FTC Solar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FTC Solar Bundle

FTC Solar navigates a dynamic solar industry, facing moderate buyer power as project developers seek competitive pricing. Supplier power is also a key consideration, with the availability and cost of critical components influencing margins.

The threat of new entrants, while present, is somewhat mitigated by the capital intensity and established relationships required in the utility-scale solar sector. However, the threat of substitutes, such as other renewable energy sources or advancements in energy storage, demands continuous innovation.

The complete report reveals the real forces shaping FTC Solar’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The solar tracker industry, including companies like FTC Solar, heavily depends on specialized components such as high-quality steel, precision motors, and sophisticated electronic systems. The availability and pricing of these critical inputs significantly influence FTC Solar's operational costs and overall profitability.

A key factor impacting FTC Solar's bargaining power with suppliers is the concentration within the supply base for these specialized components. If only a limited number of companies can produce these essential parts, FTC Solar's ability to negotiate favorable terms is diminished. For instance, in 2024, the global steel market experienced price volatility, with benchmarks like the TSI US Midwest Hot-Rolled Coil Index fluctuating, impacting raw material costs for manufacturers.

This concentration can translate into higher input costs for FTC Solar, as dominant suppliers may have the leverage to dictate prices. Furthermore, a reliance on a few key suppliers increases the risk of supply chain disruptions. Should one of these major suppliers encounter production issues, quality control problems, or even go out of business, it could directly impact FTC Solar's ability to fulfill orders and maintain its production schedules.

Switching suppliers for critical solar components can be a costly endeavor for FTC Solar. These costs aren't just about finding a new vendor; they often involve significant investments in re-engineering product designs to accommodate new parts, rigorous re-qualification processes for those new components, and the establishment of entirely new logistical and supply chain networks. For instance, in 2024, the average cost for a solar manufacturer to switch a key component supplier could range from tens of thousands to hundreds of thousands of dollars, depending on the complexity of the part and integration.

These high switching costs effectively bolster the bargaining power of FTC Solar's suppliers. When it's difficult and expensive for FTC Solar to move to an alternative supplier, existing suppliers gain leverage. This can translate into less favorable pricing, less flexible contract terms, and a reduced ability for FTC Solar to negotiate aggressively on cost or delivery schedules, potentially impacting the company's profitability and operational efficiency.

Suppliers providing highly specialized or proprietary components for FTC Solar's Voyager tracker, such as advanced control systems or unique durable materials, wield significant bargaining power. The reliance on these non-replicable inputs allows these suppliers to negotiate favorable terms and potentially higher prices.

Threat of Forward Integration by Suppliers

If a key supplier possesses the capability or incentive to manufacture solar trackers themselves, FTC Solar faces a significant increase in supplier bargaining power. This potential for forward integration means suppliers could transition from component providers to direct competitors, leveraging their existing expertise in materials or manufacturing processes.

This threat can compel FTC Solar to negotiate less favorable terms, such as higher component prices or stricter payment conditions, simply to secure essential supplies and avoid losing their supplier to a direct competitive role. For instance, a large-scale solar panel manufacturer with an established supply chain for raw materials might explore producing their own trackers to capture more of the value chain.

- Forward Integration Threat: Suppliers entering the solar tracker market directly diminishes FTC Solar's leverage.

- Competitive Advantage: Suppliers can use component knowledge to become rivals.

- Negotiation Impact: FTC Solar may face pressure for less favorable contract terms.

Impact of Raw Material Price Volatility

The price of raw materials, especially steel which is a key component in solar trackers, directly affects supplier costs and, by extension, FTC Solar's purchasing expenses. For instance, steel prices saw significant fluctuations in 2024, with some reports indicating increases of over 15% in certain periods due to supply chain disruptions and increased demand from infrastructure projects.

This instability in global commodity markets can give suppliers more leverage, allowing them to adjust their prices more frequently. This dynamic can limit FTC Solar's capacity to secure consistent or reduced pricing for its essential inputs.

