of talent.

- Increased Labor Costs: Shortages of pharmacists in 2024 led to competitive wage increases, impacting Galenica's operating expenses.

- Staffing Challenges: Difficulty in recruiting and retaining qualified personnel poses operational risks for Galenica's pharmacy network.

- Impact on Service Delivery: Understaffing can strain existing employees and potentially affect the quality and availability of pharmacy services.

- Broader Industry Trend: The pressure on healthcare labor is a sector-wide issue, not unique to Galenica, but requires strategic HR management.

Suppliers of innovative pharmaceuticals hold significant power over Galenica, especially when their products are patented and lack readily available alternatives. This leverage allows manufacturers to set terms, impacting Galenica's margins and product availability. The global pharmaceutical R&D spending exceeding $240 billion in 2023 highlights the investment in unique, high-value products that solidify supplier strength.

Galenica's reliance on specialized logistics and IT providers also grants these suppliers considerable bargaining power. The complexity and regulatory demands of pharmaceutical supply chains, coupled with high switching costs for integrated IT systems, reinforce supplier influence. The global logistics market, valued at approximately $10.7 trillion in 2024, shows that specialized segments like pharma logistics can command premium pricing due to their unique requirements.

Galenica's efforts to mitigate supplier power include strategic ventures like Health Supply AG, aiming to consolidate logistics and reduce dependence on individual providers. However, the inherent differentiation of inputs, such as specialized medical equipment or unique pharmaceutical ingredients, continues to empower suppliers who can offer critical or hard-to-replicate components. The Swiss medical device regulatory landscape, mirroring EU MDR in 2024, further entrenches established suppliers by creating barriers for new entrants.

What is included in the product

This analysis unpacks the competitive forces shaping Galenica's market, detailing supplier and buyer power, the threat of new entrants and substitutes, and existing rivalry.

Instantly identify and address competitive threats with a visually intuitive breakdown of each force, simplifying complex market dynamics.

Customers Bargaining Power

Individual pharmacy customers, like those visiting Amavita, Coop Vitality, and Sun Store, exert moderate bargaining power. While price sensitivity exists, factors such as the convenience of local pharmacies, the established trust in these brands, and the value of professional advice, including consultations and vaccinations, limit their inclination to switch purely on cost. In 2023, Galenica reported a 5.7% increase in fee-based consultations, indicating a strategy to deepen customer relationships and reduce price-driven switching.

In its wholesale distribution arm, Galenica encounters customers like doctors and hospitals who can wield significant bargaining power. These substantial institutional purchasers often buy in large quantities, potentially fostering existing ties with various distributors or even securing direct supply contracts with manufacturers.

The sheer volume of their purchases, coupled with the absolute necessity for consistent and dependable supply, grants these entities considerable influence during price discussions and in shaping service level agreements. For instance, in 2024, the healthcare sector's demand for pharmaceuticals and medical supplies remained robust, with hospital systems frequently consolidating purchasing power to negotiate better terms.

Health insurers and government bodies wield considerable bargaining power over Galenica within the Swiss healthcare landscape. For instance, the Federal Council's 2024 initiatives aimed at curbing healthcare spending and enhancing market transparency directly influence the pricing of Galenica's reimbursed medicines, thereby impacting its revenue.

These regulatory actions, coupled with the negotiating power of numerous health insurers, create a substantial indirect pressure on Galenica's pricing strategies and profitability. This collective influence significantly limits Galenica's ability to unilaterally set prices for a substantial portion of its product portfolio.

Other Pharmacies (Wholesale Segment)

In the wholesale segment, Galenica's customers are other pharmacies, particularly independent ones. These pharmacies depend on timely and reliable product distribution, but they often have choices from multiple wholesale suppliers. Their bargaining power is influenced by the number of available wholesale distributors and the specific value-added services Galenica provides beyond basic product delivery.

The concentration of wholesale distributors in the market plays a key role. If there are many wholesalers competing for business, individual pharmacies gain more leverage. Conversely, a more consolidated market might reduce their power. For instance, in 2024, the pharmaceutical wholesale market in many European countries saw continued consolidation, potentially shifting the balance of power.

- Customer Concentration: The bargaining power of other pharmacies as customers is higher when there are numerous wholesale distribution options available.

- Switching Costs: Pharmacies' ability to switch wholesalers easily, considering factors like IT integration and ordering system compatibility, impacts their leverage.

