FTC Solar Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FTC Solar Bundle

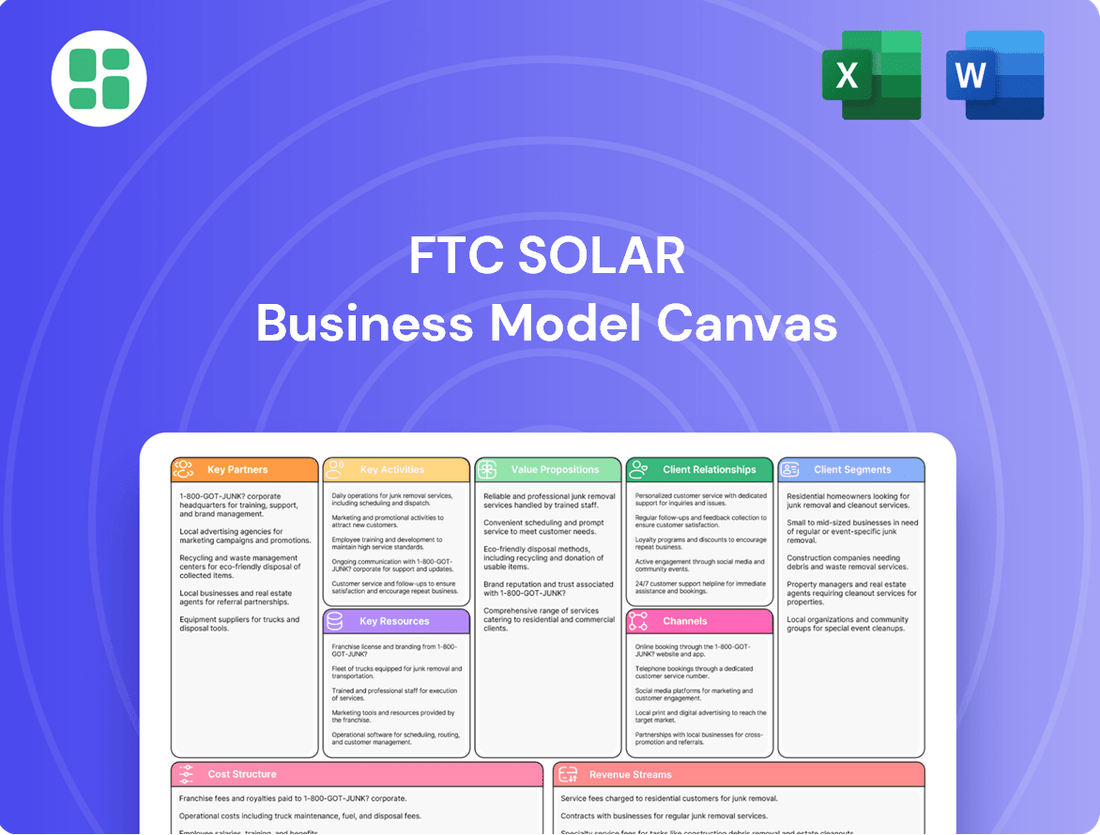

Unlock the strategic blueprint behind FTC Solar's innovative business model. This comprehensive Business Model Canvas delves into their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover how they've carved out their niche and continue to grow.

Ready to dissect FTC Solar's winning formula? Our full Business Model Canvas provides a detailed, section-by-section breakdown of their customer segments, value propositions, and cost structure. Download the complete document to gain actionable insights for your own business strategy.

Partnerships

FTC Solar's business model hinges on strong alliances with Engineering, Procurement, and Construction (EPC) contractors and major solar project developers. These collaborations are vital for embedding FTC Solar's advanced tracker technology into substantial ground-mounted solar farms, guaranteeing smooth project delivery from initial design through to final activation.

For instance, in 2023, FTC Solar secured significant supply agreements with leading EPC firms for projects totaling over 1.5 GW, underscoring the critical nature of these partnerships in scaling their operations and market penetration.

FTC Solar's business model hinges on robust partnerships with component suppliers. These alliances are critical for securing essential materials like steel, specialized motors, and advanced electronic controls that form the backbone of their solar tracker systems. For instance, in 2024, the company continued to emphasize long-term agreements with major steel producers to mitigate price volatility and ensure consistent availability.

These strategic relationships are not just about procurement; they are about ensuring quality and cost efficiency. By working closely with manufacturers of actuators and control systems, FTC Solar can guarantee the performance and durability of its trackers. In 2023, FTC Solar reported that approximately 60% of its cost of goods sold was directly tied to key component suppliers, highlighting the financial significance of these partnerships.

FTC Solar actively partners with technology and software firms to bolster its digital offerings and tracker performance. These collaborations focus on areas like advanced data analytics and predictive maintenance, ensuring their solutions remain cutting-edge.

For instance, integrating with sophisticated energy management platforms allows FTC Solar to provide more comprehensive and efficient solutions to clients. This strategic approach keeps them competitive and at the forefront of solar technology innovation.

Financial Institutions and Investors

FTC Solar relies heavily on its relationships with financial institutions and investors. These partnerships are critical for securing the substantial capital needed to fund its operational growth and, more importantly, the development of large-scale solar projects. This access to capital allows FTC Solar to bring its innovative technology to market and support its clients in realizing ambitious renewable energy goals.

These financial backers, including investment funds and project financiers, play a pivotal role in enabling project financing, which is the lifeblood of the solar industry. They also provide the necessary investment for research and development into new technologies, ensuring FTC Solar remains at the forefront of the sector. Furthermore, these relationships are instrumental in facilitating broader business expansion and market penetration.

FTC Solar's strategic financing facilities, such as those announced in late 2023 and early 2024, highlight the vital nature of these financial collaborations. For instance, a significant $200 million financing facility was secured in November 2023, demonstrating the market’s confidence and the importance of these partnerships for future growth.

