Franklin Covey Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Franklin Covey Bundle

Franklin Covey operates within a dynamic landscape shaped by intense competition, powerful suppliers, and evolving customer demands. Understanding these forces is crucial for any business aiming for sustained success. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Franklin Covey’s competitive dynamics, market pressures, and strategic advantages in detail, providing you with the comprehensive insights needed to navigate its industry effectively.

Suppliers Bargaining Power

Franklin Covey's reliance on specialized content creators and expert facilitators can create a degree of supplier power. If these key individuals or entities are few in number or possess unique, hard-to-replicate skills, they can influence pricing and terms. For instance, a highly sought-after thought leader in a niche area of leadership development could command higher fees.

However, the broader market for general training content and digital delivery platforms tends to mitigate this supplier concentration. The availability of numerous content developers and a wide array of technology solutions means Franklin Covey isn't overly dependent on any single supplier. This competitive landscape for many inputs generally keeps supplier bargaining power in check.

Franklin Covey faces potential supplier power if switching their content creators or technology platforms involves significant costs. This could occur if their current content is deeply embedded within proprietary systems or if they have enduring agreements with crucial subject matter experts, thereby strengthening the leverage of these suppliers. For instance, if a substantial portion of their productivity training content relies on a specific, licensed methodology or requires specialized software for delivery, migrating to an alternative could incur substantial retraining, content redevelopment, and platform integration expenses.

Franklin Covey's strength lies in its proprietary content, which significantly limits supplier power over its core intellectual property. However, for specialized areas like unique research or advanced technology for their learning platforms, they may depend on external experts. If these specialized inputs are difficult to find elsewhere or have very few alternatives, those suppliers gain considerable leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge to Franklin Covey. Suppliers, such as independent consultants or online learning platform providers, could leverage their existing infrastructure and client relationships to offer similar training and consulting services directly. This would essentially allow them to compete head-to-head with Franklin Covey, thereby increasing their bargaining power.

For instance, a technology provider that supplies Franklin Covey with its learning management system might decide to develop and offer its own proprietary training content. This move would bypass Franklin Covey’s value chain and directly capture a portion of the end-customer market. The success of such a strategy would depend on the supplier's brand recognition and their ability to establish direct rapport with clients.

- Suppliers might develop their own training content.

- This directly competes with Franklin Covey's core offerings.

- Strong supplier brands or direct client relationships amplify this threat.

- A platform provider launching its own content library is a prime example.

Importance of Franklin Covey to Suppliers

Franklin Covey's significant global presence and established brand likely make it a key client for many of its suppliers. If a supplier derives a substantial portion of its revenue from Franklin Covey, its ability to exert pressure on pricing or terms is diminished due to its reliance on this business relationship. Conversely, if Franklin Covey represents only a small fraction of a supplier's overall sales, that supplier holds greater leverage.

Franklin Covey's purchasing volume and the nature of its supplier relationships are critical factors. For instance, in 2023, Franklin Covey reported total cost of sales of $209.2 million, indicating substantial procurement activity. The company's need for specialized content, technology platforms, and distribution services means it relies on a diverse supplier base, each with varying degrees of dependence on Franklin Covey.

- Supplier Dependence: If Franklin Covey constitutes a large percentage of a supplier's revenue, the supplier's bargaining power is reduced.

- Franklin Covey's Market Position: As a major player in the productivity and leadership development space, Franklin Covey's purchasing power can offset supplier leverage.

- Supplier Diversification: The extent to which Franklin Covey relies on a single supplier versus a diversified base impacts the bargaining power of individual suppliers.

- Contractual Agreements: Long-term contracts or exclusive supply agreements can significantly alter the bargaining power dynamics between Franklin Covey and its suppliers.

Franklin Covey's bargaining power with suppliers is influenced by the uniqueness of its inputs and the supplier's market position. While the company's proprietary content reduces reliance on external creators, specialized expertise or technology can grant suppliers leverage. For example, if a key facilitator for a niche leadership program is difficult to replace, they can negotiate higher fees. The availability of numerous alternative content developers and technology solutions generally limits the power of most suppliers.

