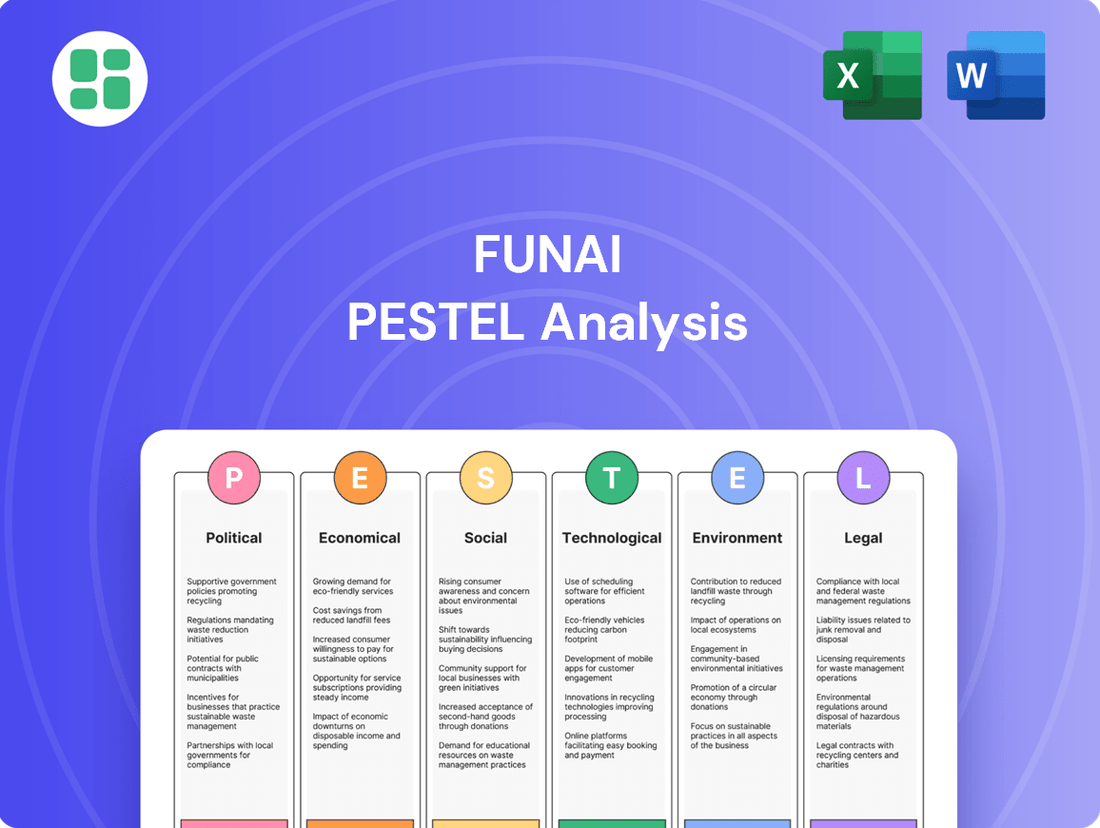

Funai PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Funai Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Funai's trajectory. This comprehensive PESTLE analysis offers actionable insights to navigate the complex external landscape. Equip yourself with the knowledge to anticipate challenges and seize opportunities. Download the full report now and gain a strategic advantage.

Political factors

Geopolitical trade tensions, especially between the United States and China, continue to shape the global economic landscape. These ongoing disputes can directly affect Funai's operations by potentially increasing the cost of imported components through tariffs, as seen in various sectors throughout 2023 and into 2024. Such measures can disrupt supply chains, making it more expensive for Funai to source the materials needed for its electronics and IT solutions.

Furthermore, these tensions might lead to restrictions on technology transfers, impacting Funai's ability to innovate and access cutting-edge components. For example, export controls implemented in recent years have already demonstrated the potential to limit access to critical technologies. While Funai's diverse product portfolio, including commercial offerings, provides some buffer, its dependence on global component sourcing remains a significant vulnerability in this environment.

The Japanese government is actively promoting the revitalization of its semiconductor and electronics sectors through substantial investments and strategic collaborations. For instance, in 2023, Japan committed over ¥1 trillion (approximately $7 billion USD) to bolster domestic chip production and research, aiming to secure technological sovereignty.

These initiatives, including incentives for research and development in cutting-edge fields like artificial intelligence and advanced manufacturing, could create a more robust and innovative ecosystem. This supportive environment may indirectly benefit companies like Funai by fostering technological advancements and enhancing the overall competitiveness of Japanese industries.

