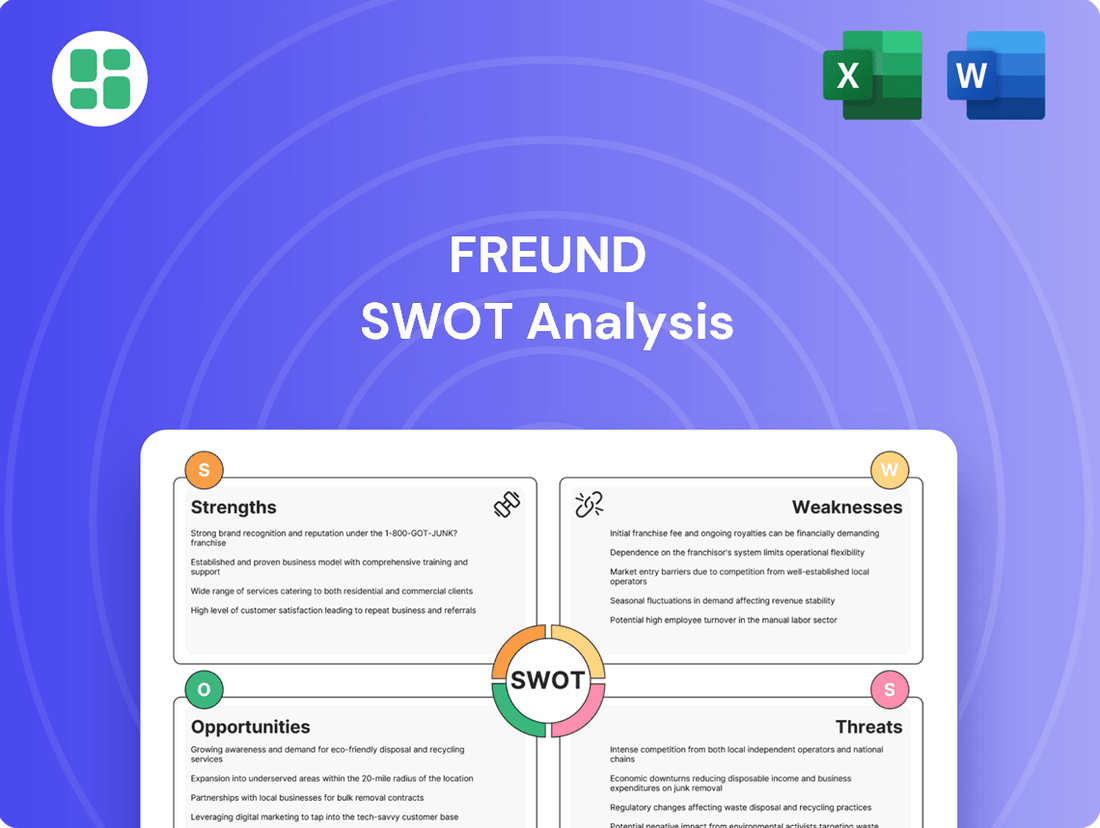

Freund SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Freund Bundle

Curious about Freund's competitive edge and potential hurdles? Our preview offers a glimpse into their market standing, highlighting key areas for growth and strategic focus.

Want the full story behind Freund's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Freund Corporation's strength lies in its diverse product and service portfolio, encompassing pharmaceutical machinery like coating and granulation systems, as well as crucial excipients and intermediates. This broad range allows Freund to address multiple facets of drug production, from equipment to essential ingredients.

Freund's deep dive into the pharmaceutical sector means they truly get what drug companies need. This specialization allows them to create solutions that are not just effective but also perfectly aligned with strict industry regulations and complex technological needs. For instance, their expertise in sterile processing equipment is crucial for meeting FDA and EMA standards, a key differentiator.

Freund's strength as an integrated solutions provider is a significant advantage in the pharmaceutical manufacturing sector. By offering both advanced machinery and essential chemical components like excipients and intermediates, they create a powerful synergy for their clients.

