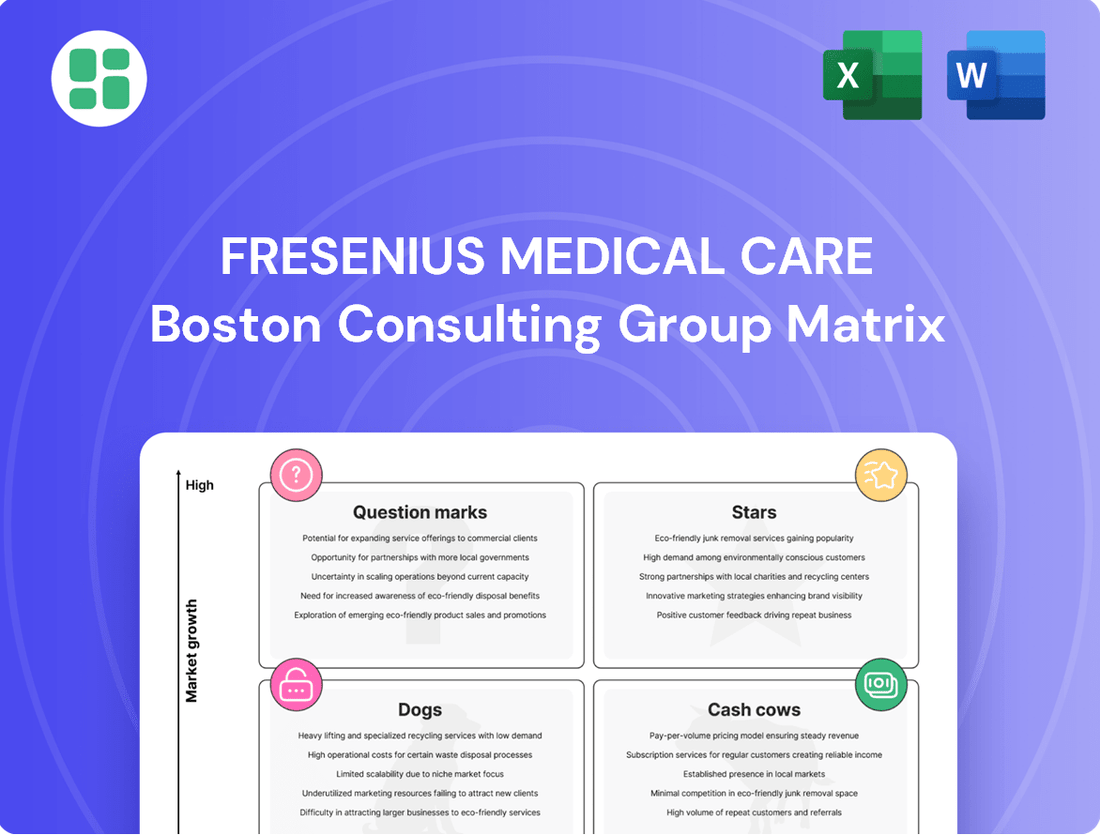

Fresenius Medical Care Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresenius Medical Care Bundle

Fresenius Medical Care's BCG Matrix reveals a dynamic portfolio, with some offerings generating significant cash while others require careful consideration for future investment. Understanding these positions is crucial for strategic growth and resource allocation.

This preview offers a glimpse into how Fresenius Medical Care navigates its market landscape. To truly unlock actionable strategies and a comprehensive understanding of their product portfolio's potential, purchase the full BCG Matrix report.

Get the full BCG Matrix for Fresenius Medical Care and gain a clear, data-driven roadmap to optimize your investments and product development. Don't miss out on the insights that will drive your business forward.

Stars

Dialysis Equipment and Products are a strong Star for Fresenius Medical Care. This segment includes essential items like dialysis machines and dialyzers. The global market for dialysis equipment is expected to see robust growth, with a projected compound annual growth rate of 8.6% between 2025 and 2032.

Fresenius Medical Care enjoys a dominant position in this market, holding roughly half of the hemodialysis machine market share. In the first quarter of 2025, the Care Enablement segment, which houses these products, reported a healthy 5% organic revenue increase. Furthermore, operating income within this segment surged by an impressive 49%, successfully meeting its target margin range.

