Fulton Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fulton Bank Bundle

Fulton Bank operates within a dynamic environment shaped by political stability, economic fluctuations, and evolving social attitudes. Our PESTLE analysis dives deep into these external forces, revealing critical opportunities and potential challenges. Understand how regulatory shifts and technological advancements are impacting the banking sector. Download the full version now to gain a strategic advantage and make informed decisions for Fulton Bank's future.

Political factors

The U.S. banking sector is bracing for potential regulatory shifts in 2025, largely driven by the anticipated impact of a new political administration. These changes might usher in deregulation, which could reduce compliance costs for institutions like Fulton Bank. For instance, a rollback on certain Dodd-Frank provisions could streamline operations, though the exact scope remains uncertain.

Despite potential easing, regional banks, including Fulton, must maintain robust governance and sophisticated risk management frameworks. This proactive approach is crucial for navigating the dynamic regulatory environment and ensuring continued stability. The Federal Reserve's ongoing supervision, even amidst potential deregulation, will still demand adherence to capital adequacy ratios and liquidity requirements.

Government and regulatory bodies, including the Federal Reserve and FDIC, are intensifying their focus on financial stability, particularly following the regional bank failures of early 2023. This heightened scrutiny means Fulton Bank, like other regional players, must navigate increasingly stringent requirements for capital adequacy and liquidity, alongside robust recovery and resolution planning to ensure its resilience.

For instance, the Federal Reserve's proposed rules in late 2023 aimed to bolster capital requirements for mid-sized banks, a direct response to the vulnerabilities exposed by the failures of Silicon Valley Bank and Signature Bank. Fulton Bank will need to adapt its strategies to meet these evolving capital and liquidity management standards, ensuring it can withstand potential economic shocks.

Fulton Bank's 'Outstanding' rating in its 2024 Community Reinvestment Act (CRA) evaluation highlights its dedication to low- and moderate-income communities. This strong performance is a testament to its proactive approach to fulfilling its social responsibilities.

Regulators and local governments will likely maintain a keen focus on CRA compliance and community development initiatives. This political priority means banks like Fulton will continue to be encouraged, and sometimes mandated, to invest in affordable housing, small business lending, and community services in the areas they serve.

Consumer Protection Regulations

Consumer protection regulations are a significant political factor for Fulton Bank. While federal oversight may experience adjustments, the real story is the surge in state-level data privacy laws. Several of these, impacting Fulton Bank's key operating states like Delaware and New Jersey, are set to take effect in 2025.

This evolving landscape demands constant vigilance. Fulton Bank must continuously assess its internal controls and how it handles customer data to ensure full compliance. Failure to adapt could lead to substantial fines and, perhaps more damaging, a significant blow to its reputation.

- State Data Privacy Laws: New legislation in Delaware and New Jersey effective 2025.

- Compliance Burden: Requires ongoing review of data handling and internal controls.

- Reputational Risk: Non-compliance can severely damage public trust.

- Federal Shifts: Potential changes in federal consumer protection policies add another layer of complexity.

Geopolitical and Trade Policies

Broader geopolitical shifts and evolving trade policies, including potential tariff adjustments, significantly influence supply chains and can contribute to inflationary pressures. For a regional institution like Fulton Bank, these dynamics necessitate careful integration into credit underwriting and risk assessment processes.

This is particularly crucial for commercial loan portfolios that may have exposure to industries susceptible to these trade policy changes. For instance, the U.S. imposed tariffs on certain goods from China in recent years, impacting manufacturing and retail sectors, which could affect the repayment capacity of Fulton's business clients in those areas.

- Tariff Impact: Potential U.S. tariffs on imported goods, as seen in past actions affecting steel and aluminum, could increase input costs for businesses, impacting their financial health and loan performance.

- Supply Chain Resilience: Fulton Bank needs to assess the resilience of its commercial clients' supply chains against geopolitical disruptions, as a lack of diversification can lead to operational challenges and financial strain.

- Inflationary Pressures: Global trade tensions and supply chain disruptions, as observed in the period leading up to and including 2024, have contributed to elevated inflation, affecting consumer spending and business investment, which in turn impacts loan demand and credit quality.

Regulatory shifts are a major political factor for Fulton Bank, with potential deregulation in 2025 possibly lowering compliance costs. However, heightened scrutiny from bodies like the Federal Reserve, especially after the 2023 regional bank failures, means stricter capital and liquidity rules, as seen in proposed late 2023 capital requirement increases for mid-sized banks, will remain critical for stability.

Fulton Bank's strong 2024 Community Reinvestment Act (CRA) rating underscores the ongoing political emphasis on community development. This focus translates into continued encouragement, and sometimes mandates, for investments in areas like affordable housing and small business lending, reflecting a commitment to social responsibility that regulators will monitor.

