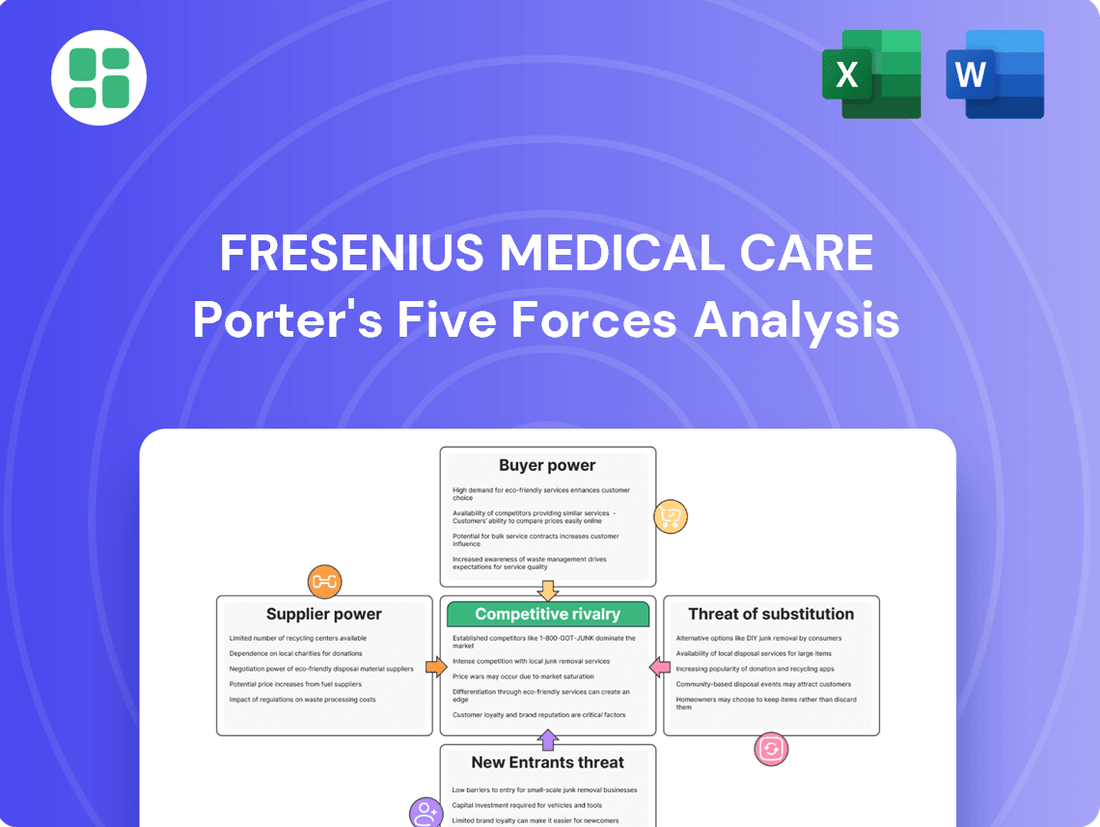

Fresenius Medical Care Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresenius Medical Care Bundle

Fresenius Medical Care navigates a complex landscape shaped by significant buyer and supplier power, particularly within the healthcare sector. While the threat of new entrants is somewhat mitigated by high capital requirements and regulatory hurdles, the intense rivalry among existing dialysis providers and the constant pressure from substitute treatments demand strategic agility.

The complete report reveals the real forces shaping Fresenius Medical Care’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The dialysis industry's dependence on specialized components and raw materials for dialyzers, alongside certain pharmaceuticals, places significant leverage in the hands of a limited number of suppliers. If these critical inputs are sourced from only a handful of providers, their bargaining power naturally escalates, potentially driving up costs for Fresenius Medical Care.

Fresenius Medical Care actively works to counter this supplier leverage by securing long-term supply agreements and exploring the development of in-house manufacturing capabilities for certain essential components. For instance, in 2024, Fresenius continued its strategic focus on supply chain resilience, aiming to reduce reliance on single-source suppliers for key materials used in its dialysis machines and consumables.

