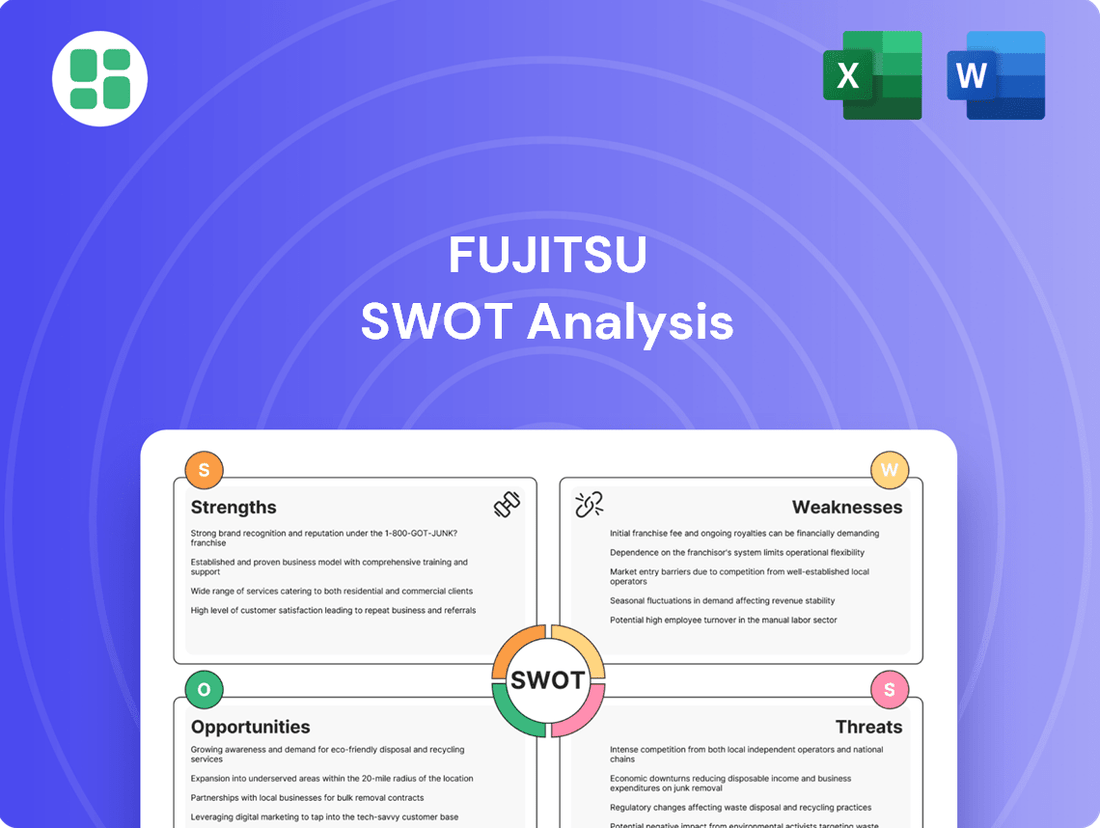

Fujitsu SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fujitsu Bundle

Fujitsu's strategic positioning is a complex interplay of technological innovation and global market challenges. While their strengths lie in advanced computing and digital transformation services, understanding their vulnerabilities and the competitive landscape is crucial for any forward-thinking investor or strategist.

Want the full story behind Fujitsu's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fujitsu's strength lies in its extensive and diverse IT portfolio, encompassing everything from high-performance computing and software development to telecommunications infrastructure and advanced microelectronics. This broad offering allows Fujitsu to cater to a wide array of customer needs across various industries and geographies. For instance, in fiscal year 2023, Fujitsu reported total revenue of ¥3.7 trillion (approximately $25 billion USD), underscoring the scale and reach of its operations powered by this comprehensive product and service suite.

Fujitsu's strategic emphasis on digital transformation and advanced technologies is a significant strength. The company is actively integrating AI, cloud computing, and cybersecurity into its core offerings, positioning itself at the forefront of technological innovation.

A key aspect of this focus is Fujitsu's ambition to become a global leader in enterprise generative AI. This strategic push is backed by substantial investments in research and development, as well as the creation of new service portfolios designed to meet the evolving needs of businesses seeking AI-driven solutions.

