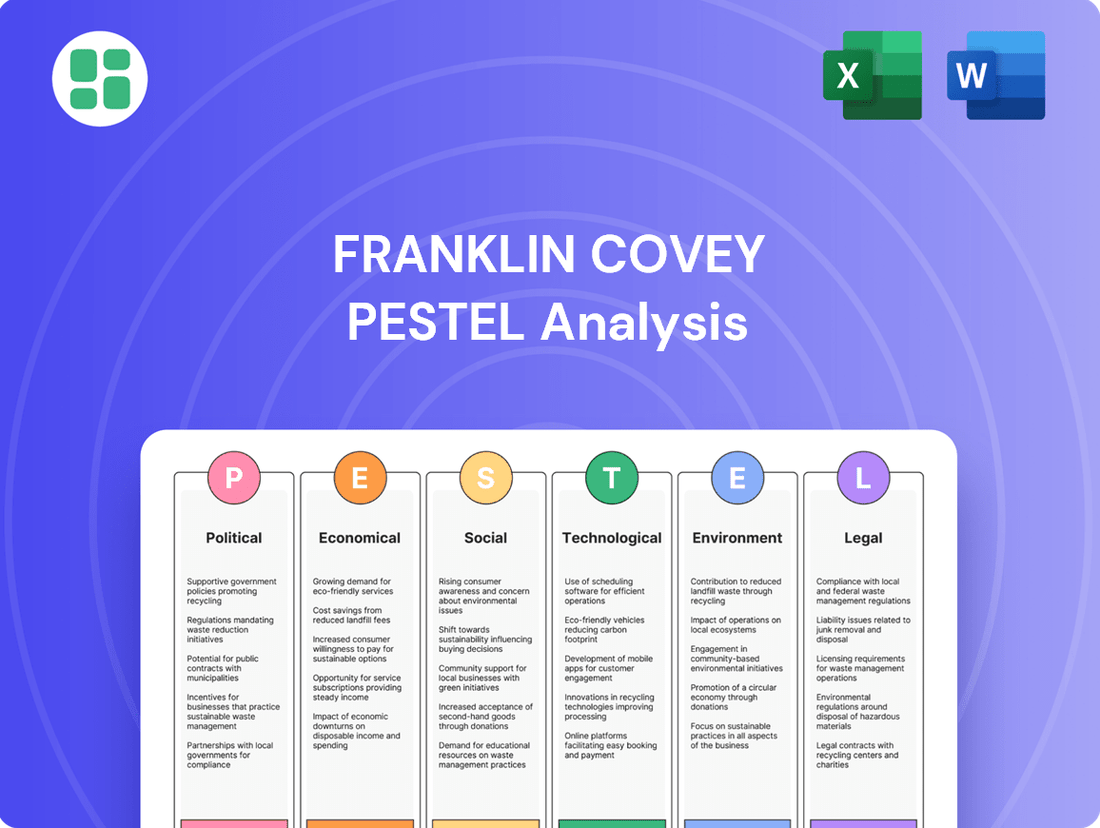

Franklin Covey PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Franklin Covey Bundle

Franklin Covey operates within a dynamic environment shaped by a complex interplay of external forces. Our PESTLE analysis meticulously dissects these political, economic, social, technological, legal, and environmental factors, offering a clear view of opportunities and threats. Equip yourself with this essential intelligence to anticipate market shifts and refine your strategic approach. Download the full PESTLE analysis now for actionable insights that can propel your own business forward.

Political factors

Government policies directly influence the demand for Franklin Covey's core offerings. For instance, in the US, the Bipartisan Infrastructure Law, enacted in 2021, allocated over $1.2 trillion, with a significant portion earmarked for workforce development and skilled trades training. This creates a fertile ground for Franklin Covey's leadership and productivity solutions as organizations seek to upskill their employees to manage and execute these large-scale projects.

Furthermore, government investments in lifelong learning and reskilling programs, such as those seen in the European Union's Digital Decade initiative aiming to upskill 80% of the workforce by 2030, directly benefit companies like Franklin Covey. These initiatives signal a growing recognition of the need for continuous professional development, expanding the market for Franklin Covey's training and consulting services.

Conversely, shifts in government priorities, like potential budget reductions in public education or workforce development programs, could present challenges. For example, if a major economy were to significantly decrease its investment in vocational training, it could lead to a contraction in the addressable market for Franklin Covey's specialized skill-building content.