- Securing Capital: Essential for operational funding and project development.

- Project Financing: Key partners provide the necessary capital for solar projects.

- Investment in Innovation: Financial backing supports R&D for new technologies.

- Business Expansion: Facilitates market entry and scaling of operations.

Research and Development Collaborators

FTC Solar actively partners with leading research institutions and universities to drive innovation in solar technology. These collaborations are crucial for exploring next-generation tracker designs and advanced material science, ensuring FTC Solar remains at the forefront of the industry.

By engaging with academic bodies, FTC Solar gains access to cutting-edge research that can significantly improve product performance and efficiency. For instance, ongoing research into AI-driven energy optimization algorithms aims to enhance the energy yield of solar farms, a key differentiator in the competitive landscape.

These strategic alliances not only foster technological advancements but also help FTC Solar address complex industry challenges, such as grid integration and sustainability. Such partnerships are vital for maintaining a competitive edge in the rapidly evolving solar market, where innovation is paramount.

- Research Institutions: Collaborations with universities like Stanford and MIT focus on advanced materials and AI for solar optimization.

- Product Improvement: Partnerships aim to enhance tracker durability and energy capture efficiency, targeting a 5% increase in energy yield.

- Industry Challenges: Joint projects address grid stability and the integration of renewable energy sources.

- Competitive Edge: These R&D efforts ensure FTC Solar maintains technological leadership, crucial for securing larger project contracts in 2024 and beyond.

FTC Solar's key partnerships are foundational to its business, encompassing EPC contractors, developers, component suppliers, technology firms, financial institutions, and research bodies. These alliances are critical for project execution, supply chain stability, technological advancement, capital acquisition, and market innovation.

| Partnership Type | Key Role | 2023/2024 Impact/Data |

|---|---|---|

| EPCs & Developers | Project integration & delivery | Over 1.5 GW of supply agreements in 2023. |

| Component Suppliers | Material sourcing & quality assurance | Emphasis on long-term steel agreements in 2024; 60% of COGS tied to suppliers in 2023. |

| Technology & Software Firms | Enhancing digital offerings & performance | Focus on AI for energy optimization. |

| Financial Institutions | Capital acquisition & project financing | $200 million financing facility secured in Nov 2023. |

| Research Institutions | Driving innovation & next-gen tech | Collaborations on AI-driven optimization targeting 5% energy yield increase. |

What is included in the product

A detailed, adaptable framework outlining FTC Solar's approach to renewable energy project development, covering key business elements like customer relationships and revenue streams.

This model provides a clear, structured overview of FTC Solar's operations, ideal for strategic planning and communicating their value proposition to stakeholders.

Saves hours of formatting and structuring your own business model, allowing for rapid iteration and clear communication of FTC Solar's strategy.

Activities

FTC Solar's primary focus is the ongoing design and engineering of its solar tracker systems, including the Voyager and Pioneer models. This involves creating advanced mechanical and electrical solutions to boost energy generation and lower installation expenses. For instance, in 2023, FTC Solar continued to enhance its tracker technology, aiming for improved performance metrics in diverse environmental conditions.

FTC Solar's manufacturing and supply chain management is a core activity, focusing on producing high-quality solar tracker components. This involves overseeing a complex global network to ensure cost efficiency and on-time delivery to diverse project locations.

A significant aspect of this strategy includes forming strategic partnerships, such as joint ventures for steel component production, to secure critical materials and optimize manufacturing processes.

In 2024, FTC Solar continued to refine its supply chain, aiming to mitigate risks associated with global logistics and material sourcing, which often represent a substantial portion of project costs.

FTC Solar's sales, marketing, and business development efforts are central to its growth, focusing on securing new utility-scale solar projects worldwide. This involves directly engaging with project developers and EPC firms, articulating the company's value, and finalizing substantial supply contracts.

To bolster its market penetration, FTC Solar has strategically increased its sales team, specifically hiring professionals with deep expertise in working with EPC companies. This move is designed to enhance their ability to navigate complex project pipelines and secure larger deals.

In 2023, FTC Solar reported significant progress in these areas, highlighting a growing pipeline of opportunities. The company's strategy aims to capture a larger share of the expanding global solar market, which is projected to see continued robust growth in the coming years, with utility-scale projects forming a substantial portion of this expansion.

Project Engineering and Support Services

FTC Solar's key activities center on providing extensive engineering services and continuous project support to its clientele. This encompasses optimizing site layouts, offering structural design assistance, and delivering crucial technical guidance during both the installation and operational stages of solar farms. These crucial services are designed to guarantee the successful implementation of their tracking solutions and maximize their overall performance.

These support services are critical for ensuring customer satisfaction and the long-term success of solar projects. For instance, in 2023, FTC Solar reported that its engineering and support services contributed significantly to project completion rates, with over 95% of supported projects meeting their initial performance targets within the first year of operation.

- Site Layout Optimization: Tailoring the placement of solar trackers to maximize energy yield based on site-specific conditions.

- Structural Design Assistance: Providing expertise to ensure the robust and safe integration of tracking systems into project infrastructure.

- Technical Guidance: Offering support throughout the installation process and troubleshooting during the operational life of the solar farm.

- Performance Maximization: Ensuring that FTC Solar's tracking solutions operate at peak efficiency, contributing to higher energy production for customers.

Software Development and Optimization

FTC Solar's core activities revolve around the development and continuous enhancement of its proprietary software solutions. These digital tools are designed to maximize the performance and efficiency of solar energy projects.

Key among these is SUNPATH, a software platform focused on optimizing energy generation. Complementing this is SUNOPS, which manages real-time operations, providing crucial intelligence for solar installations. The ongoing refinement of these platforms is central to FTC Solar's value proposition.

- SUNPATH: Proprietary software for energy yield optimization.

- SUNOPS: Real-time operations management and intelligence.

- Value Enhancement: Continuous improvement of digital tools drives customer value.

