FTC Solar Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FTC Solar Bundle

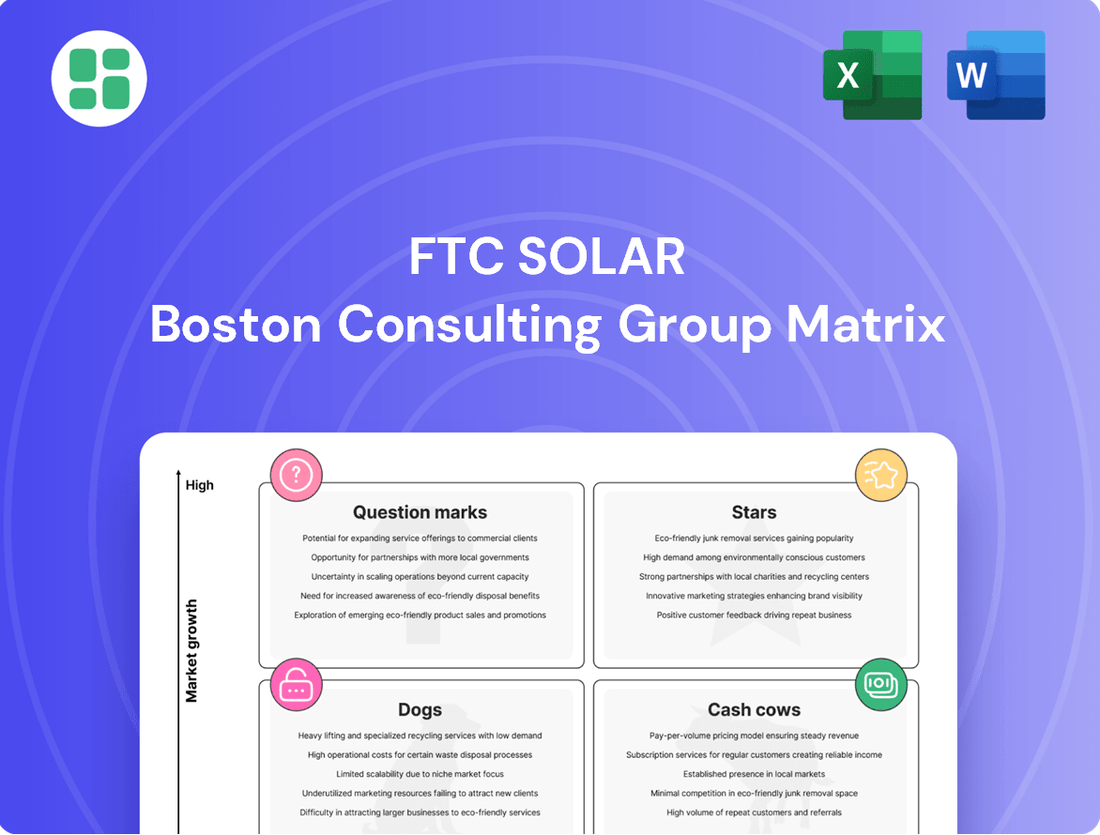

Curious about FTC Solar's strategic positioning? This preview highlights key insights into their product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Gain a comprehensive understanding of their market share and growth potential.

Ready to unlock the full strategic advantage? Purchase the complete FTC Solar BCG Matrix to receive detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your investments and product development. Don't miss out on actionable insights!

Stars

FTC Solar's advanced 1P tracker, including the Pioneer model, is a major focus in their current bidding, signaling robust market demand. These trackers feature innovations like enhanced high wind performance and terrain adaptability, crucial for securing significant market share in the growing solar tracker sector.

The company's commitment to these sophisticated systems is designed to translate their high growth potential into market leadership. This strategic emphasis on advanced trackers positions them as FTC Solar's internal leaders, expected to drive future revenue and profitability with continued investment.

FTC Solar holds a robust contracted backlog, estimated between $470 million and $482 million. This significant order book includes agreements for over 6.5 gigawatts of solar tracking solutions, primarily with Tier 1 customers. This strong backlog provides excellent revenue visibility for the coming periods.