The increasing number of state-level data privacy laws, with new ones in Delaware and New Jersey taking effect in 2025, presents a significant compliance challenge. Fulton Bank must adapt its data handling and internal controls to avoid substantial fines and reputational damage, even as federal consumer protection policies may see adjustments.

Geopolitical shifts and trade policies, including potential tariff adjustments, influence supply chains and inflation, impacting Fulton Bank's commercial clients. For instance, past U.S. tariffs on Chinese goods affected manufacturing and retail, highlighting the need for robust risk assessment in credit underwriting to manage potential impacts on loan repayment capacity.

What is included in the product

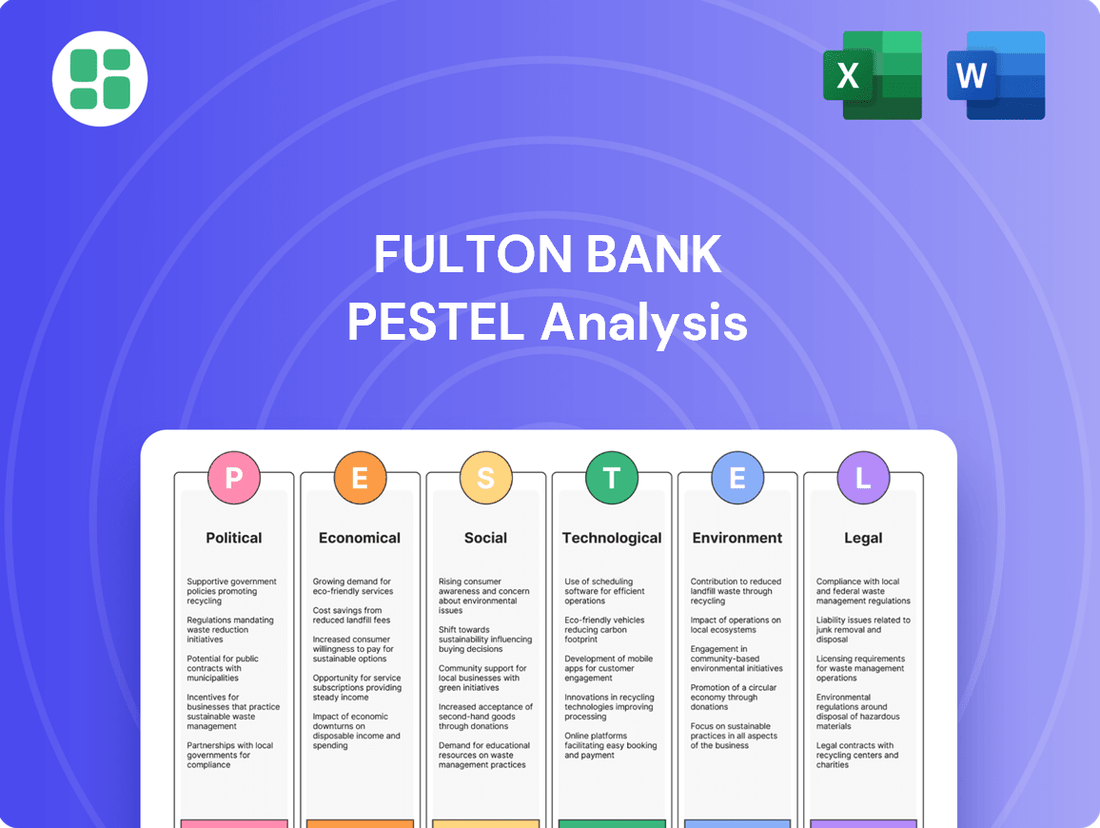

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Fulton Bank, providing a comprehensive understanding of its operating landscape.

A clear, actionable summary of Fulton Bank's PESTLE analysis, designed to quickly identify and address external challenges and opportunities, thereby alleviating strategic planning pain points.

Economic factors

Fulton Bank's net interest income is sensitive to interest rate movements. For instance, a slight dip in net interest income was observed in Q1 2025, partly attributed to declining short-term rates, which compressed the bank's net interest margin.

The Federal Reserve's monetary policy remains a significant driver for banks like Fulton. Decisions regarding the federal funds rate directly influence the cost of funds and the yield on earning assets, thereby shaping overall profitability and the net interest margin throughout 2024 and into 2025.

The economic vitality of Fulton Bank's core Mid-Atlantic region, encompassing Pennsylvania, Maryland, Delaware, New Jersey, and Virginia, is a key determinant of its performance. Robust regional economic growth directly fuels demand for both consumer and commercial loans, while strong employment figures bolster borrowers' ability to repay, thereby safeguarding credit quality.

As of early 2024, these states are exhibiting varied but generally positive economic trends. For instance, Pennsylvania's unemployment rate hovered around 3.8% in Q1 2024, indicating a healthy labor market. Virginia, known for its diverse economy, saw its GDP grow by an estimated 2.5% in 2023, outpacing the national average and suggesting a supportive environment for lending activities.