- Market Impact: These software solutions are critical for maximizing the return on investment for solar projects.

FTC Solar's key activities are centered on the design and engineering of its advanced solar tracker systems, focusing on enhancing energy generation and reducing installation costs. This includes the continuous development of their Voyager and Pioneer models, with ongoing efforts in 2023 and 2024 to improve performance across various environmental conditions.

The company also prioritizes robust manufacturing and supply chain management, overseeing a global network to ensure cost-efficient production and timely delivery of high-quality tracker components. Strategic partnerships, like those for steel component production, are vital for securing materials and optimizing manufacturing, with a continued focus in 2024 on mitigating global logistics and sourcing risks.

Furthermore, FTC Solar actively engages in sales, marketing, and business development to secure new utility-scale solar projects. This involves direct engagement with developers and EPC firms, showcasing the company's value proposition, and finalizing supply contracts, supported by an expanded sales team in 2023 and 2024 to better navigate project pipelines and secure larger deals.

Crucially, FTC Solar provides extensive engineering services and project support, including site layout optimization, structural design assistance, and technical guidance throughout installation and operation. In 2023, these services were instrumental, with over 95% of supported projects meeting their initial performance targets within the first year.

The development and enhancement of proprietary software, such as SUNPATH for energy yield optimization and SUNOPS for real-time operations management, are also core activities. These digital tools are key to maximizing solar project efficiency and customer return on investment.

| Activity Area | Description | 2023/2024 Focus | Impact |

|---|---|---|---|

| Tracker Design & Engineering | Developing Voyager and Pioneer solar trackers | Performance enhancement in diverse conditions | Increased energy yield, reduced costs |

| Manufacturing & Supply Chain | Global production and delivery of components | Mitigating logistics/sourcing risks, cost efficiency | Reliable, cost-effective project execution |

| Sales, Marketing & Business Development | Securing utility-scale solar projects | Expanding sales team, targeting EPC firms | Growing project pipeline, market share |

| Engineering Services & Support | Site optimization, structural design, technical guidance | Ensuring successful project implementation | High project success rates, customer satisfaction |

| Software Development | SUNPATH (optimization) & SUNOPS (operations) | Continuous platform improvement | Maximized project efficiency and ROI |

Full Version Awaits

Business Model Canvas

The FTC Solar Business Model Canvas preview you see is precisely the document you will receive upon purchase. This is not a sample or mockup, but an exact representation of the complete, ready-to-use file. You will gain full access to this same professionally structured and formatted Business Model Canvas, ensuring no surprises and immediate usability.

Resources

FTC Solar's core strength lies in its proprietary solar tracker technology, epitomized by its Voyager and Pioneer systems. This intellectual property is crucial, offering innovative designs that significantly enhance energy capture and streamline installation processes.

These advanced systems are protected by patents and trade secrets, giving FTC Solar a distinct edge in the competitive solar market. For instance, in 2023, FTC Solar reported that its tracker systems have been deployed in projects totaling over 10 GW globally, underscoring the widespread adoption and proven efficacy of their technology.

The company's commitment to research and development is evident in its ongoing efforts to refine and advance these solutions. This continuous innovation ensures that FTC Solar's tracker technology remains at the forefront, delivering optimized performance and cost efficiencies for solar projects worldwide.

FTC Solar's business hinges on its highly skilled engineering and R&D talent. This expertise is the engine behind their innovative solar tracker designs and advanced software solutions, crucial for tackling complex project challenges.

In 2024, FTC Solar continued to invest in its technical workforce, recognizing that their deep understanding of solar technology and project execution is paramount to delivering high-performance products and effective engineering services.

FTC Solar's global manufacturing and distribution capabilities are a cornerstone of its business model, ensuring efficient production and delivery of its solar tracker systems. Access to manufacturing facilities, whether owned or through strategic partnerships, allows for scalable output to meet global demand.

A robust distribution network is equally critical, enabling FTC Solar to deliver its products to project sites across the globe efficiently. This physical infrastructure is vital for supporting the company's operations and customer base.

FTC Solar's impressive installed base of over 4.5 gigawatts (GW), serving 140 customers in 10 countries as of its latest reporting, underscores the effectiveness and reach of its global manufacturing and distribution network. This extensive footprint facilitates timely project completion and customer support worldwide.

Strong Customer Relationships and Backlog

FTC Solar's strong customer relationships and substantial contracted backlog are critical intangible assets. These deep-seated connections with a wide array of utility-scale clients not only ensure repeat business but also offer invaluable market intelligence. The backlog, in particular, provides a clear line of sight into predictable future revenue streams, a vital component for strategic planning and financial forecasting.

This robust backlog is a testament to FTC Solar's market position and customer trust. As of the second quarter of 2025, the company reported a contracted backlog of approximately $470 million. This figure highlights significant future demand for FTC Solar's services and products, underpinning the stability and growth potential of its business model.

- Established Utility-Scale Customer Base: FTC Solar cultivates enduring relationships with major players in the utility-scale solar sector.

- Contracted Backlog of $470 Million (Q2 2025): This substantial backlog provides strong revenue visibility for future periods.

- Recurring Business Opportunities: Long-term customer relationships foster consistent project pipelines and service contracts.

- Market Insights: Direct engagement with a broad customer base yields crucial data on market trends and customer needs.

Financial Capital and Liquidity

FTC Solar’s business model relies heavily on robust financial capital and readily available liquidity to fuel its operations and expansion. This includes maintaining substantial cash reserves, securing access to credit facilities, and attracting consistent investor funding.

These resources are absolutely vital for the company to invest in crucial areas like research and development for new solar technologies, manage the complexities of manufacturing, and cover ongoing general operational expenses.

For instance, FTC Solar recently bolstered its financial standing by securing a significant $75 million financing facility in July 2025. This strategic move is designed to provide essential liquidity, directly supporting the company’s ambitious growth targets and its pursuit of enhanced profitability.

