Fulton Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fulton Bank Bundle

Fulton Bank's SWOT analysis reveals a solid foundation built on strong customer relationships and a growing digital presence. However, it also highlights potential challenges in a competitive market and evolving regulatory landscapes.

Want the full story behind Fulton Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fulton Financial Corporation demonstrated impressive financial strength, achieving a record revenue of $1.2 billion in 2024 and reporting diluted earnings per share of $1.57. This strong performance is underpinned by solid capitalization, with total committed liquidity exceeding $9 billion as of 2024.

Further bolstering its financial standing, Fulton Financial saw its common equity tier 1 capital ratio improve to 11.0% by the first quarter of 2025. This robust financial health equips the company with a stable platform for pursuing growth initiatives and weathering potential economic downturns.

Fulton Bank's strategic acquisitions, notably the April 2024 deal for Republic First Bank, have dramatically expanded its market reach. This acquisition nearly doubled its presence in the thriving Philadelphia and southern New Jersey areas, adding substantial assets.

The integration of Republic First Bank, expected to finalize by the end of 2025, brought approximately $4.2 billion in deposits and $2.9 billion in loans into Fulton's portfolio. This influx positions Fulton Bank as a top five institution by assets within the Mid-Atlantic region, significantly enhancing its competitive standing and operational scale.

Fulton Bank's diverse service spectrum, encompassing community banking, wealth management via Fulton Financial Advisors, and insurance, provides a significant competitive advantage. This broad offering allows them to cater to a wide range of client needs under one umbrella.

Their strong emphasis on community banking fosters deep local relationships and supports consistent loan expansion, evidenced by a 2.5% annualized loan growth in the second quarter of 2025. This customer-centric model is a cornerstone of their operational strategy.

Furthermore, Fulton Bank's commitment to community development is substantial, with investments totaling $303 million in 2024. This dedication not only strengthens their local presence but also enhances their brand reputation and customer loyalty.

High Community Reinvestment Act (CRA) Rating

Fulton Bank's 'Outstanding' Community Reinvestment Act (CRA) rating from the Office of the Comptroller of the Currency in 2024 is a significant strength. This top-tier assessment highlights the bank's dedication to serving all communities, including low- and moderate-income areas.

This strong CRA performance translates into tangible benefits:

- Enhanced Reputation: An 'Outstanding' CRA rating bolsters Fulton Bank's image as a socially responsible institution, fostering trust and goodwill within the communities it serves.

- Customer Loyalty: Demonstrating a commitment to community reinvestment often resonates with customers who value corporate citizenship, potentially leading to increased loyalty and business.

- Regulatory Favor: A consistently high CRA rating can positively influence regulatory relationships and may be viewed favorably in future merger or expansion approvals.

- Community Impact: The rating underscores Fulton Bank's active role in addressing local credit needs through lending, investment, and service initiatives, contributing to economic development.

Commitment to Digital Capabilities and Operational Efficiency

Fulton Bank's commitment to enhancing digital capabilities, as detailed in its 2024 Corporate Social Responsibility Report, positions it strongly against competitors. This focus is not just about online presence; it's about creating a seamless customer experience that blends digital convenience with personalized banking.

The strategic 'FultonFirst' initiative underscores a significant drive towards operational efficiency. By targeting $50 million in annual cost savings by 2026, the bank is freeing up capital to invest directly into improving its digital banking tools. This reinvestment is crucial for staying competitive in a rapidly evolving financial landscape.

Tangible results of this efficiency drive are already evident. Fulton Bank has successfully automated processes, eliminating an impressive 24,000 hours of manual work. This not only boosts productivity but also allows employees to focus on higher-value customer interactions.

The bank's strategic allocation of savings towards digital innovation and community development demonstrates a forward-thinking approach. This dual focus ensures that technological advancements directly benefit both the bank's operational health and its commitment to the communities it serves.

Fulton Bank's financial performance is a significant strength, highlighted by a record revenue of $1.2 billion in 2024 and a solid diluted earnings per share of $1.57. Its strong capitalization, with over $9 billion in committed liquidity as of 2024, provides a stable foundation.