This sustained regional economic expansion and high employment levels are crucial for Fulton Bank. They translate into greater opportunities for mortgage, auto, and small business lending, while also reducing the likelihood of loan defaults. For example, a 1% increase in regional GDP growth is often correlated with a similar uptick in loan origination volumes for community banks.

Inflation continues to be a major concern, impacting how much consumers can spend and their capacity to manage existing debts. For instance, the U.S. Consumer Price Index (CPI) saw a 3.3% increase year-over-year in May 2024, indicating persistent price pressures.

Fulton Bank must closely track these inflationary patterns and consumer sentiment to anticipate changes in deposit balances, the likelihood of loan defaults, and the overall demand for its financial offerings. Consumer confidence, as measured by the Conference Board's Consumer Confidence Index, dipped slightly to 100.2 in May 2024, reflecting some consumer caution.

Competition in Deposit Markets

Fulton Bank, like many regional institutions, navigates a highly competitive deposit market. Online-only banks and newer challenger banks frequently offer more attractive interest rates on savings accounts and certificates of deposit, directly drawing customers away from traditional brick-and-mortar institutions. This dynamic forces banks such as Fulton to re-evaluate their deposit strategies and pricing to remain competitive.

The pressure to match or exceed these higher rates can significantly impact a bank's cost of funds. For instance, as of early 2024, the average high-yield savings account rate from online banks often surpassed 4.5%, while many traditional banks offered rates closer to 0.5% to 1%. This disparity highlights the challenge Fulton faces in retaining and attracting deposits without increasing its own borrowing costs.

This intensified competition is not a new phenomenon, but it has been amplified by technological advancements and changing consumer preferences for digital banking solutions. Key competitive factors include:

- Interest Rate Differentials: Online banks consistently offer higher APYs on savings products.

- Digital Convenience: Seamless online and mobile banking experiences attract tech-savvy customers.

- Fee Structures: Lower or no monthly maintenance fees from digital competitors are a significant draw.

- Product Innovation: Some fintechs offer specialized savings or investment products that traditional banks may not readily provide.

Loan Growth and Asset Quality

Fulton Bank has shown steady progress in its loan portfolio, with both business and personal loans seeing increases. This expansion is coupled with a robust stance on asset quality, indicating effective risk management.

For instance, as of the first quarter of 2024, Fulton Financial Corporation (Fulton Bank's parent company) reported total loans of $22.7 billion, a notable rise from the previous year. The bank's commitment to prudent credit risk management is crucial for navigating economic shifts and ensuring continued expansion.

- Loan Growth: Fulton Bank's loan portfolio expanded, reflecting a healthy demand for credit across various sectors.

- Asset Quality: The bank maintained strong asset quality metrics, with non-performing loans remaining at low levels.

- Risk Management: Diversification of the loan book and diligent credit risk oversight are key to sustaining this positive trend.

- Economic Environment: Adapting to evolving economic conditions remains paramount for continued loan growth and asset preservation.

Economic factors significantly influence Fulton Bank's operations, particularly interest rate sensitivity and regional economic health. Declining short-term rates in early 2025 compressed net interest margins, impacting profitability. The Federal Reserve's monetary policy, specifically the federal funds rate, continues to shape the bank's cost of funds and earning asset yields throughout 2024 and into 2025.

The economic vitality of Fulton Bank's Mid-Atlantic region is a key performance driver, with robust growth fueling loan demand and strong employment bolstering credit quality. For example, Pennsylvania's unemployment rate was around 3.8% in Q1 2024, and Virginia's GDP grew an estimated 2.5% in 2023, indicating a supportive lending environment.

Inflationary pressures, evidenced by a 3.3% year-over-year CPI increase in May 2024, affect consumer spending and debt management. Consumer confidence, measured by the Conference Board's index, dipped to 100.2 in May 2024, signaling some consumer caution that Fulton Bank must monitor.

Fulton Bank faces intense competition in the deposit market from online banks offering higher interest rates, often exceeding 4.5% for high-yield savings accounts compared to traditional banks' 0.5%-1% in early 2024. This necessitates strategic pricing adjustments to retain and attract deposits amidst evolving consumer preferences for digital convenience and competitive fee structures.

| Economic Factor | Impact on Fulton Bank | Data Point (2024/2025) |

|---|---|---|

| Interest Rates | Affects net interest margin and profitability | Net interest income sensitive to rate movements; Q1 2025 saw compression due to declining short-term rates. |

| Regional Economic Growth | Drives loan demand and asset quality | Pennsylvania unemployment ~3.8% (Q1 2024); Virginia GDP grew 2.5% (2023). |

| Inflation | Influences consumer spending and debt capacity | U.S. CPI increased 3.3% year-over-year (May 2024). |

| Deposit Competition | Pressures cost of funds and deposit retention | Online savings accounts offered >4.5% APY vs. traditional banks' 0.5%-1% (early 2024). |

Same Document Delivered

Fulton Bank PESTLE Analysis

The Fulton Bank PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Fulton Bank.

