Fujitsu Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fujitsu Bundle

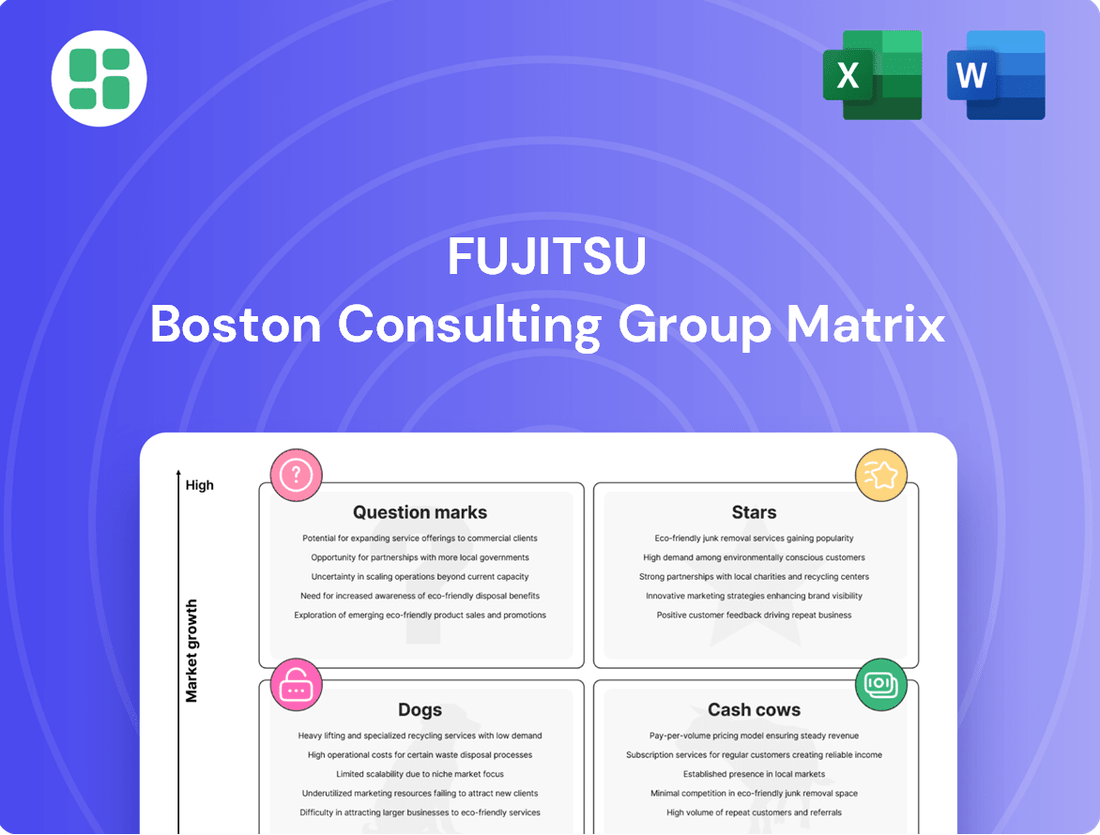

Curious about Fujitsu's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges. Understand where Fujitsu's innovations are positioned as Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full potential of this analysis by purchasing the complete Fujitsu BCG Matrix report. Gain a comprehensive understanding of their market share and growth rates, empowering you to make informed investment and resource allocation decisions.

Don't miss out on the strategic insights that can drive your own business forward. Invest in the full Fujitsu BCG Matrix today for a detailed breakdown and actionable recommendations.

Stars

Fujitsu Uvance Digital Transformation Services are positioned as a Star in the Fujitsu BCG Matrix. This is because Uvance is Fujitsu's key initiative to address societal and business challenges using digital technologies such as AI, cloud, and sustainability solutions.

The Service Solutions segment, where Uvance plays a central role, has been a significant contributor to Fujitsu's revenue and profitability growth. For instance, in fiscal year 2023, Fujitsu reported a 10.2% increase in revenue for its Service Solutions segment, reaching ¥1,565.5 billion.