The bank's strategic acquisition of Republic First Bank in April 2024, adding $4.2 billion in deposits and $2.9 billion in loans, significantly expands its market presence, particularly in the Philadelphia region. This move positions Fulton Bank as a major player in the Mid-Atlantic.

Fulton Bank's diverse service offerings, including community banking, wealth management, and insurance, cater to a broad client base. This integrated approach, coupled with a customer-centric model and a 2.5% annualized loan growth in Q2 2025, fosters deep local relationships and consistent expansion.

The bank's commitment to community development, with $303 million invested in 2024, and its 'Outstanding' CRA rating in 2024, enhance its reputation and regulatory standing. Furthermore, the 'FultonFirst' initiative aims for $50 million in annual cost savings by 2026, with a portion reinvested into digital banking improvements, evidenced by the automation of 24,000 manual work hours.

| Metric | 2024/Q1 2025 Data | Significance |

|---|---|---|

| Record Revenue | $1.2 billion (2024) | Demonstrates strong market demand and operational success. |

| Diluted EPS | $1.57 (2024) | Indicates robust profitability for shareholders. |

| Committed Liquidity | >$9 billion (2024) | Ensures financial stability and capacity for growth. |

| Common Equity Tier 1 Ratio | 11.0% (Q1 2025) | Reflects strong capital adequacy and risk management. |

| Republic First Acquisition Assets | ~$4.2B deposits, ~$2.9B loans | Expands market reach and asset base significantly. |

| Community Investment | $303 million (2024) | Boosts local presence, reputation, and customer loyalty. |

| CRA Rating | Outstanding (2024) | Enhances regulatory relationships and community trust. |

| Manual Work Hours Eliminated | 24,000 hours | Shows significant operational efficiency gains through automation. |

What is included in the product

This SWOT analysis maps out Fulton Bank's market strengths, operational gaps, and potential threats.

Offers a clear, actionable framework to identify and address Fulton Bank's competitive challenges and capitalize on growth opportunities.

Weaknesses

Fulton Bank's primary operational footprint is concentrated within a few Mid-Atlantic states, namely Pennsylvania, Maryland, Delaware, New Jersey, and Virginia. This regional focus, while fostering strong community ties, inherently exposes the bank to a heightened risk from localized economic slowdowns or state-specific regulatory shifts that could disproportionately affect its financial health compared to more geographically dispersed institutions.

Fulton Bank saw a $190.9 million decrease in deposits during the second quarter of 2025, largely driven by a reduction in interest-bearing demand deposits. This volatility in deposit balances can create challenges in managing liquidity and funding costs.

The bank, like other regional players, is navigating a period of narrowing net interest margins as the Federal Reserve begins to lower interest rates. This environment puts pressure on profitability, especially if deposit outflows continue or if the bank needs to offer higher rates to retain its deposit base.

Fulton Bank faces integration challenges with its Republic First Bank acquisition, which could lead to operational and cultural hurdles. While the target completion for integration is year-end 2025, potential delays or unexpected complexities might affect the realization of projected cost savings, estimated to be around $50 million annually.

These integration complexities could also disrupt customer experience during the transition. For instance, if systems are not seamlessly merged, customers might encounter issues with account access or transaction processing, potentially impacting Fulton Bank's reputation and customer retention rates.

Exposure to Interest Rate Fluctuations

Fulton Bank's financial results, especially its net interest margin (NIM), are quite sensitive to shifts in interest rates. While the bank has shown resilience in maintaining a healthy NIM, potential aggressive rate cuts by the Federal Reserve could force the reinvestment of maturing bonds at lower yields, squeezing margins across the industry.

Furthermore, Fulton's investment portfolios have experienced notable unrealized losses stemming from valuation adjustments directly linked to interest rate movements. For instance, as of the first quarter of 2024, unrealized losses on the bank's securities portfolio amounted to approximately $1.2 billion, a direct consequence of rising rates over the past year. This exposure presents a clear vulnerability, as further rate volatility could exacerbate these unrealized losses.

