Fulton Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fulton Bank Bundle

Fulton Bank faces moderate bargaining power from buyers and suppliers, with a notable threat from substitute financial products. Understanding these dynamics is crucial for any stakeholder.

The full Porter's Five Forces Analysis reveals the real forces shaping Fulton Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Depositors are crucial capital suppliers for Fulton Bank, and their bargaining power varies. While individual depositors typically have limited influence, larger institutional depositors or those with significant balances can negotiate more favorable interest rates, especially when competition for funds intensifies.

Fulton Bank's deposit base is robust, significantly enhanced by the integration of Republic First Bank's deposits. This strategic move not only broadens its funding sources but also diminishes its dependence on costlier forms of capital, improving its overall financial stability.

Technology and software providers wield significant bargaining power over banks like Fulton Bank, especially as digital transformation becomes paramount. Banks' increasing reliance on specialized IT services, advanced software, and robust hardware means these vendors are critical partners. In 2024, the financial services sector continued to pour resources into digital upgrades, with IT spending expected to remain high, bolstering the leverage of key tech suppliers.

Skilled employees are the bedrock of any bank, and for Fulton Bank, this rings especially true in areas like wealth management, technology, and risk. These specialized roles require deep expertise, making the talent pool a significant factor in the bank's operational success.

The competition for top talent, particularly in rapidly evolving fields such as artificial intelligence and data analytics, is fierce. This intense demand can significantly increase the bargaining power of individuals possessing these sought-after skills, potentially impacting labor costs for institutions like Fulton Bank.

Fulton Bank actively works to attract and retain this crucial human capital by fostering a strong corporate culture and providing robust professional development opportunities. For instance, as of early 2024, the bank reported investing millions in employee training programs aimed at upskilling and career advancement.

Interbank Lending Market Participants

Banks frequently borrow and lend to each other in the interbank market. This market's interest rates and liquidity directly impact a bank's cost of funds, essentially acting as a key supplier cost. Fulton Bank's Q1 2025 results, showing a stable net interest margin and a lower cost of funds, indicate they are managing these supplier relationships effectively.

The bargaining power of suppliers in the interbank lending market is influenced by several factors:

- Concentration of Suppliers: A few large financial institutions often dominate the interbank market, giving them significant leverage.

- Availability of Substitutes: While interbank lending is crucial, banks can also access funds through other channels like deposits or issuing debt, which can temper supplier power.

- Switching Costs: The costs associated with changing funding sources can influence a bank's ability to negotiate better terms.

- Supplier Profitability: Highly profitable suppliers may have less incentive to offer competitive rates.

Regulatory Bodies and Compliance Frameworks

Regulatory bodies are significant suppliers for banks, providing the essential operating licenses and compliance frameworks. These frameworks, such as capital adequacy ratios, act as non-negotiable requirements that influence a bank's strategic decisions and operational costs. For instance, stringent regulations can increase the cost of doing business, effectively acting as a cost imposed by these regulatory 'suppliers'.

Fulton Bank, like all financial institutions, must adhere to these regulatory demands. A key metric demonstrating this adherence is the Common Equity Tier 1 (CET1) capital ratio. As of the first quarter of 2024, Fulton Bank reported a robust CET1 ratio of 11.5%, significantly exceeding the minimum regulatory requirements. This strong capital position allows Fulton Bank to navigate the demands of these regulatory suppliers effectively.

- CET1 Ratio: Fulton Bank's CET1 ratio stood at 11.5% in Q1 2024, a testament to its compliance with regulatory capital standards.

- Regulatory Costs: Compliance with frameworks like Basel III imposes fixed costs and operational constraints, impacting profitability.

- Licensing Power: Operating licenses are essential, and regulatory bodies hold the power to grant or revoke them, influencing bank operations.

Fulton Bank’s reliance on technology suppliers, particularly for digital transformation, grants these vendors significant bargaining power. As banks invest heavily in IT, as evidenced by the continued high spending in the financial services sector throughout 2024, specialized software and hardware providers become critical partners. This dependence can lead to increased costs for essential services.

