Fresenius Medical Care SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresenius Medical Care Bundle

Fresenius Medical Care, a leader in dialysis products and services, boasts significant strengths in its global reach and established brand, but also faces challenges in regulatory environments and market competition. Understanding these dynamics is crucial for any stakeholder looking to navigate this complex healthcare landscape.

Want the full story behind Fresenius Medical Care’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fresenius Medical Care commands a leading position in the global dialysis sector, caring for millions of patients worldwide. This dominance is built on a vast network of over 4,000 dialysis clinics spanning more than 50 countries, demonstrating impressive operational scale and market penetration.

Fresenius Medical Care boasts a comprehensive product and service portfolio, covering everything a kidney disease patient needs. This includes in-center and home dialysis treatments, as well as the manufacturing and distribution of essential dialysis equipment and disposables. This integrated model, which saw Fresenius Medical Care's revenue reach €21.1 billion in 2023, allows them to manage the entire patient care journey.

Fresenius Medical Care's robust research and development (R&D) and innovation capabilities are a cornerstone of its competitive strength. The company consistently allocates significant resources to R&D, aiming to push the boundaries of dialysis technology and treatment methods. This dedication to innovation fuels the creation of next-generation products, including more efficient dialysis machines and advanced dialyzers, directly contributing to improved patient outcomes and solidifying its market position. For instance, in 2023, Fresenius Medical Care reported R&D expenses of approximately €1.3 billion, underscoring its commitment to staying at the forefront of medical advancements.

Vertically Integrated Business Model

Fresenius Medical Care's vertically integrated business model is a significant strength, combining dialysis services with the manufacturing of dialysis products. This integration allows for substantial operational efficiencies and enhanced cost control throughout its value chain. For instance, in 2023, the company reported that its integrated model contributed to a more resilient supply chain, especially crucial given global disruptions.

By manufacturing its own dialysis equipment and consumables, Fresenius Medical Care gains direct oversight of quality and can potentially achieve lower procurement costs compared to relying solely on external suppliers. This internal production capability also creates a captive market for its manufactured goods, ensuring a baseline demand.

- Operational Efficiencies: Streamlined processes from manufacturing to service delivery.

- Cost Control: Reduced reliance on external suppliers for critical components.

- Quality Assurance: Direct control over the manufacturing of dialysis products.

- Supply Chain Resilience: Mitigated risks associated with external supply chain disruptions.

High Barriers to Entry in Dialysis Market

The dialysis market presents formidable barriers to entry, a significant strength for Fresenius Medical Care. These include stringent regulatory approvals for both treatments and manufacturing, demanding substantial time and resources. For instance, establishing a new dialysis clinic often involves navigating complex state and federal licensing processes, which can take years.

Furthermore, the substantial capital outlay required for building and equipping dialysis centers, along with the manufacturing of essential equipment like dialysis machines and dialyzers, deters new entrants. Fresenius Medical Care's established infrastructure and ongoing investment in these areas, estimated in the billions of dollars annually for the broader healthcare equipment sector, solidify its competitive advantage.

The necessity for highly specialized medical expertise, including nephrologists, nurses, and technicians trained in dialysis procedures, creates another layer of difficulty for potential competitors. This specialized workforce is not easily replicated, reinforcing Fresenius Medical Care's entrenched market position and protecting its profitability.

- Regulatory Hurdles: Complex and lengthy approval processes for dialysis services and equipment.

- Capital Intensity: High upfront investment needed for clinic construction, equipment, and manufacturing facilities.

- Specialized Expertise: Requirement for a highly trained and experienced medical and technical workforce.

- Entrenched Infrastructure: Existing, large-scale operational networks that are costly and time-consuming to replicate.

Fresenius Medical Care's leading global market share in dialysis services and products is a significant strength, supported by its extensive network of over 4,000 clinics across more than 50 countries. This vast operational scale allows for significant economies of scale and broad patient reach. The company's revenue in 2023 reached €21.1 billion, demonstrating its substantial market presence and financial capacity.

The company's vertically integrated business model, encompassing both dialysis services and the manufacturing of essential equipment and disposables, provides considerable operational efficiencies and cost control. This integration, which saw R&D expenses of approximately €1.3 billion in 2023, also enhances supply chain resilience and quality assurance, as Fresenius Medical Care directly oversees production.