Funai's operations are significantly influenced by the political stability and regulatory landscape in its key markets, particularly in Asia where much of its manufacturing occurs. Political stability in countries like Japan, where Funai Electric is headquartered, and in Southeast Asian nations where it has manufacturing bases, is vital for consistent operations. For instance, a stable political climate in Vietnam, a significant manufacturing hub, supports predictable labor costs and supply chain continuity, which is essential for Funai's cost-competitiveness.

International Relations and Market Access

Funai Electric's global reach hinges on robust international relations and unimpeded market access. Disruptions in diplomatic ties between Japan and key trading partners, such as the United States or European Union nations, could trigger protectionist measures, impacting Funai's exports of commercial and IT products. For instance, in 2023, Japan's trade surplus with the US narrowed slightly, highlighting the sensitivity of bilateral trade flows to geopolitical shifts.

Maintaining diversified market exposure is crucial for Funai to buffer against risks concentrated in any single region. This strategy proved beneficial in 2024 as Funai navigated varying economic conditions across its major sales territories, with North America remaining a significant contributor to revenue, alongside steady performance in Europe.

- Trade Agreements: Funai benefits from Japan's participation in agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which facilitates smoother trade with member nations.

- Geopolitical Stability: Ongoing political stability in key markets like Southeast Asia, where Funai has manufacturing operations, is vital for consistent production and supply chain integrity.

- Tariff Policies: Fluctuations in import tariffs imposed by countries like the US or EU can directly affect the cost competitiveness of Funai's products, influencing sales volumes.

- Regulatory Harmonization: Efforts towards harmonizing product safety and environmental regulations across major markets can reduce compliance burdens for Funai's international operations.

Data Governance and Cybersecurity Policies

As Funai Electric shifts its strategic focus towards IT and solutions, the evolving landscape of government policies on data governance, privacy, and cybersecurity across its operating regions presents a significant political factor. Stricter regulations, such as Japan's Act on the Protection of Personal Information (APPI), which was significantly amended in 2022 to enhance data protection and user rights, demand robust compliance frameworks. These mandates directly influence Funai's product development, service offerings, and data handling practices, requiring substantial investment in security infrastructure and personnel to meet stringent requirements.

The global trend towards data localization and increased scrutiny of cross-border data transfers, exemplified by the EU's General Data Protection Regulation (GDPR) and similar initiatives in other major markets, adds another layer of complexity. Funai must navigate these varying international legal frameworks to ensure its IT solutions and services are compliant, potentially impacting market entry strategies and operational costs. For instance, non-compliance with GDPR can result in fines up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the financial implications of policy adherence.

- Data Governance and Privacy Laws: Funai must align with evolving global regulations like Japan's APPI and the EU's GDPR, impacting how customer data is collected, stored, and processed.

- Cybersecurity Mandates: Government-imposed cybersecurity standards and reporting requirements for IT infrastructure and services necessitate continuous investment in security measures and threat mitigation.

- Cross-Border Data Transfer Restrictions: Navigating varying national policies on international data flows can influence Funai's ability to offer integrated IT solutions across different geographical markets.

- Consumer Protection in Digital Services: Policies aimed at protecting consumers in the digital realm can shape the design and functionality of Funai's IT products and services, demanding transparency and user control.

Geopolitical trade tensions, particularly between major economies, directly influence Funai's supply chain costs and access to technology, as seen with tariff impacts in 2023-2024. Government initiatives in Japan, such as the ¥1 trillion investment in semiconductors announced in 2023, aim to bolster domestic tech sectors, potentially benefiting companies like Funai. Political stability in manufacturing hubs like Vietnam is crucial for Funai's operational consistency and cost competitiveness.

What is included in the product

The Funai PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the organization, providing a comprehensive understanding of its external operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global economic growth is projected to reach 3.2% in 2024, according to the IMF, a slight uptick from 2023. However, this growth is uneven, with significant recession risks persisting in key markets due to geopolitical tensions and persistent inflation.

These economic conditions directly impact Funai's diverse product lines. A slowdown in global growth could reduce corporate IT spending, affecting demand for Funai's solutions, while a recession might curb consumer spending on electronics, impacting residual sales.

Conversely, a strengthening global economy in 2025 could boost demand for Funai's commercial products and IT services as businesses increase capital expenditures. This is particularly relevant as many companies are looking to upgrade their infrastructure following a period of cautious investment.