The interbank lending market represents another key supplier group for Fulton Bank, influencing its cost of funds. While a concentrated market with fewer dominant players can increase supplier leverage, the availability of alternative funding sources and varying switching costs can mitigate this power. Fulton Bank's stable net interest margin in Q1 2025 suggests effective management of these relationships.

Regulatory bodies act as essential suppliers by providing operating licenses and setting compliance frameworks. These requirements, such as capital adequacy ratios, impose costs and operational constraints. Fulton Bank's robust CET1 ratio of 11.5% in Q1 2024 demonstrates its strong compliance, enabling it to manage these supplier demands effectively.

| Supplier Type | Bargaining Power Factors | Fulton Bank Context (as of Q1 2024/2025) |

|---|---|---|

| Technology Providers | High reliance on digital transformation, specialized IT needs | Continued high IT spending in financial services in 2024 |

| Interbank Market | Market concentration, availability of substitutes, switching costs | Stable net interest margin, lower cost of funds in Q1 2025 |

| Regulatory Bodies | Licensing power, compliance costs, capital requirements | CET1 ratio of 11.5% in Q1 2024, exceeding minimums |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Fulton Bank's position in the regional banking sector.

Fulton Bank's Porter's Five Forces analysis offers a structured framework to identify and mitigate competitive threats, transforming complex market dynamics into actionable insights.

This tool simplifies the assessment of industry attractiveness, enabling Fulton Bank to proactively address potential challenges and capitalize on opportunities.

Customers Bargaining Power

For typical banking products like checking and savings accounts, retail depositors face minimal costs when switching banks. This low barrier means customers have some leverage to find better interest rates, fewer fees, or superior service elsewhere. In 2024, the average interest rate on savings accounts across major US banks remained relatively low, often below 1%, incentivizing depositors to shop around.

Larger commercial clients, especially those needing intricate financial solutions, hold considerable sway. Their ability to negotiate better terms stems from the sheer volume of business they bring to Fulton Bank. For instance, in 2023, Fulton Bank's commercial and industrial loans grew by 7.5%, indicating a strong focus on these clients.

Fulton Bank actively cultivates these relationships by focusing on personalized lending and bolstering its offerings in commercial real estate and small business finance. This strategy directly addresses the bargaining power of these key customers by providing tailored services that meet their complex needs.

Investment management clients, particularly those in wealth management and advisory services, often have high expectations for both returns and the quality of service. This segment of the market sees a significant degree of client mobility, meaning they can relatively easily move their assets to different financial institutions if they are not satisfied or find better offers elsewhere. In 2024, the average client retention rate for wealth management firms hovered around 90%, indicating that while loyalty is valued, a 10% churn is a real factor.

Fulton Financial Advisors and Fulton Private Bank are actively working to address this by offering a broad spectrum of investment management services. Their strategy is to cultivate and sustain strong client trust and loyalty. This involves not just performance but also transparent communication and personalized financial planning, crucial elements for retaining clients in a competitive landscape where switching costs are perceived as low.

Enhanced Information Access and Digital Tools

Customers today have unprecedented access to information, thanks to the proliferation of online platforms and mobile banking apps. This makes comparing financial products, services, and rates across different institutions incredibly simple. For instance, in 2024, a significant portion of banking customers actively utilized comparison websites to evaluate mortgage rates or savings account yields, directly impacting how banks compete on price and service.

Fulton Bank recognizes this shift and is actively investing in its digital banking infrastructure. By continuously upgrading its online platforms and mobile applications, the bank aims to provide a seamless and informative customer experience. This strategic focus on digital tools is crucial for meeting evolving customer expectations and staying competitive in a market where transparency and ease of access are paramount.

- Increased Customer Empowerment: Digital tools allow customers to easily research and compare offerings from multiple financial institutions.

- Fulton Bank's Digital Investment: The bank is enhancing its online and mobile platforms to cater to these informed customers.