Substantial barriers to entry, including stringent regulatory requirements, high capital investment for facilities and manufacturing, and the need for specialized medical expertise, protect Fresenius Medical Care's market position. These factors make it difficult for new competitors to establish a comparable presence, solidifying the company's competitive advantage.

| Strength | Description | Supporting Data (2023) |

| Market Leadership | Dominant global presence in dialysis care and products. | Over 4,000 clinics in 50+ countries; €21.1 billion revenue. |

| Vertical Integration | Control over services and product manufacturing. | Integrated model enhances efficiency and supply chain resilience. |

| Innovation Focus | Commitment to R&D for advanced dialysis solutions. | €1.3 billion in R&D expenses. |

| Barriers to Entry | High regulatory, capital, and expertise requirements deter competitors. | Complex licensing, substantial capital outlay, specialized workforce needs. |

What is included in the product

Analyzes Fresenius Medical Care’s competitive position through key internal and external factors, detailing its strengths in market leadership, operational efficiency, and innovation, while addressing weaknesses in cost management and potential threats from regulatory changes and increased competition.

Offers a clear, actionable SWOT analysis for Fresenius Medical Care, pinpointing key areas to address competitive pressures and operational challenges.

Weaknesses

Fresenius Medical Care's profitability is heavily tied to reimbursement policies for dialysis, with a substantial portion of its income coming from government and private payers. For instance, in 2023, Medicare reimbursement rates for dialysis services in the US saw adjustments, impacting the revenue stream for providers like Fresenius.

Any adverse changes to these reimbursement rates, or shifts in how dialysis treatments are paid for, can directly affect Fresenius's financial performance and overall stability. This dependency places the company at the mercy of regulatory and political decisions, factors beyond its immediate influence.

Fresenius Medical Care faces significant operational hurdles managing its extensive global network of dialysis clinics and manufacturing sites. Navigating the patchwork of healthcare laws, quality mandates, and data protection rules across numerous countries adds substantial administrative complexity and cost. For instance, in 2023, the company reported operating in over 150 countries, each with unique compliance requirements.

This intricate regulatory landscape poses a constant risk. Failure to comply with diverse standards, such as varying patient data privacy laws like GDPR in Europe or HIPAA in the US, can result in severe penalties. In 2024, the healthcare sector saw increased regulatory scrutiny globally, with fines for data breaches alone reaching millions for some companies, directly impacting profitability and brand trust.

Fresenius Medical Care faces a significant weakness in its high capital expenditure requirements. Maintaining and expanding its vast network of dialysis clinics and manufacturing facilities demands substantial, ongoing investments. For instance, in 2023, the company reported capital expenditures of approximately €1.4 billion, a figure that underscores the asset-intensive nature of its operations.

This continuous need for capital can strain free cash flow, potentially limiting the company's flexibility to invest in other growth initiatives or research and development. The sheer scale of its global infrastructure means that keeping it state-of-the-art and expanding into new markets requires a consistent and significant financial commitment, posing a persistent challenge to financial resource allocation.

Litigation and Compliance Risks

Fresenius Medical Care, as a major player in the healthcare sector, is exposed to significant litigation and compliance risks. These stem from the nature of patient care, potential product liability issues, and the complexities of its business operations. For instance, in 2023, the company continued to address investigations and legal proceedings related to its dialysis services and products, which can lead to substantial financial settlements and ongoing legal expenses.

The company operates within a highly regulated environment, making compliance with laws like the Anti-Kickback Statute and fraud and abuse regulations a constant challenge. Failure to adhere to these stringent requirements can result in severe penalties, including fines and exclusion from government healthcare programs. Such breaches not only impact the bottom line but also erode trust with patients and partners.

- Litigation Exposure: Fresenius Medical Care faces ongoing lawsuits concerning patient care standards and product safety, a common challenge for large healthcare providers.

- Compliance Scrutiny: The company must navigate complex healthcare regulations, including anti-kickback statutes and fraud and abuse laws, with significant penalties for non-compliance.

- Financial and Reputational Impact: Adverse legal judgments or compliance failures can lead to substantial financial penalties, increased operational costs, and damage to the company's reputation.