Fujitsu has ambitious plans to expand Fujitsu Uvance considerably by fiscal year 2025, signaling its high growth potential and strategic importance. This focus on digital transformation services aligns with the growing market demand for advanced technological solutions to drive business efficiency and sustainability.

Fujitsu is making significant strides in Artificial Intelligence, aiming for a top global position in enterprise generative AI and embedding AI across its Uvance portfolio. This strategic push is already yielding results, with AI-powered network infrastructure and AI agents for manufacturing and IT operations being showcased. The company's substantial investment underscores AI solutions as a critical, high-growth segment for Fujitsu's future.

Fujitsu's cybersecurity services are a prime example of a Stars business within its BCG Matrix. The company has significantly ramped up its investment in this sector, building a robust team of experts and dedicating substantial resources. This strategic push is driven by the recognition of cybersecurity as a high-growth market with strong potential for long-term, high-margin contracts.

The company's commitment aims to capture substantial market share in an industry experiencing rapid expansion. For instance, the global cybersecurity market was valued at approximately $217.9 billion in 2023 and is projected to reach $400 billion by 2027, demonstrating a compound annual growth rate (CAGR) of over 16%. Fujitsu's focus here aligns perfectly with its broader digital transformation initiatives, leveraging this momentum to drive future revenue and profitability.

Modernization Business

Fujitsu's modernization business, a key component of its Service Solutions segment, is experiencing substantial growth. This area focuses on helping clients update their foundational IT systems and transition to cloud environments, a critical need in today's digital landscape.

The demand for these modernization services is particularly strong, fueled by companies looking to move away from aging, inefficient legacy systems. This trend is a significant driver for Fujitsu's service revenue and overall profitability.

- Robust Growth: Fujitsu's modernization business within Service Solutions has shown consistent year-on-year expansion.

- Demand Drivers: Strong demand stems from system renewals and migration from legacy IT assets.

- Profitability Contribution: This segment plays a vital role in enhancing the overall profitability of Fujitsu's service portfolio.

- Market Trend Alignment: The business is well-positioned to capitalize on the ongoing digital transformation trends across industries.

Cloud-Native Solutions

Fujitsu's strategic focus on cloud-native solutions is a significant driver of profitability within its Service Solutions segment. These modern, adaptable solutions are integral to the company's broader digital transformation efforts, catering to evolving global IT demands.

Cloud-native offerings represent an increasing share of Fujitsu's high-margin digital services portfolio. This shift reflects a deliberate move away from legacy IT services towards more lucrative, cloud-based digital solutions.

- Increased Profitability: Cloud-native solutions are directly contributing to higher profit margins in Fujitsu's Service Solutions.

- Digital Transformation Alignment: These offerings are central to Fujitsu's strategy for digital transformation, meeting current market needs.

- Growing High-Margin Segment: Cloud-native services are becoming a larger part of Fujitsu's profitable digital services.

- Shift in Service Model: The company is actively transitioning from traditional IT services to cloud-centric digital services.

Fujitsu's Uvance Digital Transformation Services, including its cybersecurity and modernization businesses, are firmly positioned as Stars in the BCG Matrix. These areas demonstrate robust growth and are key contributors to Fujitsu's revenue and profitability. The company's strategic investments in AI further solidify its Star status by targeting high-growth markets and embedding advanced technologies across its portfolio.

