F.P.E.E. Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.P.E.E. Industries Bundle

Uncover the critical Political, Economic, Environmental, Social, Technological, Legal, and Environmental factors shaping F.P.E.E. Industries's path. Our meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate challenges and seize opportunities. Don't navigate the future blindfolded – gain a competitive edge by downloading the full, actionable report today.

Political factors

Government investment in infrastructure projects, like roads and bridges, directly fuels demand for precast concrete. These initiatives create a robust market for F.P.E.E. Industries' products.

The Bipartisan Infrastructure Law in the U.S., enacted in 2021, is projected to inject $1.2 trillion into infrastructure improvements, with a significant portion allocated to transportation and utilities through 2025. This substantial federal commitment is expected to drive increased demand for construction materials, benefiting companies like F.P.E.E. Industries.

F.P.E.E. Industries must navigate a complex landscape of evolving building codes and regulations, particularly those emphasizing safety and sustainability. For instance, the US Green Building Council's LEED (Leadership in Energy and Environmental Design) v4.1, updated in 2020 and continuing to influence standards, sets benchmarks for energy efficiency and material sourcing, directly impacting precast concrete production and design.

The increasing global focus on climate change means stricter mandates for energy-efficient materials and construction practices. By 2024, many regions saw a rise in requirements for embodied carbon reduction in building materials, a trend that will likely intensify. F.P.E.E. Industries must ensure its precast concrete solutions not only meet these updated green building standards but also proactively exceed them to maintain a competitive edge.

Changes in trade policies and the imposition of tariffs directly affect F.P.E.E. Industries' production costs. For instance, a 2024 report indicated that tariffs on imported steel could increase construction material expenses by up to 15%, impacting the company's bottom line.

Geopolitical tensions, such as ongoing trade disputes between major economies in 2024-2025, create significant supply chain volatility. This can lead to unpredictable spikes in the cost of essential raw materials like cement and aggregates, forcing F.P.E.E. Industries to adapt its pricing strategies to remain competitive.

Political Stability and Investment Climate

Political stability is a cornerstone for attracting both public and private investment in the construction and civil engineering sectors, directly impacting F.P.E.E. Industries. A predictable political landscape fosters confidence, leading to increased capital allocation for infrastructure development and large-scale projects. For instance, in 2024, many developed nations are focusing on infrastructure spending to stimulate economic growth, creating a favorable environment for companies like F.P.E.E. Industries.

Conversely, political instability poses significant risks. It can lead to project delays, increased operational costs due to unforeseen regulations or security concerns, and a general reluctance from investors to commit capital. This uncertainty can directly affect F.P.E.E. Industries' ability to secure new contracts and manage existing ones efficiently. For example, regions experiencing political unrest often see a sharp decline in foreign direct investment in construction, as highlighted by a 2024 World Bank report indicating a 15% drop in construction FDI in unstable regions.

- Government infrastructure spending plans for 2024-2025 are crucial for F.P.E.E. Industries, with major economies like the US and EU countries earmarking billions for upgrades.

- Regulatory changes and policy shifts, often a byproduct of political transitions, can impact material sourcing and environmental compliance for F.P.E.E. Industries.

- The upcoming 2024-2025 election cycles in several key markets introduce a degree of political uncertainty that could influence future government contracts.

- Geopolitical tensions can disrupt supply chains and increase the cost of raw materials essential for F.P.E.E. Industries' operations.

Government Incentives for Sustainable Construction

Government incentives for sustainable construction are a significant driver for F.P.E.E. Industries. Policies encouraging green building practices, such as subsidies and tax breaks for using eco-friendly materials, directly boost demand for products like F.P.E.E.'s durable precast concrete. For instance, the push towards net-zero emissions under frameworks like the European Green Deal, which aims for a 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels, prioritizes materials with lower embodied carbon. Similarly, the growing adoption of LEED (Leadership in Energy and Environmental Design) certifications, with over 100,000 projects registered globally as of early 2024, creates a market preference for sustainable building solutions.

These political factors create a favorable environment for F.P.E.E. Industries:

- Government subsidies and tax credits for sustainable building materials can reduce the upfront cost for developers, making F.P.E.E.'s precast concrete more competitive.

- Stringent environmental regulations, like those associated with the European Green Deal, mandate the use of materials with lower environmental impact, aligning with F.P.E.E.'s product offerings.

- Certifications such as LEED and BREEAM are increasingly becoming standard requirements for new construction, directly benefiting companies providing certified sustainable materials.

- Public procurement policies often favor green building, providing F.P.E.E. with opportunities in government-funded infrastructure projects.