Fluctuations in the Japanese Yen (JPY) exchange rate significantly impact Funai's operations. For instance, during 2024, the Yen experienced considerable volatility against the US Dollar, at times trading around 150 JPY to 1 USD. This means a weaker Yen can make Funai's electronics more affordable for international buyers, boosting export sales.

Conversely, a stronger Yen, which saw brief periods of appreciation in late 2023 and early 2024, increases the cost of imported components and raw materials Funai relies on. This directly impacts Funai's cost of goods sold and can squeeze profit margins if not managed effectively through pricing strategies or hedging.

Funai, operating in the electronics sector, faces significant risks from fluctuating raw material prices and supply chain disruptions. For instance, the average price of semiconductors, a key component, saw considerable volatility in 2024, impacting manufacturing costs.

Higher expenses for essential materials and transportation directly affect Funai's profit margins, particularly for its manufacturing services. The cost of shipping a 40-foot container from Asia to Europe, a crucial logistics metric, remained elevated throughout much of 2024, impacting overall operational expenses.

Geopolitical events and global tensions continue to create uncertainty, leading to price instability and potential shortages within the electronic component supply chains that Funai relies upon. For example, trade disputes in late 2024 highlighted the vulnerability of these global networks.

Business Investment Trends

Funai Electric's strategic focus on commercial products and IT solutions positions its performance directly in sync with broader business investment trends. When companies are confident about the future, they tend to spend more on upgrading their printing hardware, investing in new IT infrastructure, and adopting various business technologies, all of which directly impact Funai's sales.

The ongoing push towards digitalization and automation across industries serves as a significant catalyst for this business investment. For instance, in 2024, global IT spending was projected to reach $5.1 trillion, a 6.8% increase from 2023, indicating a strong appetite for technology upgrades that could benefit companies like Funai.

- Increased Business Confidence: Higher business confidence often correlates with increased capital expenditure on new equipment and technologies.

- Digital Transformation Initiatives: Companies are investing heavily in digital solutions to improve efficiency and competitiveness, driving demand for IT and printing infrastructure.

- Automation Adoption: The trend towards automating business processes necessitates investments in compatible hardware and software, including advanced printing and IT systems.

Inflation and Interest Rates

Rising inflation presents a significant challenge for Funai, potentially increasing its operational costs. For instance, if inflation reaches 3.5% in 2024, as some forecasts suggest, Funai's expenses for raw materials, components, and labor could climb substantially. This puts pressure on profit margins unless these increased costs can be effectively passed on to consumers or mitigated through efficiency gains.

Simultaneously, elevated interest rates, which have seen central banks globally maintain or even increase benchmark rates through late 2024 and into 2025 to combat inflation, can impact Funai's financial flexibility. Higher borrowing costs make it more expensive for Funai to finance new projects or manage its debt. Furthermore, this impacts Funai's business customers who may face increased costs for financing their own operations or purchases of Funai's products, potentially dampening overall market demand.

- Inflationary Pressures: Forecasts for global inflation in 2024 hover around 3.0% to 4.0%, directly impacting Funai's cost of goods sold and operating expenses.

- Interest Rate Hikes: Central bank rates in major economies remained at multi-year highs through late 2024, increasing the cost of capital for businesses like Funai.

- Reduced Investment: Higher interest rates can lead to a decrease in capital expenditure by businesses, as the hurdle rate for new investments rises, potentially affecting demand for Funai's B2B products.

- Consumer Spending: Increased borrowing costs for consumers can also curb discretionary spending, impacting Funai's sales in consumer electronics and related segments.

Global economic growth projections for 2024, around 3.2%, show modest improvement but are tempered by recession risks in key markets, influenced by ongoing geopolitical issues and persistent inflation. These factors directly affect Funai's sales, with slower growth potentially reducing corporate IT spending and consumer electronics demand.

Exchange rate volatility, particularly for the Japanese Yen, significantly impacts Funai. A weaker Yen in 2024, trading around 150 JPY to the USD, can boost export competitiveness by making products cheaper for international buyers. However, a stronger Yen increases the cost of imported components, squeezing profit margins.

