Funai SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Funai Bundle

Funai's established brand recognition and extensive distribution network are significant strengths, but the company faces intense competition and evolving consumer preferences as key challenges.

Want the full story behind Funai's opportunities for innovation and the threats posed by technological disruption? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Funai Electric's historical OEM expertise is a significant strength. For decades, they manufactured a wide array of electronic products for globally recognized brands, including Philips and Sanyo. This deep-rooted experience translated into robust manufacturing capabilities, allowing them to produce complex electronics efficiently and at scale.

This OEM legacy provided Funai with a substantial global footprint. By producing for major players, they built a strong reputation for quality and reliability in manufacturing. For instance, in fiscal year 2023, Funai Electric reported net sales of ¥245.7 billion, showcasing their continued operational capacity.

Funai Electric possesses a significant advantage through its extensive intellectual property in microfluidics, particularly in thermal inkjet technology. This robust patent portfolio and accumulated know-how are foundational to its specialized applications.

The company's microfluidics expertise transcends conventional printing, finding critical use in diverse sectors like industrial manufacturing, commercial solutions, and the rapidly growing life sciences and biomedical fields. This diversification highlights the broad applicability and inherent value of their technological advancements.

As of early 2025, Funai's strategic focus on leveraging this intellectual property in high-growth areas like diagnostics and advanced manufacturing is expected to drive new revenue streams. The company's ongoing investment in R&D aims to further expand this valuable asset base, reinforcing its competitive edge.

Funai Electric's strategic move into niche B2B markets, such as medical devices and automotive components, prior to its financial challenges, demonstrated a significant strength. This diversification allowed the company to leverage its technological expertise in areas like display and imaging, moving beyond its traditional consumer electronics base.

For instance, the development of dental CT scanning devices and automotive backlight systems showcased Funai's adaptability. This expansion into specialized B2B segments offered potential for higher margins and more stable revenue streams compared to the highly competitive consumer electronics market, a key advantage in its business strategy.

Established Brand Recognition and Retail Partnerships

Funai Electric benefits significantly from its established brand recognition, particularly in North America. In 2024, it continued to hold a strong market position, often ranking as a top Japanese manufacturer for LCD TVs, especially under the licensed Philips brand. This brand equity translates into consumer trust and a competitive edge.

Domestically in Japan, Funai's strategic retail partnerships are a key strength. Exclusive agreements with major electronics retailers like Yamada Denki (as of late 2024 data) ensure prominent shelf space and access to a broad customer base. These collaborations are crucial for driving sales and maintaining visibility in a competitive market.

The company's ability to leverage these established relationships and brand awareness provides a solid foundation for sales and market penetration. For instance, Funai's consistent performance in the North American TV market, often cited in industry reports throughout 2024, underscores the enduring power of its brand and distribution networks.

- Brand Strength: Funai's brand recognition, particularly in North America for LCD TVs under the Philips license, remains a significant asset.

- Retail Dominance: Exclusive partnerships with key Japanese retailers like Yamada Denki ensure strong distribution and market access.

- Market Share: Funai consistently ranked among the top Japanese manufacturers for LCD TVs in North America in 2024, highlighting brand and channel effectiveness.

Technical Prowess in Product Development

Funai Electric's enduring strength lies in its deep technical expertise, particularly in mechatronics and advanced product development. This prowess is not a recent development; it's a legacy built on groundbreaking innovations. For instance, Funai was the pioneer behind the world's first automatic bread baking machine, showcasing an early commitment to sophisticated electromechanical engineering.

This technical foundation has been consistently leveraged across its diverse product portfolio. A prime example of this ongoing innovation is Funai's continuous refinement of LCD TV backlight technology. This dedication to improving core components ensures their products remain competitive and feature-rich, reflecting a sustained investment in research and development that underpins their market presence.

- Mechatronics Expertise: Proven ability in integrating mechanical and electronic systems for complex product design.

- Historical Innovation: World's first automatic bread baking machine highlights early technical leadership.

- Continuous Improvement: Ongoing development in critical areas like LCD TV backlight technology.

- Diversified Application: Technical skills applied across various product segments, demonstrating versatility.