Home dialysis systems represent a significant growth opportunity for Fresenius Medical Care, aligning with patient preferences for convenience and autonomy. The global home dialysis market is projected to expand at a compound annual growth rate of 10.21% between 2025 and 2034, indicating robust future demand.

Fresenius Medical Care is actively investing in and developing advanced home dialysis solutions. A key development was the FDA clearance in August 2023 for its Versi®HD system featuring GuideMe Software, enhancing the user experience for patients undergoing home hemodialysis.

Fresenius Medical Care is aggressively expanding its high-volume hemodiafiltration (HDF) offerings, a sophisticated form of kidney replacement therapy. By June 2024, over 61% of patients in their European clinics were already receiving HDF, demonstrating its widespread adoption and clinical preference.

The company views the U.S. market as a prime area for making HDF the standard of care, signaling a substantial growth avenue. This strategic push is designed to boost treatment volumes and enhance patient well-being.

Value-Based Care Partnerships

Fresenius Medical Care's strategic push into value-based care (VBC) partnerships, exemplified by the formation of InterWell Health, positions them within a rapidly expanding market. This move broadens their reach beyond traditional dialysis services to encompass holistic kidney disease management, tapping into a significantly larger patient population and a focus on improved health outcomes.

This expansion into VBC is a key driver for Fresenius, as it targets a high-growth segment of the healthcare industry. By managing patient care proactively and focusing on outcomes rather than volume, Fresenius aims to capture greater value and demonstrate improved patient results.

- Market Expansion: InterWell Health, a joint venture involving Fresenius, aims to manage the care of 1 million patients with chronic kidney disease by 2025, indicating substantial market penetration.

- Growth Potential: The VBC model offers high growth prospects by shifting focus to comprehensive patient management and improved clinical outcomes, a departure from traditional fee-for-service models.

- Strategic Alignment: This strategy aligns with broader healthcare trends emphasizing preventative care and cost-effectiveness, positioning Fresenius as a leader in innovative kidney care delivery.

Digital Health and AI Innovations

Fresenius Medical Care's significant investments in digital health and AI position it as a Star. The company is actively developing AI-powered algorithms and personalized medicine approaches to enhance kidney care. These advancements are designed to refine clinical decision-making, boost patient results, and streamline operations, ensuring Fresenius remains at the forefront of the industry.

The company's focus on remote patient monitoring and predictive analytics represents a forward-thinking strategy in renal therapy. For instance, Fresenius's commitment to innovation was highlighted in its 2023 financial reports, which showed increased R&D spending directed towards digital solutions. This strategic allocation of resources underscores their belief in the transformative power of technology for kidney disease management.

- Digital Health Investment: Fresenius Medical Care is channeling substantial resources into digital health platforms, aiming to create a more connected and efficient patient care ecosystem.

- AI-Powered Insights: The integration of AI-based algorithms is intended to provide deeper clinical insights, enabling earlier detection of complications and more tailored treatment plans.

- Personalized Medicine: By embracing personalized medicine, Fresenius seeks to move beyond one-size-fits-all approaches, offering treatments customized to individual patient needs and genetic profiles.

- Future-Proofing Kidney Care: Innovations like remote monitoring and predictive analytics are key to future-proofing kidney care, addressing the growing demand and complexity of managing chronic kidney disease.

Fresenius Medical Care's Dialysis Equipment and Products segment, including machines and dialyzers, is a strong Star. The global market for dialysis equipment is projected to grow at an 8.6% CAGR from 2025 to 2032. Fresenius holds about half of the hemodialysis machine market share, and its Care Enablement segment saw a 5% organic revenue increase in Q1 2025.

Home dialysis systems are another Star, with the market expected to grow at a 10.21% CAGR from 2025 to 2034. Fresenius is investing in advanced solutions, evidenced by the FDA clearance of its Versi®HD system with GuideMe Software in August 2023.

The company's expansion into high-volume hemodiafiltration (HDF) also positions it as a Star. By June 2024, over 61% of patients in their European clinics were receiving HDF, and Fresenius aims to make it the standard of care in the U.S.

Fresenius Medical Care's strategic move into value-based care (VBC) through partnerships like InterWell Health is a significant Star. This venture aims to manage the care of 1 million chronic kidney disease patients by 2025, tapping into a high-growth segment focused on improved patient outcomes.

