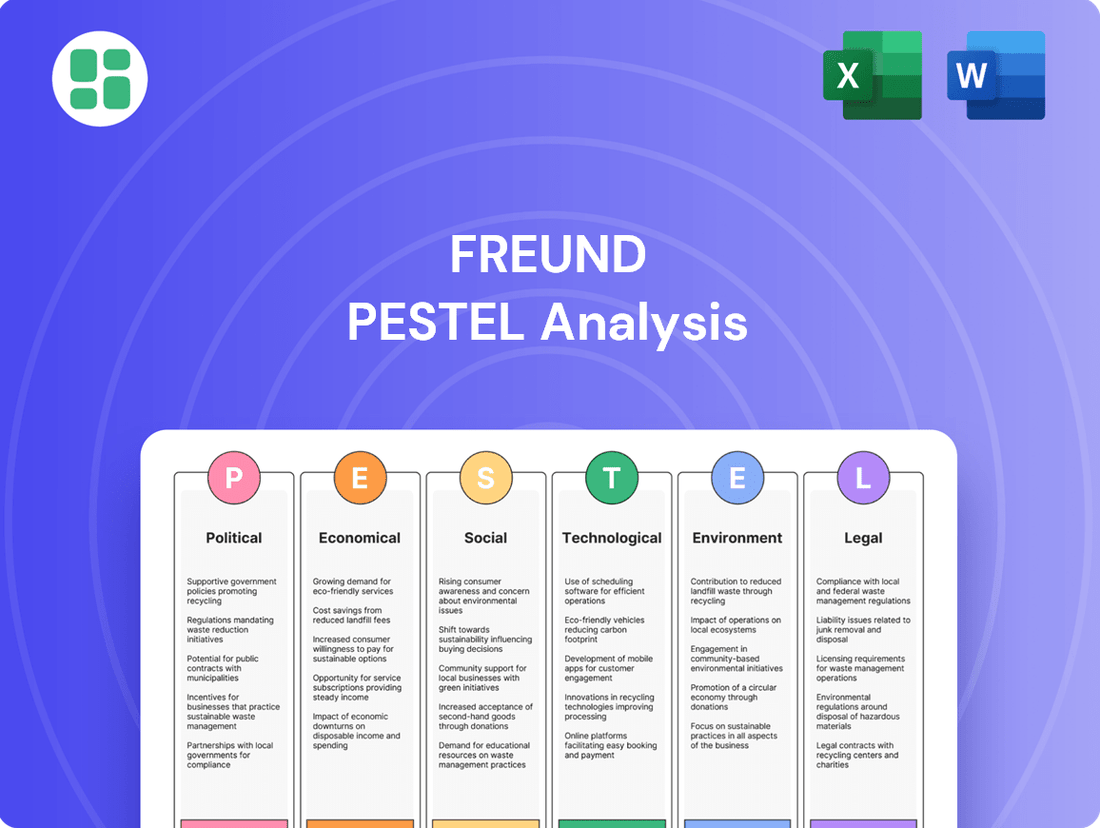

Freund PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Freund Bundle

Navigate the complex external landscape affecting Freund with our expert PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its future. Gain a competitive edge by leveraging these critical insights. Purchase the full analysis now for actionable intelligence.

Political factors

Government healthcare policies, including those concerning drug pricing and reimbursement, significantly shape the demand for pharmaceutical products. For instance, in 2024, many governments continued to explore or implement measures to control drug costs, potentially impacting the volume of production and, by extension, the need for manufacturing equipment and excipients.

Increased government healthcare spending often translates to a more robust pharmaceutical market. In 2024, global healthcare spending was projected to rise, with many nations prioritizing public health initiatives, which can drive demand for pharmaceutical machinery and raw materials. Conversely, fiscal constraints or shifts towards austerity could dampen this growth, as seen in some European countries facing economic pressures.

International trade agreements and tariffs directly influence Freund Corporation's global operations. For instance, the USMCA, which replaced NAFTA, impacts trade flows for manufactured goods and agricultural products, potentially affecting Freund's sourcing of raw materials or distribution of finished products in North America. Changes in tariffs, such as those imposed on specific industrial components or finished goods, can alter production costs and competitiveness in key markets.

Geopolitical tensions, particularly between the United States and China, present ongoing risks. In 2023, tariffs on various goods continued to be a factor, with discussions around potential new levies on technology and manufacturing inputs. Such tensions can disrupt the supply of essential machinery or pharmaceutical ingredients, forcing Freund to re-evaluate its supply chain resilience and explore alternative sourcing strategies to mitigate risks and maintain operational continuity.

Regulatory stability is paramount for pharmaceutical companies like Freund's clients. In 2024, the FDA continued its focus on ensuring drug safety and efficacy, with ongoing updates to its Good Manufacturing Practices (GMP) guidelines. For instance, the FDA's proposed changes to pharmaceutical quality systems, aiming for greater modernization and flexibility, could require significant investment in process validation and technology upgrades for manufacturers, directly impacting their ability to purchase Freund's services.