Government infrastructure spending plans for 2024-2025 are a critical driver for F.P.E.E. Industries, with major economies like the US and EU countries allocating significant funds towards upgrades. Regulatory shifts, often a consequence of political changes, can impact material sourcing and environmental compliance for the company. Upcoming election cycles in key markets introduce political uncertainty that might affect future government contracts, while geopolitical tensions can disrupt supply chains and escalate raw material costs.

| Political Factor | Impact on F.P.E.E. Industries | 2024-2025 Data/Trend |

|---|---|---|

| Government Infrastructure Spending | Increased demand for precast concrete | US Bipartisan Infrastructure Law projected to inject $1.2 trillion by 2025. EU nations also earmarking billions for upgrades. |

| Environmental Regulations & Incentives | Demand for sustainable materials, compliance costs | LEED v4.1 influential; European Green Deal targeting 55% emission reduction by 2030. Over 100,000 LEED projects registered globally by early 2024. |

| Trade Policies & Tariffs | Increased production costs | Tariffs on imported steel can increase construction material expenses by up to 15% (2024 report). |

| Political Stability & Geopolitics | Investment confidence, supply chain volatility | Political instability can cause a 15% drop in construction FDI in unstable regions (World Bank 2024 report). Trade disputes in 2024-2025 create supply chain volatility. |

What is included in the product

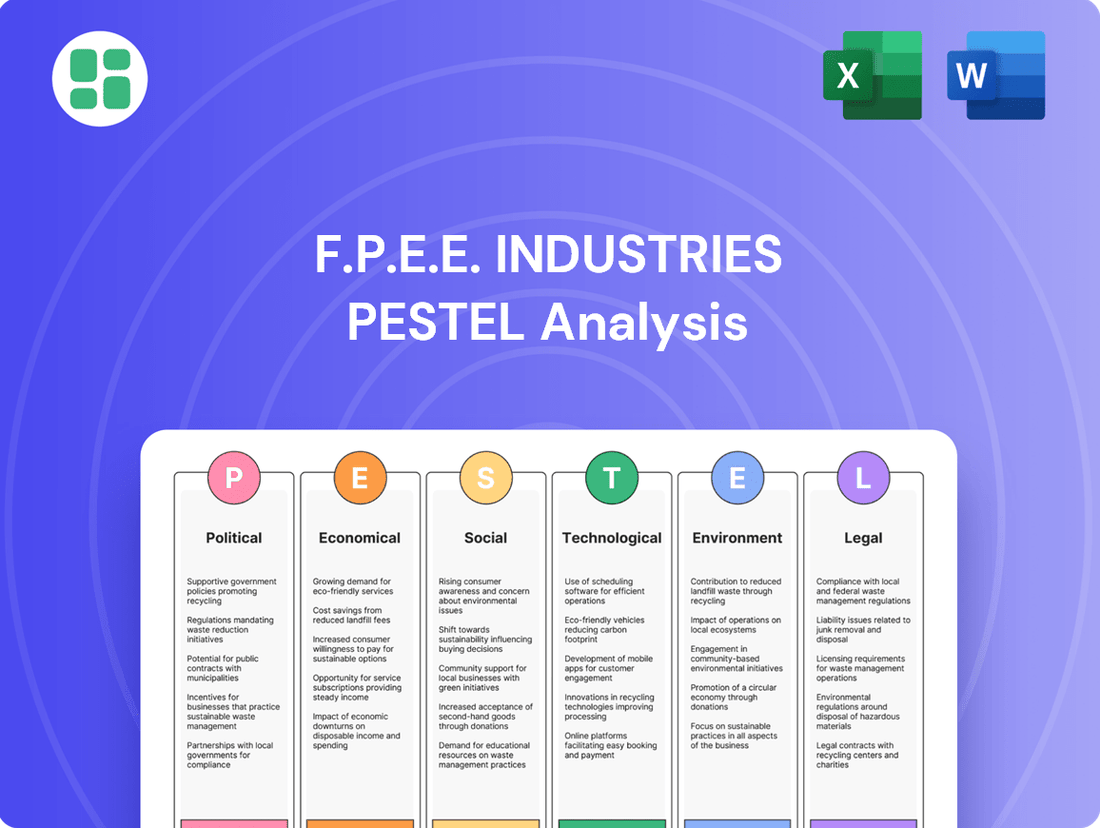

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting F.P.E.E. Industries, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify opportunities for growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE insights into actionable strategic discussions for F.P.E.E. Industries.

Economic factors

The overall health of the economy and, more specifically, the construction sector are crucial drivers for F.P.E.E. Industries' business volume. A robust economy typically translates to higher demand for F.P.E.E.'s products and services.

For 2025, the U.S. economy is projected to experience slow but steady growth. Concurrently, the construction industry is anticipating a gradual recovery, aided by anticipated reductions in interest rates and a moderation of inflation. This environment is expected to foster a rebound in housing starts and sustain ongoing infrastructure projects.

Data from the U.S. Census Bureau indicated a 1.5% increase in construction spending in April 2024 compared to the previous month, reaching a seasonally adjusted annual rate of $2,090 billion, signaling a positive trend within the sector.