- Steel Price Fluctuations: Global steel prices experienced volatility throughout 2024, impacting manufacturing costs.

- Supplier Pricing Power: Volatile commodity markets enable suppliers to dictate pricing more assertively.

- Procurement Challenges: FTC Solar faces challenges in negotiating stable, lower prices for its primary raw materials.

- Impact on Margins: Increased input costs due to supplier power can compress profit margins for FTC Solar.

Suppliers to FTC Solar, particularly those providing specialized components like advanced motors or proprietary electronic systems, hold considerable bargaining power. This is amplified when these suppliers are few in number or when switching to an alternative is costly and time-consuming for FTC Solar. For example, in 2024, the cost to re-engineer and qualify a new critical component supplier for solar tracking systems could easily range from $50,000 to $250,000, depending on the component's complexity.

This leverage allows suppliers to command higher prices and less favorable terms, directly impacting FTC Solar's cost structure and profit margins. The concentration of suppliers for essential materials like high-grade steel, which saw price increases of up to 15% in certain periods of 2024 due to global demand, further strengthens supplier influence.

Furthermore, if suppliers have the capability to integrate forward into manufacturing solar trackers themselves, FTC Solar faces an increased risk of its suppliers becoming direct competitors, which can lead to less favorable contract negotiations to secure vital components.

| Factor | Impact on FTC Solar | 2024 Data/Example |

|---|---|---|

| Supplier Concentration | Reduced negotiation power for FTC Solar | Limited number of manufacturers for specialized motors |

| Switching Costs | Bolsters supplier leverage | $50,000 - $250,000 to re-qualify a key component supplier |

| Raw Material Volatility | Increased input costs for FTC Solar | Steel prices up to 15% in some 2024 periods |

| Forward Integration Threat | Potential for suppliers to become competitors | Large component manufacturers exploring tracker production |