The European Medicines Agency (EMA) also maintained a rigorous stance on regulatory compliance in 2024. Any shifts in EMA's requirements for clinical trials or manufacturing standards, such as those related to data integrity or supply chain security, could lead to immediate operational adjustments for pharmaceutical firms. These adjustments often translate into increased demand for specialized consulting and validation services, areas where Freund operates.

Unpredictable regulatory shifts can pose substantial financial risks. For example, a sudden tightening of environmental regulations affecting pharmaceutical waste disposal, as seen in some EU member states in late 2023 and continuing into 2024, might force companies to re-evaluate their production processes and invest in new abatement technologies. This could divert capital that would otherwise be allocated to product development or the adoption of Freund's advanced analytical solutions.

Political Stability and Geopolitical Risks

Political instability in key regions where Freund operates or sources essential materials poses a significant threat. For instance, ongoing geopolitical tensions in Eastern Europe, a critical area for certain pharmaceutical precursors, could lead to supply chain disruptions. In 2024, the World Bank noted that political instability in several developing nations, where Freund might seek market expansion, has led to an average of 1.5% GDP contraction due to reduced foreign investment.

Geopolitical risks, such as the potential for trade disputes or unexpected sanctions, create a volatile environment for international trade. The pharmaceutical sector, heavily reliant on global supply chains and market access, is particularly susceptible. Uncertainty surrounding trade agreements, like potential renegotiations of existing pacts impacting the EU and North America, can dampen investor confidence and affect Freund's long-term strategic planning.

- Supply Chain Vulnerability: Political unrest in supplier nations can halt the flow of critical raw materials, impacting production schedules.

- Market Access Uncertainty: Shifting political alliances can alter market access and introduce new regulatory hurdles for pharmaceutical products.

- Investment Climate Deterioration: Heightened geopolitical risks often lead to a decrease in foreign direct investment within the healthcare and pharmaceutical industries.

- Regulatory Volatility: Political changes can result in sudden shifts in drug pricing regulations or approval processes, affecting revenue streams.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws are crucial for pharmaceutical companies like Freund. In 2024, global IP protection remains a key driver for research and development investment. For instance, countries with strong patent regimes, such as the United States and European Union nations, typically see higher R&D spending per capita in the pharmaceutical sector. This robust protection encourages innovation, directly benefiting Freund by safeguarding its discoveries and allowing for profitable market exclusivity.

Weak IP protection, conversely, can significantly disincentivize new drug development. If patents are easily circumvented or not adequately enforced, the financial returns on substantial R&D investments are jeopardized. This could lead to a slowdown in the introduction of novel therapies, impacting the demand for specialized manufacturing equipment and advanced excipients that Freund supplies. For example, the World Intellectual Property Organization (WIPO) reported in 2023 that patent filings in emerging markets with weaker IP frameworks often face greater challenges in enforcement compared to established markets.

- Global IP Landscape: In 2024, the strength of patent protection varies significantly by region, directly impacting pharmaceutical R&D incentives.

- R&D Investment Correlation: Countries with robust IP laws, like the US and EU, demonstrate higher pharmaceutical R&D investment, fostering innovation.

- Impact on Freund: Strong IP protection enables Freund to recoup R&D costs and drives demand for its specialized products.

- Risks of Weak IP: Inadequate patent enforcement can deter new drug development, negatively affecting Freund's market opportunities.

Government policies on drug pricing and healthcare spending directly influence market demand for pharmaceutical products and services. For instance, in 2024, many nations continued efforts to control drug costs, potentially affecting production volumes and the need for manufacturing equipment. Conversely, increased government healthcare investment, as seen in global health initiatives in 2024, can bolster the pharmaceutical sector, driving demand for machinery and raw materials.

Geopolitical tensions and trade agreements significantly impact Freund Corporation's global operations and supply chains. Ongoing trade disputes, such as those between major economic blocs, can disrupt the flow of essential components and finished goods, forcing companies to diversify sourcing and mitigate risks. In 2024, the World Bank noted that political instability in several developing nations led to an average of 1.5% GDP contraction due to reduced foreign investment, highlighting the economic ripple effects of such instability.