Investments in digital health and AI are also key Star components for Fresenius. The company is developing AI-powered algorithms and personalized medicine to enhance kidney care, with R&D spending on digital solutions increasing in 2023.

| Segment | BCG Category | Key Growth Drivers | Market Data/Performance | Strategic Focus |

|---|---|---|---|---|

| Dialysis Equipment & Products | Star | Robust global market growth (8.6% CAGR 2025-2032) | Fresenius holds ~50% hemodialysis machine market share; 5% organic revenue growth in Care Enablement (Q1 2025) | Dominant market position, innovation in machines |

| Home Dialysis Systems | Star | Patient preference for convenience (10.21% CAGR 2025-2034) | FDA clearance for Versi®HD with GuideMe Software (Aug 2023) | Development of advanced home solutions |

| Hemodiafiltration (HDF) | Star | Clinical preference for advanced therapy | Over 61% of European patients on HDF (June 2024); U.S. market expansion planned | Making HDF standard of care in U.S. |

| Value-Based Care (VBC) Partnerships (e.g., InterWell Health) | Star | Shift to holistic kidney disease management, improved outcomes | InterWell Health aims to manage 1 million CKD patients by 2025 | Expanding reach beyond traditional dialysis, proactive patient management |

| Digital Health & AI | Star | Enhancing clinical decision-making, patient results, operational efficiency | Increased R&D spending on digital solutions (2023); AI-powered algorithms and personalized medicine development | Future-proofing kidney care through technology |

What is included in the product

This overview highlights which Fresenius Medical Care units to invest in, hold, or divest based on market growth and share.

The Fresenius Medical Care BCG Matrix offers a clear, visual analysis of their diverse business units, simplifying strategic decisions and resource allocation.

Cash Cows

Fresenius Medical Care's global in-center dialysis services are a clear Cash Cow. With over 3,600 clinics serving around 299,000 patients, this segment is a bedrock of their Care Delivery business. The in-center dialysis market, valued at an estimated USD 114.9 billion in 2024, demonstrates its substantial and enduring revenue-generating capability.

Fresenius Medical Care's established dialyzer and consumables manufacturing stands as a prime example of a Cash Cow within its BCG Matrix. This segment benefits from a dominant market share in a product category with consistently high demand, acting as a reliable engine for revenue generation.

The essential nature of these products for ongoing dialysis treatments ensures a steady and predictable income stream. In 2024, the hemodialysis consumables segment, in particular, solidified its Cash Cow status by holding the highest market share within Fresenius Medical Care's portfolio, underscoring its enduring strength and profitability.

Renal pharmaceuticals and medications, a cornerstone of Fresenius Medical Care's offerings, represent a robust cash cow. This segment, often bundled with dialysis services, boasts high profit margins due to its essential nature in managing chronic kidney disease complications.

These vital medications are integral to the Care Enablement segment, which has consistently shown impressive profitability. For instance, in 2023, Fresenius Medical Care reported significant revenue from its pharmaceuticals and related products, underscoring their role as a stable income generator for the company.

Mature U.S. Dialysis Operations

Fresenius Medical Care's mature U.S. dialysis operations are a prime example of a Cash Cow within the BCG Matrix. This segment benefits from a stable, albeit growing, patient base and well-established reimbursement structures, ensuring reliable revenue streams.

The U.S. dialysis services market, despite seasonal challenges like flu outbreaks, continues to be a significant and mature sector. Fresenius Medical Care's strong presence here, bolstered by consistent patient demand, translates into predictable and substantial cash flow generation.

- Market Position: Leading operator in the mature U.S. dialysis market.

- Revenue Stability: Benefits from established reimbursement frameworks and consistent patient demand.

- Growth Indicator: U.S. same-market treatment growth turned positive in Q4 2024, signaling market stability.

- Profitability: Continues to be a consistent generator of cash for the company.

Operational Efficiency from FME25 Program

The FME25 transformation program is a key driver of operational efficiency for Fresenius Medical Care, targeting EUR 750 million in sustainable savings by the end of 2025. This initiative directly boosts the company's cash-generating capabilities by instilling greater cost discipline throughout its operations.

