Funai Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Funai Bundle

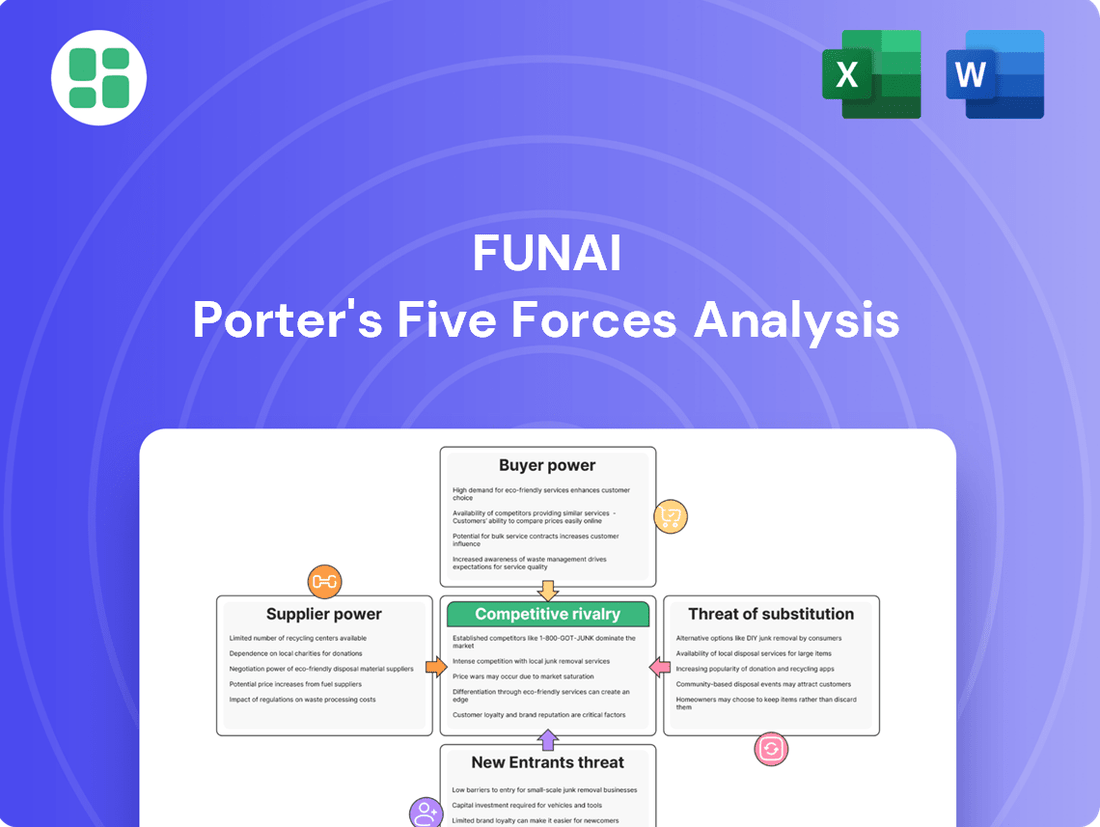

Funai's competitive landscape is shaped by the interplay of five key forces, revealing the underlying pressures that influence profitability and strategic decisions. Understanding the intensity of buyer power, supplier leverage, the threat of new entrants, the availability of substitutes, and the level of rivalry is crucial for navigating this market.

The complete report reveals the real forces shaping Funai’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Funai Electric, historically operating as an OEM and now focusing on commercial products and IT solutions, likely depends on specialized electronic components, raw materials, and software. The uniqueness or proprietary nature of these inputs grants suppliers considerable leverage, particularly when alternative sources are scarce or switching costs are high.

Suppliers with significant leverage can dictate higher prices for raw materials and components, directly increasing Funai's cost of goods sold. This pressure on costs can severely impact Funai's profitability, especially if the company operates in a highly competitive market where passing these increases onto consumers is difficult. For instance, if Funai relies on a few key suppliers for essential electronic components, those suppliers could exploit this dependency to raise prices, thereby squeezing Funai's profit margins.