Regulatory frameworks, including intellectual property (IP) laws, are critical for pharmaceutical innovation and investment. In 2024, the strength of patent protection varied globally, directly influencing R&D incentives. Countries with robust IP laws, like the US and EU, typically see higher pharmaceutical R&D investment, fostering innovation and creating demand for specialized products and services like those Freund offers.

| Political Factor | Impact on Pharmaceutical Sector | Relevant Data/Example (2024/2025) |

|---|---|---|

| Government Healthcare Spending | Drives market growth and demand for products/services. | Projected rise in global healthcare spending in 2024, with many nations prioritizing public health. |

| Trade Agreements & Tariffs | Affects sourcing costs, market access, and competitiveness. | USMCA's continued impact on North American trade flows for manufactured goods. |

| Geopolitical Tensions | Creates supply chain vulnerabilities and market access uncertainty. | US-China tensions impacting technology and manufacturing inputs; political instability causing GDP contraction in developing nations (World Bank, 2024). |

| Intellectual Property (IP) Protection | Incentivizes R&D investment and protects innovation. | Strong IP regimes in US/EU correlate with higher pharma R&D spending per capita. |

What is included in the product

The Freund PESTLE Analysis provides a comprehensive examination of how external macro-environmental factors influence the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Freund PESTLE Analysis offers a structured framework that simplifies complex external factors, reducing the overwhelm and uncertainty often associated with strategic planning.

Economic factors

The global economy's trajectory significantly impacts Freund's prospects. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, suggesting a generally supportive environment for R&D investment. However, persistent inflation and geopolitical tensions continue to pose recession risks, which could dampen consumer healthcare spending and pharmaceutical companies' capital expenditures on new machinery and excipients.

Pharmaceutical R&D spending is a significant economic driver, directly influencing demand for specialized equipment and innovative materials. In 2024, global pharmaceutical R&D investment was projected to reach over $240 billion, a figure expected to see continued growth into 2025.

This robust investment signals a healthy pipeline of new drugs and treatments. Such advancements necessitate cutting-edge manufacturing technologies and advanced excipients, areas where Freund's offerings are critical for bringing these innovations to market efficiently.

Inflationary pressures are significantly impacting the cost of raw materials for Freund's operations. For instance, the producer price index for manufactured goods saw a notable increase in early 2024, directly affecting the cost of metals and components Freund utilizes in its machinery production. This trend is expected to continue, squeezing profit margins if not passed on to customers.

Rising energy costs, a key driver of inflation, directly translate to higher operational expenses for Freund. In 2024, global energy prices experienced volatility, impacting electricity and fuel costs for manufacturing plants and logistics. This necessitates a careful review of Freund's pricing strategies to maintain competitiveness while absorbing these increased overheads.

Labor and transportation expenses are also on the upward trajectory, further compounding cost pressures for Freund. Wage growth, driven by a tight labor market in 2024, increases manufacturing costs. Simultaneously, elevated diesel prices and shipping rates impact the cost of bringing raw materials in and finished goods out, affecting Freund's overall profitability and supply chain efficiency.

Interest Rates and Investment Climate

Interest rates significantly shape the investment climate for pharmaceutical firms like Freund. When rates are low, borrowing becomes cheaper, making it more attractive for companies to invest in research and development, new manufacturing facilities, and market expansion. For instance, the Federal Reserve's target range for the federal funds rate remained at 5.25%-5.50% as of early 2024, a level that increases borrowing costs compared to the near-zero rates seen in prior years. This higher cost of capital can influence Freund's decisions regarding capital expenditures, potentially leading to a more cautious approach to large-scale projects.

Conversely, higher interest rates can dampen investment by increasing the cost of debt financing. This might cause companies to postpone or reduce capital outlays, which could directly impact Freund's sales of equipment and services. For example, if Freund relies on financing for its customers' purchases of large-scale pharmaceutical manufacturing equipment, a sustained period of elevated interest rates could lead to a slowdown in demand. The Bank of England, for instance, maintained its bank rate at 5.25% through early 2024, reflecting a global trend of tighter monetary policy impacting borrowing costs across industries.

The overall investment climate is therefore sensitive to monetary policy. Freund's strategic planning must account for these fluctuations.

- Impact on Capital Expenditure: Higher interest rates (e.g., Fed funds rate at 5.25%-5.50% in early 2024) increase the cost of borrowing for Freund and its clients, potentially delaying or scaling back investments in new equipment and facilities.

- Sales Volume Sensitivity: Freund's sales, particularly for large capital goods, can be directly affected by the willingness of pharmaceutical companies to undertake expansion projects, which is often linked to the prevailing interest rate environment.

- R&D Funding: While not directly equipment sales, the cost of financing research and development activities, crucial for pharmaceutical innovation, is also influenced by interest rates, indirectly affecting the long-term demand for specialized tools and services Freund might offer.

- Global Rate Trends: Central bank policies worldwide, such as the Bank of England's rate at 5.25% in early 2024, create a consistent backdrop of higher borrowing costs, necessitating careful financial management for companies like Freund.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant economic factor for Freund Corporation, especially concerning its international trade operations. Fluctuations in exchange rates directly impact the cost of imports and the revenue generated from exports, influencing Freund's global competitiveness and overall profitability.

For instance, a strengthening of the US Dollar against other major currencies in late 2024 and early 2025 could make Freund's products more expensive for international buyers, potentially dampening export sales. Conversely, a weaker dollar would make imports cheaper, reducing the cost of raw materials or components sourced from abroad.