Integration Challenges of Acquisitions

Integrating acquired companies, particularly substantial ones, presents significant hurdles. These include aligning disparate corporate cultures, achieving operational efficiencies, and ensuring technological systems work together seamlessly. For instance, Fresenius Medical Care's acquisition of NxStage Medical in 2019, a substantial deal, likely involved complex integration processes that could impact ongoing operations.

A key weakness lies in the potential for integration failures. If these challenges aren't managed effectively, it can result in operational disruptions, inflated expenses, and an inability to capture the expected advantages from the acquisition. This risk is particularly relevant as Fresenius Medical Care continues its strategy of expanding through mergers and acquisitions.

Failure to achieve anticipated synergies from acquisitions can directly impact financial performance. For example, if cost savings or revenue enhancements projected from an acquisition do not materialize due to poor integration, it can lead to a drag on profitability and shareholder returns. This underscores the critical need for robust post-merger integration planning and execution.

The company's ability to successfully absorb and leverage new entities is crucial for realizing the full value of its M&A strategy.

Fresenius Medical Care's reliance on government and private reimbursement policies for dialysis services presents a significant vulnerability. Changes in these rates, as seen with Medicare adjustments in 2023, directly impact revenue streams, making the company susceptible to regulatory and political decisions.

The company's vast global operations, spanning over 150 countries as of 2023, create substantial administrative complexity and compliance costs due to differing healthcare laws and data protection rules. Increased regulatory scrutiny in 2024, with potential fines for data breaches, highlights this risk.

High capital expenditure, exemplified by €1.4 billion in capital expenditures in 2023, is a weakness that strains free cash flow and limits investment flexibility. Maintaining its extensive infrastructure requires consistent, significant financial commitment.

Fresenius faces considerable litigation and compliance risks due to the nature of patient care and product liability. Ongoing legal proceedings and adherence to stringent regulations like anti-kickback statutes can lead to substantial financial penalties and reputational damage.