- Value-Added Services: Galenica's differentiation through services like advanced logistics, inventory management solutions, or digital ordering platforms can mitigate customer bargaining power.

- Market Dynamics: The overall competitive landscape of pharmaceutical wholesale in 2024, including pricing pressures and service level agreements, shapes the negotiation power of these pharmacy customers.

Online Pharmacy Users

The bargaining power of customers in the online pharmacy sector is growing, particularly in Switzerland. This shift is fueled by convenience and the ongoing digitalization of healthcare services. Customers who value digital access and potentially better pricing are increasingly turning to online platforms, which naturally increases their leverage.

Galenica, while actively pursuing its own digital strategies like the Prescription Manager, faces heightened competition from pure-play online pharmacies. This competition fosters greater price transparency. For instance, by mid-2025, online pharmacies are projected to capture a significant portion of the Swiss prescription market, estimated to be growing at an annual rate of 15% according to industry reports. This trend empowers digitally-savvy customers with more choices and a stronger negotiating position.

- Digital Convenience Drives Choice: Swiss consumers increasingly opt for online pharmacies due to ease of access and 24/7 availability, a trend that accelerated significantly in 2024.

- Price Transparency Increases Leverage: The proliferation of online platforms makes price comparisons straightforward, giving customers more power to seek out the best deals.

- Pure-Play Competition Intensifies: Dedicated online pharmacies, unburdened by physical retail overheads, can often offer more competitive pricing, directly challenging established players.

- Growing Market Share: By early 2025, online pharmacies were estimated to hold approximately 8-10% of the Swiss pharmaceutical market, a figure expected to climb steadily.

Galenica's individual pharmacy customers, such as those visiting Amavita, Coop Vitality, and Sun Store, generally possess moderate bargaining power. While price sensitivity exists, the convenience of local access, established brand trust, and the value of professional services like consultations and vaccinations temper their willingness to switch solely based on cost. For example, Galenica's focus on fee-based consultations, which saw a 5.7% increase in 2023, demonstrates a strategy to enhance customer loyalty beyond price.

In its wholesale operations, Galenica serves institutional customers like hospitals and doctors who can exert significant bargaining power. Their large-volume purchases and the critical need for uninterrupted supply enable them to negotiate favorable terms. The robust demand in the healthcare sector throughout 2024 saw many hospital systems consolidating their purchasing power to secure better pricing and service agreements.

Health insurers and government bodies in Switzerland hold considerable influence over Galenica's pricing, particularly for reimbursed medicines. Federal initiatives in 2024 aimed at controlling healthcare expenditures and increasing market transparency directly impact the pricing of Galenica's products, limiting its ability to set prices unilaterally.

Independent pharmacies, as Galenica's wholesale customers, possess varying degrees of bargaining power. Their leverage depends on the availability of alternative wholesale distributors and the specific value-added services Galenica offers beyond basic logistics. The concentration within the pharmaceutical wholesale market in 2024, with some consolidation observed, could influence this balance.

The bargaining power of customers in the online pharmacy sector is escalating, driven by convenience and the increasing digitalization of healthcare. Customers seeking digital access and competitive pricing are shifting towards online platforms, enhancing their negotiating position. Galenica's digital initiatives, like the Prescription Manager, face competition from pure-play online pharmacies, fostering greater price transparency. Projections for mid-2025 indicated online pharmacies capturing a notable share of the Swiss prescription market, with an estimated annual growth rate of 15%, empowering digitally-savvy consumers.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | 2024/2025 Data Points |

|---|---|---|---|

| Individual Pharmacy Customers | Moderate | Convenience, Brand Trust, Professional Services, Price Sensitivity | 5.7% increase in fee-based consultations (2023) |

| Institutional Buyers (Hospitals, Doctors) | High | Purchase Volume, Need for Reliable Supply, Consolidation of Purchasing Power | Robust healthcare sector demand in 2024 |

| Health Insurers & Government Bodies | High | Regulatory Initiatives, Healthcare Spending Controls, Market Transparency Demands | Federal Council initiatives in 2024 targeting healthcare cost reduction |

| Independent Pharmacies (Wholesale Customers) | Moderate to High | Availability of Alternative Wholesalers, Value-Added Services, Market Concentration | Continued consolidation in European pharmaceutical wholesale market (2024) |

| Online Pharmacy Customers | Growing | Digital Convenience, Price Transparency, Pure-Play Competition, Market Share Growth | 15% projected annual growth for online prescription market (mid-2025); 8-10% estimated market share by early 2025 |

Full Version Awaits

Galenica Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Galenica Porter's Five Forces Analysis details the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

Galenica faces a dynamic competitive landscape in Switzerland, characterized by both other pharmacy chains and a significant number of independent pharmacies. While Galenica boasts the largest network, its market share is constantly challenged by these entities.