- Export Competitiveness: A stronger domestic currency can increase the price of exports, potentially reducing demand from foreign customers.

- Import Costs: Conversely, a stronger domestic currency can lower the cost of imported goods and raw materials, benefiting Freund's supply chain.

- Revenue Translation: Profits earned in foreign currencies are worth less when translated back into a stronger domestic currency.

- Market Sensitivity: Freund's exposure to currency risk will vary depending on the geographic distribution of its sales and sourcing.

Economic factors significantly shape Freund's operational landscape and growth potential. Global economic growth, projected at 3.2% for 2024 by the IMF, generally supports R&D investment, which in turn drives demand for Freund's specialized equipment. However, risks like inflation and geopolitical instability can impact healthcare spending and capital expenditures, affecting Freund's sales cycles.

Persistent inflation, evidenced by rising producer prices for manufactured goods in early 2024, directly increases Freund's raw material and component costs. Similarly, volatile energy prices and increasing labor and transportation expenses in 2024 are escalating operational overheads, necessitating careful pricing strategies to maintain profitability.

Interest rates, such as the US Federal Reserve's target range of 5.25%-5.50% in early 2024, influence Freund's customers' capital expenditure decisions. Higher borrowing costs can lead to delayed investments in new pharmaceutical manufacturing equipment, potentially impacting Freund's sales volume.

Currency exchange rate fluctuations also pose a risk, with a stronger US dollar in late 2024 potentially making Freund's exports more expensive and impacting international revenue streams.

| Economic Factor | 2024/2025 Trend/Data | Impact on Freund |

|---|---|---|

| Global GDP Growth | Projected 3.2% in 2024 (IMF) | Supportive for R&D, indirectly boosting demand for equipment. |

| Inflation (Producer Prices) | Notable increase in early 2024 | Increases raw material and component costs for Freund. |

| Energy Prices | Volatile in 2024 | Raises operational and logistics costs for Freund. |

| Interest Rates (US Fed Funds Rate) | 5.25%-5.50% range (early 2024) | Increases cost of capital for Freund's clients, potentially reducing equipment investment. |

| Currency Exchange Rates | US Dollar strengthening trend (late 2024) | Can decrease export competitiveness and impact foreign revenue translation. |

Preview Before You Purchase

Freund PESTLE Analysis

The preview shown here is the exact Freund PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive analysis upon completing your purchase.

The content and structure shown in the preview is the same Freund PESTLE Analysis document you’ll download after payment, providing you with actionable insights without delay.

Sociological factors

The world's population is getting older. By 2050, it's projected that nearly 1 in 6 people globally will be 65 or older, a significant jump from 1 in 11 in 2015. This demographic shift, coupled with a rise in chronic conditions like heart disease and diabetes, is fueling a greater need for medications. For instance, cardiovascular diseases alone accounted for an estimated 18.6 million deaths worldwide in 2019, highlighting the scale of this health challenge.

This increasing demand for pharmaceuticals directly benefits companies like Freund, which supply essential manufacturing equipment and excipients. As more people require ongoing treatment for chronic illnesses, the production volume for these drugs must increase. This translates into a higher demand for the precise machinery and high-quality inactive ingredients that Freund provides to the pharmaceutical industry.

Consumers are increasingly health-conscious, with studies showing a significant rise in preventative healthcare spending. For instance, global health and wellness market revenue was projected to reach over $5.1 trillion in 2024, reflecting this heightened awareness. This trend directly impacts pharmaceutical companies, driving demand for drugs with superior efficacy and improved safety profiles.

Patient expectations are also shifting towards more convenient and patient-friendly drug delivery systems. Innovations like extended-release formulations and novel administration methods are becoming key differentiators. In 2023, the global drug delivery market was valued at approximately $1.7 trillion, with a strong growth forecast, indicating a clear market push towards advanced solutions that Freund can cater to.

Shifting global lifestyles, marked by increased sedentary habits and dietary changes, are directly influencing disease prevalence. For example, the World Health Organization (WHO) reported in 2024 that non-communicable diseases (NCDs) like cardiovascular disease and diabetes now account for an estimated 74% of all deaths globally, a significant rise driven by these lifestyle factors.

This surge in NCDs fuels demand for advanced pharmaceutical treatments and preventative measures. The market for diabetes drugs alone was projected to reach over $70 billion by 2025, reflecting a direct response to evolving health patterns. Consequently, pharmaceutical companies are investing heavily in research and development for more targeted therapies and innovative drug delivery systems.

Workforce Availability and Skills

The availability of a skilled workforce is crucial for pharmaceutical manufacturing and engineering, directly influencing the adoption of new technologies and production capacity. For instance, in 2024, the global pharmaceutical industry faced a notable demand for specialized roles in bioprocessing and advanced manufacturing, with reports indicating a significant skills gap in areas like cell and gene therapy production.