These substantial savings are crucial for improving profit margins and strengthening cash flow. This enhanced financial position enables Fresenius Medical Care to strategically allocate capital towards promising growth opportunities and simultaneously reduce its existing debt burden.

- FME25 Savings Target: EUR 750 million by end of 2025.

- Impact: Improved operational efficiency and cost discipline.

- Financial Benefits: Enhanced profit margins and increased cash flow.

- Strategic Use of Funds: Investment in growth areas and debt reduction.

Fresenius Medical Care's established dialyzer and consumables manufacturing represents a significant Cash Cow. This segment benefits from a dominant market share in a product category with consistently high demand, acting as a reliable engine for revenue generation.

The essential nature of these products for ongoing dialysis treatments ensures a steady and predictable income stream. In 2024, the hemodialysis consumables segment, in particular, solidified its Cash Cow status by holding the highest market share within Fresenius Medical Care's portfolio, underscoring its enduring strength and profitability.

Fresenius Medical Care's mature U.S. dialysis operations are a prime example of a Cash Cow within the BCG Matrix. This segment benefits from a stable, albeit growing, patient base and well-established reimbursement structures, ensuring reliable revenue streams.

The U.S. dialysis services market, despite seasonal challenges, continues to be a significant and mature sector. Fresenius Medical Care's strong presence here, bolstered by consistent patient demand, translates into predictable and substantial cash flow generation.

| Segment | BCG Category | Key Characteristics | 2024 Data Point |

|---|---|---|---|

| In-center Dialysis Services (Global) | Cash Cow | High market share, stable patient base, essential service | ~3,600 clinics, ~299,000 patients |

| Dialyzers & Consumables Manufacturing | Cash Cow | Dominant market share, high demand, reliable revenue | Highest market share in hemodialysis consumables |

| U.S. Dialysis Operations | Cash Cow | Mature market, established reimbursement, consistent demand | Same-market treatment growth positive in Q4 2024 |

Delivered as Shown

Fresenius Medical Care BCG Matrix

The Fresenius Medical Care BCG Matrix you see is the complete, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This preview accurately represents the final report, meticulously crafted with industry-specific data and analysis, ensuring you get precisely what you need for informed decision-making. Once purchased, this BCG Matrix will be instantly downloadable, allowing you to seamlessly integrate its insights into your business planning and competitive strategy without any further modifications. You are viewing the actual, professionally designed BCG Matrix report that will be delivered to you, providing a clear and actionable overview of Fresenius Medical Care's product portfolio for your business intelligence needs.

Dogs

Fresenius Medical Care has strategically divested clinic operations in regions like Latin America, Sub-Saharan Africa, and Türkiye. This move is part of a broader plan to streamline its portfolio. For instance, in 2024, these divested operations were identified as having a negative impact on the company's revenue and operating income.

These markets were deemed non-core and dilutive to overall performance. The decision to exit these specific geographical areas suggests they were not expected to provide sufficient returns on further investment, aligning with a strategy to focus on more profitable ventures.

The divestment of Cura Day Hospitals Group in Australia by Fresenius Medical Care underscores a strategic move to streamline its operations. This action is consistent with Fresenius Medical Care's ongoing portfolio optimization, aiming to shed non-core assets that no longer align with its long-term vision or deliver satisfactory returns.

Cura Day Hospitals Group, by its nature as a divestment, likely represented a segment that required significant capital investment but offered limited growth potential, fitting the profile of a 'Dog' in the BCG matrix framework. Such divestitures are a common tactic for companies seeking to improve overall profitability and focus resources on more promising ventures.

Fresenius Medical Care divested select U.S. laboratory testing services assets from Spectra Laboratories. This move suggests these units were considered underperforming or not core to their future strategy.

In 2024, Fresenius Medical Care continued its strategic portfolio adjustments. The divestiture of Spectra Laboratories' U.S. assets aligns with a broader trend of healthcare companies refining their focus on core competencies and divesting non-essential or lower-growth segments.

Less Profitable Acute Care Contracts

Fresenius Medical Care strategically exited less profitable acute care contracts in the U.S. This move, which reduced underlying U.S. same-market treatment growth by 0.2% in 2023, reflects a deliberate shift towards optimizing profitability. These contracts likely offered minimal margins and constrained expansion opportunities, making their discontinuation a logical step in the company's revitalization efforts. Focusing on higher-margin segments is central to Fresenius Medical Care's ongoing turnaround strategy.