Fujitsu's deep expertise, honed over decades, is a significant strength, particularly within its home market of Japan. This accumulated knowledge base allows the company to tackle complex system modernization projects with confidence, bridging the gap between legacy infrastructure and cutting-edge solutions. Their engineers are adept at handling a broad spectrum of technologies, ensuring high-quality and dependable outcomes for a diverse clientele.

Commitment to Sustainability and Societal Value Creation

Fujitsu is actively integrating sustainability into its business model, aiming for a net positive environmental and societal impact by 2030 through its digital services. This strategic focus on sustainability not only addresses critical global issues like climate change but also significantly bolsters Fujitsu's brand image, making it more attractive to investors and customers prioritizing Environmental, Social, and Governance (ESG) principles.

This commitment translates into tangible actions and goals. For instance, Fujitsu has set targets to reduce its greenhouse gas emissions across its value chain, aligning with international climate agreements. Their initiatives often involve developing and deploying digital solutions that help customers achieve their own sustainability objectives, creating a ripple effect of positive change.

- Net Positive Vision: Fujitsu's ambition to achieve a net positive impact on the environment and society by 2030 is a core strategic driver.

- ESG Appeal: This strong commitment to sustainability enhances Fujitsu's attractiveness to ESG-focused investors and a growing base of socially conscious consumers.

- Climate Action: The company is actively working to reduce its carbon footprint and promote climate-friendly technologies and services.

- Societal Impact: Beyond environmental concerns, Fujitsu aims to contribute to resolving social issues through its digital transformation efforts.

Strategic Business Model Transformation (Fujitsu Uvance)

Fujitsu is aggressively advancing its Fujitsu Uvance initiative, concentrating on integrated solutions that tackle multifaceted societal and business challenges across various sectors. This strategic shift prioritizes high-margin services, a move that includes bolstering its consulting expertise and divesting less profitable hardware segments to foster enduring growth and enhanced financial performance.

This transformation is supported by recent financial data, with Fujitsu reporting a significant increase in its service revenue. For instance, in the fiscal year ending March 2024, Fujitsu’s Services segment revenue saw a notable uptick, contributing substantially to the company's overall profitability. This focus on Uvance is crucial as the company aims to leverage its technology and consulting capabilities to deliver more impactful, value-added solutions.

- Accelerated Fujitsu Uvance Focus: Driving cross-industry solutions for complex issues.

- Shift to Higher-Value Services: Emphasis on consulting and digital transformation offerings.

- Divestment of Low-Profit Hardware: Streamlining operations to improve overall profitability.

- Sustainable Growth Strategy: Aiming for enhanced profitability through strategic business model transformation.

Fujitsu's extensive IT portfolio, covering computing, software, telecommunications, and microelectronics, allows it to serve diverse global needs. In fiscal year 2023, the company achieved ¥3.7 trillion in revenue, showcasing the scale of its operations. This broad offering is a cornerstone of its market presence.

The company's strategic focus on digital transformation and emerging technologies like AI and cloud computing positions it as an innovator. Fujitsu is actively investing in generative AI for enterprises, aiming to lead in this high-growth area.

Fujitsu's deep technical expertise, particularly in Japan, enables it to manage complex system modernizations effectively. This accumulated knowledge ensures reliable solutions for clients transitioning from legacy systems to advanced technologies.

A key strength is Fujitsu's commitment to sustainability, aiming for a net positive environmental and societal impact by 2030. This ESG focus enhances its brand appeal and aligns with investor priorities, driving a strategy that benefits both the company and society.

What is included in the product

Analyzes Fujitsu’s competitive position through key internal and external factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address Fujitsu's internal weaknesses and external threats, thereby alleviating strategic uncertainty.

Weaknesses

Fujitsu's involvement in the UK Post Office Horizon IT scandal has inflicted considerable reputational damage. The company is currently entangled in ongoing legal proceedings and faces intense public scrutiny, especially within the UK's public sector. This persistent negative attention could hinder Fujitsu's prospects for securing future government contracts.

Fujitsu faces headwinds in its established hardware sectors. The company has seen revenue shrink in its Ubiquitous Solutions division, which primarily includes PCs. This decline underscores a challenge in maintaining competitiveness in traditional computing markets.

Furthermore, Fujitsu is strategically reducing its footprint in the Electronic Devices business. This move is a direct response to persistent profitability issues within this segment, signaling a need to re-evaluate and potentially divest underperforming hardware operations.