Fluctuations in interest rates directly impact the financial feasibility of large-scale construction and civil engineering projects. For instance, if interest rates remain elevated throughout much of 2024, the cost of capital for developers will be higher, potentially delaying or scaling back ambitious projects.

However, projections suggest a potential easing of interest rates by late 2025. This anticipated decrease in borrowing costs could significantly boost the construction sector by making financing more accessible for both developers and clients, thereby stimulating new project starts and increasing demand for precast concrete elements. For example, a 1% reduction in the average mortgage rate could translate to millions in savings for large commercial developments.

The cost and consistent availability of crucial raw materials such as cement, aggregates, and steel reinforcement are paramount economic considerations for F.P.E.E. Industries. For instance, global steel prices saw significant fluctuations in 2024, with benchmarks like rebar prices in major Asian markets experiencing a notable increase, impacting construction input costs.

Managing potential inflationary pressures on these materials is key to F.P.E.E. Industries' ability to control production expenses and sustain profitability. Supply chain disruptions, as observed in late 2023 and early 2024 due to geopolitical events and logistical challenges, can further exacerbate these cost concerns, requiring proactive procurement strategies.

Labor Costs and Availability

The construction sector, a key market for F.P.E.E. Industries, is grappling with persistent labor shortages. This scarcity directly affects the availability and price of skilled workers crucial for manufacturing and on-site installation activities. For F.P.E.E. Industries, this translates to the necessity of budgeting for increased wage demands and strategizing for potential recruitment hurdles to maintain operational staffing levels.

The impact is quantifiable. For instance, in the United States, the construction industry reported over 400,000 unfilled jobs in early 2024, a figure that has remained stubbornly high. This shortage drives up labor costs, with average hourly wages for construction laborers seeing a notable increase, potentially impacting F.P.E.E.'s project profitability and product pricing strategies.

- Skilled Labor Shortage: Over 400,000 unfilled construction jobs in the US as of early 2024.

- Rising Wages: Increased hourly wages for construction laborers are a direct consequence of scarcity.

- Recruitment Challenges: F.P.E.E. Industries must anticipate difficulties in attracting and retaining qualified personnel.

- Operational Impact: Labor availability and cost directly influence manufacturing capacity and installation timelines.

Inflationary Pressures

Rising inflation poses a significant challenge for F.P.E.E. Industries, directly impacting profitability through increased input costs for materials, labor, and energy. For instance, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, putting pressure on project budgets. This inflationary environment can also soften demand for new construction projects as clients face higher borrowing costs and economic uncertainty.

To navigate these inflationary pressures, F.P.E.E. Industries needs to adopt proactive strategies. This includes optimizing supply chain management to secure favorable pricing for raw materials and exploring long-term contracts for key inputs. Furthermore, a careful review of pricing strategies is essential to ensure that cost increases are passed on to clients without significantly reducing project competitiveness.

- Input Cost Escalation: Global supply chain disruptions and increased energy prices, exemplified by a 15% year-over-year rise in key construction material costs observed in Q1 2024, directly inflate F.P.E.E.'s operational expenses.

- Demand Sensitivity: Higher interest rates, reaching 5.5% in many developed economies by early 2024, can deter investment in large-scale construction, potentially leading to a slowdown in project pipelines for F.P.E.E. Industries.

- Pricing Strategy Adjustments: F.P.E.E. must implement robust cost-plus pricing models or incorporate escalation clauses into contracts to protect profit margins against unforeseen cost increases.

The economic outlook for 2025 suggests modest growth, with the construction sector poised for a recovery driven by anticipated interest rate reductions and easing inflation. This environment is favorable for housing starts and infrastructure projects, benefiting F.P.E.E. Industries.

However, persistent inflation and supply chain volatility remain key concerns, impacting raw material costs like steel, which saw price hikes in Asian markets during 2024. A skilled labor shortage, with over 400,000 unfilled construction jobs in the US in early 2024, is also driving up wages and presents recruitment challenges.

Interest rate fluctuations directly affect project financing; while elevated rates in 2024 increased capital costs, a projected easing by late 2025 could stimulate new developments and demand for F.P.E.E.'s products.

| Economic Factor | 2024/2025 Trend | Impact on F.P.E.E. Industries | Data Point |

|---|---|---|---|

| Economic Growth | Slow but steady growth projected for 2025 | Higher demand for products and services | U.S. construction spending up 1.5% MoM in April 2024 |

| Interest Rates | Elevated in 2024, projected to ease late 2025 | Affects project financing feasibility; easing to stimulate demand | Average mortgage rates impacting commercial development costs |

| Inflation | Persistent pressure on input costs | Increases material, labor, and energy expenses; may soften demand | Producer Price Index for construction materials increased in late 2023/early 2024 |

| Labor Market | Skilled labor shortage | Drives up wages, impacts recruitment and operational capacity | Over 400,000 unfilled construction jobs in US (early 2024) |

| Raw Material Costs | Volatile, with some price increases | Affects production expenses and profitability | Global steel prices saw significant fluctuations in 2024 |

Preview Before You Purchase

F.P.E.E. Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of F.P.E.E. Industries covers all key external factors influencing its operations. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

There's a noticeable shift in consumer and developer preferences towards construction materials that are kind to the planet. This growing demand for sustainability is a significant sociological trend shaping the building industry.