Rising inflation, potentially reaching 3.5% in 2024, increases Funai's operational costs for materials and labor. Coupled with elevated interest rates maintained by central banks through late 2024 and into 2025 to combat inflation, this raises borrowing costs for Funai and its business customers, potentially dampening demand.

| Economic Factor | 2024 Projection/Trend | Impact on Funai |

| Global GDP Growth | ~3.2% | Mixed: Higher growth boosts B2B sales, recession risks hurt consumer electronics. |

| JPY Exchange Rate | Volatile (e.g., ~150 JPY/USD) | Weaker Yen aids exports; stronger Yen increases import costs. |

| Inflation | ~3.0%-4.0% | Increases operational costs, pressures profit margins. |

| Interest Rates | Multi-year highs | Higher borrowing costs for Funai and customers, potentially reducing investment. |

Preview the Actual Deliverable

Funai PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Funai PESTLE analysis covers political, economic, social, technological, legal, and environmental factors impacting the company.

You'll gain valuable insights into the external forces shaping Funai's strategic landscape, enabling informed decision-making.

Sociological factors

Businesses are rapidly embracing digital transformation, creating a strong demand for sophisticated IT services, efficient commercial printing, and seamless system integration. This societal shift means companies need tools that boost productivity and simplify their workflows.

Funai's strategic move into commercial products and solutions directly addresses this trend, positioning them to supply businesses with the technology that supports their digital ambitions. For example, the global digital transformation market was valued at over $500 billion in 2023 and is projected to grow significantly, indicating a robust market for Funai's offerings.

Japan's workforce is significantly shaped by its aging population and declining birth rates, a trend that directly impacts labor availability. By 2024, the proportion of the population aged 65 and over reached approximately 30%, creating a shrinking pool of younger workers. This demographic shift can lead to critical labor shortages, especially in sectors like manufacturing and areas requiring specialized technical skills, which Funai Electric operates within.

The scarcity of available labor in Japan is likely to drive up employment costs for companies like Funai. As the demand for workers outstrips supply, wages and benefits may need to increase to attract and retain talent. This necessitates a strategic focus on enhancing operational efficiency and potentially increasing investment in automation and advanced production systems to mitigate the impact of rising labor expenses and maintain competitive production capabilities.

Societal expectations are increasingly pushing companies like Funai towards greener operations. Consumers and business partners alike want to see a commitment to environmental responsibility throughout the product's life, from manufacturing to disposal.

Funai's commercial and IT sectors feel this pressure directly, with clients demanding evidence of eco-friendly manufacturing processes and responsible e-waste management. For instance, in 2024, the global market for sustainable electronics was estimated to reach over $200 billion, highlighting the significant financial incentive for companies to prioritize these practices.

Emphasis on Data Security and Privacy

Societal concern over data security and privacy is a growing trend, particularly as businesses like Funai integrate more digital solutions. Consumers and clients are increasingly aware of how their personal and corporate information is handled, demanding robust protection. This heightened awareness directly impacts trust and brand reputation.

Funai, as an IT and solutions provider, faces pressure to adhere to stringent data protection standards. Meeting these expectations is crucial for maintaining client confidence and ensuring compliance with a landscape of evolving privacy regulations. For instance, a 2024 survey indicated that 78% of consumers are more likely to choose businesses with transparent data privacy policies.

The escalating reliance on digital platforms means that data breaches can have significant financial and reputational consequences. Funai's commitment to cybersecurity is therefore not just a technical requirement but a fundamental aspect of its social license to operate. Failure to prioritize this can lead to loss of business and damage to its market position.

- Increased consumer demand for data privacy: By 2025, it's projected that over 80% of consumers will actively review privacy policies before engaging with a service.

- Regulatory scrutiny on data handling: Global data protection laws, such as GDPR and CCPA, continue to influence corporate practices, with fines for non-compliance reaching millions.

- Reputational risk from breaches: A significant data breach in 2024 resulted in a 25% drop in customer acquisition for the affected company.

- Funai's strategic imperative: Investing in advanced security measures is essential for Funai to retain and attract clients in a data-sensitive market.

Technological Literacy and Adoption Rates

The increasing technological literacy across the global workforce is a significant driver for Funai's advanced solutions. As more individuals become comfortable with digital tools, the market for sophisticated office equipment and integrated systems expands. For instance, a 2024 report indicated that over 75% of office workers in developed economies regularly use cloud-based collaboration software, a trend that directly benefits companies like Funai offering seamless integration and smart functionalities.

Adoption rates for new technologies directly impact the demand for Funai's product portfolio. Businesses that readily embrace AI-powered tools, for example, are more likely to invest in the smart office equipment and advanced printing solutions Funai provides. Data from early 2025 suggests that small and medium-sized enterprises (SMEs) are increasingly adopting automation, with over 40% implementing AI in at least one business process, creating a fertile ground for Funai's innovative offerings.