Preview Before You Purchase

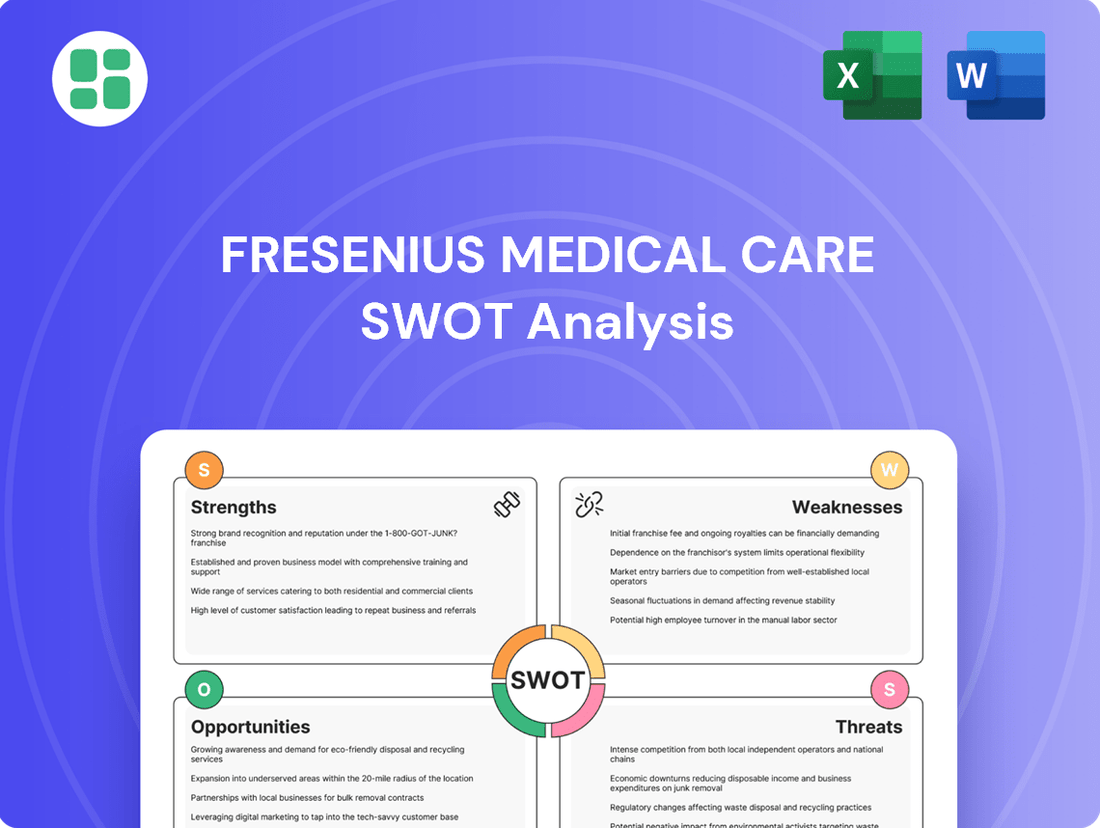

Fresenius Medical Care SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You'll gain a comprehensive understanding of Fresenius Medical Care's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing actionable insights into the company's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Fresenius Medical Care SWOT analysis, ready for your strategic planning.

Opportunities

The global burden of chronic kidney disease (CKD) and end-stage renal disease (ESRD) is on the rise, fueled by aging demographics and the increasing prevalence of conditions like diabetes and hypertension. This upward trend directly translates to a larger patient population requiring dialysis and related treatments, a core service for Fresenius Medical Care.

For instance, the World Health Organization reported in 2024 that over 850 million people worldwide have kidney disease, a figure projected to grow. This expanding patient pool signifies a sustained and growing demand for Fresenius Medical Care's dialysis services and products, presenting a substantial opportunity for organic market expansion.

The increasing demand for home dialysis, including peritoneal dialysis (PD) and home hemodialysis (HHD), presents a significant opportunity. This trend is fueled by patient desire for greater convenience, better quality of life, and potential cost savings for healthcare systems.

Fresenius Medical Care is strategically positioned to leverage this shift, given its established home dialysis offerings and robust manufacturing infrastructure. The company's commitment to innovation in home care technologies and patient support services can drive substantial revenue growth in this expanding market segment.

Ongoing advancements in medical technology present a significant opportunity for Fresenius Medical Care. Innovations like AI-powered patient management systems and more efficient dialysis machines are transforming renal care. For instance, the global market for AI in healthcare was projected to reach $10.4 billion in 2024, with a significant portion dedicated to patient care and diagnostics, a trend Fresenius is well-positioned to capitalize on.

Fresenius can leverage its robust R&D to integrate these cutting-edge technologies, thereby boosting treatment effectiveness and improving patient well-being. Embracing digital health solutions not only enhances patient engagement but also streamlines operations. The company's investment in innovation is crucial to staying ahead in a rapidly evolving healthcare landscape.

Emerging Markets Penetration

Many developing nations face a substantial burden of kidney disease, yet access to sophisticated renal care remains limited. Fresenius Medical Care is well-positioned to broaden its reach in these under-served emerging markets, which offer considerable growth prospects due to their vast populations and developing healthcare systems.

The company can leverage strategic investments and collaborations within these regions to diversify its income streams and enhance its global market standing. For instance, as of early 2024, the World Health Organization reported that non-communicable diseases, including kidney disease, are increasingly prevalent in low- and middle-income countries, presenting a clear opportunity for companies like Fresenius Medical Care to expand their service offerings.

- Untapped Demand: Significant unmet needs for dialysis and related treatments exist in many emerging economies.

- Population Growth: Large and growing populations in these regions translate to a substantial patient base.

- Healthcare Development: Improving healthcare infrastructure in emerging markets facilitates the establishment of advanced medical services.

- Market Share Expansion: Penetrating these markets can lead to a considerable increase in Fresenius Medical Care's global footprint and revenue.

Value-Based Care and Integrated Care Models

The healthcare industry's pivot to value-based care, rewarding outcomes and efficiency over sheer service volume, presents a significant opportunity for Fresenius Medical Care. This model directly complements Fresenius's established integrated care approach, which aims to manage kidney patients throughout their entire health journey.

By demonstrating tangible improvements in patient health and cost savings through these integrated pathways, Fresenius can position itself as a highly attractive partner for payers. This could translate into preferential network inclusion and more robust, long-term contracts, thereby solidifying revenue stability.

- Alignment with Value-Based Care: Fresenius's comprehensive kidney care model naturally fits the shift towards incentivizing patient outcomes and cost-effectiveness.

- Demonstrating Superior Value: Integrated care pathways across the patient continuum allow Fresenius to showcase better results and efficiency to payers.

- Strengthening Payer Relationships: Success in value-based arrangements can lead to preferred provider status and more secure, long-term revenue streams.