- Sensitivity to Interest Rate Changes: Fulton's net interest margin is directly impacted by fluctuations in market interest rates.

- Risk of Margin Compression: Aggressive rate cuts could lead to lower yields on reinvested assets, potentially reducing profitability.

- Unrealized Losses: The bank's investment portfolios have shown significant unrealized losses due to interest rate-driven valuation changes, with Q1 2024 reporting approximately $1.2 billion in such losses.

- Reinvestment Risk: Maturing debt instruments may need to be replaced with lower-yielding assets in a declining rate environment.

Increasing Non-Performing Assets

Fulton Bank's non-performing assets (NPAs) saw a slight uptick. At the close of 2024, NPAs reached $222.7 million, representing 0.69% of total assets. This is an increase from the $205.0 million, or 0.64% of total assets, reported at the end of the third quarter of 2024.

While the overall NPA ratio remains low, this upward trend warrants attention. A continued increase could signal potential issues with the bank's credit quality, particularly if economic conditions worsen and lead to more loan defaults.

- Non-Performing Assets (December 31, 2024): $222.7 million

- NPA Ratio (December 31, 2024): 0.69% of total assets

- Non-Performing Assets (September 30, 2024): $205.0 million

- NPA Ratio (September 30, 2024): 0.64% of total assets

Fulton Bank's concentrated geographic footprint in the Mid-Atlantic region exposes it to localized economic downturns and state-specific regulatory risks. The bank also experienced a significant deposit decrease of $190.9 million in Q2 2025, impacting liquidity management. Furthermore, integration challenges with the Republic First Bank acquisition, aiming for completion by year-end 2025, could delay projected annual cost savings of approximately $50 million and potentially disrupt customer experience.