- Growing Digital Skills: By 2024, global internet penetration reached nearly 65%, indicating a broad base of users familiar with digital interfaces, which supports the adoption of advanced tech.

- AI Integration in Business: Projections for 2025 show a continued surge in AI adoption, with an estimated 30% of businesses planning to integrate AI into their core operations, boosting demand for AI-enabled hardware.

- Smart Office Adoption: The smart office market is expected to grow significantly, with a compound annual growth rate (CAGR) of over 15% anticipated between 2024 and 2028, directly benefiting Funai's connected device strategies.

Societal expectations are increasingly pushing companies like Funai towards greener operations, with consumers and business partners alike wanting to see a commitment to environmental responsibility throughout the product's life. Funai's commercial and IT sectors feel this pressure directly, as clients demand evidence of eco-friendly manufacturing processes and responsible e-waste management.

Societal concern over data security and privacy is a growing trend, particularly as businesses integrate more digital solutions. Consumers and clients are increasingly aware of how their personal and corporate information is handled, demanding robust protection, which directly impacts trust and brand reputation.

The increasing technological literacy across the global workforce is a significant driver for advanced solutions. As more individuals become comfortable with digital tools, the market for sophisticated office equipment and integrated systems expands, with over 75% of office workers in developed economies regularly using cloud-based collaboration software by 2024.

Adoption rates for new technologies directly impact the demand for Funai's product portfolio. Businesses that readily embrace AI-powered tools are more likely to invest in the smart office equipment and advanced printing solutions Funai provides, with over 40% of SMEs implementing AI in at least one business process by early 2025.

Technological factors

Funai's printing division must keep pace with rapid technological shifts, including advancements in inkjet, direct-to-film (DTF), and hybrid printing. These innovations directly impact print quality, operational speed, and the range of applications possible, which are critical for staying competitive in the commercial printing market.

The global digital printing market, for instance, was valued at approximately $23.9 billion in 2023 and is projected to grow significantly, reaching an estimated $43.6 billion by 2030. This growth underscores the demand for enhanced printing technologies that Funai needs to leverage.

The increasing integration of AI and automation is fundamentally reshaping the IT and business solutions landscape. For Funai, this means leveraging AI and machine learning to inject greater efficiency and predictive capabilities into its offerings, providing clients with automated workflows and advanced analytics.

By 2024, global spending on AI systems was projected to reach $200 billion, highlighting the significant market demand for AI-driven solutions. Funai's strategic adoption of these technologies will be crucial for maintaining competitiveness and delivering value-added services in this rapidly evolving sector.

Funai's reliance on information technology means it must embrace the ongoing migration to cloud-based services, sophisticated data centers, and dependable network architectures. This evolution is critical for delivering the scalable, secure, and efficient IT solutions that today's businesses require, leveraging the power of cloud computing.

The global cloud computing market is projected to reach over $1.3 trillion by 2025, highlighting the significant opportunity and necessity for companies like Funai to integrate these advanced capabilities. This shift allows for greater agility and cost-effectiveness in IT operations.

Cybersecurity Technologies and Threats

The escalating digitalization of business operations means cybersecurity threats are becoming more complex and pervasive. For Funai, this translates into a critical need for ongoing investment in cutting-edge cybersecurity technologies to safeguard sensitive client information and uphold brand integrity. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the significant financial risks associated with inadequate security measures.

Funai must actively integrate advanced solutions like AI-powered threat detection, zero-trust architecture, and robust data encryption across its product ecosystem. This proactive approach is essential not only for compliance but also for maintaining customer confidence in an era where data breaches can have devastating reputational and financial consequences. For instance, in 2024, companies experiencing significant data breaches reported an average financial impact of $4.45 million.

Key technological factors influencing Funai's cybersecurity strategy include:

- Advancements in AI and Machine Learning for threat detection: These technologies enable faster identification and response to novel cyber threats.

- The rise of ransomware and sophisticated phishing attacks: Businesses must implement multi-layered defenses, including employee training and advanced endpoint protection.

- Increasing regulatory scrutiny on data privacy: Compliance with regulations like GDPR and CCPA necessitates strong cybersecurity frameworks.

- The evolving landscape of IoT security: As connected devices proliferate, securing these endpoints becomes paramount to prevent network infiltration.

Research and Development (R&D) Investment

Funai Electric's commitment to Research and Development is crucial for staying ahead in the dynamic technology sector. In 2024, the company's focus remains on enhancing its commercial printing and IT solutions. This involves exploring novel materials and integrating advanced features into its product lines to anticipate and satisfy evolving customer demands.