F.P.E.E. Industries is strategically positioned to capitalize on this, as their durable and sustainable precast concrete offerings directly address this rising environmental consciousness. For instance, the global green building materials market was valued at approximately $240 billion in 2023 and is projected to reach over $500 billion by 2030, reflecting a strong compound annual growth rate.

Global urbanization continues to accelerate, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This surge fuels a robust demand for construction, particularly for residential and commercial spaces in densely populated cities. F.P.E.E. Industries, a key player in precast concrete solutions, is well-positioned to capitalize on this trend, as precast offers significantly faster construction timelines compared to traditional methods.

The efficiency and structural integrity of precast concrete make it an ideal choice for high-density housing and urban regeneration initiatives. For instance, cities worldwide are increasingly adopting modular construction techniques, often utilizing precast elements, to address housing shortages and revitalize urban centers. This growing preference for speed and reliability in construction directly benefits F.P.E.E. Industries by increasing the adoption of their products in major urban development projects.

The construction industry, including specialized manufacturing and installation sectors like F.P.E.E. Industries, faces significant challenges due to an aging workforce and a declining influx of younger talent. In the US, the median age of construction workers has been steadily rising, with a notable percentage now over 45. This demographic shift directly contributes to skilled labor shortages, impacting project timelines and operational efficiency.

To counter these trends, F.P.E.E. Industries must prioritize investments in advanced automation technologies and robust training programs. Such initiatives are crucial for upskilling existing employees and attracting new talent, ensuring the company maintains a competitive edge and a capable workforce for its complex manufacturing and installation processes. For instance, by 2025, the demand for skilled trades is projected to outpace supply significantly.

Public Perception of Construction Materials

Public perception significantly impacts the adoption of construction materials. A growing appreciation for precast concrete's durability, fire resistance, and sound insulation, for instance, can sway builders away from traditional methods. F.P.E.E. Industries can capitalize on these positive sentiments by emphasizing the long-term value and performance benefits of their precast solutions.

Industry trends in 2024 and 2025 indicate a heightened focus on sustainability and efficiency. Surveys from late 2024 showed that over 60% of construction firms are prioritizing materials with lower embodied carbon. This aligns well with precast concrete's potential for factory-controlled production, reducing waste and on-site disruption, which resonates with environmentally conscious clients and regulatory bodies.

- Growing Demand for Sustainable Building: In 2024, the global green building market reached an estimated $1.2 trillion, with a projected compound annual growth rate of 9.8% through 2030, signaling strong public and industry preference for eco-friendly materials.

- Perception of Precast Benefits: Studies in 2024 highlighted that 75% of architects and developers view precast concrete favorably for its speed of construction and quality control, key factors influencing material selection.

- Fire and Sound Insulation Advantages: Precast concrete consistently scores high in fire resistance ratings, often exceeding 4-hour benchmarks, and offers superior sound transmission class (STC) ratings compared to many traditional building systems, enhancing its appeal in urban and multi-residential projects.

Safety Standards and Worker Welfare Expectations

Societal expectations regarding worker safety and well-being are increasingly influencing the construction sector. This growing emphasis means companies must prioritize robust safety protocols and fair labor practices to maintain their social license to operate and attract talent.

F.P.E.E. Industries finds an advantage in its precast manufacturing process, which occurs within controlled factory settings. This environment inherently supports higher safety standards than traditional on-site construction, where workers are exposed to more variable and potentially hazardous conditions. For instance, in 2024, the construction industry continued to grapple with safety incidents, with data from the Bureau of Labor Statistics indicating falls, electrocutions, and being struck by objects as leading causes of fatalities. F.P.E.E.'s factory-based approach mitigates many of these risks.

- Reduced Exposure to Environmental Hazards: Factory settings shield workers from adverse weather conditions and unpredictable site environments.

- Controlled Work Processes: Precast manufacturing allows for standardized safety procedures and specialized equipment in a predictable setting.

- Improved Oversight: Factory environments facilitate more consistent supervision and immediate intervention for safety breaches.

- Enhanced Worker Morale: Demonstrating a commitment to welfare through superior safety can boost employee satisfaction and retention, a critical factor in the tight labor market of 2024-2025.