Fujitsu's Service Solutions segment, particularly driven by Uvance initiatives, experienced a notable 10.2% revenue increase in fiscal year 2023, reaching ¥1,565.5 billion. This growth is underpinned by strong demand for digital transformation, cybersecurity, and cloud-native solutions.

| Business Area | BCG Category | Key Growth Drivers | FY23 Revenue Contribution (Approx.) |

|---|---|---|---|

| Uvance Digital Transformation Services | Star | Societal/business challenges, AI, Cloud, Sustainability | Significant contributor to ¥1,565.5 billion Service Solutions revenue |

| Cybersecurity Services | Star | Growing market demand, high-margin contracts, digital security needs | Part of the growing Service Solutions segment |

| Modernization Business | Star | Legacy system renewal, cloud migration, digital infrastructure upgrades | Key driver of Service Solutions revenue and profitability |

| Cloud-Native Solutions | Star | Digital transformation, high-margin digital services, evolving IT demands | Increasing share of profitable digital services |

What is included in the product

The Fujitsu BCG Matrix offers strategic guidance by categorizing business units based on market share and growth, helping to allocate resources effectively.

Get a clear, actionable view of Fujitsu's portfolio, quickly identifying areas needing investment or divestment.

Cash Cows

Fujitsu's traditional IT services in Japan represent a classic Cash Cow within the BCG matrix. The company commands the leading market share in this mature sector, a testament to its deeply entrenched position and long-standing customer relationships.

This segment is a powerhouse for generating stable and predictable revenue streams. In 2024, the Japanese IT services market, while mature, continues to show resilience, with Fujitsu's established presence ensuring a consistent inflow of cash. This robust cash flow is crucial, acting as the financial engine to fuel innovation and expansion in other, more dynamic business areas.

Fujitsu's enterprise server business, particularly strong in Japan, acts as a significant cash cow, generating consistent revenue from its established client base. This segment, while operating in a growing overall market, represents a mature operation for Fujitsu, allowing it to extract reliable profits.

In fiscal year 2023, Fujitsu reported significant revenue from its Infrastructure Services segment, which includes servers, contributing to its overall financial stability. This steady income stream from existing enterprise contracts allows Fujitsu to fund investments in other, more growth-oriented areas.

Fujitsu's managed infrastructure services, particularly those under mature, long-term contracts, are a bedrock of its financial stability. These agreements, often spanning multiple years, ensure a predictable and consistent revenue stream, acting as a reliable cash generator for the company.

While not a high-growth segment, the essential nature of these IT infrastructure services, coupled with deep-seated client relationships, underpins their consistent cash flow generation. This stability is vital for Fujitsu's overall financial health.

In 2024, Fujitsu reported significant revenue from its Managed Services segment, with a substantial portion attributed to these established infrastructure contracts. This segment's consistent performance allows Fujitsu to invest in innovation and support its more dynamic business units.

PC Business (Business-focused and Japan Market)

Fujitsu's PC business, primarily targeting the Japanese market, functions as a Cash Cow within its portfolio. Despite exiting certain European operations, the company maintains a strong presence in Japan, a mature market where it holds a notable share of laptop ownership. This strategic focus ensures consistent revenue streams and healthy cash flow generation.

The business-focused segment, offering notebooks, desktops, and workstations, benefits from recent model refreshes, indicating continued investment and customer engagement. This steady performance in a mature market underscores its Cash Cow status, providing reliable financial contributions to Fujitsu.

- Market Focus: Primarily Japan, a mature but stable PC market.

- Product Offering: Business notebooks, desktops, and workstations.

- Financial Contribution: Generates steady sales and positive cash flow.

- Recent Activity: Model refreshes indicate ongoing commitment and relevance.

Established Network and Communication Services

Fujitsu's established network and communication services, particularly those catering to long-term clients and government agencies, are a significant source of dependable revenue. These offerings are entrenched in mature markets where Fujitsu holds substantial market share within particular segments. This allows for steady cash flow without requiring heavy investment in marketing or growth initiatives.

The company's extensive experience in providing these services translates to operational efficiencies and a strong reputation, further solidifying its position. For instance, Fujitsu's involvement in critical infrastructure projects often guarantees long-term contracts, creating a predictable income stream.

- Reliable Revenue Generation: Fujitsu's established network and communication services, especially those with long-standing clients and government contracts, consistently generate stable income.

- Mature Market Dominance: Operating in mature markets, these services benefit from high market share in specific niches, ensuring consistent cash generation.