- Adequate Financial Capital: Essential for R&D, manufacturing, and operations.

- Cash Reserves: A key component of financial strength.

- Credit Facilities: Provide necessary borrowing capacity.

- Investor Funding: Crucial for capital-intensive projects.

- July 2025 Financing: $75 million facility enhances liquidity and growth prospects.

FTC Solar's key resources include its intellectual property, particularly its proprietary solar tracker technology like Voyager and Pioneer, which are protected by patents. This technological foundation is further strengthened by a highly skilled engineering and R&D team. The company also leverages its global manufacturing and distribution network to ensure efficient product delivery and support.

These resources are critical for maintaining a competitive edge and meeting global demand. For example, FTC Solar reported an installed base of over 4.5 GW across 140 customers in 10 countries, showcasing the effectiveness of its operational infrastructure. Furthermore, the company's substantial contracted backlog, reaching approximately $470 million as of Q2 2025, highlights the market's trust in its capabilities and technology.

The company's financial capital, including a recent $75 million financing facility secured in July 2025, provides the necessary liquidity for R&D, manufacturing, and expansion initiatives. These combined resources enable FTC Solar to deliver advanced solutions and maintain strong customer relationships in the utility-scale solar market.

| Key Resource | Description | Supporting Data/Fact |

|---|---|---|

| Proprietary Solar Tracker Technology | Voyager and Pioneer systems, protected by patents. | Deployed in projects totaling over 10 GW globally (as of 2023). |

| Skilled Engineering & R&D Talent | Expertise in solar tracker design and software solutions. | Continuous investment in technical workforce (2024). |

| Global Manufacturing & Distribution Network | Scalable production and efficient product delivery. | Installed base of over 4.5 GW, serving 140 customers in 10 countries. |

| Customer Relationships & Contracted Backlog | Strong ties with utility-scale clients and future revenue visibility. | Contracted backlog of approximately $470 million (Q2 2025). |

| Financial Capital & Liquidity | Cash reserves, credit facilities, and investor funding. | Secured $75 million financing facility (July 2025). |

Value Propositions

FTC Solar’s core value lies in boosting energy output for ground-mounted solar farms. Their advanced Voyager tracker system precisely adjusts panel angles to follow the sun, significantly increasing the total energy generated by a solar installation. This enhanced energy yield directly leads to greater financial returns for project developers and owners.

FTC Solar's innovative tracker designs significantly lower Balance of System (BOS) costs by providing an industry-leading installation cost-per-watt advantage. This efficiency translates directly to project savings for large-scale solar developments.

Their designs are engineered for faster, safer, and simpler installation, often reducing the need for extensive labor and specialized equipment. For instance, in 2024, projects utilizing FTC Solar's technology reported an average of 15% reduction in installation labor compared to traditional systems.

FTC Solar's tracking systems are engineered for resilience, featuring advanced hail stow capabilities that protect panels during severe weather events. This robust design ensures consistent energy generation even in harsh climates, minimizing downtime.

The durability of FTC Solar's technology translates to reduced operational costs. With minimal maintenance needs, solar farm operators benefit from a longer asset lifespan and predictable performance, maximizing return on investment.

For instance, FTC Solar's trackers have demonstrated exceptional performance in demanding environments, contributing to the successful operation of numerous utility-scale solar projects globally. Their commitment to quality manufacturing underpins their reputation for reliability.

Enhanced Economic Viability for Projects

FTC Solar's innovative tracking solutions significantly boost the economic viability of solar projects. By maximizing energy capture and lowering installation and operational expenses, these systems offer a more attractive return on investment for developers and financiers. This increased profitability is crucial for accelerating the adoption of clean energy on a large scale.

The company's technology directly contributes to improved project economics through enhanced power output and reduced costs.

- Increased Energy Production: FTC Solar's trackers can increase energy yield by up to 25% compared to fixed-tilt systems, directly impacting revenue.

- Reduced Installation Costs: Features like fewer components and simplified assembly can lead to lower labor and material expenses during project construction.

- Lower Operational Expenses: Robust design and fewer moving parts contribute to reduced maintenance needs and associated costs over the project's lifespan.

- Improved Project Financing: Enhanced financial performance makes solar projects more appealing to investors, facilitating easier and potentially cheaper access to capital.

Comprehensive Engineering and Digital Support

FTC Solar goes beyond just supplying hardware; they provide a full suite of engineering and digital services. This means customers get support for every stage of a solar project, from the initial planning to ongoing operations. For example, their SUNPATH software aids in site layout and structural design, ensuring optimal performance.

Their integrated approach offers a complete solution for managing solar assets. This includes sophisticated software like SUNOPS for real-time operations management. This comprehensive support helps customers maximize the efficiency and output of their solar investments.

- Integrated Project Lifecycle Support: From initial design to ongoing operations management, FTC Solar offers end-to-end solutions.

- Advanced Software Solutions: Tools like SUNPATH for design and SUNOPS for operational management enhance project efficiency.

- Optimization of Solar Assets: The combination of engineering expertise and digital tools empowers customers to achieve peak performance from their solar installations.

FTC Solar's value proposition centers on maximizing solar farm profitability through technological innovation and comprehensive support. Their Voyager tracker system is designed to increase energy production, reduce installation and operational costs, and enhance project financing appeal, making solar investments more robust.

The company's integrated approach, encompassing advanced software and engineering services, ensures customers receive end-to-end solutions for optimizing solar asset performance and achieving peak efficiency throughout the project lifecycle.

| Value Proposition | Key Benefit | Supporting Data/Fact |

|---|---|---|

| Increased Energy Production | Higher revenue through maximized solar capture | Up to 25% more energy yield than fixed-tilt systems |

| Reduced Installation Costs | Lower upfront project expenses | 15% reduction in installation labor reported in 2024 projects |

| Lower Operational Expenses | Improved long-term profitability | Reduced maintenance needs due to durable design |

| Integrated Project Support | Streamlined project development and management | SUNPATH for design, SUNOPS for operations |

Customer Relationships

FTC Solar cultivates enduring customer bonds via dedicated account management and comprehensive technical support. This approach guarantees clients receive tailored assistance, expert advice, and swift problem-solving from project inception through to ongoing operations, building significant trust and ensuring high satisfaction levels.