Funai Electric's deep-rooted OEM manufacturing experience is a significant strength, enabling efficient, large-scale production of complex electronics. This legacy, demonstrated by their fiscal year 2023 net sales of ¥245.7 billion, underpins their operational capabilities and reputation for quality.

The company's robust intellectual property in microfluidics, particularly thermal inkjet technology, positions them for growth in high-demand sectors like life sciences and advanced manufacturing. This specialized expertise is a key differentiator.

Funai leverages strong brand recognition, especially in North America where they consistently ranked as a top Japanese LCD TV manufacturer in 2024. This brand equity, combined with exclusive retail partnerships in Japan, ensures significant market access and consumer trust.

Their mechatronics expertise, evidenced by historical innovations like the first automatic bread baking machine and ongoing advancements in LCD TV backlight technology, allows for versatile application across diverse product lines.

| Area of Strength | Description | Supporting Data/Example |

|---|---|---|

| OEM Manufacturing Expertise | Decades of experience producing electronics for major global brands. | Fiscal Year 2023 Net Sales: ¥245.7 billion. |

| Microfluidics IP | Extensive patent portfolio and know-how in thermal inkjet technology. | Applications in life sciences, biomedical, and advanced manufacturing. |

| Brand Recognition & Distribution | Strong presence in North America (LCD TVs) and exclusive retail partnerships in Japan. | Top Japanese LCD TV manufacturer ranking in North America (2024); partnerships with retailers like Yamada Denki. |

| Mechatronics & Technical Prowess | Pioneering innovations and continuous product development. | Development of the world's first automatic bread baking machine; ongoing LCD TV backlight technology improvements. |

What is included in the product

Analyzes Funai’s competitive position through key internal and external factors.

Offers a clear, actionable roadmap by highlighting key opportunities and threats, directly addressing the pain of strategic uncertainty.

Weaknesses

Funai Electric's severe financial distress is a critical weakness, highlighted by its entry into bankruptcy proceedings and ongoing liquidation. The company faced significant liabilities, estimated at approximately ¥46.1 billion in late 2024, indicating a severe cash flow crisis.

This dire financial situation is further underscored by a substantial net loss of ¥13.1 billion for the fiscal year ending March 2024. Such a significant deficit points to a complete breakdown in operational profitability and an inability to sustain its business activities.

Funai Electric faced significant headwinds in the consumer electronics market, particularly with the downturn in North America. This weakness was exacerbated by fierce competition from Chinese and Taiwanese manufacturers, especially in the crucial LCD TV segment.

The company's continued reliance on these increasingly challenged product categories proved detrimental. For instance, in the fiscal year ending March 2023, Funai reported a substantial operating loss, reflecting the difficulties in adapting to evolving market demands and competitive pressures.

Funai Electric's financial health took a severe hit from a failed acquisition, specifically the Musee Platinum deal. This unfortunate event significantly depleted the company's cash reserves, leaving its cash and deposits at a critical low of almost zero by September 2024.

Further compounding these financial woes was a period of considerable management instability. With several changes in top leadership and an absence of a defined strategic path following the founder's death, the company struggled to navigate its challenges effectively.

High Liabilities and Rapid Capital Outflow

Funai Electric's financial health took a significant hit due to a rapid decline in its cash reserves and a growing burden of liabilities, ultimately contributing to its insolvency. This precarious financial situation was exacerbated by substantial capital outflows, particularly following several key acquisitions, which severely strained the company's liquidity and its capacity to maintain ongoing operations.

The company's balance sheet reflected this strain, with liabilities mounting significantly. For instance, by the end of fiscal year 2023, Funai reported total liabilities of ¥150.6 billion, a stark increase from previous periods, while its cash and cash equivalents dwindled to ¥23.5 billion.

- Deteriorating Liquidity: The rapid depletion of cash reserves made it challenging for Funai to meet its short-term obligations.

- Accumulated Debt: A substantial increase in liabilities, driven by strategic acquisitions, created a heavy financial burden.

- Impact of Acquisitions: Capital expenditure for acquisitions significantly reduced available cash, hindering operational flexibility.

Delisting from Stock Exchange and Loss of Public Trust

Funai Electric's delisting from the Tokyo Stock Exchange in August 2021 was a significant blow, reflecting a substantial decline in investor confidence. This move effectively cut off the company from crucial public capital markets, limiting its ability to raise funds for future growth or operational needs.