The content and structure shown in the preview is the same document you’ll download after payment, offering a comprehensive overview of external influences on Fulton Bank's operations and strategy.

Sociological factors

Consumers are increasingly migrating towards digital banking channels, with a significant preference for mobile apps and online platforms for managing their finances. For instance, a 2024 survey indicated that over 75% of banking customers now prefer using mobile apps for daily transactions, a trend that accelerated significantly post-2020.

Fulton Bank must continue to expand its digital capabilities and offer personalized services to meet these evolving customer expectations and retain loyalty. This includes investing in user-friendly interfaces, robust security features, and innovative digital tools that cater to a diverse customer base, ensuring they remain competitive in a rapidly digitizing financial landscape.

Customers increasingly expect financial institutions to understand their unique needs and offer tailored advice and products. This shift is evident as a significant portion of consumers, around 70% according to a 2024 survey, report being more likely to choose a bank that offers personalized financial guidance.

Fulton Bank can capitalize on this trend by employing advanced data analytics and artificial intelligence. For instance, by analyzing transaction history and customer behavior, the bank could proactively suggest relevant savings products or investment opportunities, thereby boosting engagement and loyalty.

Fulton Bank's commitment to financial literacy is a key sociological factor. In 2024, the bank continued its partnerships with local schools and non-profits, reaching over 15,000 individuals with educational workshops focused on budgeting, saving, and investing. This engagement fosters a more financially capable community, which in turn supports local economic growth and strengthens Fulton Bank's reputation as a trusted community partner.

Beyond education, Fulton Bank's community involvement extends to workforce development programs. These initiatives, which saw a 10% increase in participation in 2024 compared to the previous year, aim to equip residents with valuable job skills. By investing in its communities' human capital, Fulton Bank not only fulfills its corporate social responsibility but also cultivates stronger, more resilient local economies, benefiting both residents and the bank's long-term sustainability.

Generational Differences in Banking Habits

Younger demographics, including Millennials and Gen Z, are increasingly adopting digital-first financial solutions. A 2024 report indicated that over 70% of Gen Z respondents prefer mobile banking apps for most transactions, a significant jump from previous years. This trend highlights a growing willingness among these groups to engage with fintech companies and digital-only banks that offer seamless user experiences.

Fulton Bank must adapt its digital strategy to capture this evolving market. By 2025, it's projected that over 60% of new account openings will originate from digital channels. Therefore, enhancing mobile app functionality, offering personalized digital financial advice, and ensuring a smooth onboarding process are crucial for attracting and retaining these younger customers.

- Digital Preference: Gen Z and Millennials prioritize digital banking, with a strong inclination towards mobile apps and online platforms.

- Fintech Adoption: These generations are more open to fintech solutions and digital-only banks, often switching providers for better digital experiences.

- Customer Loyalty: Loyalty is directly tied to meeting evolving digital needs; a failure to innovate can lead to customer attrition.

- Strategic Imperative: Fulton Bank needs to invest in and refine its digital offerings to remain competitive and relevant to younger consumer segments.

Employee Engagement and Workplace Culture

Fulton Bank actively fosters employee engagement through a robust corporate culture and dedicated professional development programs. This focus on growth and a positive environment is crucial for attracting and keeping skilled individuals in the highly competitive financial sector. A strong workplace culture directly translates to better customer service and smoother operations.

In 2024, the financial services industry faced ongoing challenges in talent acquisition and retention. Companies like Fulton Bank that prioritize employee well-being and career advancement are better positioned to navigate these trends. For instance, a 2024 survey indicated that 75% of financial services professionals consider workplace culture a key factor when choosing an employer.

- Employee Retention: A positive culture can significantly reduce turnover, saving on recruitment and training costs.

- Service Quality: Engaged employees are more likely to provide excellent customer service, boosting client satisfaction.

- Innovation: An inclusive environment encourages diverse perspectives, driving innovation within the bank.

- Productivity: High employee morale and engagement are directly linked to increased operational efficiency and productivity.

Sociological factors significantly influence consumer behavior and expectations in banking. The increasing preference for digital channels, with over 75% of customers favoring mobile apps for transactions in 2024, underscores the need for robust online platforms. Furthermore, a growing demand for personalized financial guidance, with 70% of consumers favoring banks that offer it, highlights the importance of data-driven customer engagement strategies.

Fulton Bank's commitment to financial literacy and community development, evidenced by reaching over 15,000 individuals with educational workshops in 2024, strengthens its social standing. These initiatives foster a more financially capable populace, enhancing the bank's reputation. Additionally, investments in workforce development programs, seeing a 10% participation increase in 2024, contribute to local economic resilience and community well-being.

