Formosa Petrochemical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Formosa Petrochemical Bundle

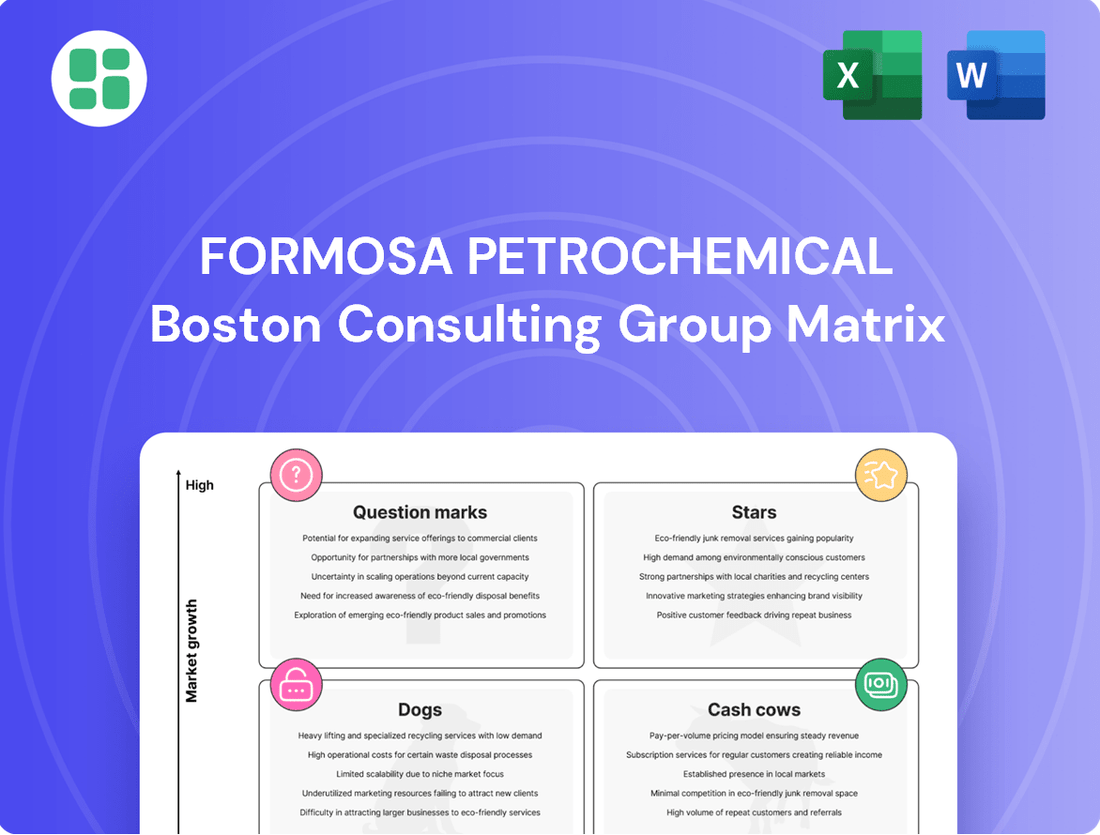

Formosa Petrochemical's BCG Matrix offers a critical lens into its product portfolio's performance. Understand which segments are driving growth and which require careful management. This preview is just the beginning; purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Formosa Petrochemical Corporation (FPCC) is strategically focusing on high-value specialty petrochemicals, aiming for enhanced profitability by moving beyond commodity markets. This initiative targets niche applications where specialized products command premium pricing and offer greater margin potential.

These high-value products are anticipated to see robust growth, driven by their unique functionalities and strong competitive positioning in specific industries. For instance, FPCC's investment in advanced materials for electronics and automotive sectors exemplifies this shift. In 2023, the global specialty chemicals market was valued at approximately $660 billion, with projections indicating continued expansion.

Jet fuel production for Formosa Petrochemical Corporation (FPCC) is a star in its business portfolio. In 2023, FPCC saw a remarkable 49.8% increase in jet fuel demand, a clear sign of the aviation industry's strong rebound.