The decision to divest from these lower-profitability agreements underscores a commitment to enhancing overall financial performance. By shedding these less attractive segments, Fresenius Medical Care frees up resources and management attention to concentrate on more lucrative areas of its business. This strategic pruning is a common tactic for companies seeking to improve efficiency and boost shareholder value, particularly during periods of operational adjustment.

- Exit from less profitable acute care contracts in the U.S.

- Impacted underlying U.S. same-market treatment growth by 0.2% in 2023.

- Prioritization of higher-margin business segments.

- Strategic move to enhance overall profitability and efficiency.

Underperforming Regional Dialysis Centers

While Fresenius Medical Care boasts a strong global presence, certain regional dialysis centers might be lagging. This underperformance could stem from intense local competition, an oversaturated market, or simply lower patient numbers in specific areas. These underperforming units, if they aren't contributing substantially to Fresenius's overall profit or market share, would fall into the Dogs category within the BCG Matrix.

Fresenius Medical Care's strategic approach involves actively managing its portfolio. This includes identifying and addressing underperforming assets to improve financial outcomes. For instance, in 2024, Fresenius continued its focus on operational efficiency, aiming to streamline processes across its vast network of centers. The company's overall strategy includes optimizing its operating model to enhance financial returns.

- Underperforming Regional Centers: Identified as potential Dogs in the BCG Matrix.

- Reasons for Underperformance: Local market saturation, competitive pressures, lower patient volumes.

- Strategic Focus: Optimizing the operating model to enhance financial returns across the portfolio.

Certain regional dialysis centers within Fresenius Medical Care's extensive network may be classified as Dogs in the BCG Matrix due to underperformance. These units likely face challenges such as intense local competition or lower patient volumes, impacting their growth potential and market share. Fresenius's 2024 strategy includes optimizing its operational model to address such underperforming segments and enhance overall financial returns.

The divestment of Cura Day Hospitals Group in Australia and select U.S. laboratory testing services from Spectra Laboratories are examples of Fresenius Medical Care shedding assets that fit the 'Dog' profile. These actions align with a broader portfolio optimization strategy aimed at improving profitability and focusing resources on more promising ventures.

Fresenius Medical Care's exit from less profitable acute care contracts in the U.S., which reduced same-market treatment growth by 0.2% in 2023, further illustrates the management of 'Dog' assets. This strategic pruning allows the company to concentrate on higher-margin business segments and enhance overall efficiency.

The company's ongoing portfolio adjustments in 2024 reflect a commitment to refining its focus on core competencies and divesting lower-growth or underperforming segments to boost shareholder value.

| BCG Category | Fresenius Medical Care Examples | Key Characteristics | Strategic Action |

|---|---|---|---|

| Dogs | Underperforming regional dialysis centers, Divested clinic operations (Latin America, Sub-Saharan Africa, Türkiye), Cura Day Hospitals Group, Spectra Laboratories U.S. assets, Less profitable acute care contracts (U.S.) | Low market share, Low growth potential, May require significant investment with limited returns, Negative impact on profitability | Divestment, Streamlining operations, Focusing on core competencies, Optimizing operating model |

Question Marks

Fresenius Medical Care is heavily investing in emerging digital diagnostics and AI-based prognostic tools for kidney care. These innovations, while offering high growth potential, are currently in the nascent stages of market adoption. Significant R&D expenditure is necessary to secure market share and demonstrate commercial viability for these groundbreaking technologies.

The development of these advanced tools demands substantial capital outlay, positioning them as cash consumers within Fresenius Medical Care's portfolio. This strategic investment aims to revolutionize kidney care, but the path to widespread commercial success requires sustained financial commitment and market penetration efforts.

Fresenius Medical Care's strategic expansion into managing earlier stages of Chronic Kidney Disease (CKD) stages 3-5 positions them in a high-growth, but currently low-market-share segment. This move acknowledges the increasing prevalence of CKD, with an estimated 37 million Americans affected by CKD in 2024, many in these earlier stages.

This strategic pivot necessitates the development of innovative care models and substantial investment in patient engagement technologies. For instance, the company is focusing on digital health platforms to monitor patients proactively, a key differentiator in this nascent market. Such investments are crucial for capturing this expanding addressable market.