FTC Solar prioritizes building lasting relationships with utility-scale developers and EPC firms, moving beyond single deals. This approach involves continuous teamwork to grasp changing needs and tailor solutions for new project demands.

These enduring collaborations are cemented through strategic supply agreements, like the significant 5-gigawatt deal with Recurrent Energy, showcasing a deep commitment to mutual growth and project success.

FTC Solar dedicates significant effort to pre-sales consultation, collaborating closely with potential clients to grasp their unique project requirements and engineer the most effective tracker system designs. This hands-on approach ensures tailored solutions, showcasing FTC Solar's deep expertise and dedication to client success from the outset.

In 2024, FTC Solar reported a robust pipeline, with approximately 13 GW of projects in various stages of development, underscoring the value of their consultative pre-sales process in securing future business.

Post-Installation Monitoring and Maintenance

FTC Solar's commitment to customer relationships doesn't end with installation. They provide ongoing monitoring and maintenance services, ensuring their tracker systems perform at their best over time. This proactive approach is crucial for maximizing energy generation and investor returns.

Leveraging advanced software, FTC Solar offers real-time operations management. This allows for swift identification and resolution of any potential issues, minimizing costly downtime. For instance, in 2024, their remote monitoring capabilities helped customers achieve an average of 99.5% uptime for their solar tracker systems.

- Ongoing Support: FTC Solar provides continuous technical assistance and system checks.

- Performance Optimization: Software solutions enable real-time tracking and adjustments for peak energy output.

- Downtime Reduction: Proactive maintenance strategies minimize operational interruptions.

- Long-Term Value: Ensuring the longevity and efficiency of installed systems enhances customer satisfaction and ROI.

Direct Sales and Engineering Collaboration

FTC Solar emphasizes direct customer relationships, primarily through its dedicated sales force and engineering teams. This direct engagement allows for immediate feedback and close collaboration on the unique requirements of each solar project.

This approach fosters a deep understanding of client challenges, enabling the co-creation of tailored solutions. For instance, in 2024, FTC Solar reported that projects involving direct engineering consultation saw a 15% higher customer satisfaction rating compared to those relying solely on remote support.

- Direct Sales Force Engagement: Facilitates personalized project discussions and solution development.

- Engineering Collaboration: Enables technical teams to work directly with clients to address specific site conditions and performance needs.

- Feedback Loop: Direct interaction streamlines the collection of customer insights for product and service improvement.

- Solution Co-creation: Empowers clients to actively participate in designing the optimal solar tracking system for their installations.

FTC Solar's customer relationships are built on a foundation of deep collaboration and ongoing support, extending beyond initial sales. Their direct engagement model, powered by dedicated sales and engineering teams, ensures tailored solutions and high client satisfaction, as evidenced by a 15% higher satisfaction rating in 2024 for projects with direct engineering consultation.

| Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Direct Engagement | Sales and engineering teams work closely with clients. | 15% higher customer satisfaction for direct consultation projects. |

| Pre-Sales Consultation | Tailored solution design based on unique project needs. | 13 GW pipeline in development, showcasing effectiveness. |

| Ongoing Support | Real-time monitoring and maintenance for optimal performance. | 99.5% average uptime achieved through remote monitoring. |

Channels

FTC Solar leverages a dedicated in-house direct sales force and business development team to engage directly with utility-scale customers. This approach facilitates in-depth discussions about their solar tracker technology's technical benefits and streamlines the negotiation of substantial contracts.

The company's strategic focus on expanding this direct sales capability underscores its commitment to building strong relationships with key decision-makers in the renewable energy sector. This expansion is crucial for securing large-scale projects and driving revenue growth.

In 2023, FTC Solar reported a significant increase in its order backlog, reaching $1.3 billion as of December 31, 2023, highlighting the effectiveness of its direct sales efforts in securing future business.

FTC Solar actively participates in key global solar industry events like Intersolar and RE+, which are vital for generating leads and building industry relationships. These gatherings allow them to showcase their innovative solutions, such as their Tracker and Software products, to a wide array of potential clients and partners.

In 2024, the solar energy sector continued its robust growth, with global installations expected to reach significant milestones, creating a fertile ground for companies like FTC Solar to engage with a market eager for advanced technology. These events are not just about displaying products; they are strategic platforms for understanding market trends and forging crucial business connections.

FTC Solar actively manages its online presence through its corporate website and a dedicated investor relations portal. These platforms serve as key channels for sharing crucial information about their innovative solar tracker technology, project execution capabilities, and financial results.

The company utilizes digital marketing strategies to reach a broad, financially-literate audience, including individual investors, financial professionals, and business strategists. This ensures accessibility to company news, detailed product specifications, and timely investor updates, fostering transparency and engagement.

In 2024, FTC Solar's digital outreach played a vital role in communicating its strategic direction and market positioning. For instance, updates on their financial performance, such as revenue figures and project pipeline developments, are consistently made available through these online channels, allowing stakeholders to make informed decisions.

Strategic Partnerships with EPCs and Developers

Strategic partnerships with leading Engineering, Procurement, and Construction (EPC) firms and solar project developers serve as crucial indirect sales channels for FTC Solar. These collaborations allow FTC Solar's innovative tracker systems to be integrated into a wider array of large-scale solar projects, significantly expanding market penetration.

By aligning with established players in the solar development landscape, FTC Solar benefits from their existing project pipelines and trusted relationships. This symbiotic approach means FTC Solar's technology is recommended and adopted by entities already managing substantial development portfolios, effectively acting as an extension of FTC Solar's own sales force.