- Competitive Landscape: Enhanced information access intensifies competition, forcing banks to offer competitive rates and superior digital services.

Breadth of Available Alternatives

The breadth of available alternatives significantly impacts Fulton Bank's customer bargaining power. Customers today have an extensive selection of financial service providers, ranging from established credit unions to innovative fintech companies, all competing for their business. This wide array of choices means customers can easily switch providers if they find better rates, more convenient services, or superior customer support elsewhere.

Fulton Bank, operating in the competitive Mid-Atlantic region, faces this reality daily. For instance, as of early 2024, the U.S. banking sector sees numerous neobanks and digital-first platforms offering attractive interest rates on savings accounts and streamlined mobile banking experiences. This forces Fulton Bank to constantly evaluate its offerings and pricing to remain competitive.

- Customer Choice: Customers can choose from traditional banks, credit unions, and a growing number of fintech alternatives.

- Competitive Landscape: Fulton Bank operates in a Mid-Atlantic market with significant competition, requiring differentiation.

- Fintech Influence: Digital-only banks and payment apps provide convenient and often lower-cost options, increasing customer leverage.

- Rate Sensitivity: The availability of competitive interest rates on deposits and loans means customers can easily shop around for the best deals.

The bargaining power of customers for Fulton Bank is significant, driven by low switching costs for basic banking products and the readily available information customers have to compare offerings. In 2024, the ease with which consumers can access online comparison tools for everything from savings account yields to mortgage rates means banks must remain competitive on price and service to retain business.

Larger commercial clients and wealth management clients wield even more influence due to the volume of business they represent and their ability to move substantial assets. For example, while wealth management client retention rates in 2024 averaged around 90%, the remaining 10% churn highlights the ongoing need for superior service and performance to maintain these valuable relationships.

| Customer Segment | Bargaining Power Drivers | 2024/2023 Data Points |

|---|---|---|

| Retail Depositors | Low switching costs, easy information access | Savings account rates often below 1% (incentivizing comparison) |

| Commercial Clients | High volume of business, need for tailored solutions | Fulton Bank's C&I loan growth was 7.5% in 2023 |

| Investment Management Clients | Potential to move assets, high service expectations | Wealth management client retention averaged ~90% in 2024 |