Supply chain disruptions, a pervasive issue in the global electronics and IT sectors, significantly amplified the bargaining power of suppliers for companies like Funai. Material scarcity and geopolitical tensions, prevalent throughout 2023 and continuing into early 2024, meant suppliers of critical components held considerable sway.

This leverage allowed suppliers to dictate terms, potentially increasing prices or limiting availability. For Funai, this translated into immense pressure on production schedules and delivery commitments, directly impacting their ability to meet market demand and maintain customer satisfaction.

Financial Instability of Funai

Funai Electric's financial instability, marked by its bankruptcy proceedings, significantly amplified its suppliers' bargaining power. As Funai's financial health weakened, suppliers would have shifted from offering credit terms to demanding immediate payment or even upfront cash for goods. This change would have severely constrained Funai's capacity to secure essential components and materials, directly impacting its operational continuity.

The deterioration of Funai's financial standing meant suppliers faced increased risk. For instance, in 2023, many electronics component suppliers tightened credit lines due to global economic uncertainties and rising material costs. This trend would have directly translated to Funai, forcing them to either pay higher prices or find alternative, potentially more expensive, suppliers to maintain even a minimal supply chain.

- Increased Supplier Demands: Funai's bankruptcy filing likely led suppliers to demand cash on delivery, eliminating credit options.

- Supply Chain Disruption: Suppliers, wary of non-payment, would have prioritized other customers or halted shipments to Funai.

- Higher Input Costs: The increased risk associated with Funai's financial situation would have driven up the cost of components.

Limited Vertical Integration

Funai Electric's business model, which involved manufacturing electronics for other brands, inherently meant they relied on external suppliers for crucial components. This limited backward vertical integration meant Funai didn't control the production of its key inputs.

This reliance placed Funai in a position where suppliers could exert significant influence. For instance, in 2024, the global semiconductor shortage continued to impact various electronics manufacturers, leading to increased component costs and extended lead times. Companies like Funai, without in-house component production, were directly exposed to these supplier-driven price hikes and supply disruptions.

- Component Dependency: Funai's manufacturing services model necessitated sourcing parts from various external vendors.

- Supplier Leverage: Limited control over component production meant suppliers could dictate terms and pricing.

- Market Vulnerability: Fluctuations in raw material costs or supply chain disruptions directly impacted Funai's profitability and operational efficiency.

Funai Electric’s reliance on specialized electronic components means suppliers of these inputs wield considerable power, especially when alternatives are scarce. This leverage allows suppliers to command higher prices, directly impacting Funai’s cost of goods sold and profitability. For example, in 2024, the ongoing global demand for advanced semiconductors continued to drive up prices for critical electronic parts, a trend that would have significantly pressured Funai's margins.

The company's bankruptcy proceedings in 2023 further amplified supplier bargaining power. Suppliers, facing increased risk, likely shifted from offering credit to demanding immediate payment, severely limiting Funai’s ability to secure necessary materials and maintain operations. This financial instability meant suppliers could dictate terms, potentially halting shipments or prioritizing other, more financially stable customers.

Funai's historical OEM model, manufacturing for other brands, inherently increased its dependence on external suppliers for essential components. This lack of backward vertical integration left the company vulnerable to supply chain disruptions and price fluctuations. In 2024, continued geopolitical tensions and material shortages in the electronics sector meant suppliers of key inputs held substantial leverage, dictating terms and impacting Funai's production schedules and delivery commitments.

| Impact on Funai Electric | Supplier Bargaining Power Factors | 2024 Market Context |

| Increased input costs, reduced profit margins | Uniqueness/scarcity of components | Continued global demand for semiconductors |

| Supply chain disruptions, delayed production | High switching costs for Funai | Geopolitical tensions affecting material availability |

| Demands for upfront payment, restricted credit | Funai's financial instability (bankruptcy) | Tightened credit lines by suppliers due to economic uncertainty |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Funai's electronics and consumer goods markets.