This segment is anticipated to be the most robust among FPCC's refined products, pointing towards a market with substantial growth potential. FPCC's existing infrastructure for jet fuel manufacturing is a key advantage, enabling it to effectively meet this escalating demand.

Formosa Petrochemical Corporation (FPCC), a key player within the Formosa Plastics Group (FPG), is strategically involved in the production of electronics materials. FPG's significant investment in expanding its facilities in Huizhou underscores a commitment to solidifying its global leadership in this dynamic sector. This move positions FPCC to capitalize on the robust growth characteristic of the electronics industry.

The electronics sector is experiencing rapid expansion, driven by innovation and increasing consumer demand for advanced devices. FPCC's role in supplying foundational raw materials and components places it squarely within this high-growth market segment. For instance, FPG's overall revenue reached approximately NT$1.25 trillion (around $38 billion USD) in 2023, with its petrochemical and plastics divisions forming a substantial part of this figure, directly supporting downstream industries like electronics.

Specific Olefin Derivatives for Growing Industries

Even with broader olefins market oversupply concerns, Formosa Petrochemical Corporation (FPCC) can carve out strong positions by focusing on specific derivatives essential for growing industries. Ethylene and propylene, fundamental olefins, are increasingly vital for sectors like packaging, automotive, and construction, which are experiencing robust expansion.

FPCC's strategic advantage lies in producing specialized olefin derivatives tailored to these high-demand applications. This focus allows them to capture significant market share within these specific, lucrative segments, effectively turning potential challenges into opportunities. For instance, the global demand for polyethylene, a key ethylene derivative, is projected to grow, with the packaging sector alone representing a substantial portion of this demand.

- Ethylene and Propylene Demand: Global ethylene demand was estimated to reach over 170 million metric tons in 2024, driven by packaging and automotive sectors.

- Packaging Growth: The flexible packaging market, a major consumer of polyethylene, is expected to see a compound annual growth rate of around 4-5% through 2028.

- Automotive Lightweighting: Propylene derivatives like polypropylene are crucial for automotive components, contributing to vehicle lightweighting and fuel efficiency, a trend accelerating in 2024 models.

- Construction Applications: Olefin derivatives are also used in construction for pipes, insulation, and coatings, with global construction spending projected to increase in 2024.

Sustainable Petrochemical Solutions

Formosa Petrochemical Corporation (FPCC) is actively investing in pioneering sustainable technologies, demonstrating a commitment to environmental stewardship within the petrochemical sector. Initiatives like microalgae carbon capture are at the forefront of their efforts to reduce emissions.

The company is also focused on developing greener manufacturing processes, aligning with the global shift towards sustainability. This strategic focus positions FPCC to capitalize on the growing demand for eco-friendly petrochemical products and processes.

- Microalgae Carbon Capture: FPCC is exploring advanced biological methods for CO2 sequestration.

- Greener Process Development: Investment in R&D for reduced energy consumption and waste generation.

- Market Transformation: The petrochemical industry is experiencing a significant pivot towards sustainability, with products and processes offering a reduced environmental footprint expected to capture substantial market share.

- Growth Potential: This evolving market segment represents a high-growth opportunity for companies like FPCC that are proactively embracing sustainable solutions.

Jet fuel production stands out as a Star for Formosa Petrochemical Corporation (FPCC). The aviation industry's strong recovery fueled a significant 49.8% surge in jet fuel demand for FPCC in 2023. This segment is poised for continued robust growth, bolstered by FPCC's existing manufacturing capabilities.

FPCC's involvement in electronics materials also positions it as a Star. The company is expanding its Huizhou facilities, underscoring its commitment to the rapidly growing electronics sector. The broader Formosa Plastics Group's 2023 revenue of approximately NT$1.25 trillion highlights the significant contribution of its petrochemical divisions to industries like electronics.