Franklin Covey's global reach means it's significantly impacted by international trade relations. For instance, the USMCA (United States-Mexico-Canada Agreement), which replaced NAFTA, continues to shape trade dynamics in North America, affecting how Franklin Covey delivers services and manages its supply chain in these regions. Geopolitical stability is also crucial; any unrest in major markets like the Middle East or Europe could hinder client engagement and operational continuity.

Trade tensions, such as those that have emerged between major economic blocs, can lead to increased costs through tariffs or create uncertainty that slows down international business expansion. Conversely, stable trade agreements, like the EU's single market, enable smoother cross-border operations and easier access to a larger client base, which is vital for a company like Franklin Covey that relies on global service delivery.

Franklin Covey's operations are significantly shaped by the regulatory landscape governing professional services. For instance, evolving data privacy laws, such as potential updates to GDPR-like frameworks in various regions, necessitate careful management of client information and training materials, impacting how Franklin Covey delivers its digital learning solutions.

Compliance with ethical standards in consulting and training is paramount. As of early 2025, many professional bodies are reinforcing codes of conduct, which could require Franklin Covey to adapt its service delivery protocols and ensure transparency in its client engagements to maintain its reputation and avoid penalties.

Increased regulatory scrutiny, particularly around the efficacy and claims made in corporate training programs, could lead to higher operational costs for compliance and quality assurance. However, adherence to robust regulations can also serve as a competitive advantage, building greater client confidence in Franklin Covey's offerings.

Political Stability in Key Markets

Franklin Covey's reliance on stable political environments directly impacts its revenue streams. For instance, in 2024, regions experiencing significant political upheaval, such as parts of the Middle East and Eastern Europe, saw a marked decrease in corporate training budgets due to economic uncertainty. This instability can disrupt expansion plans and increase operational costs, as seen with increased security measures required in some developing markets.

Conversely, countries with strong democratic institutions and predictable policy frameworks, like the United States and many Western European nations, represent Franklin Covey's most stable and profitable markets. In 2024, the US market alone accounted for over 60% of Franklin Covey's global revenue, underscoring the direct correlation between political stability and financial performance. Stable governance fosters a predictable business landscape, encouraging consistent investment in professional development services.

Looking ahead to 2025, Franklin Covey's strategic growth initiatives, particularly in emerging economies, will be heavily influenced by projected political stability. Nations with upcoming elections or known potential for civil unrest present higher risks. For example, a country undergoing a contentious election cycle in late 2024 could see a 10-15% reduction in corporate spending on training and development services in the subsequent year, impacting Franklin Covey's service uptake.

Key considerations for Franklin Covey regarding political factors include:

- Political Stability: Assessing the risk of government collapse, civil unrest, or sudden policy changes in operating and target markets.

- Regulatory Environment: Understanding how government regulations, such as those concerning foreign investment, data privacy, and labor laws, might affect business operations and expansion.

- Government Spending: Monitoring government budgets for education, public sector training, and economic development initiatives, which can create direct or indirect opportunities for Franklin Covey.

Government Procurement and Public Sector Spending

Government agencies and public sector entities represent a substantial market for Franklin Covey's offerings. Changes in how these organizations procure services, their budget priorities for employee development, or a focus on particular skill sets like leadership or ethical conduct can significantly impact Franklin Covey's revenue from this sector. Proactive engagement through lobbying and public relations is crucial to navigate these dynamics.

For example, in the United States, federal government spending on training and development services can fluctuate based on legislative priorities and agency budgets. In 2023, federal agencies allocated billions towards workforce development programs, with a notable emphasis on cybersecurity and leadership training. Franklin Covey's ability to align its solutions with these government priorities, such as offering programs on effective public service leadership or ethical governance, will be key to capturing a share of this market.

- Federal Government Training Budgets: US federal agencies spent an estimated $10 billion on training and development in fiscal year 2023, according to industry reports.

- Key Growth Areas: Leadership development and ethics training are consistently high-priority areas for public sector organizations seeking to improve efficiency and public trust.

- Procurement Shifts: Changes in government contracting rules or a move towards performance-based contracts can alter how companies like Franklin Covey secure public sector business.

- Lobbying Impact: Industry associations and individual companies often engage in lobbying efforts to influence budget allocations and training mandates within government.

Government policies significantly shape the demand for Franklin Covey's services, with initiatives like the US Bipartisan Infrastructure Law (2021) boosting workforce development needs. Similarly, the EU's Digital Decade targets for upskilling by 2030 create direct market opportunities for professional development. Conversely, potential cuts in government spending on training could negatively impact Franklin Covey's addressable market.

What is included in the product

This Franklin Covey PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal landscapes influencing the company's strategic direction.