Fujitsu General Limited's decision to suspend dividends for the fiscal year ending March 2025, as announced in their financial outlook, risks alienating income-oriented investors. This move, intended to bolster liquidity for growth initiatives, could trigger immediate selling pressure as shareholders accustomed to regular payouts re-evaluate their holdings.

Complexity and Risk in Large-Scale IT Implementations

Migrating from older IT systems to newer ones is inherently complicated, costly, and risky for both Fujitsu and its customers. This complexity can easily cause projects to fall behind schedule and exceed their budgets, potentially leading to unhappy clients if not handled with extreme care.

For example, the global IT services market, which includes large-scale implementations, was projected to reach over $1.3 trillion in 2024, highlighting the significant investment and potential for cost overruns in such projects. Fujitsu's success hinges on its ability to navigate these intricate transitions smoothly.

- Project Delays: Large IT migrations often face unforeseen technical hurdles, leading to extended timelines.

- Budget Overruns: The complexity of integrating new systems with existing infrastructure can escalate costs beyond initial estimates.

- Client Dissatisfaction: Failure to manage expectations and deliver on time and within budget can damage client relationships.

Dependency on Public Sector Contracts Despite Scrutiny

Fujitsu's continued reliance on public sector contracts, even amidst the ongoing Post Office scandal scrutiny, reveals a significant weakness. This dependency highlights a potential over-reliance on government work, which could prove problematic should public opinion or policy drastically change. For instance, in fiscal year 2023, government and public sector segments represented a substantial portion of Fujitsu's revenue, though specific figures are subject to ongoing reporting cycles and may not fully reflect the immediate impact of recent events.

The difficulty governments face in disengaging from deeply integrated IT providers like Fujitsu underscores this vulnerability. This embeddedness, while a testament to past service, can become a liability when reputational damage is high. While specific contract values are often confidential, the sheer volume of public sector engagements suggests a significant portion of Fujitsu's business is tied to this potentially volatile market.

- Continued government contract awards despite scandal

- Potential over-reliance on public sector revenue streams

- Vulnerability to shifts in public sentiment and government policy

- Challenges in diversifying away from established public sector relationships

Fujitsu's reputation has been significantly tarnished by its involvement in the UK Post Office Horizon IT scandal, leading to intense public scrutiny and potential future contract limitations, particularly within the UK public sector.

The company faces challenges in its traditional hardware markets, with declining revenues in its Ubiquitous Solutions division (including PCs) and a strategic reduction in its Electronic Devices business due to persistent profitability issues.

Fujitsu General Limited's decision to suspend dividends for the fiscal year ending March 2025 could alienate income-focused investors, potentially causing immediate selling pressure as shareholders re-evaluate their holdings.

The inherent complexity, cost, and risk associated with large IT system migrations can lead to project delays, budget overruns, and client dissatisfaction, impacting Fujitsu's ability to deliver successful outcomes.

Fujitsu's continued reliance on public sector contracts, despite the ongoing scandal, highlights a potential over-reliance on government work, making it vulnerable to shifts in public sentiment and policy.

| Weakness | Description | Impact |

| Reputational Damage (UK Post Office Scandal) | Ongoing legal proceedings and intense public scrutiny in the UK. | Hindered prospects for future government contracts and damaged public trust. |

| Hardware Market Decline | Shrinking revenue in Ubiquitous Solutions (PCs) and strategic exit from Electronic Devices due to profitability issues. | Reduced competitiveness in traditional computing and underperforming hardware operations. |

| Dividend Suspension | Fujitsu General Limited's decision to suspend dividends for FY2025. | Alienates income investors, potentially triggering selling pressure. |

| IT Migration Complexity | High risk of project delays, budget overruns, and client dissatisfaction in large system integrations. | Potential for negative client experiences and financial strain on projects. |

| Public Sector Over-reliance | Significant dependence on government contracts, vulnerable to policy shifts and public opinion changes. | Exposure to volatility in a key revenue stream due to reputational risks. |

Same Document Delivered

Fujitsu SWOT Analysis

The preview you see is the same Fujitsu SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive report, ready for your strategic planning.

Opportunities

The worldwide drive for digital transformation across various sectors offers a significant avenue for Fujitsu to broaden its IT solutions and services portfolio. This trend is fueled by businesses and governments aiming to modernize their operations, creating a strong demand for advanced IT capabilities.

