Formosa Petrochemical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Formosa Petrochemical Bundle

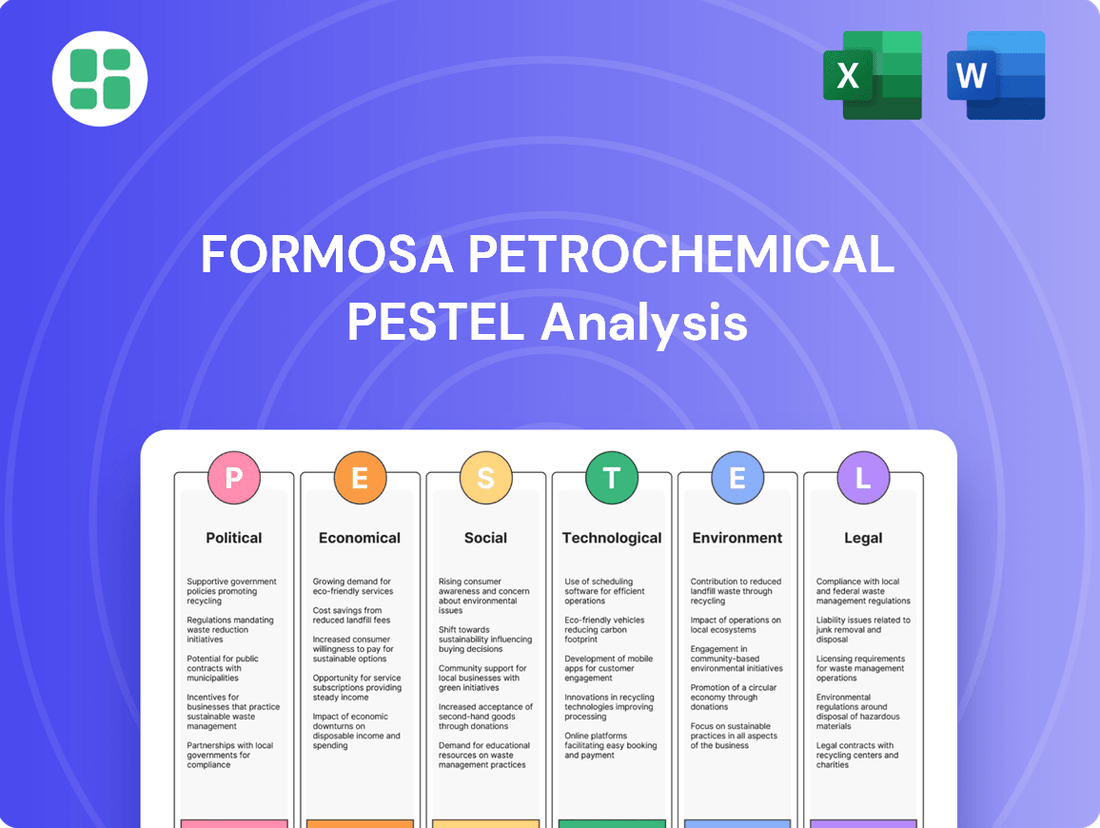

Navigate the complex external forces impacting Formosa Petrochemical with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, environmental regulations, and socio-cultural trends are shaping its operational landscape. Gain a strategic advantage by identifying opportunities and mitigating risks.

Unlock critical insights into Formosa Petrochemical's operating environment. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that influence its strategic decisions and market position. Empower your business planning and investment strategies with this essential intelligence.

Stay ahead of the curve with our expertly crafted PESTLE analysis for Formosa Petrochemical. Discover how global trends in technology, sustainability, and geopolitical stability present both challenges and opportunities for the company. Download the full report to gain actionable insights for your own strategic planning.

Political factors

Taiwan's government has outlined a significant shift in its energy landscape, aiming for 20% renewable energy generation by 2026, a slight delay from the original 2025 target. This strategic pivot, which also involves increasing reliance on natural gas while phasing out coal and nuclear power, directly influences Formosa Petrochemical's operational costs and the availability of key feedstocks.

Formosa Petrochemical must therefore integrate these evolving national energy directives into its long-term planning to maintain regulatory adherence and operational sustainability. For instance, the increasing demand for natural gas as a transition fuel could present both opportunities and challenges for the company's supply chain and pricing strategies.

Geopolitical tensions, especially in the Middle East, directly affect crude oil supply, a key input for Formosa Petrochemical. For instance, the ongoing conflict in the Red Sea, which began in late 2023, has rerouted many oil tankers, increasing shipping times and costs. This instability can lead to price volatility for crude oil, impacting Formosa Petrochemical's raw material expenses and overall profitability.

Cross-strait relations with China also pose significant risks. Any escalation in tensions could disrupt shipping lanes vital for Formosa Petrochemical's imports and exports. In 2024, trade between Taiwan and China remained substantial, with China being a major destination for Taiwanese petrochemical products, highlighting the vulnerability of these trade flows to political changes.