What is included in the product

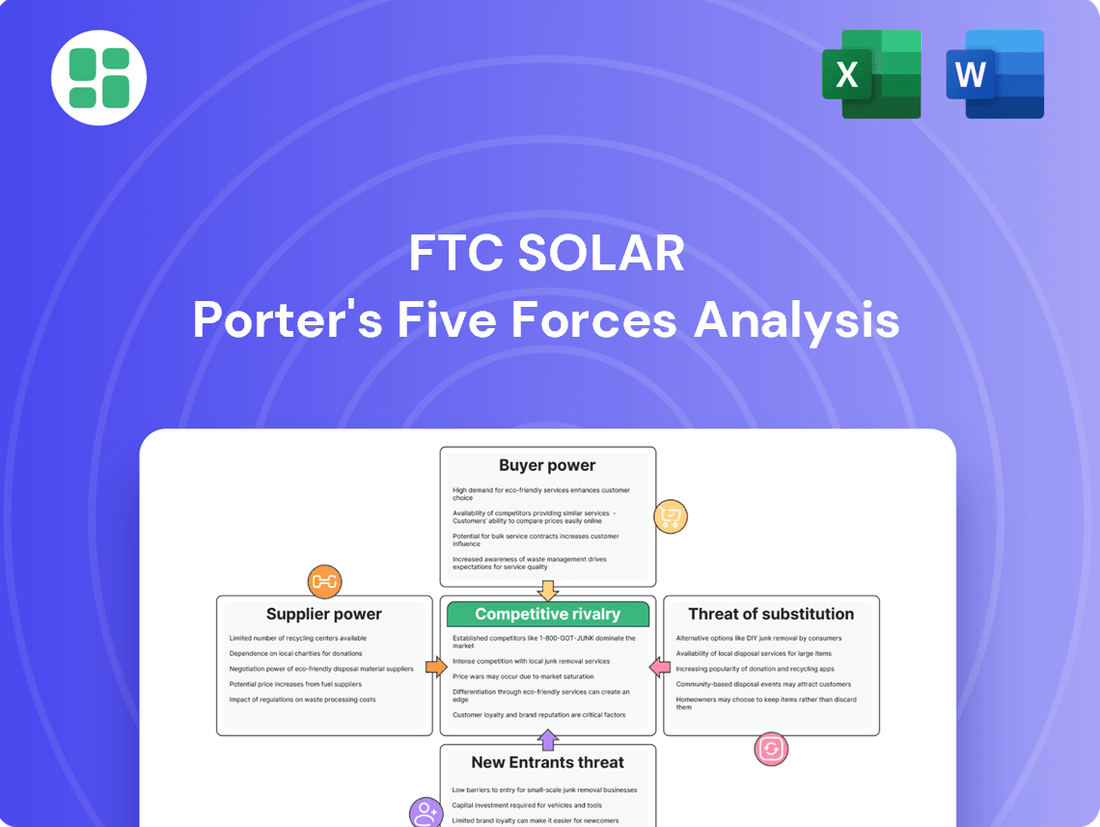

This analysis dissects FTC Solar's competitive environment by examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the solar industry.

Effortlessly visualize competitive pressures with a dynamic spider chart, allowing for instant strategic insights into FTC Solar's market position.

Customers Bargaining Power

FTC Solar's customer base is primarily composed of large utility-scale solar project developers and independent power producers. These are not small, one-off purchases; these clients are making substantial investments.

The sheer size of the orders placed by these customers means that a few key clients can represent a significant portion of FTC Solar's revenue. For instance, in 2023, FTC Solar reported that its top two customers accounted for approximately 37% of its total revenue, highlighting the impact of customer concentration.

This concentration of significant buyers grants them considerable bargaining power. They can leverage their large order volumes to negotiate more favorable pricing, extended payment schedules, or even request specific product modifications, directly impacting FTC Solar's profit margins and operational flexibility.

If solar tracker systems become highly standardized, customers gain significant leverage. This standardization allows them to easily compare offerings across different providers, much like comparing different brands of smartphones. With minimal effort and cost to switch, customers can demand lower prices, directly impacting FTC Solar's ability to set its own rates.

While FTC Solar is pushing innovation with its Voyager tracker, a widespread perception of interchangeability among tracker technologies would empower buyers. This perception means customers could easily switch to a competitor if they offer a slightly better price or more favorable terms. This commoditization directly threatens FTC Solar's pricing power and, consequently, its profit margins.

In 2023, the global solar tracker market was valued at approximately $5.2 billion, with projections indicating continued growth. However, a significant portion of this market relies on established technologies. If new innovations, including FTC Solar's, are perceived as easily replicable or interchangeable, the bargaining power of large utility-scale solar project developers, who are FTC Solar's primary customers, will increase substantially, potentially leading to price pressures on all suppliers.

For utility-scale solar projects, the primary goal is to minimize the Levelized Cost of Energy (LCOE). This makes customers extremely sensitive to the pricing of every component, including the solar trackers FTC Solar offers. For instance, in 2024, the global average LCOE for utility-scale solar PV has continued to decline, with some projects achieving figures as low as $20-$30 per megawatt-hour, underscoring the pressure on suppliers to be cost-competitive.

FTC Solar must clearly articulate how its trackers provide tangible cost savings or enhanced performance to justify their price. If these advantages aren't evident, customers will likely push for lower prices, leveraging the competitive landscape of solar component suppliers.

Customers' Ability to Backward Integrate

Large solar project developers and Engineering, Procurement, and Construction (EPC) firms possess the potential to design and manufacture their own solar tracker systems. This is particularly true for massive, standardized projects where economies of scale can be realized. While the capital outlay and technical know-how are substantial, the mere possibility of such backward integration significantly bolsters customer bargaining power.