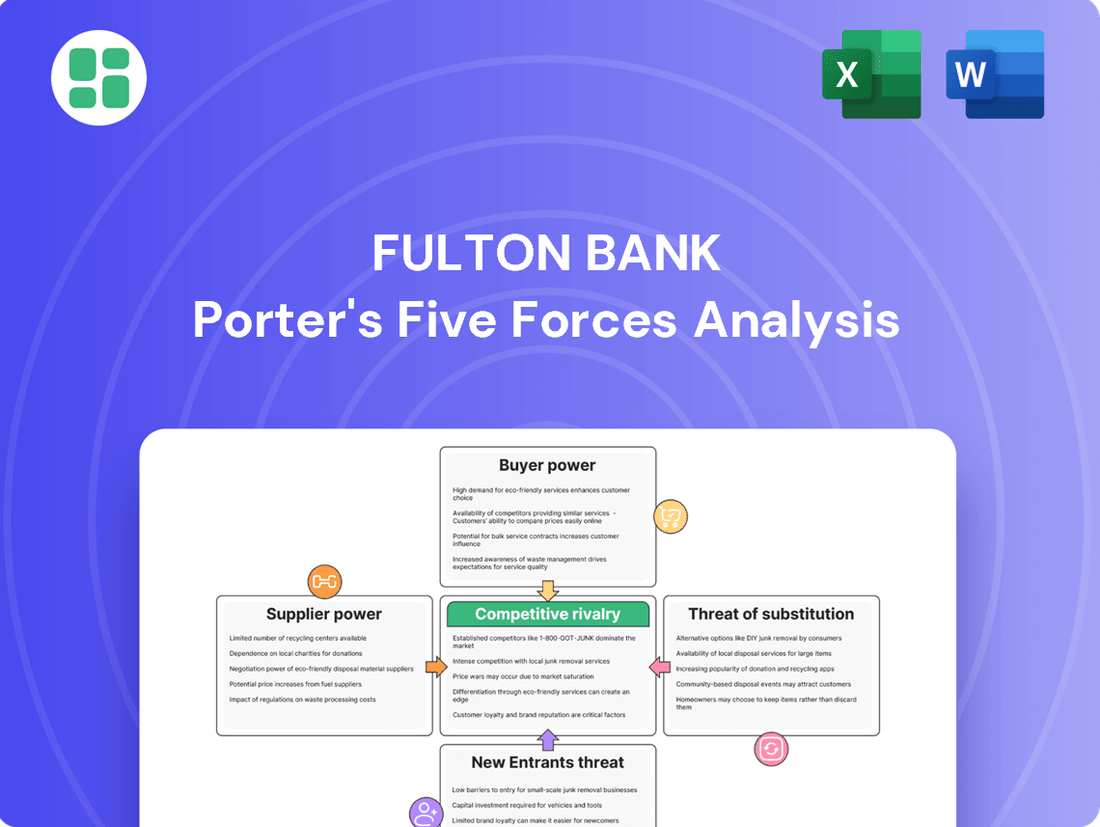

Preview the Actual Deliverable

Fulton Bank Porter's Five Forces Analysis

This preview showcases the complete Fulton Bank Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the company. You're looking at the actual document; once your purchase is complete, you’ll get instant access to this exact, professionally formatted file. This comprehensive analysis will equip you with a deep understanding of Fulton Bank's industry positioning and potential challenges.

Rivalry Among Competitors

Fulton Bank faces intense competition from a wide array of financial service providers. This includes not only other banks, from small community ones to large national players, but also credit unions and various non-bank financial institutions. The sheer volume of these rivals, with Tracxn data pointing to over 6,000 active competitors, highlights the highly fragmented and competitive landscape Fulton Bank navigates.

The Mid-Atlantic banking landscape, Fulton Bank's core territory, is a mature market. This maturity translates into intense competition as established institutions vie for a larger slice of the customer base. This rivalry necessitates strategic maneuvers to stand out and capture growth opportunities.

Fulton Bank's acquisition of Republic First Bank in April 2024 exemplifies a proactive growth strategy in this competitive environment. This significant move aimed to boost Fulton's market share, particularly in the crucial Greater Philadelphia and Southern New Jersey areas, directly addressing the challenge of market saturation by consolidating and expanding its footprint.

Many traditional banking products, like checking accounts and basic loans, are seen as commodities. This forces banks to compete mainly on price, how good their service is, or how easy it is to use their services. For example, in 2023, the average interest rate for a 30-year fixed-rate mortgage hovered around 6.8%, a key differentiator for many institutions.

Fulton Bank aims to set itself apart by focusing on personalized customer service and constantly improving its digital tools. This strategy is crucial in a market where product features can be very similar. In the first quarter of 2024, Fulton Bank reported a net interest margin of 3.55%, indicating their focus on efficient operations and customer relationships to drive profitability amidst this competitive landscape.

Persistent Pricing Pressure

The banking industry is notoriously competitive, which often forces institutions like Fulton Bank to offer less favorable pricing. This means lower interest rates on loans and higher rates on deposits, squeezing profit margins. In the first quarter of 2025, Fulton Bank reported a net interest margin of 3.25%, demonstrating their ability to navigate this persistent pricing pressure effectively.

This intense rivalry directly impacts Fulton Bank's ability to generate income from its core lending and deposit-taking activities. The pressure to remain competitive means they must constantly balance customer acquisition and retention with profitability.

- Intense Competition: The banking sector faces significant competition, leading to price wars on loans and deposits.

- Margin Squeeze: Downward pressure on loan rates and upward pressure on deposit rates directly impact net interest margins.

- Fulton Bank's Performance: Fulton Bank maintained a net interest margin of 3.25% in Q1 2025, indicating successful management of these pressures.