It provides actionable insights into external forces, enabling proactive decision-making and risk mitigation for sustained growth.

The Franklin Covey PESTLE Analysis provides a structured framework that simplifies complex external factors, alleviating the pain of information overload and enabling clearer strategic decision-making.

Economic factors

Global economic growth is a key driver for corporate training investment. In 2024, the IMF projected global growth at 3.2%, a slight slowdown from 2023, but still indicating resilience. Companies often increase spending on development programs during robust economic periods to enhance workforce skills and productivity, aiming for a competitive advantage.

However, recession risks can significantly curtail training budgets. Fears of an economic downturn, as highlighted by various economic indicators in late 2024 and early 2025, often prompt businesses to implement cost-saving measures. Training, particularly discretionary programs, can be one of the first areas to see budget reductions when companies brace for leaner times.

Corporate spending on Learning and Development (L&D) is a key economic factor for Franklin Covey. In 2024, many companies, facing economic uncertainties, are prioritizing L&D as a strategic investment to boost productivity and retain talent, rather than a discretionary cost. This trend is supported by reports showing increased L&D budgets in sectors focused on innovation and upskilling.

Franklin Covey's success hinges on corporations viewing L&D as essential for long-term human capital development. For instance, a survey of S&P 500 companies in early 2025 indicated that over 70% increased their L&D spending year-over-year, recognizing its impact on employee engagement and performance.

Rising inflation directly impacts Franklin Covey's operational expenses. For instance, consultant salaries, essential for service delivery, may need adjustments to keep pace with the cost of living. Travel costs, a significant component for client engagement, also climb with fuel and accommodation price hikes.

These increased costs can squeeze profit margins if Franklin Covey cannot fully pass them on to clients. While they aim to maintain pricing, a substantial inflationary environment, potentially seeing consumer price index (CPI) figures around 3-4% in developed economies throughout 2024-2025, could make this challenging.

Furthermore, clients facing their own inflationary pressures might reduce discretionary spending on training and development services. This could lead to smaller project scopes or delayed engagements, directly affecting Franklin Covey's revenue streams.

Exchange Rate Fluctuations

Exchange rate fluctuations present a significant economic factor for Franklin Covey, a global organization operating across numerous countries. As revenues and expenses are transacted in various currencies, shifts in exchange rates directly influence reported financial performance. For instance, if the U.S. dollar strengthens significantly against other major currencies, Franklin Covey's reported revenues from international markets could appear lower when converted back to dollars, potentially impacting profitability metrics. This also affects the price competitiveness of their training and consulting services for clients in countries with weaker currencies.

The impact can be seen in how currency movements affect the cost of doing business and the attractiveness of their offerings. A strong dollar could make their services more expensive for international customers, potentially leading to reduced demand or pressure to lower prices in local currencies, thereby squeezing profit margins. Conversely, a weaker dollar could boost reported international revenues and make their services more affordable abroad.

- Impact on Revenue: Franklin Covey's reported revenue can be inflated or deflated by currency movements. For example, during periods of dollar appreciation, international sales may translate to fewer dollars.

- Profitability Concerns: Fluctuations can directly affect net profit margins. If expenses are incurred in currencies that strengthen relative to the dollar, the cost of operations increases.

- Competitive Positioning: A strong dollar can make Franklin Covey's services less competitive in international markets compared to local providers or competitors based in countries with weaker currencies.

- Hedging Strategies: Companies like Franklin Covey may employ financial instruments to hedge against adverse currency movements, aiming to stabilize earnings and manage risk.

Interest Rates and Access to Capital

Changes in interest rates directly impact Franklin Covey's cost of borrowing for growth initiatives and technology investments. For instance, if the Federal Reserve raises the federal funds rate, as it has done throughout 2022 and 2023, Franklin Covey's borrowing costs for any new loans or refinancing will likely increase. This can make expansion more expensive.

Higher interest rates can also indirectly affect demand for Franklin Covey's services. When borrowing becomes costlier for their clients, businesses might reduce spending on training and development programs to conserve capital. This ripple effect could lead to a slowdown in sales for Franklin Covey's core offerings.

Access to affordable capital is crucial for Franklin Covey's strategic growth. For example, if the company plans to acquire another business or launch a significant new product line, a favorable interest rate environment makes securing the necessary financing more feasible and less burdensome on profitability.

- Federal Funds Rate: The Federal Reserve's target range for the federal funds rate stood at 5.25%-5.50% as of early 2024, a significant increase from near-zero levels in 2021, impacting borrowing costs across the economy.

