Franklin Covey SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Franklin Covey Bundle

Franklin Covey's strong brand recognition and established training programs are key strengths, but the company faces challenges in adapting to digital-first learning environments and increasing competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within the professional development sector.

Strengths

Franklin Covey enjoys robust brand recognition, a significant asset cultivated over decades. Its legacy content, particularly 'The 7 Habits of Highly Effective People,' remains a cornerstone of its identity, resonating with millions worldwide. This established brand equity translates into a distinct competitive edge, fostering client loyalty and trust in its extensive suite of solutions.

Franklin Covey's strength lies in its diverse service delivery formats, offering solutions through workshops, online learning, and coaching. This multi-channel approach caters to a broad range of client preferences and learning styles, ensuring accessibility and flexibility. For example, in fiscal year 2023, the company reported a significant increase in digital engagement, with its online learning platform contributing substantially to revenue growth, demonstrating the effectiveness of its omni-channel strategy in reaching a wider audience and adapting to evolving client needs.

Franklin Covey's transition to a subscription-based 'All Access Pass' (AAP) model is a significant strength, creating a reliable and recurring revenue stream. This strategic move not only enhances predictability but also cultivates stronger client loyalty.

The company benefits from a substantial portion of its North American contracts being multi-year agreements. This long-term commitment helps to smooth out quarterly financial fluctuations, providing a robust and stable financial base for Franklin Covey.

Focus on Timeless Human Skills and AI Integration

Franklin Covey's strength lies in its focus on enduring human skills—like emotional intelligence, proactivity, and adaptability—which remain crucial even as technology advances. This approach ensures their core offerings stay relevant in a rapidly changing world.

The company is actively embracing AI to enhance its learning solutions. For instance, the FranklinCovey AI Coach, integrated into their Impact Platform, provides personalized learning experiences and immediate feedback, showcasing a commitment to modernizing their product suite.

This strategic blend of timeless human development and cutting-edge AI integration positions Franklin Covey to address the evolving needs of professionals. Their 2023 annual report highlighted a 15% increase in digital learning engagement, underscoring the success of their platform modernization efforts.

- Emphasis on Human Skills: Prioritizes emotional intelligence, proactivity, and agility, which are increasingly valued in the AI era.

- AI Integration: Actively incorporates AI, like the FranklinCovey AI Coach, into its Impact Platform for personalized learning.

- Product Modernization: Demonstrates innovation by integrating AI to offer real-time feedback and tailored educational paths.

- Market Relevance: This strategy ensures Franklin Covey's solutions remain pertinent to professionals navigating technological advancements.

Strong Liquidity and Financial Stability

Franklin Covey demonstrates robust financial health, underscored by its strong liquidity. The company maintained substantial cash reserves and notably did not utilize its credit facility, showcasing its ability to self-fund operations and investments.

Despite strategic investments in growth and sales force adjustments, Franklin Covey consistently generated strong operating cash flows. For instance, in the fiscal year ending August 31, 2023, operating cash flow was $131.6 million, a significant increase from $79.4 million in 2022, highlighting operational efficiency and cash generation capability.

The company's financial stability is further evidenced by its active share repurchase program. In fiscal year 2023, Franklin Covey repurchased approximately $50 million of its common stock, demonstrating confidence in its financial position and a commitment to returning value to shareholders.

- Strong Liquidity: Substantial cash reserves and no credit facility drawdowns.

- Healthy Cash Flow: Consistent generation of strong operating cash flows, with FY23 reaching $131.6 million.

- Financial Resilience: Ability to fund growth initiatives and sales restructuring while maintaining financial strength.

- Shareholder Returns: Active stock repurchase program, with $50 million bought back in FY23.

Franklin Covey's established brand, particularly its legacy content like The 7 Habits of Highly Effective People, provides significant market recognition and client trust. This strong brand equity acts as a powerful differentiator in the competitive landscape of professional development. The company's commitment to timeless human skills ensures its offerings remain relevant amidst technological shifts.