Ethylene and propylene derivatives represent another Star, particularly those tailored for high-demand sectors. Despite broader olefins market concerns, FPCC's focus on specialized derivatives for packaging and automotive applications allows it to capture lucrative market share. Global ethylene demand is projected to exceed 170 million metric tons in 2024, with packaging being a key driver.

| Business Segment | BCG Category | Key Growth Drivers | 2023 Performance Indicator |

|---|---|---|---|

| Jet Fuel | Star | Aviation industry rebound, increased travel demand | 49.8% increase in demand |

| Electronics Materials | Star | Technological advancements, growing consumer electronics market | Expansion of Huizhou facilities |

| Specialized Olefin Derivatives (e.g., for packaging, automotive) | Star | Demand for lightweight materials, growth in packaging sector | Global ethylene demand > 170 million metric tons (2024) |

What is included in the product

This analysis categorizes Formosa Petrochemical's business units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

The Formosa Petrochemical BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain of complex portfolio analysis.

Cash Cows

Formosa Petrochemical Corporation (FPCC) holds a significant position in Taiwan's energy sector, being the island's only private refiner and naphtha cracker operator. As of December 2023, FPCC commanded roughly 22.4% of the domestic oil products market, demonstrating its substantial market share.

Domestic gasoline and diesel sales represent a classic Cash Cow for FPCC. While the broader refining industry might be experiencing slower growth, these essential fuel products contribute a stable and substantial revenue stream. This is largely due to FPCC's well-established infrastructure and extensive network of customers, ensuring consistent demand and reliable cash flow.

Formosa Petrochemical Corporation's (FPCC) core naphtha cracker operations are undeniably its Cash Cows. With an impressive annual ethylene production capacity of 2.935 million tons, this complex is a powerhouse, churning out essential building blocks for a vast array of petrochemical products.

This massive scale and integration grant FPCC a commanding presence in Taiwan's petrochemical feedstock market. Even when market conditions fluctuate, these operations consistently generate robust cash flow, solidifying their status as a reliable profit engine for the company.

Formosa Petrochemical Corporation's (FPCC) ethylene and propylene production stands as a cornerstone of its business, even amidst global petrochemical overcapacity. FPCC commands a significant market share in these high-volume, basic petrochemical commodities, underscoring its position as a major producer.

These fundamental building blocks, while experiencing market volatility, consistently deliver robust cash flows. Their critical role as raw materials for countless downstream industries, from plastics to synthetic fibers, ensures sustained demand and profitability for FPCC.

For instance, in 2024, the global ethylene market was projected to reach over 170 million metric tons, with FPCC being a substantial contributor to this volume. Similarly, propylene demand remained strong, driven by its use in polypropylene production, a material ubiquitous in automotive and packaging sectors.

Fuel Oil and Asphalt Production

Formosa Petrochemical Corporation (FPCC) produces fuel oil and asphalt, vital commodities for industrial processes and infrastructure projects. These products serve a mature market with relatively stable demand, characteristic of a cash cow.

FPCC benefits from its position as a major refiner, allowing it to maintain a significant market share in these essential products. This strong market presence translates into reliable and consistent revenue generation for the company.

- Fuel Oil and Asphalt Market: These are foundational products for many industries, including power generation and construction.

- FPCC's Market Share: As a large-scale refiner, FPCC holds a substantial portion of the market for these commodities, ensuring consistent sales volume.

- Revenue Contribution: The steady demand and FPCC's established position contribute significantly to the company's overall revenue stability, even in low-growth environments.

- 2024 Data Insight: While specific 2024 figures for fuel oil and asphalt revenue are still being finalized, FPCC's refining segment, which includes these products, has historically been a bedrock of its financial performance, often accounting for over 60% of its total revenue in previous years.

Utilities (Electricity and Steam Sales)

Formosa Petrochemical Corporation's (FPCC) Utilities segment, encompassing electricity, steam, and water sales, operates as a classic Cash Cow within its business portfolio. This segment consistently generates substantial, reliable cash flows due to the essential nature of its products and services, which are crucial for both FPCC's internal industrial operations and external customers. Despite the stable demand, the growth prospects for this segment are inherently limited, aligning with the characteristics of a mature market.