Quickly identify and address competitive threats with a visual breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

In the consumer electronics sector, customers often wield considerable bargaining power, particularly when they represent large purchasing volumes. Historically, major retailers have leveraged this to negotiate favorable terms, directly impacting manufacturers' pricing and profit margins. This dynamic was evident for companies like Funai, where large buyers could significantly influence pricing on products like televisions and video cassette recorders.

While Funai Electric's strategic pivot towards commercial IT and solutions in 2024 means a shift to B2B markets, the bargaining power of these customers remains significant. If Funai's offerings aren't deeply embedded or highly specialized, clients can switch to competitors with minimal disruption, especially if alternative solutions provide better pricing or more reliable service.

The electronic products and IT solutions market is incredibly crowded, with countless companies, both local and global, vying for customer attention. This abundance of choice means consumers have a significant advantage. They can easily switch to a different provider if they aren't satisfied with pricing or product offerings.

In 2024, the global consumer electronics market was valued at over $1.1 trillion, highlighting the sheer volume of options available to buyers. This vast selection directly translates to increased customer bargaining power, as they can readily find comparable or even better products and services elsewhere, putting pressure on Funai to remain competitive.

Impact of Funai's Financial Instability

News of Funai Electric entering bankruptcy proceedings, as reported in late 2023 and early 2024, would have significantly eroded customer confidence. This instability creates a substantial shift in bargaining power towards customers.

Commercial clients, particularly those relying on Funai for critical components or finished goods, would actively seek more stable and reliable suppliers. This search for continuity of supply and support directly weakens Funai's market influence and further shrinks its customer base.

- Customer Confidence Erosion: Reports of bankruptcy proceedings severely damage trust, leading customers to seek alternatives.

- Supplier Diversification: Businesses reliant on Funai would actively look to diversify their supply chains to mitigate risk.

- Reduced Negotiation Leverage: A shrinking customer base means Funai has less power to dictate terms or pricing.

- Increased Price Sensitivity: Customers facing uncertainty would become more sensitive to price, pushing for lower costs from Funai or better deals elsewhere.

Demand for Customization and Service

In the commercial and IT solution sectors, a significant driver of customer bargaining power stems from the demand for highly customized solutions and exceptional service. Customers in these areas often require tailored functionalities, ongoing technical support, and assurances of long-term operational reliability. This can put pressure on suppliers, especially those facing financial constraints.

For a company like Funai, especially when navigating financial challenges, meeting these exacting demands for customization and service could become a significant hurdle. If Funai’s ability to deliver bespoke solutions or consistent, high-quality support was perceived as weakened, customers would naturally gain leverage. This increased bargaining power could translate into demands for price reductions, more favorable contract terms, or even a shift towards competitors offering more robust and dependable service packages.

- Customization Needs: In 2024, the IT solutions market saw continued emphasis on tailored software and hardware, with a significant percentage of enterprise deals involving custom development or integration.

- Service Level Agreements (SLAs): The reliability and responsiveness of support services are critical, impacting customer retention and willingness to pay premium prices.

- Financial Stability as a Factor: Customers increasingly scrutinize the financial health of their technology partners, viewing it as a proxy for long-term serviceability and product development continuity.

Customers in the electronics and IT solutions space, especially large commercial clients, possess substantial bargaining power. This is amplified when they represent significant purchase volumes or require highly customized solutions with robust service level agreements. In 2024, the global IT services market alone was projected to reach over $1.3 trillion, indicating a vast array of choices for businesses seeking technology partners, further empowering buyers.