Strategic Initiatives and Consolidation

Fulton Bank actively pursues mergers and acquisitions to enhance its market position and operational efficiency. The bank's strategic 'FultonFirst' initiative aims for significant cost reductions, with a portion of these savings earmarked for digital banking enhancements and community investment. This proactive approach is crucial in a banking landscape characterized by intense competition and the constant need for adaptation.

The acquisition of Republic First Bank in 2024 was a pivotal move, substantially increasing Fulton's asset base and deposit volume. This consolidation is a direct response to the high degree of competitive rivalry, allowing Fulton to achieve greater economies of scale and broaden its service offerings. Such strategic integrations are common as banks strive to remain competitive and meet evolving customer demands.

- FultonFirst Initiative: Focused on cost savings and reinvestment in digital banking and community development.

- Republic First Bank Acquisition (2024): Significantly boosted assets and deposits, enhancing competitive standing.

- Industry Trend: Banks frequently engage in M&A and operational transformations to gain an edge.

Fulton Bank operates in a fiercely competitive banking environment, facing rivals ranging from local credit unions to large national institutions, with over 6,000 active competitors identified by Tracxn. This intense rivalry, particularly in its core Mid-Atlantic market, pressures banks to differentiate through service and digital offerings rather than just product features, as seen in the 2023 average 30-year fixed mortgage rate of 6.8%.

Fulton Bank's strategic acquisitions, such as the 2024 purchase of Republic First Bank, are direct responses to this competitive pressure, aiming to increase market share and achieve economies of scale. The bank's focus on personalized service and digital enhancements, coupled with its 'FultonFirst' initiative for cost reduction, are key strategies to navigate this challenging landscape and maintain profitability.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Net Interest Margin | 3.55% | 3.25% |

| Competitor Count (Tracxn) | >6,000 | >6,000 |

| 30-Year Fixed Mortgage Rate (Avg. 2023) | ~6.8% | N/A |

SSubstitutes Threaten

Fintech companies are increasingly offering digital payment platforms, online lending, and personal finance management apps that directly compete with Fulton Bank's core offerings. These solutions are particularly attractive to younger, tech-oriented customers, representing a significant substitute threat. For example, the global fintech market was valued at over $110 billion in 2023 and is projected for substantial growth, indicating the scale of this challenge.

Fulton Bank recognizes this threat and is actively investing in enhancing its digital capabilities. This strategy aims to retain existing customers and attract new ones who might otherwise opt for the convenience and specialized features of fintech alternatives. By expanding its digital services, Fulton Bank seeks to counter the appeal of these non-bank substitutes.

Credit unions present a significant threat of substitutes for Fulton Bank, particularly for consumers seeking lower costs and potentially more personalized service. As non-profit entities, credit unions can often extend more favorable terms, such as higher savings rates and lower loan interest, directly impacting customer acquisition for traditional banks. For instance, in 2023, credit unions collectively held over $2.1 trillion in assets, demonstrating their substantial market presence and ability to attract a considerable customer base.

Fulton Bank faces direct competition from these member-owned institutions within its core operating areas. The appeal of credit unions often lies in their community focus and a perception of being more customer-centric than larger commercial banks. This can draw away segments of Fulton Bank's retail and small business clientele who prioritize these attributes or are sensitive to fee structures and interest rate differentials.

The rise of peer-to-peer (P2P) lending and crowdfunding platforms presents an evolving threat to traditional banking models like Fulton Bank. These platforms, such as LendingClub and Prosper, allow individuals and businesses to secure loans or raise capital directly from a pool of investors, bypassing intermediaries. While they often cater to niche markets or specific borrower profiles, their growing popularity signifies a shift in how capital is accessed.

In 2023, the global P2P lending market was valued at approximately $100 billion, with projections indicating continued growth. Crowdfunding also saw significant activity, with platforms like Kickstarter and Indiegogo facilitating billions in funding for various projects and businesses. These alternative channels, though not yet a direct substitute for the broad services offered by a bank like Fulton, can divert certain lending and investment opportunities, particularly for smaller businesses and personal loans.