Suppliers of highly specialized or proprietary medical components and pharmaceuticals hold significant leverage over Fresenius Medical Care. This is particularly true when switching to an alternative supplier necessitates costly retooling, extensive regulatory approvals, or rigorous quality assurance procedures. For instance, the validation of new suppliers for critical dialysis equipment and consumables can involve substantial financial and time investments, making it difficult for Fresenius to switch providers easily.

The threat of suppliers integrating forward into Fresenius Medical Care's operations, such as offering dialysis services or complete dialysis machines, would significantly boost their bargaining power. However, the substantial capital investment required for dialysis centers and the intricate regulatory landscape for medical device manufacturing generally limit the feasibility of this threat.

For instance, establishing a new dialysis clinic involves millions of dollars in upfront costs for equipment, facilities, and staffing, alongside navigating complex healthcare regulations. Similarly, the development and production of sophisticated dialysis machines demand extensive R&D and manufacturing expertise, making direct competition by suppliers a challenging proposition.

Importance of Fresenius Medical Care to Suppliers

Fresenius Medical Care's substantial global presence and consistent demand for medical supplies significantly influence its suppliers. For large, diversified suppliers, Fresenius represents a major client, potentially diluting the supplier's individual bargaining power due to the sheer volume of business it represents. This makes it harder for these suppliers to dictate terms independently.

However, the dynamic shifts for smaller, specialized suppliers. For these entities, Fresenius Medical Care can be a disproportionately large, even dominant, customer. In such cases, Fresenius Medical Care gains considerable leverage, as the supplier’s revenue may heavily depend on the business secured from Fresenius. This dependency allows Fresenius to negotiate favorable pricing and terms.

In 2024, Fresenius Medical Care continued its robust procurement activities, with its global operations requiring a steady influx of critical components and finished goods. For instance, their dialysis machines and related consumables are sourced from a wide array of manufacturers. The company's scale means it often accounts for a substantial percentage of a niche supplier's total output, thereby enhancing Fresenius's negotiating position.

- Significant Customer for Large Suppliers: Fresenius Medical Care's extensive global footprint means it is a key customer for many large, diversified suppliers in the healthcare sector.

- Dominant Customer for Niche Suppliers: For smaller or specialized suppliers, Fresenius can represent a dominant portion of their revenue, increasing Fresenius's bargaining power.

- Impact on Pricing and Terms: This leverage allows Fresenius Medical Care to negotiate favorable pricing and terms, directly impacting supplier profitability and strategic decisions.

- Supply Chain Stability: Fresenius's ability to exert influence helps ensure a stable and cost-effective supply chain for its critical medical products and services.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences supplier bargaining power. If Fresenius Medical Care can readily source alternative raw materials or components, even if not perfectly identical, it reduces the leverage of any single supplier. This is particularly true for standardized components where multiple manufacturers exist.

Fresenius Medical Care's extensive global operations and sheer scale are crucial in mitigating supplier power. By having a diversified supplier base across different regions, the company can switch suppliers more easily if one attempts to exert excessive pressure on pricing or terms. For instance, in 2023, Fresenius reported that its cost of sales was €16.7 billion, highlighting the substantial volume of inputs it procures and the importance of strategic sourcing.

- Diversified Sourcing: Fresenius Medical Care actively seeks multiple suppliers for critical components to avoid over-reliance on any single entity.

- Global Reach: Operations in numerous countries enable access to a wider array of potential suppliers, fostering competitive pricing.

- Negotiating Leverage: The company's large procurement volume grants it significant power to negotiate favorable terms and prices with its suppliers.

- Substitute Material Research: Continuous evaluation of alternative materials and components helps maintain flexibility and reduce dependence on specific suppliers.

Suppliers of specialized dialysis components and pharmaceuticals can wield considerable power over Fresenius Medical Care, especially when alternatives are scarce or costly to implement. This leverage is amplified if Fresenius relies heavily on a limited number of providers for critical inputs, potentially driving up procurement costs.