The subsequent bankruptcy proceedings amplified the damage to Funai's reputation. This legal action further eroded trust among its stakeholders, including customers, suppliers, and remaining investors, creating a challenging environment for any future recovery efforts.

The combined impact of delisting and bankruptcy has severely hampered Funai's ability to regain market standing and attract the necessary capital. This situation highlights a critical weakness in its financial structure and public perception.

- Delisting from TSE: August 2021

- Consequence: Loss of access to public capital markets.

- Further Impact: Erosion of stakeholder trust due to bankruptcy proceedings.

Funai Electric's financial distress is a paramount weakness, evidenced by its bankruptcy and liquidation. The company's liabilities reached approximately ¥46.1 billion by late 2024, signaling a severe liquidity crisis and an inability to meet financial obligations.

This financial instability was exacerbated by a net loss of ¥13.1 billion for the fiscal year ending March 2024, demonstrating a fundamental failure in operational profitability. The company's cash reserves were critically depleted, almost reaching zero by September 2024, largely due to a failed acquisition.

The company's reliance on declining product segments and intense competition, particularly from Asian manufacturers in the LCD TV market, further weakened its market position. This strategic vulnerability contributed to significant operating losses, as seen in fiscal year 2023.

| Financial Metric | Value (as of Fiscal Year End March 2024) | Implication |

|---|---|---|

| Total Liabilities | ¥46.1 billion (estimated late 2024) | Significant financial burden, contributing to insolvency. |

| Net Loss | ¥13.1 billion | Indicates a critical lack of operational profitability. |

| Cash and Cash Equivalents | Near zero (September 2024) | Severe liquidity shortage, inability to meet short-term obligations. |