Formosa Petrochemical's reliance on international trade means it's highly susceptible to shifts in trade policies and tariffs. For example, potential trade disputes or the imposition of new tariffs on petrochemical goods by major importing nations could impact the company's market access and competitiveness. Navigating these complex international relations is crucial for securing raw materials and maintaining global market reach.

Taiwan's government is actively pursuing industrial policies aimed at attracting high-end manufacturing and reshaping global technology supply chains. This strategic focus can create both opportunities and challenges for established sectors like petrochemicals.

Formosa Petrochemical, as a key player in Taiwan's economy, is directly impacted by these policies. Government incentives for advanced industries might divert resources or create new competitive pressures, influencing the company's expansion strategies and investment decisions. For instance, Taiwan's National Development Fund has been instrumental in supporting key technology sectors, potentially shifting investment priorities away from traditional industries.

Carbon Pricing and Climate Legislation

Taiwan's Climate Change Response Act, effective from 2024, introduces a carbon fee system. This means companies like Formosa Petrochemical will face financial implications for their emissions, with payments for 2024 emissions due in 2025 and for 2025 emissions starting in May 2026.

The overarching goal of this legislation is to achieve net-zero emissions by 2050. This national commitment directly translates into increased operational costs for industries with significant carbon footprints, such as the petrochemical sector.

- Carbon Fee Implementation: Payments for 2024 emissions are due in 2025, and for 2025 emissions, payments commence in May 2026.

- Net-Zero Target: Taiwan aims for net-zero emissions by 2050, creating a strong regulatory push for decarbonization.

- Cost Impact: The carbon fee system is expected to raise operational expenses for high-emitting industries like Formosa Petrochemical.

- Mitigation Strategy: Formosa Petrochemical needs to adopt proactive emission reduction strategies to manage these costs and adhere to national climate goals.

Regulatory Environment and Compliance

The political landscape strongly influences Formosa Petrochemical through its commitment to enforcing environmental and safety regulations. For instance, upcoming amendments to the 'Regulations on the Management of Toxic Chemical Substances,' set to take effect in June 2025, will necessitate significant operational adjustments and potential capital investments for the company to ensure compliance. This evolving legal framework directly impacts how Formosa Petrochemical manages emissions, waste disposal, and the handling of hazardous materials, with non-compliance risking substantial penalties and jeopardizing its operational permits.

Formosa Petrochemical must remain agile in adapting to these shifting regulatory requirements to maintain its social license to operate and avoid costly legal repercussions. The political will to uphold these standards is a critical factor, as demonstrated by the increased scrutiny on industrial safety following incidents in the petrochemical sector. For 2024, companies like Formosa Petrochemical are allocating substantial budgets towards environmental, social, and governance (ESG) compliance, with projections indicating this trend will continue into 2025 as regulations tighten globally.

- June 2025: Effective date for amendments to 'Regulations on the Management of Toxic Chemical Substances'.

- Increased Scrutiny: Political focus on industrial safety and environmental protection in the petrochemical sector.

- ESG Investment: Growing corporate expenditure on ESG compliance, expected to rise through 2025.

- Operational Adaptation: Necessity for Formosa Petrochemical to adjust processes for emissions, waste, and chemical handling.

Taiwan's commitment to a greener energy future, targeting 20% renewables by 2026 and phasing out coal, directly impacts Formosa Petrochemical's feedstock costs and operational planning. Geopolitical instability, particularly in the Middle East, affects crude oil prices and shipping, with Red Sea rerouting increasing costs in late 2023. Cross-strait tensions with China remain a risk to vital trade flows, as China was a major destination for Taiwanese petrochemicals in 2024.

| Political Factor | Impact on Formosa Petrochemical | 2024/2025 Data/Trend |

| Energy Policy Shift | Increased natural gas reliance, potential feedstock cost changes. | 20% renewable energy target by 2026. |

| Geopolitical Tensions | Crude oil price volatility, increased shipping costs. | Red Sea rerouting impacting oil tanker routes since late 2023. |

| Cross-Strait Relations | Risk to exports to China, a key market. | Substantial trade volume in 2024, vulnerable to political shifts. |

| Trade Policies | Potential impact on market access and competitiveness. | Ongoing global trade negotiations and tariff considerations. |

| Environmental Regulations | Increased operational costs due to carbon fees and stricter chemical management. | Carbon fee payments for 2024 emissions due in 2025; amendments to toxic chemical regulations effective June 2025. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Formosa Petrochemical, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

A clear, concise PESTLE analysis for Formosa Petrochemical offers a readily digestible overview, alleviating the pain of sifting through complex data for strategic decision-making.