The threat of suppliers integrating forward, meaning they start offering their own training services, is a significant concern. A technology provider for Franklin Covey's learning platform could potentially develop and sell its own content, directly competing with the company. This risk is amplified if these suppliers possess strong brand recognition or established direct relationships with Franklin Covey's clients.

Franklin Covey's substantial purchasing volume, as evidenced by its 2023 cost of sales of $209.2 million, can often offset supplier leverage. However, the extent to which Franklin Covey represents a supplier's total business is critical; if Franklin Covey is a minor client, the supplier holds more power. Conversely, if Franklin Covey is a major revenue source, the supplier is less likely to exert significant pressure on pricing or terms.

| Factor | Impact on Supplier Bargaining Power | Example for Franklin Covey |

|---|---|---|

| Uniqueness of Input | High power if input is specialized and hard to replicate. | A highly sought-after expert in a niche leadership area. |

| Availability of Alternatives | Low power if many suppliers exist for the input. | Numerous general content developers and digital platform providers. |

| Switching Costs | High power if switching suppliers is costly. | Deep integration of current content into proprietary systems. |

| Threat of Forward Integration | High power if suppliers can compete directly. | A learning management system provider developing its own training content. |

| Supplier Dependence on Franklin Covey | Low power if Franklin Covey is a major client. | If Franklin Covey accounts for a large portion of a supplier's revenue. |