Fresenius Medical Care actively mitigates this by forging long-term supply contracts and exploring in-house production for key materials. For instance, in 2024, the company prioritized supply chain resilience, aiming to reduce dependence on single-source suppliers for essential dialysis machine and consumable components.

The bargaining power of suppliers is also influenced by Fresenius Medical Care's own market position. As a major global player, Fresenius often represents a significant portion of business for large, diversified suppliers, which can dilute their individual leverage. Conversely, for niche suppliers, Fresenius can be a dominant customer, granting Fresenius greater negotiating power.

The availability of substitute materials and the cost and complexity of switching suppliers are key factors. High switching costs, including retooling and regulatory approvals, strengthen supplier positions. Fresenius's extensive global sourcing network and large procurement volumes, which reached €16.7 billion in cost of sales in 2023, provide it with substantial leverage to negotiate favorable terms.

| Factor | Impact on Fresenius Medical Care | Mitigation Strategies |

| Supplier Concentration | High for specialized inputs; potential for increased costs. | Diversified sourcing, long-term agreements, in-house production exploration. |

| Switching Costs | High for proprietary components, impacting supplier power. | Continuous evaluation of alternative materials and components. |

| Fresenius's Purchasing Power | Significant for large suppliers; dominant for niche suppliers. | Leveraging global scale and procurement volume for favorable terms. |

| Availability of Substitutes | Reduces supplier leverage for standardized components. | Actively seeking multiple suppliers and alternative materials. |

What is included in the product

This analysis details the competitive forces impacting Fresenius Medical Care, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the dialysis and healthcare services market.

Instantly understand the competitive landscape of the dialysis market, revealing key pressures on Fresenius Medical Care for informed strategic adjustments.

Customers Bargaining Power

In markets like the U.S., government programs such as Medicare, alongside major private insurers, reimburse a substantial amount of dialysis services. This concentration of large payers, coupled with consolidated hospital networks, grants them significant leverage to negotiate pricing for both dialysis treatments and related medical products. For instance, in 2023, Medicare spending on kidney disease, which includes dialysis, was a considerable portion of the overall healthcare expenditure, highlighting the payers' financial influence.

While patients with End-Stage Renal Disease (ESRD) rely on dialysis, their selection of a treatment center can be swayed by proximity, perceived quality of care, and physician endorsements. This can grant them some leverage. In 2023, approximately 790,000 Americans were living with kidney failure, with over 550,000 of those requiring dialysis or a kidney transplant, highlighting the significant patient base.

The bargaining power of customers is significantly influenced by price sensitivity stemming from reimbursement models. Healthcare systems and insurers, particularly in the face of increasing chronic kidney disease prevalence, are keenly focused on cost containment. This cost-consciousness directly impacts Fresenius Medical Care's pricing strategies.

Bundled payment systems, a common reimbursement model in healthcare, reward providers for efficiency and cost-effectiveness. This incentivizes Fresenius to manage its costs diligently, but it also translates into heightened pressure on the prices of both its dialysis services and the medical products it supplies. For instance, in 2024, the global dialysis market is experiencing intense competition, with payers actively negotiating for lower rates, putting Fresenius under direct price scrutiny.

Availability of Alternative Dialysis Providers

The bargaining power of customers in the dialysis market is significantly influenced by the availability of alternative providers. In many geographic areas, patients can choose from multiple dialysis service providers, such as DaVita, Baxter, and U.S. Renal Care, as well as various product manufacturers. This competitive landscape directly translates to increased customer choice and enhanced negotiation leverage for patients and their insurers.

This competitive environment allows patients to compare services, pricing, and quality across different providers. For instance, as of early 2024, the U.S. dialysis market is characterized by a duopoly of DaVita and Fresenius Medical Care, but the presence of smaller regional players and the potential for new entrants, coupled with the availability of home dialysis technologies, can still exert pressure on established providers. This forces companies like Fresenius to offer competitive pricing and superior service to retain their patient base.

- Provider Choice: Patients can select from multiple dialysis centers, influencing provider market share.