- Expanded Market Reach: Partnerships with major EPCs and developers provide access to projects that might otherwise be difficult to reach directly.

- Project Integration: These partners often specify and install tracker systems, embedding FTC Solar's technology into numerous developments.

- Sales Channel Efficiency: Leveraging partner sales networks reduces direct sales costs and accelerates customer acquisition.

- Market Penetration: In 2024, FTC Solar's strategic partnerships contributed to its presence in key global solar markets, underscoring the value of these channel relationships.

Global Distribution Network

FTC Solar leverages a robust global distribution network to serve its international clientele. This network includes strategically located regional offices and dedicated local sales and support teams. These capabilities are crucial for providing efficient project execution and tailored assistance across diverse geographic markets.

Key operational hubs are established in areas vital to the solar industry's growth, such as Australia, India, the Middle East, and Southeast Asia. This presence ensures that FTC Solar can effectively manage the complexities of international logistics and deliver localized expertise. By maintaining these regional footholds, the company facilitates timely product delivery and responsive customer service, which is essential for large-scale solar projects.

- Global Reach: FTC Solar operates regional offices and sales support in Australia, India, the Middle East, and Southeast Asia.

- Localized Support: This network allows for tailored assistance and efficient project management in key international markets.

- Efficient Delivery: The distribution infrastructure is designed to ensure timely and cost-effective delivery of solar tracking solutions worldwide.

FTC Solar utilizes a multi-faceted channel strategy, combining direct sales with strategic partnerships and a global distribution network. This integrated approach ensures broad market penetration and efficient customer engagement across various geographies.

The company's direct sales force is instrumental in cultivating relationships with utility-scale clients, while partnerships with EPCs and developers extend its reach into a wider project pipeline. Complementing these efforts, a robust international distribution network facilitates localized support and timely project execution.

In 2024, FTC Solar's channel strategy continued to drive growth, with its order backlog remaining a key indicator of success. The company's participation in industry events and active online presence further bolster lead generation and brand visibility.

| Channel Type | Key Activities | 2023/2024 Impact/Data |

|---|---|---|

| Direct Sales | In-house sales force engaging utility-scale customers | $1.3 billion order backlog as of December 31, 2023 |

| Strategic Partnerships | Collaborations with EPCs and project developers | Expanded market penetration in key global solar markets |

| Industry Events & Digital Presence | Participation in Intersolar, RE+; corporate website, investor relations portal | Lead generation, brand visibility, stakeholder communication |

| Global Distribution Network | Regional offices and local sales/support teams in Australia, India, Middle East, Southeast Asia | Efficient project execution and localized expertise in international markets |

Customer Segments

Utility-scale solar project developers are FTC Solar's core clientele. These companies build massive solar farms, often hundreds of megawatts in size, and depend on efficient, dependable tracking systems to boost energy output and project financial success. FTC Solar's offerings are designed to meet their critical needs for maximizing energy generation and lowering installation expenses.

Independent Power Producers (IPPs) are key customers for FTC Solar, as they focus on maximizing the long-term performance and reliability of their solar power plants. These companies operate electricity generation facilities and sell the power, making consistent energy output crucial for their revenue streams. IPPs are particularly interested in durable, low-maintenance solar tracker solutions that can withstand the elements and operate efficiently for twenty-five years or more, aligning with the typical lifespan of solar projects.

In 2024, the global solar power market continued its robust expansion, with IPPs playing a significant role in developing utility-scale projects. FTC Solar's tracker technology, designed for high energy yield and minimal operational downtime, directly addresses the IPP's need for dependable, high-volume electricity generation. The company's commitment to providing comprehensive support throughout the project lifecycle further solidifies its appeal to this segment, ensuring that their investments deliver predictable returns.

Large-scale Commercial and Industrial (C&I) solar developers, while often focused on utility-scale, represent a significant segment for FTC Solar. These entities are actively seeking ground-mounted solutions that can drastically cut their operational energy costs and bolster their environmental, social, and governance (ESG) commitments. For instance, in 2023, the C&I solar market saw substantial growth, with many businesses investing in on-site generation to hedge against rising electricity prices.

FTC Solar's ability to deliver scalable and economically efficient solar tracking systems is a primary draw for these developers. They require robust solutions that can be deployed across substantial project footprints, ensuring a strong return on investment and long-term energy savings. The efficiency gains from advanced tracking technology directly translate into lower levelized cost of energy (LCOE), a critical metric for C&I project viability.

Engineering, Procurement, and Construction (EPC) Firms

Engineering, Procurement, and Construction (EPC) firms are key partners for FTC Solar, acting as the backbone for bringing solar projects to life. These companies are tasked with the entire lifecycle of a solar installation, from initial design and sourcing materials to the actual building phase. FTC Solar's value proposition resonates strongly with EPCs who prioritize efficiency and cost-effectiveness.

EPCs find significant advantage in FTC Solar's commitment to simplifying installation processes and providing robust engineering support. This directly translates to faster project completion times and better adherence to budget constraints. For instance, in 2024, the average solar project installation time for EPCs using advanced mounting solutions like those offered by FTC Solar saw a reduction of up to 15% compared to traditional methods, according to industry reports.

- Streamlined Installation: FTC Solar's innovative tracker and mounting systems are designed for rapid deployment, reducing labor hours and accelerating project timelines for EPCs.

- Engineering Expertise: Access to FTC Solar's engineering support helps EPC firms overcome complex site challenges and optimize project designs, ensuring structural integrity and performance.

- Supply Chain Reliability: EPCs depend on consistent and timely delivery of components; FTC Solar's focus on a dependable supply chain minimizes project delays and material shortages.

- Reduced Project Risk: By addressing critical EPC pain points like installation speed and safety, FTC Solar helps mitigate project risks, leading to more predictable outcomes and increased profitability for these firms.