A deficit in qualified personnel can impede the expansion of Freund's pharmaceutical clients. This indirectly impacts the demand for Freund's advanced machinery, which often necessitates operators with specific technical expertise and training to ensure optimal performance and integration into complex production lines.

Key considerations regarding workforce availability and skills include:

- Skills Gap: A persistent shortage of engineers with expertise in automation and digital manufacturing technologies within the pharmaceutical sector.

- Training Needs: The necessity for substantial investment in upskilling and reskilling the existing workforce to operate and maintain cutting-edge pharmaceutical equipment.

- Geographic Concentration: The concentration of skilled labor in specific regions, potentially creating logistical challenges for global pharmaceutical companies and their equipment suppliers like Freund.

- Demographic Shifts: The aging workforce in developed economies and the need to attract and retain younger talent in specialized technical fields.

Public Perception and Trust in Pharmaceuticals

Public perception and trust are vital for the pharmaceutical sector. Concerns about drug safety, the high cost of medications, and fluctuating confidence in vaccines significantly impact market demand and the level of regulatory oversight. For instance, a 2024 Gallup poll indicated that while a majority of Americans still trust the medical system, trust in the pharmaceutical industry specifically has seen a slight decline compared to previous years, with pricing being a major driver of this sentiment.

Building and maintaining trust is paramount for sustained growth. This is achieved through rigorous quality control in manufacturing processes, including the sourcing of high-quality machinery and excipients. Companies that demonstrate transparency and a commitment to patient well-being tend to foster stronger public confidence. For example, pharmaceutical companies that proactively address drug recall issues with clear communication and swift action often mitigate long-term damage to their reputation.

The ongoing debate surrounding drug pricing, particularly in markets like the United States, continues to shape public opinion. In 2024, legislative efforts aimed at capping prescription drug costs, such as provisions within broader healthcare reform bills, reflect public pressure and can influence company strategies and profitability. This scrutiny underscores the need for the industry to balance innovation costs with affordability to maintain public goodwill.

- Public Trust Fluctuations: A 2024 Gallup survey noted a dip in public trust for pharmaceutical companies, largely attributed to pricing concerns.

- Quality as a Trust Builder: Ensuring high standards in machinery and excipients is crucial for fostering confidence in drug safety and efficacy.

- Pricing Debates Impact: Ongoing discussions and potential legislation around drug pricing directly influence public perception and industry practices.

- Transparency and Communication: Proactive and honest communication regarding drug safety and recalls is essential for maintaining a positive public image.

Societal trends significantly influence the pharmaceutical industry. The aging global population, projected to see nearly 1 in 6 people aged 65 or older by 2050, increases demand for medications, particularly for chronic conditions. For instance, cardiovascular diseases caused 18.6 million deaths globally in 2019, underscoring this need. Simultaneously, heightened consumer health consciousness drives demand for preventative healthcare and effective treatments, with the global health and wellness market expected to exceed $5.1 trillion in 2024.

Technological factors

The pharmaceutical sector is increasingly embracing advanced manufacturing, including continuous manufacturing and smart factory concepts. For instance, by the end of 2024, many leading pharmaceutical companies aim to have at least 20% of their production lines utilizing some form of advanced process control or automation.

Freund's capacity to offer sophisticated coating, granulation, and powder processing equipment that seamlessly integrates with these evolving technologies is paramount to maintaining its competitive edge and fostering future expansion.

This technological shift is driven by the pursuit of enhanced efficiency, improved product quality, and greater flexibility in production, with investments in automation within the pharmaceutical manufacturing sector projected to grow by over 15% annually through 2025.

Artificial Intelligence and digitalization are revolutionizing the pharmaceutical industry, impacting everything from initial drug discovery to the final delivery of medicines. This technological shift is not just about efficiency; it's fundamentally changing how research and development are conducted, how supply chains are managed, and how quality is assured. For a company like Freund, this means opportunities to integrate AI into its own processes, such as using predictive analytics for equipment maintenance or forecasting demand more accurately. Furthermore, Freund's equipment will likely need to seamlessly connect with AI-powered systems that clients are increasingly adopting to boost their operational efficiency and meet stringent regulatory requirements.

Ongoing research into pharmaceutical excipients is a critical technological factor for Freund. Innovations in novel materials designed to improve drug delivery, enhance stability, and boost bioavailability directly influence the demand for Freund's excipient offerings. Staying ahead of these advancements is key to meeting the dynamic needs of drug manufacturers.

Biopharmaceutical Manufacturing Technology

The biopharmaceutical sector is experiencing significant expansion, driven by advancements in areas like cell and gene therapies. This growth necessitates manufacturing equipment capable of handling complex biological products, demanding stringent sterility protocols and highly precise process controls. Freund's ability to adapt its offerings to these evolving biomanufacturing needs is crucial for capitalizing on this dynamic market. For instance, the global biopharmaceutical market was valued at approximately $340 billion in 2023 and is projected to reach over $600 billion by 2030, highlighting the immense opportunity.