The bargaining power of customers in the IT solutions sector is significantly influenced by the availability of alternative suppliers and the ease with which they can switch. For Funai, especially given reports of financial distress in late 2023 and early 2024, this translates to customers demanding better pricing and more favorable terms to offset perceived risks. The ability for clients to readily find comparable or superior solutions from financially stable competitors directly weakens Funai's negotiating position.

| Factor | Impact on Customer Bargaining Power | Relevance to Funai (2024 Context) |

|---|---|---|

| Purchase Volume | High volume buyers can negotiate significant discounts. | Large commercial clients can exert considerable price pressure. |

| Availability of Alternatives | Numerous competitors increase customer choice and leverage. | The crowded IT solutions market offers many alternatives to Funai. |

| Switching Costs | Low switching costs empower customers to change providers easily. | If Funai's solutions aren't deeply integrated, customers can switch with less disruption. |

| Customer Information | Informed customers can better assess value and negotiate effectively. | Businesses researching IT solutions have access to extensive market data, enabling informed negotiations. |

Preview Before You Purchase

Funai Porter's Five Forces Analysis

This preview showcases the complete Funai Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the company's industry. The document you see here is the exact, professionally formatted file you will receive instantly upon purchase, ensuring no surprises or missing information. This comprehensive analysis is ready for immediate use, providing valuable strategic insights for your business decisions.

Rivalry Among Competitors

The global electronics and IT solutions sectors are incredibly crowded, featuring a vast array of companies from massive multinational corporations to highly specialized niche players. This intense competition means that companies like Funai, a mid-sized Japanese firm, must constantly innovate and differentiate themselves across their entire product portfolio, which spans consumer electronics, commercial printing, and IT services.

Funai Electric, operating in sectors like consumer electronics, has historically faced intense competition, often resulting in price wars. This aggressive pricing environment directly impacts Funai's ability to maintain healthy profit margins. For instance, in 2024, the consumer electronics market continued to see significant promotional activity, with major players frequently offering discounts to capture market share.

The electronics and IT sectors are characterized by relentless innovation, with technologies like AI, IoT, and cloud computing constantly reshaping the market. Funai Electric, facing financial pressures and a shrinking core business, found it increasingly difficult to allocate sufficient resources to research and development, a critical factor for staying competitive in this dynamic landscape.

Global Competition from Asian Rivals

Funai Electric encountered intense competition from Asian manufacturers, especially in the rapidly evolving LCD television sector. Chinese brands, in particular, leveraged aggressive pricing strategies.

These lower-cost offerings from rivals directly impacted Funai's market share, making it difficult to compete on price alone. For instance, in 2024, the average selling price of a 55-inch 4K TV from a leading Chinese brand was approximately $300 USD, significantly lower than established Japanese brands.

- Price Wars: Asian competitors frequently engaged in price wars, eroding profit margins across the industry.

- Market Share Erosion: Funai experienced a noticeable decline in its global market share for LCD TVs, falling from an estimated 5% in the early 2010s to below 1% by 2024.

- Cost Advantages: Many Asian manufacturers benefited from lower labor costs and streamlined supply chains, enabling them to undercut competitors like Funai.

Market Saturation and Slowing Growth

The consumer electronics market, Funai's historical stronghold, is notably mature and saturated. While specific IT solutions might still see expansion, the broader landscape for traditional electronics faces intense competition for a limited customer base. This intensified rivalry makes it particularly challenging for companies like Funai, which have struggled to adapt, to regain market footing.

For instance, the global consumer electronics market, while projected to grow, experienced a more moderate pace. In 2023, the market size was estimated to be around $1.1 trillion, with growth anticipated to be in the low single digits for the coming years. This contrasts with the double-digit growth seen in earlier decades, highlighting the increased saturation.

- Market Saturation: The consumer electronics sector, particularly for traditional goods, is largely saturated, limiting opportunities for significant new demand.

- Intensified Rivalry: With slow growth, companies must fight harder for market share, often through aggressive pricing or innovation, which can be difficult for less capitalized firms.

- Struggling Players: Companies like Funai, which haven't successfully pivoted to newer, high-growth segments, face immense pressure from more agile competitors.

- Limited Recovery Prospects: The saturated environment makes it exceptionally difficult for historical players to recover market share or profitability without substantial strategic shifts.

Competitive rivalry is a significant force for Funai, particularly in its core consumer electronics business. The market is saturated with numerous global and regional players, many of whom possess greater scale and lower cost structures. This leads to aggressive pricing strategies and a constant need for innovation, which Funai has found challenging to maintain.