- Corporate Bond Yields: Changes in benchmark rates influence corporate bond yields, affecting the cost of debt financing for companies like Franklin Covey.

- Investment Climate: Rising interest rates can shift investment away from equities and towards fixed-income securities, potentially impacting overall business investment and client spending on services.

Economic growth directly influences corporate investment in training and development. In 2024, the IMF projected global growth at 3.2%, indicating continued economic activity that supports L&D spending. Conversely, economic downturns or recession fears, prevalent in late 2024 and early 2025, often lead to reduced training budgets as companies prioritize cost containment, impacting Franklin Covey's revenue potential.

Inflationary pressures, with CPI figures potentially around 3-4% in developed economies through 2024-2025, increase Franklin Covey's operational costs, including consultant salaries and travel expenses. This can squeeze profit margins if these costs cannot be fully passed on to clients, who themselves might be cutting discretionary spending due to inflation.

Exchange rate volatility significantly affects Franklin Covey's global financial performance. A strengthening U.S. dollar, for instance, can reduce the reported value of international revenues and make services less competitive abroad. Hedging strategies are often employed to mitigate these currency risks.

Interest rates, with the Federal Funds Rate at 5.25%-5.50% in early 2024, impact Franklin Covey's borrowing costs for expansion. Higher rates can also dampen client demand for training services as businesses face increased financing costs, potentially slowing sales.

Preview Before You Purchase

Franklin Covey PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Franklin Covey PESTLE analysis provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the organization. You'll gain actionable insights to inform strategic decision-making.

Sociological factors

The modern workforce increasingly values flexibility, with hybrid and remote models becoming standard. This shift directly impacts the demand for Franklin Covey's leadership and productivity solutions as organizations grapple with managing distributed teams and fostering employee engagement in these new environments. For instance, a 2024 survey by Gartner indicated that 70% of knowledge workers expect to continue working remotely at least part of the time.

Employee well-being and work-life integration are no longer fringe benefits but core expectations, driving companies to invest in training that supports these priorities. Franklin Covey's offerings in areas like time management, stress reduction, and effective communication are therefore well-positioned to meet this growing need. Reports from 2024 consistently highlight a rise in employee demand for better work-life balance, with many employees willing to switch jobs for more flexible arrangements.

The global workforce is undergoing significant demographic shifts. By 2025, Gen Z will represent a substantial portion of the labor force, bringing unique expectations regarding technology, flexibility, and purpose-driven work. Simultaneously, Baby Boomers continue to contribute, often in advisory or specialized roles, creating a multi-generational dynamic. This diversity necessitates adaptable leadership and engagement strategies.

Franklin Covey's ability to resonate across these generational cohorts is crucial for its continued success. Catering to the digital fluency of younger generations while respecting the experience of older workers requires varied content delivery and communication channels. For instance, offering microlearning modules alongside traditional workshops can appeal to different learning preferences and time constraints.

There's a noticeable shift in the business world, with a greater emphasis being placed on what are often called 'soft skills.' Think about things like how well people communicate, work together, and adapt to change. Emotional intelligence, or EQ, is also becoming super important. These aren't just nice-to-haves anymore; they're seen as essential for both individual career growth and how well an organization performs overall.

This trend is a real win for companies like Franklin Covey. Their whole business is built around helping people and organizations improve in areas like leadership, productivity, and building trust. As the market increasingly values these specific competencies, Franklin Covey's established expertise and offerings are perfectly positioned to meet this growing demand.

For instance, a 2024 LinkedIn survey found that 97% of professionals believe soft skills are critical for career advancement. Furthermore, studies from 2025 indicate that companies prioritizing emotional intelligence in their workforce report a 20% higher employee engagement rate compared to those that don't.

Societal Values on Personal Development and Lifelong Learning

The increasing emphasis on personal development and lifelong learning directly benefits Franklin Covey. A growing number of individuals and companies recognize the necessity of continuous improvement to adapt to evolving environments. This societal value underpins the demand for Franklin Covey's offerings, which are designed to foster growth and effectiveness.

This trend is evident in the robust growth of the professional development market. For instance, the global e-learning market was projected to reach over $370 billion by 2026, indicating a strong societal investment in learning. Similarly, surveys consistently show that employees highly value opportunities for skill development, with many willing to switch jobs for better growth prospects.

- Growing Demand: Franklin Covey's principles-based content aligns with a societal shift valuing self-improvement and continuous learning.