The shift towards personalized medicine and genomic-driven therapies in kidney disease represents a significant growth area. This innovative approach promises better patient results but is still in its early stages, demanding considerable investment in research, clinical trials, and market education for broad acceptance. Fresenius Medical Care is strategically entering this frontier, which is currently characterized by high capital expenditure.

New Renal Care Models leveraging AI and Data Analytics

Fresenius Medical Care is actively developing innovative renal care models that harness the power of artificial intelligence and big data analytics. These advancements are geared towards providing more personalized and comprehensive care, particularly focusing on home-based treatments. The company's investment in these digital solutions signifies a strategic move towards future growth, though the immediate financial returns and widespread adoption are still in the early stages of development.

These new models aim to fundamentally shift kidney therapy delivery, moving towards a more patient-centric and data-driven approach. While the potential for improved patient outcomes and operational efficiencies is substantial, the market penetration and profitability of these nascent technologies remain a key area of focus. Fresenius Medical Care's commitment to these areas underscores their belief in the long-term value of digital transformation in healthcare.

- Personalized Home Care: AI-driven insights enable tailored treatment plans for patients at home.

- Data Analytics for Efficiency: Big data is used to optimize resource allocation and patient monitoring.

- Future Growth Investment: Significant capital is being deployed into these evolving care models.

- Uncertain Immediate Returns: Market penetration and profitability are still being established for these new approaches.

Entry into New Geographic Markets for High-Growth Modalities

Fresenius Medical Care (FMC) might be strategically entering or expanding in new geographic markets for high-growth modalities, such as home dialysis or advanced therapies, even as it divests from certain existing regions. This approach targets areas where its current presence is minimal but the growth potential for these specific treatments is substantial. Such expansions require significant initial investment in infrastructure and market development, positioning these new ventures as potential future stars or question marks within FMC's portfolio.

FMC's overarching mission is to deliver care to an increasing global patient population, and this strategy aligns with that goal by tapping into emerging markets for innovative dialysis solutions. For instance, in 2023, the global home dialysis market was valued at approximately USD 12.5 billion and is projected to grow significantly, presenting a clear opportunity for FMC to establish a stronger foothold.

- Strategic Expansion: Targeting nascent markets for home dialysis and advanced therapies where FMC has low current penetration but sees high growth potential.

- Investment Focus: Significant upfront capital allocation for infrastructure, technology, and market education in these new territories.

- Mission Alignment: Supporting FMC's commitment to providing care for a growing worldwide patient base by introducing innovative treatment options.

- Market Opportunity: Capitalizing on the expanding global demand for home-based and advanced renal care solutions, a sector projected for robust future growth.

Fresenius Medical Care's strategic focus on emerging digital diagnostics and AI-based prognostic tools for kidney care places these initiatives in the Question Marks category of the BCG Matrix. These areas represent high growth potential due to their innovative nature and the increasing prevalence of kidney disease, with an estimated 37 million Americans affected in 2024. However, they currently have low market share and require substantial R&D investment, making them cash consumers. The company's expansion into earlier stages of Chronic Kidney Disease (CKD) and personalized medicine further exemplifies this positioning, demanding significant capital for new care models and genomic-driven therapies.

| BCG Category | Fresenius Medical Care Initiatives | Market Growth | Market Share | Cash Flow | Strategic Rationale |

|---|---|---|---|---|---|

| Question Marks | Digital Diagnostics & AI Prognostics | High | Low | Negative (Cash Consumer) | Capturing future growth in advanced kidney care technology. |

| Question Marks | Managing CKD Stages 3-5 | High | Low | Negative (Cash Consumer) | Expanding into a larger, underserved segment of the kidney disease market. |

| Question Marks | Personalized Medicine/Genomic Therapies | High | Low | Negative (Cash Consumer) | Pioneering next-generation treatments for improved patient outcomes. |

| Question Marks | New Geographic Markets for Home Dialysis | High | Low | Negative (Cash Consumer) | Establishing presence in high-potential markets for innovative dialysis solutions, e.g., global home dialysis market valued at approx. USD 12.5 billion in 2023 and growing. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Fresenius Medical Care's financial reports, internal sales figures, and global market research to accurately assess product performance and market share.