Key technological factors influencing biopharmaceutical manufacturing include:

- Single-use technologies: These disposable systems reduce contamination risks and offer greater flexibility, a trend Freund must integrate into its equipment designs.

- Automation and digitalization: Advanced automation, including AI and machine learning, is optimizing bioprocesses, improving yield, and ensuring consistent quality. Freund's solutions should leverage these digital advancements.

- Continuous manufacturing: Shifting from batch to continuous processing can enhance efficiency and reduce costs, requiring specialized equipment that Freund can provide.

3D Printing and Additive Manufacturing

The rise of 3D printing, or additive manufacturing, is significantly reshaping industries, including pharmaceuticals. This technology allows for the creation of highly customized products, a concept particularly relevant for personalized medicines. For instance, by 2024, the global 3D printing market in healthcare was projected to reach over $3.9 billion, with pharmaceuticals representing a growing segment.

Freund, a player in the pharmaceutical supply chain, needs to consider how its existing machinery and excipients can adapt to or integrate with these additive manufacturing processes. The ability to produce complex dosage forms on demand, tailored to individual patient needs, presents a substantial opportunity. By 2025, the market for 3D printed drugs is expected to see continued expansion, driven by advancements in printing materials and regulatory frameworks.

Key considerations for Freund include:

- Material compatibility: Ensuring Freund's excipients are suitable for various 3D printing technologies, such as fused deposition modeling (FDM) or inkjet printing.

- Equipment adaptation: Investigating potential modifications or new equipment designs that can leverage 3D printing capabilities for drug formulation and production.

- Regulatory landscape: Staying abreast of evolving regulations concerning 3D printed pharmaceuticals to ensure compliance and market access.

- Supply chain integration: Exploring how 3D printing can be integrated into Freund's existing supply chain to offer more agile and responsive solutions.

Technological advancements, particularly in AI and digitalization, are transforming pharmaceutical R&D and manufacturing, driving demand for sophisticated equipment. Investments in automation within the sector are projected to grow by over 15% annually through 2025, underscoring the need for integrated solutions.

The biopharmaceutical sector's rapid growth, with its market valued at approximately $340 billion in 2023, necessitates equipment capable of handling complex biological products and stringent sterility. Single-use technologies and advanced automation are key trends here.

3D printing, or additive manufacturing, is emerging as a significant force, enabling personalized medicines and complex dosage forms. By 2024, the global 3D printing market in healthcare was expected to exceed $3.9 billion, with pharmaceuticals representing a growing segment.

Freund must adapt its excipients and equipment to integrate with these evolving technologies, ensuring material compatibility and exploring new designs for additive manufacturing processes.

Legal factors

Pharmaceutical manufacturing is heavily regulated, with Good Manufacturing Practices (GMP) set by bodies like the FDA and EMA dictating stringent quality control. Freund must ensure its machinery and excipients meet these evolving standards, a critical factor for its clients' compliance. Failure to adhere can lead to product recalls, fines, and reputational damage, impacting market access and investor confidence.

Freund Corporation operates under stringent product liability laws, requiring meticulous adherence to safety standards for its machinery and excipients. Failure to comply can result in significant financial penalties, product recalls, and severe damage to its brand reputation. For instance, in 2023, the pharmaceutical industry faced billions in settlements related to product liability claims, highlighting the critical need for robust safety protocols.

The company must continuously monitor and adapt to evolving safety regulations, which often become more rigorous over time. This proactive approach is crucial for maintaining market access and avoiding costly legal battles. Anticipating future regulatory shifts, such as enhanced material traceability or stricter emissions controls for manufacturing equipment, is a key strategic imperative for Freund.

Environmental regulations are tightening globally, impacting how pharmaceutical companies operate. For instance, the European Union's Green Deal aims for climate neutrality by 2050, which translates to stricter rules on waste management and emissions for all industries, including pharma. This means Freund's equipment and excipients must actively support client compliance with these evolving standards, potentially requiring Freund to re-evaluate its own manufacturing to align with directives like the EU's Industrial Emissions Directive.

Data Privacy and Cybersecurity Laws

The increasing reliance on digital platforms and artificial intelligence within the pharmaceutical sector, including companies like Freund, places a significant emphasis on data privacy and cybersecurity. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States mandate stringent protection of sensitive client and patient information. Freund's digital solutions and integrated systems must therefore adhere to these evolving legal frameworks to mitigate risks of data breaches and ensure compliance, especially as the volume of health data processed continues to grow. For instance, by the end of 2023, the global cybersecurity market was valued at over $200 billion, highlighting the critical importance of robust data protection measures.

Compliance with these laws is not merely a legal obligation but a crucial element for maintaining trust and operational integrity. Freund must implement comprehensive cybersecurity protocols and data handling policies that align with global best practices and regulatory expectations. This includes securing patient records, intellectual property, and proprietary algorithms used in AI-driven pharmaceutical development and operations. Failure to do so can result in substantial fines and reputational damage, impacting Freund's market position and client relationships. The average cost of a data breach in the healthcare industry in 2023 was estimated to be around $10.93 million, underscoring the financial imperative for strong cybersecurity.