Funai's R&D efforts are strategically directed towards bolstering its core competencies. For instance, advancements in inkjet technology are key to improving print quality and reducing operational costs for businesses. The company is also investing in software development to create more integrated and user-friendly IT solutions, aiming to streamline workflows for its clients.

Financial allocations for R&D are a significant indicator of Funai's forward-looking strategy. While specific R&D spending figures for 2024 are often part of internal reporting, industry trends suggest a continued emphasis on innovation. Companies in the printing and IT sectors typically dedicate between 5% to 10% of their revenue to R&D to maintain a competitive edge.

- Focus on Next-Generation Inkjet Technology: Enhancing print speed, resolution, and ink efficiency.

- Development of Smart IT Solutions: Integrating AI and cloud capabilities for enhanced data management and connectivity.

- Exploration of Sustainable Materials: Researching eco-friendly components for product manufacturing.

- Advancements in Printer Reliability and Durability: Improving product lifespan and reducing maintenance needs.

Funai Electric faces a landscape where technological advancements in printing, such as direct-to-film and hybrid systems, are reshaping market expectations for quality and speed. The global digital printing market is a testament to this, projected to grow from approximately $23.9 billion in 2023 to $43.6 billion by 2030, indicating a strong demand for innovative solutions that Funai must embrace.

The increasing integration of AI and automation offers significant opportunities for Funai to enhance its IT and business solutions, driving efficiency and predictive capabilities. Global spending on AI systems was projected to exceed $200 billion in 2024, underscoring the substantial market for AI-driven services that Funai can tap into.

Funai's IT infrastructure must adapt to the ongoing migration towards cloud computing, sophisticated data centers, and robust network architectures. The global cloud computing market is anticipated to surpass $1.3 trillion by 2025, highlighting the critical need for companies like Funai to leverage these scalable and efficient capabilities.

The escalating digitalization necessitates a strong focus on cybersecurity, as threats become more complex and pervasive. With the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, Funai's investment in advanced cybersecurity measures, such as AI-powered threat detection, is paramount to protect client data and maintain trust.

Legal factors

Funai's IT solutions and commercial products, which often involve handling sensitive customer information, are directly impacted by data protection regulations. Japan's Act on the Protection of Personal Information (APPI) is a key example, and upcoming amendments slated for 2025 will introduce more stringent requirements for data handling, consent mechanisms, and cross-border data transfers. This necessitates careful review and potential adjustments to Funai's data management strategies and operational procedures to ensure ongoing compliance and maintain customer trust.

Protecting Funai's intellectual property, encompassing its unique designs, advanced technologies, and proprietary software, is paramount for maintaining its competitive edge in the dynamic electronics and IT sectors. This involves navigating and leveraging robust legal frameworks for patent, trademark, and copyright protection across diverse global markets. For instance, in 2024, the global intellectual property market continued its robust growth, with patent filings increasing by an estimated 5% year-over-year, highlighting the increasing importance of securing innovations.

Funai Electric, as a global manufacturer of electronics and commercial equipment, must navigate a complex web of product safety and compliance standards. These regulations, which cover everything from design to labeling, are critical for ensuring consumer safety and market access. For instance, in 2024, the European Union's General Product Safety Regulation (GPSR) continues to emphasize manufacturer responsibility for product safety throughout the supply chain, with potential fines for non-compliance.

Adherence to standards like UL certification in North America or CE marking in Europe is non-negotiable for Funai's product lines, including their audio-visual equipment and appliances. In 2025, continued focus on cybersecurity for connected devices will likely introduce new compliance requirements, impacting how Funai designs and tests its smart home products. Failing to meet these evolving legal mandates can lead to costly recalls, reputational damage, and significant market exclusion.

Labor Laws and Employment Regulations

Funai Electric's operations are significantly shaped by labor laws and employment regulations in Japan and any other countries where it has a presence. Ensuring compliance with these rules, which cover everything from minimum wages and working hours to employee benefits and dismissal procedures, is paramount. For instance, Japan's labor laws mandate specific standards for overtime pay and paid leave, which directly influence Funai's operational costs and HR strategies.

Changes in these legal frameworks can introduce new financial burdens or operational complexities. For example, an increase in the statutory minimum wage in a key manufacturing country could directly raise Funai's production costs. Similarly, new regulations on employee benefits or working conditions might necessitate adjustments to HR policies and potentially increase overall compensation expenses.