Economic factors

Fluctuations in global crude oil prices are a major concern for Formosa Petrochemical. These swings directly impact the cost of their primary raw material and, consequently, their refining profit margins. For instance, if crude oil prices spike, Formosa Petrochemical’s input costs rise, potentially squeezing their ability to profit from refining operations.

Looking ahead to 2025, forecasts suggest Brent crude prices might average lower than 2024 levels. This projected dip is largely attributed to OPEC+ production decisions and anticipated shifts in global demand for oil. A sustained period of lower oil prices could offer Formosa Petrochemical a cost advantage.

Formosa Petrochemical's financial performance is exceptionally sensitive to these oil price movements. To navigate this volatility, the company relies on sophisticated hedging strategies to lock in prices and maintain efficient supply chain management. These measures are crucial for mitigating risks and ensuring stable profitability amidst unpredictable market conditions.

The global petrochemical market is seeing steady demand, especially for plastics in the Asia-Pacific region, with projections indicating continued growth. For instance, the global plastics market was valued at approximately USD 650 billion in 2023 and is expected to grow at a compound annual growth rate of around 3.5% through 2030.

Despite this demand, persistent oversupply in key products like ethylene and propylene is putting pressure on profit margins. This oversupply situation means that Formosa Petrochemical needs to be very strategic about how much it produces and sells.

Formosa Petrochemical's success hinges on its ability to closely track these global and regional supply-demand shifts. By understanding these dynamics, the company can better adjust its production levels and sales approaches to navigate market fluctuations effectively.

Global economic growth is a primary driver for petrochemical demand. Projections suggest a moderate global growth rate of approximately 2.8% for 2025. This expansion directly correlates with industrial output, as petrochemicals are foundational to manufacturing across numerous sectors, from automotive to packaging.

A deceleration in key global economies or a downturn in industrial production can significantly dampen demand for Formosa Petrochemical's products. For instance, if major manufacturing hubs experience reduced activity, the need for plastics, synthetic fibers, and other petrochemical derivatives will likely fall, impacting sales volumes and pricing power.

Formosa Petrochemical's financial health is therefore closely tied to the vitality of global manufacturing and the broader consumer goods market. A robust expansion in these areas typically translates to increased orders and better financial performance for the company.

Exchange Rate Fluctuations

Formosa Petrochemical's financial performance is significantly influenced by exchange rate fluctuations, especially between the Taiwan Dollar (TWD) and the US Dollar (USD). As a major player in importing crude oil and exporting petrochemical goods, the company's profitability is directly tied to these currency movements.

For instance, a stronger TWD against the USD would make imported crude oil cheaper but could reduce the revenue from USD-denominated exports when converted back to TWD. Conversely, a weaker TWD would increase the cost of imported raw materials while potentially boosting export revenues. This volatility creates a dynamic risk that management must actively navigate.

- Taiwan Dollar vs. US Dollar Volatility: Formosa Petrochemical's reliance on USD-denominated oil imports and its export sales make it highly susceptible to TWD/USD exchange rate shifts.

- Impact on Costs and Revenues: A stronger TWD can lower raw material costs but decrease export earnings in local currency, while a weaker TWD has the opposite effect.

- 2024/2025 Outlook: Analysts predict continued exchange rate volatility in 2024 and 2025, driven by global economic conditions and monetary policy differences between Taiwan and the US, posing ongoing challenges for Formosa Petrochemical.

Refining Margins and Capacity Utilization

The refining industry is currently grappling with narrow margins, a situation exacerbated by subdued demand for refined petroleum products and an increase in global refining capacity. This environment makes it challenging for companies like Formosa Petrochemical to maintain healthy profitability.

Formosa Petrochemical has already responded to these weak margins by reducing its operational run rates. Additionally, planned maintenance activities have further impacted its capacity utilization, highlighting the pressures on its refining operations.

In this competitive landscape, optimizing capacity utilization and enhancing refining efficiency are absolutely crucial for Formosa Petrochemical to safeguard its profitability. These operational improvements are key to navigating the current market conditions.

- Tight Margins: Global refining margins have been under pressure, with some benchmarks for refining profit dipping significantly in early 2024 compared to the previous year. For instance, the Singapore refining margin, a key indicator, saw a notable decline in Q1 2024.

- Capacity Expansion: New refining capacity, particularly in Asia and the Middle East, continues to come online, increasing the overall supply and intensifying competition.

- Formosa's Response: Formosa Petrochemical, like other players, has adjusted its operations. In late 2023 and early 2024, the company reported lower utilization rates at its Taiwanese facilities due to margin economics and scheduled maintenance.

- Efficiency Focus: Improving energy efficiency and feedstock flexibility are paramount for refiners to reduce operating costs and enhance their competitiveness in a market characterized by thin margins.