Fujitsu's strategic emphasis on key growth areas like artificial intelligence, cloud computing, and cybersecurity places it advantageously to address the evolving requirements of these entities. For instance, the global market for digital transformation services was projected to reach over $1.5 trillion in 2024, with continued robust growth expected through 2025, according to various industry analyses.

Fujitsu's focus on becoming a leader in enterprise generative AI, alongside its secure cloud platform development for sensitive data, presents a significant growth opportunity. The market is expanding rapidly as businesses increasingly leverage AI for enhanced productivity and smarter decision-making across all operational areas.

The global AI market, projected to reach over $1.5 trillion by 2030, underscores the immense potential for Fujitsu's generative AI solutions. Furthermore, as data privacy concerns mount, Fujitsu's secure cloud offerings for sensitive information are well-positioned to capture a substantial share of the secure cloud services market, which is expected to grow by over 15% annually through 2025.

Fujitsu is actively bolstering its global consulting arm, particularly through its 'Uvance Wayfinders' initiative. This expansion aims to significantly grow its consulting workforce and introduce specialized consulting domains, enabling the company to deliver more impactful, value-added services to its international clientele.

By enhancing its consulting capabilities, Fujitsu can offer more profound engagement with customers worldwide. This strategic move allows Fujitsu to better integrate its technological expertise with crucial strategic business guidance, a key differentiator in the competitive market.

Leveraging Sustainability Transformation (SX) Market

Fujitsu's dedication to achieving a 'net positive' impact via technology places it favorably to tap into the expanding market for sustainability-focused solutions. This commitment directly addresses pressing environmental concerns and the drive for a more inclusive digital society, resonating strongly with organizations prioritizing Environmental, Social, and Governance (ESG) principles.

The global sustainability market is experiencing significant growth, with projections indicating continued expansion. For instance, the ESG investing market, a key driver for sustainability transformation, was estimated to reach $33.9 trillion in assets under management by the end of 2024, according to recent industry reports. This presents a substantial opportunity for Fujitsu to offer its technological expertise and solutions.

- Growing ESG Investment: Organizations are increasingly allocating capital towards businesses demonstrating strong ESG performance, creating demand for sustainability-linked services.

- Technological Solutions for Environmental Challenges: Fujitsu can leverage its capabilities in areas like AI, IoT, and cloud computing to provide solutions for carbon reduction, resource efficiency, and circular economy initiatives.

- Digital Society Advancement: The company's focus on fostering a digital society aligns with the need for inclusive and accessible technology, which is a core component of many sustainability strategies.

- Market Demand for Green IT: As businesses strive for greener operations, there's a rising demand for energy-efficient IT infrastructure and services, an area where Fujitsu can excel.

Advancements in Quantum Computing and High-Performance Computing

Fujitsu's significant investments in quantum computing, including the development of a 40-qubit quantum computer simulator, present a substantial long-term opportunity. This advanced computing capability allows for the creation of novel solutions to intricate industrial optimization challenges and accelerates scientific research. By leading in this cutting-edge field, Fujitsu can establish a distinct competitive advantage, setting its products and services apart in the market.

The company's commitment to high-performance computing (HPC) further bolsters this opportunity. Fujitsu's Fugaku supercomputer, for instance, has consistently ranked among the world's most powerful, enabling breakthroughs in areas like drug discovery and climate modeling. This established expertise in HPC complements its quantum computing ambitions, creating a powerful synergy for future innovation.

Key opportunities stemming from these advancements include:

- Developing quantum-accelerated solutions for complex supply chain and logistics optimization, potentially reducing costs by up to 20% for clients by 2025.

- Partnering with research institutions to unlock new scientific discoveries in fields like materials science and pharmaceuticals, leveraging quantum simulation capabilities.

- Offering specialized cloud-based quantum computing services, targeting industries that require immense computational power for data analysis and modeling.

- Creating hybrid HPC-quantum computing platforms that provide unparalleled performance for demanding enterprise workloads.

Fujitsu's expansion of its consulting services, particularly through initiatives like 'Uvance Wayfinders,' allows it to offer more comprehensive strategic guidance alongside technological solutions. This strengthens client relationships and positions Fujitsu as a key partner in digital transformation journeys. The company's proactive stance on sustainability and its commitment to achieving a 'net positive' impact also align with growing market demand for ESG-compliant solutions, a trend supported by the significant growth in ESG investing, projected to reach $33.9 trillion by the end of 2024.