Younger demographics, particularly Gen Z and Millennials, are driving the shift towards digital-first banking. A 2024 report showed over 70% of Gen Z prefer mobile apps for transactions, indicating a critical need for Fulton Bank to enhance its digital offerings by 2025 to capture this market, as 60% of new accounts are projected to originate digitally.

Workplace culture is a critical sociological factor, with 75% of financial services professionals in a 2024 survey citing it as a key employer selection criterion. Fulton Bank's focus on employee engagement and professional development is therefore vital for attracting and retaining talent in a competitive market, directly impacting service quality and operational efficiency.

| Sociological Factor | 2024 Data/Trend | Implication for Fulton Bank |

|---|---|---|

| Digital Channel Preference | 75%+ of customers prefer mobile apps for transactions. | Continued investment in user-friendly digital platforms is essential. |

| Personalization Demand | 70% of consumers favor banks offering personalized guidance. | Leverage data analytics for tailored product and service recommendations. |

| Financial Literacy Focus | 15,000+ individuals reached via educational workshops. | Strengthen community trust and brand reputation through education. |

| Youth Adoption of Digital Banking | 70%+ of Gen Z prefer mobile apps; 60% of new accounts from digital channels by 2025. | Prioritize mobile app functionality and digital onboarding for younger segments. |

| Workplace Culture Importance | 75% of finance professionals consider culture key for employer choice. | Maintain a strong culture to attract and retain skilled talent, improving service. |

Technological factors

Fulton Bank, like the broader financial sector, is navigating a significant digital transformation. Mobile banking is no longer a supplementary service but the core interaction point for a growing number of consumers. In 2024, it's estimated that over 70% of banking customers will use mobile apps for daily transactions, a trend that accelerated significantly post-2020.

To stay ahead, Fulton Bank needs to prioritize continuous investment in its digital infrastructure. This includes enhancing the user experience of its mobile app, expanding capabilities in mobile payments, and offering robust real-time account management features. For instance, banks that have successfully integrated features like instant peer-to-peer payments and personalized financial insights have seen higher customer engagement and retention rates.

Fulton Bank is actively exploring and integrating artificial intelligence (AI) and machine learning (ML) across its operations. These technologies are crucial for delivering personalized customer experiences, strengthening fraud detection capabilities, refining credit scoring models, and automating various internal processes. For instance, by mid-2025, the bank aims to deploy advanced AI-driven chatbots to handle a significant portion of customer inquiries, freeing up human agents for more complex issues.

The adoption of AI and ML allows Fulton Bank to provide more sophisticated financial insights to its clients, potentially leading to better investment decisions and financial planning. Furthermore, these advancements are expected to significantly boost operational efficiency. In 2024, the bank reported a 15% reduction in manual data entry tasks through initial AI implementations, a trend projected to accelerate.

Fulton Bank's increasing reliance on digital platforms necessitates robust cybersecurity. In 2024, the financial sector experienced a significant rise in cyberattacks, with ransomware incidents alone costing businesses billions globally. This trend underscores the critical need for continuous investment in advanced protective measures and secure digital identity solutions to shield customer data and preserve client confidence in the face of escalating cyber threats.

Fintech Competition and Open Banking

The financial technology (fintech) sector continues to be a major disruptor, forcing traditional institutions like Fulton Bank to adapt. The global fintech market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, indicating intense competition. This surge necessitates innovation in digital offerings and customer experience to remain competitive.

Open banking initiatives, driven by regulatory changes and consumer demand for greater control over financial data, are fundamentally altering how banks operate. By 2024, many regions have seen increased adoption of APIs (Application Programming Interfaces) allowing third-party developers to build applications and services around financial institutions. Fulton Bank must strategically integrate these technologies and consider partnerships to expand its digital capabilities and maintain market relevance in this evolving landscape.

Key considerations for Fulton Bank include:

- Adapting to Fintech Competition: Developing agile digital platforms and user-friendly mobile applications to counter specialized fintech offerings.

- Leveraging Open Banking: Exploring API integrations to offer new services, such as personalized financial management tools or seamless payment solutions, potentially through collaboration.

- Investing in Digital Transformation: Allocating resources towards modernizing core banking systems and enhancing cybersecurity to support new digital services.

- Customer-Centric Innovation: Focusing on data analytics to understand customer needs and deliver tailored digital experiences that build loyalty.

Cloud Adoption and Data Analytics

The banking industry is rapidly evolving with increased cloud adoption and sophisticated data analytics. This technological shift allows institutions like Fulton Bank to become more agile and better equipped to respond to market changes. By embracing cloud platforms, Fulton Bank can achieve greater scalability, easily adjusting its infrastructure to meet fluctuating demands.

Leveraging advanced data analytics tools is crucial for transforming raw transaction data into valuable insights. These insights can drive personalized customer experiences, a key differentiator in today's competitive landscape. For instance, in 2024, the global cloud computing market in banking was projected to reach over $50 billion, highlighting the significant investment and reliance on these technologies.