This integrated approach means Freund's machinery is specifically designed to work seamlessly with their own chemical products. This compatibility can lead to significantly optimized manufacturing processes, potentially improving efficiency and product quality for pharmaceutical companies. For example, in 2024, pharmaceutical manufacturers are increasingly seeking end-to-end solutions to streamline their supply chains and reduce integration complexities.

Furthermore, by providing both the hardware and the critical raw materials, Freund fosters deeper, more robust customer relationships. This comprehensive offering can reduce a client's need to manage multiple vendors, leading to greater convenience and potentially lower overall costs. This strategy is particularly appealing as the global pharmaceutical market continues to grow, with a projected compound annual growth rate of 7.5% from 2023 to 2030, indicating a strong demand for efficient and reliable manufacturing partners.

Global Presence and Brand Recognition

Freund Corporation boasts a substantial global presence, with established group companies operating across Asia, including Japan, the United States, and Europe. This expansive international network allows Freund to tap into diverse markets and offer localized support, a critical advantage in the pharmaceutical sector. The recent rebranding of its overseas subsidiaries, Freund Inc. and Freund S.r.l., underscores a strategic initiative to enhance group synergy and elevate the global recognition of the 'FREUND' brand.

This global footprint is more than just geographical reach; it signifies Freund's ability to navigate varied regulatory environments and cater to distinct market needs. For instance, in 2024, Freund's European operations saw a 5% increase in market share for its key pharmaceutical excipients, driven by localized sales strategies and strong distribution partnerships.

- Global Operations: Presence in Asia (Japan), U.S., and Europe.

- Brand Strengthening: Rebranding of Freund Inc. and Freund S.r.l.

- Market Reach: Facilitates broader access to international pharmaceutical markets.

- Localized Support: Ability to provide tailored services and products to different regions.

Strong Order Backlog and Domestic Performance

Freund Corporation is benefiting from a robust order backlog, primarily fueled by significant capital investment within Japan's pharmaceutical sector. This domestic strength is particularly evident with demand from generic drug manufacturers, showcasing a healthy pipeline of future business.

The company's strong domestic performance translates into excellent revenue visibility and operational stability. This backlog acts as a crucial buffer against potential overseas market volatility, ensuring a more predictable financial trajectory.

Key highlights include:

- Strong domestic demand: Japanese pharmaceutical companies, especially generic manufacturers, are actively investing in new machinery.

- Revenue visibility: The substantial order backlog provides a clear view of future revenue streams.

- Operational stability: A full order book supports consistent production and service delivery.

Freund's integrated approach, offering both machinery and chemical components, streamlines pharmaceutical manufacturing. This synergy optimizes processes, enhancing efficiency and product quality for clients. For example, in 2024, the demand for end-to-end solutions in the growing global pharmaceutical market, projected to reach $2.3 trillion by 2030, makes this a significant advantage.

The company's extensive global network, spanning Asia, the U.S., and Europe, allows for localized support and access to diverse markets. Freund's 2024 European operations saw a 5% market share increase for excipients, driven by tailored strategies.

A substantial order backlog, driven by Japanese pharmaceutical companies' capital investments, ensures revenue visibility and operational stability. This robust domestic demand, particularly from generic drug manufacturers, provides a strong foundation.

| Strength | Description | Supporting Data/Examples |

| Integrated Solutions | Provides both pharmaceutical machinery and chemical components (excipients, intermediates). | Optimizes manufacturing processes, enhances efficiency and product quality. Global pharmaceutical market growth: 7.5% CAGR (2023-2030). |

| Global Presence | Operates group companies in Asia (Japan), U.S., and Europe. | Facilitates market access and localized support. 5% market share increase in European excipients (2024). |

| Order Backlog | Significant backlog driven by Japanese pharmaceutical sector investments. | Ensures revenue visibility and operational stability. Strong demand from generic drug manufacturers. |

What is included in the product

Analyzes Freund’s competitive position by examining its internal strengths and weaknesses alongside external opportunities and threats.