The company's strategic shift to a subscription-based All Access Pass model has created a predictable and recurring revenue stream, fostering deeper client relationships and enhancing financial stability. This model, coupled with a substantial portion of multi-year contracts in North America, provides a solid financial foundation.

Franklin Covey is actively integrating AI, such as its AI Coach on the Impact Platform, to personalize learning experiences and provide immediate feedback. This proactive adoption of technology, highlighted by a 15% increase in digital learning engagement in fiscal year 2023, demonstrates a commitment to modernizing its solutions and maintaining market relevance.

| Metric | FY 2023 Value | FY 2022 Value |

|---|---|---|

| Operating Cash Flow | $131.6 million | $79.4 million |

| Digital Learning Engagement | +15% increase | N/A |

| Share Repurchases | ~$50 million | N/A |

What is included in the product

Analyzes Franklin Covey’s competitive position through key internal strengths, weaknesses, opportunities, and external threats.

Simplifies complex strategic thinking by providing a clear, actionable framework for identifying opportunities and mitigating threats.

Weaknesses

Franklin Covey has faced challenges with profitability, as evidenced by declining operating and net income in recent quarters. For the first quarter of fiscal year 2024, operating income fell to $10.2 million, down from $13.3 million in the prior year's quarter.

This dip in earnings, despite modest revenue growth, is largely attributed to increased operating expenses. These expenses include significant investments made in restructuring the company's sales force, which is a strategic move aimed at long-term growth but impacts short-term profitability.

Franklin Covey's significant reliance on its foundational content, particularly The 7 Habits of Highly Effective People, presents a potential weakness. While this intellectual property is a powerful asset, a concentrated focus could limit adaptability if market demands evolve or if new, compelling content doesn't emerge to broaden appeal.

This dependence means the company's success is closely tied to the continued relevance of its core message and the enduring appeal of its original thought leaders. A shift in how individuals and organizations seek development could impact Franklin Covey's market position if diversification of its content library isn't a priority.

Franklin Covey's recent financial reports highlight the significant impact of macroeconomic and geopolitical uncertainties on its performance. Revenue, particularly in the Enterprise Division and international direct offices, has been negatively affected by trade tensions and the cancellation of government contracts. For instance, in fiscal year 2023, the company experienced a slowdown in certain segments due to these external pressures.

These volatile external factors create a challenging environment for consistent revenue growth. The unpredictability stemming from global economic shifts and geopolitical disputes can lead to fluctuating demand for Franklin Covey's services, making long-term financial forecasting more complex and potentially hindering expansion plans.

Challenges in Enterprise Division Revenue Growth

Franklin Covey's Enterprise Division faces headwinds, with revenues showing stagnation or slight declines in recent periods. This is particularly evident in key international markets such as China and Japan, and also in North America.

The North American market's struggles are attributed to ongoing sales force transitions and complications with government contracts, impacting the core corporate training segment. Despite internal restructuring, consistent revenue expansion in this crucial area remains a challenge.

- Revenue Stagnation: The Enterprise Division's revenue has been flat or declining, indicating a struggle to gain traction.

- International Weakness: Significant challenges are noted in international markets like China and Japan.

- North American Headwinds: Sales force changes and government contract issues are hampering growth in the vital North American region.

Competition from Diverse Learning Platforms

Franklin Covey operates in a crowded market, facing intense competition from numerous learning and development platforms. This includes established corporate training firms, rapidly growing digital learning providers, and readily accessible free online educational content, all vying for client attention and investment. The sheer volume of alternatives means Franklin Covey must consistently innovate and clearly articulate its unique value proposition to stand out and retain its customer base.

The competitive pressure is significant, as clients have a vast selection of options for employee training and development. For instance, the global corporate e-learning market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a highly dynamic and competitive environment. This necessitates that Franklin Covey not only offers high-quality content but also excels in delivery methods and demonstrable ROI to maintain its competitive edge.