- Negotiation Leverage: Competition empowers patients and insurers to negotiate better terms and pricing.

- Product Alternatives: Availability of different dialysis machines and consumables from various manufacturers increases customer options.

- Market Dynamics: The presence of both large national chains and smaller regional providers creates a dynamic competitive environment impacting customer power.

Customer Knowledge and Transparency

Customer knowledge and transparency are significantly impacting Fresenius Medical Care. As healthcare information becomes more readily available, patients and payers are better informed about treatment choices, expected results, and associated expenses. This heightened transparency empowers customers to seek greater value and improved outcomes, directly influencing their selection of healthcare providers.

In 2024, the increasing accessibility of health data means patients can compare dialysis providers based on factors like machine technology, staff-to-patient ratios, and patient satisfaction scores. For instance, online platforms and patient advocacy groups often publish comparative data, allowing informed decision-making. This trend forces Fresenius to compete not just on service quality but also on demonstrable value and transparency in pricing and outcomes.

- Increased Patient Information: Patients are actively researching treatment options and provider performance, leading to more informed choices.

- Payer Scrutiny: Insurance companies and government payers are demanding greater transparency in costs and quality metrics, influencing reimbursement rates.

- Digital Health Platforms: The rise of telehealth and patient portals provides platforms for information sharing and comparison, amplifying customer power.

- Focus on Value-Based Care: A shift towards value-based care models incentivizes providers like Fresenius to demonstrate superior outcomes at competitive costs.

The bargaining power of customers, particularly large payers like government programs and private insurers, is substantial due to their significant purchasing volume and focus on cost containment. This leverage intensifies as healthcare systems and payers actively negotiate pricing for dialysis services and related medical products, driven by increasing prevalence of chronic kidney disease and bundled payment models. For instance, in 2024, the global dialysis market is witnessing payers aggressively seeking lower rates, directly impacting Fresenius Medical Care's pricing strategies.

Patients, while dependent on dialysis, do possess some leverage through their ability to choose providers based on factors like location, perceived quality, and physician recommendations. In 2023, over 550,000 Americans required dialysis or a transplant, illustrating the significant patient base whose choices influence market dynamics. The availability of alternative providers, such as DaVita and Baxter, alongside increasing transparency in healthcare data, further empowers patients and payers to compare services and negotiate for better terms and pricing.

| Factor | Impact on Fresenius | Supporting Data/Trend (2023-2024) |

| Payer Concentration | High leverage for price negotiation | Medicare and major private insurers are dominant payers in the U.S. dialysis market. |

| Patient Choice & Information | Pressure to offer competitive pricing and superior service | Over 550,000 Americans on dialysis (2023); increasing patient access to comparative data online. |

| Bundled Payments | Incentive for cost management, but also price pressure | Common reimbursement model in healthcare, rewarding efficiency. |

| Market Competition | Need for differentiation and value proposition | Presence of large competitors like DaVita and smaller regional players. |

Same Document Delivered

Fresenius Medical Care Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces Analysis of Fresenius Medical Care presented here meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the healthcare sector. This professionally formatted analysis is ready for your immediate use.

Rivalry Among Competitors

The global dialysis market is notably concentrated, with Fresenius Medical Care, DaVita Inc., and Baxter International Inc. collectively dominating a substantial portion of market share in both dialysis products and services. This intense concentration naturally fuels fierce rivalry among these key players.

In 2024, Fresenius Medical Care reported substantial revenue, underscoring its significant presence. This market dominance means that competition often revolves around securing patient volume, innovating new treatment modalities, and optimizing operational efficiency to maintain or expand market share.

While the global dialysis market benefits from increasing Chronic Kidney Disease (CKD) rates and an aging demographic, growth in established regions like North America and Europe is moderating. This slower expansion in mature markets intensifies the rivalry among established players like Fresenius Medical Care, as companies vie for a larger share of the existing patient pool. For instance, in 2024, the dialysis market in Western Europe experienced a growth rate of approximately 3-4%, a noticeable slowdown from previous years.