Competition intensifies across several fronts, including pricing strategies, the breadth of services offered like health consultations and vaccinations, the strategic placement of outlets, and the development of digital platforms. For instance, the convenience of a pharmacy's location can significantly influence customer choice.

To counter this, Galenica is actively pursuing a strategy of network expansion and digital innovation. Initiatives like the Prescription Manager aim to streamline patient care and solidify Galenica's position in a market where customer loyalty is hard-won.

Galenica faces intense competition in pharmaceutical wholesaling, with rivals vying for market share by excelling in logistics, product variety, and IT-enabled services. This dynamic environment necessitates constant innovation to maintain a competitive edge.

The company's strategic focus is evident in its performance, with Galenica reporting strong growth in the doctors' segment during 2024, demonstrating its ability to effectively compete and gain traction in this crucial distribution channel.

The competitive rivalry among online pharmacies is intensifying, with both domestic and international players increasingly challenging traditional brick-and-mortar models, especially for over-the-counter (OTC) and general health products. These digital competitors frequently leverage price and convenience as key differentiators, forcing established companies to adapt. For instance, the global online pharmacy market was valued at approximately USD 107.5 billion in 2023 and is projected to reach USD 250 billion by 2030, indicating substantial growth and competitive pressure.

Galenica's strategic response includes significant investments in its own digital services and platforms. This proactive approach aims to directly counter the competitive threat posed by online pharmacies by enhancing its own e-commerce capabilities and customer convenience. By bolstering its digital presence, Galenica seeks to capture market share and maintain relevance in an evolving pharmaceutical landscape where online accessibility is paramount.

Direct-to-Consumer (DTC) Health and Beauty Brands

Galenica's own health and beauty brands, like those under Verfora, encounter significant rivalry from both established consumer health companies and nimble direct-to-consumer (DTC) brands. These DTC players often excel in digital marketing and e-commerce, allowing them to reach consumers directly and build strong brand loyalty. This dynamic necessitates continuous innovation and sophisticated marketing strategies from Galenica to maintain its market position.

The competitive landscape for health and beauty products is particularly intense. In 2024, the global beauty and personal care market was valued at approximately $579 billion, with DTC brands capturing an increasing share. This growth is fueled by their ability to personalize offerings and engage consumers through social media and influencer marketing, creating a challenging environment for traditional players like Galenica.

- Intense Digital Competition: DTC brands leverage targeted digital advertising and social media campaigns, forcing traditional companies to enhance their online presence and customer engagement strategies.

- Evolving Consumer Preferences: Consumers increasingly seek personalized experiences and direct relationships with brands, a trend that DTC models are well-positioned to satisfy.

- Innovation Pressure: The rapid pace of product development and marketing innovation by DTC competitors puts pressure on Galenica to constantly refresh its product lines and promotional activities.

- Market Share Dynamics: While specific 2024 market share data for DTC versus traditional brands within Galenica's specific product categories isn't publicly detailed, the overall trend shows DTC brands gaining ground across the broader consumer health and beauty sector.

Drug Manufacturers (Direct Sales)

Some pharmaceutical manufacturers are increasingly exploring direct-to-pharmacy or direct-to-hospital distribution channels, aiming to bypass traditional intermediaries like Galenica. This shift, while subject to regulatory oversight, can intensify competition within the wholesale segment. For Galenica, this necessitates a stronger emphasis on its core value proposition, particularly in sophisticated logistics and ensuring broad market access for its clients.

For instance, in 2024, several major pharmaceutical companies announced pilot programs for direct distribution of certain specialty drugs, bypassing wholesalers for a portion of their supply chain. This trend is driven by a desire for greater control over product delivery and patient support services. The global pharmaceutical wholesale market, valued at approximately $1.5 trillion in 2023, faces potential disruption as manufacturers seek to optimize their distribution networks.

- Direct Distribution Models: Manufacturers may adopt direct-to-pharmacy or direct-to-hospital sales, cutting out traditional wholesalers.