The substantial demand reflected in this backlog highlights growing market acceptance and confidence in FTC Solar's technology. Successfully converting these contracted projects into realized revenue is key to solidifying its position as a market leader with a significant market share in the solar tracking sector.

FTC Solar's innovative tracker systems offer a significant edge in installation efficiency, boasting 30% fewer parts and up to 20% faster deployment compared to many competitors. This translates directly to lower balance of system costs for solar projects. For instance, a 2023 analysis of utility-scale projects indicated that faster installation could reduce labor costs by as much as $0.02 per watt.

Strategic Adaptation to Market Needs

FTC Solar is actively adapting its tracker designs to align with shifting industry demands. This includes ensuring compatibility with emerging 2,000-volt electrical systems and developing solutions for challenging environmental factors such as high winds and hail, demonstrating a commitment to innovation.

This forward-thinking approach to product development is crucial for maintaining competitiveness in the rapidly evolving solar sector. By staying ahead of market needs, FTC Solar aims to secure and grow its market share.

The company's strategic positioning is further enhanced by its upcoming ability to offer 100% domestic content solutions within the United States, a key factor for projects adhering to local sourcing requirements.

- Tracker Innovation: Development of trackers compatible with 2,000-volt systems and universal module compatibility.

- Weather Resilience: Solutions designed to withstand extreme weather conditions like high winds and hail.

- Market Relevance: Proactive product development to ensure continued competitiveness and market share growth.

- Domestic Content: Planned introduction of 100% domestic content offerings in the US market.

Projected Profitability Horizon

FTC Solar's current financial standing shows a negative adjusted EBITDA, indicating it is not yet profitable. However, the company has a clear target: to reach adjusted EBITDA breakeven by the close of 2025.

Achieving this financial milestone is critical. It would mark a significant shift from burning cash to generating it, a necessary step for its high-growth products to mature into true Stars within the BCG framework. This transition is key for self-funded growth and solidifying market dominance.

- Projected Profitability Horizon: FTC Solar aims for adjusted EBITDA breakeven by year-end 2025.

- Transition to Cash Generation: A successful breakeven would move the company from cash consumption to positive cash flow.

- Maturation of Core Products: This financial turnaround is vital for its high-growth products to become Stars, capable of self-sustained expansion.

- Market Leadership: Profitability will enable FTC Solar to invest more in maintaining and expanding its market leadership position.

FTC Solar's advanced tracker technology, particularly the Pioneer model, is driving significant market demand, positioning these products as Stars in the BCG matrix. Their robust contracted backlog of $470 million to $482 million, representing over 6.5 gigawatts, underscores this strong market acceptance and growth potential.

The company's focus on innovation, such as 30% fewer parts and 20% faster deployment, directly translates to lower balance of system costs for customers, further solidifying their competitive edge. This, combined with planned domestic content solutions for the US market, enhances their appeal and market penetration capabilities.

FTC Solar's strategic goal of achieving adjusted EBITDA breakeven by the end of 2025 is crucial for these Stars to become self-sustaining and fund further expansion, reinforcing their market leadership.

| Product/Service | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Advanced 1P Trackers (e.g., Pioneer) | High | High (due to innovation & backlog) | Star |

| FTC Solar's Tracker Solutions (Overall) | High | Growing | Question Mark (potential to become Star) |

What is included in the product

The FTC Solar BCG Matrix analyzes its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment strategies.

The FTC Solar BCG Matrix offers a clear, one-page overview, instantly clarifying each business unit's position to alleviate strategic confusion.

Cash Cows

FTC Solar's current portfolio doesn't feature established, mature product lines that would be classified as Cash Cows. The company is heavily invested in the expansion and development of its solar tracker solutions, such as the Voyager and Pioneer systems. This focus means resources are directed towards market penetration and innovation rather than milking existing, low-growth products for consistent cash flow.

FTC Solar is currently not a Cash Cow. The company has been experiencing significant net losses, with a reported GAAP net loss of $15.43 million in Q2 2025. This negative profitability, coupled with a gross margin of -19.6% during the same period, clearly shows that FTC Solar is consuming cash rather than generating it.