What is included in the product

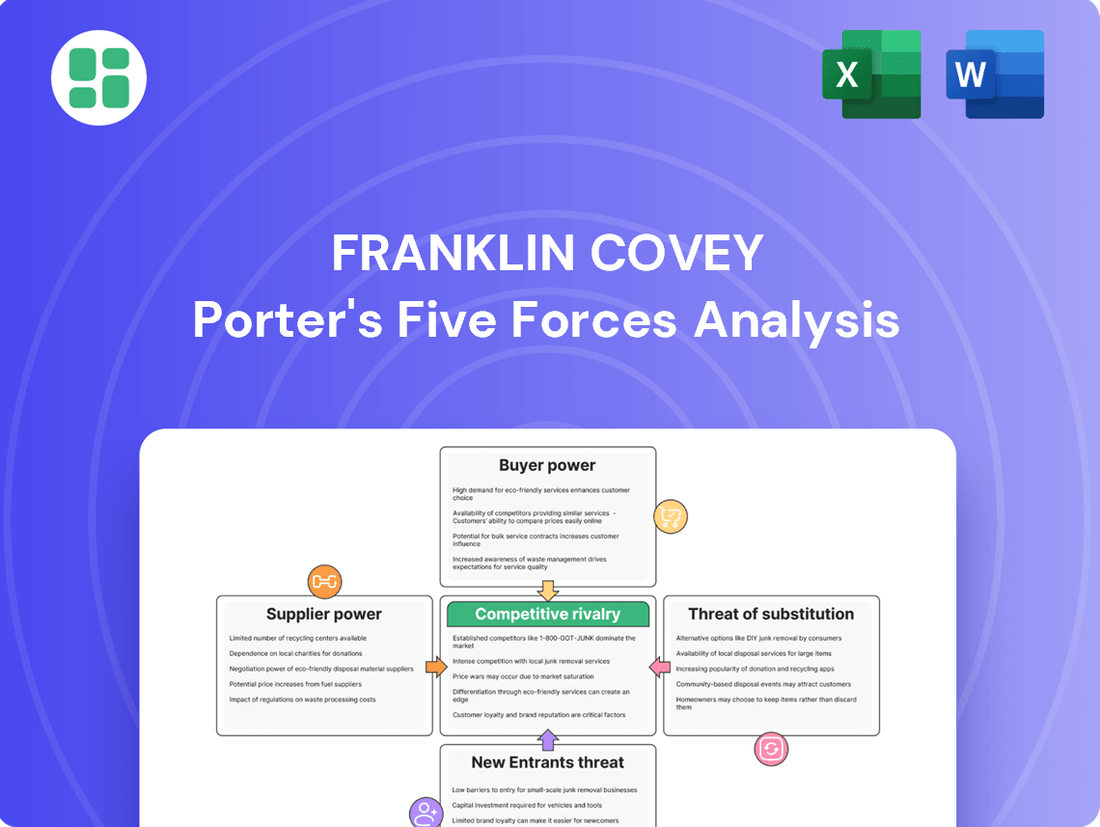

Franklin Covey's Porter's Five Forces analysis dissects the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the productivity and leadership development industry.

Effortlessly identify and mitigate competitive threats with a structured framework that clarifies industry dynamics.

Customers Bargaining Power

Franklin Covey's customer base spans individuals and substantial organizations, with large corporate clients holding considerable sway. These entities, particularly those investing in the All Access Pass for their entire workforce, represent significant purchase volumes, granting them amplified bargaining power.

The scale of these corporate commitments allows them to negotiate more favorable terms and pricing. For example, in fiscal year 2023, Franklin Covey reported a 12% increase in their Enterprise division revenue, highlighting the growing importance and influence of these larger clients in their sales structure.

Customer switching costs significantly influence bargaining power. For organizations deeply embedded in Franklin Covey's methodologies, the expense and disruption of retraining staff and re-establishing development programs can be substantial, effectively locking them in and bolstering Franklin Covey's leverage.

However, the impact varies. Individual consumers or smaller businesses might find it easier and cheaper to transition to alternative productivity or leadership training solutions, thereby possessing greater bargaining power. For instance, in 2024, the corporate training market saw a significant shift towards digital and modular solutions, potentially lowering switching costs for some clients seeking more flexible options.

The availability of numerous substitutes significantly enhances customer bargaining power. For leadership and productivity training, alternatives abound, including internal company programs, rival consulting firms, readily accessible online courses, and even self-directed learning materials.

This wide array of choices allows customers to easily switch providers if they perceive better value elsewhere. In 2024, the online learning market alone saw substantial growth, with platforms like Coursera and Udemy offering a vast selection of courses, many at competitive price points, further intensifying this pressure.

Price Sensitivity of Customers

Customers are highly sensitive to price, particularly when budgets are tight. In 2024, many companies reviewed discretionary spending, making them more cautious about investments in areas like general leadership training. This heightened price sensitivity means providers must clearly articulate the return on investment for their services.

- Price Sensitivity: Economic headwinds in 2024 and projected for 2025 have made corporate training budgets a focus for cost scrutiny.

- ROI Demonstration: Clients increasingly demand quantifiable benefits and a clear return on investment to justify expenditures on productivity and leadership development programs.

- Competitive Landscape: The availability of numerous training options, from niche providers to digital platforms, intensifies price competition, forcing established players to differentiate on value rather than just cost.

Customer Information Asymmetry

Customer information asymmetry has significantly diminished, particularly in the training and consulting sector. Clients now have readily available access to a wealth of data, including detailed service reviews, competitor analyses, and pricing benchmarks. This transparency empowers them to make far more informed choices, directly increasing their negotiation leverage.

The ease with which customers can compare different training providers and their service packages means they are less reliant on a single supplier's narrative. For instance, a recent survey indicated that over 70% of B2B buyers conduct extensive online research before engaging with a service provider, actively seeking out comparative information.

- Informed Decision-Making: Customers can easily access and analyze data on service quality, pricing, and client testimonials, reducing reliance on provider claims.

- Enhanced Negotiation: With clear market benchmarks, customers are better positioned to negotiate favorable terms and pricing for training and consulting services.

- Increased Transparency: The digital age has fostered an environment where information about service offerings is widely disseminated, leveling the playing field.