Key areas of labor law impacting Funai include:

- Wage and Hour Laws: Adherence to minimum wage, overtime pay, and maximum working hour regulations in all operating jurisdictions. In 2024, Japan's minimum wage varies by prefecture, with some exceeding ¥1,100 per hour, impacting labor costs for Funai's Japanese facilities.

- Employee Benefits and Social Security: Compliance with mandates for health insurance, pensions, unemployment insurance, and other social security contributions. For example, Japanese employers are required to contribute to employee pension and health insurance schemes.

- Termination and Severance: Following legal procedures for employee dismissals, including notice periods and severance pay requirements, which can vary significantly by country.

- Workplace Safety and Health: Implementing and maintaining safe working environments as stipulated by national occupational health and safety standards.

E-waste and Recycling Legislation

Funai Electric faces increasing pressure from evolving e-waste and recycling legislation, particularly in key markets like Japan. These laws, often aligned with international frameworks such as the Basel Convention, are becoming more stringent, impacting how Funai manages its products from design through disposal.

These regulations mandate responsible end-of-life management, pushing for higher recycling rates and potentially imposing extended producer responsibility (EPR) schemes. For instance, Japan's Home Appliance Recycling Law requires manufacturers to contribute to the costs of collecting and recycling specified appliances, directly influencing Funai's operational costs and product design choices to facilitate easier disassembly and material recovery.

- Stricter Recycling Mandates: Funai must ensure its products meet higher recycling efficiency targets, impacting material selection and manufacturing processes.

- Extended Producer Responsibility (EPR): The company may face financial obligations for the collection, treatment, and disposal of its products after consumer use, a trend seen across many developed nations.

- Product Design Influence: Legislation encourages designing for durability, repairability, and recyclability, potentially requiring Funai to invest in R&D for more sustainable product lifecycles.

Funai's adherence to intellectual property laws is crucial for safeguarding its innovations, from product designs to software. Global patent filings saw a continued increase in 2024, underscoring the competitive need for robust IP protection. Navigating international trademark and copyright regulations ensures Funai's brand and technology are legally protected across its diverse markets.

Environmental factors

Funai faces increasing pressure from evolving environmental regulations concerning electronic waste, especially with Japan's new e-waste export rules taking effect in January 2025. This means the company must proactively adapt its practices to ensure compliance and minimize its environmental impact.

To navigate these changes, Funai will need to prioritize investments in sustainable product design, making electronics easier to repair and recycle. Developing robust internal recycling programs and partnering with certified disposal facilities are crucial steps to manage end-of-life products responsibly.

The global e-waste problem is substantial, with estimates suggesting over 53 million metric tons were generated worldwide in 2019, a figure projected to reach 74 million metric tons by 2030. Funai's commitment to responsible e-waste management is therefore not just a regulatory necessity but a vital component of its corporate social responsibility.

Funai faces growing demands from governments, consumers, and investors to shrink its carbon footprint. This pressure is driving the company to implement more energy-efficient manufacturing and develop products that use less power. For example, in 2024, the EU's Carbon Border Adjustment Mechanism (CBAM) began impacting imports, signaling a global trend towards carbon pricing that could affect Funai's supply chain and product costs.

Meeting carbon emission targets directly influences how Funai operates and designs its products. Companies are increasingly investing in renewable energy sources for their facilities; in 2024, global corporate investment in renewable energy reached record highs, indicating a strong market shift. Funai's commitment to these targets will likely involve innovating in product lifecycle management and exploring greener materials.

Funai faces increasing environmental pressure to ensure its entire supply chain is sustainable and ethically sourced. This means scrutinizing where raw materials and components come from, looking at everything from their environmental footprint to labor conditions.

Companies like Funai are increasingly evaluated on their suppliers' adherence to responsible mining and manufacturing practices. For instance, in 2024, consumer electronics companies reported an average of 85% of their key suppliers undergoing sustainability audits, a significant jump from previous years, highlighting the growing demand for transparency.

Resource Scarcity and Raw Material Availability

The electronics sector, including companies like Funai, is heavily dependent on a range of raw materials. Many of these, such as rare earth elements and certain metals, are finite and their availability can be significantly impacted by geopolitical tensions and surging global demand. For instance, the International Energy Agency reported in 2024 that demand for critical minerals essential for clean energy technologies, which often overlap with electronics components, is projected to grow substantially in the coming years, potentially leading to price volatility and supply chain disruptions.