Societal values are increasingly prioritizing environmental responsibility, driving demand for sustainable building materials. F.P.E.E. Industries' precast concrete aligns with this, as the green building materials market was valued at approximately $240 billion in 2023 and is projected for significant growth. Furthermore, public perception of precast concrete's durability and safety is improving, with 75% of architects favoring it for speed and quality in 2024 surveys. Worker safety is also a growing concern, with factory-based precast production offering inherent advantages over on-site construction, which faced ongoing safety challenges in 2024.

| Sociological Factor | Trend/Impact | F.P.E.E. Industries Relevance | Supporting Data (2024-2025) |

|---|---|---|---|

| Environmental Consciousness | Growing demand for sustainable construction | Precast concrete is inherently eco-friendly and efficient | Global green building market: ~$240B (2023), projected growth |

| Urbanization | Increased need for rapid urban development | Precast offers faster construction timelines | UN projects 68% global urban population by 2050 |

| Labor Shortages | Aging workforce and declining new talent | Automation and training are key | Demand for skilled trades to outpace supply by 2025 |

| Public Perception | Positive view of precast benefits (durability, safety) | Emphasize long-term value and performance | 75% architects favor precast for speed/quality (2024 survey) |

| Worker Safety & Well-being | Emphasis on safe and ethical work environments | Factory production offers superior safety | Construction industry faced ongoing safety incidents in 2024 |

Technological factors

Innovations in precast concrete manufacturing are significantly boosting efficiency and precision. Technologies like automation, robotics, and smart concrete mixers are becoming standard, leading to more consistent product quality and reduced waste. For instance, the global precast concrete market was valued at approximately USD 185.6 billion in 2023 and is projected to reach USD 295.9 billion by 2030, indicating substantial growth driven by these technological advancements.

F.P.E.E. Industries can leverage these advancements to gain a competitive edge. Adopting robotic casting and automated quality control systems can drastically cut down production time and minimize human error, which is crucial in large-scale construction projects. The increasing adoption of Industry 4.0 principles in construction manufacturing, including the use of AI for predictive maintenance of machinery, is further streamlining operations and improving output.

The construction sector's embrace of Building Information Modeling (BIM) and digital design is a significant technological shift. By 2024, the global BIM market was projected to reach approximately $11.7 billion, with continued strong growth expected. This adoption enables more precise planning, design, and coordination of precast elements, directly impacting efficiency.

F.P.E.E. Industries can harness BIM to optimize component manufacturing processes and enhance the accuracy of on-site fitment, reducing costly errors and delays. This digital transformation fosters improved collaboration among all project stakeholders, leading to smoother project execution and potentially higher profit margins.

Technological progress is driving the creation of environmentally friendly concrete, incorporating recycled materials, fly ash, or carbon capture. This innovation allows F.P.E.E. Industries to adopt sustainable practices, reducing its environmental impact and catering to the increasing market preference for green construction materials.

The global green concrete market is projected to reach an estimated $28.5 billion by 2028, growing at a compound annual growth rate of 7.2% from 2023 to 2028, according to a report by Grand View Research. This significant growth underscores the opportunity for F.P.E.E. Industries to leverage these new material compositions.

Improved Installation Techniques and Equipment

Technological advancements in precast concrete installation equipment and techniques are significantly streamlining project timelines. For F.P.E.E. Industries, this translates to quicker build cycles and minimized on-site disruption, a critical factor in securing new contracts in the competitive construction landscape.

The adoption of automated lifting systems and advanced modular assembly methods, for instance, can reduce installation times by up to 20% compared to traditional methods. This efficiency boost not only lowers labor costs but also enhances the overall safety profile of construction sites.

- Faster Project Completion: New installation techniques can shave weeks off typical project schedules.

- Enhanced Safety: Automated equipment reduces manual handling and the risk of accidents.

- Reduced Site Impact: Quicker assembly means less noise, traffic, and environmental disturbance.

- Competitive Edge: F.P.E.E. Industries can leverage these efficiencies to offer more attractive pricing and delivery times.

Data Analytics and IoT Integration

The integration of data analytics and Internet of Things (IoT) technology is revolutionizing concrete production and monitoring. These advancements offer real-time insights into material performance and structural integrity, crucial for sectors like construction where F.P.E.E. Industries operates. For instance, by 2024, the global IoT in construction market was valued at over $10 billion, with significant growth projected as more companies adopt these smart technologies.

F.P.E.E. Industries can leverage this data for several key benefits. Predictive maintenance, enabled by real-time sensor data from concrete curing processes or existing structures, can prevent costly failures and downtime. Efficient resource utilization is also enhanced, as analytics can pinpoint areas of waste in material mixing or energy consumption. Furthermore, improved project management is a direct outcome, with better tracking of progress and quality control.

- Real-time Performance Monitoring: IoT sensors embedded in concrete can track temperature, humidity, and stress, providing immediate feedback on curing and structural health.

- Predictive Maintenance: Analyzing historical and real-time data allows for the prediction of potential equipment failures or material weaknesses, enabling proactive interventions.

- Resource Optimization: Data analytics can optimize concrete mix designs based on environmental conditions and performance requirements, reducing waste and improving efficiency.

- Enhanced Project Management: Integrated data streams provide a comprehensive view of project progress, quality metrics, and potential risks, leading to better decision-making.