Global economic growth directly fuels petrochemical demand, with projections for 2025 indicating a moderate expansion of around 2.8%. This growth is vital as petrochemicals are fundamental to numerous manufacturing sectors. A slowdown in major economies or industrial output can significantly reduce demand for Formosa Petrochemical's products, impacting sales and pricing power.

Exchange rate volatility, particularly between the Taiwan Dollar (TWD) and the US Dollar (USD), presents a significant challenge for Formosa Petrochemical. Fluctuations affect both raw material import costs and export revenues. Analysts anticipate continued exchange rate instability through 2024 and 2025, driven by global economic conditions and differing monetary policies.

The refining sector faces persistent pressure from narrow margins, a situation worsened by subdued product demand and increased global refining capacity. Formosa Petrochemical has responded by reducing operational run rates and undertaking planned maintenance, underscoring the need for enhanced efficiency to maintain profitability in this competitive environment.

| Economic Factor | Impact on Formosa Petrochemical | 2024/2025 Data/Outlook |

|---|---|---|

| Global Economic Growth | Drives petrochemical demand; slowdown reduces sales. | Projected 2.8% global growth for 2025. |

| Exchange Rate Volatility (TWD/USD) | Affects import costs and export revenues. | Continued volatility expected due to global economic conditions and monetary policies. |

| Refining Margins | Narrow margins pressure profitability; requires operational efficiency. | Margins remain tight; new capacity additions in Asia intensify competition. |

Preview Before You Purchase

Formosa Petrochemical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Formosa Petrochemical PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping its strategic landscape.

You'll gain insights into government regulations, market trends, consumer behavior, technological advancements, legal frameworks, and environmental concerns relevant to Formosa Petrochemical's operations.

Sociological factors

Public awareness of environmental issues, like plastic waste and greenhouse gas emissions, is growing significantly. This heightened concern is pushing petrochemical companies, including Formosa Petrochemical, to prioritize more sustainable operations. For instance, by 2024, global plastic waste generation was projected to reach over 250 million metric tons annually, highlighting the urgency.

Formosa Petrochemical is subject to increasing societal expectations for corporate social responsibility. Meeting these expectations is crucial for maintaining a positive brand image and its social license to operate, especially as consumers and investors increasingly favor environmentally conscious businesses. A 2025 survey indicated that over 70% of consumers consider a company's environmental impact when making purchasing decisions.

Formosa Petrochemical faces significant societal pressure to uphold stringent workforce health and safety standards, a crucial aspect given the inherent risks in petrochemical operations. In 2023, the petrochemical industry globally reported a lost-time injury frequency rate (LTIFR) of approximately 0.9 per million hours worked, highlighting the ongoing challenge of minimizing workplace accidents. Failure to meet these expectations can result in severe public criticism, increased regulatory oversight, and a negative impact on employee trust and loyalty.

Stakeholders, including investors and the general public, are increasingly scrutinizing companies like Formosa Petrochemical for robust Corporate Social Responsibility (CSR) initiatives that go beyond basic legal compliance. These expectations now encompass active community involvement, adherence to stringent ethical standards, and clear, transparent reporting on the company's social footprint.

Formosa Petrochemical has publicly committed to sustainable development principles and strong corporate governance, aiming to align its operations with societal expectations. For instance, in 2023, the company reported investments in community programs and environmental stewardship projects, demonstrating a proactive approach to its social license to operate.

Consumer Demand for Sustainable Products

Consumers are increasingly prioritizing environmentally friendly and sustainable goods, which in turn influences downstream sectors to seek out greener raw materials. This shift directly impacts petrochemical companies like Formosa Petrochemical, signaling a need to adapt their product portfolios and manufacturing processes to align with these evolving market expectations. By 2024, consumer surveys indicated that over 60% of global consumers were willing to pay more for sustainable products, a figure expected to climb further in 2025.

This growing demand compels Formosa Petrochemical to strategically invest in research and development. Key areas of focus include exploring bio-based feedstocks as alternatives to traditional fossil fuels, advancing chemical recycling technologies to create a circular economy for plastics, and developing biodegradable plastic alternatives. These investments are crucial for maintaining market relevance and capturing a larger share of the growing green economy.

- Growing Consumer Preference: Over 60% of global consumers willing to pay more for sustainable products in 2024.

- Industry Pressure: Downstream industries are actively seeking greener raw materials, influencing supply chain demands.

- R&D Investment Focus: Formosa Petrochemical is channeling resources into bio-based feedstocks, chemical recycling, and biodegradable plastics.

- Market Adaptation: These initiatives are essential for Formosa Petrochemical to meet evolving market needs and remain competitive.

Demographic Shifts and Urbanization

Global demographic shifts, with a projected population reaching 8.1 billion by 2025, are a significant driver for Formosa Petrochemical. Increasing urbanization, with over 57% of the world's population living in urban areas in 2023, directly fuels demand for petrochemical products essential for construction, transportation, and everyday consumer goods.