This inherent threat can constrain FTC Solar's pricing flexibility, as customers can leverage this option to negotiate more favorable terms. For instance, a developer undertaking a gigawatt-scale project might calculate the cost savings of in-house production versus purchasing from FTC Solar, thereby influencing contract negotiations. The global solar tracker market, projected to reach over $15 billion by 2028, sees intense competition, making this customer leverage a critical factor.

- Potential for In-House Manufacturing: Large developers can explore designing and producing their own tracker systems for large-scale, repetitive projects.

- Investment and Expertise Barrier: Significant capital and specialized knowledge are required for backward integration, acting as a partial deterrent.

- Threat of Backward Integration: The mere possibility of customers producing their own trackers increases their leverage in negotiations with suppliers like FTC Solar.

- Impact on Pricing: This customer power can limit FTC Solar's ability to charge premium prices for its tracker solutions.

Availability of Alternative Tracking Solutions

The availability of alternative tracking solutions significantly impacts the bargaining power of FTC Solar's customers. Customers can choose from a range of single-axis trackers, dual-axis trackers, and even fixed-tilt mounting systems offered by competitors. For instance, in 2024, the global solar tracker market was estimated to be worth over $10 billion, with numerous players offering diverse solutions.

This multiplicity of viable alternatives, each with its own cost-performance characteristics, grants customers considerable leverage. They can compare offerings from companies like Array Technologies, Nextracker, and others, using this information to negotiate more favorable terms with FTC Solar. The ability to switch providers based on price, technological features, or specific project needs directly strengthens the customer's position.

Customers can leverage these choices to secure better pricing or more tailored solutions. For example, a customer might find that a competitor’s fixed-tilt system, while less efficient, offers a significantly lower upfront cost, which can be a deciding factor in large-scale projects. This competitive landscape means FTC Solar must remain competitive in its pricing and product development to retain its customer base.

- Broad Market Options: Customers have access to multiple types of solar mounting and tracking systems from various manufacturers.

- Competitive Pricing: The presence of numerous alternatives allows customers to compare pricing and negotiate for better deals.

- Feature Differentiation: Different tracking solutions offer varying levels of energy yield and operational complexity, giving customers choice based on project specifics.

- Switching Ease: The relative ease of switching between different tracker providers, especially for standardized systems, empowers customers.

FTC Solar's customers, primarily large utility-scale solar developers, wield significant bargaining power due to their substantial order volumes and focus on minimizing the Levelized Cost of Energy (LCOE). This sensitivity to cost means that even minor price reductions from competitors can shift purchasing decisions. For instance, with global average LCOE for utility-scale solar PV in 2024 sometimes reaching as low as $20-$30 per megawatt-hour, every component's cost is scrutinized.

The threat of customers potentially developing their own tracker systems for massive projects, coupled with the availability of numerous alternative tracking solutions from competitors, further amplifies this power. This competitive landscape, where the global solar tracker market was valued at over $10 billion in 2024, compels FTC Solar to maintain competitive pricing and continuous innovation to retain its client base.

| Factor | Customer Bargaining Power | Impact on FTC Solar |

|---|---|---|

| Order Volume Concentration | High (Top 2 customers ~37% revenue in 2023) | Enables negotiation for better pricing and terms. |

| LCOE Sensitivity | High (Focus on cost reduction for projects) | Drives demand for lower-priced, cost-competitive solutions. |

| Backward Integration Potential | Moderate to High (For large, standardized projects) | Constrains pricing flexibility; threat of in-house production. |

| Availability of Alternatives | High (Numerous competitors and system types) | Facilitates price comparison and switching; limits pricing power. |

Preview the Actual Deliverable

FTC Solar Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual FTC Solar Porter's Five Forces Analysis, detailing competitive forces within the solar industry. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning.

Rivalry Among Competitors

The solar tracker market is quite crowded, featuring both large, global corporations and smaller, more specialized companies that focus specifically on tracker technology. This means FTC Solar isn't operating in a vacuum; it's up against a variety of competitors.