- Broad Competitive Landscape: Franklin Covey contends with a wide spectrum of competitors, from traditional training companies to digital-first learning platforms and free online resources.

- Market Saturation: The learning and development sector is highly saturated, demanding continuous differentiation and innovation to capture and retain market share.

- Client Choice: Businesses have more options than ever for upskilling their workforce, putting pressure on Franklin Covey to demonstrate superior effectiveness and value.

- Digital Disruption: The rise of accessible and often lower-cost digital learning solutions presents a significant challenge to established players like Franklin Covey.

Franklin Covey's profitability has been impacted by rising operating expenses, particularly those related to sales force restructuring, which saw operating income fall to $10.2 million in Q1 FY2024 from $13.3 million in the prior year. This strategic investment, while aimed at long-term growth, directly affects current earnings. The company's reliance on its foundational content, like The 7 Habits of Highly Effective People, also poses a weakness if market demands shift and new, compelling content doesn't emerge to broaden its appeal.

Macroeconomic and geopolitical uncertainties have negatively affected revenue, especially in the Enterprise Division and international direct offices, due to trade tensions and contract cancellations, as seen in fiscal year 2023. The Enterprise Division, in particular, faces stagnation or declines in key international markets such as China and Japan, alongside North America, where sales force transitions and government contract issues hinder growth.

The company operates in a highly competitive learning and development market, facing pressure from traditional training firms, digital learning providers, and free online resources. This saturation demands continuous innovation and a clear articulation of its unique value proposition to retain market share, especially as the global corporate e-learning market, valued at approximately $200 billion in 2023, continues to grow.