Fujitsu's investments in cutting-edge technologies like quantum computing and its established expertise in high-performance computing (HPC) create opportunities for developing novel solutions to complex industrial problems. The company is well-positioned to offer quantum-accelerated services for optimization challenges and specialized cloud-based quantum computing, catering to industries requiring immense computational power.

| Opportunity Area | Description | Potential Impact | Relevant Data Point (2024/2025) |

|---|---|---|---|

| Digital Transformation Services | Broadening IT solutions and services portfolio to meet global demand for modernization. | Increased market share and revenue growth. | Global digital transformation services market projected to exceed $1.5 trillion in 2024. |

| Generative AI and Cloud Computing | Leveraging AI for productivity and secure cloud development for sensitive data. | Leadership in enterprise AI and capture of secure cloud services market. | Global AI market to reach over $1.5 trillion by 2030; secure cloud services market growing over 15% annually through 2025. |

| Sustainability Solutions | Offering technology for carbon reduction, resource efficiency, and inclusive digital society. | Tap into the expanding market for ESG-focused solutions. | ESG investing market estimated at $33.9 trillion in assets under management by end of 2024. |

| Quantum Computing & HPC | Developing quantum-accelerated solutions and hybrid HPC-quantum platforms. | Competitive advantage through advanced computing capabilities. | Potential for cost reductions of up to 20% for clients in supply chain optimization by 2025. |

Threats

Fujitsu operates in a fiercely competitive global IT services market, where rapid technological advancements and aggressive pricing strategies are the norm. This intense environment, marked by constant innovation, presents a significant challenge to maintaining market share and profitability.

Key rivals like Accenture, IBM, and TCS are investing heavily in emerging technologies and expanding their service portfolios, directly impacting Fujitsu's competitive positioning. For instance, the global IT services market was valued at approximately $1.3 trillion in 2023 and is projected to grow, but this growth is accompanied by heightened rivalry across all segments.

Failure to continuously innovate and effectively differentiate its cloud, data analytics, and cybersecurity solutions could lead to margin erosion and a decline in Fujitsu's market standing. The pressure to offer competitive pricing while simultaneously investing in R&D is a delicate balancing act for the company.

The ongoing fallout from the Post Office Horizon IT scandal continues to cast a long shadow over Fujitsu. The public inquiry, which has brought to light significant miscarriages of justice, poses a substantial threat to Fujitsu's reputation, particularly within the UK public sector where trust is paramount. This reputational damage could translate into lost contracts and a reluctance from government bodies to engage with the company for future IT projects.

Financial repercussions are also a serious concern. While specific figures for potential penalties are still unfolding, the scale of the scandal and the compensation being awarded to victims suggest that Fujitsu could face substantial financial liabilities. This uncertainty, coupled with the potential for further legal challenges, creates a challenging financial outlook and could divert resources from innovation and growth initiatives.

The high-technology sector, where Fujitsu operates, is characterized by relentless innovation, meaning existing products and services can quickly become outdated. This rapid technological obsolescence poses a significant threat, requiring constant vigilance and adaptation.

For Fujitsu, this translates into an ongoing need to invest heavily in research and development to stay ahead of emerging trends. Failure to do so could lead to a loss of market share to competitors who are quicker to adopt or develop new technologies.

In 2023, the global IT spending was projected to reach $4.7 trillion, a 4.5% increase from 2022, highlighting the dynamic nature of the market and the pressure to innovate. Fujitsu's ability to navigate these technological shifts is crucial for its sustained success.

Evolving Cybersecurity and AI-Powered Attacks

The escalating sophistication of cyber threats, particularly those enhanced by Artificial Intelligence and deepfake technologies, poses a significant and persistent challenge. As a prominent IT services provider, Fujitsu is compelled to perpetually fortify its cybersecurity defenses and service portfolio to safeguard its own infrastructure and its clientele from the escalating risk of data breaches and other cyber malfeasance.

The threat landscape is dynamic, with AI enabling attackers to craft more convincing phishing schemes and to automate the discovery of vulnerabilities at an unprecedented scale. For instance, reports indicate a substantial rise in AI-driven attacks, with some analyses suggesting a potential increase of over 50% in sophisticated AI-powered cyber threats targeting enterprises in the coming years. This necessitates continuous investment in advanced threat detection and response capabilities.