Leading the pack are major players like Array Technologies and Nextracker, which have secured substantial portions of the market. For instance, Nextracker reported a significant increase in its backlog in early 2024, indicating strong demand and its prominent position. Array Technologies also continues to expand its global reach and product offerings.

This intense competition puts considerable pressure on FTC Solar. To succeed, the company must find ways to make its products and services stand out from the crowd, offering unique value propositions to customers in a market where many similar solutions exist.

While the global solar market is still expanding, the solar tracker segment might see uneven growth or saturation in certain areas. For instance, in 2023, the global solar PV market installed a record 413 GW, a 37% increase from 2022, showing continued strong demand. However, within this, the tracker market's growth rate can vary significantly by region.

In regions where solar adoption is more mature or the market is becoming saturated, competition among solar tracker manufacturers is likely to heat up. This intensified rivalry often translates into more aggressive pricing tactics and a greater emphasis on marketing and sales efforts as companies vie for a larger piece of the existing market share.

FTC Solar's competitive edge hinges on its Voyager tracker technology and sophisticated software, designed to boost energy output. The real test of this differentiation lies in how much customers truly value these innovations. If rivals can easily match these advancements, competition will likely intensify, pushing the focus towards cost reduction rather than unique features.

Exit Barriers for Competitors

FTC Solar faces a challenge from high exit barriers within the solar industry. Significant investments in specialized manufacturing equipment and research and development represent substantial sunk costs for many competitors. For instance, the capital expenditure for a typical solar wafer manufacturing line can easily run into hundreds of millions of dollars, making it economically unfeasible for companies to simply shut down operations when facing losses.

These high exit barriers mean that even unprofitable competitors may remain in the market, contributing to overcapacity. This situation intensifies price competition, as these companies prioritize covering variable costs rather than realizing their fixed investments. In 2024, the global solar panel market experienced continued price pressures, with average selling prices for polysilicon modules seeing a decline of approximately 10-15% year-over-year, partly due to this persistent oversupply.

- Sunk Costs: High capital investment in manufacturing facilities and specialized technology.

- Intellectual Property: Proprietary processes and patents can be difficult to divest.

- Long-Term Contracts: Existing supply and offtake agreements can obligate continued operation.

- Market Dynamics: Companies may operate at low margins to avoid the costs associated with exiting the market.

Pricing Pressure and Profitability

The solar tracker industry, including FTC Solar, faces significant pricing pressure. This is largely due to the substantial capital required for solar projects and a strong customer emphasis on the Levelized Cost of Energy (LCOE). Companies frequently engage in aggressive bidding to win major utility-scale contracts.

This intense price competition directly impacts profitability. When competitors bid aggressively, it can lead to compressed profit margins throughout the sector, posing a challenge for FTC Solar's financial results.

- Pricing Pressure: Customers prioritize LCOE, driving down prices for solar trackers.

- Aggressive Bidding: Competitors often engage in fierce bidding wars for large projects.

- Margin Compression: Intense price competition can significantly reduce profit margins for companies like FTC Solar.

- Financial Performance Impact: Reduced margins directly challenge the financial health and performance of industry players.

The solar tracker market is highly competitive, with established giants like Nextracker and Array Technologies holding significant market share, as evidenced by Nextracker's robust backlog growth in early 2024. FTC Solar must differentiate its Voyager tracker and software to stand out against these well-entrenched players. This rivalry intensifies in mature markets, leading to price wars and increased marketing spend. High exit barriers, such as substantial investments in manufacturing, keep even struggling competitors in the game, contributing to overcapacity and further price pressure, with polysilicon module prices seeing a 10-15% year-over-year decline in 2024.

| Competitor | Market Position | Key Strengths |

|---|---|---|

| Nextracker | Market Leader | Strong backlog, extensive global presence, advanced technology |

| Array Technologies | Major Player | Global expansion, diverse product portfolio, established customer base |

| FTC Solar | Challenger | Voyager tracker technology, sophisticated software, focus on innovation |