Operating dialysis clinics and manufacturing specialized equipment, like Fresenius Medical Care's dialysis machines and disposables, demands significant upfront investment. These high fixed costs, encompassing facilities, advanced machinery, and regulatory compliance, create substantial barriers for new entrants and make exiting the market difficult for existing players. For instance, the capital expenditure for a single dialysis clinic can run into millions of dollars, and the specialized nature of the manufacturing equipment further locks in capital.

Because of these substantial fixed costs and the specialized nature of the assets, companies like Fresenius Medical Care face high exit barriers. This means that even when market conditions are unfavorable, or profitability dips, companies are incentivized to continue operating rather than abandoning their investments. This persistent presence fuels intense competition as firms strive to cover their fixed costs, leading to sustained rivalry within the dialysis sector.

Product and Service Differentiation

Competitive rivalry in the dialysis market is intense, with companies like Fresenius Medical Care differentiating themselves through more than just pricing. They focus heavily on the quality of patient care, investing in cutting-edge technology for their dialysis machines and dialyzers. For instance, Fresenius has been a leader in developing advanced hemodialysis and peritoneal dialysis systems designed for improved patient outcomes and ease of use.

The expansion of service offerings is another key battleground. Companies are increasingly offering home dialysis solutions, which provide greater convenience and autonomy for patients. Fresenius, in particular, has been actively promoting its home dialysis programs. Furthermore, the shift towards value-based care models, where providers are reimbursed based on patient outcomes rather than the volume of services, compels companies to offer integrated care solutions that manage the entire patient journey, from treatment to post-treatment support.

- Technological Advancements: Fresenius’s innovation in dialysis machines, such as the 4008 and 5008 series, highlights their commitment to improving treatment efficiency and patient comfort.

- Service Expansion: The company’s focus on home hemodialysis (HHD) and peritoneal dialysis (PD) reflects a strategic move to capture a larger share of the growing home-based treatment market.

- Integrated Care Models: Fresenius aims to provide end-to-end patient management, encompassing dialysis treatments, pharmaceuticals, and ancillary services, thereby creating a more holistic and differentiated offering.

- Market Share: As of early 2024, Fresenius Medical Care remains one of the largest providers globally, indicating successful differentiation strategies in a highly competitive landscape.

Regulatory Environment and Consolidation

The dialysis industry, especially in the United States, operates under a stringent regulatory framework. This environment often creates significant hurdles for new companies looking to enter the market, effectively acting as a barrier to entry. Established, larger companies like Fresenius Medical Care are better equipped to manage these complex compliance demands, giving them an advantage.

This regulatory landscape also tends to drive consolidation within the sector. Larger organizations can absorb the costs and complexities associated with regulatory adherence more readily than smaller ones. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to implement policies impacting dialysis providers, requiring substantial investment in compliance and quality reporting.

- Regulatory Hurdles: The dialysis sector faces extensive regulations, particularly concerning patient care standards and data privacy, which are costly to meet.

- Consolidation Trend: Industry consolidation is observed as companies seek economies of scale to manage regulatory burdens and enhance negotiating power.

- Incumbent Advantage: Large, established players leverage their size to navigate compliance, influence policy, and negotiate favorable terms with payers.

- 2024 Impact: Ongoing regulatory adjustments in 2024 by bodies like CMS necessitate continuous adaptation and investment from providers, favoring those with greater resources.

Competitive rivalry within the dialysis sector is intense, driven by a concentrated market structure where Fresenius Medical Care, DaVita, and Baxter hold significant sway. This rivalry forces companies to innovate and optimize operations to secure patient volume and market share, especially as growth moderates in developed regions.

Differentiation strategies are crucial, with companies like Fresenius focusing on advanced technology, improved patient care, and expanding service offerings like home dialysis. The shift towards value-based care also pushes providers to offer integrated solutions, managing the entire patient journey to stand out in this competitive landscape.

High fixed costs associated with dialysis clinics and specialized equipment create substantial barriers to entry and exit, ensuring persistent competition. Companies must continue operating to cover these costs, leading to ongoing efforts to gain an edge through technological advancements and service expansion.