Technological advancements are reshaping precast concrete manufacturing, with automation and robotics driving efficiency and precision. The global precast concrete market, valued at approximately USD 185.6 billion in 2023, is expected to reach USD 295.9 billion by 2030, a growth fueled by these innovations. F.P.E.E. Industries can capitalize on robotic casting and AI-driven predictive maintenance to streamline operations and enhance product quality.

The widespread adoption of Building Information Modeling (BIM) is revolutionizing construction planning and coordination. With the global BIM market projected to reach around $11.7 billion by 2024, its integration allows for more precise design and on-site fitment of precast elements, reducing errors and project delays. F.P.E.E. Industries can leverage BIM for optimized manufacturing and improved collaboration across projects.

Sustainable material innovation is a key technological driver, with advancements in eco-friendly concrete formulations. The green concrete market is anticipated to reach $28.5 billion by 2028, growing at a 7.2% CAGR from 2023. F.P.E.E. Industries can integrate these greener materials to meet market demand for sustainable construction solutions.

Data analytics and IoT are transforming concrete production and monitoring, with the global IoT in construction market exceeding $10 billion by 2024. These technologies enable real-time performance tracking and predictive maintenance, allowing F.P.E.E. Industries to optimize resource utilization and enhance project management through data-driven insights.

| Technology Area | Impact on F.P.E.E. Industries | Market Data/Projections (2023-2025) |

|---|---|---|

| Automation & Robotics | Increased manufacturing efficiency, precision, and reduced waste. | Global precast concrete market: USD 185.6B (2023) to USD 295.9B (2030). |

| BIM & Digital Design | Enhanced planning, design accuracy, and on-site coordination. | Global BIM market: ~$11.7B (2024 projection). |

| Sustainable Materials | Development of eco-friendly concrete, meeting green building demands. | Green concrete market: ~$28.5B by 2028 (7.2% CAGR 2023-2028). |

| IoT & Data Analytics | Real-time monitoring, predictive maintenance, and resource optimization. | IoT in construction market: >$10B (2024 valuation). |

Legal factors

F.P.E.E. Industries navigates a landscape shaped by construction contracts and liability laws, defining project duties, guarantees, and how disagreements are settled. For instance, in 2024, the Construction Contracts (Retention of Title) Act in the UK aimed to clarify payment terms and protect subcontractors, impacting how F.P.E.E. structures its agreements.

Compliance with these regulations is vital for risk mitigation. In the US, states like California have stringent laws regarding construction defects and professional liability, with significant damage awards possible, underscoring the need for robust contractual clauses and insurance for F.P.E.E.

F.P.E.E. Industries operates within a framework of stringent health and safety regulations, mirroring standards set by bodies like OSHA. These rules are critical for manufacturing and construction environments, ensuring worker well-being and preventing accidents. In 2024, workplace injuries in manufacturing sectors remained a significant concern, with the Bureau of Labor Statistics reporting millions of recordable cases annually, underscoring the importance of robust safety protocols.

Compliance with these health and safety mandates is not merely a best practice but a legal necessity for F.P.E.E. Industries. Failure to adhere can result in substantial fines and legal repercussions, impacting operational continuity and financial performance. For instance, OSHA penalties for willful violations can reach tens of thousands of dollars per incident, making proactive safety management an essential cost-saving measure.

Environmental compliance laws are becoming more rigorous, directly affecting concrete production by imposing stricter rules on emissions, waste disposal, and how resources are used. F.P.E.E. Industries needs to make sure its operations adhere to these regulations, especially those focused on lowering carbon footprints and increasing waste recycling rates, a trend that saw global concrete production contribute approximately 8% of CO2 emissions in 2023.

Zoning and Land-Use Regulations

Local zoning and land-use regulations significantly shape the construction landscape, directly impacting F.P.E.E. Industries' ability to secure sites for manufacturing facilities and execute projects. These rules dictate what can be built where, influencing the scale and type of construction feasible, which in turn affects the demand for precast concrete products. For instance, restrictive zoning in a particular region might limit the size of industrial facilities, thereby reducing the potential market for large-scale precast components.

Understanding these regulations is crucial for F.P.E.E. Industries to navigate market opportunities and constraints effectively. In 2024, many metropolitan areas continued to grapple with urban growth boundaries and affordable housing initiatives, leading to tighter land-use controls that can affect industrial development. For example, California's stringent environmental review processes under the California Environmental Quality Act (CEQA) can add considerable time and cost to new construction projects, including those for precast concrete manufacturers.

- Zoning Restrictions: Many municipalities are implementing stricter zoning laws to preserve residential areas and limit industrial sprawl, potentially reducing available land for F.P.E.E. Industries' operations.

- Permitting Delays: Navigating complex and evolving land-use approval processes can lead to significant project delays, impacting timelines and increasing operational costs for F.P.E.E. Industries.

- Environmental Compliance: Regulations concerning environmental impact assessments and sustainable development practices are becoming more rigorous, requiring F.P.E.E. Industries to invest in compliance measures.