Franklin Covey's large corporate clients possess significant bargaining power due to their substantial purchase volumes, enabling them to negotiate better terms. For example, the company's Enterprise division saw a 12% revenue increase in fiscal year 2023, underscoring the influence of these major clients.

While high switching costs can lock in some clients, the growing availability of digital and modular training solutions in 2024 has lowered these barriers for others, increasing their leverage. The abundance of substitute training options, from online courses to internal programs, further empowers customers to seek better value, as seen with the significant growth in the online learning market in 2024.

Customers are increasingly price-sensitive, especially given budget scrutiny in 2024, demanding clear ROI demonstrations. This heightened sensitivity, coupled with widespread access to comparative data and competitor analyses, amplifies customer bargaining power, allowing for more informed negotiations and a greater ability to secure favorable pricing.

| Factor | Impact on Franklin Covey | 2024/2025 Trend |

|---|---|---|

| Client Size | Large clients have more leverage | Growing Enterprise revenue (12% FY23) |

| Switching Costs | High for embedded clients, lower for others | Digital solutions reduce costs for some |

| Availability of Substitutes | High, intensifying competition | Online learning market growth |

| Price Sensitivity | Increasing, demand for ROI | Budget scrutiny, focus on quantifiable benefits |

| Information Asymmetry | Diminishing, increasing customer knowledge | Over 70% of B2B buyers research extensively |

Preview Before You Purchase

Franklin Covey Porter's Five Forces Analysis

This preview showcases the complete Franklin Covey Porter's Five Forces Analysis, ensuring you receive the exact, professionally formatted document you see. You'll gain immediate access to this comprehensive strategic tool upon purchase, allowing you to apply its insights without delay. There are no hidden sections or placeholder content; what you preview is precisely what you will download and utilize for your business strategy.

Rivalry Among Competitors

The corporate training and consulting arena is incredibly fragmented, featuring a vast array of participants. This includes major global consulting firms like EY and Gallup, alongside specialized boutique agencies and independent consultants, all competing for attention and business.

This wide spectrum of competitors, from large established players to smaller, agile firms, significantly heats up the rivalry. Each entity strives to capture a piece of the market, leading to intense competition for clients and projects.

In 2024, the global corporate training market was valued at approximately $380 billion, a figure expected to grow, highlighting the significant opportunity that also attracts a diverse and numerous competitive set.

The global corporate training market is experiencing robust expansion, with projections indicating continued strong growth. This upward trend is fueled by the increasing demand for upskilling and reskilling workforces to adapt to rapid technological advancements, particularly in areas like artificial intelligence. For instance, the AI training market alone is expected to reach substantial figures, creating fertile ground for competition.

Franklin Covey's competitive advantage is built on its unique principles-based content and proprietary systems, such as the All Access Pass, which offers a comprehensive suite of development tools. This focus on deeply ingrained principles differentiates them from many providers offering more surface-level training.

However, the landscape is crowded with competitors who also leverage differentiation. Many offer specialized expertise in niche areas, innovative delivery methods like AI-driven personalized learning, or flexible microlearning modules. For instance, platforms like Coursera and LinkedIn Learning provide vast libraries of courses, often at lower price points, forcing Franklin Covey to continually innovate its offerings to maintain its distinct position.

High Fixed Costs and Exit Barriers

The training and consulting sector, where Franklin Covey operates, often carries substantial fixed costs. These include the creation of proprietary content, the development and maintenance of technology platforms for delivery, and the establishment of a global sales and support network. These investments, once made, do not fluctuate with sales volume.

High fixed costs can intensify competitive rivalry. When demand softens, companies may engage in aggressive price competition to ensure their fixed overheads are covered, leading to thinner profit margins for all players. This dynamic is particularly evident during economic downturns.

Exit barriers in this industry can also be significant. The specialized nature of training content, established brand reputations, and sunk costs in technology and human capital make it difficult for firms to divest or exit the market without substantial losses. This can trap less profitable firms, further fueling competition.