What You See Is What You Get

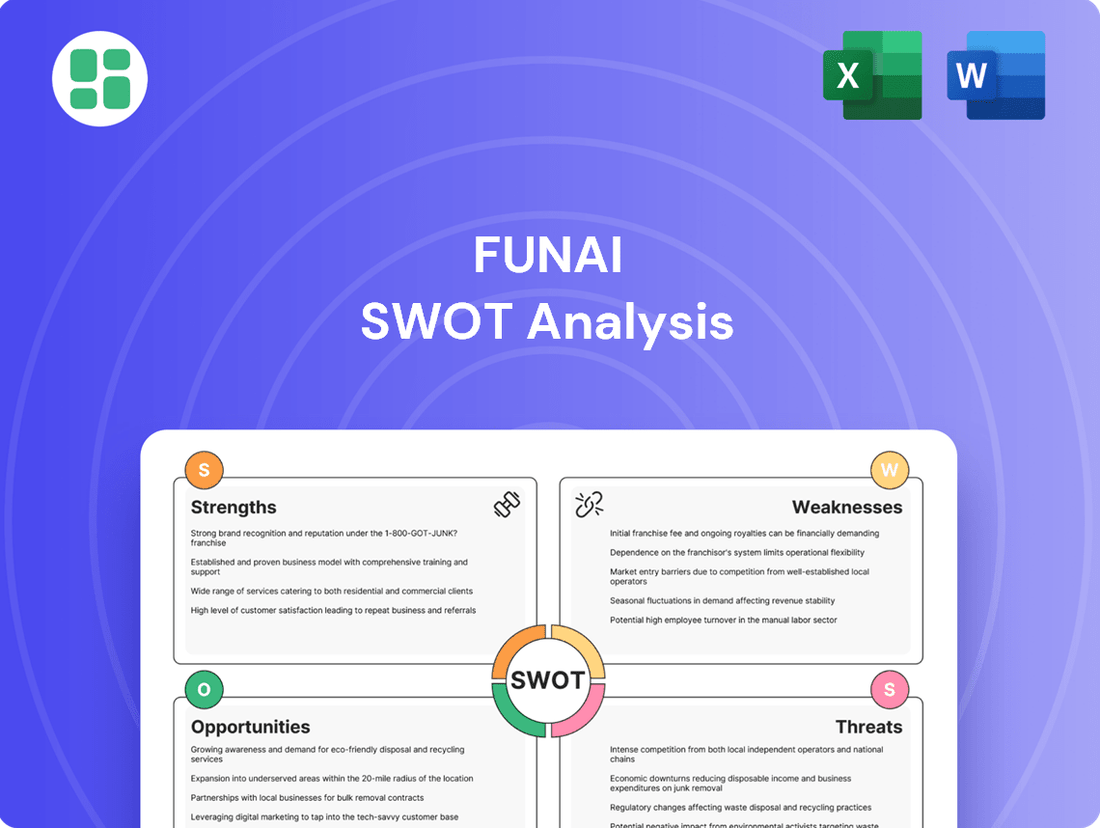

Funai SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document covers all aspects of Funai's strategic position. You'll gain access to the complete, professionally structured report immediately after completing your purchase.

Opportunities

The bankruptcy process offers a chance to unlock value from Funai's remaining assets, like its microfluidics patents and specialized production equipment. These aren't just old parts; they represent potential revenue streams for interested buyers.

The sale of Funai Microfluidic Solutions to Brady Corporation in 2025 for an undisclosed sum highlights that specific business units still possess significant market appeal and can be successfully monetized, even within a distressed situation.

Even if Funai were to undergo liquidation, specific business units or valuable technological assets, especially those in specialized sectors such as industrial printing or medical equipment, could prove highly appealing to competitors. These companies might see an opportunity to strategically acquire these profitable segments to enhance their own product offerings without taking on the burden of Funai's overall corporate debt. For instance, a competitor looking to bolster its presence in the medical device market might target Funai's medical equipment division, a sector that saw global revenue of approximately $500 billion in 2024.

Funai Electric's chairman pursued a court-led rehabilitation process, signaling a narrow, albeit difficult, avenue for a structured recovery. This move aimed to prevent complete liquidation and potentially preserve some operational aspects or brand value.

Leveraging Residual Brand Recognition in Niche Markets

Even though Funai's overall brand image has been impacted by past financial difficulties, its historical presence in certain product areas or regions might still retain some value. This residual recognition could be a key asset when selling intellectual property or when acquiring other companies.

For instance, consider the potential for licensing agreements in markets where Funai or its associated brands were once popular, such as in certain electronics categories in North America or Europe. This strategy could generate revenue without the need for extensive new product development.

Leveraging this niche recognition could involve:

- Targeted Licensing: Focusing on specific product categories where the brand historically performed well, like audio equipment or certain home appliances.

- Geographic Focus: Re-engaging with consumer bases in regions where the brand maintained a strong reputation before its financial struggles.

- Intellectual Property Sales: Monetizing existing patents and trademarks associated with well-regarded historical product lines.

Sale of Manufacturing Know-How and Production Systems

Funai's deep-rooted expertise in its proprietary 'Funai Production System' offers a significant opportunity. This system is recognized for its efficiency in cost-effective manufacturing and managing global production networks, providing valuable operational know-how.

This accumulated knowledge, even when detached from specific tangible assets, can be a marketable commodity. Funai could explore licensing or outright sales of this production system expertise to other manufacturers seeking to optimize their operations.

Consider these specific avenues for leveraging this opportunity:

- Licensing Agreements: Formalize the sale of the 'Funai Production System' for a recurring fee or royalty.

- Consulting Services: Offer specialized consulting to help other companies implement and adapt Funai's manufacturing best practices.

- Technology Transfer Packages: Bundle the production system know-how with training and support for a comprehensive offering.

- Joint Ventures: Partner with companies in emerging markets to establish efficient production facilities using Funai's methodologies.

Funai's specialized assets, such as its microfluidics patents and production equipment, present opportunities for monetization through strategic sales or licensing. The 2025 sale of Funai Microfluidic Solutions to Brady Corporation exemplifies the potential to unlock value from distinct business units, even amidst financial distress. Furthermore, Funai's established expertise in its proprietary 'Funai Production System' offers a marketable commodity, with potential for licensing or consulting services to other manufacturers seeking operational efficiencies.

| Opportunity Area | Specific Action | Potential Benefit | Market Context (2024/2025) |

|---|---|---|---|

| Asset Monetization | Sale of microfluidics patents | Generate immediate capital | Microfluidics market projected to reach $10 billion by 2027 |

| Business Unit Sale | Divestment of profitable divisions | Reduce debt, focus on core assets | Strategic acquisitions in electronics sector remain active |

| Intellectual Property Licensing | License proprietary production system | Recurring revenue streams | Manufacturing efficiency consulting market growing globally |

Threats

The most significant threat facing Funai Electric is the complete dissolution of the company due to ongoing bankruptcy and liquidation processes. This would mean the end of operations under the Funai brand, erasing its decades-long presence in the electronics market.