Direct Investment Platforms and Brokerages

The rise of direct investment platforms and online brokerages presents a significant threat of substitution for Fulton Bank's wealth management and advisory services. These platforms, such as Schwab and Fidelity, offer increasingly sophisticated, low-cost, self-service investment tools that directly compete with traditional, more human-centric approaches. For instance, by mid-2024, many robo-advisor platforms managed billions in assets, attracting younger investors seeking affordability and convenience.

Fulton Financial Advisors and Fulton Private Bank must actively differentiate their value proposition beyond mere investment execution. The threat is amplified as these digital alternatives continue to expand their offerings, incorporating more advanced planning tools and personalized guidance, often at a fraction of the cost of traditional advisory fees. By the end of 2023, the digital wealth management market was valued in the trillions, demonstrating the scale of this competitive pressure.

- Low-Cost Alternatives: Direct platforms often charge significantly lower management fees compared to traditional advisors.

- Accessibility and Convenience: Online brokerages provide 24/7 access to investment accounts and trading.

- Growing Sophistication: Digital tools are increasingly offering personalized financial planning and automated portfolio management.

- Investor Preference Shift: A growing segment of investors, particularly younger demographics, prefer digital-first financial solutions.

Specialized Non-Bank Lenders

Specialized non-bank lenders, such as dedicated mortgage companies and auto finance providers, present a significant threat by offering highly focused loan products that can attract customers away from full-service commercial banks. This specialization allows them to often provide more competitive rates or tailored terms. For instance, in 2023, non-bank mortgage originations accounted for a substantial portion of the market, highlighting their competitive presence.

Fulton Bank counters this threat by maintaining a comprehensive suite of consumer and commercial lending solutions. This includes offering residential mortgage services through its subsidiary, Fulton Mortgage Company, ensuring it can meet diverse customer needs and retain market share. By providing a broad spectrum of financial products, Fulton Bank aims to be a one-stop shop for its clients, minimizing the incentive to seek specialized services elsewhere.

- Specialized Lenders: Companies focusing solely on mortgages, auto loans, or other specific credit products can offer niche expertise and potentially better pricing.

- Market Diversion: These specialized entities can siphon off profitable segments of the lending market from traditional banks.

- Fulton's Response: Fulton Bank offers a wide range of lending products, including residential mortgages via Fulton Mortgage Company, to capture and retain customer business.

- Competitive Advantage: By providing integrated services, Fulton Bank seeks to reduce customer attrition to specialized, non-bank competitors.

The threat of substitutes for Fulton Bank is multifaceted, encompassing fintech innovations, credit unions, P2P lending, direct investment platforms, and specialized lenders. These alternatives often offer lower costs, greater convenience, or more tailored services, compelling banks to adapt. For instance, the global fintech market exceeded $110 billion in 2023, underscoring the scale of digital competition.

Entrants Threaten

Stringent regulatory requirements act as a significant deterrent for new entrants in the banking sector, including institutions like Fulton Bank. The industry demands extensive licensing, strict adherence to complex compliance standards, and continuous oversight from federal and state authorities. For instance, in 2024, the Federal Reserve continued to emphasize capital adequacy and liquidity ratios, making it costly and time-consuming for new players to establish operations and meet these benchmarks.

The banking industry, including institutions like Fulton Bank, faces a significant threat from new entrants due to the substantial capital investment required to even begin operations. To comply with stringent regulatory capital requirements, establish necessary technological infrastructure, and absorb initial operating costs and potential losses, new banks must deploy considerable financial resources. For context, Fulton Financial Corporation, as of the first quarter of 2024, reported total assets exceeding $30 billion, underscoring the immense scale of capital that established players command and that newcomers must match to be competitive.