- Low Investment Needs: The mature nature of these services means relatively low investment is needed for promotion or expansion, maximizing cash flow.

- Strategic Importance: These services often underpin critical infrastructure, providing Fujitsu with a secure and predictable revenue base.

Fujitsu's traditional IT services in Japan, its enterprise server business, and its PC offerings in the Japanese market are prime examples of Cash Cows within the BCG matrix. These segments benefit from high market share in mature, stable markets, generating consistent and predictable revenue streams. This robust cash flow is vital, providing the financial backbone to support investments in more dynamic or emerging business areas for Fujitsu.

| Business Segment | Market Position | Cash Flow Generation | Strategic Role |

|---|---|---|---|

| Traditional IT Services (Japan) | Leading market share in a mature sector | Stable and predictable revenue | Funds innovation and growth initiatives |

| Enterprise Server Business (Japan) | Strong established client base | Consistent revenue and reliable profits | Supports investment in other business units |

| PC Business (Japan) | Notable share in a mature market | Steady sales and positive cash flow | Provides reliable financial contributions |

What You See Is What You Get

Fujitsu BCG Matrix

The Fujitsu BCG Matrix report you are currently previewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no demo content—just the comprehensive, professionally formatted analysis ready for your strategic decision-making. You can be confident that the insights and structure you see here are precisely what will be delivered, enabling you to seamlessly integrate this valuable strategic tool into your business planning and presentations without any further work required.

Dogs

Fujitsu's decision to phase out mainframes and Unix servers by 2030 firmly places these legacy hardware segments into the Dogs category of the BCG Matrix. This strategic move acknowledges the declining market for these technologies, characterized by low future growth prospects.

These segments likely represent a low market share for Fujitsu, coupled with diminishing profitability as customer demand shifts towards newer, more agile solutions. Consequently, these products are candidates for divestiture or a carefully managed, phased discontinuation to minimize disruption and reallocate resources.

Fujitsu's Ubiquitous Solutions segment saw a revenue dip in Europe, largely due to strategic exits from unprofitable ventures. This move signals a focus on efficiency, shedding operations that were draining resources without yielding adequate returns.

In 2023, Fujitsu reported that its European business, particularly within the Ubiquitous Solutions area, faced challenges leading to a revenue decline. This decline was a direct consequence of the company's decision to discontinue certain services and products in the region that were deemed unprofitable.

Fujitsu's pre-2024 strategy saw them exit the European personal computer market, a move driven by declining sales. This decision highlighted a strategic retreat from consumer segments where their market share was low and growth was negative, particularly in older PC models that struggled to compete.

The company's withdrawal from Europe in the PC sector underscored a broader challenge: maintaining profitability in a highly competitive consumer market. This was evident as global PC shipments saw a significant decline in 2023, with IDC reporting a 14.8% year-over-year drop, indicating a tough environment for many players.

Non-core Device Solutions Business

Fujitsu's Non-core Device Solutions Business, as part of its strategic review, has been categorized under discontinued operations. This classification indicates that these segments were not central to Fujitsu's long-term growth strategy and demonstrated limited profitability.

The decision to divest or wind down these operations reflects a focus on core competencies and higher-margin businesses. For instance, in fiscal year 2023, Fujitsu reported a significant shift in its operational focus, moving away from certain hardware-centric businesses.

- Discontinued Operations: The Device Solutions segment, encompassing areas like personal computers and related peripherals, is now treated as a discontinued operation in Fujitsu's financial reporting.

- Low Profitability: These non-core units historically struggled with consistent profitability, making them less attractive compared to the company's strategic growth areas.

- Strategic Realignment: The divestment aligns with Fujitsu's broader strategy to concentrate on digital transformation, cloud services, and artificial intelligence, areas offering greater growth potential and synergy.

- Financial Impact: While specific figures for the discontinued device solutions segment in 2024 are still being consolidated, the overall impact of such strategic exits aims to improve the company's profitability and resource allocation.