- Increased Competition: This strategy heightens rivalry in the wholesale distribution sector, impacting established players.

- Value Proposition Emphasis: Galenica must highlight its strengths in logistics efficiency and market access to retain business.

- Market Dynamics: The move reflects a broader industry trend towards supply chain optimization and direct customer engagement.

Galenica operates in a highly competitive Swiss pharmaceutical market, facing pressure from both large pharmacy chains and numerous independent pharmacies. This rivalry extends to pricing, service offerings, location strategy, and digital presence, with convenience being a major customer draw.

The rise of online pharmacies, both domestic and international, presents a significant challenge, particularly for over-the-counter products. These digital competitors often win on price and convenience, pushing established players like Galenica to invest heavily in their own e-commerce capabilities to remain competitive.

Galenica's own health and beauty brands also contend with intense competition from established consumer health companies and agile direct-to-consumer (DTC) brands. DTC brands, in particular, leverage strong digital marketing and direct customer engagement to build loyalty, a trend highlighted by the global beauty and personal care market’s approximate $579 billion valuation in 2024.

Furthermore, pharmaceutical manufacturers are increasingly exploring direct distribution models, potentially bypassing wholesalers like Galenica. This trend, seen in pilot programs for specialty drugs in 2024, intensifies competition in the wholesale segment, forcing Galenica to emphasize its logistical expertise and market access.

| Competitive Aspect | Galenica's Response/Challenge | Market Data/Trend |

|---|---|---|

| Pharmacy Chains & Independents | Network expansion, digital innovation (e.g., Prescription Manager) | Intense price and service competition; location is key. |

| Online Pharmacies | Investment in own digital platforms and e-commerce | Global online pharmacy market valued at ~$107.5 billion in 2023, growing rapidly. |

| Health & Beauty Brands (DTC) | Continuous innovation, sophisticated marketing | DTC brands gain share in the ~$579 billion global beauty market via digital marketing. |

| Direct Manufacturer Distribution | Emphasis on logistics efficiency and market access | Pilot programs for direct specialty drug distribution emerged in 2024. |

SSubstitutes Threaten

The most significant substitute threat for Galenica stems from online retailers and e-commerce platforms, particularly for non-prescription medications, health, and beauty products. These digital channels provide unparalleled convenience, often boast more competitive pricing, and present a broader product assortment than traditional brick-and-mortar pharmacies.

This shift towards online purchasing is a well-documented trend. For instance, in 2024, the global e-commerce market for health and beauty products continued its robust growth, with projections indicating a significant portion of consumers opting for online convenience. This directly impacts Galenica's physical locations and its own online offerings by siphoning potential customers seeking readily available and often cheaper alternatives.

Supermarkets and discount stores present a significant threat of substitutes for Galenica, especially concerning basic over-the-counter (OTC) medicines, vitamins, and general health and beauty products. These retailers leverage their broad customer base and high sales volumes to offer these items at competitive prices, making them an attractive alternative for consumers seeking convenience and value for everyday health needs. For instance, in 2024, major supermarket chains reported significant growth in their health and wellness aisles, capturing a larger share of the OTC market.

The rise of telemedicine and digital health services presents a significant threat of substitution for traditional pharmacy models. Online doctor consultations and digital prescriptions can bypass the need for in-person visits, directly impacting foot traffic to physical pharmacies. For instance, by mid-2024, the global telemedicine market was projected to reach over $200 billion, indicating a substantial shift in healthcare delivery preferences.

While Galenica is investing in digital offerings like 'Book a Doc,' a complete migration towards purely digital healthcare could diminish the role of physical pharmacies for routine prescription fulfillment and over-the-counter advice. This trend, accelerated by convenience and accessibility, means patients might increasingly opt for digital channels, reducing reliance on established brick-and-mortar locations.

Alternative Therapies and Wellness Trends

The threat of substitutes for Galenica Porter is intensifying due to a growing consumer shift towards alternative therapies and holistic wellness. As more individuals explore non-pharmacological solutions and natural remedies, demand for traditional pharmaceutical products could see a decline. For instance, the global wellness market, which encompasses these trends, was valued at approximately $5.6 trillion in 2023, demonstrating a significant market for alternatives.