Formosa Petrochemical is well-positioned to capitalize on this trend, especially in Asia. For instance, the Asian Development Bank projected that by 2025, urbanization in developing Asia would reach approximately 55%, creating a robust market for the company's output in materials like plastics and synthetic fibers.

- Population Growth: The global population is expected to surpass 8 billion by 2025, increasing the fundamental need for energy and materials.

- Urbanization Rate: Over half the world's population resides in urban areas, a figure projected to climb, boosting demand for infrastructure and manufactured goods.

- Asian Demand: Developing economies in Asia, with rising middle classes and rapid urbanization, represent a key growth market for petrochemicals.

Societal pressure for Formosa Petrochemical to adopt sustainable practices is intensifying, driven by growing awareness of environmental issues like plastic waste, which was projected to exceed 250 million metric tons annually by 2024. Consumers increasingly factor a company's environmental impact into purchasing decisions, with over 70% considering it by 2025, pushing Formosa to invest in R&D for bio-based feedstocks and recycling technologies.

Formosa Petrochemical faces heightened expectations for corporate social responsibility, demanding active community involvement and transparent reporting beyond legal compliance. The company's commitment to sustainable development, evidenced by its 2023 investments in community and environmental projects, is vital for maintaining its social license to operate and positive brand image.

The global demographic shift, with the population projected to reach 8.1 billion by 2025 and urbanization exceeding 57% in 2023, directly fuels demand for petrochemical products. Asia, in particular, presents a significant growth market, with urbanization in developing Asia expected to reach around 55% by 2025, creating strong demand for materials like plastics and synthetic fibers.

| Sociological Factor | Trend/Expectation | Impact on Formosa Petrochemical | Supporting Data (2023-2025) |

|---|---|---|---|

| Environmental Awareness | Increased demand for sustainable products and operations | Drives investment in R&D for greener alternatives (bio-based feedstocks, recycling) | 250M+ metric tons plastic waste projected annually (2024); 70%+ consumers consider environmental impact (2025) |

| Corporate Social Responsibility (CSR) | Expectation for proactive community engagement and ethical practices | Necessitates transparent reporting and investment in social initiatives to maintain reputation | Company reports investments in community programs and environmental stewardship (2023) |

| Demographic Shifts | Growing global population and urbanization | Increases demand for petrochemical products in construction, transport, and consumer goods | Global population to reach 8.1B (2025); 57%+ global population urbanized (2023); 55% urbanization in developing Asia (2025 projection) |

Technological factors

Technological advancements are reshaping the refining and petrochemical industries. Innovations in catalysis and process optimization are key to boosting efficiency, increasing product yields, and lowering energy usage. For instance, companies are exploring advanced catalytic cracking technologies to extract more value from crude oil.

Formosa Petrochemical is actively integrating artificial intelligence into its operations, aiming to create smart factories. This strategic move is designed to fine-tune production processes, leading to enhanced operational efficiency and a higher value for its diverse product portfolio.

The aviation industry's push towards decarbonization is accelerating the development and uptake of sustainable aviation fuels (SAF). This shift presents a substantial technological and market avenue for companies like Formosa Petrochemical.

Formosa Petrochemical is strategically positioning itself in this evolving sector, with plans to produce approximately 5,500 tons of SAF in 2025. This venture into environmentally friendlier fuels signifies a key technological advancement and a promising market expansion for the company.

Formosa Petrochemical is actively embracing Industry 4.0, integrating advanced digital tools like AI, IoT, and big data analytics to streamline its operations. This digital transformation is crucial for boosting efficiency, refining supply chain management, and implementing predictive maintenance strategies, which can significantly reduce downtime and operational costs.

The company's commitment to this digital shift is evident in initiatives like the 'Formosa Oil APP.' Launched in 2023, this platform is designed not only to improve how customers interact with Formosa's fuel products but also to provide valuable data insights that can enhance overall business performance and customer loyalty.

Carbon Capture, Utilization, and Storage (CCUS) Technologies

As global carbon emission regulations tighten, Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming increasingly crucial for petrochemical firms like Formosa Petrochemical to manage their environmental footprint. These technologies offer a pathway to significantly reduce greenhouse gas emissions from industrial processes.

Formosa Petrochemical's strategic investment in and deployment of CCUS solutions is essential for achieving its stated carbon reduction goals and ensuring ongoing regulatory compliance. For instance, by 2024, many nations are implementing or strengthening carbon pricing mechanisms, making CCUS a more economically viable option.

The development and scaling of CCUS are critical technological factors impacting the petrochemical industry. Formosa Petrochemical must stay abreast of advancements in capture efficiency, transportation, and storage or utilization methods to remain competitive and environmentally responsible.

- CCUS Investment: Companies are increasingly allocating capital towards CCUS projects to meet net-zero commitments.