Impacted Public Sector Contracts (Post Office Scandal Fallout)

The ongoing fallout from the Post Office Horizon scandal has severely impacted Fujitsu's standing in the UK public sector. This reputational damage has directly translated into lost contracts and a diminished capacity to win new government business.

Several public sector engagements, previously considered stable, are now viewed as low-growth and potentially unprofitable due to the scandal's lingering effects. These contracts can become a drain on Fujitsu's resources and further tarnish its image.

- Reputational Damage: The scandal has led to widespread public distrust, making government bodies hesitant to award new contracts.

- Lost Business: Fujitsu has reportedly lost or had to renegotiate contracts valued in the tens of millions of pounds due to the scandal. For example, reports in early 2024 indicated potential losses of significant value from ongoing government IT projects.

- Increased Scrutiny: Future bids for public sector work will face heightened scrutiny, increasing the cost and complexity of securing new agreements.

- Financial Strain: The costs associated with legal settlements and compensation related to the scandal, estimated to be in the hundreds of millions of pounds, further strain Fujitsu's financial resources, impacting its ability to invest in new growth areas.

Fujitsu's legacy hardware, like mainframes and Unix servers, are now firmly in the Dogs category due to declining demand and low future growth. These segments, characterized by low market share and diminishing profitability, are candidates for divestiture or a carefully managed phase-out to reallocate resources to more promising areas.

Fujitsu's exit from the European PC market in 2023, driven by declining sales and intense competition, exemplifies a Dog strategy. This move, coupled with the classification of its Non-core Device Solutions Business as discontinued operations, underscores a focus on shedding unprofitable ventures to improve overall financial health and concentrate on high-growth sectors.

The Post Office Horizon scandal has significantly impacted Fujitsu's UK public sector business, leading to lost contracts and a diminished ability to secure new government work. This reputational damage has made existing contracts low-growth and potentially unprofitable, further straining Fujitsu's financial resources as it faces increased scrutiny and costs.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Data/Impact |

|---|---|---|---|

| Mainframes & Unix Servers | Dogs | Declining market, low future growth, low market share for Fujitsu, diminishing profitability. | Phasing out by 2030; strategic exit from unprofitable ventures in Europe (Ubiquitous Solutions) contributed to revenue dip. |

| Personal Computers (Europe) | Dogs | Low market share, negative growth, highly competitive market. | Exited European PC market in 2023 due to declining sales; global PC shipments dropped 14.8% YoY in 2023 (IDC). |

| Non-core Device Solutions | Dogs | Not central to long-term strategy, limited profitability, historically struggled with consistent returns. | Classified as discontinued operations; strategic realignment to focus on digital transformation, cloud, and AI. |

| UK Public Sector IT Services (Post-Scandal) | Dogs | Reputational damage, lost contracts, increased scrutiny, potential for low growth/unprofitability. | Reported losses of tens of millions of pounds in early 2024; legal settlements and compensation costs in hundreds of millions. |

Question Marks

Fujitsu is heavily investing in quantum computing, with a goal of creating a superconducting quantum computer boasting over 10,000 qubits by 2030. This aggressive R&D push signifies their commitment to a sector poised for substantial future growth, even though the technology is still in its infancy.

Currently, Fujitsu's quantum computing ventures are in the early stages of development. This means they are a significant drain on research and development funds, with minimal to no current market share or revenue generation from these specific offerings.

Advanced Generative AI Applications, while a part of Fujitsu's broader AI Star, are currently positioned as Question Marks. These highly specialized solutions, often targeting niche industries like advanced drug discovery or hyper-personalized content creation, are in their nascent stages. Despite their significant future growth potential, they currently exhibit low market penetration and unproven profitability, demanding substantial investment to establish a foothold.

Fujitsu's ambitious plan to quintuple its consultancy staff and dramatically boost consulting revenue by fiscal 2025/2026 places it squarely in the Question Mark quadrant of the BCG Matrix. This strategy targets rapid expansion in a high-growth market.