- Significant fixed costs in content development and technology platforms.

- Global sales and delivery infrastructure requires substantial upfront investment.

- Price wars can erupt to cover overheads during slow growth periods.

- High exit barriers keep less profitable firms competing.

Strategic Stakes and Acquisitions

The consulting landscape is a mix of many small players and a few larger ones, and we're seeing a trend where private equity firms are buying up these consulting businesses. This is often to gain access to specific expertise or new technology. For Franklin Covey, this means the competitive field is always shifting as rivals grow or merge, making the fight for clients and talent more intense.

This consolidation means that competitors are frequently upgrading their skills and changing how they position themselves in the market. For instance, in 2023, the global management consulting market size was valued at approximately $360 billion, with significant M&A activity contributing to this figure. This constant evolution directly escalates the rivalry Franklin Covey faces.

Key drivers of this heightened competition include:

- Private Equity Investment: Increased M&A activity by PE firms seeking to consolidate fragmented markets and build scale.

- Talent and Technology Acquisition: Competitors are actively acquiring firms to gain specialized talent or proprietary technology platforms.

- Evolving Capabilities: The need for consulting firms to continuously adapt and expand their service offerings to meet changing client demands.

- Market Positioning: Firms are strategically repositioning themselves through mergers and acquisitions to capture greater market share.

The corporate training and consulting sector is intensely competitive, characterized by a vast number of players ranging from global giants to niche specialists. This crowded market, valued at approximately $380 billion in 2024, forces companies like Franklin Covey to constantly innovate and differentiate their offerings to stand out. The drive to capture market share leads to aggressive strategies, including price competition, especially when demand fluctuates.

High fixed costs associated with content creation and technology platforms, coupled with significant exit barriers, further intensify this rivalry. Firms often find it difficult to leave the market without incurring substantial losses, which keeps even less profitable entities actively competing. This dynamic is exacerbated by ongoing industry consolidation, where private equity firms acquire businesses to build scale and acquire expertise, creating a constantly shifting competitive landscape.

| Factor | Impact on Rivalry | Example/Data Point |

|---|---|---|

| Number of Competitors | High | Global training market valued at ~$380 billion in 2024, with numerous players. |

| Industry Growth Rate | Moderate to High | Demand for upskilling and reskilling fuels market expansion. |

| Fixed Costs | High | Content development, technology platforms, sales networks require significant investment. |

| Exit Barriers | High | Specialized content, brand reputation, and sunk costs make exiting difficult. |

| Switching Costs | Varies | Loyalty programs and integrated solutions can increase switching costs for clients. |

SSubstitutes Threaten

Many organizations increasingly choose to develop and deliver training programs internally. This trend is fueled by the desire for tailored content and cost savings, making in-house L&D departments and subject matter experts a potent substitute for external training providers.

The rise of sophisticated Learning Management Systems (LMS) and readily available digital content creation tools further lowers the barrier to entry for in-house training. For instance, in 2024, companies are investing heavily in these platforms, with the global LMS market projected to reach over $30 billion, indicating a strong internal capability development.

By utilizing internal expertise and infrastructure, businesses can bypass the often significant fees associated with external training consultants and off-the-shelf courses. This direct control over curriculum development and delivery allows for greater alignment with specific organizational goals and a more agile response to evolving skill needs.

The rise of online learning platforms like Coursera, LinkedIn Learning, and Udemy presents a significant threat of substitutes for traditional education and corporate training. These platforms offer a vast array of courses, often at a fraction of the cost of in-person instruction, making them highly attractive for skill development. For instance, by mid-2024, Coursera reported having over 129 million registered learners and partnered with more than 300 leading universities and companies, demonstrating the sheer scale and accessibility of these alternatives.