Funai must proactively address these challenges. Strategies could involve investing in research and development for alternative materials with better availability or exploring advanced recycling technologies to recover valuable components from electronic waste. Diversifying the geographic sources of its raw materials is also crucial to reduce reliance on any single region, thereby building a more resilient supply chain against potential disruptions.

- Supply Chain Vulnerability: Geopolitical events in 2023-2024, particularly in regions rich in critical minerals, highlighted the fragility of global electronics supply chains.

- Material Innovation: Companies are exploring the use of more abundant materials and designing products for easier disassembly and component recovery.

- Recycling Initiatives: The global e-waste recycling market is expanding, with projections indicating significant growth through 2030, offering a potential source of recovered materials.

- Sourcing Diversification: Efforts are underway to identify and secure raw material sources from a wider array of countries to mitigate risks associated with concentrated supply.

Corporate Environmental Responsibility (CER) Expectations

Societal expectations for Corporate Environmental Responsibility (CER) now extend far beyond mere legal compliance. Consumers and stakeholders increasingly demand proactive environmental stewardship from businesses. For Funai, demonstrating a robust commitment to sustainability can significantly bolster its brand image, attracting a growing segment of environmentally aware customers. This commitment also resonates with investors, with ESG (Environmental, Social, and Governance) factors becoming critical in investment decisions. For instance, in 2024, the global sustainable investment market was valued at over $37 trillion, highlighting the financial imperative for companies to prioritize environmental performance.

Funai's proactive environmental initiatives can translate into tangible competitive advantages. By integrating eco-friendly practices into its operations, the company can reduce waste, optimize resource utilization, and potentially lower operational costs. This not only appeals to the environmentally conscious consumer base but also attracts clients who prioritize sustainability in their supply chains. Furthermore, a strong CER record can improve investor confidence, as seen in the increasing correlation between high ESG scores and positive stock performance in recent years. For example, companies with strong environmental policies often experience lower capital costs.

Key aspects of Funai's CER expectations include:

- Reducing carbon footprint: Implementing strategies to lower greenhouse gas emissions across all operational facets.

- Sustainable sourcing: Prioritizing suppliers with strong environmental credentials and ethical practices.

- Waste management and circular economy principles: Minimizing waste generation and adopting circular economy models for product lifecycles.

- Water conservation and pollution control: Implementing measures to reduce water usage and prevent environmental contamination.

Funai must navigate a complex web of environmental regulations, including Japan's new e-waste export rules effective January 2025, and increasing global pressure to reduce its carbon footprint. The company is also facing demands for more sustainable sourcing and ethical labor practices throughout its supply chain, with a significant percentage of electronics suppliers undergoing sustainability audits in 2024.

The growing global e-waste challenge, projected to reach 74 million metric tons by 2030, necessitates robust recycling programs and a focus on product design for repairability and recyclability. Furthermore, the demand for critical minerals used in electronics is rising, potentially leading to price volatility and supply chain vulnerabilities, underscoring the need for material innovation and diversified sourcing.

Societal expectations for Corporate Environmental Responsibility (CER) are high, with ESG factors increasingly influencing investment decisions, as evidenced by the over $37 trillion global sustainable investment market in 2024. Funai's commitment to reducing its carbon footprint, sustainable sourcing, waste management, and water conservation can provide a competitive advantage and enhance investor confidence.

| Environmental Factor | 2024/2025 Data/Trend | Impact on Funai |

|---|---|---|

| E-Waste Regulations | Japan's new e-waste export rules (Jan 2025) | Requires compliance, investment in recycling infrastructure |

| Carbon Footprint Reduction | Global corporate investment in renewables at record highs (2024) | Drives adoption of energy-efficient manufacturing and renewable energy sources |

| Supply Chain Sustainability | 85% of key suppliers audited for sustainability (2024) | Necessitates scrutiny of supplier environmental and labor practices |

| Raw Material Availability | Projected substantial growth in demand for critical minerals (IEA, 2024) | Increases risk of price volatility and supply chain disruptions; drives material innovation |

| Corporate Environmental Responsibility (CER) | Global sustainable investment market > $37 trillion (2024) | Enhances brand image, attracts environmentally conscious consumers and investors |

PESTLE Analysis Data Sources

Our Funai PESTLE Analysis is meticulously constructed using data from reputable sources including government publications, international economic organizations, and leading market research firms. This ensures that every aspect of the analysis, from political stability to technological advancements, is grounded in factual and current information.