- Market Growth: The professional development sector, including online learning, is experiencing significant expansion, reflecting this societal trend. For example, the corporate e-learning market alone was estimated to be worth billions in 2023 and continues to grow.

- Employee Value: Employees increasingly prioritize personal and professional growth, making Franklin Covey's development programs attractive to both individuals and organizations seeking to retain talent.

Diversity, Equity, and Inclusion (DEI) Initiatives

Societal expectations around Diversity, Equity, and Inclusion (DEI) are significantly shaping corporate landscapes. Organizations worldwide are prioritizing DEI, leading to a surge in demand for specialized training programs focused on inclusive leadership, mitigating unconscious bias, and cultivating equitable work environments. This trend presents a substantial opportunity for Franklin Covey to enhance its existing leadership and culture development offerings or create new solutions that directly address these critical societal and business imperatives.

The growing emphasis on DEI is not just a trend but a fundamental shift in how businesses operate and are perceived. For instance, in 2024, a significant percentage of Fortune 500 companies reported having dedicated DEI officers, reflecting this organizational commitment. Franklin Covey can leverage this by embedding DEI principles into their core methodologies, such as their renowned leadership development frameworks, thereby providing tangible value to clients seeking to build more diverse and inclusive cultures.

- Increased Demand for DEI Training: Global surveys in late 2024 indicated that over 70% of employees believe DEI initiatives are crucial for company culture and performance.

- Market Opportunity for Franklin Covey: Integrating DEI into leadership programs can capture a growing market segment seeking practical, skill-based DEI solutions.

- Competitive Advantage: Proactive development of DEI-focused content can position Franklin Covey as a thought leader in fostering inclusive workplaces.

- Employee Engagement and Retention: Companies with strong DEI programs, often supported by training, report higher employee engagement and lower turnover rates, a key metric for business success.

Societal values are increasingly prioritizing mental health and well-being, creating a demand for resources that support employee resilience and stress management. Franklin Covey's focus on principles like prioritization and effective execution directly addresses these needs, offering practical tools for individuals and organizations. By 2025, mental health support is expected to be a standard component of employee benefits packages across many industries.

The global emphasis on ethical business practices and corporate social responsibility is growing. Consumers and employees alike expect organizations to operate with integrity and contribute positively to society. Franklin Covey's foundational principles of character and trust align perfectly with this societal expectation, providing a framework for ethical leadership and operations.

The digital transformation continues to reshape how people learn and interact, with a growing preference for accessible, on-demand content. Franklin Covey's investment in digital platforms and blended learning solutions caters to this preference, ensuring their programs remain relevant and engaging for a modern workforce. A 2024 report by Deloitte highlighted that 70% of organizations are increasing their investment in digital learning technologies.

| Societal Factor | Impact on Franklin Covey | Supporting Data (2024-2025) |

|---|---|---|

| Mental Health & Well-being | Increased demand for stress management and resilience training. | Surveys show a 25% rise in employee requests for mental health resources in 2024. |

| Ethical Business Practices | Reinforces demand for integrity and trust-building solutions. | Consumers are 60% more likely to purchase from brands perceived as ethical (2025 study). |

| Digital Learning Preference | Drives adoption of online and blended learning formats. | The corporate e-learning market is projected to grow by 15% annually through 2025. |

Technological factors

The digital learning landscape is constantly shifting, with platforms like Coursera and edX seeing significant growth. In 2024, the global e-learning market was projected to reach over $400 billion, underscoring the demand for accessible, high-quality online education. Franklin Covey's investment in advanced digital delivery systems is crucial for maintaining its competitive edge in this expanding market.

Virtual classrooms and interactive tools are now standard for effective remote learning. Franklin Covey's ability to leverage these technologies allows for greater scalability and wider reach, enabling them to serve a global clientele more efficiently. This focus on technological innovation directly supports their mission of helping individuals and organizations achieve greater effectiveness.

Artificial intelligence is poised to transform how Franklin Covey delivers training. By integrating AI, the company can create highly personalized learning journeys for each participant, adapting content and pace to individual needs. This means moving beyond one-size-fits-all approaches to a more dynamic and effective educational model.

AI's capabilities extend to intelligent content curation and robust performance analytics. Franklin Covey can utilize AI to sift through vast amounts of information, recommending the most relevant resources for specific learning objectives. Furthermore, AI-powered analytics can provide deep insights into participant engagement, skill acquisition, and overall program effectiveness, enabling data-driven improvements.

For clients, this translates into more impactful and measurable training outcomes. Imagine adaptive learning paths that adjust in real-time or AI coaches offering personalized feedback. Franklin Covey can leverage predictive analytics to identify potential learning gaps early, allowing for proactive interventions and ultimately enhancing the return on investment for their training solutions.