- Regulatory Compliance: Stricter emissions standards, like those expected to be reinforced in 2024-2025, necessitate the adoption of CCUS.

- Technological Advancement: Ongoing innovation in CCUS aims to lower costs and improve the efficiency of carbon capture and storage.

- Market Incentives: Government incentives and carbon credits are driving the economic feasibility of CCUS implementation.

Bio-based Feedstocks and Circular Economy Solutions

Formosa Petrochemical is increasingly exploring innovation in bio-based feedstocks and advanced recycling technologies, such as pyrolysis and gasification, to create sustainable alternatives to traditional fossil fuel inputs. These circular economy solutions are vital for reducing reliance on virgin resources and mitigating environmental impact.

The company's commitment to these initiatives is not just about environmental stewardship; it's a strategic imperative for long-term competitiveness. For instance, the global chemical recycling market, which includes pyrolysis and gasification, was valued at approximately USD 1.5 billion in 2023 and is projected to grow significantly, reaching an estimated USD 6.8 billion by 2030, according to various industry reports. This growth underscores the increasing demand for and viability of these circular solutions.

- Market Growth: The chemical recycling market is expanding rapidly, indicating a strong industry shift towards sustainable feedstocks.

- Technological Advancement: Innovations in pyrolysis and gasification are making these processes more efficient and economically feasible for petrochemical production.

- Competitiveness: Embracing circular economy models is crucial for Formosa Petrochemical to maintain its market position amidst evolving regulatory landscapes and consumer preferences.

- Sustainability Goals: Integrating bio-based feedstocks aligns with broader corporate sustainability targets and contributes to a more resource-efficient operational model.

Formosa Petrochemical is leveraging advanced digital tools, including AI and IoT, to create smart factories, boosting operational efficiency and product value. The company is also investing in sustainable aviation fuels (SAF), with plans to produce 5,500 tons in 2025, tapping into a growing decarbonization trend in aviation. Furthermore, Formosa is exploring Carbon Capture, Utilization, and Storage (CCUS) technologies to meet tightening emission regulations, a crucial step as carbon pricing mechanisms strengthen globally in 2024-2025.

| Technology Focus | Formosa Petrochemical's Action/Plan | Industry Trend/Impact | Data/Year |

|---|---|---|---|

| AI & Digitalization | Implementing AI for smart factories | Enhancing operational efficiency | Ongoing |

| Sustainable Aviation Fuels (SAF) | Plans to produce 5,500 tons | Decarbonization of aviation sector | 2025 |

| CCUS | Investing in CCUS solutions | Meeting emission regulations, carbon pricing | 2024-2025 |

| Circular Economy | Exploring bio-based feedstocks, chemical recycling | Reducing reliance on virgin resources, market growth (USD 1.5B in 2023, projected USD 6.8B by 2030) | 2023-2030 |

Legal factors

Taiwan's Climate Change Response Act, effective from early 2023, sets ambitious greenhouse gas reduction targets and introduces a carbon fee mechanism. This legislation directly impacts Formosa Petrochemical by increasing compliance costs associated with emissions, potentially affecting its operational expenses and profitability. For instance, the initial phase of carbon fees, implemented in 2024, targets major emitters, and Formosa Petrochemical, as a significant industrial player, will be subject to these charges.

The company must navigate a complex web of environmental protection laws governing air quality, water discharge, and industrial waste management. Non-compliance with these regulations, such as exceeding permissible emission levels or improper waste disposal, can lead to substantial fines, operational disruptions, and reputational damage, as evidenced by past environmental incidents faced by similar petrochemical companies in the region.

Taiwan's rigorous occupational health and safety regulations directly impact Formosa Petrochemical's operations, mandating stringent protocols to safeguard its workforce. These laws require comprehensive risk assessments, regular safety training, and the implementation of protective measures to prevent workplace incidents.

Failure to adhere to these regulations can result in significant penalties, including fines and operational shutdowns. For instance, in 2023, Taiwan's Ministry of Labor reported over NT$100 million in fines issued for OHS violations across various industries, underscoring the financial risks associated with non-compliance for companies like Formosa Petrochemical.

Amendments to Taiwan's Regulations on the Management of Toxic Chemical Substances and Their Handling, effective June 2025, will classify 397 additional chemicals as toxic. This regulatory shift mandates Formosa Petrochemical to revise its protocols for handling, storing, and reporting these newly designated substances. The company must ensure strict adherence to these updated legal frameworks to maintain operational compliance and mitigate potential penalties.

International Trade Laws and Tariffs

Formosa Petrochemical navigates a complex web of international trade laws and agreements, which directly influence its import and export costs. For instance, evolving trade policies, particularly those from major economic blocs like the United States, can introduce new tariffs or alter existing ones. These shifts can significantly impact the company's global competitiveness by affecting the price of raw materials and finished products. In 2023, global trade faced headwinds, with the World Trade Organization forecasting only a 0.8% increase in merchandise trade volume, a stark contrast to the 5.3% growth seen in 2022, highlighting the sensitivity of companies like Formosa Petrochemical to such legal and policy changes.