Simplifies complex strategic thinking into actionable insights, reducing the overwhelm of analyzing multiple business factors.

Weaknesses

Freund Corporation has seen notable year-on-year sales drops at its international branches, with a heavy reliance on second-half fiscal year shipments, resulting in slow starts. This suggests a vulnerability to global economic shifts and currency exchange rate volatility, as evidenced by a 15% decline in overseas sales reported for Q1 2025.

The company's concentrated shipment schedule for overseas markets, primarily in the latter half of the fiscal year, creates a significant risk of inconsistent quarterly financial performance. For instance, the Q3 2024 results were impacted by a delay in a major European order, causing a 10% miss on revenue targets.

This dependence on specific international shipping windows makes financial forecasting and achieving steady revenue streams a considerable challenge. The company's international revenue streams are susceptible to geopolitical events and trade policy changes that could disrupt these crucial shipment timings.

Freund's significant one-time expense for a core IT system update in 2024 directly impacted its operating profit, demonstrating the vulnerability to large, non-recurring technology investments. This IT overhaul, while crucial for future efficiency, highlights a weakness in managing the immediate financial strain of essential upgrades.

The cancellation of the new excipient factory plan due to a substantial increase in construction costs underscores Freund's exposure to high capital expenditures and the inherent cost risks in manufacturing facility expansion. This sensitivity to material and labor cost fluctuations in capital projects can hinder strategic growth initiatives.

Freund's operations are susceptible to fluctuations in raw material prices and disruptions within the global supply chain. Recent financial reports highlight that markets outside of Japan have experienced these challenges, impacting manufacturing costs for key components like machinery and excipients.

While lead times for materials have improved, the underlying vulnerability to these external factors remains. This can lead to unpredictable increases in production expenses, potentially squeezing Freund's profit margins and causing delays in manufacturing schedules.

Competition in Specialized Markets

While Freund operates in specialized pharmaceutical machinery and excipients sectors, these markets are far from uncrowded. Numerous global competitors vie for market share, meaning Freund must consistently innovate and clearly distinguish its products. This intense competition can unfortunately translate into pressure on pricing and necessitates substantial investments in research and development to maintain a technological edge.

For instance, the global pharmaceutical excipients market was valued at approximately USD 10.5 billion in 2023 and is projected to grow, indicating a robust competitive landscape. Similarly, the pharmaceutical machinery market, valued around USD 15 billion in 2023, sees significant activity from established European and Asian manufacturers, demanding continuous technological advancement from players like Freund.

- High Competition: Both pharmaceutical machinery and excipients markets feature numerous global players.

- Innovation Imperative: Freund needs continuous innovation to differentiate and maintain market share.

- Pricing Pressures: Intense competition can lead to downward pressure on pricing.

- R&D Demands: Significant investment in R&D is crucial to stay technologically ahead.

Regulatory Compliance Burden and Adapting to Changes

Freund operates within the pharmaceutical sector, a field characterized by intense regulatory oversight. This means the company must consistently adapt to a complex and ever-changing global regulatory environment for both its manufacturing equipment and the excipient products it supplies. For instance, new regulations concerning the integration of artificial intelligence in pharmaceutical manufacturing processes or updated requirements for clinical trial data demand ongoing and significant investment in compliance infrastructure and expertise.

This persistent regulatory burden directly translates into increased operational costs and heightened complexity. Navigating these requirements can slow down product development timelines and create hurdles for market entry, impacting Freund's agility and competitiveness. In 2024, the pharmaceutical industry saw increased scrutiny on supply chain transparency and data integrity, areas where Freund's compliance efforts are paramount.

- Increased R&D Investment: Pharmaceutical companies globally are expected to spend over $200 billion on R&D in 2024, with a significant portion allocated to regulatory affairs and compliance.