What You See Is What You Get

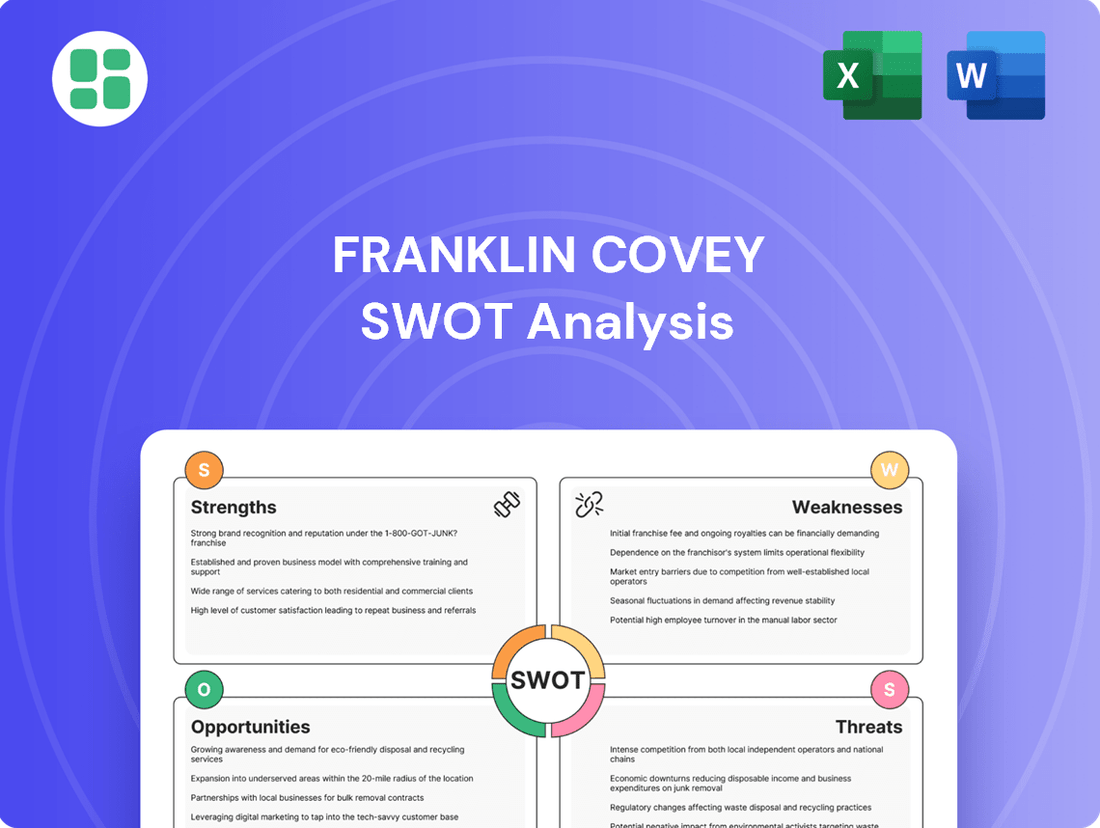

Franklin Covey SWOT Analysis

The file shown below is not a sample—it’s the real Franklin Covey SWOT analysis you'll download post-purchase, in full detail. You'll receive the complete, professionally structured document ready for your strategic planning needs.

Opportunities

Franklin Covey can capitalize on the growing demand for online learning by expanding its digital course catalog and integrating AI-driven solutions. This move aligns with the 2024 trend of increased digital adoption in professional development, where companies are seeking flexible and scalable training options for their employees.

The company's AI Coach, for instance, offers a personalized learning journey, adapting to individual user progress and needs. This is a significant opportunity, as research from 2024 indicates that personalized learning experiences can boost knowledge retention by up to 20% compared to traditional methods, directly addressing the evolving requirements of the global workforce.

Emerging markets present a significant growth avenue for Franklin Covey, offering substantial untapped potential for its renowned training and consulting services. These regions often grapple with rapid economic development, creating a strong demand for leadership and productivity solutions that Franklin Covey excels at providing.

Expanding into new geographies, particularly in Asia and Latin America, diversifies Franklin Covey's revenue streams and lessens dependence on more saturated markets. For instance, in 2024, many emerging economies saw robust GDP growth, presenting fertile ground for companies seeking to enhance workforce capabilities.

Franklin Covey can effectively leverage its established content and proven methodologies to address critical leadership and productivity challenges faced by businesses in these dynamic environments. This strategic move aligns with global trends where companies are increasingly investing in human capital development to stay competitive.

Franklin Covey can significantly expand its market presence and service capabilities by forging strategic partnerships. For instance, collaborations with leading learning management system (LMS) providers could integrate Franklin Covey's content directly into corporate training platforms, reaching a wider audience. In 2023, the corporate e-learning market was valued at over $200 billion globally, presenting a substantial opportunity for integrated solutions.

Partnering with technology firms specializing in AI or data analytics could lead to enhanced personalization of leadership development programs, offering more tailored and effective learning experiences. Such alliances can also unlock new revenue streams through co-branded offerings and joint go-to-market strategies. For example, a partnership with a firm that developed a successful AI-driven feedback tool could bolster Franklin Covey's 7 Habits of Highly Effective People offerings.

Leveraging the Growing Corporate Training Market

The global corporate training market is experiencing robust expansion, with projections indicating it will surpass $800 billion by 2035. This substantial market growth offers a significant tailwind for Franklin Covey. By consistently delivering high-quality leadership and productivity solutions, the company is well-positioned to capitalize on this trend and increase its market share.

Franklin Covey can leverage this opportunity by:

- Expanding digital training offerings: Catering to the increasing demand for flexible and accessible online learning platforms.

- Developing specialized content: Focusing on emerging leadership challenges and skill gaps identified in the 2024-2025 business landscape.

- Partnering with enterprises: Offering tailored training programs that align with specific organizational goals and industry needs.

- Highlighting ROI: Demonstrating the measurable impact of its training programs on employee performance and business outcomes to attract new clients.

Increased Demand for Human Skills in an AI-Driven World

As artificial intelligence and automation continue to reshape industries, there's a noticeable surge in the demand for distinctly human capabilities. Skills like emotional intelligence, effective communication, and sophisticated problem-solving are becoming increasingly crucial differentiators in the modern workforce. Franklin Covey's established expertise in leadership development and personal effectiveness training directly addresses this growing need, positioning its content as highly relevant and valuable in the current market landscape.