The company's access to key international markets is also contingent on compliance with these trade regulations. For example, adherence to World Trade Organization (WTO) guidelines and regional trade pacts is crucial for maintaining market entry and avoiding punitive measures. A substantial portion of Formosa Petrochemical's revenue is derived from international sales, making its exposure to trade disputes and protectionist measures a significant risk factor. The ongoing geopolitical tensions in 2024 continue to create uncertainty around trade flows and the potential for new trade barriers.

Key considerations for Formosa Petrochemical regarding international trade laws and tariffs include:

- Impact of US trade policy: Potential for tariffs on petrochemical products could increase import costs for raw materials or reduce export competitiveness.

- Global trade agreements: Changes in agreements like those within ASEAN or bilateral trade pacts can affect market access and pricing strategies.

- Tariff volatility: Fluctuations in tariff rates due to trade disputes or policy shifts directly influence the cost of goods sold and overall profitability.

- Regulatory compliance costs: Ensuring adherence to diverse international trade laws necessitates ongoing investment in legal and compliance expertise.

Corporate Governance and Disclosure Requirements

Taiwan's corporate governance landscape mandates robust transparency in financial reporting and business operations, alongside strict adherence to established corporate policies. Formosa Petrochemical, being a publicly traded entity, is obligated to meet these stringent regulatory demands.

This includes the punctual dissemination of financial results and comprehensive sustainability reports, crucial for preserving investor confidence and maintaining its regulatory standing. For instance, in 2024, Formosa Petrochemical, like other listed firms, would be subject to the Taiwan Stock Exchange's continuous disclosure rules, ensuring market participants have access to material information promptly.

- Transparency Mandates: Adherence to Taiwanese regulations requiring clear and timely disclosure of financial performance and operational activities.

- Investor Trust: Maintaining investor confidence through consistent and accurate reporting of financial results and corporate governance practices.

- Sustainability Reporting: Compliance with evolving requirements for publishing sustainability reports, reflecting environmental, social, and governance (ESG) performance, a growing focus in 2024 and beyond.

- Regulatory Compliance: Ensuring all corporate actions and disclosures align with the rules set forth by Taiwanese financial authorities and stock exchanges.

Taiwan's evolving legal framework, particularly the Climate Change Response Act effective early 2023, imposes direct costs through carbon fees on major emitters like Formosa Petrochemical, impacting operational expenses. Furthermore, stringent occupational health and safety regulations, with fines in 2023 exceeding NT$100 million for violations across industries, necessitate robust safety protocols and compliance investments.

Amendments to toxic chemical substance regulations in June 2025 will require Formosa Petrochemical to adapt handling and reporting procedures for newly classified substances, underscoring the need for continuous legal vigilance. The company's international trade operations are also subject to fluctuating tariffs and trade agreements, with global trade volume growth slowing to an estimated 0.8% in 2024, affecting raw material costs and export competitiveness.

Environmental factors

Formosa Petrochemical faces significant pressure from global and national climate policies, such as Taiwan's 2050 net-zero emissions goal and the introduction of carbon fees. These regulations directly influence operational costs and strategic planning for the petrochemical sector.

The company has proactively set emission reduction targets: a 20% reduction by 2025 and a 35% reduction by 2030, both measured against a 2007 baseline. These ambitious goals reflect the growing imperative to decarbonize heavy industry operations.

Formosa Petrochemical faces increasing pressure from resource scarcity, particularly concerning water and land availability. Stricter waste management regulations are also a significant factor, compelling the company to adopt more efficient resource utilization and waste reduction strategies. For instance, in 2023, Formosa Petrochemical reported a 5% decrease in water consumption per ton of product compared to 2022, showcasing proactive measures in this area.

The petrochemical sector, including companies like Formosa Petrochemical, faces ongoing scrutiny regarding its environmental impact, particularly concerning air and water pollution. This industry is a major contributor to emissions, driving continuous pressure for more stringent pollution control regulations globally.

Formosa Petrochemical is compelled to make substantial investments in cutting-edge pollution abatement technologies to meet these evolving standards. For instance, in 2023, the company reported significant capital expenditures on environmental protection initiatives, aiming to reduce its ecological footprint and avert potential regulatory fines and operational disruptions.

Biodiversity Protection and Land Use

Formosa Petrochemical's extensive industrial operations, particularly its Mailiao complex, directly influence local ecosystems. The sheer scale of these facilities necessitates careful land use planning to mitigate impacts on biodiversity and sensitive habitats. This is becoming a critical area of focus for the company.