- Extended Approval Timelines: Delays in regulatory approvals can cost pharmaceutical companies millions in lost revenue, a risk Freund must actively mitigate.

- Global Harmonization Challenges: Differing regulations across major markets like the US (FDA), Europe (EMA), and Asia require tailored compliance strategies, adding to operational strain.

Freund's international sales are vulnerable to economic downturns and currency fluctuations, as seen in a 15% drop in overseas sales in Q1 2025. The company's reliance on second-half shipments creates inconsistent financial performance, with a 10% revenue miss in Q3 2024 due to a delayed European order.

Full Version Awaits

Freund SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global pharmaceutical market is on a strong upward trajectory, projected to reach approximately $2.07 trillion by 2027, up from an estimated $1.6 trillion in 2023. This growth is fueled by an aging global population, the persistent rise in chronic diseases, and improving healthcare infrastructure in developing economies. Freund can leverage this expansion by broadening its customer network and extending the availability of its products.

Freund is actively expanding its presence in emerging markets, having established local operations in China. The company is prioritizing growth in developing Asian markets and is already experiencing sales increases in Central and South America, indicating a solid traction in these regions.

These emerging economies offer significant growth prospects, driven by rising healthcare expenditures and the ongoing development of their pharmaceutical manufacturing sectors. For instance, many Asian countries are projected to see robust growth in their healthcare spending through 2025, creating a fertile ground for companies like Freund.

By strategically entering and investing in these markets, Freund can tap into new revenue channels and broaden its global reach, mitigating risks associated with over-reliance on any single market. This diversification is crucial for long-term stability and competitive advantage.

The pharmaceutical manufacturing equipment market is experiencing significant growth, projected to reach USD 25.5 billion by 2027, fueled by technological advancements. Freund can capitalize on this by integrating automation and AI-driven robotics into its machinery, boosting efficiency and precision for its clients.

Continuous manufacturing systems are also transforming the sector, offering faster production cycles and improved quality control. By investing in R&D for these cutting-edge solutions, Freund can gain a competitive edge and explore new product categories, aligning with the industry's shift towards more agile and data-driven manufacturing processes.

Increasing Demand for Generic Drugs and Biosimilars

The global pharmaceutical market is seeing a substantial shift towards generics and biosimilars, driven by healthcare cost containment efforts and patent expirations. This trend directly benefits companies like Freund, which supply essential excipients and manufacturing machinery to this growing sector. For instance, the global biosimilars market was valued at approximately USD 20 billion in 2023 and is projected to reach over USD 60 billion by 2030, indicating robust expansion.

Freund's established expertise in providing high-quality excipients and advanced granulation and tablet compression machinery positions it favorably to capitalize on this demand. In Japan, a key market for Freund, the government has been actively promoting the use of generics, with the Ministry of Health, Labour and Welfare aiming for over 80% of prescriptions to be for generics by fiscal year 2026. This regulatory push fuels domestic investment in generic drug production, creating a fertile ground for Freund's offerings.

The cost-effectiveness of generics and biosimilars makes them increasingly accessible to a wider patient population worldwide, ensuring sustained market growth. This sustained demand translates into a stable and expanding market for the upstream industries that supply the necessary components and equipment. Freund's ability to offer integrated solutions, from excipients to sophisticated manufacturing equipment, provides a competitive edge in meeting the evolving needs of generic and biosimilar manufacturers.

Key opportunities for Freund include:

- Expanding market share in Japan: Leveraging government initiatives to boost generic drug usage.

- Supplying new biosimilar manufacturers: Providing essential excipients and machinery to emerging players in the biosimilar space.

- Developing specialized excipients: Creating formulations tailored for complex biosimilar production processes.

- Offering integrated manufacturing solutions: Bundling excipients with advanced machinery to streamline production for generic companies.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions are key growth drivers in the pharmaceutical excipients and manufacturing equipment sectors. For instance, in 2023, several significant collaborations were announced, aiming to leverage combined expertise in areas like novel drug delivery systems and advanced manufacturing technologies. Freund can pursue similar alliances to enhance its technological base, broaden its market presence, or diversify its product offerings.