The stringent regulatory environment, particularly in the US, further shapes competition by favoring larger, established players like Fresenius Medical Care. These incumbents are better positioned to manage compliance costs and navigate complex regulations, often leading to industry consolidation.

| Key Competitor | 2024 Revenue (Approximate USD billions) | Market Focus | Competitive Strategy Example |

|---|---|---|---|

| Fresenius Medical Care | ~30.0 | Dialysis Products & Services (Global) | Advancing home dialysis technology and integrated care models. |

| DaVita Inc. | ~12.0 | Dialysis Services (Primarily US) | Focusing on patient outcomes and operational efficiency in clinics. |

| Baxter International Inc. | ~15.0 (Total Revenue, significant portion in Renal Care) | Renal Care Products & Services (Global) | Expanding peritoneal dialysis offerings and innovative drug delivery. |

SSubstitutes Threaten

Kidney transplantation is the preferred treatment for End-Stage Renal Disease (ESRD), offering superior quality of life and longer survival rates than dialysis. This preference inherently creates a substitute for dialysis services, impacting providers like Fresenius Medical Care.

While dialysis remains a critical lifeline, the increasing success rates and accessibility of kidney transplants present a significant threat. In 2023, the United Network for Organ Sharing (UNOS) reported over 25,000 kidney transplants performed in the US, a testament to its growing prevalence.

Future advancements, such as xenotransplantation (using animal organs) and the development of bioengineered kidneys, could further diminish the reliance on traditional dialysis. These innovations, if successful and widely adopted, represent a long-term, potent substitute for current dialysis modalities.

The emergence of new pharmacological treatments poses a significant threat of substitutes for Fresenius Medical Care. Drugs like GLP-1 receptor agonists and SGLT2 inhibitors are demonstrating efficacy in slowing chronic kidney disease (CKD) progression. For instance, studies have shown SGLT2 inhibitors can reduce the risk of CKD progression by up to 37% in certain patient populations, potentially reducing demand for dialysis services.

The development of implantable bioartificial kidneys and advanced wearable dialysis devices poses a substantial long-term threat of substitutes to Fresenius Medical Care's traditional dialysis services. These emerging technologies promise more integrated, less disruptive treatment options for kidney disease patients.

Innovations in bioartificial kidneys, which use living cells to filter blood, and sophisticated wearable dialysis machines aim to provide continuous, at-home treatment, potentially reducing reliance on in-center dialysis. For instance, research into implantable devices is progressing, with some early-stage clinical trials showing promise in mimicking natural kidney function, offering a significant shift from current treatment paradigms.

Preventative Care and Early Detection

The growing emphasis on preventative care and early detection of chronic diseases like diabetes and hypertension poses a significant threat to Fresenius Medical Care. These conditions are primary drivers of End-Stage Renal Disease (ESRD), the main reason for dialysis. As public health initiatives and advanced diagnostic tools become more widespread, the incidence of ESRD could decrease, directly impacting the demand for dialysis services. For instance, in 2024, global healthcare spending on chronic disease management is projected to exceed USD 2 trillion, reflecting a substantial investment in preventing conditions that lead to kidney failure.

This shift towards proactive health management means fewer individuals may progress to needing dialysis. Improved patient outcomes through better management of underlying conditions could reduce the patient pool requiring Fresenius's core services.

- Reduced Incidence of CKD: Early interventions for diabetes and hypertension can slow or halt the progression to Chronic Kidney Disease (CKD).

- Lower Demand for Dialysis: As fewer patients develop ESRD, the need for dialysis treatments will naturally decline.

- Increased Focus on Non-Dialysis Treatments: Preventative care might also lead to greater adoption of treatments that delay or avoid dialysis altogether.

- Impact on Revenue Streams: A shrinking patient base for dialysis directly affects Fresenius's primary revenue generators.