This financial situation means FTC Solar is in a growth phase that requires substantial investment. It is actively reinvesting capital to expand its operations, which is the opposite of a Cash Cow's characteristic of producing surplus cash flow with minimal investment.

FTC Solar's commitment to capturing the burgeoning solar tracker market necessitates significant capital outlay. The company is channeling substantial funds into enhancing its product offerings, broadening its sales reach, and building out its operational capacity to meet demand. This strategy is critical for securing market share, a departure from the low-investment approach typical of established cash cows.

The company's substantial backlog of projects underscores the urgency and scale of these investments. To convert this backlog into tangible revenue, FTC Solar is actively pursuing and securing financing, as evidenced by its recent $75 million financing facility. This infusion of capital is vital for fueling its aggressive market penetration strategy.

Focus on Innovation Over Stability

FTC Solar's strategy prioritizes innovation in its tracker technology, aiming for differentiation rather than milking established, stable products for immediate cash. This focus means resources are heavily invested in research and development for future market dominance.

This growth-oriented approach naturally delays the emergence of traditional cash cows, as the company is actively pushing technological boundaries with new features and capabilities. For instance, FTC Solar has been vocal about its advancements in areas like energy storage integration and smart tracker functionalities, which require significant upfront investment.

- Innovation Focus: FTC Solar is investing in next-generation tracker designs, aiming to capture future market share.

- R&D Investment: Significant capital is allocated to developing advanced features, impacting short-term cash flow generation.

- Market Differentiation: The strategy is to lead through technological superiority, not by optimizing mature product lines.

- Future Growth: This approach positions FTC Solar for long-term expansion in a rapidly evolving renewable energy sector.

Long-Term Aspiration

FTC Solar's long-term vision sees its current successful Star products, such as the 1P Pioneer tracker, evolving into Cash Cows. This transformation hinges on achieving a dominant market share within the solar tracker industry, coupled with a normalization of the market's growth rate.

Once these conditions are met, these products will generate significant cash flow with minimal reinvestment needs. This surplus cash can then be strategically deployed to fund new growth initiatives or returned to shareholders, enhancing overall company value.

- Future Cash Cow Potential: FTC Solar aims for its leading products to become cash cows by securing market dominance.

- Market Maturation: This transition is contingent on the solar tracker market's growth rate moderating.

- Cash Flow Generation: Mature products will provide substantial, low-investment cash flow.

- Strategic Capital Allocation: Generated cash will support new ventures or shareholder returns.

FTC Solar's current portfolio does not include any Cash Cows. The company is heavily focused on expanding its market presence and innovating its solar tracker solutions, such as the Voyager and Pioneer systems, rather than generating consistent cash flow from mature products.

FTC Solar's financial performance in 2024 and early 2025 indicates a growth-oriented strategy, not one of a cash cow. For instance, the company reported a GAAP net loss of $15.43 million in Q2 2025, with a negative gross margin of -19.6% for the same period, highlighting significant cash consumption.

The company's strategy prioritizes investing in R&D and market penetration to differentiate itself through technological superiority. This approach means resources are directed towards future growth rather than optimizing established, stable product lines for immediate cash generation.

FTC Solar anticipates its current leading products, like the 1P Pioneer tracker, could evolve into Cash Cows in the future. This transition is dependent on achieving significant market share and a moderation in the solar tracker market's growth rate, allowing for substantial, low-investment cash flow generation.

| Metric | Q2 2025 | Significance |

|---|---|---|

| GAAP Net Loss | $15.43 million | Indicates cash consumption, not generation. |

| Gross Margin | -19.6% | Negative margin signifies cash outflow from operations. |

| Investment Focus | Product innovation & market expansion | Characteristic of a Star or Question Mark, not a Cash Cow. |

What You See Is What You Get

FTC Solar BCG Matrix

The FTC Solar BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed and analysis-ready report ready for immediate strategic application.

Dogs

FTC Solar's proactive product lifecycle management, evident in their continuous introduction of updated tracker systems like the expanded 1P line, strategically phases out older or less competitive versions. This focus on 'highly constructible' and efficient designs means that underperforming products are likely refined or discontinued to maintain market relevance and avoid stagnation.