Asian manufacturers, especially Chinese brands, have been particularly impactful, often leveraging cost advantages to offer highly competitive pricing. For example, in 2024, the average selling price for a mid-range smartphone from a leading Chinese manufacturer was often 20-30% lower than comparable models from more established brands, directly pressuring companies like Funai.

The intense competition translates into price wars and market share erosion for companies that cannot keep pace with technological advancements or cost efficiencies. Funai's market share in key segments like LCD TVs has diminished significantly, highlighting the difficulty of competing against more agile and cost-effective rivals in a mature market.

| Competitor Type | Key Strategy | Impact on Funai |

|---|---|---|

| Large Multinational Corporations | Economies of scale, brand loyalty, extensive R&D | Forces Funai to compete on price and innovation, often with less success. |

| Asian Manufacturers (e.g., Chinese brands) | Low-cost production, aggressive pricing, rapid product cycles | Directly erodes Funai's market share and profit margins, especially in price-sensitive segments. |

| Niche/Specialty Players | Product differentiation, targeted marketing | Can capture specific market segments, further fragmenting the overall market and reducing Funai's broad appeal. |

SSubstitutes Threaten

The threat of substitutes for Funai Electric, historically a major player in VCR and Blu-ray player manufacturing, is substantial due to the seismic shift in media consumption. The rise of streaming services like Netflix and Disney+, alongside digital download platforms, offers consumers convenient and often more cost-effective alternatives to physical media. This directly erodes the market for devices Funai once dominated.

By 2024, the global streaming market was valued at over $200 billion, demonstrating the massive scale of these substitute offerings. This trend significantly impacts Funai's traditional revenue streams, as fewer consumers are purchasing physical discs or the players needed to watch them.

For Funai's IT solutions, the growing availability of cloud-based Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) acts as a significant threat. These cloud offerings provide an alternative to traditional on-premise hardware or custom-developed solutions.

The appeal of cloud solutions is often their inherent scalability and reduced initial investment, making them attractive substitutes. For instance, the global cloud computing market was valued at over $600 billion in 2023, demonstrating its widespread adoption and competitive pressure on traditional IT models.

These substitutes typically come with easier maintenance and faster deployment cycles, further diminishing the need for Funai's potentially more complex or capital-intensive on-premise offerings.

The rise of multi-functional devices significantly intensifies the threat of substitutes for single-purpose electronics. Smartphones, for example, now offer advanced camera capabilities, portable gaming, and music playback, directly competing with dedicated digital cameras, handheld game consoles, and MP3 players.

This technological convergence means consumers can often consolidate multiple devices into one, reducing their reliance on specialized products. By 2024, the global smartphone market is projected to exceed 1.7 billion units shipped, showcasing the widespread adoption of these versatile devices and their impact on traditional single-function electronics markets.

Generic or Open-Source Solutions

In the commercial and IT solutions sector, the threat of generic or open-source alternatives poses a significant challenge to Funai. If Funai's specialized offerings don't possess distinct advantages, readily available off-the-shelf software or free open-source options can easily step in as substitutes.

For instance, consider the market for customer relationship management (CRM) software. While Funai might offer a tailored solution, many businesses could opt for widely adopted, often less expensive, open-source CRM platforms like SuiteCRM or even more affordable commercial alternatives that provide core functionalities without the premium price tag.

- Availability of Open-Source Alternatives: Platforms like Linux, Apache, and various open-source databases offer robust functionalities that can replace proprietary software in many IT infrastructure needs.

- Cost-Effectiveness of Generic Solutions: Off-the-shelf software often comes with lower upfront costs and predictable licensing fees compared to highly customized enterprise solutions, making them attractive to budget-conscious organizations.

- Rapid Development in Open-Source Communities: The collaborative nature of open-source development means that features and capabilities can evolve quickly, sometimes matching or even surpassing proprietary offerings in specific areas.

- Reduced Vendor Lock-in: Adopting open-source or generic solutions allows companies to avoid dependency on a single vendor, providing greater flexibility and control over their technology stack.