Lifestyle Modifications and Dietary Management

Lifestyle modifications and dietary management represent a significant threat of substitutes for Fresenius Medical Care. For individuals in the early stages of Chronic Kidney Disease (CKD), adopting stringent dietary changes and healthy lifestyle habits can effectively slow the progression of the disease. This proactive approach can delay, and in some cases, even postpone the need for renal replacement therapies like dialysis.

This delay directly impacts Fresenius Medical Care's patient base. By managing CKD progression through non-dialysis interventions, the pool of patients requiring Fresenius' core services is reduced. For instance, studies have shown that adherence to specific diets, such as the DASH diet or low-sodium plans, can lead to measurable improvements in kidney function markers. In 2024, the global prevalence of CKD was estimated to affect over 850 million people, highlighting the vast potential market that lifestyle interventions could impact.

- Dietary Interventions: Specific diets can slow CKD progression.

- Lifestyle Changes: Exercise and weight management play a crucial role.

- Market Impact: Delaying dialysis reduces the demand for Fresenius' services.

- Prevalence Data: Over 850 million people globally are affected by CKD as of 2024.

The threat of substitutes for Fresenius Medical Care's dialysis services is multifaceted, encompassing both established alternatives and emerging technologies. Kidney transplantation, while a superior treatment, remains a direct substitute, with over 25,000 performed in the US in 2023. Furthermore, advancements in pharmaceuticals, like SGLT2 inhibitors which can reduce CKD progression by up to 37%, and lifestyle interventions that can significantly delay the need for dialysis, pose a considerable challenge. The global prevalence of CKD, affecting over 850 million people in 2024, underscores the significant market potential for these alternative and preventative strategies.

| Substitute Type | Description | 2023/2024 Data Point |

| Kidney Transplantation | Preferred treatment for ESRD, offering better quality of life. | Over 25,000 kidney transplants performed in the US (2023). |

| Pharmacological Treatments | Drugs slowing CKD progression, reducing dialysis need. | SGLT2 inhibitors can reduce CKD progression by up to 37%. |

| Lifestyle & Dietary Management | Proactive health measures delaying or avoiding dialysis. | Over 850 million people globally affected by CKD (2024). |

| Emerging Technologies | Bioartificial kidneys, wearable dialysis devices. | Ongoing research and early-stage clinical trials. |

Entrants Threaten

Establishing a network of dialysis clinics, manufacturing complex medical devices, and investing in research and development requires substantial capital, which acts as a significant barrier for potential new entrants in the healthcare sector. For instance, building a single state-of-the-art dialysis facility can cost millions of dollars, encompassing equipment, real estate, and regulatory compliance. Fresenius Medical Care, a leader in kidney care, has demonstrated this through its extensive global infrastructure, representing decades of investment.

The dialysis industry faces significant barriers to entry due to stringent regulatory oversight. Health authorities, such as the U.S. Food and Drug Administration (FDA), impose rigorous standards on both dialysis facilities and the medical devices used. For instance, the FDA's approval process for new dialysis equipment can take years and involve substantial investment in clinical trials and documentation, effectively limiting the number of new companies that can enter the market.

Existing players like Fresenius Medical Care enjoy significant cost advantages due to their established scale in manufacturing, purchasing, and running dialysis clinics. This means they can produce more or provide treatments at a lower individual cost. For instance, in 2023, Fresenius Medical Care reported revenue of €22.3 billion, indicating a substantial operational footprint that new entrants would find difficult to replicate quickly.

Newcomers would face a steep challenge in matching these efficiencies. Building a comparable supply chain and operational infrastructure from scratch would require massive upfront investment, making it hard to compete on price with incumbents who have already benefited from years of experience and volume discounts. This learning curve and accumulated expertise further solidify the barrier for new companies entering the dialysis market.

Established Brand Reputation and Patient Loyalty

Fresenius Medical Care's established brand reputation and deep-rooted patient loyalty represent a significant barrier to new entrants. Their decades of operation have cultivated trust and a perception of quality, making it difficult for newcomers to gain traction. This loyalty translates into a stable patient base that new competitors must actively court.