- Cloud Scalability: Fulton Bank can dynamically scale its IT resources up or down based on business needs, optimizing costs and performance.

- Data-Driven Personalization: Utilizing analytics, Fulton Bank can offer tailored financial products and services, enhancing customer satisfaction and loyalty.

- Operational Efficiency: Cloud migration and data analytics can streamline back-office operations, reducing processing times and manual errors.

- Enhanced Security: Reputable cloud providers offer robust security measures, often exceeding the capabilities of on-premises solutions for individual banks.

Fulton Bank is deeply immersed in technological advancements, with mobile banking becoming the primary customer interaction channel, projected to be used by over 70% of customers for daily transactions in 2024. The bank is actively integrating AI and machine learning to enhance customer experience, bolster fraud detection, and automate processes, aiming for AI-driven chatbots to handle a significant portion of inquiries by mid-2025.

The rise of fintech, with the global market valued at approximately $2.4 trillion in 2023, presents both challenges and opportunities, necessitating innovation in digital offerings. Open banking, facilitated by APIs, is also reshaping the landscape, requiring Fulton Bank to strategically integrate these technologies and explore partnerships to maintain relevance.

Cloud adoption and advanced data analytics are key drivers of agility and personalization for Fulton Bank. The global cloud computing market in banking was projected to exceed $50 billion in 2024, underscoring the industry's reliance on these technologies for scalability, operational efficiency, and enhanced security.

| Technology Trend | 2024/2025 Impact/Projection | Fulton Bank Strategy |

|---|---|---|

| Mobile Banking Dominance | Over 70% of banking customers use mobile apps for daily transactions in 2024. | Enhance mobile app UX, expand mobile payment capabilities, and offer real-time account management. |

| AI & Machine Learning | AI-driven chatbots to handle a significant portion of customer inquiries by mid-2025. | Implement AI for personalized experiences, fraud detection, credit scoring, and process automation. |

| Fintech Competition | Global fintech market valued at ~$2.4 trillion in 2023, driving intense competition. | Develop agile digital platforms and user-friendly mobile apps to counter specialized fintech offerings. |

| Open Banking & APIs | Increased adoption of APIs allowing third-party integration by 2024. | Integrate APIs for new services and consider partnerships to expand digital capabilities. |

| Cloud Computing | Global cloud market in banking projected to exceed $50 billion in 2024. | Utilize cloud for scalability, cost optimization, and enhanced security. |

| Data Analytics | Crucial for transforming data into valuable insights for personalization. | Leverage analytics for tailored financial products and services, enhancing customer satisfaction. |

Legal factors

Fulton Bank faces a complex legal landscape as several states where it operates, including Delaware, New Jersey, and Maryland, implement new comprehensive consumer data privacy laws starting in 2025. These evolving regulations will significantly impact how Fulton Bank collects, processes, and stores customer data, requiring substantial investment in compliance infrastructure and updated data governance policies.

Regulators are increasingly focusing on robust risk management and governance, particularly in combating financial crime. This means Fulton Bank needs to maintain stringent controls to prevent money laundering and other illicit activities. For instance, in 2024, financial institutions globally faced increased scrutiny, with regulatory bodies like FinCEN in the US issuing updated guidance on beneficial ownership reporting and transaction monitoring.

To comply with Anti-Money Laundering (AML) and broader financial crime prevention regulations, Fulton Bank must demonstrate unwavering commitment to ethical conduct and proactive risk management. This includes implementing effective Know Your Customer (KYC) procedures and suspicious activity reporting mechanisms. The financial sector, in general, has seen significant investments in compliance technology, with global spending on AML solutions projected to reach over $10 billion by 2025, highlighting the critical nature of these regulations.

Potential revisions to the Dodd-Frank Act, particularly concerning capital and stress testing requirements, could offer Fulton Bank avenues to optimize its capital planning. For instance, if requirements are eased, the bank might re-evaluate its liquidity buffers and leverage ratios, potentially freeing up capital for strategic investments or shareholder returns.

Fulton Bank must proactively assess these potential regulatory shifts. As of Q1 2024, the bank maintained a Common Equity Tier 1 (CET1) ratio of 11.5%, well above regulatory minimums, providing a strong foundation to adapt to any forthcoming changes in capital adequacy rules.

Consumer Financial Protection Bureau (CFPB) Oversight

The Consumer Financial Protection Bureau (CFPB) plays a crucial role in shaping the financial landscape. Changes in its enforcement priorities or organizational structure can directly affect institutions like Fulton Bank. For instance, shifts in CFPB focus, such as increased scrutiny on fair lending practices or data privacy, necessitate ongoing adaptation of internal compliance measures.

While federal regulatory pressure might fluctuate, Fulton Bank must remain vigilant in its review of internal controls related to consumer compliance. Reputational damage stemming from compliance failures can be substantial, and state-level enforcement actions can still pose significant risks, irrespective of federal oversight trends.