Increasingly, Formosa Petrochemical faces heightened scrutiny from environmental groups and regulatory bodies concerning its land use practices. The company is expected to demonstrate a commitment to habitat protection and responsible environmental stewardship, which can translate into operational adjustments and investment in conservation initiatives. For instance, in 2023, Taiwan's Environmental Protection Administration continued to monitor industrial sites for compliance with land use and biodiversity protection regulations, with penalties for non-compliance potentially impacting operational continuity.

- Land Use Impact: Large industrial complexes like Mailiao occupy significant land, potentially altering natural landscapes and affecting local flora and fauna.

- Biodiversity Concerns: Operations can lead to habitat fragmentation, pollution, and disruption of wildlife corridors, necessitating robust mitigation strategies.

- Regulatory Pressure: Formosa Petrochemical must navigate evolving environmental regulations in Taiwan and globally, which increasingly emphasize biodiversity conservation and sustainable land management.

Transition to a Low-Carbon Economy and Renewable Energy Adoption

The global push towards a low-carbon economy is accelerating, with significant implications for petrochemical companies like Formosa Petrochemical. This transition, driven by climate change concerns and policy initiatives, is reshaping energy markets and demanding a strategic pivot. For instance, by the end of 2023, renewable energy sources accounted for an increasing share of global electricity generation, a trend expected to continue through 2024 and beyond.

Formosa Petrochemical faces both hurdles and openings as it navigates this evolving landscape. Adapting its business model is crucial for long-term viability. This includes venturing into new energy sectors, such as the development of lithium iron phosphate battery cell factories, which are essential components for electric vehicles and energy storage solutions. Such diversification can offset declining demand for traditional fossil fuels.

Integrating renewable energy sources directly into its own operations also presents a pathway to enhanced competitiveness and sustainability. By reducing its carbon footprint and operational costs through solar or wind power adoption, Formosa Petrochemical can better align with regulatory requirements and investor expectations. For example, many industrial players are setting ambitious targets for renewable energy procurement, with some aiming for 100% renewable electricity by 2030.

- Global Renewable Energy Growth: Renewable energy capacity additions are projected to reach new heights in 2024, with solar PV and wind power leading the expansion, according to the International Energy Agency (IEA) forecasts.

- Investment in New Energy: Formosa Petrochemical's investment in battery technology, like lithium iron phosphate, taps into a rapidly growing market driven by the electric vehicle revolution. The global battery market is anticipated to grow significantly in the coming years.

- Operational Efficiency: Adopting renewable energy for its own facilities can lead to cost savings and reduced exposure to volatile fossil fuel prices, improving overall financial resilience.

- Carbon Emission Reduction Targets: Many countries and corporations are setting net-zero emission targets, creating a market demand for low-carbon products and processes, which Formosa Petrochemical can leverage.

Formosa Petrochemical is significantly impacted by evolving environmental regulations, including Taiwan's net-zero goals and carbon pricing mechanisms, which directly affect operational costs and strategic planning. The company has set targets to reduce emissions by 20% by 2025 and 35% by 2030 from a 2007 baseline, reflecting the increasing pressure to decarbonize heavy industry.

Resource scarcity, particularly water and land availability, coupled with stricter waste management rules, compels Formosa Petrochemical towards more efficient resource use and waste reduction. For instance, the company reported a 5% decrease in water consumption per ton of product in 2023 compared to 2022, indicating proactive management in this area.

The company must invest in advanced pollution control technologies to meet stringent environmental standards, as evidenced by significant capital expenditures on environmental initiatives in 2023 aimed at reducing its ecological footprint and avoiding regulatory penalties.

Formosa Petrochemical's large-scale operations, like the Mailiao complex, require careful land use planning to mitigate impacts on local ecosystems and biodiversity, facing increased scrutiny from environmental groups and regulators regarding responsible land management practices.

| Environmental Factor | Impact on Formosa Petrochemical | Relevant Data/Initiative (2023/2024) |

| Climate Policy & Carbon Pricing | Increased operational costs, strategic shift towards lower emissions. | Taiwan's 2050 net-zero goal; Carbon fee introduction. |

| Emission Reduction Targets | Operational adjustments and investment in cleaner technologies. | 20% reduction by 2025, 35% by 2030 (vs. 2007 baseline). |

| Resource Scarcity & Waste Management | Focus on efficiency, water conservation, and waste reduction. | 5% decrease in water consumption per ton of product (2023 vs. 2022). |

| Pollution Control & Abatement | Significant capital investment in environmental protection technologies. | Increased CAPEX on environmental initiatives in 2023. |

| Land Use & Biodiversity | Scrutiny on land use practices, need for habitat protection. | Ongoing monitoring by Taiwan's EPA for compliance. |

PESTLE Analysis Data Sources

Our Formosa Petrochemical PESTLE Analysis is built on a robust foundation of data from official government agencies, international financial institutions, and reputable industry research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to ensure comprehensive and accurate insights.