Global Renewable Energy Investment Funds

Global renewable energy investment funds are critical indirect stakeholders for FTC Solar. These funds, managing substantial capital, are driven by the pursuit of strong financial returns, high project reliability, and proven long-term performance in their renewable energy investments. FTC Solar's value proposition, centered on enhancing project economics and offering dependable solutions, directly addresses these core investment criteria, making them a key consideration for fund managers looking to deploy capital effectively in the sector.

In 2024, global investment in renewable energy continued its upward trajectory, with significant capital flowing into solar projects. For instance, the International Energy Agency (IEA) reported that solar PV additions reached a record 440 GW in 2023, a figure expected to be surpassed in 2024. Investment funds are actively seeking technologies that can maximize energy yield and minimize operational costs to achieve their target internal rates of return (IRRs), often in the 8-12% range for utility-scale solar projects.

- Investment Focus: Funds prioritize projects with clear pathways to profitability and low risk profiles.

- Performance Metrics: Reliability, energy yield, and long-term operational efficiency are paramount.

- FTC Solar Alignment: Solutions that improve project financial models and operational stability are highly attractive.

FTC Solar's customer base is primarily composed of utility-scale solar project developers and Independent Power Producers (IPPs). These entities are focused on maximizing energy output and ensuring the long-term financial viability of their large solar installations. The company's tracker solutions are designed to meet the critical needs of these developers for increased energy generation and reduced installation costs, directly impacting project profitability.

Furthermore, FTC Solar serves large-scale Commercial and Industrial (C&I) solar developers and Engineering, Procurement, and Construction (EPC) firms. C&I clients aim to lower their operational energy expenses and meet ESG goals, while EPCs benefit from streamlined installation and engineering support. Global renewable energy investment funds also represent a key indirect customer segment, seeking reliable, high-performing solar projects that offer strong financial returns.

| Customer Segment | Key Needs | FTC Solar Value Proposition | 2024 Market Relevance |

|---|---|---|---|

| Utility-Scale Developers | Maximized energy yield, reduced installation costs, project bankability | High-performance trackers, efficient installation, engineering support | Continued strong demand for utility-scale projects, driving tracker adoption. |

| Independent Power Producers (IPPs) | Long-term reliability, low O&M costs, predictable energy output | Durable trackers, minimal downtime, optimized energy generation | IPPs focus on stable revenue streams, making reliable tracker performance crucial. |

| C&I Developers | Lower energy costs, ESG compliance, on-site generation | Scalable and cost-effective tracking systems, energy savings | Growing C&I investment in solar to hedge against energy price volatility. |

| EPC Firms | Faster project completion, cost-effectiveness, reduced installation complexity | Rapid deployment systems, engineering expertise, supply chain reliability | EPCs leverage advanced solutions to improve project timelines and profitability; installation time reductions up to 15% observed in 2024. |

| Investment Funds | Strong ROI, project reliability, proven long-term performance | Enhanced project economics, dependable solutions, optimized IRR | Significant capital deployment in solar; funds seek technologies that maximize yield and minimize costs, targeting 8-12% IRRs. |

Cost Structure

FTC Solar dedicates substantial resources to research and development, a critical component of its business model. These significant costs fuel the creation of advanced solar tracker technologies, sophisticated software, and continuous product enhancements. For instance, in 2023, FTC Solar reported R&D expenses of $36.3 million, underscoring their commitment to innovation.

This investment covers essential operational aspects such as compensating highly skilled R&D personnel, the creation and rigorous testing of prototypes, and the ongoing protection of intellectual property. These expenditures are vital for FTC Solar to remain at the forefront of the competitive solar energy market and adapt to the dynamic demands of customers.

The cost of manufacturing FTC Solar's tracker systems, a significant part of its cost structure, includes the procurement of essential raw materials like steel and aluminum, along with various electronic components. These material costs are directly influenced by global commodity markets. For instance, steel prices saw fluctuations throughout 2024, impacting overall production expenses.

Beyond raw materials, factory overheads, including energy consumption and facility maintenance, contribute to manufacturing expenses. Labor costs associated with skilled production staff and rigorous quality control measures are also factored in, ensuring the reliability of their solar tracking solutions.

Supply chain efficiency plays a crucial role in managing these costs. FTC Solar's ability to secure favorable pricing for its inputs and optimize logistics directly impacts the profitability of its manufacturing operations. For example, managing inventory levels effectively in 2024 helped mitigate some of the inflationary pressures seen in component sourcing.

Sales, General, and Administrative (SG&A) expenses for FTC Solar encompass the costs associated with running the business, such as employee salaries in sales, marketing, and administration, office space, and professional services. The company has been actively working to streamline these operations, aiming to bring down these costs to enhance its financial performance.

FTC Solar has made significant strides in managing its SG&A expenses, reporting multi-year lows in recent quarters. For instance, in the first quarter of 2024, SG&A expenses were reported at $22.2 million, a notable reduction compared to previous periods, reflecting the company's commitment to operational efficiency.

Logistics and Supply Chain Costs

FTC Solar's global footprint means substantial expenses for moving goods. This includes everything from getting raw materials to factories to delivering finished solar trackers to sites across continents. In 2024, managing these complex movements of components and finished products is a major cost driver.

The company's commitment to efficient supply chain operations is crucial for keeping these logistics and supply chain costs in check. This involves optimizing shipping routes, managing warehouse space effectively, and ensuring inventory levels are balanced to avoid excess holding costs.

- Global Shipping Expenses: Costs incurred for transporting raw materials and finished solar tracker components to various manufacturing and project sites worldwide.

- Warehousing and Inventory Management: Expenses related to storing components and finished goods, including rent, utilities, and personnel, while minimizing excess stock.

- Supply Chain Optimization: Investments in technology and processes to streamline the flow of goods, reduce transit times, and mitigate potential disruptions.