| Metric | Q2 2025 | Q1 2024 |

|---|---|---|

| Deposit Change | -$190.9 million | N/A |

| Unrealized Losses (Securities) | N/A | ~$1.2 billion |

| NPA Ratio | 0.69% (End of 2024) | 0.64% (End of Q3 2024) |

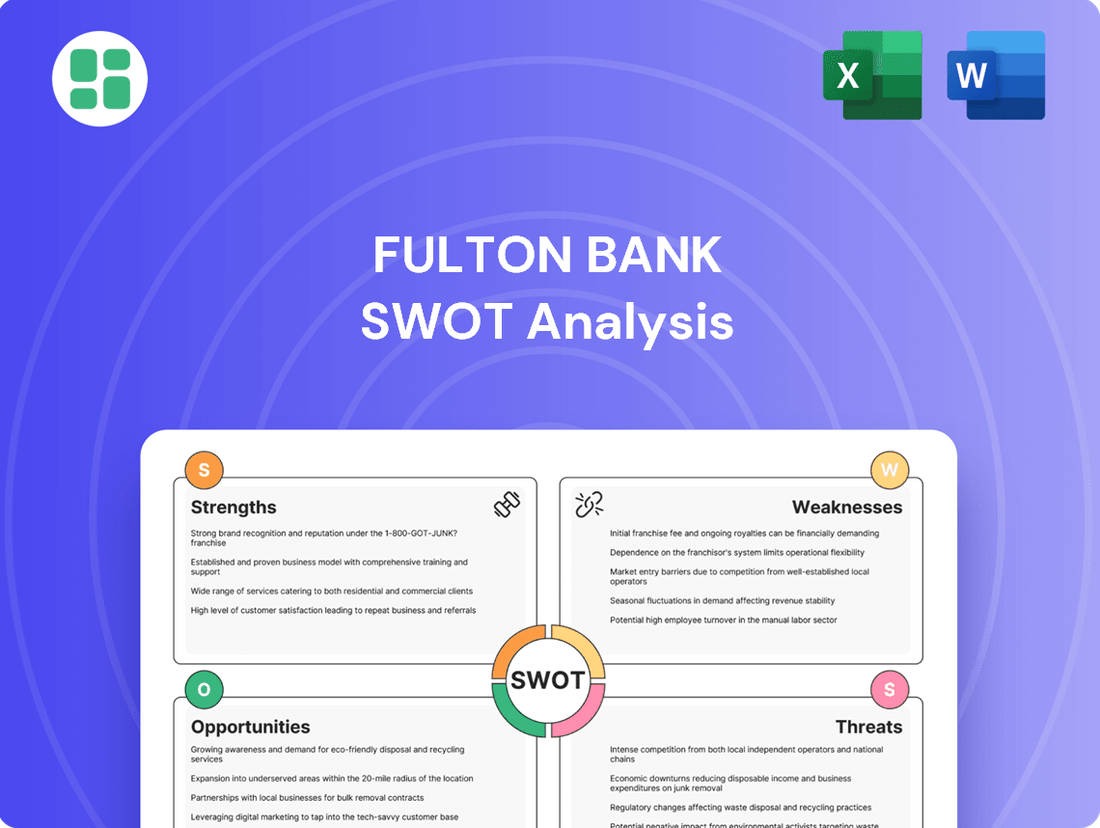

Preview the Actual Deliverable

Fulton Bank SWOT Analysis

The preview you see is the actual Fulton Bank SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting – a professional and comprehensive report.

This is a real excerpt from the complete Fulton Bank SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual Fulton Bank SWOT analysis file. The complete version, offering in-depth insights, becomes available immediately after checkout.

Opportunities

Fulton Bank's strategic push into digital banking and fintech integration offers a compelling avenue for growth. By enhancing its online and mobile platforms, the bank can significantly improve customer engagement and streamline internal operations. This focus aligns directly with the bank's 'FultonFirst' initiative, which aims for substantial annual cost savings through efficiency gains.

Investing in cutting-edge fintech solutions is key to attracting a younger, digitally inclined customer base. For instance, in 2024, the banking sector saw a continued surge in digital adoption, with mobile banking usage growing by an estimated 15% year-over-year. Fulton Bank can leverage this trend to offer more personalized services, faster transaction processing, and a smoother overall customer journey, thereby reducing reliance on traditional, more costly branch interactions.

Fulton Bank's acquisition of Republic First Bank in 2024 significantly boosted its presence, particularly in commercial and retail banking. This expansion offers a prime opportunity to deepen its commercial real estate lending and small business financing services, tapping into markets with substantial growth potential.

The bank's established commitment to community banking principles is a key asset. This focus fosters strong local relationships, which are crucial for driving continued organic loan growth across both its commercial and consumer lending portfolios, further solidifying its market position.

Fulton Bank can leverage its broad range of financial products, such as investment management and insurance, to boost cross-selling opportunities within its growing customer base. This strategy is supported by the fact that Fulton Financial Advisors already saw a 9% increase in assets under management in 2023, managing approximately $15 billion.

This significant growth in wealth management, managing nearly $15 billion in assets as of 2023, highlights a substantial avenue for further expansion. The bank can capitalize on this momentum to enhance its wealth management and treasury services offerings, driving increased revenue and customer loyalty.

Leveraging Community Engagement for Market Penetration

Fulton Bank's 'Outstanding' Community Reinvestment Act (CRA) rating, underscored by a substantial $303 million in community development investments during 2024, presents a significant opportunity for enhanced market penetration. This strong community focus can be leveraged to attract new customer segments and deepen relationships in underserved markets.

By actively promoting its commitment to financial literacy, job skills training, and community revitalization through programs like Fulton Forward, the bank can build trust and loyalty. These initiatives resonate with individuals and businesses seeking banking partners invested in local economic growth.

- Community Development Investment: Fulton Bank invested $303 million in community development in 2024, demonstrating a robust commitment.

- CRA Rating: The bank holds an 'Outstanding' CRA rating, a key indicator of successful community engagement.

- Programmatic Focus: Initiatives like Fulton Forward target financial literacy and job skills training, addressing critical community needs.