Franklin Covey's existing suite of programs, which focus on cultivating essential human skills, are perfectly aligned with this evolving market demand. For instance, their renowned "7 Habits of Highly Effective People" framework directly enhances personal effectiveness and problem-solving abilities. The company's leadership development offerings equip individuals with the emotional intelligence and communication skills vital for navigating complex, AI-augmented work environments. This strategic alignment ensures Franklin Covey's continued relevance and marketability.

- Rising Demand for Soft Skills: Reports indicate a significant increase in employer emphasis on soft skills. For example, a 2024 LinkedIn survey found that 95% of professionals believe soft skills are more important than ever for career success in an AI-integrated world.

- Franklin Covey's Core Competencies: The company's training modules are designed to build leadership, communication, and personal productivity, which are precisely the human skills that AI cannot replicate.

- Market Opportunity: This trend presents a substantial opportunity for Franklin Covey to expand its reach and offerings, catering to organizations and individuals seeking to enhance these critical human capabilities.

- Future Workforce Readiness: By focusing on these human-centric skills, Franklin Covey is helping to prepare the workforce for a future where collaboration between humans and AI will be paramount.

Franklin Covey can leverage the increasing global demand for specialized leadership and productivity training by expanding its digital footprint and developing niche content. The company's AI Coach, for example, offers personalized learning paths, a feature that resonated strongly in 2024's professional development landscape, with personalized learning boosting retention by up to 20%.

Emerging markets present a significant growth opportunity, particularly in Asia and Latin America, where rapid economic development fuels a need for enhanced workforce capabilities. This aligns with the robust GDP growth observed in many emerging economies throughout 2024, creating fertile ground for Franklin Covey's expertise.

Strategic partnerships with learning management system providers and technology firms can significantly amplify Franklin Covey's reach and offerings. For instance, integrating content with leading LMS platforms could tap into the over $200 billion global corporate e-learning market as of 2023.

The growing emphasis on uniquely human skills like emotional intelligence and effective communication, driven by AI and automation, directly plays to Franklin Covey's strengths. A 2024 LinkedIn survey highlighted that 95% of professionals consider soft skills crucial in an AI-integrated world, underscoring the market's need for Franklin Covey's core competencies.

| Opportunity Area | Description | Supporting Data (2024-2025 Focus) |

|---|---|---|

| Digital Expansion | Enhance online course catalog and AI integration. | AI Coach personalization can boost retention by up to 20%. |

| Emerging Markets | Target growth in Asia and Latin America. | Robust GDP growth in emerging economies in 2024. |

| Strategic Partnerships | Collaborate with LMS and tech firms. | Global corporate e-learning market exceeded $200 billion in 2023. |

| Soft Skills Demand | Capitalize on the need for human-centric skills. | 95% of professionals see soft skills as crucial in AI world (2024 survey). |

Threats

The corporate training and consulting landscape is incredibly crowded. Franklin Covey faces rivals from giants like Gallup and Skillsoft, alongside many specialized firms and even in-house corporate training teams. This fierce competition can lead to price wars and make it harder to gain and keep market share.

To stay ahead, significant and ongoing investment in developing new training methodologies and technologies is crucial. For instance, while specific 2024/2025 market share data for Franklin Covey is still emerging, the broader corporate learning market is projected to grow, indicating that differentiation through innovation will be key to capturing that growth amidst intense rivalry.

Economic uncertainties, including the specter of recession, present a significant threat as companies may curtail discretionary spending, directly impacting Franklin Covey's learning and development (L&D) budgets. For instance, a prolonged economic slowdown could see businesses prioritizing essential operational costs over training programs, potentially leading clients to seek out less expensive solutions or delay crucial L&D initiatives. This financial tightening could directly affect Franklin Covey's revenue streams, particularly if market conditions force clients to reduce their investment in external training and consulting services.