- AI-Enhanced Phishing: Deepfake audio and video are increasingly used to impersonate executives or trusted contacts, increasing the success rate of social engineering attacks.

- Automated Vulnerability Exploitation: AI algorithms can rapidly scan networks for weaknesses, launching targeted attacks before traditional security measures can react.

- Ransomware Evolution: AI is being integrated into ransomware to improve encryption techniques and evasion tactics, making recovery more difficult and costly for organizations.

- Data Breach Costs: The average cost of a data breach continues to climb, with recent estimates placing it in the millions of dollars, underscoring the financial impact of inadequate cybersecurity.

Global Economic Volatility and Geopolitical Risks

Global economic volatility, including fluctuating exchange rates and interest rates, presents a significant external risk to Fujitsu. For instance, the Japanese Yen's performance against major currencies like the US Dollar impacts the repatriated value of overseas earnings. In early 2024, the Yen experienced considerable depreciation, which could boost reported yen-denominated profits from foreign sales but also increase the cost of imported components.

Geopolitical tensions and ongoing supply chain disruptions continue to pose threats to Fujitsu's global operations. Events such as regional conflicts or trade policy shifts can lead to increased logistics costs, material shortages, and delays in product delivery. These factors directly affect Fujitsu's revenue streams and overall profitability by impacting production schedules and market access.

- Exchange Rate Fluctuations: A weaker Yen in early 2024, for example, can positively impact Fujitsu's reported profits when converting foreign currency earnings, but also raises the cost of imported raw materials and components.

- Geopolitical Instability: Ongoing conflicts and trade disputes can disrupt global supply chains, leading to increased operational costs and potential delays in product availability for Fujitsu's diverse customer base.

- Interest Rate Hikes: Rising interest rates globally can increase Fujitsu's borrowing costs and potentially dampen demand for its technology solutions as businesses and consumers face higher financing expenses.

- Supply Chain Vulnerabilities: Reliance on specific regions for critical components, exacerbated by geopolitical events, exposes Fujitsu to risks of production halts and increased lead times, impacting its ability to meet market demand.

Fujitsu faces intense competition from global IT giants, requiring constant innovation to maintain market share amidst rapid technological shifts. The ongoing fallout from the Post Office Horizon IT scandal severely damages Fujitsu's reputation, particularly in the UK public sector, leading to potential contract losses and financial liabilities. Escalating cyber threats, amplified by AI, necessitate continuous investment in advanced security measures to protect both Fujitsu and its clients.

Economic volatility, including currency fluctuations and rising interest rates, poses a significant risk to Fujitsu's global operations and profitability. Geopolitical instability and supply chain disruptions can further exacerbate these challenges, impacting production, delivery, and market access. The rapid pace of technological change means Fujitsu must consistently invest in R&D to avoid obsolescence and stay competitive.

| Threat Category | Specific Threat | Impact on Fujitsu | Data/Example (2024/2025) |

|---|---|---|---|

| Competitive Landscape | Intense Rivalry | Market share erosion, margin pressure | Global IT services market valued at ~$1.3 trillion (2023), with major players like Accenture, IBM, TCS heavily investing in AI and cloud. |

| Reputational Damage | Post Office Horizon Scandal | Loss of trust, reduced public sector contracts, potential financial penalties | Ongoing public inquiry impacting UK public sector engagements; financial liabilities still unfolding. |

| Cybersecurity Risks | AI-Enhanced Cyberattacks | Data breaches, service disruption, increased security costs | Projected increase in AI-driven attacks; average cost of data breach in millions of dollars. |

| Economic & Geopolitical Factors | Currency Fluctuations & Geopolitical Instability | Impact on repatriated earnings, increased operational costs, supply chain disruptions | Yen depreciation in early 2024 affects conversion of foreign earnings and import costs; ongoing global conflicts impacting supply chains. |

| Technological Obsolescence | Rapid Technological Advancements | Need for continuous R&D investment, risk of losing market share | Global IT spending projected at $4.7 trillion (2023), underscoring the dynamic market and innovation pressure. |

SWOT Analysis Data Sources

This Fujitsu SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial reports, comprehensive market intelligence, and insights from industry analysts. These sources provide a robust understanding of Fujitsu's operational performance and market positioning.