- Market Penetration: These efforts create a strong foundation for attracting new customers and strengthening loyalty, particularly in underserved areas.

Optimizing Balance Sheet and Cost Efficiencies

Fulton Bank's 'FultonFirst' initiative is a key opportunity, targeting $50 million in annual cost savings by 2026. This program focuses on streamlining operations and upgrading technology to boost efficiency.

Optimizing the balance sheet presents another significant opportunity. By actively reducing reliance on high-cost deposits and increasing the origination of more profitable commercial loans, Fulton Bank can better manage margin compression. This strategic shift is anticipated to bolster overall profitability and financial resilience.

- Cost Savings Target: $50 million annually by 2026 through 'FultonFirst'.

- Balance Sheet Focus: Reducing high-cost deposits and increasing commercial loan origination.

- Profitability Enhancement: Mitigating margin compression and improving net interest margin.

Fulton Bank's strategic expansion, notably the 2024 acquisition of Republic First Bank, opens doors to enhanced commercial real estate lending and small business financing. This move allows the bank to tap into markets with significant growth potential, leveraging its community banking ethos to foster strong local relationships and drive organic loan growth.

The bank's digital transformation, driven by initiatives like 'FultonFirst', presents a prime opportunity to boost customer engagement and operational efficiency. With digital banking adoption surging, an estimated 15% year-over-year growth in mobile banking usage in 2024, Fulton can attract a younger demographic and streamline services, reducing costs associated with traditional branch interactions.

Fulton's wealth management segment, which saw a 9% increase in assets under management in 2023, managing approximately $15 billion, offers substantial cross-selling potential. Capitalizing on this momentum allows for enhanced wealth and treasury services, driving revenue and customer loyalty.

An 'Outstanding' CRA rating, backed by $303 million in community development investments in 2024, positions Fulton for deeper market penetration. Leveraging its commitment to financial literacy and community revitalization through programs like Fulton Forward builds trust, attracting new customer segments and strengthening ties in underserved markets.

| Opportunity Area | Key Action | Supporting Data/Initiative | Potential Impact |

| Market Expansion | Leverage Republic First Bank acquisition | 2024 Acquisition; Focus on CRE & Small Business | Increased loan origination, market share growth |

| Digital Enhancement | Invest in digital platforms | 'FultonFirst'; 15% YoY mobile banking growth (2024 est.) | Improved customer engagement, operational efficiency |

| Wealth Management Growth | Expand wealth and treasury services | $15B AUM (2023); 9% AUM growth (2023) | Enhanced cross-selling, increased revenue |

| Community Engagement | Promote CRA initiatives | $303M community development (2024); 'Outstanding' CRA rating | Deeper market penetration, customer loyalty |

Threats

The Mid-Atlantic banking landscape is a battleground, with established giants and nimble fintechs vying for customer attention. Fulton Bank faces significant pressure as larger institutions expand their reach into its core markets, leading to heightened pricing competition for loans and deposits. This intensified rivalry, particularly evident in the ongoing market share battles observed throughout 2024 and projected into 2025, could impact Fulton's ability to grow its loan portfolio and retain its valuable deposit base.

Economic downturns pose a significant threat, potentially increasing non-performing assets and credit loss provisions for Fulton Bank. While the bank's current non-performing asset ratio is low, a severe economic contraction could devalue its loan portfolios and negatively impact its financial stability.

Fulton Bank, like all financial institutions, faces the ongoing threat of evolving regulatory landscapes. For instance, in 2024, the banking sector continued to grapple with the implementation and adaptation to new rules stemming from Basel III endgame proposals, which can significantly impact capital adequacy ratios. These changes often necessitate substantial investments in technology and personnel to ensure compliance, thereby increasing operational expenses and potentially reducing profitability.

Furthermore, shifts in consumer protection laws, such as those concerning fair lending practices or data privacy, can introduce new compliance burdens. A hypothetical example could be a new regulation requiring more extensive customer data protection measures, forcing Fulton Bank to update its systems and processes, adding to its cost structure and operational complexity in 2025.