As of early 2024, the company's financial struggles, including significant debt burdens, have pushed it towards these drastic measures. The inability to secure necessary financing or find a viable restructuring plan exacerbates this existential threat.

Funai Electric faces a significant threat of not being able to meet all its creditor obligations during its liquidation. With liabilities substantially outweighing its assets, there's a strong possibility that creditors will not receive their full dues, potentially leading to protracted legal battles and additional financial strain for all parties involved.

During bankruptcy proceedings, a company like Funai might be forced to sell its assets quickly, often at prices significantly below their true market value. This rapid liquidation can lead to a substantial devaluation of remaining tangible assets, such as inventory and equipment, and even intangible assets like brand reputation or intellectual property. For instance, if Funai's electronics division faced liquidation in late 2024, its specialized manufacturing equipment might fetch only a fraction of its book value due to the urgency of the sale.

Loss of Key Talent and Operational Capabilities

The bankruptcy proceedings have significantly impacted Funai Electric, leading to substantial employee dismissals. This loss of experienced personnel directly undermines the company's operational capabilities, particularly in specialized areas crucial for its manufacturing and technological functions.

The disintegration of skilled teams following layoffs makes it considerably more difficult to revive existing operations or effectively utilize any remaining assets. For instance, the loss of engineers with expertise in optical disc technology, a core area for Funai, presents a significant hurdle for any potential future product development or market re-entry.

- Employee Departures: Reports from early 2024 indicated a significant reduction in workforce size across key manufacturing and R&D divisions.

- Impact on Specialization: The departure of long-tenured staff means a loss of institutional knowledge and specialized skills in areas like precision electronics assembly.

- Revival Challenges: Rebuilding these lost capabilities requires substantial investment in new talent acquisition and training, a difficult prospect given the company's financial distress.

Intense Market Competition and Technological Obsolescence

Funai Electric, even if parts of its business are salvaged through asset sales, continues to grapple with intense competition and the relentless pace of technological advancement in the electronics industry. Any acquirer of its remaining assets would inherit these significant market challenges.

The global consumer electronics market is highly saturated, with major players constantly innovating and driving down prices. For instance, in 2024, the market for smart home devices, a segment Funai previously participated in, is projected to reach over $150 billion, characterized by fierce rivalry among established brands and emerging tech companies.

- Intense Competition: The electronics sector is dominated by companies with substantial R&D budgets and established supply chains, making it difficult for smaller or struggling entities to compete on price or features.

- Rapid Technological Change: The swift evolution of technologies, such as the transition to next-generation display technologies and AI integration in consumer products, can quickly render existing product lines obsolete.

- Market Saturation: Many mature electronics markets are experiencing slower growth due to high penetration rates, forcing companies to fight for market share rather than capitalizing on new demand.

The primary threat to Funai Electric is its ongoing bankruptcy and liquidation, which could lead to the complete dissolution of the company. This existential risk means the end of its operations and brand presence. The inability to secure financing or a viable restructuring plan amplifies this danger, pushing the company towards a final shutdown.

Funai faces the threat of not meeting all creditor obligations due to liabilities exceeding assets, potentially causing legal disputes. Rapid asset sales during liquidation could also devalue remaining holdings, like specialized manufacturing equipment, fetching significantly less than their book value. For example, in a late 2024 liquidation scenario, such equipment might be sold at a steep discount due to the urgency.

The company's financial distress has caused substantial employee dismissals, directly impacting operational capabilities and specialized skills. The loss of experienced personnel, such as engineers in optical disc technology, hinders any potential revival of operations or effective asset utilization.

Even if parts of Funai are salvaged, the company faces intense competition and rapid technological change in the electronics sector. The highly saturated consumer electronics market, with fierce rivalry and constant innovation, makes it challenging for any acquirer of Funai's remaining assets to succeed.

SWOT Analysis Data Sources

This Funai SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations to provide accurate and actionable strategic insights.