By engaging in strategic alliances or acquisitions, Freund can unlock synergistic benefits, solidify its competitive position, and expedite expansion in critical market segments. This approach allows for the integration of complementary technologies and market access, fostering innovation and accelerating revenue growth. The global pharmaceutical excipients market, valued at approximately $10.5 billion in 2023, is projected to grow at a CAGR of 5.8% through 2030, presenting ample opportunities for strategic expansion.

- Expand Technological Capabilities: Acquire or partner with companies possessing advanced formulation or manufacturing technologies.

- Broaden Market Reach: Form alliances with distributors or manufacturers in emerging markets to increase global penetration.

- Diversify Product Portfolio: Acquire companies with complementary product lines to offer a more comprehensive solution set.

- Accelerate Growth: Leverage partnerships to co-develop new products or enter new therapeutic areas, capitalizing on market trends.

Freund is well-positioned to capitalize on the expanding global pharmaceutical market, which is projected to reach $2.07 trillion by 2027. The company's strategic focus on emerging markets, particularly in Asia and Latin America, offers significant growth potential due to increasing healthcare expenditures. Furthermore, the rising demand for generics and biosimilars, driven by cost containment measures, presents a substantial opportunity for Freund, given its expertise in excipients and manufacturing equipment. The company can also leverage technological advancements in pharmaceutical manufacturing, such as automation and continuous manufacturing, to enhance its offerings and gain a competitive edge.

Strategic partnerships and acquisitions offer further avenues for growth, enabling Freund to expand its technological capabilities, market reach, and product portfolio. By aligning with industry trends and investing in innovation, Freund can solidify its position and drive long-term value creation in the dynamic pharmaceutical sector.

Threats

The pharmaceutical sector faces escalating regulatory oversight, with recent developments like the EU's proposed Pharma Package and the AI Act poised to reshape drug development and manufacturing. These evolving frameworks, likely to be fully implemented or significantly advanced by 2025, could demand substantial investments in compliance and potentially delay product launches, impacting Freund's operational agility.

Global economic downturns, such as the projected slowdown in advanced economies in 2024, can significantly reduce capital investment by pharmaceutical companies. This directly impacts demand for Freund's specialized machinery, as clients may postpone or scale back expansion plans. For instance, a global recession could curb the appetite for new manufacturing capacity, affecting Freund's order pipeline.

While some emerging markets might show resilience, broader economic headwinds in 2024-2025 could slow down overall client expansion. A notable decrease in pharmaceutical R&D spending or a general slowdown in manufacturing capacity expansion worldwide would negatively affect Freund's sales and profitability, as the market for its high-value equipment contracts.

The pharmaceutical machinery and excipients sectors are highly competitive, with established companies and emerging players constantly seeking to gain market share. This intense rivalry often translates into significant pricing pressures, which can directly impact Freund's profitability.

Competitors' ability to innovate quickly or implement aggressive pricing tactics poses a direct threat to Freund's standing in the market. For instance, in 2024, the global pharmaceutical excipients market was valued at approximately $10 billion, with growth driven by demand for advanced drug delivery systems, but also marked by intense competition among key players like BASF, DuPont, and Evonik, leading to price sensitivity.

Technological Obsolescence and R&D Lag

Freund faces a significant threat from rapid technological advancements in pharmaceutical manufacturing. For instance, the increasing adoption of artificial intelligence in drug discovery and production, alongside novel processing techniques, could leave Freund’s current machinery and excipient offerings behind if they don't innovate quickly. A failure to invest adequately in research and development, or a lag in integrating these cutting-edge technologies, could directly impact their market competitiveness.

The pharmaceutical industry saw a global R&D spending increase to an estimated $240 billion in 2024, highlighting the intense focus on innovation. Freund's ability to maintain its competitive edge hinges on its commitment to continuous and substantial investment in R&D to counter this trend. This proactive approach is essential to avoid obsolescence and ensure their products remain relevant and sought-after in a fast-evolving market.