The company boasts an extensive network of dialysis clinics, which not only provides convenience for existing patients but also serves as a powerful referral source for physicians. Replicating this widespread infrastructure and the associated physician relationships is a formidable and costly undertaking for any new player in the market.

- Brand Equity: Fresenius Medical Care's long-standing presence has built substantial brand equity, fostering patient and physician trust.

- Network Effect: An extensive clinic network creates a significant advantage, facilitating patient retention and physician referrals.

- Customer Loyalty: Patients often exhibit high loyalty due to established relationships and perceived quality of care, making switching difficult.

- Barriers to Entry: The cost and time required to build comparable brand recognition and clinic infrastructure are substantial deterrents for new entrants.

Access to Distribution Channels and Nephrologist Relationships

The threat of new entrants in the dialysis market, particularly concerning access to distribution channels and established nephrologist relationships, is notably low for Fresenius Medical Care. Existing providers have cultivated deep, long-standing partnerships with nephrologists, hospitals, and crucial referral networks. These relationships are the lifeblood of patient acquisition, making it exceedingly difficult for newcomers to establish a comparable patient flow. For instance, in 2024, the concentration of dialysis centers within established healthcare systems often means that new entrants must negotiate complex and often exclusive agreements to gain access, a hurdle that requires substantial time and capital investment.

New companies would face significant hurdles in replicating the trust and operational integration that incumbent players like Fresenius have built over decades. Securing a consistent stream of patients requires not just state-of-the-art facilities but also the confidence of the medical community. In 2023, the average dialysis patient referral pathway often involves multiple touchpoints with existing providers, highlighting the ingrained nature of these relationships. This deep integration acts as a formidable barrier.

- Established Nephrologist Relationships: Incumbents benefit from decades of trust and collaboration with nephrologists, who are key decision-makers in patient referrals.

- Hospital and Referral Network Access: Existing players have secured vital access to hospital networks and patient referral streams, which are difficult and time-consuming for new entrants to penetrate.

- Patient Acquisition Costs: The cost and effort required for a new entity to build the necessary relationships and secure a comparable patient volume are exceptionally high, deterring potential new market participants.

- Brand Loyalty and Reputation: Long-standing providers have cultivated strong brand loyalty and reputations within the medical community and among patient advocacy groups, creating a significant competitive advantage.

The threat of new entrants for Fresenius Medical Care is considerably low due to the immense capital required for establishing dialysis facilities and manufacturing advanced medical equipment, with new clinic constructions easily exceeding multi-million dollar investments. Furthermore, stringent regulatory hurdles, such as lengthy FDA approval processes for new devices, demand significant investment in clinical trials and documentation, acting as a substantial deterrent for potential market entrants in 2024.

Existing players like Fresenius benefit from substantial cost advantages derived from economies of scale in manufacturing, procurement, and operations, a position difficult for newcomers to match. For instance, Fresenius Medical Care’s 2023 revenue of €22.3 billion underscores its vast operational footprint. New entrants would struggle to replicate this efficiency and benefit from the learning curve and accumulated expertise that incumbents possess, making price competition challenging.

| Barrier Type | Description | Impact on New Entrants | Fresenius Medical Care Advantage |

| Capital Requirements | High cost for clinics & equipment | Significant barrier | Decades of investment in infrastructure |

| Regulatory Hurdles | Strict FDA approval for devices | Time-consuming & costly | Established compliance processes |

| Economies of Scale | Lower per-unit costs for incumbents | Difficulty competing on price | Vast operational scale and purchasing power |

| Brand & Relationships | Patient loyalty & physician trust | Challenging to build | Long-standing reputation and extensive network |

Porter's Five Forces Analysis Data Sources

Our Fresenius Medical Care Porter's Five Forces analysis is built upon a foundation of comprehensive data, including company annual reports, SEC filings, and industry-specific market research from sources like IBISWorld and Statista.

We leverage insights from financial statements, analyst reports, and competitor press releases, alongside data from healthcare regulatory bodies and macroeconomic indicators, to provide a robust assessment of the competitive landscape.