- Stable Revenue Stream: In 2023, FPCC's utilities segment contributed significantly to its overall financial stability, demonstrating the dependable nature of essential services.

- Low Growth, High Reliability: While not a high-growth area, the consistent demand for electricity, steam, and water ensures a predictable and robust cash flow generation, a hallmark of a Cash Cow.

- Internal and External Demand: The segment effectively serves FPCC's extensive industrial complex while also catering to external clients, broadening its revenue base and operational efficiency.

Formosa Petrochemical Corporation's (FPCC) domestic gasoline and diesel sales are firmly established Cash Cows. These products are essential for daily life and transportation, ensuring a consistent and substantial revenue stream for the company. FPCC's extensive infrastructure and customer network further solidify its stable market position in this mature segment.

FPCC's core naphtha cracker operations, particularly ethylene and propylene production, represent significant Cash Cows. With substantial production capacities, these operations consistently generate robust cash flows due to their critical role as raw materials for numerous downstream industries. For instance, in 2024, the global ethylene market was projected to exceed 170 million metric tons, with FPCC being a key contributor.

The company's fuel oil and asphalt sales also function as Cash Cows. These products cater to mature markets with stable demand, driven by industrial processes and infrastructure development. FPCC's large-scale refining capabilities allow it to maintain a significant market share, ensuring reliable revenue generation.

FPCC's Utilities segment, providing electricity, steam, and water, is another prime example of a Cash Cow. The essential nature of these services guarantees consistent demand and predictable cash flows, even with limited growth prospects. In 2023, this segment played a vital role in FPCC's overall financial stability.

Delivered as Shown

Formosa Petrochemical BCG Matrix

The Formosa Petrochemical BCG Matrix preview you see is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, detailing Formosa Petrochemical's product portfolio within the BCG framework, will be delivered without any watermarks or demo content, ensuring you get a professional and actionable strategic tool.

Dogs

Undifferentiated commodity plastics, such as basic polyethylene (PE) grades, represent a challenging segment for Formosa Petrochemical within the BCG Matrix. The global PE market is grappling with substantial overcapacity, projected to reach over 110 million metric tons by 2024, which puts downward pressure on prices and profitability.

Formosa Petrochemical's exposure to these undifferentiated PE products, especially if they lack unique selling propositions or significant market share, places them in a difficult position. This segment is characterized by low growth and intense competition, making it hard to generate substantial returns on investment.

These commodity plastics could be considered cash traps, consuming capital for production and maintenance without yielding the necessary cash flow to fund growth in other business areas. For instance, the average operating rates for PE plants in Asia hovered around 75-80% in early 2024, indicating an oversupplied market.

Older or less adaptable refining units within Formosa Petrochemical Corporation (FPCC) would likely be categorized as Dogs in the BCG Matrix. The global refining industry is facing a structural decline, with projections indicating shrinking capacity and persistent margin pressure. For instance, in 2024, refining margins for complex refineries in Asia averaged around $5-7 per barrel, a figure that has been under pressure due to overcapacity and shifting demand.

These older units may struggle to meet evolving demand patterns, such as the increasing shift towards petrochemical feedstocks over traditional transportation fuels, or comply with stricter environmental regulations. Units that cannot efficiently adapt will consume valuable resources without generating sufficient profits, acting as a drag on FPCC's overall financial performance in a challenging market environment.

Formosa Petrochemical Corporation (FPCC) has seen its overall revenue affected by subdued demand and intense price competition, with China's economic recovery not meeting earlier projections. Certain petrochemical product lines heavily dependent on exports to a slowing Chinese market, particularly where FPCC's competitive standing is weaker, are likely experiencing consistent underperformance. These segments, facing both external demand weakness and internal market share challenges, fit the profile of 'dogs' within a BCG matrix framework.

Traditional Lubricants and Base Oils with Low Differentiation

Formosa Petrochemical's traditional lubricants and base oils, particularly those with limited product differentiation, likely fall into the Dogs category of the BCG Matrix. This segment faces a mature market with intense competition from established global giants, making it challenging to achieve significant market share or premium pricing.