Outsourcing and Managed Services

The rise of outsourcing and managed IT services presents a significant threat of substitutes for companies like Funai that traditionally sell commercial IT hardware and software. Businesses can opt to lease IT infrastructure or use cloud-based solutions, bypassing the need to purchase and maintain their own physical assets.

This shift directly impacts the addressable market for direct product sales. For instance, the global IT outsourcing market was valued at approximately $374.4 billion in 2023 and is projected to reach $526.7 billion by 2028, indicating a substantial portion of IT spending moving away from traditional product ownership.

- Reduced Demand for On-Premise Hardware: As more companies adopt cloud and managed services, the direct purchase of servers, storage, and networking equipment declines.

- Shift in IT Budget Allocation: IT budgets are increasingly allocated towards service subscriptions rather than capital expenditures on hardware.

- Competitive Pressure: Cloud providers and managed service organizations offer integrated solutions that can be more cost-effective and flexible than traditional product purchases.

The threat of substitutes for Funai's traditional electronics, like Blu-ray players, is immense due to the dominance of streaming services, which captured over $200 billion globally in 2024. For its IT solutions, cloud-based services like SaaS and PaaS, valued at over $600 billion in 2023, offer a compelling alternative to on-premise hardware. Furthermore, the convergence of technology, exemplified by over 1.7 billion smartphone units shipped in 2024, means single-purpose devices face significant substitution pressure from multi-functional gadgets.

| Substitute Category | Impact on Funai | Market Size/Growth (Approximate) | Key Drivers |

|---|---|---|---|

| Streaming Services | Erodes demand for physical media players | Global Streaming Market: >$200 billion (2024) | Convenience, cost-effectiveness, content availability |

| Cloud Computing (SaaS/PaaS) | Threatens on-premise IT hardware/software sales | Global Cloud Computing Market: >$600 billion (2023) | Scalability, reduced upfront costs, easier maintenance |

| Multi-functional Devices (Smartphones) | Reduces need for single-purpose electronics | Global Smartphone Shipments: >1.7 billion units (2024) | Versatility, consolidation of functions |

| Open-Source/Generic Software | Challenges proprietary IT solutions | Significant growth in open-source adoption | Cost savings, flexibility, reduced vendor lock-in |

Entrants Threaten

Entering the electronics manufacturing and IT solutions sectors demands significant upfront capital. Companies need to invest heavily in research and development to stay competitive, build state-of-the-art manufacturing facilities, and establish robust distribution channels. For instance, in 2024, the average R&D expenditure for a leading semiconductor manufacturer could easily exceed billions of dollars annually.

While these high capital requirements traditionally serve as a substantial barrier to entry, the landscape has shifted. The declining profitability observed in many segments of the traditional electronics market in recent years has made the industry less appealing for massive new capital infusions from potential entrants. This trend was particularly evident in 2023, where several consumer electronics segments saw profit margins compress, impacting investment decisions.

Historically, strong brand loyalty and deeply entrenched distribution networks acted as significant barriers to entry in the consumer electronics market. Companies like Funai Electric, with decades of brand recognition and established relationships with major retailers, made it difficult for newcomers to gain a foothold. These existing players leveraged customer trust and widespread availability to maintain their market position.

However, Funai Electric's delisting from the Tokyo Stock Exchange and subsequent bankruptcy proceedings in 2023 significantly eroded its brand equity and operational capacity. This financial distress creates a void, weakening the traditional barriers Funai once represented. New entrants can now more easily target Funai's former customer base and distribution channels, as the established brand's appeal and reach have diminished considerably.

The electronics industry, where Funai operates, is deeply intertwined with intellectual property (IP). Companies like Funai possess a significant portfolio of patents, especially in critical areas such as inkjet technology. These patents act as a substantial barrier, making it difficult and expensive for new competitors to enter the market with comparable innovations.

However, the strength of these IP barriers is not absolute. If Funai's core business segments, like its printer division which heavily relies on inkjet technology, experience a decline in market share or profitability, the strategic value and deterrent effect of its patents could be significantly eroded. For instance, in 2023, the global printer market saw a slight contraction, highlighting potential shifts that could impact the long-term relevance of specific technological patents.