SSubstitutes Threaten

Fixed-tilt ground-mounted solar systems act as a significant substitute for more advanced tracker technologies. While they capture less energy, typically around 5-15% less than single-axis trackers, their lower upfront cost makes them attractive. For instance, in 2024, the global average cost for fixed-tilt utility-scale solar installations hovered around $0.90-$1.20 per watt, compared to $1.10-$1.50 per watt for systems with trackers, making them a compelling choice for budget-conscious projects.

The simplicity of installation and maintenance for fixed-tilt systems further enhances their appeal as a substitute. This translates to lower operational expenditures over the lifetime of the project. Consequently, the availability and cost-effectiveness of fixed-tilt solutions can cap the market penetration and pricing power of solar tracker manufacturers, limiting the overall potential for higher-efficiency, but more expensive, tracking systems.

Rooftop solar installations present a significant threat of substitution for FTC Solar's core business of large-scale, ground-mounted solar projects. While differing in scale, rooftop solar directly addresses energy needs, offering a viable alternative for commercial and industrial clients who might otherwise consider utility-scale solutions. In 2024, the distributed solar market continued its robust growth, with rooftop solar accounting for a substantial portion of new renewable energy capacity additions, particularly in regions with favorable net metering policies.

From a wider energy viewpoint, alternatives like wind, hydro, and geothermal power compete with solar energy. While not directly replacing solar trackers, improvements and lower costs in these other renewables can shift investment away from large-scale solar farms, impacting the overall market for solar infrastructure.

Energy Storage Solutions and Grid Modernization

The growing adoption of battery energy storage systems (BESS) and smarter grid management technologies presents a significant threat of substitutes for solar tracking solutions. As grids become more modernized and energy storage becomes more cost-effective, the fundamental value proposition of maximizing instantaneous energy yield from solar trackers may diminish. For instance, by mid-2024, the levelized cost of storage (LCOS) for utility-scale battery storage has continued its downward trend, making grid-level energy buffering more economically viable. This reduces the urgency to capture every possible kilowatt-hour from solar panels at the exact moment of peak generation, potentially lowering the premium placed on sophisticated tracking systems.

This shift could lead to a reallocation of capital. Instead of investing heavily in advanced tracking hardware, project developers might prioritize investments in BESS and grid integration software. For example, the global BESS market was projected to reach over $150 billion by 2025, indicating substantial investment flows into this area. If stored energy can reliably meet demand, the competitive advantage of trackers in optimizing output might be less critical, impacting the market for these technologies.

- Reduced Need for Peak Generation Optimization: As BESS becomes more prevalent, the ability to store solar energy and dispatch it during peak demand periods lessens the reliance on maximizing instantaneous solar output through tracking.

- Shifting Investment Priorities: Capital that might have been allocated to advanced solar tracking systems could be redirected towards battery storage and grid modernization technologies due to their increasing economic viability.

- Cost-Effectiveness of Storage: Declining costs in battery technology and improved grid management software make energy storage a more attractive substitute for maximizing solar generation efficiency, potentially impacting the demand for sophisticated tracking solutions.

Technological Advancements in Solar Panels

Technological advancements in solar panels present a significant threat of substitutes. For instance, the development of bifacial solar modules, which capture sunlight from both sides, and higher wattage panels are directly impacting the value proposition of solar trackers. These innovations mean that a smaller area can now generate sufficient power with static panel configurations.

This trend could diminish the economic justification for the added complexity and cost associated with solar tracking systems. For example, while trackers can increase energy yield by 15-25% compared to fixed-tilt systems, the improved efficiency of static panels might narrow this gap. By 2024, the cost of solar PV has fallen dramatically, making highly efficient static panels increasingly competitive.