These products are likely experiencing low growth and low profitability. For instance, in 2024, the global base oil market, while substantial, is characterized by overcapacity in certain grades, impacting pricing power for less specialized producers. Formosa Petrochemical's less differentiated offerings would struggle to stand out in such an environment.

- Low Market Share: Limited differentiation means Formosa Petrochemical struggles to capture a significant portion of the market for these specific products.

- Low Growth Market: The overall market for traditional, undifferentiated lubricants is mature and exhibits minimal expansion.

- Profitability Challenges: Intense price competition from larger, more integrated players erodes profit margins for these offerings.

- Strategic Consideration: Formosa Petrochemical may need to consider divesting, niche marketing, or investing in differentiation for these products to improve their standing.

Declining Export Petroleum Product Segments

Formosa Petrochemical's (FPCC) export volume for petroleum products saw a decrease of 3.2% in 2023, signaling a challenging environment for some of its product segments.

Segments experiencing consistently shrinking demand in their export markets, coupled with FPCC's limited or declining market share, would be categorized as Dogs within the BCG Matrix. These areas represent potential liabilities.

- Declining Export Volumes: Formosa Petrochemical's overall export volume of petroleum products declined by 3.2% in 2023.

- Market Share Erosion: Specific export-oriented product lines where FPCC holds a small or diminishing market presence are particularly vulnerable.

- Strategic Reassessment: These "Dog" segments may necessitate a strategic review, potentially leading to divestiture or a significant shift in focus to mitigate losses.

Formosa Petrochemical's less differentiated, traditional lubricants and base oils are likely positioned as Dogs in the BCG Matrix. This segment operates in a mature, highly competitive market where achieving significant market share or premium pricing is difficult due to the presence of larger, integrated global players.

These products typically exhibit low growth and low profitability, exacerbated by overcapacity in certain grades that pressures pricing power for less specialized producers. For example, the global base oil market in 2024 faced such conditions.

Formosa Petrochemical's export volumes for petroleum products saw a 3.2% decrease in 2023, indicating challenges in certain product segments. Those export-oriented lines with shrinking demand and a limited or declining market share for FPCC are prime candidates for the Dog category, representing potential liabilities that may require divestiture or a strategic refocus.

| Product Segment | BCG Category | Market Characteristics | FPCC Performance Indicators |

|---|---|---|---|

| Undifferentiated PE Grades | Dog | Low growth, high competition, global overcapacity (over 110M MT by 2024) | Pressure on prices and profitability, potential cash trap |

| Older Refining Units | Dog | Structural decline, shrinking capacity, margin pressure ($5-7/bbl avg. refining margin in Asia 2024) | Struggle to meet demand shifts, compliance costs |

| Traditional Lubricants/Base Oils | Dog | Mature market, intense competition, overcapacity in certain grades | Low market share, low profitability, limited differentiation |

| Specific Export Petroleum Products | Dog | Shrinking demand in export markets | 3.2% decrease in FPCC export volume (2023), declining market share |

Question Marks

Formosa Plastics Group, including Formosa Petrochemical Corporation (FPCC), began building Taiwan's largest lithium iron phosphate (LFP) battery cell factory in 2023. This strategic move targets the burgeoning new energy market, a sector experiencing rapid expansion.

While the new energy sector offers substantial growth potential, FPCC's current market share in LFP battery production is minimal. This positions the venture as a question mark within the BCG matrix, indicating high market growth but low relative market share.

Establishing a competitive presence and scaling production in the LFP battery industry demands considerable capital investment. For instance, similar large-scale battery factories often require investments in the hundreds of millions to billions of dollars for initial setup and ongoing development, making the future success of FPCC's venture inherently uncertain.

Formosa Petrochemical Corporation (FPCC) is actively investing in microalgae carbon capture technology as a key component of its strategy toward carbon neutrality. This innovative approach leverages the natural ability of microalgae to absorb carbon dioxide, offering a promising avenue for emissions reduction.