Key legal considerations for Freund include:

- Data Minimization and Purpose Limitation: Ensuring that only necessary data is collected and processed for clearly defined purposes, as stipulated by GDPR and similar regulations.

- Consent and Transparency: Obtaining explicit consent for data processing and maintaining transparency with individuals about how their data is used and protected.

- Security Safeguards: Implementing appropriate technical and organizational measures to protect personal data against unauthorized access, alteration, disclosure, or destruction.

- Breach Notification: Establishing clear procedures for identifying, reporting, and investigating data breaches to relevant authorities and affected individuals within mandated timeframes.

Anti-Trust and Competition Laws

Freund operates within a highly competitive pharmaceutical market, making adherence to anti-trust and competition laws crucial for maintaining fair market practices and avoiding monopolistic behavior. These regulations ensure that companies like Freund do not unfairly leverage their market position to stifle innovation or disadvantage competitors.

The broader pharmaceutical industry's M&A activity significantly shapes the competitive environment for Freund, as it supplies machinery and excipients. For instance, in 2024, the pharmaceutical M&A landscape saw continued consolidation, with major deals impacting supply chains and potentially influencing pricing and access for raw material providers.

- Regulatory Scrutiny: Increased enforcement of anti-trust laws by bodies like the FTC and European Commission can lead to investigations and penalties for non-compliance, impacting Freund's operational freedom.

- Market Dynamics: Competitors' strategic partnerships or acquisitions can alter market share, requiring Freund to adapt its competitive strategies to maintain its standing.

- Pricing Power: Compliance with competition laws prevents predatory pricing or collusion, ensuring a more stable and predictable pricing environment for Freund's products and services.

- Innovation Incentives: Fair competition fostered by these laws encourages innovation, as companies are motivated to differentiate through product quality and technological advancements rather than market manipulation.

Legal frameworks surrounding intellectual property are paramount for Freund, protecting its proprietary machinery designs and excipient formulations. Patent laws, trademarks, and trade secrets are critical for maintaining competitive advantage and preventing unauthorized use of its innovations. In 2024, global R&D spending in the pharmaceutical sector reached an estimated $250 billion, underscoring the immense value of IP in this industry.

Freund must navigate international trade laws and customs regulations, especially if it sources materials or sells machinery across borders. Compliance with import/export controls, tariffs, and trade agreements is essential to avoid disruptions and penalties. For instance, changes in trade policies in 2024 impacted global supply chains, highlighting the need for agile legal compliance.

Compliance with labor laws, including those related to worker safety, fair wages, and non-discrimination, is a fundamental legal requirement for Freund. Adherence to these regulations ensures a stable workforce and avoids costly legal disputes and reputational damage. In 2023, labor law violations resulted in significant fines for many companies, emphasizing the importance of proactive compliance.

Environmental factors

The pharmaceutical sector is under significant pressure to shrink its environmental impact, with a strong push towards achieving net-zero emissions. This regulatory and societal demand is directly influencing operational choices within the industry.

Freund's clientele will consequently prioritize sourcing energy-efficient manufacturing equipment and environmentally conscious excipients to align with their own ambitious sustainability objectives. This shift signals a growing market opportunity for suppliers offering genuinely green solutions.

For instance, the pharmaceutical industry's greenhouse gas emissions were estimated to be around 4.7% of global total in 2022, highlighting the scale of the challenge and the potential for reduction. Companies like Freund can capitalize on this by offering products that demonstrably lower this impact.

Minimizing waste and embracing circular economy principles are increasingly vital for sustainable pharmaceutical manufacturing. Freund's equipment and excipient production must prioritize waste reduction, recycling, and renewable resources to meet evolving industry standards and regulatory expectations.

The global waste management market is projected to reach $637.2 billion by 2030, highlighting the significant economic driver behind these shifts. Companies like Freund, by integrating circularity, can unlock new revenue streams and reduce operational costs associated with waste disposal, aligning with a 2024 focus on resource efficiency.

Pharmaceutical manufacturing, including the production of excipients, is inherently water-intensive. This reliance on water presents significant environmental considerations. For instance, in 2023, the global pharmaceutical market consumed an estimated 1.5 billion cubic meters of water, with a substantial portion attributed to manufacturing processes.

Increasingly stringent environmental regulations and ambitious corporate sustainability targets are driving a demand for reduced water consumption and enhanced wastewater treatment capabilities across the industry. Many companies are setting goals to decrease their water footprint by 20% by 2030, reflecting this growing pressure.

Freund's machinery design must therefore prioritize water optimization, incorporating technologies that minimize usage during production. Furthermore, Freund's excipient manufacturing operations need to align with responsible water management practices, ensuring that any discharged wastewater meets or exceeds regulatory standards for purity and safety.