Franklin Covey's clients increasingly demand clear evidence of training program impact and return on investment (ROI). Advanced data analytics is crucial for demonstrating tangible results like enhanced productivity or sales growth. For instance, in 2024, companies are allocating an average of 15% of their learning and development budgets to analytics tools to quantify training effectiveness.

By leveraging data analytics, Franklin Covey can showcase the direct correlation between their solutions and key business metrics. This data-driven approach strengthens their value proposition, showing how improved leadership or sales performance translates into measurable financial gains for clients. In 2025, the demand for such quantifiable outcomes is expected to drive significant growth in the corporate training analytics market, projected to reach $3.2 billion globally.

Cybersecurity and Data Privacy Concerns

Franklin Covey's reliance on digital platforms and client data makes cybersecurity and data privacy critical. Protecting sensitive information from breaches is paramount for maintaining client trust and avoiding significant legal penalties. This necessitates ongoing investment in robust security infrastructure and protocols to safeguard against evolving cyber threats.

The increasing frequency and sophistication of cyberattacks underscore the need for proactive defense. For instance, a 2024 report indicated that the average cost of a data breach reached $4.45 million globally. Franklin Covey must therefore prioritize continuous updates to its cybersecurity measures to mitigate these risks effectively.

- Data Breach Costs: Global average cost of a data breach was $4.45 million in 2024.

- Regulatory Compliance: Adherence to evolving data privacy regulations like GDPR and CCPA is essential to avoid fines.

- Client Trust: Maintaining client confidence hinges on the company's ability to secure their personal and business information.

Emergence of Virtual and Augmented Reality (VR/AR) in Learning

Virtual and augmented reality (VR/AR) are poised to revolutionize corporate training by offering deeply immersive learning experiences. While still in early adoption for widespread use, these technologies can transform skill development, especially in areas like leadership simulations and complex interpersonal communication. For instance, a 2024 report indicated that the global VR in education and training market is projected to reach over $13 billion by 2026, demonstrating significant growth potential.

Franklin Covey can leverage VR/AR to develop highly engaging and experiential learning modules, offering a distinct competitive advantage. Imagine leadership training where participants navigate realistic scenarios, making critical decisions with immediate feedback, or practicing difficult conversations in a safe, simulated environment. This approach moves beyond traditional methods, fostering deeper understanding and retention.

The potential impact is substantial:

- Enhanced Skill Acquisition: VR/AR allows for hands-on practice in realistic settings, accelerating learning curves for complex skills.

- Increased Engagement: Immersive experiences capture learner attention more effectively than passive methods.

- Cost-Effectiveness Over Time: While initial investment is required, VR/AR can reduce the need for physical resources and travel for training.

- Data-Driven Insights: VR/AR platforms can track learner performance and provide detailed analytics for personalized feedback and program improvement.

The ongoing digital transformation necessitates continuous investment in advanced learning platforms and tools. Franklin Covey's commitment to leveraging AI for personalized learning paths and data analytics for measuring training impact is key to its future success. As of 2024, the global e-learning market exceeded $400 billion, highlighting the immense demand for effective digital education solutions.

Legal factors

Franklin Covey's core business thrives on its unique principles-based content, methodologies, and training tools. Protecting these valuable assets through robust intellectual property strategies, including trademarks, copyrights, and potentially patents for novel processes, is paramount for their global operations.

Failure to adequately safeguard their intellectual property can lead to significant financial repercussions and damage to their established brand reputation. For instance, unauthorized use or infringement of their copyrighted training materials or trademarked branding could directly impact their revenue streams and market position, requiring substantial investment in legal defense.

Franklin Covey's global operations necessitate adherence to a complex landscape of data privacy laws like GDPR and CCPA. These regulations dictate the responsible handling of client and participant information, from collection to secure storage and processing. Non-compliance can lead to significant financial penalties and harm brand reputation.

Franklin Covey, operating globally with consultants, trainers, and administrative staff, navigates a complex web of employment and labor laws. These regulations cover everything from fair hiring and minimum wage requirements to safe working conditions and employee benefits. For instance, in 2024, many regions saw adjustments to minimum wage laws, impacting payroll expenses.

Compliance with these diverse legal frameworks is critical for Franklin Covey's human resource management. Understanding and adhering to laws regarding employee termination, overtime, and anti-discrimination is essential to avoid costly legal battles and maintain a positive employer brand. The International Labour Organization (ILO) reported in late 2023 that labor laws continue to evolve globally, often emphasizing worker protections and fair compensation.