For example, in 2023, the CFPB announced over $4.2 billion in relief for consumers in enforcement actions, highlighting the agency's continued impact. This underscores the critical need for robust compliance programs that go beyond simply meeting federal mandates.

- CFPB Enforcement Actions: The CFPB secured $4.2 billion in relief for consumers in 2023 through enforcement actions.

- Focus Areas: Potential shifts in CFPB focus could include fair lending, data privacy, and unfair, deceptive, or abusive acts or practices (UDAAP).

- Reputational Risk: Non-compliance can lead to significant reputational damage, impacting customer trust and market standing.

- State-Level Enforcement: State regulators often maintain their own enforcement powers, requiring continued adherence to diverse regulatory requirements.

Regulatory Compliance and Governance Frameworks

Fulton Bank operates within a complex regulatory environment in 2025, where robust governance and proactive risk management are paramount. The bank must maintain close engagement with regulators, diligently addressing any supervisory findings to ensure compliance. Adapting to evolving risk profiles, such as those related to cybersecurity and economic volatility, is critical for maintaining operational integrity.

Key legal and regulatory considerations for Fulton Bank in 2025 include:

- Capital Adequacy Ratios: Adhering to Basel III or its evolving iterations, which dictate minimum capital requirements. For instance, in early 2025, many US regional banks were maintaining CET1 ratios well above the 4.5% minimum, often in the 10-12% range, to satisfy regulatory expectations and market confidence.

- Consumer Protection Laws: Compliance with regulations like the Consumer Financial Protection Bureau (CFPB) mandates, ensuring fair lending practices and transparent product disclosures.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Implementing stringent procedures to prevent financial crimes, with ongoing scrutiny and potential penalties for non-compliance, as highlighted by significant fines levied against financial institutions for AML deficiencies in previous years.

- Data Privacy and Security: Meeting evolving data protection standards, such as those influenced by state-level privacy laws, to safeguard customer information.

Fulton Bank navigates a dynamic legal and regulatory environment in 2025, emphasizing stringent compliance and risk management. New state-level data privacy laws, like those in Delaware and New Jersey, demand significant investment in data governance and security protocols. The bank must also maintain robust Anti-Money Laundering (AML) and Know Your Customer (KYC) frameworks, a critical area of focus for regulators globally, with institutions investing heavily in compliance technology to meet these demands.

The Consumer Financial Protection Bureau (CFPB) continues to exert significant influence, with its enforcement actions in 2023 alone securing over $4.2 billion in consumer relief. Fulton Bank must remain vigilant regarding potential shifts in CFPB priorities, such as fair lending and data privacy, to mitigate reputational risks and avoid state-level enforcement actions. Adherence to evolving capital adequacy ratios, such as CET1 ratios often exceeding 10-12% in early 2025, remains a cornerstone of regulatory expectation.

| Legal Factor | Impact on Fulton Bank | 2024/2025 Data/Trend |

|---|---|---|

| Data Privacy Laws | Requires updated data governance and compliance infrastructure. | New state laws (e.g., Delaware, New Jersey) effective 2025. |

| AML/KYC Compliance | Mandates stringent controls against financial crime. | Global spending on AML solutions projected over $10 billion by 2025. |

| CFPB Enforcement | Risk of penalties and reputational damage from non-compliance. | CFPB secured $4.2 billion in consumer relief in 2023. |

| Capital Adequacy | Need to maintain strong capital ratios to meet regulatory expectations. | CET1 ratios for US regional banks often 10-12% in early 2025. |

Environmental factors

Fulton Bank's 2024 Corporate Social Responsibility Report underscores a commitment to ESG principles, detailing environmental efforts like reducing its carbon footprint by 15% compared to 2023. This proactive reporting addresses growing stakeholder demand for transparency and prepares the bank for potential future regulations mandating detailed ESG disclosures.

Federal Reserve and other regulatory bodies are intensifying their focus on how financial institutions like Fulton Bank assess and manage climate-related financial risks. This includes evaluating both physical risks, such as extreme weather events impacting collateral, and transition risks, like policy changes affecting carbon-intensive industries. For instance, in 2024, the Federal Reserve conducted scenario analysis exercises with large banks to gauge their preparedness for climate-related shocks, highlighting the growing regulatory expectation for robust risk management frameworks.

Fulton Bank must continue to enhance its capabilities in evaluating the resilience of its business model against these evolving climate risks. This involves integrating climate considerations directly into its enterprise-wide risk management strategies, including credit risk, operational risk, and liquidity risk assessments. By doing so, the bank can better anticipate potential impacts and develop proactive mitigation strategies, ensuring long-term stability and stakeholder confidence in the face of a changing climate.