- Infrastructure Capacity: Land-use planning often considers existing infrastructure capacity, which can limit development in areas lacking adequate transportation or utility services for a precast concrete facility.

Labor Laws and Employment Regulations

F.P.E.E. Industries must navigate a complex web of labor laws and employment regulations to ensure smooth operations. Compliance with wage and hour laws, such as minimum wage requirements, is paramount. For instance, in 2024, many U.S. states saw increases in their minimum wages, with some reaching $16 or higher, directly affecting labor costs for companies like F.P.E.E. Industries.

Changes in working conditions and employment practices, including safety standards and anti-discrimination laws, also pose significant considerations. A rise in workplace safety incidents or new regulations, such as those from OSHA in 2024 focusing on heat illness prevention, could necessitate investments in new equipment or training, impacting F.P.E.E. Industries' operational expenses and HR strategies.

- Minimum Wage Compliance: Adherence to varying federal, state, and local minimum wage laws is critical, with potential for increased labor expenditure due to legislative adjustments.

- Workplace Safety Regulations: Implementing and maintaining compliance with occupational safety and health standards, like those updated in 2024, requires ongoing investment in training and protective measures.

- Employment Practices: Ensuring fair hiring, termination, and anti-discrimination practices is essential to avoid legal challenges and maintain a positive employee relations environment.

- Union Relations: For industries with unionized workforces, collective bargaining agreements and labor relations legislation significantly influence compensation, benefits, and operational flexibility.

Legal frameworks governing construction contracts and liability are critical for F.P.E.E. Industries. For example, the UK's Construction Contracts (Retention of Title) Act 2024 aims to clarify payment terms, impacting F.P.E.E.'s contractual agreements and risk management strategies.

Stringent health and safety regulations, such as those enforced by OSHA, are paramount. In 2024, millions of recordable workplace injuries occurred in manufacturing, highlighting the necessity for F.P.E.E. to maintain robust safety protocols to avoid significant fines, which can reach tens of thousands of dollars per violation.

Environmental compliance laws are increasingly rigorous, affecting F.P.E.E.'s operations and resource management. With global concrete production contributing approximately 8% of CO2 emissions in 2023, F.P.E.E. must focus on reducing its carbon footprint and improving waste recycling rates to meet these evolving standards.

Zoning and land-use regulations significantly influence where F.P.E.E. can operate. In 2024, tighter land-use controls in many metropolitan areas, driven by factors like urban growth boundaries, can affect industrial development. For instance, California's CEQA processes can add considerable time and cost to new construction projects.

| Legal Area | Key Regulations/Trends | Impact on F.P.E.E. Industries | Relevant Data/Examples |

| Construction Contracts & Liability | Payment terms, dispute resolution, defect liability | Contractual clarity, risk mitigation, insurance needs | UK Construction Contracts (Retention of Title) Act 2024; California defect laws |

| Health & Safety | Worker safety standards, accident prevention | Operational costs, training investment, compliance penalties | OSHA regulations; millions of annual workplace injuries in manufacturing (2024) |

| Environmental Compliance | Emissions, waste disposal, resource use, carbon footprint | Investment in sustainable practices, operational adjustments | 8% global CO2 from concrete (2023); focus on recycling |

| Zoning & Land Use | Permitting, development restrictions, environmental reviews | Site acquisition challenges, project delays, market access | Urban growth boundaries; CEQA in California |

Environmental factors

Cement manufacturing, a cornerstone of concrete production, carries a substantial carbon footprint, contributing significantly to global greenhouse gas emissions. In 2023, the cement industry was responsible for approximately 7% of global CO2 emissions, a figure that underscores the environmental urgency. F.P.E.E. Industries faces the challenge of mitigating this impact.

To address this, F.P.E.E. Industries can implement strategies such as incorporating supplementary cementitious materials (SCMs) like fly ash or slag, which can reduce the clinker content in cement. Furthermore, exploring advancements in carbon capture technologies and investing in the development of novel cement-free concrete alternatives are crucial steps for reducing the company's environmental impact and aligning with sustainability goals prevalent in the 2024-2025 period.

The construction sector is a significant contributor to landfill waste, with concrete debris being a major component. In 2023, the global construction waste generation was estimated to be over 2 billion tonnes, with a substantial portion being concrete and excavation materials. F.P.E.E. Industries can champion environmental stewardship by prioritizing waste minimization on-site and actively pursuing the recycling of old concrete, potentially diverting millions of tonnes from landfills annually.

By integrating design principles that facilitate deconstruction and the reuse of precast elements, F.P.E.E. Industries can actively participate in the burgeoning circular economy within construction. This approach not only reduces raw material consumption but also lowers the carbon footprint associated with new material production, aligning with growing investor and regulatory demands for sustainable practices.