The increasing global prevalence of kidney disease, driven by factors like aging populations and rising rates of diabetes and hypertension, creates a continuously expanding patient pool for Fresenius Medical Care's core services. This growing demand, with over 850 million people worldwide affected by kidney disease as of 2024 according to the WHO, directly translates into significant opportunities for market penetration and revenue growth.

The strong trend towards home dialysis, including peritoneal dialysis (PD) and home hemodialysis (HHD), offers Fresenius a prime chance to capitalize on patient preference for convenience and improved quality of life. Fresenius's established home dialysis solutions and manufacturing capabilities position it to lead in this expanding segment.

Advancements in medical technology, such as AI-driven patient management and more efficient dialysis equipment, present opportunities for Fresenius to enhance treatment effectiveness and patient outcomes. The global AI in healthcare market, projected to reach $10.4 billion in 2024, highlights the potential for integrated technological solutions.

Emerging markets with high burdens of kidney disease but limited access to advanced care represent a substantial growth avenue. Fresenius can leverage strategic investments in these regions to diversify its revenue and increase its global market share, aligning with the increasing prevalence of non-communicable diseases in low- and middle-income countries reported by the WHO.

Fresenius's integrated care model is well-suited to the healthcare industry's shift towards value-based care, which rewards efficient, outcome-driven treatments. By demonstrating superior patient results and cost savings, Fresenius can secure stronger partnerships with payers and achieve more stable, long-term revenue streams.

Threats

The renal care landscape is intensely competitive, featuring established global giants and agile regional players all seeking to grow their market presence. This heightened competition, particularly in key product categories and geographical areas, poses a significant risk of downward pressure on pricing, potentially impacting Fresenius Medical Care's profit margins and market share.

For instance, the global dialysis market, a core area for Fresenius, was valued at approximately $110 billion in 2023 and is projected to reach over $150 billion by 2028, indicating substantial growth but also attracting more competitors. Innovations and aggressive market tactics from rivals could directly challenge Fresenius Medical Care's established competitive advantages, forcing it to adapt quickly to maintain its position.

The healthcare sector is under constant scrutiny, and changes in regulations, especially concerning how dialysis services are paid for and the quality standards required, present a substantial challenge for Fresenius Medical Care. These evolving rules can directly impact their revenue streams and operational strategies.

Governments and private insurance companies are increasingly focused on managing healthcare expenditures. This trend could translate into lower reimbursement rates for dialysis treatments and medical devices, squeezing profit margins. For instance, in the US, Medicare reimbursement rates for dialysis services are subject to annual adjustments, and any unfavorable changes directly affect providers like Fresenius.

Furthermore, stricter regulatory oversight or the introduction of new compliance mandates can elevate operational costs and introduce greater complexity. Navigating these intricate requirements demands significant investment in compliance infrastructure and personnel, potentially diverting resources from innovation or expansion efforts.

Fresenius Medical Care faces the persistent threat of technological disruption. While the company dedicates significant resources to research and development, a competitor could emerge with a groundbreaking innovation that fundamentally changes renal care. For instance, the successful commercialization of advanced artificial kidneys or novel regenerative therapies by rivals could diminish the market share for Fresenius's established dialysis services.

This necessitates a vigilant approach to monitoring emerging technologies. The company's 2024 R&D spending, reported at €780 million, underscores its commitment to innovation, but staying ahead of disruptive forces requires more than just internal investment. It demands a keen awareness of the broader scientific and technological advancements occurring globally in the fight against kidney disease.

Global Economic Instability and Supply Chain Disruptions

Global economic instability presents a significant threat. Persistent inflation, as seen in the elevated consumer price index (CPI) figures in many developed economies throughout 2024, can directly reduce discretionary healthcare spending by patients and governments. Geopolitical tensions, such as those impacting energy prices and trade routes in 2024, further exacerbate these concerns, potentially increasing Fresenius Medical Care's operational costs and impacting its global revenue streams.

Supply chain vulnerabilities remain a critical challenge. The disruptions experienced in recent years, including those related to semiconductor shortages affecting medical device manufacturing and logistics bottlenecks in 2024, highlight the company's reliance on a complex global network. These disruptions can lead to increased costs for raw materials and components, impacting production schedules and potentially causing shortages of essential products like dialysis machines and related supplies.