- Improved Static Panel Efficiency: Innovations like PERC, TOPCon, and heterojunction (HJT) technologies are pushing static panel efficiency higher, potentially reducing the need for tracking.

- Bifacial Module Adoption: Bifacial panels, which can account for 10-30% of total energy gain depending on ground albedo, offer increased energy density without tracking.

- Cost Reduction in PV: The continued decline in solar panel costs makes the upfront investment in advanced static panels more attractive relative to the combined cost of trackers and less efficient panels.

- Reduced Incremental Benefit of Tracking: As static panel technology improves, the incremental energy gain from trackers may not always justify their added cost and maintenance, especially in specific project contexts.

The threat of substitutes for FTC Solar's tracking solutions is multifaceted, encompassing alternative solar configurations, other renewable energy sources, and advancements in energy storage and grid management. Fixed-tilt systems, while less efficient, offer a lower upfront cost, making them a viable substitute for projects with tighter budgets. For instance, in 2024, the cost difference between fixed-tilt and tracked systems remained significant, with fixed-tilt systems often costing $0.20-$0.30 per watt less.

Rooftop solar installations also serve as a substitute by directly meeting distributed energy needs, potentially diverting demand from utility-scale projects. Furthermore, broader energy market dynamics, including the competitiveness of wind, hydro, and geothermal power, can influence overall investment in solar infrastructure. The increasing economic viability of battery energy storage systems (BESS) and improved grid management technologies also presents a substantial substitution threat, as these solutions can mitigate the need for peak generation optimization typically provided by trackers.

Technological progress in solar panels themselves, such as higher-efficiency static panels and bifacial modules, further erodes the unique selling proposition of tracking systems. By 2024, the cost of solar PV had fallen so dramatically that advanced static panels became increasingly competitive, narrowing the gap in energy yield compared to tracked systems. This trend means that the incremental energy gain from trackers may not always justify their added cost and maintenance, especially when considering the enhanced performance of static panel technology.

| Substitute Technology | Key Advantage | 2024 Cost Comparison (Approximate) | Impact on Trackers |

|---|---|---|---|

| Fixed-Tilt Solar Systems | Lower upfront cost, simpler installation | $0.90-$1.20/watt (utility-scale) vs. $1.10-$1.50/watt (tracked) | Limits pricing power and market penetration of trackers |

| Rooftop Solar | Distributed generation, direct energy use | N/A (system cost varies widely) | Diverts demand from utility-scale projects |

| Battery Energy Storage Systems (BESS) | Energy storage and dispatchability | Declining LCOS, market projected >$150B by 2025 | Reduces need for instantaneous peak generation optimization |

| High-Efficiency Static Panels | Improved energy density without tracking | Continued cost reduction in PV | Narrows the incremental energy gain benefit of trackers |

Entrants Threaten

Establishing a solar tracker manufacturing and distribution business, particularly for large utility-scale projects, demands significant capital. This includes substantial investment in research and development, setting up advanced manufacturing facilities, and building out extensive sales and engineering support networks. For instance, in 2024, the average cost to build a new utility-scale solar farm in the US can range from $1 million to $2 million per megawatt, with tracker systems representing a notable portion of this cost.

These high upfront financial barriers effectively discourage many potential new entrants from entering the solar tracker market. The sheer scale of investment needed to compete with established players means that only well-funded companies can realistically consider entering this space, thereby limiting the threat of new competition.

FTC Solar's competitive edge is significantly bolstered by its proprietary technology and intellectual property, particularly its advanced tracker systems and sophisticated software. These innovations, often protected by patents, represent substantial investments in research and development, making it difficult for newcomers to replicate the same level of performance and efficiency.

The high cost and lengthy development cycles associated with creating cutting-edge solar tracking solutions act as a formidable barrier. For instance, the development of a new generation of solar trackers can require millions in R&D, alongside years of testing and refinement. New entrants must either acquire licenses for existing technologies, which can be costly, or undertake their own development, risking patent infringement claims from established players like FTC Solar.