While microalgae carbon capture represents a high-growth environmental technology, its commercial viability and broad market adoption are still in nascent stages of development. FPCC's commitment signifies a forward-looking investment in a potentially disruptive climate solution.

Currently, this segment consumes significant capital for research and development, reflecting its early-stage nature. However, the potential for substantial future returns is high, contingent on successful scaling and market integration, positioning it as a question mark within FPCC's business portfolio.

Formosa Petrochemical is investing heavily in AI for smart factories, aiming to boost production efficiency and product quality. These digital transformation efforts are crucial for staying competitive in a rapidly advancing industry.

While these AI and digital initiatives represent significant potential for future growth and value creation, they require substantial capital expenditure. For instance, the global industrial AI market was valued at approximately $11.5 billion in 2023 and is projected to grow substantially, indicating the scale of investment required.

Currently, the direct impact of these AI strategies on Formosa Petrochemical's immediate revenue generation or market share is limited, placing them in a position of high potential but low current market penetration, characteristic of a question mark in the BCG matrix.

Overseas Green/Sustainable Product Development

Formosa Petrochemical's overseas green/sustainable product development aligns with the 'Question Mark' category of the BCG matrix. These initiatives focus on new, environmentally friendly products for international markets. While current market share might be low, the strong growth potential driven by increasing global environmental awareness makes them strategic investments requiring careful nurturing.

These products are designed to meet evolving consumer and regulatory demands for sustainability. For instance, Formosa Plastics Group is actively investing in the development of energy-saving and recyclable materials for export. This strategic pivot aims to capture future market share in a rapidly expanding sector.

- Market Potential: Growing global demand for sustainable products, with environmental consciousness being a key driver.

- Current Share: Initial market penetration for these new green products is typically low.

- Investment Needs: Significant capital is required for research, development, and market entry to foster growth.

- Strategic Focus: Nurturing these 'Question Mark' products is crucial for long-term competitive advantage and alignment with ESG goals.

New Product Development in Emerging Petrochemical Niches

Formosa Petrochemical Corporation (FPCC) is actively pursuing new product development in emerging petrochemical niches, aiming to create differentiated, high-value-added products that foster industrial advancement. These initiatives represent a strategic move into high-growth segments, though they are currently in their nascent stages of market acceptance.

These new product lines, characteristic of a 'Question Mark' in the BCG Matrix, exhibit low current market share. Significant investment in both marketing efforts and continued product refinement is essential for them to gain substantial traction and achieve meaningful market penetration.

- Focus on High-Value Niches: FPCC's strategy targets specialized petrochemical segments with strong growth potential, moving beyond commodity products.

- Early Market Adoption: These new product lines are in the initial phases of market introduction, facing the challenge of building awareness and demand.

- Investment Requirements: Substantial capital is allocated to research, development, and marketing to overcome initial market barriers and establish a competitive position.

- Potential for Growth: Despite current low market share, successful development and market penetration could elevate these products to 'Star' status within FPCC's portfolio.

Formosa Petrochemical's ventures into LFP battery production, microalgae carbon capture, AI for smart factories, overseas green products, and new petrochemical niches all represent 'Question Marks' in the BCG matrix. These are characterized by high market growth potential but currently low relative market share, requiring significant investment to achieve success.

The LFP battery factory, for instance, targets a rapidly expanding new energy market but is starting with minimal production. Similarly, microalgae carbon capture is a promising climate solution with nascent commercial viability, demanding substantial R&D capital. The global industrial AI market, valued around $11.5 billion in 2023, highlights the scale of investment needed for FPCC's digital transformation initiatives.

These 'Question Mark' businesses, while requiring substantial capital for development and market entry, hold the promise of becoming future 'Stars' if they can successfully navigate market challenges and scale their operations. Strategic nurturing and continued investment are critical for their long-term competitive advantage and alignment with evolving market demands.

BCG Matrix Data Sources

Our Formosa Petrochemical BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable insights.