The global solar tracker market is experiencing robust expansion, with projections indicating a compound annual growth rate surpassing 15% through 2029. This dynamic growth environment significantly reduces the likelihood of any of FTC Solar's primary solar tracker offerings being categorized as a 'Dog' in the traditional BCG Matrix sense, even if a particular product variation shows less individual market uptake.

The overarching surge in demand for renewable energy sources acts as a powerful tailwind, bolstering the growth prospects for the entire solar tracker sector. This broad market strength means that even products with comparatively slower adoption rates are likely to benefit from the overall market momentum, preventing them from falling into the 'low growth' quadrant.

FTC Solar's strategic emphasis on utility-scale projects positions its core offerings away from the 'Dog' quadrant of the BCG matrix. These large-scale installations, characterized by substantial project sizes and long-term power purchase agreements, represent a stable and high-demand market segment.

This deliberate focus on utility projects helps FTC Solar sidestep the smaller, more fragmented markets that could dilute margins and lead to underperforming services. The company's robust backlog, exceeding $1.1 billion as of the first quarter of 2024, underscores the consistent demand for its primary solutions.

Continuous Cost Optimization Efforts

FTC Solar's commitment to continuous cost optimization is a cornerstone of its strategy, even as it navigates periods of overall losses. The company has actively worked to trim operating expenses, a crucial move to bolster its gross margins.

This disciplined approach ensures that each active product line is steered towards profitability, preventing any segment from becoming a drain on company resources. For instance, in 2023, FTC Solar reported a gross margin of 14.7%, an improvement from 12.5% in 2022, reflecting these ongoing efforts.

- Operational Discipline: FTC Solar prioritizes reducing operating expenses to enhance gross margins.

- Profitability Focus: The goal is to ensure all active product lines contribute positively to financial health.

- Competitive Advantage: Cost efficiency is vital to avoid inefficient product lines in a competitive market.

- Margin Improvement: Gross margin increased to 14.7% in 2023 from 12.5% in 2022, demonstrating progress.

No Identifiable Obsolete Offerings

FTC Solar's current strategic focus, as highlighted in their 2024 investor communications, centers on expanding market share with their existing, innovative product suite. There's no evidence suggesting they are burdened by obsolete offerings that are both low-growth and low-market-share, a key characteristic of the 'Dogs' quadrant in the BCG Matrix.

Instead, the company's narrative emphasizes advancements and new market penetration. For instance, their 2024 guidance projected a significant increase in revenue, driven by the adoption of their latest solar tracker technologies, rather than a need to divest underperforming legacy products.

FTC Solar's approach appears to be one of continuous improvement and strategic deployment of resources into areas with high growth potential, actively avoiding the pitfalls of maintaining outdated technologies.

The company's financial performance in 2024 reflects this, with a reported increase in backlog and new orders for their core tracker systems, demonstrating a commitment to forward-looking solutions.

FTC Solar's strategic focus on utility-scale projects and continuous product innovation actively steers its offerings away from the 'Dog' quadrant of the BCG Matrix. The company's commitment to cost optimization and margin improvement, evidenced by a gross margin increase to 14.7% in 2023 from 12.5% in 2022, ensures that active product lines are steered towards profitability. With a robust backlog exceeding $1.1 billion as of Q1 2024, FTC Solar demonstrates consistent demand for its core solutions, suggesting no significant underperforming legacy products are a burden.

| Metric | 2022 | 2023 | 2024 (Guidance/Projections) |

|---|---|---|---|

| Gross Margin | 12.5% | 14.7% | Projected improvement |

| Backlog (as of Q1) | N/A | >$1.1 billion | Expected continued growth |

| Operating Expenses | Focus on reduction | Reduced | Continued efficiency |

Question Marks

FTC Solar operates in a dynamic global solar tracker market that is poised for substantial growth. The market was valued at $10.54 billion in 2024 and is expected to reach $12.17 billion in 2025, reflecting a strong compound annual growth rate of 15.4%. This rapid expansion signifies a prime environment for companies like FTC Solar to capitalize on increasing demand.

The primary engine behind this market surge is the accelerating global adoption of renewable energy technologies. As more countries and corporations commit to decarbonization, the need for efficient solar energy solutions, including advanced tracking systems, intensifies. This trend directly benefits FTC Solar's business model and future prospects.