This trend presents a substantial challenge as consumers increasingly prioritize preventive health measures and natural approaches. Many are seeking to manage conditions or improve well-being without relying solely on prescription medications. This can directly impact sales of certain Galenica products, especially those addressing lifestyle-related or chronic conditions where alternative interventions are gaining traction.

Key areas of substitute threat include:

- Herbal supplements and nutraceuticals: These are increasingly popular for managing common ailments, with the global dietary supplements market projected to reach $230.7 billion by 2027.

- Mind-body practices: Yoga, meditation, and acupuncture are being adopted for stress reduction and pain management, offering alternatives to pain relievers and sedatives.

- Preventive lifestyle changes: Focus on diet, exercise, and sleep hygiene can reduce the need for medications to manage conditions like hypertension or type 2 diabetes.

- Digital health and wellness apps: These provide tools for tracking health, managing chronic conditions, and accessing personalized wellness advice, often at a lower cost than traditional healthcare.

Hospital Pharmacies and In-house Distribution for Hospitals

Hospitals can bypass external distributors like Galenica by directly sourcing medications from manufacturers or by managing their own in-house pharmacies for distribution. This alternative route is particularly appealing if it offers a more cost-effective or efficient supply chain solution. For instance, a hospital might find it cheaper to negotiate bulk discounts directly with drug makers, bypassing wholesale markups.

The choice between using a wholesaler and managing in-house distribution often comes down to a strategic assessment of operational capabilities and financial benefits. In 2024, many hospitals are evaluating their supply chain resilience, which could lead to increased interest in direct procurement models to ensure a steady supply of critical medications, especially in light of potential disruptions. This can also offer greater control over inventory management.

- Direct Procurement: Hospitals negotiate directly with pharmaceutical manufacturers, potentially securing lower unit costs.

- In-house Pharmacies: Hospitals manage their own pharmaceutical inventory and distribution, offering greater control but requiring significant infrastructure.

- Cost-Benefit Analysis: The decision hinges on comparing the total cost of wholesale distribution versus the investment and operational costs of in-house solutions.

- Supply Chain Strategy: Hospitals are increasingly prioritizing supply chain security and flexibility, influencing their preference for direct relationships or robust internal systems.

The threat of substitutes for Galenica is multifaceted, encompassing online retailers, supermarkets, telemedicine, and alternative wellness practices. These substitutes offer convenience, competitive pricing, and a broader appeal for specific consumer needs, directly impacting Galenica's market share and revenue streams.

Online platforms and discount retailers are capturing a growing segment of the over-the-counter and health product market. In 2024, the global e-commerce market for health and beauty products continued its strong upward trajectory, with consumers increasingly prioritizing digital convenience and value. This trend pressures traditional pharmacy models like Galenica's physical locations.

Telemedicine and digital health services are also redefining healthcare access, potentially reducing the need for in-person pharmacy visits for prescription fulfillment and advice. The telemedicine market's projected growth to over $200 billion by mid-2024 highlights this significant shift in consumer preference for accessible digital healthcare solutions.

Furthermore, the expanding wellness market, valued at approximately $5.6 trillion in 2023, signifies a growing consumer interest in alternative therapies and lifestyle changes. This includes herbal supplements, mind-body practices, and preventive health measures, which can directly substitute for traditional pharmaceutical products.

| Substitute Category | Key Offerings | 2024 Market Trend/Data Point |

|---|---|---|

| Online Retailers | Non-prescription meds, health & beauty | Continued robust growth in health & beauty e-commerce |

| Supermarkets/Discount Stores | OTC medicines, vitamins, general health | Significant growth in supermarket health & wellness aisles |

| Telemedicine/Digital Health | Online consultations, digital prescriptions | Global telemedicine market projected >$200 billion by mid-2024 |

| Alternative Wellness | Herbal supplements, mind-body practices | Global wellness market valued at ~$5.6 trillion in 2023 |

Entrants Threaten

The Swiss pharmaceutical and healthcare market presents a formidable barrier to entry due to its highly regulated nature. New companies must navigate a complex web of licensing requirements for everything from operating pharmacies to wholesale distribution and drug development.

Compliance with the Swiss Therapeutic Products Act and its associated ordinances is not merely a formality; it's a critical hurdle. These stringent regulations, which often require substantial investment in time and resources for approval, significantly deter potential new entrants from challenging established players.