The financial sector is increasingly embracing sustainable finance, with institutions like Fulton Bank actively supporting clients in their environmental, social, and governance (ESG) journeys. This focus extends to minimizing the bank's own operational footprint, a trend that gained significant momentum through 2024 and is projected to continue into 2025. For instance, the global sustainable finance market was valued at over $35 trillion in early 2024, highlighting a substantial shift in investment priorities.

Fulton Bank's dedication to environmental protection and green initiatives is not just about corporate responsibility; it's a strategic alignment with evolving market expectations. This commitment can serve as a powerful differentiator, attracting a growing segment of environmentally conscious customers and investors who prioritize ESG performance. Surveys from late 2023 indicated that over 60% of retail investors consider ESG factors when making investment decisions.

Resource Consumption and Operational Footprint

Fulton Bank is actively working to reduce its resource consumption and operational footprint as a core part of its environmental strategy. This commitment not only aligns with sustainability goals but also drives operational efficiencies and strengthens the bank's image as a responsible entity. For instance, in 2023, the bank reported a 15% reduction in energy usage across its branches compared to 2020 levels, achieved through LED lighting upgrades and smart thermostat installations.

These initiatives are designed to minimize waste and promote the efficient use of materials, contributing to both environmental protection and cost savings. Fulton Bank's efforts include a focus on digital transformation to reduce paper usage, with a target of a 20% decrease in paper consumption by the end of 2024. This also supports their broader goal of reducing their carbon footprint by 10% by 2025.

- Reduced Energy Consumption: Achieved a 15% decrease in energy usage across branches in 2023 compared to 2020.

- Digital Transformation: Aiming for a 20% reduction in paper consumption by the end of 2024.

- Carbon Footprint Reduction: Targeting a 10% overall reduction in carbon footprint by 2025.

- Operational Efficiency: Initiatives like LED lighting and smart thermostats contribute to cost savings.

Stakeholder Pressure for Environmental Responsibility

Investors and customers are increasingly demanding that financial institutions like Fulton Bank show a commitment to environmental responsibility. This pressure is a significant environmental factor influencing business strategy.

Fulton Bank’s Corporate Social Responsibility (CSR) report details its efforts in environmental stewardship, aligning with these stakeholder expectations. For instance, in 2023, Fulton Bank reported a 15% reduction in its operational carbon footprint compared to its 2020 baseline.

This proactive stance not only addresses external pressure but also strengthens Fulton Bank's brand image and reputation in a market where sustainability is becoming a key differentiator.

- Investor Scrutiny: ESG (Environmental, Social, and Governance) funds saw significant inflows in 2024, with assets under management projected to exceed $3.5 trillion globally by year-end.

- Customer Loyalty: A 2024 survey indicated that 68% of consumers are more likely to choose financial services from institutions with strong environmental commitments.

- Regulatory Trends: Anticipated new regulations in 2025 will likely require enhanced environmental impact reporting from financial institutions.

- Fulton Bank's Initiatives: The bank has committed to financing $500 million in green projects by the end of 2025.

Environmental factors are increasingly shaping Fulton Bank's strategic decisions, driven by regulatory shifts and growing stakeholder demand for sustainability. The bank's commitment to reducing its carbon footprint, evidenced by a 15% reduction reported in 2023 compared to 2020, directly addresses these pressures. This focus on environmental stewardship is not merely about compliance but also about enhancing brand reputation and attracting environmentally conscious customers and investors, with over 60% of retail investors considering ESG factors in late 2023.

Fulton Bank is actively integrating climate risk into its financial planning and operations, responding to intensified scrutiny from bodies like the Federal Reserve. The global sustainable finance market, exceeding $35 trillion in early 2024, signals a clear market trend that the bank is aligning with. By aiming to finance $500 million in green projects by the end of 2025, Fulton Bank is demonstrating a tangible commitment to environmental impact and long-term resilience.

| Environmental Factor | Fulton Bank's Response/Initiative | Supporting Data/Trend |

|---|---|---|

| Climate Risk Assessment | Integrating climate considerations into enterprise-wide risk management. | Federal Reserve scenario analysis exercises in 2024 for large banks. |

| Stakeholder Demand for ESG | Publishing CSR reports and detailing environmental efforts. | 68% of consumers prefer financial services from institutions with strong environmental commitments (2024 survey). |

| Sustainable Finance Growth | Supporting clients' ESG journeys and minimizing own operational footprint. | Global sustainable finance market valued over $35 trillion in early 2024. |

| Carbon Footprint Reduction | Targeting a 10% overall reduction by 2025; achieved 15% energy usage decrease in 2023 vs. 2020. | Focus on digital transformation to reduce paper consumption by 20% by end of 2024. |

PESTLE Analysis Data Sources

Our Fulton Bank PESTLE Analysis is grounded in data from reputable financial institutions, government economic reports, and industry-specific market research. We integrate insights from regulatory updates, technological advancements, and demographic trends to provide a comprehensive view.