Existing players in the solar industry, including FTC Solar, leverage significant economies of scale in their operations. This means they can produce solar components and manage projects at a lower cost per unit due to high-volume manufacturing and bulk purchasing power. For instance, in 2023, the global solar PV market installed a record 413 GW, indicating the scale achieved by leading companies.

New entrants would find it challenging to compete with these established cost structures. They would likely face higher initial per-unit costs for materials, manufacturing, and project development, making it difficult to offer competitive pricing against incumbents like FTC Solar who have already optimized their supply chains and operational efficiencies.

Furthermore, the experience curve plays a crucial role. Companies like FTC Solar have accumulated years of practical knowledge in solar tracker design, installation, and project management. This accumulated expertise translates into greater operational efficiency, reduced waste, and faster project completion times, advantages that are difficult for newcomers to replicate quickly.

Established Customer Relationships and Brand Loyalty

Established customer relationships and brand loyalty in the utility-scale solar market are formidable barriers to new entrants. Companies like FTC Solar thrive on proven track records and deep, long-term partnerships with developers and Engineering, Procurement, and Construction (EPC) firms. New players must overcome the inherent trust deficit and the difficulty of breaking into established networks to secure initial contracts.

Building a reputation for reliability and consistent performance in this sector is a lengthy and resource-intensive undertaking. For instance, securing a significant utility-scale project often requires a history of successful installations and demonstrated operational efficiency. This makes it challenging for newcomers to compete against established players who can leverage their existing client base and industry credibility.

- Customer Loyalty: Developers and EPC firms often prioritize suppliers with a history of successful project execution and dependable service, making it hard for new entrants to gain initial traction.

- Trust and Reputation: The utility-scale solar market demands high levels of trust due to the long-term nature of projects and the significant capital investment involved.

- Network Effects: Established relationships create a powerful network effect, where existing clients are more likely to continue working with trusted partners, further isolating new entrants.

- Time to Market: The time required to build a credible track record and establish these crucial relationships can be several years, representing a significant hurdle for new companies.

Regulatory Hurdles and Industry Standards

The solar industry is heavily regulated, with new entrants needing to comply with a maze of building codes, grid interconnection standards, and environmental regulations. For instance, in 2024, the U.S. Department of Energy continued to emphasize stringent safety and performance standards for solar installations to ensure grid stability and consumer protection. Navigating these diverse international and regional requirements, which often necessitate costly certifications, presents a significant barrier to entry, slowing down market penetration for newcomers.

These regulatory complexities translate into substantial upfront investment and time for new companies. Obtaining necessary permits and approvals can take months, if not years, delaying revenue generation. For example, the process for obtaining interconnection agreements with utilities, a crucial step for any solar project, can vary significantly by region and often involves detailed technical reviews and adherence to specific grid codes, as highlighted by industry reports in late 2023 and early 2024.

- Stringent Building Codes: Solar installations must meet local and national building codes, impacting design and material choices.

- Grid Interconnection Standards: Compliance with utility-specific technical requirements is mandatory for connecting solar systems to the grid.

- Environmental Regulations: Adherence to environmental protection laws, including those related to manufacturing and disposal, is essential.

- Certification Requirements: Products and installations often require certifications (e.g., UL, IEC) proving safety and performance, adding cost and time.

The threat of new entrants in the solar tracker market is generally low for FTC Solar due to substantial capital requirements for manufacturing and R&D, as well as established economies of scale. New companies face significant hurdles in replicating the technological advancements and operational efficiencies of incumbents. Furthermore, strong customer loyalty and the need for extensive regulatory compliance add further barriers, making market entry challenging.

Porter's Five Forces Analysis Data Sources

Our FTC Solar Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, government regulatory filings, and publicly available financial statements of key industry players. This comprehensive approach ensures a thorough understanding of the competitive landscape.