The threat of new entrants for Galenica is significantly reduced by the high capital investment required to establish a comparable pharmacy network or a robust pharmaceutical wholesale and logistics infrastructure. For instance, building out a national distribution network can easily run into hundreds of millions of dollars, encompassing state-of-the-art warehouses, specialized transport fleets, and advanced inventory management systems. This substantial financial hurdle acts as a powerful deterrent, making it exceptionally difficult for newcomers to challenge an established player like Galenica.

Galenica's strong brand loyalty, cultivated through its well-known pharmacy chains like Amavita, Coop Vitality, and Sun Store, presents a significant barrier to new entrants. These established brands have built trust over time, making it difficult for newcomers to attract customers. This loyalty is further cemented by Galenica's extensive nationwide network, which offers convenience and accessibility that new players would struggle to replicate quickly.

The substantial investment required for marketing and brand building in the Swiss pharmacy sector means new entrants face a steep uphill battle to gain market share. Galenica's existing customer base, nurtured by years of consistent service and brand recognition, is not easily swayed. The company's focus on customer consultations also strengthens its network effect, as satisfied customers are more likely to return and recommend the service, further entrenching Galenica's market position.

Economies of Scale in Wholesale and Logistics

Galenica's extensive wholesale and logistics network offers substantial economies of scale, enabling highly cost-effective product distribution. This operational efficiency presents a significant barrier for new entrants, who would require immense volume to replicate such cost advantages and compete on price in the wholesale market.

For instance, in 2024, major pharmaceutical distributors often operate with overheads that are a fraction of revenue compared to smaller players due to their scale. This means a new entrant would need to invest heavily to achieve comparable per-unit distribution costs.

- Economies of Scale: Galenica's large-scale operations reduce per-unit costs in wholesale and logistics.

- Cost Efficiency: This scale allows for more competitive pricing, challenging new entrants.

- Barrier to Entry: New companies face difficulty matching Galenica's distribution efficiencies without significant initial volume.

Access to Supply Chains and Supplier Relationships

New entrants into the pharmaceutical wholesale market, especially those aiming to compete with established players like Galenica, would encounter significant hurdles in establishing robust supply chain access. Securing favorable relationships with major pharmaceutical manufacturers is a cornerstone of this industry, and such partnerships are not easily forged by newcomers.

Galenica, for instance, benefits from decades of experience and deeply entrenched relationships with leading drug producers. These long-standing agreements provide them with preferential terms and consistent supply, advantages that are exceptionally difficult for a new entrant to replicate in a short timeframe. For example, in 2023, the top 10 pharmaceutical manufacturers accounted for over 70% of global pharmaceutical sales, highlighting the concentration of supply power that new entrants must contend with.

The threat of new entrants is therefore moderated by the difficulty in accessing and maintaining critical supplier relationships. This barrier is amplified by the need for specialized logistics and distribution networks, which require substantial upfront investment and operational expertise. Galenica's extensive distribution network, covering numerous countries, represents a significant competitive advantage that new entrants would struggle to match.

- Difficulty in securing favorable terms with major pharmaceutical manufacturers.

- Long-standing relationships and supply chain expertise of established players like Galenica are hard to replicate.

- Concentration of supply power among top pharmaceutical manufacturers presents a barrier.

- Substantial investment required for specialized logistics and distribution networks.

The threat of new entrants for Galenica is significantly low due to substantial barriers. These include stringent Swiss regulations, high capital requirements for infrastructure, and established brand loyalty. Galenica's extensive wholesale and logistics network, coupled with strong supplier relationships, further solidifies its market position.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Compliance | Navigating Swiss Therapeutic Products Act and licensing. | High cost and time investment for approvals. |

| Capital Investment | Establishing pharmacy networks or wholesale infrastructure. | Requires hundreds of millions for warehouses, fleets, and systems. |

| Brand Loyalty & Network | Established brands like Amavita, Coop Vitality, Sun Store. | Difficult to attract customers from trusted, accessible networks. |

| Economies of Scale | Cost-effective distribution due to large operations. | New entrants struggle to match per-unit distribution costs without significant volume. |

| Supplier Relationships | Securing terms with major pharmaceutical manufacturers. | Long-standing agreements provide preferential terms; difficult for newcomers to replicate. |

Porter's Five Forces Analysis Data Sources

Our Galenica Porter's Five Forces analysis is built on a robust foundation of data, including publicly available financial statements, industry expert interviews, and market research reports from reputable firms. This comprehensive approach ensures a nuanced understanding of competitive pressures.