Contract Law and Client Agreements

Contract law forms the bedrock of Franklin Covey's client engagements. Clear, legally robust agreements are essential for defining service scope, payment schedules, and intellectual property ownership, thereby minimizing potential disputes and fostering trust. For instance, in 2023, Franklin Covey reported revenue of $876.1 million, underscoring the scale of its client relationships and the importance of well-defined contracts to secure these revenue streams.

Navigating the complexities of international contract law is a significant consideration for Franklin Covey's global operations. Adherence to diverse legal frameworks ensures compliance and protects the company's interests across different jurisdictions. This is particularly relevant as Franklin Covey continues to expand its presence in markets like Asia and Europe, where legal nuances can impact service delivery and revenue recognition.

- Clarity in Scope: Contracts must precisely outline deliverables and service expectations to prevent misunderstandings.

- Payment Terms: Clearly defined payment schedules and terms are crucial for financial stability and cash flow management.

- Intellectual Property: Agreements must protect Franklin Covey's proprietary content and methodologies.

- Dispute Resolution: Provisions for arbitration or mediation can offer efficient ways to resolve disagreements.

Anti-Bribery and Corruption Laws (e.g., FCPA, UK Bribery Act)

Franklin Covey, as a global entity, must navigate a complex web of anti-bribery and corruption legislation. Key among these are the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, which impose stringent requirements on companies operating internationally. Failure to comply can lead to significant financial penalties and irreparable reputational damage.

To mitigate these risks, Franklin Covey likely implements robust compliance programs. These programs typically include comprehensive ethical guidelines for employees and rigorous due diligence processes for third-party engagements, especially in regions with higher perceived corruption risks. For instance, Transparency International's 2023 Corruption Perception Index shows varying levels of perceived corruption globally, underscoring the need for tailored compliance efforts.

- FCPA and UK Bribery Act: Global legal frameworks requiring strict adherence.

- Compliance Programs: Essential for preventing violations and associated penalties.

- Due Diligence: Crucial for vetting international partners and transactions.

- Reputational Risk: Non-compliance can severely damage public trust and brand image.

Franklin Covey's adherence to intellectual property laws is crucial for protecting its core assets, including trademarks and copyrighted training materials. Failure to do so can lead to significant financial losses and brand damage, as seen in cases of unauthorized use. The company's global operations also necessitate strict compliance with data privacy regulations like GDPR and CCPA, impacting how client information is handled, with non-compliance resulting in substantial fines.

Environmental factors

Clients and stakeholders increasingly demand that companies like Franklin Covey showcase robust Corporate Social Responsibility (CSR) and sustainable operations. This translates to tangible actions like minimizing their environmental impact, ensuring ethical supply chains, and actively participating in community development initiatives.

For instance, a 2024 report indicated that over 70% of consumers consider sustainability when making purchasing decisions, a trend that is only expected to grow. Companies demonstrating strong ESG (Environmental, Social, and Governance) performance, which includes CSR, often see a positive correlation with financial performance and investor confidence.

By aligning with these evolving expectations, Franklin Covey can significantly bolster its brand image, attracting a growing segment of socially conscious clientele and fostering a more engaged and motivated workforce. This commitment to sustainability can also lead to operational efficiencies and reduced long-term risks.

Franklin Covey's increased emphasis on virtual and online learning delivery, a trend amplified in the 2024-2025 period, directly impacts its carbon footprint. By reducing the necessity for extensive business travel associated with in-person workshops, the company can significantly lower its greenhouse gas emissions.

This strategic shift towards digital platforms supports environmental sustainability goals. For instance, a single round-trip business flight can emit over a ton of CO2 per passenger, making virtual alternatives a considerably greener option for global service delivery.

While Franklin Covey's core business isn't manufacturing, environmental regulations still touch their operations. This includes rules around waste disposal from their offices and energy efficiency standards for their buildings. For instance, many commercial buildings are subject to energy performance disclosure laws, which could impact their facility management costs and reporting needs.

Furthermore, there's a growing expectation for companies to report on their environmental, social, and governance (ESG) performance. This could mean Franklin Covey needs to track and disclose data on their carbon footprint or waste generation, even if it's on a smaller scale than heavy industry. As of 2024, investor interest in robust ESG reporting continues to climb, with many funds screening companies based on these metrics.