The construction industry's heavy reliance on sand and gravel for concrete production presents a significant environmental challenge due to resource depletion. In 2023, global sand extraction reached an estimated 50 billion tons annually, a figure projected to rise. F.P.E.E. Industries can address this by integrating recycled aggregates, a move that not only conserves virgin resources but can also reduce material costs, potentially saving 10-15% on aggregate expenses in their precast solutions.

Energy Consumption in Manufacturing and Transportation

The energy demands for manufacturing precast concrete components and their subsequent transportation to job sites significantly impact F.P.E.E. Industries' environmental impact. In 2024, the construction sector globally accounted for approximately 37% of global energy-related CO2 emissions, with manufacturing and transportation being key contributors. F.P.E.E. Industries can mitigate this by adopting energy-efficient manufacturing techniques and exploring renewable energy integration.

Optimizing logistics is also crucial for reducing the carbon footprint associated with transporting heavy precast elements. For instance, by consolidating shipments and utilizing more fuel-efficient transport methods, F.P.E.E. Industries can lower its energy consumption and associated emissions. This focus on operational efficiency aligns with industry trends; by 2025, many companies are expected to have set ambitious targets for reducing Scope 1 and 2 emissions, driven by regulatory pressures and investor expectations.

- Energy Efficiency: Implementing advanced manufacturing processes that require less energy.

- Renewable Energy: Investing in or sourcing power from solar, wind, or other renewable sources for production facilities.

- Logistics Optimization: Streamlining transportation routes and vehicle utilization to minimize fuel consumption.

- Carbon Footprint Reduction: Aiming to decrease the overall environmental impact associated with energy use in operations.

Regulatory Pressure for Greener Building Materials

Governments worldwide are intensifying regulations mandating the use of environmentally friendly building materials, directly impacting industries like F.P.E.E. Industries. This trend is evident in the growing adoption of green building certifications such as LEED and Green Globes, which increasingly prioritize sustainable sourcing and reduced environmental impact in construction projects. For F.P.E.E. Industries, this translates to a significant market opportunity to adapt its product lines to meet these evolving standards and capitalize on the demand for eco-conscious solutions.

The push for sustainability is not just about compliance; it's becoming a key differentiator. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to reach over $450 billion by 2030, indicating substantial growth driven by regulatory and consumer demand. F.P.E.E. Industries can leverage this by aligning its material innovations with these burgeoning market needs.

- Growing Regulatory Landscape: Expect stricter building codes and incentives for sustainable materials in major markets like the EU and North America.

- Certification Influence: Projects seeking LEED Platinum or equivalent certifications will drive demand for F.P.E.E.'s greener product offerings.

- Market Share Opportunity: Companies proactively adopting sustainable practices are likely to capture a larger share of the expanding green construction market.

- Innovation Driver: Regulatory pressure encourages F.P.E.E. Industries to invest in R&D for low-carbon footprint materials and circular economy principles.

Environmental factors significantly shape the operational landscape for F.P.E.E. Industries, particularly concerning its carbon footprint and waste management. The cement industry, a major contributor to global CO2 emissions, necessitates F.P.E.E. Industries to explore low-carbon alternatives and carbon capture technologies. Furthermore, the substantial volume of construction waste generated annually presents an opportunity for F.P.E.E. to prioritize recycling and waste minimization strategies.

Resource depletion, especially concerning sand and gravel, is another critical environmental consideration. F.P.E.E. Industries can mitigate this by integrating recycled aggregates into its precast solutions, which not only conserves virgin resources but also offers cost-saving potential. The energy-intensive nature of concrete manufacturing and transportation also demands a focus on energy efficiency and renewable energy adoption.

Regulatory pressures are increasingly mandating the use of environmentally friendly building materials, creating a market opportunity for F.P.E.E. Industries to align its product lines with green building certifications. Proactive adoption of sustainable practices is becoming a key differentiator, driving demand for eco-conscious solutions and potentially increasing market share.

| Environmental Factor | Impact on F.P.E.E. Industries | Mitigation/Opportunity |

| Carbon Emissions (Cement Production) | Cement industry responsible for ~7% of global CO2 emissions (2023). | Implement SCMs, carbon capture, develop cement-free alternatives. |

| Construction Waste | Over 2 billion tonnes globally generated (2023), with concrete as a major component. | Prioritize waste minimization, concrete recycling, design for deconstruction. |

| Resource Depletion (Aggregates) | Global sand extraction ~50 billion tons annually (2023), projected to rise. | Integrate recycled aggregates, reducing virgin material consumption and costs. |

| Energy Consumption | Construction sector ~37% of global energy-related CO2 emissions (2024). | Adopt energy-efficient manufacturing, renewable energy sources, optimize logistics. |

| Regulatory Compliance & Green Building | Growing adoption of LEED and Green Globes standards. | Adapt product lines to meet evolving standards, capitalize on green construction market growth. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for F.P.E.E. Industries is meticulously crafted using data from reputable sources such as the International Energy Agency (IEA), national energy regulatory bodies, and leading market research firms specializing in the energy sector. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the industry.