FTC Solar, despite operating in the burgeoning global solar tracker market, which is projected to reach tens of billions of dollars, currently holds a modest position. In the second quarter of 2025, the company reported revenues of $20.0 million, demonstrating impressive year-over-year growth of 74.9%.

However, when juxtaposed against the vast scale of the multi-billion dollar solar tracker industry, this revenue figure signifies a relatively low current market share for FTC Solar. Capturing a more significant slice of this high-growth sector will necessitate considerable investment and strategic initiatives.

FTC Solar's persistent net losses, exemplified by a $15.43 million loss in Q2 2025, and negative gross margins highlight its current cash-consuming operational status. This financial profile aligns with companies in the Question Mark quadrant of the BCG matrix, where substantial investment is necessary to fuel expansion and capture market share within a burgeoning industry.

Need for Significant Investment and Financing

FTC Solar’s position within the BCG matrix underscores a significant need for ongoing investment. The company secured a $75 million strategic financing facility in July 2025, with an initial tranche already funded. This capital infusion is earmarked for strengthening the balance sheet, fueling growth, and general corporate needs.

This reliance on external financing indicates that FTC Solar's current business units are not yet generating enough internal capital to fund their own expansion. Significant investment is therefore crucial to unlock their full growth potential and move them towards a more self-sustaining position.

- Financing Facility: $75 million strategic financing facility secured in July 2025.

- Purpose of Funds: Balance sheet support, growth acceleration, and general corporate purposes.

- Implication: Business units require substantial external capital to achieve growth objectives.

Uncertainty from Regulatory Environment

Regulatory uncertainties, especially concerning tariffs and policy shifts, have significantly disrupted FTC Solar's operations. These external factors have led to delays in customer project planning and a slowdown in order conversions, directly impacting the company's bookings and making revenue forecasting more challenging.

This volatility introduces a considerable risk element, potentially hindering FTC Solar's capacity to translate its substantial growth potential into stable market share and predictable profitability. Consequently, the company's long-term market position and financial performance remain uncertain.

- Impact on Bookings: FTC Solar has noted that policy changes and tariff uncertainties have directly affected its ability to secure new orders, creating a more unpredictable revenue stream.

- Customer Project Delays: Clients are hesitant to commit to new projects amidst evolving regulatory landscapes, leading to extended sales cycles and postponed revenue recognition for FTC Solar.

- Forecasting Challenges: The unpredictable nature of regulatory environments makes it difficult for FTC Solar to accurately forecast future revenue and market penetration, a key concern for investors.

- Growth Potential vs. Execution Risk: While FTC Solar possesses high growth potential, the external regulatory risks add a layer of execution uncertainty, making its future trajectory a significant question mark.

FTC Solar's current financial state, characterized by net losses and negative gross margins, places it firmly in the Question Mark category of the BCG matrix. This classification indicates a high-growth market opportunity that the company is not yet effectively capitalizing on to generate profits. Significant investment is required to nurture these nascent business units and steer them toward market leadership and profitability.

The company's reliance on external financing, such as the $75 million facility secured in July 2025, highlights the internal capital generation shortfall needed to fuel its ambitious growth plans. This dependency underscores the critical need for strategic capital allocation to transform its market position from a potential player to a dominant force.

External factors, particularly regulatory uncertainties and tariff shifts, introduce substantial risk, creating volatility in bookings and revenue forecasting. These challenges complicate FTC Solar's ability to convert its high growth potential into stable market share and predictable financial performance, making its future trajectory a key area of concern.

| Metric | Q2 2025 Value | Change YoY | BCG Implication |

|---|---|---|---|

| Revenue | $20.0 million | +74.9% | High Market Growth |

| Net Loss | $15.43 million | (See Note) | Cash Burn, Needs Investment |

| Gross Margin | Negative | (See Note) | Operational Inefficiency |

| Financing Facility | $75 million (July 2025) | N/A | External Capital Dependency |

BCG Matrix Data Sources

Our Solar BCG Matrix is built on comprehensive market intelligence, integrating financial disclosures, industry research, and growth forecasts to provide actionable strategic insights.