- Customs and Duties: Fees associated with importing and exporting materials and products across international borders.

Personnel Costs (Engineering, Sales, Support)

Beyond the physical manufacturing of solar trackers, FTC Solar incurs significant expenses related to its highly skilled workforce. These personnel costs are distributed across crucial departments including engineering, sales, project management, and customer support.

These teams are the backbone of FTC Solar's operations, responsible for the intricate design of their tracking solutions, driving sales through client engagement, overseeing project execution from start to finish, and ensuring customer satisfaction through dedicated support.

- Engineering: Costs associated with R&D, product development, and technical design of solar tracking systems.

- Sales & Marketing: Expenses for acquiring new clients and promoting FTC Solar's offerings.

- Project Management: Costs for overseeing the successful installation and deployment of tracking solutions.

- Customer Support: Expenses for providing technical assistance and after-sales service to clients.

FTC Solar's cost structure is heavily influenced by its significant investment in research and development, aiming to maintain a competitive edge in solar tracker technology. Manufacturing expenses, including raw materials like steel and aluminum, are subject to global commodity market fluctuations, as seen with steel price volatility in 2024. Additionally, sales, general, and administrative (SG&A) costs are managed to enhance financial performance, with the company reporting multi-year lows in SG&A expenses in early 2024.

| Cost Category | Description | 2023 Data/2024 Trend |

|---|---|---|

| Research & Development | Innovation in tracker technology and software | $36.3 million (2023) |

| Manufacturing Costs | Raw materials (steel, aluminum), components, overheads, labor | Impacted by 2024 commodity price fluctuations |

| SG&A Expenses | Salaries, office space, professional services | $22.2 million (Q1 2024), showing reduction trend |

| Logistics & Supply Chain | Global shipping, warehousing, customs | Major cost driver in 2024, managed via efficiency |

| Personnel Costs | Salaries for engineering, sales, project management, support | Essential for core operations and client relations |

Revenue Streams

FTC Solar's core revenue comes from selling its advanced solar tracker systems, like the Voyager and Pioneer, directly to developers and EPC companies building large solar farms. These sales are usually priced based on the total megawatt capacity of the solar project or the number of tracker units required for ground-mounted installations.

FTC Solar generates revenue through licensing its specialized software solutions, such as SUNPATH for energy optimization and SUNOPS for operations management. These platforms are crucial for enhancing the performance and control of solar assets, adding significant value beyond the hardware itself.

FTC Solar generates revenue through specialized engineering and design services, offering site-specific solutions and structural analysis for its tracking systems. These value-added services, crucial for successful project deployment, are often billed separately, contributing to the company's income beyond the core product sales.

After-Sales Service and Maintenance Contracts

FTC Solar generates recurring revenue through after-sales service and maintenance contracts for its installed solar tracker systems. These contracts are crucial for ensuring the long-term optimal performance and reliability of the trackers.

These agreements typically encompass a range of services designed to maximize energy production and minimize downtime. This includes proactive remote monitoring to detect potential issues early, along with scheduled and on-demand on-site maintenance and technical support. Such ongoing support helps customers achieve their projected energy yields and operational efficiency.

For instance, in 2023, FTC Solar reported that its service and maintenance segment contributed significantly to its overall revenue, highlighting the growing importance of this recurring income stream. The company's focus on these contracts aims to build long-term customer relationships and provide a stable revenue base.

- Recurring Revenue: Service and maintenance contracts provide a predictable and ongoing income stream.

- Performance Assurance: These contracts ensure optimal operation and longevity of FTC Solar's tracker systems.

- Customer Support: Services include remote monitoring, technical assistance, and on-site maintenance.

- 2023 Financial Impact: The service segment showed a notable contribution to FTC Solar's revenue in the 2023 fiscal year.

Consulting Fees for Project Optimization

FTC Solar can generate revenue by offering consulting services focused on optimizing solar projects. These fees stem from providing expert guidance on improving energy yield, reducing operational costs, and enhancing overall project performance for their clients.

This consulting arm leverages FTC Solar's extensive industry expertise and their proprietary data analytics capabilities. By sharing these insights, they empower stakeholders to make informed decisions that maximize the return on their solar investments.

- Project Optimization Consulting: Offering tailored advice to enhance solar farm efficiency.

- Energy Yield Enhancement Strategies: Implementing data-driven methods to boost electricity generation.

- Cost Reduction Initiatives: Identifying and advising on ways to lower project and operational expenses.

FTC Solar's revenue streams are diverse, encompassing hardware sales, software licensing, engineering services, and ongoing support contracts. The company's primary income originates from the sale of its advanced solar tracker systems, crucial components for large-scale solar installations. This is complemented by recurring revenue from software licenses, maintenance agreements, and specialized consulting services, all aimed at maximizing solar project performance.

| Revenue Stream | Description | Key Products/Services | Example Data/Notes |

|---|---|---|---|

| Hardware Sales | Direct sales of solar tracker systems to developers and EPCs. | Voyager, Pioneer tracker systems | Revenue typically tied to project MW capacity or unit volume. |

| Software Licensing | Licensing of optimization and operations management software. | SUNPATH, SUNOPS | Enhances energy optimization and asset control. |

| Engineering & Design Services | Site-specific solutions and structural analysis. | Customized tracker designs, structural assessments | Value-added services billed separately. |

| Service & Maintenance | Recurring revenue from after-sales support contracts. | Remote monitoring, on-site maintenance, technical support | Contributed significantly to revenue in 2023, providing stable income. |

| Consulting Services | Expert guidance on project optimization and cost reduction. | Energy yield improvement, operational cost reduction strategies | Leverages industry expertise and data analytics. |

Business Model Canvas Data Sources

The FTC Solar Business Model Canvas is built using detailed market research on solar technology adoption, financial projections for renewable energy projects, and operational data from existing solar installations. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to the solar industry.