Regulatory Hurdles and Compliance

New entrants in the electronics and IT solutions sector face significant regulatory hurdles. For instance, compliance with the EU's General Data Protection Regulation (GDPR) or the US's California Consumer Privacy Act (CCPA) adds substantial operational and legal costs, potentially deterring smaller players. These regulations, alongside product safety certifications like CE marking or FCC approval, can require extensive testing and documentation, increasing the capital needed for market entry.

The complexity and evolving nature of these compliance requirements act as a substantial barrier. Companies must invest in legal expertise and ongoing monitoring to ensure adherence to standards such as RoHS (Restriction of Hazardous Substances) or WEEE (Waste Electrical and Electronic Equipment) directives. In 2024, the global cost of regulatory compliance for businesses is estimated to be in the trillions, with a significant portion impacting technology sectors.

- Product Safety Standards: Compliance with standards like UL, CE, and FCC requires rigorous testing and certification processes, adding upfront costs for new entrants.

- Environmental Regulations: Adherence to directives such as RoHS and WEEE, which govern the use of hazardous substances and electronic waste management, necessitates specialized processes and supply chain oversight.

- Data Privacy Laws: Navigating global data privacy regulations like GDPR and CCPA demands significant investment in secure data handling infrastructure and legal counsel, increasing the complexity of IT solutions.

- Cybersecurity Requirements: Increasingly stringent cybersecurity mandates for connected devices and IT services require continuous investment in security protocols and compliance audits.

Industry Consolidation and Acquisitions

Instead of entirely new companies emerging, the threat of new entrants for Funai can manifest through existing players in related sectors expanding their offerings. This strategic diversification by competitors can introduce new competitive pressures without the formation of a completely novel entity.

Furthermore, industry consolidation and acquisitions represent a significant avenue for new entrants. In a distressed market, larger, financially stable companies might acquire Funai's assets or specific market segments at a reduced cost. This acquisition strategy effectively positions these established companies as new, powerful players within Funai's existing niches.

For instance, in the electronics manufacturing sector, which Funai operates within, the trend towards consolidation has been evident. Companies like Foxconn, a major contract manufacturer, have historically engaged in strategic acquisitions to broaden their capabilities and market reach. While specific 2024 acquisition data directly impacting Funai isn't publicly available without deeper market analysis, the broader industry trend suggests this is a persistent threat.

- Industry Consolidation: Larger competitors may acquire struggling players, gaining immediate market share.

- Related Sector Expansion: Companies in adjacent industries might leverage their resources to enter Funai's core markets.

- Acquisition of Assets: Financially sound entities could purchase Funai's production facilities or intellectual property, becoming de facto new entrants.

The threat of new entrants for Funai, within the electronics and IT sectors, is moderate but evolving. High capital requirements for R&D and manufacturing, estimated in billions for semiconductor firms in 2024, remain a significant barrier. However, declining profitability in some consumer electronics segments, as seen in 2023, reduces the allure for massive new investments.

While strong brand loyalty and established distribution networks historically deterred newcomers, Funai's bankruptcy in 2023 has weakened these traditional defenses. Furthermore, the threat isn't solely from new companies but also from existing players expanding into related sectors or acquiring distressed assets, a trend exemplified by major contract manufacturers like Foxconn.

Intellectual property, such as Funai's patents in inkjet technology, also presents a barrier, though its deterrent effect can diminish with market share declines, as potentially indicated by the slight contraction in the global printer market in 2023. Regulatory compliance, including data privacy laws like GDPR and environmental directives like RoHS, adds substantial costs, estimated in trillions globally for 2024, further impacting potential entrants.

Porter's Five Forces Analysis Data Sources

Our Funai Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources. We leverage company annual reports, investor presentations, and SEC filings for insights into internal strategies and financial health. Additionally, industry-specific trade publications and market research reports provide crucial context on market trends and competitive landscapes.