Despite this growth aspiration, Fujitsu faces significant hurdles, including admitted recruitment difficulties and operating profit margins that trail behind industry leaders. These challenges suggest that while the market opportunity is substantial, Fujitsu's current market share and operational efficiency are not yet competitive.

Sustainability Transformation (SX) Offerings

Fujitsu is actively positioning Sustainability Transformation (SX) as a core pillar of its strategy, utilizing digital advancements to tackle pressing environmental and social challenges. This focus aligns with a global trend where businesses are increasingly prioritizing sustainable practices.

The market for SX solutions is experiencing robust growth, with projections indicating continued expansion in the coming years. For instance, the global sustainability consulting market was valued at approximately $12.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 6% through 2030, reaching an estimated $20 billion. Fujitsu's specific market share within this dynamic and high-potential segment is likely modest at this stage, necessitating substantial investment to cultivate a leading presence.

- Market Growth: The global sustainability consulting market is a rapidly expanding sector, demonstrating significant investor and corporate interest.

- Investment Needs: To capture a substantial share of this growing market, Fujitsu will likely need to make considerable investments in developing and marketing its SX offerings.

- Digital Integration: Fujitsu's approach emphasizes integrating digital technologies, such as AI and IoT, to create innovative solutions for sustainability challenges.

- Strategic Importance: SX is recognized as a crucial area for future business growth and competitive advantage, driving companies to adopt more sustainable operational models.

AI-Enhanced Network Infrastructure (New Deployments)

Fujitsu is actively demonstrating AI capabilities designed to streamline 5G and optical network operations, signaling a strategic push into advanced network infrastructure. This segment represents a significant growth opportunity fueled by global efforts in network upgrades and expansion. For instance, the global 5G infrastructure market was valued at approximately USD 45.5 billion in 2023 and is projected to reach USD 149.7 billion by 2030, growing at a CAGR of 18.7%.

Fujitsu's investment in AI for these new deployments positions them to capitalize on this expanding market. However, their current market share in these nascent, AI-integrated networking solutions is likely in its early stages. Continued research and development, along with strategic partnerships, will be crucial for Fujitsu to secure a competitive position and gain substantial market traction in this high-growth area.

- Market Growth: The 5G infrastructure market is experiencing robust expansion, driven by increasing demand for faster connectivity and new applications.

- AI Integration: Fujitsu's focus on AI for network optimization highlights a key trend in modernizing and enhancing network performance.

- Market Share Development: As a relatively new entrant in AI-enhanced infrastructure, Fujitsu's market share is expected to grow with continued investment and innovation.

- Investment Focus: Significant R&D and strategic alliances are vital for Fujitsu to establish a strong foothold in this competitive and evolving sector.

Question Marks in Fujitsu's portfolio represent areas with high growth potential but currently low market share. These ventures require significant investment to develop and gain traction. The company is strategically investing in these nascent technologies, aiming to establish a strong future market position.

| Business Area | Market Growth | Market Share | Investment Needs | Strategic Outlook |

|---|---|---|---|---|

| Quantum Computing | Very High (Emerging) | Negligible | Very High | Long-term potential, high risk |

| Advanced Generative AI Apps | High | Low | High | Niche applications, future growth |

| Consultancy Services | High | Moderate (Growing) | Moderate to High | Rapid expansion target |

| Sustainability Transformation (SX) | High (e.g., $12.5B in 2023, 6% CAGR projected) | Low | High | Core strategic pillar, digital integration |

| AI for 5G/Optical Networks | Very High (e.g., $45.5B in 2023, 18.7% CAGR projected) | Low | High | Leveraging AI for infrastructure growth |

BCG Matrix Data Sources

Our Fujitsu BCG Matrix is constructed using a blend of internal financial performance data, comprehensive market research reports, and industry-specific growth forecasts to provide a robust strategic overview.