These digital alternatives provide unparalleled flexibility, allowing individuals to learn at their own pace and on their own schedule, a key advantage over more rigid traditional models. The availability of free or low-cost MOOCs further intensifies this competitive pressure, as they democratize access to high-quality educational content. In 2023, the global e-learning market was valued at over $270 billion, with projections indicating continued robust growth, underscoring the substantial and expanding reach of these substitute offerings.

The proliferation of free and low-cost self-help resources presents a significant threat of substitutes for Franklin Covey's core offerings. Individuals seeking to improve leadership, productivity, and personal development can readily access a vast array of content through books, articles, podcasts, and YouTube tutorials. These readily available alternatives, often costing little to nothing, can fulfill many of the knowledge-acquisition needs that Franklin Covey's paid programs address.

Coaching and Mentoring Programs

Formal and informal coaching and mentoring, whether developed internally or sourced from independent professionals, present a significant threat of substitutes for Franklin Covey's structured leadership and performance programs. These personalized approaches offer direct guidance and practical skill application, often at a more flexible or lower cost point.

For instance, a 2024 survey indicated that 70% of companies utilize internal mentoring programs, while 45% engage external coaches to supplement their development efforts. This widespread adoption highlights the accessibility and perceived value of these substitute offerings.

- Internal Mentoring: Organizations foster talent by pairing experienced employees with rising leaders, providing tailored advice and career pathing.

- External Coaching: Independent coaches offer specialized expertise in areas like executive presence, strategic thinking, and change management, often with flexible engagement models.

- Peer-to-Peer Learning: Informal knowledge sharing and collaborative problem-solving among colleagues can also address development needs, bypassing formal programs.

- Online Learning Platforms: While not always personalized, platforms offering courses on leadership and productivity can serve as cost-effective alternatives for acquiring specific skills.

AI-Powered Tools and Solutions

The rise of AI-powered tools presents a significant threat of substitution for traditional training and consulting services. AI tutors, for instance, can deliver personalized learning experiences, while AI-driven content creation platforms can automate the development of training materials. This automation can reduce the reliance on human trainers and consultants for certain tasks.

These AI solutions can perform functions like data analysis to identify performance gaps and suggest tailored learning paths, directly competing with human expertise. For example, by 2024, the global AI market is projected to reach hundreds of billions of dollars, with a substantial portion dedicated to enterprise solutions that include training and development automation.

- AI Tutors: Offer scalable, personalized learning, potentially replacing some one-on-one coaching.

- Automated Content Creation: Reduces the need for manual instructional design and material development.

- Data Analytics for Performance: Provides insights that might otherwise come from consultant analysis.

- Personalized Learning Paths: AI can adapt content and delivery based on individual progress, a core consulting offering.

The availability of readily accessible and often free or low-cost self-help resources, including books, podcasts, and online tutorials, directly competes with Franklin Covey's structured programs. These alternatives fulfill the need for personal development and skill acquisition without the associated program costs.

Entrants Threaten

While a small consulting firm might need minimal startup capital, building a global enterprise like Franklin Covey, complete with its own intellectual property, extensive delivery systems, and established brand recognition, demands significant financial backing. This high capital requirement acts as a formidable barrier for potential new entrants aiming to compete at scale.

Franklin Covey's investment in developing and maintaining its unique training content and delivery platforms, including digital solutions and a vast network of facilitators, represents a substantial upfront cost. For instance, in fiscal year 2023, Franklin Covey reported total assets of $594.2 million, reflecting the scale of investment in its infrastructure and intangible assets.

Franklin Covey's formidable brand reputation and deep-seated trust are significant barriers for new entrants. For decades, the company has cultivated an image synonymous with effective leadership and productivity solutions, making it a go-to for organizations seeking tangible improvements.

Building comparable credibility in the competitive training and consulting market is a lengthy and resource-intensive endeavor for newcomers. Clients, particularly large corporations, often prioritize established providers with proven track records, especially when investing in critical areas like executive coaching and talent management.

Franklin Covey's core strength lies in its deeply ingrained principles-based content and proprietary methodologies. This intellectual property is a significant barrier to entry, as new competitors would need to invest heavily in research, development, and expert validation to create comparable content.