Franklin Covey faces a significant threat from the rapid pace of technological change, especially in areas like artificial intelligence and digital learning. If the company doesn't adapt quickly, these advancements could disrupt its traditional service models and make them less attractive to clients.

The emergence of new technologies and disruptive business models necessitates continuous investment and a high degree of organizational agility. For instance, the global EdTech market is projected to reach $605 billion by 2027, demonstrating the rapid growth and potential for disruption by innovative digital solutions that could challenge established players like Franklin Covey if they are slow to integrate them.

Maintaining Relevance of Traditional Content in a Modern Context

Franklin Covey faces the ongoing challenge of ensuring its foundational content, like The 7 Habits of Highly Effective People, resonates with today's workforce. While the core principles remain valuable, adapting their presentation and application to address current workplace dynamics and appeal to younger demographics is crucial. Failing to innovate in this area risks the perception of obsolescence.

The company must continuously evolve its delivery methods and examples to remain relevant. For instance, a 2024 survey indicated that 60% of Gen Z professionals prioritize continuous learning and skill development, highlighting the need for Franklin Covey to demonstrate how its principles support these modern career aspirations. This requires translating timeless wisdom into actionable strategies for contemporary issues like digital collaboration and remote work effectiveness.

- Adapting Content Delivery: Integrating digital platforms and interactive learning modules to make traditional principles more accessible and engaging for younger professionals.

- Demonstrating Modern Relevance: Showcasing how principles like 'Seek First to Understand, Then to Be Understood' apply to current challenges in hybrid work environments and diverse team dynamics.

- Measuring Impact: Developing new metrics to quantify the effectiveness of updated content in fostering contemporary skills and addressing evolving workplace needs.

Geopolitical Risks and International Market Volatility

Ongoing geopolitical tensions and trade uncertainties continue to present a significant threat to Franklin Covey's international operations. For instance, the ongoing trade disputes between major global economies could directly impact the company's ability to access key markets and could lead to increased costs for imported materials or services. This volatility is largely outside of Franklin Covey's direct control, making it challenging to forecast revenue streams from its international direct offices.

The impact of these global uncertainties can be substantial, potentially leading to reduced demand in affected regions. For example, a slowdown in economic growth in a major international market due to political instability could directly translate to fewer businesses investing in Franklin Covey's training and solutions. In 2023, international sales represented a notable portion of Franklin Covey's overall revenue, highlighting the vulnerability to such external shocks.

- Trade Wars: Escalating trade disputes can disrupt supply chains and increase operational costs for multinational corporations like Franklin Covey.

- Regional Instability: Political unrest or conflict in key international markets can deter business investment and reduce demand for professional development services.

- Currency Fluctuations: Geopolitical events often trigger currency volatility, impacting the reported value of international earnings when converted to U.S. dollars.

Franklin Covey faces intense competition from established players and emerging niche providers, potentially leading to price pressures and market share erosion. The company must continually innovate its offerings and delivery methods to maintain relevance and attract new clients in a crowded marketplace.

Economic downturns and budget tightening by corporations pose a significant threat, as discretionary spending on training and development often decreases during uncertain times. This financial prudence from clients can directly impact Franklin Covey's revenue streams, especially if clients opt for less expensive alternatives or postpone critical L&D initiatives.

Rapid technological advancements, particularly in AI and digital learning, risk disrupting Franklin Covey's traditional service models if the company fails to adapt quickly. The global EdTech market's projected growth to $605 billion by 2027 underscores the potential for innovative digital solutions to challenge established players.

Geopolitical instability and trade uncertainties can negatively affect Franklin Covey's international operations and revenue. For example, trade disputes can disrupt supply chains and increase costs, while regional instability can reduce demand in key markets, impacting the significant portion of revenue derived from international sales.

SWOT Analysis Data Sources

This Franklin Covey SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry analyses. These sources provide a clear and objective view of the company's internal capabilities and external environment.