Client Demand for Eco-Friendly Solutions

Client demand for eco-friendly solutions is a growing environmental factor influencing businesses like Franklin Covey. Many corporate clients are increasingly scrutinizing their vendors' environmental practices, favoring those who demonstrate a commitment to sustainability. This trend is driven by a desire to align their own corporate social responsibility (CSR) goals with their supply chains.

Franklin Covey can leverage this by emphasizing the environmental benefits of its digital learning platforms. For instance, a significant reduction in paper usage and travel associated with in-person training directly translates to a lower carbon footprint. This focus on sustainability can serve as a key differentiator in a competitive market.

Consider these points regarding client demand for eco-friendly solutions:

- Growing Client Prioritization: A 2024 survey indicated that over 60% of B2B buyers consider a vendor's sustainability practices when making purchasing decisions.

- Digital Solutions Advantage: Franklin Covey's investment in digital learning can be framed as an eco-friendly alternative, reducing the need for physical materials and travel, which are major contributors to corporate emissions.

- Competitive Edge: Highlighting internal sustainability initiatives, such as reduced energy consumption in offices or waste reduction programs, can further enhance Franklin Covey's appeal to environmentally conscious clients.

Climate Change Risks and Business Continuity

Extreme weather events, a growing concern due to climate change, pose potential disruptions to Franklin Covey's operations and client accessibility. For instance, the increasing frequency of severe storms or floods could impact travel for their consultants or clients in affected regions, potentially delaying crucial training sessions or advisory services. The economic impact of such events can also be significant; in 2023, natural disasters caused an estimated $250 billion in economic losses globally, according to the reinsurance company Swiss Re.

To mitigate these risks, Franklin Covey is likely focusing on enhancing its business continuity planning. This involves developing strategies to ensure service delivery can continue even when faced with unforeseen environmental challenges. For example, a 2024 survey by Gartner found that 70% of organizations are increasing their investment in resilience and business continuity capabilities.

- Increased Frequency of Extreme Weather: Global average temperatures have risen, leading to more intense heatwaves, storms, and floods impacting various regions.

- Supply Chain Vulnerabilities: Climate-related disruptions can affect the transportation of materials or the availability of venues, impacting service delivery.

- Client Operations: Franklin Covey's clients may also face operational challenges due to climate events, potentially affecting their ability to engage in training or utilize services.

- Resilience Investment: Businesses are increasingly investing in robust business continuity plans, with a focus on digital solutions and remote capabilities to maintain operations.

Environmental factors are increasingly shaping how companies like Franklin Covey operate and are perceived by stakeholders. Growing client demand for sustainability means businesses must demonstrate eco-friendly practices, influencing vendor selection and brand loyalty. For instance, a 2024 study by Accenture found that 60% of consumers prefer to buy from brands that are environmentally conscious.

Franklin Covey's strategic pivot towards digital and virtual learning platforms directly addresses this by significantly reducing its carbon footprint compared to traditional in-person training. This shift aligns with global efforts to combat climate change and appeals to a market segment that prioritizes environmental responsibility.

Extreme weather events, exacerbated by climate change, also present operational risks, necessitating robust business continuity plans. In 2023, natural disasters resulted in approximately $250 billion in global economic losses, highlighting the need for resilience. As a result, 70% of organizations are boosting investments in business continuity capabilities, according to a 2024 Gartner survey.

Environmental regulations, while not directly tied to manufacturing for Franklin Covey, still impact office operations through waste disposal and energy efficiency standards. Furthermore, the expectation for transparent ESG reporting is a growing trend, with investor interest in these metrics continuing to climb in 2024.

| Environmental Factor | Impact on Franklin Covey | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Client Demand for Sustainability | Influences purchasing decisions, vendor selection, and brand perception. | 60% of consumers prefer environmentally conscious brands (Accenture, 2024). |

| Shift to Digital Learning | Reduces carbon footprint, lowers travel emissions, and appeals to eco-conscious clients. | Virtual alternatives significantly cut CO2 emissions compared to business travel. |

| Extreme Weather Events | Disrupts operations, travel, and service delivery; necessitates business continuity planning. | $250 billion in global economic losses from natural disasters (Swiss Re, 2023); 70% of organizations increasing business continuity investment (Gartner, 2024). |

| Environmental Regulations & ESG Reporting | Affects office operations (waste, energy); increases demand for transparent environmental data. | Investor interest in ESG reporting continues to climb in 2024. |

PESTLE Analysis Data Sources

Our Franklin Covey PESTLE Analysis is meticulously constructed using data from reputable sources including government publications, international organizations, and leading market research firms. This ensures each identified trend and potential impact is grounded in verified information.