The cost and time required to develop unique, impactful training and development materials, akin to Franklin Covey's established offerings, deter potential new entrants. Without their own proprietary content or the ability to license existing materials, newcomers face a substantial hurdle in establishing credibility and offering competitive solutions.

Access to Distribution Channels and Client Relationships

Franklin Covey's established distribution channels, including a dedicated direct sales force and a global network of licensees for workshops and coaching, present a significant barrier to new entrants. These channels are not easily replicated, requiring substantial investment and time to build. For instance, in 2023, Franklin Covey reported revenue from its Direct Sales segment exceeding $500 million, underscoring the scale of its existing reach.

New competitors face the daunting task of not only developing comparable content but also securing access to clients and building the trust and relationships that Franklin Covey has cultivated over decades. This makes it difficult for newcomers to gain traction and effectively deliver their services on a large scale.

- Established Distribution Network: Franklin Covey leverages a global network of direct sales, licensees, and partners to deliver its training and solutions.

- Client Relationship Capital: Decades of experience have allowed Franklin Covey to build strong, long-term relationships with a diverse client base.

- Cost and Time Investment: Replicating Franklin Covey's distribution reach and client loyalty requires significant financial resources and extended periods.

- Market Penetration Difficulty: New entrants struggle to achieve the same level of market penetration and brand recognition due to these entrenched advantages.

Economies of Scale and Experience Curve

Franklin Covey, as a well-established global entity, likely leverages significant economies of scale. This advantage is evident in their extensive content library development, sophisticated platform infrastructure, and broad marketing reach. Newcomers entering the professional development and productivity solutions market often begin at a much smaller scale, inherently facing higher per-unit costs for content creation, technology, and customer acquisition. This cost disadvantage can hinder their ability to compete on price or match the substantial investment in research and development that established players like Franklin Covey can sustain.

The experience curve also plays a crucial role. Franklin Covey has accumulated years of operational experience, refining its processes for content delivery, client engagement, and service optimization. This accumulated knowledge allows for greater efficiency and potentially lower operating costs over time. New entrants must invest considerable time and resources to reach similar levels of operational maturity, making the initial climb on the experience curve a significant barrier.

- Economies of Scale: Franklin Covey's global presence allows for cost efficiencies in content production and distribution, making it harder for smaller competitors to match pricing.

- Experience Curve: Years of operational refinement enable Franklin Covey to deliver services more efficiently, a benefit new entrants must build over time.

- Investment Capacity: Larger firms can reinvest profits into innovation and marketing, creating a substantial hurdle for startups with limited capital.

- Brand Recognition: Established brands benefit from trust and awareness, reducing customer acquisition costs compared to unproven new entrants.

The threat of new entrants for Franklin Covey is moderate, primarily due to the significant capital investment required to replicate its established infrastructure, proprietary content, and global distribution network. While the professional development market can appear accessible, building a brand with the same level of trust and reach as Franklin Covey, which reported total assets of $594.2 million in fiscal year 2023, demands substantial financial backing and time. Newcomers must overcome high upfront costs for content development, technology platforms, and establishing client relationships, making it challenging to compete effectively at scale.

| Barrier Type | Franklin Covey's Position | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High (e.g., $594.2M in total assets FY23) | Significant hurdle for startups |

| Brand Reputation & Trust | Decades of cultivation, strong client loyalty | Difficult and time-consuming to replicate |

| Proprietary Content & IP | Unique principles-based methodologies | Requires substantial R&D investment to match |

| Distribution Channels | Global direct sales, licensees (>$500M revenue FY23) | Costly and slow to build comparable reach |

Porter's Five Forces Analysis Data Sources

Our Franklin Covey Porter's Five Forces analysis is built upon a foundation of comprehensive data, including industry-specific market research reports, publicly available financial statements from key players, and expert commentary from leading business publications.