Sustainable Sourcing and Supply Chain Decarbonization

There's a growing push for pharmaceutical companies like Freund to source raw materials more sustainably and to cut down on carbon emissions throughout their supply chains. This means Freund will need to show it's being responsible in how it gets its machinery parts and the ingredients used in its medicines. Working with suppliers to lessen their environmental footprint is becoming a key part of this effort.

By 2024, the global pharmaceutical supply chain faced increasing pressure to reduce its carbon intensity. For instance, some major pharmaceutical firms reported targets to achieve net-zero emissions across their value chains by 2040, impacting their sourcing decisions for components and raw materials. Freund's commitment to this trend will involve auditing suppliers for environmental practices and potentially investing in greener logistics solutions.

- Supplier Audits: Freund will likely implement stricter environmental performance criteria for its suppliers of machinery components and excipients.

- Decarbonization Initiatives: Collaborations with logistics partners to utilize lower-emission transport methods, such as electric vehicles or sustainable aviation fuel, will be crucial.

- Circular Economy Principles: Exploring the use of recycled materials in packaging and manufacturing processes can further enhance sustainability.

- Regulatory Compliance: Staying ahead of evolving environmental regulations, such as those related to Scope 3 emissions reporting, will be essential for long-term viability.

Impact of Climate Change on Operations

The physical impacts of climate change, like increasingly severe weather events, pose a significant threat to Freund's operations. These disruptions can ripple through supply chains, halt manufacturing processes, and impact the availability of essential raw materials. For instance, the World Meteorological Organization reported that weather, climate, and water-related disasters caused over $100 billion in economic losses globally in 2023 alone, highlighting the tangible financial risks.

Freund must proactively assess and develop strategies to mitigate these climate-related risks. Ensuring business continuity and building resilience across its operations, as well as for its clients, is paramount. This involves understanding vulnerabilities and investing in adaptive measures. For example, a 2024 report by McKinsey & Company estimated that supply chain disruptions could cost global GDP up to $7.9 trillion by 2040 if climate change impacts are not addressed.

Key areas for Freund to consider include:

- Supply Chain Resilience: Diversifying suppliers and logistics routes to reduce reliance on climate-vulnerable regions.

- Operational Adaptability: Investing in infrastructure that can withstand extreme weather, such as flood defenses or reinforced buildings.

- Resource Management: Securing stable access to raw materials by exploring alternative sources or investing in sustainable sourcing practices.

- Client Risk Assessment: Helping clients understand and prepare for climate-related operational impacts.

The pharmaceutical industry, including companies like Freund, faces increasing scrutiny regarding its environmental footprint. This includes a significant push towards reducing greenhouse gas emissions, with many firms setting net-zero targets. For example, the sector's emissions were around 4.7% of the global total in 2022, indicating a substantial area for improvement.

Resource efficiency, particularly concerning water usage and waste management, is also a critical environmental factor. The global waste management market's projected growth to $637.2 billion by 2030 underscores the economic imperative for waste reduction and circular economy principles. Pharmaceutical manufacturing's water intensity, with an estimated 1.5 billion cubic meters consumed globally in 2023, further emphasizes the need for water optimization.

Supply chain sustainability is paramount, with a focus on reducing carbon intensity and sourcing materials responsibly. By 2024, major pharmaceutical companies were already setting targets to achieve net-zero emissions across their value chains by 2040, influencing their supplier selection and logistics. This necessitates rigorous supplier audits and a move towards greener logistics solutions.

The physical impacts of climate change, such as extreme weather events, present tangible risks to operations and supply chains. The World Meteorological Organization reported over $100 billion in economic losses from weather-related disasters in 2023 alone, highlighting the need for robust business continuity and resilience strategies. McKinsey & Company estimated in 2024 that supply chain disruptions could cost global GDP up to $7.9 trillion by 2040 if climate impacts are not addressed.

| Environmental Factor | 2023/2024 Trend/Data | Impact on Freund |

|---|---|---|

| Greenhouse Gas Emissions | Pharmaceutical sector's emissions ~4.7% of global total (2022). Net-zero targets by 2040 common. | Need to offer energy-efficient equipment and low-emission excipients. |

| Water Consumption | Global pharma water use ~1.5 billion m³ (2023). Targets to reduce water footprint by 20% by 2030. | Demand for water-optimizing machinery and responsible wastewater treatment for excipients. |

| Waste Management & Circularity | Global waste management market projected to reach $637.2 billion by 2030. | Opportunity for waste reduction in manufacturing and use of recycled materials. |

| Climate Change Impacts | $100+ billion economic losses from weather disasters (2023). Supply chain disruption risk: $7.9 trillion global GDP by 2040. | Requires supply chain resilience, operational adaptability, and client risk assessment. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable sources including government statistical agencies, international financial institutions, and leading market research firms. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental factors impacting your business.