Cybersecurity Risks and Data Breaches

Fulton Bank, like all financial institutions, is a prime target for cyberattacks and data breaches. The increasing sophistication of these threats means that even substantial investments in security can be overcome. A breach could expose sensitive customer information, leading to identity theft and significant financial repercussions for both customers and the bank itself.

The potential fallout from a cybersecurity incident extends beyond immediate financial losses. Reputational damage can be severe and long-lasting, eroding the trust that is fundamental to a banking relationship. In 2023, the financial services sector experienced a significant increase in cyberattacks, with some reports indicating a rise of over 50% compared to the previous year, highlighting the persistent and evolving nature of these risks.

- Customer Data Compromise: Exposure of personal and financial details.

- Financial Losses: Costs associated with remediation, regulatory fines, and potential lawsuits.

- Reputational Damage: Erosion of customer trust and brand image.

- Operational Disruption: Interruption of banking services and business continuity.

Talent Acquisition and Retention Challenges

The financial services industry faces persistent competition for skilled professionals, especially in crucial fields like digital banking, cybersecurity, and wealth management. Fulton Bank's ability to attract and keep top talent directly impacts its capacity to execute strategic plans, maintain operational effectiveness, and drive innovation, all of which are vital for sustained growth.

The ongoing demand for specialized skills means that companies like Fulton Bank must invest heavily in competitive compensation, robust training programs, and a compelling work environment. For instance, as of early 2025, the average salary for a cybersecurity analyst in the financial sector has seen a year-over-year increase of approximately 8%, reflecting the intense competition for these in-demand roles.

- Digital Banking Expertise: Difficulty in hiring individuals with advanced skills in digital platform development and customer experience design.

- Cybersecurity Talent Gap: A significant shortage of experienced cybersecurity professionals capable of safeguarding sensitive financial data.

- Wealth Management Specialists: Challenges in recruiting and retaining advisors who can manage complex client portfolios and provide personalized financial planning.

- Competitive Compensation: The need to offer attractive salary packages and benefits to compete with larger institutions and tech companies for top talent.

Fulton Bank operates in a highly competitive Mid-Atlantic market, facing pressure from larger banks and fintechs, which could erode its market share and profitability. Economic downturns present a risk, potentially increasing loan defaults and impacting the bank's financial health.

Evolving regulations, such as those related to capital adequacy and consumer protection, require continuous investment in compliance, adding to operational costs. Furthermore, the constant threat of sophisticated cyberattacks poses a significant risk of data breaches, financial losses, and reputational damage.

The bank also faces challenges in attracting and retaining skilled talent in critical areas like digital banking and cybersecurity, with salary demands rising. This talent gap can hinder innovation and operational efficiency.

| Threat Category | Description | Impact on Fulton Bank | 2024/2025 Data/Trend |

|---|---|---|---|

| Market Competition | Rivalry with larger banks and fintechs | Potential loss of market share, pressure on margins | Increased deposit and loan rate competition observed throughout 2024 |

| Economic Downturn | Recessionary pressures, rising unemployment | Higher non-performing assets, increased credit loss provisions | Continued economic uncertainty projected for late 2024/early 2025 |

| Regulatory Changes | New compliance requirements (e.g., Basel III endgame) | Increased operational costs, potential impact on capital ratios | Ongoing adaptation to new rules, requiring technology and personnel investment |

| Cybersecurity Threats | Sophisticated cyberattacks and data breaches | Financial losses, reputational damage, operational disruption | Financial sector saw over 50% rise in cyberattacks in 2023; trend continues |

| Talent Acquisition | Competition for skilled professionals | Difficulty in innovation and maintaining operational effectiveness | 8% year-over-year increase in cybersecurity analyst salaries (early 2025) |

SWOT Analysis Data Sources

This Fulton Bank SWOT analysis is built upon a robust foundation of data, drawing from the bank's official financial filings, comprehensive market research reports, and expert industry commentary to ensure a well-informed and strategic assessment.