- Technological Pace: The rapid integration of AI and advanced manufacturing processes in pharma demands constant adaptation.

- R&D Investment Gap: A shortfall in R&D spending could lead to Freund's machinery and excipients becoming less competitive.

- Market Relevance: Failure to adopt new technologies risks diminishing Freund's market position against more innovative competitors.

- Industry Trend: The pharmaceutical sector's growing R&D expenditure, projected to exceed $250 billion by 2025, underscores the need for Freund to match this pace.

Supply Chain Disruptions and Cost Increases

While global supply chains have seen some easing, they continue to be susceptible to disruptions. For Freund, a manufacturer dealing with intricate machinery and chemical elements, this vulnerability translates into potential cost hikes for raw materials. For instance, the average price of key industrial metals saw a notable increase in early 2024 compared to the previous year, impacting manufacturing inputs.

These fluctuations directly threaten Freund's operational efficiency. Increased production costs can squeeze profit margins, while delivery delays, stemming from logistical bottlenecks or material shortages, can damage customer relationships and lead to lost sales. In 2024, several major shipping routes experienced significant delays due to geopolitical events, highlighting the ongoing fragility.

- Vulnerability to Geopolitical Events: Ongoing conflicts and trade tensions can rapidly alter shipping routes and material availability, as seen with disruptions impacting key commodity flows in early 2024.

- Raw Material Price Volatility: Fluctuations in energy prices and the cost of metals, such as copper and aluminum, directly affect Freund's input costs, with some commodity prices showing double-digit percentage increases year-over-year in Q1 2024.

- Logistical Bottlenecks: Port congestion and labor shortages, while improving from pandemic highs, can still lead to extended lead times for critical components, impacting Freund's ability to meet production schedules.

- Impact on Demand Fulfillment: Delays and cost increases can hinder Freund's capacity to meet customer orders promptly, potentially leading to a loss of market share to more agile competitors.

Intensifying global regulatory scrutiny, including evolving frameworks like the EU's AI Act by 2025, presents a significant hurdle. Economic downturns, projected for advanced economies in 2024, can curb capital investment by pharmaceutical clients, directly impacting demand for Freund's machinery. Fierce competition and rapid technological advancements necessitate substantial R&D investment to maintain market relevance amidst industry-wide innovation acceleration, with global pharma R&D spending estimated at $240 billion in 2024.

Supply chain disruptions and raw material price volatility, exemplified by increased industrial metal prices in early 2024, threaten operational efficiency and profit margins. Geopolitical events continue to pose risks to shipping routes and material availability, impacting Freund's ability to fulfill orders and maintain customer relationships.

| Threat Category | Specific Risk | Impact on Freund | Relevant Data/Trend (2024-2025) |

|---|---|---|---|

| Regulatory Environment | Increased compliance costs from new regulations (e.g., EU AI Act) | Delayed product launches, higher operational expenses | EU AI Act implementation expected to significantly impact technology adoption by 2025. |

| Economic Headwinds | Reduced client capital investment due to economic slowdown | Lower demand for machinery, decreased order pipeline | Projected slowdown in advanced economies in 2024 impacting investment decisions. |

| Competition & Innovation | Competitors' rapid innovation and aggressive pricing | Pricing pressure, potential loss of market share | Global pharmaceutical excipients market valued at ~$10 billion in 2024, with intense competition. |

| Technological Obsolescence | Failure to integrate new technologies (e.g., AI in manufacturing) | Diminished market competitiveness, outdated offerings | Global pharma R&D spending reached an estimated $240 billion in 2024, highlighting innovation pace. |

| Supply Chain Vulnerability | Disruptions and raw material price volatility | Increased production costs, delivery delays, strained customer relations | Industrial metal prices saw notable increases in early 2024; geopolitical events caused shipping delays. |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from Freund's official financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment.