F.P.E.E. Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.P.E.E. Industries Bundle

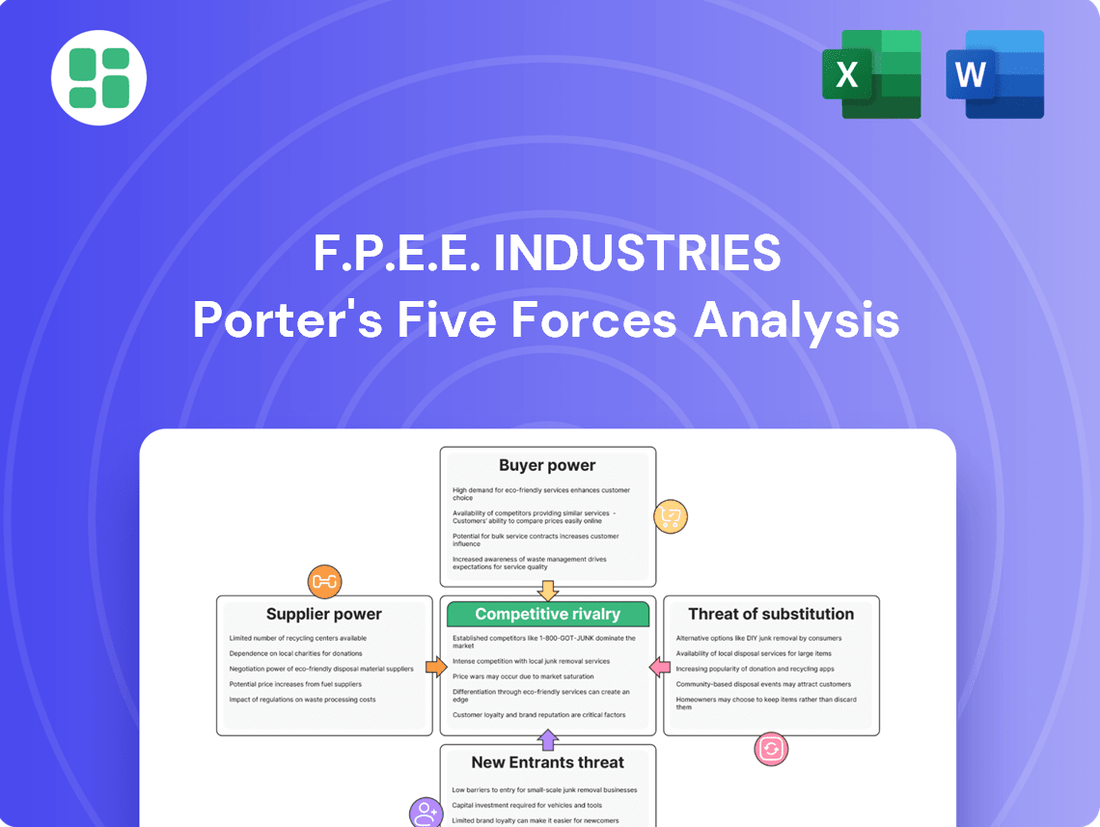

Our Porter's Five Forces analysis for F.P.E.E. Industries reveals a dynamic competitive landscape, highlighting significant pressures from rivals and the constant threat of new entrants. Understanding these forces is crucial for navigating the market effectively.

The complete report provides a detailed, force-by-force breakdown of F.P.E.E. Industries’s industry, including supplier and buyer power, and the intensity of substitute products. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers in the precast concrete industry is influenced by the concentration and uniqueness of key material providers. Major inputs like cement, aggregates (sand and gravel), and steel reinforcement are critical. In 2024, cement prices saw fluctuations, with some regions experiencing increases due to energy costs and demand, impacting the power of cement suppliers.

The industry's reliance on these fundamental materials means suppliers of cement and steel, in particular, can wield significant influence, especially when supply chains face disruptions or demand surges. For instance, global steel prices can directly affect the cost of reinforcement bars, a vital component in precast concrete, giving steel suppliers considerable leverage.

Furthermore, suppliers offering specialized molds or advanced concrete additives possess enhanced bargaining power. Their unique products, often protected by intellectual property or requiring specific manufacturing expertise, create a less competitive supplier landscape, allowing them to command higher prices or more favorable terms.

Switching suppliers for essential materials like cement and steel presents F.P.E.E. Industries with moderate to high costs. These expenses stem from the need to recalibrate production machinery, implement new quality assurance protocols, and manage potential interruptions to their manufacturing timelines. In 2024, the global average cost for retooling a production line for a new material input was estimated to be around $50,000 to $150,000, depending on the complexity of the process.

Beyond the technical adjustments, F.P.E.E. Industries also faces the financial and time investment required to build relationships with new vendors and negotiate new supply agreements. This process can involve extensive due diligence, site visits, and contract reviews, all of which add to the overall cost of supplier switching.

The availability of substitutes for a company's core inputs significantly impacts supplier bargaining power. For F.P.E.E. Industries, the primary inputs for precast concrete—cement, aggregates, and steel—have limited direct substitutes that can match their structural integrity and cost-effectiveness at the scale required for construction projects. While advancements in cementitious materials and the use of recycled aggregates are emerging, they do not yet offer a complete replacement for traditional components across all applications.

This limited substitutability means that suppliers of these essential materials hold considerable sway. For instance, the global cement market, a key input for F.P.E.E. Industries, saw production reach approximately 4.2 billion metric tons in 2023, with major producers often dictating terms due to the high capital investment and established infrastructure required for their operations. This scarcity of viable alternatives strengthens the negotiating position of existing cement, aggregate, and steel suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers forward integrating into precast concrete manufacturing for F.P.E.E. Industries is generally considered low. This is primarily because raw material suppliers typically operate with business models focused on material extraction and processing, which are fundamentally different from the complex, capital-intensive nature of precast concrete production. The significant investments in specialized machinery, design capabilities, and installation expertise required in the precast sector present a substantial barrier to entry for these suppliers.

For instance, the precast concrete industry demands advanced engineering and logistical planning, areas where raw material providers often lack the necessary competencies. In 2024, the global precast concrete market was valued at approximately $200 billion, highlighting the specialized nature of this industry that requires more than just raw material supply. Suppliers focusing on cement, aggregate, or steel reinforcement have distinct operational focuses and profit drivers that do not naturally align with the intricate manufacturing and project-specific demands of precast concrete solutions.

- Low Barrier to Entry: Suppliers typically lack the capital, specialized equipment, and technical expertise needed for complex precast manufacturing.

- Distinct Business Models: Raw material suppliers' core competencies are in extraction and processing, not in the design, engineering, and installation of precast concrete products.

- Industry Specialization: The precast concrete sector, valued at around $200 billion globally in 2024, requires specialized knowledge and infrastructure that raw material providers generally do not possess.

- High Capital Investment: Forward integration into precast production involves significant upfront costs for manufacturing facilities and advanced technology.

Impact of Input Costs on F.P.E.E.'s Profitability

Fluctuations in the prices of crucial raw materials like cement and steel directly affect F.P.E.E. Industries' production expenses and, consequently, its profit margins. For instance, in early 2024, global steel prices saw an upward trend, averaging around $750 per metric ton, a significant increase from the previous year, which would have directly pressured F.P.E.E.'s cost of goods sold.

The extent to which F.P.E.E. can absorb or pass on these escalating input costs hinges on its own leverage with customers and the overall competitive landscape. If F.P.E.E. faces strong competition, its ability to increase prices to offset higher material expenses is limited, thereby squeezing profitability.

- Raw Material Price Volatility: Cement and steel prices are subject to global supply and demand dynamics, impacting F.P.E.E.'s cost structure.

- Cost Pass-Through Ability: F.P.E.E.'s capacity to transfer increased input costs to its clients is a critical determinant of its profitability.

- Market Competition: A highly competitive market restricts F.P.E.E.'s pricing power, making it harder to maintain margins when faced with rising supplier costs.

- Supplier Concentration: A concentrated supplier base for key inputs can amplify supplier bargaining power, forcing F.P.E.E. to accept less favorable terms.

The bargaining power of suppliers for F.P.E.E. Industries is significant, primarily due to the concentrated nature of essential raw material providers and the limited availability of direct substitutes. In 2024, the global cement market, a critical input, continued to be dominated by a few large players, granting them considerable leverage. This concentration, coupled with the high switching costs for F.P.E.E., such as retooling and establishing new supplier relationships, reinforces the suppliers' strong negotiating position.

| Factor | Impact on F.P.E.E. Industries | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | High for cement and steel; moderate for aggregates | Major cement producers control significant market share. |

| Switching Costs | Moderate to high (retooling, new supplier relationships) | Estimated $50,000-$150,000 for production line recalibration. |

| Availability of Substitutes | Low for core inputs (cement, steel) | Emerging materials do not yet fully replace traditional components. |

| Threat of Forward Integration | Low | Raw material suppliers lack precast manufacturing expertise. |

What is included in the product

This analysis dissects the competitive landscape for F.P.E.E. Industries by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products.

Instantly diagnose competitive pressures with a visually intuitive F.P.E.E. Industries Porter's Five Forces analysis, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

F.P.E.E. Industries operates within the building and civil engineering sectors, where key clients are often large entities like major contractors, developers, or government bodies. These significant customers, particularly those involved in substantial infrastructure projects, possess considerable bargaining power. This strength stems from the sheer volume of their purchases and their capacity to negotiate favorable bulk pricing, directly impacting F.P.E.E.'s pricing flexibility.

Customers in the construction sector, especially those involved in major projects, exhibit significant price sensitivity. This is largely driven by the stringent budget constraints and the highly competitive nature of project bidding. For instance, in 2024, the average bid win rate for large construction projects globally often hinges on achieving cost efficiencies, with price being a primary differentiator.

This intense focus on cost means clients will actively search for the most economical options that still fulfill their technical requirements. Consequently, F.P.E.E. Industries faces considerable pressure to ensure its pricing remains competitive to secure these valuable contracts.

The bargaining power of customers for F.P.E.E. Industries is significantly influenced by the availability of substitute products. While precast concrete offers advantages like faster construction times and consistent quality, customers can opt for traditional cast-in-place concrete, steel framing, or even timber structures. This array of alternatives allows customers to exert considerable pressure on F.P.E.E. if its pricing, delivery schedules, or product specifications are not perceived as competitive.

Threat of Backward Integration by Customers

The threat of customers integrating backward into F.P.E.E. Industries' operations, such as precast concrete manufacturing, is typically low. This is primarily due to the substantial capital outlay and specialized technical knowledge needed to establish and efficiently run such facilities. For instance, the cost of setting up a modern precast concrete plant can easily run into millions of dollars, requiring significant upfront investment in land, machinery, and skilled labor.

While a few exceptionally large and vertically integrated construction firms might possess the resources and strategic imperative to consider backward integration, it remains an infrequent strategy for the majority of F.P.E.E. Industries' clientele. These behemoths might aim to control supply chains for massive, ongoing projects, but the operational complexities and the need to maintain focus on core construction competencies often outweigh the benefits.

The economies of scale enjoyed by established precast manufacturers like F.P.E.E. Industries also present a formidable barrier. These companies can produce at a lower per-unit cost due to high-volume production, making it economically challenging for individual customers to compete. For example, in 2024, the average cost per cubic meter for precast concrete can vary significantly, but large-scale producers often achieve cost efficiencies that smaller, captive operations cannot match.

- High Capital Investment: Establishing a precast concrete facility requires millions in upfront costs for equipment and infrastructure.

- Specialized Expertise: Operating such plants demands specific engineering and production knowledge.

- Economies of Scale: Established players benefit from lower per-unit costs due to high-volume production.

- Strategic Focus: Most customers prioritize their core construction business over manufacturing.

Customer's Access to Information

Customers in the building and civil engineering sectors, including those engaging with F.P.E.E. Industries, are generally quite knowledgeable. They often have access to detailed market pricing, precise product specifications, and a clear understanding of alternative suppliers. This is largely due to the nature of project tenders and the shared industry knowledge that circulates.

This readily available information significantly bolsters their bargaining power. It empowers them to effectively compare various offers, identify the most competitive options, and consequently, demand more favorable terms from F.P.E.E. Industries. For instance, in 2024, a significant portion of major construction bids saw multiple suppliers offering comparable materials, forcing companies to compete on price and service.

- Informed Bidding Processes: Project tenders commonly reveal pricing benchmarks and supplier capabilities, enabling customers to gauge fair market value.

- Product Specification Clarity: Detailed technical specifications for building materials and engineering services allow customers to compare offerings apples-to-apples.

- Supplier Comparison: The existence of numerous suppliers in the construction ecosystem allows customers to easily identify and switch between alternatives, increasing their leverage.

The bargaining power of customers for F.P.E.E. Industries is substantial, primarily due to the concentrated nature of its client base and the competitive landscape of the building and civil engineering sectors. Large clients, such as major contractors and government bodies, wield significant influence through their purchasing volume and ability to negotiate bulk discounts. This pricing sensitivity is amplified by the constant pressure to manage project budgets, a key factor in winning bids, especially in 2024 where cost efficiency often dictated contract awards.

Customers can readily switch to alternative materials like steel or timber, or even traditional cast-in-place concrete, if F.P.E.E. Industries' offerings are not perceived as competitive in terms of price, delivery, or specifications. The threat of backward integration by customers is minimal due to the high capital investment and specialized knowledge required for precast manufacturing, with new plant setups often costing millions of dollars. Furthermore, F.P.E.E.'s own economies of scale in production create a cost advantage that makes it difficult for customers to replicate internally.

Customers are typically well-informed, possessing detailed market pricing data and product specifications, which strengthens their negotiating position. This transparency, evident in the competitive bidding processes common in 2024, allows them to easily compare offers and demand favorable terms.

| Factor | Impact on F.P.E.E. Industries | Example/Data Point (2024) |

|---|---|---|

| Customer Concentration | High | Large infrastructure projects often involve a few dominant contractors. |

| Price Sensitivity | High | Bid win rates in 2024 heavily influenced by cost competitiveness. |

| Availability of Substitutes | Moderate to High | Steel, timber, and traditional concrete offer viable alternatives. |

| Threat of Backward Integration | Low | Setting up a precast plant can require millions in capital investment. |

| Customer Information | High | Tender processes and industry knowledge provide pricing benchmarks. |

Preview Before You Purchase

F.P.E.E. Industries Porter's Five Forces Analysis

This preview displays the complete F.P.E.E. Industries Porter's Five Forces Analysis, offering a thorough examination of competitive forces. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this exact, professionally formatted file, ready for your strategic planning.

Rivalry Among Competitors

The global precast concrete market is on a solid growth trajectory, with projections indicating it will reach USD 246.07 billion by 2032, expanding at a compound annual growth rate of 6.3% from 2025 to 2032. This expansion, fueled by increasing urbanization and significant infrastructure development worldwide, generally moderates competitive rivalry by creating ample opportunities for all market participants.

The precast concrete sector is populated by a diverse range of companies, from global giants like Holcim, CEMEX, and CRH, which have extensive operations and resources, to a multitude of smaller, regional, and local manufacturers. This mix means F.P.E.E. Industries faces competition from entities with significantly different market reach and strategic approaches.

In 2024, the global precast concrete market was valued at approximately $215 billion, with projections indicating continued growth. This broad market size supports a significant number of players, both large and small, intensifying the competitive landscape. For instance, CRH reported revenues exceeding $30 billion in 2023, showcasing the scale of major competitors.

The presence of these varied competitors, from diversified multinationals to niche specialists, creates a dynamic environment. Large players often leverage economies of scale and broad product portfolios, while smaller firms may compete on specialization, regional focus, or customer service, presenting distinct challenges and opportunities for F.P.E.E. Industries.

While standard precast concrete products often face intense price competition, F.P.E.E. Industries carves out a niche by focusing on highly customized solutions and unique architectural panels. This specialization allows for a degree of product differentiation, moving beyond basic commoditization. For instance, in 2024, the demand for bespoke precast facades saw a notable increase, with projects often specifying intricate designs and specialized finishes that command higher margins.

However, this differentiation is not exclusive to F.P.E.E. Industries. Competitors are actively pursuing their own unique selling propositions. Many are investing in enhanced quality control, offering greater design flexibility through advanced modeling software, and highlighting sustainable manufacturing processes. Furthermore, some rivals are integrating services, providing a seamless experience from initial design consultation through to final on-site installation, thereby competing on a broader service spectrum.

Exit Barriers

High capital investment in manufacturing facilities, specialized equipment, and long-term contracts creates substantial exit barriers in the precast concrete industry. This can trap companies in a market even when profitability is low, intensifying competitive rivalry.

For instance, a typical precast concrete plant might require an initial investment of $10 million to $50 million, depending on scale and specialization. These fixed costs make it economically unfeasible for many firms to simply shut down operations and exit the market.

- High Capital Investment: The significant upfront costs for specialized machinery, molds, and production lines act as a major deterrent to leaving the industry.

- Specialized Equipment: Precast concrete production often involves custom-designed equipment that has little to no resale value outside the industry.

- Long-Term Contracts: Many precast concrete suppliers are bound by multi-year contracts with construction firms or government projects, obligating them to continue production regardless of immediate market conditions.

- Reluctance to Exit: Consequently, companies may choose to continue operating at reduced capacity or lower margins rather than abandon their substantial investments, leading to sustained competitive pressure.

Industry Cost Structure

The precast concrete sector is inherently capital-intensive, demanding substantial investment in specialized machinery and plant infrastructure. This high fixed cost base necessitates large-scale production to spread costs effectively and achieve economies of scale. For instance, major precast concrete manufacturers often operate facilities costing tens of millions of dollars to build and equip.

This cost structure naturally drives a focus on volume. Companies aim to maximize their production output to lower the per-unit cost. In 2024, the industry saw continued efforts by players to secure large contracts and maintain high capacity utilization rates, often leading to competitive bidding.

- High Capital Investment: Significant upfront costs for plants and equipment.

- Economies of Scale: Lower per-unit costs achieved through high-volume production.

- Capacity Utilization: Focus on maximizing output to cover fixed expenses.

- Price Competition: Potential for aggressive pricing to secure sales and utilize capacity.

Competitive rivalry within the precast concrete market is robust, influenced by a diverse player base ranging from global giants like Holcim and CEMEX to smaller, specialized firms. While the overall market growth, projected to reach $246.07 billion by 2032, offers opportunities, the sheer number and varied capabilities of competitors intensify pressure. For instance, CRH's 2023 revenues exceeding $30 billion highlight the scale of major players, who often leverage economies of scale and broad portfolios.

| Competitor | Approximate 2023 Revenue (USD billions) | Market Focus |

| Holcim | ~30 | Global Infrastructure & Construction Solutions |

| CEMEX | ~15 | Building Materials & Solutions |

| CRH | ~30+ | Building Products & Materials |

SSubstitutes Threaten

The threat of substitutes in the precast concrete industry is significant, particularly concerning traditional construction methods. Cast-in-place concrete, steel structures, and timber framing each present a distinct price-performance trade-off. While precast concrete excels in speed and controlled quality, these alternatives can be more economical for specific project sizes or designs, or simply preferred due to long-standing industry familiarity and available expertise.

Customer propensity to switch to substitute materials is a significant factor for F.P.E.E. Industries. This inclination is shaped by project timelines, the availability of skilled labor, and on-site conditions. Furthermore, the growing emphasis on sustainable and modular construction practices directly impacts customer choices. For instance, in 2024, the global modular construction market was valued at approximately $90 billion, indicating a strong customer interest in alternative building methods.

F.P.E.E. Industries can effectively counter this threat by highlighting the inherent durability and sustainability of its precast concrete solutions. By offering products that align with the increasing demand for eco-friendly and efficient building techniques, the company can solidify its market position and reduce the likelihood of customers opting for substitutes.

The construction sector is witnessing a surge in novel materials, including cross-laminated timber (CLT), geopolymers, hempcrete, and advanced composites. These innovations, while not always direct substitutes for every precast concrete application, can increasingly replace specific structural or design elements, presenting a growing, albeit long-term, threat to traditional precast solutions.

Switching Costs for Customers

The threat of substitutes for F.P.E.E. Industries' precast concrete products is somewhat mitigated by customer switching costs. When a customer decides to move from precast concrete to alternative building materials, they often incur expenses related to redesigning their project, adapting to different construction methodologies, acquiring new labor skills, and potentially facing project delays. For instance, a shift from precast concrete panels to traditional brick and mortar might necessitate changes in structural engineering and on-site labor requirements, impacting project timelines and budgets.

These inherent switching costs act as a barrier, making it less appealing for customers to abandon precast concrete, particularly once a project has progressed beyond the initial design phase and is already specified for precast components. This inertia, driven by the financial and operational implications of changing materials mid-project, helps to solidify F.P.E.E. Industries' market position against substitutes.

- Redesign Expenses: Altering architectural and engineering plans to accommodate different materials can cost tens of thousands of dollars, depending on project complexity.

- New Construction Techniques: Adopting methods like traditional masonry or timber framing requires different equipment and expertise compared to precast installation.

- Labor Skill Adaptation: The construction industry in 2024 continues to face a skilled labor shortage, and retraining or hiring for new techniques adds to project costs and timelines.

- Potential Project Delays: Introducing new materials and processes can lead to schedule overruns, impacting overall project profitability and client satisfaction.

Perceived Value of Precast Concrete

The perceived value of precast concrete significantly influences its ability to withstand substitute threats. Its inherent durability and sustainability are key selling points, appealing to a growing demand for eco-friendly and long-lasting construction solutions. For instance, precast concrete often boasts a longer lifespan than traditional cast-in-place methods, reducing the need for frequent repairs and replacements.

F.P.E.E. Industries can effectively mitigate the threat of substitutes by highlighting these core advantages. Emphasizing superior quality control, achieved through factory production, directly addresses concerns about on-site variability. Furthermore, the accelerated construction timelines offered by precast elements, often reducing project duration by 20-30%, are highly attractive in competitive markets.

Key value propositions for precast concrete include:

- Durability and Longevity: Precast concrete structures are engineered for resilience, often outperforming traditional methods in terms of lifespan and resistance to environmental factors.

- Sustainability Credentials: Reduced waste generation during manufacturing and potential for recycled content contribute to a lower environmental footprint, aligning with green building initiatives.

- Controlled Quality: Factory-controlled production ensures consistent material properties and dimensional accuracy, leading to higher overall project quality.

- Reduced Construction Time: Prefabricated components significantly shorten on-site assembly, leading to faster project completion and lower labor costs.

The threat of substitutes for F.P.E.E. Industries' precast concrete products remains a significant consideration, influenced by evolving construction materials and customer preferences. While traditional alternatives like steel and timber persist, newer innovations in modular construction and advanced composites are gaining traction. In 2024, the global modular construction market, a key area where substitutes are prevalent, was valued at approximately $90 billion, underscoring the competitive landscape.

F.P.E.E. Industries can effectively counter this threat by emphasizing the unique value propositions of precast concrete, such as its durability, controlled quality, and accelerated construction timelines. In 2024, projects utilizing precast concrete often saw construction time reductions of 20-30% compared to traditional methods, a compelling advantage for clients prioritizing efficiency.

The perceived value of precast concrete, rooted in its longevity and sustainability, plays a crucial role in mitigating substitute threats. Precast concrete structures frequently offer a longer service life than conventional construction, minimizing long-term maintenance costs for owners. This inherent resilience, coupled with factory-controlled production ensuring consistent quality, positions precast concrete favorably against less predictable alternatives.

| Substitute Material | Key Advantages | Potential Drawbacks for F.P.E.E. Customers | 2024 Market Trend Indicator |

|---|---|---|---|

| Steel Structures | High strength-to-weight ratio, speed of erection | Corrosion susceptibility, higher initial cost for some applications | Continued strong demand in commercial and high-rise construction |

| Timber Framing (including CLT) | Sustainability, lighter weight, aesthetic appeal | Fire resistance concerns, potential for warping/decay, limited span capabilities for some types | Growing interest in sustainable building, increasing adoption of CLT in mid-rise structures |

| Modular Construction | Rapid on-site assembly, controlled environment manufacturing | Design limitations, transportation challenges for large modules, potential for less customization | Estimated global market value of $90 billion in 2024, indicating significant growth and adoption |

Entrants Threaten

Entering the precast concrete manufacturing sector demands considerable financial commitment. Businesses need to invest in land for facilities, specialized machinery for production, numerous molds for various product shapes, and a fleet of trucks for delivery. For example, a new precast plant in 2024 could easily see initial setup costs ranging from $10 million to $50 million or more, depending on scale and automation levels.

This significant upfront capital requirement acts as a formidable barrier. It effectively limits the number of new companies that can realistically enter the market, thereby protecting existing players from a flood of fresh competition.

Established players in industries like F.P.E.E. Industries often leverage significant economies of scale. This means they can produce goods or services at a lower per-unit cost due to high production volumes, bulk purchasing of raw materials, and optimized distribution networks. For example, in 2024, major automotive manufacturers achieved production cost reductions of up to 15% per vehicle through advanced automation and large-scale component sourcing.

New entrants face a considerable hurdle in matching these cost efficiencies. Without the existing infrastructure and high sales volumes, they would find it challenging to compete on price from the outset. This cost disadvantage can deter potential new companies from entering the market, as they would need substantial upfront investment to even approach the cost structures of incumbents.

F.P.E.E. Industries has cultivated strong, long-standing relationships with key contractors and civil engineering firms. This access is crucial, as it guarantees a steady flow of project opportunities and ensures reliable distribution and delivery of their products and services within the construction sector.

For any new company looking to enter the F.P.E.E. market, replicating these established distribution networks would be a significant hurdle. Building trust and securing partnerships with these vital industry players takes considerable time and effort, presenting a substantial barrier to entry.

Regulatory and Permitting Hurdles

The construction materials sector, encompassing precast concrete, faces a significant threat from new entrants due to stringent regulatory and permitting hurdles. Compliance with evolving building codes, rigorous quality standards, and diverse environmental regulations necessitates substantial investment and expertise. For instance, in 2024, the average time to obtain major building permits in the United States remained a considerable barrier, often extending beyond six months and involving multiple agency approvals, thereby increasing upfront costs and delaying market entry for potential competitors.

Navigating these complex permitting processes is a major deterrent. New companies must dedicate resources to understanding and adhering to local, state, and federal requirements, which can vary significantly by jurisdiction. This added layer of complexity and the associated expenses create a substantial barrier, making it more challenging for new players to establish a foothold against established firms that are already compliant and familiar with the regulatory landscape.

- Complex Permitting: New entrants must secure numerous permits, often involving lengthy review periods.

- Compliance Costs: Meeting building codes and environmental standards adds significant upfront expenses.

- Regulatory Uncertainty: Changes in regulations can introduce unforeseen costs and delays.

- Time to Market: The combined effect of permitting and compliance can significantly extend the time it takes for a new firm to become operational.

Brand Loyalty and Differentiation

Brand loyalty, while not as pronounced as in consumer sectors, is a significant barrier for new entrants into F.P.E.E. Industries. Established players have cultivated reputations for quality, reliability, and successful project execution, fostering trust among clients. For instance, in 2024, F.P.E.E. Industries reported a client retention rate of 92%, underscoring the strength of these existing relationships.

Newcomers would need substantial investment in marketing and a proven track record to challenge this incumbency advantage. Demonstrating superior performance, perhaps through innovative technologies or cost efficiencies, would be crucial to sway potential customers. The cost of building such trust and recognition can be prohibitive, effectively deterring many aspiring competitors.

- Established Reputation: F.P.E.E. Industries benefits from years of consistent delivery, building a strong foundation of client confidence.

- Client Retention: A high client retention rate, such as F.P.E.E.'s 92% in 2024, signifies the difficulty new entrants face in acquiring and keeping customers.

- Marketing Investment: Overcoming brand loyalty necessitates significant marketing expenditure to build awareness and credibility.

- Performance Demonstration: New entrants must offer demonstrably better quality, reliability, or value to attract clients away from established firms.

The threat of new entrants into the precast concrete manufacturing sector, which F.P.E.E. Industries operates within, is generally moderate. High capital requirements, estimated at $10 million to $50 million for a new plant in 2024, and established economies of scale for incumbents present significant financial hurdles. Furthermore, strong customer relationships and complex regulatory environments, with permit processes often exceeding six months in 2024, add further layers of difficulty for potential newcomers.

| Barrier Type | Description | Impact on New Entrants | 2024 Data/Example |

|---|---|---|---|

| Capital Requirements | Significant investment needed for land, machinery, molds, and delivery fleet. | High barrier, limiting the number of new entrants. | $10M - $50M+ for a new plant. |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to high production volumes. | New entrants struggle to compete on price initially. | Up to 15% cost reduction for large manufacturers. |

| Distribution Networks | Established relationships with contractors and engineering firms are crucial. | Replicating these networks is time-consuming and difficult. | Long-standing partnerships are key to project flow. |

| Regulatory Hurdles | Compliance with building codes, quality standards, and environmental regulations. | Adds significant upfront costs and delays market entry. | Permit acquisition often exceeds six months. |

| Brand Loyalty/Reputation | Established players have reputations for quality and reliability. | Newcomers need substantial marketing and proven track records. | F.P.E.E. Industries reported a 92% client retention rate in 2024. |

Porter's Five Forces Analysis Data Sources

Our F.P.E.E. Industries Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available financial statements, industry-specific market research reports, and government regulatory filings. This comprehensive approach ensures a thorough understanding of the competitive landscape.