- Inflationary Pressures: Continued high inflation in key markets could erode patient affordability and government reimbursement rates for dialysis services and medical products.

- Geopolitical Risks: Escalating global conflicts or trade disputes could disrupt the flow of critical components and finished goods, leading to production delays and increased logistics expenses.

- Supply Chain Bottlenecks: Lingering effects of global supply chain issues in 2024, including transportation delays and material scarcity, could impact the availability and cost of essential dialysis supplies and equipment.

- Healthcare Spending Cuts: Economic downturns may prompt governments and private insurers to reduce healthcare budgets, potentially affecting demand for Fresenius Medical Care's services and products.

Talent Recruitment and Retention Challenges

The healthcare sector, especially specialized areas like renal care, continues to grapple with difficulties in attracting and keeping skilled medical staff. This includes essential roles such as nephrologists, nurses, and technicians, who are vital for patient well-being and operational continuity.

A scarcity of qualified professionals directly affects the standard of care delivered and the company's ability to grow its service offerings. For instance, reports from late 2024 indicated a growing deficit in specialized nursing roles across the US healthcare system, a trend likely impacting Fresenius Medical Care's operational capacity.

Furthermore, escalating labor expenses, driven by competitive salary demands or persistent staffing shortages, can put significant pressure on profit margins. In 2024, the average registered nurse salary in the US saw an increase of approximately 5-7%, a cost factor that Fresenius, like its competitors, must absorb.

- Shortage of specialized medical professionals (nephrologists, nurses, technicians) impacts care quality and expansion.

- Increased labor costs due to competitive wages and staffing gaps can reduce profitability.

- The US Bureau of Labor Statistics projects continued demand for registered nurses, with employment expected to grow 6% from 2022 to 2032.

Fresenius Medical Care faces intense competition from both large, established players and nimble regional providers, potentially leading to price reductions and impacting market share, especially as the global dialysis market is projected to grow significantly. Evolving healthcare regulations and reimbursement policies, particularly in key markets like the US where Medicare rates are adjusted annually, can directly affect revenue streams and necessitate costly operational adjustments.

The company is also vulnerable to technological disruptions, where a competitor's breakthrough in areas like artificial kidneys could challenge its core dialysis services, despite Fresenius's significant R&D investment of €780 million in 2024. Economic instability, including persistent inflation seen in elevated CPI figures throughout 2024, alongside geopolitical tensions, increases operational costs and can reduce healthcare spending by patients and governments.

Supply chain vulnerabilities, exemplified by lingering semiconductor shortages and logistics bottlenecks in 2024, continue to pose a risk, potentially increasing raw material costs and impacting product availability. Furthermore, a persistent shortage of specialized medical staff, such as nurses, coupled with rising labor costs (US registered nurse salaries increased by 5-7% in 2024), can strain profitability and limit service expansion, as the US Bureau of Labor Statistics projects continued demand for nurses with 6% growth expected from 2022 to 2032.

| Threat Category | Specific Threat | Impact on Fresenius Medical Care | Supporting Data/Trend (2024/2025) |

|---|---|---|---|

| Competitive Landscape | Intensified competition in renal care | Pressure on pricing, potential market share erosion | Global dialysis market projected to exceed $150 billion by 2028 (from ~$110 billion in 2023) |

| Regulatory & Reimbursement | Changes in healthcare payment policies and quality standards | Reduced revenue streams, increased compliance costs | Annual adjustments to US Medicare reimbursement rates for dialysis services |

| Technological Disruption | Emergence of disruptive renal care technologies | Risk of obsolescence for existing services | Fresenius's 2024 R&D spending: €780 million |

| Economic & Geopolitical Instability | Inflation, geopolitical tensions | Increased operational costs, reduced healthcare spending | Elevated CPI figures in developed economies throughout 2024 |

| Supply Chain Issues | Logistics bottlenecks, material scarcity | Increased costs, production delays, product shortages | Lingering effects of semiconductor shortages and transport delays in 2024 |

| Labor Market | Shortage of skilled medical professionals, rising labor costs | Impact on care quality, operational capacity, and profitability | US registered nurse salary increase of 5-7% in 2024; projected 6% RN job growth (2022-2032) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Fresenius Medical Care's official financial statements, comprehensive market research reports, and expert industry analyses to ensure a robust and insightful assessment.