Building a strong brand reputation and earning customer trust in financial services is a long game. Consumers often gravitate towards institutions they perceive as stable and dependable for their money. Fulton Bank, with its roots tracing back to 1882, capitalizes on this by highlighting its extensive history and commitment to community involvement and tailored customer service. This approach aims to solidify trust and cultivate lasting customer loyalty.

Challenges of Economies of Scale

New entrants face a significant hurdle due to the substantial economies of scale enjoyed by established players like Fulton Bank. Existing banks leverage their size to spread costs across a vast customer base, leading to lower per-unit operational, technological, and marketing expenses. This cost advantage makes it difficult for newcomers to match pricing and efficiency without first achieving a similar scale, a process that requires considerable time and capital investment.

Fulton Bank's strategic focus on operational efficiency, exemplified by its FultonFirst initiative, further intensifies this challenge. By continuously optimizing processes and reducing costs, Fulton Bank strengthens its ability to offer competitive pricing, creating an even higher barrier for new entrants seeking to gain market share on price alone.

Consider these points regarding economies of scale as a barrier:

- Established banks benefit from lower average costs per transaction due to high transaction volumes.

- Significant upfront investment in technology and branch networks creates a cost advantage for incumbents.

- Marketing and brand recognition costs are amortized over a larger customer base for existing institutions.

- Fulton Bank's ongoing efforts to enhance efficiency directly reduce its cost structure, making it harder for new entrants to compete on price.

High Customer Acquisition Costs

The banking industry faces significant hurdles in attracting new customers, primarily due to high customer acquisition costs. Building a robust customer base requires substantial investment in marketing initiatives, developing compelling product suites, and often maintaining a physical branch network. These expenses can deter potential new entrants.

Fulton Bank's strategic acquisition of Republic First Bank in May 2024 for $96.3 million exemplifies a proactive approach to surmounting these barriers. This move not only expanded Fulton Bank's customer base but also significantly broadened its branch footprint, demonstrating a tangible strategy for rapid market penetration and overcoming the high costs associated with organic customer growth.

- High Marketing Spend: Banks typically invest heavily in advertising across various media to reach potential customers.

- Product Development Costs: Creating competitive deposit accounts, loan products, and digital banking services requires ongoing investment.

- Branch Network Investment: Maintaining and expanding physical locations adds considerable overhead.

- Strategic Acquisitions as a Solution: Acquiring established institutions, like Fulton Bank's purchase of Republic First, offers a shortcut to customer acquisition and market presence.

The threat of new entrants for Fulton Bank is generally low, primarily due to the immense capital requirements and stringent regulatory landscape inherent in the banking sector. New players must secure substantial funding to meet capital adequacy ratios, as demonstrated by the over $30 billion in total assets Fulton Financial Corporation held in Q1 2024, and navigate complex compliance protocols. Furthermore, established trust and brand loyalty, built over decades like Fulton Bank's since 1882, present a significant hurdle for newcomers seeking to attract customers.

| Barrier to Entry | Description | Fulton Bank Relevance |

|---|---|---|

| Capital Requirements | High initial investment needed for licensing, technology, and operations. | Fulton Bank's substantial asset base ($30B+ in Q1 2024) indicates the scale required. |

| Regulatory Hurdles | Strict compliance with federal and state banking laws and oversight. | Continued emphasis on capital and liquidity ratios by the Federal Reserve in 2024 adds complexity. |

| Brand Loyalty & Trust | Customers prefer established, stable institutions for financial services. | Fulton Bank leverages its long history (since 1882) and community focus to build trust. |

| Economies of Scale | Existing banks have lower per-unit costs due to high volume. | Fulton Bank's efficiency initiatives (e.g., FultonFirst) reduce costs, widening the gap. |

| Customer Acquisition Costs | High expenses for marketing, product development, and branch networks. | Fulton Bank's acquisition of Republic First Bank for $96.3M in May 2024 highlights strategies to overcome these costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fulton Bank is built upon a foundation of publicly available financial reports, including SEC filings and investor relations materials. We also incorporate insights from reputable industry research firms and financial news outlets to capture current market dynamics and competitive landscapes.