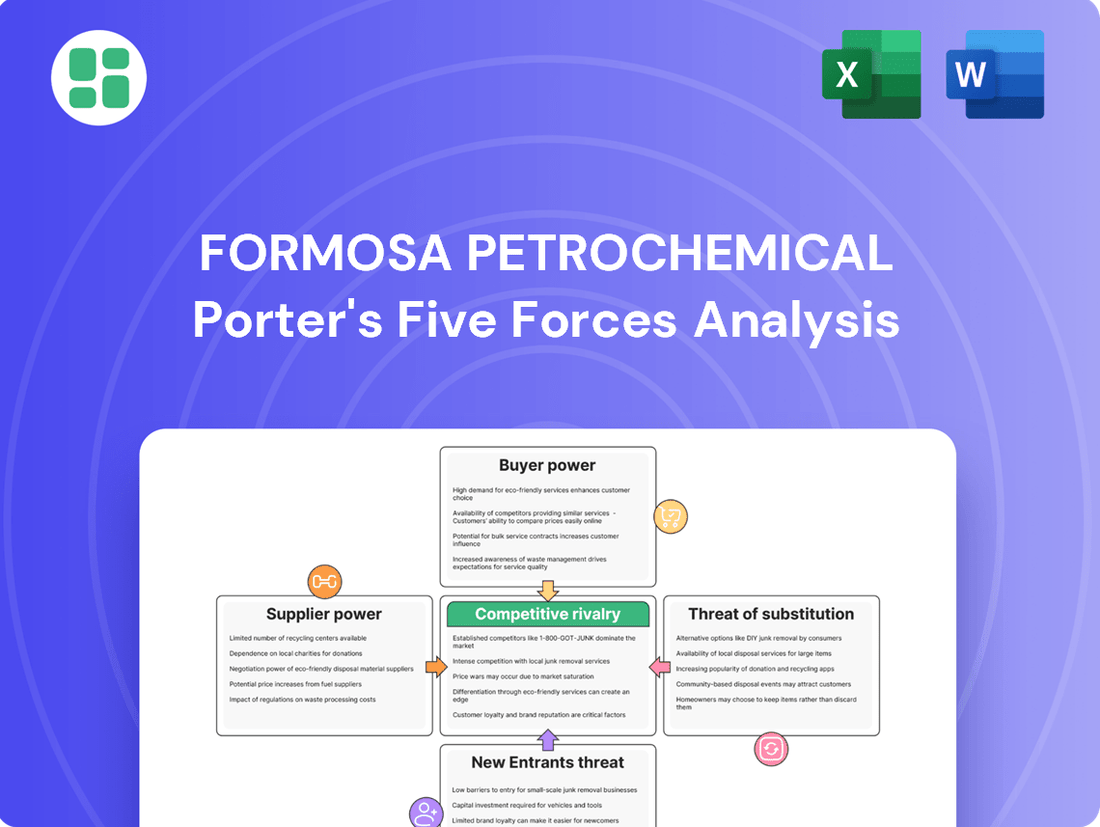

Formosa Petrochemical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Formosa Petrochemical Bundle

Formosa Petrochemical operates in a highly competitive landscape, facing significant pressure from existing rivals and the constant threat of new entrants. Understanding the bargaining power of its suppliers and buyers is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping Formosa Petrochemical’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Formosa Petrochemical is heavily influenced by the concentration of its raw material sources. For instance, crude oil, a primary input, is largely controlled by a few major global producers. In 2024, OPEC+ nations continued to hold significant sway over global oil supply, impacting pricing and availability for refiners like Formosa. This concentration means suppliers of crude oil can exert considerable leverage.

Furthermore, the criticality of certain inputs amplifies supplier power. If Formosa Petrochemical relies on a limited number of specialized catalyst suppliers for its complex petrochemical processes, these suppliers gain substantial leverage. A diversified supply chain, however, can mitigate this power by providing alternative sourcing options.

Formosa Petrochemical likely faces significant switching costs when sourcing crude oil and key petrochemical feedstocks. These costs can arise from long-term supply contracts, the need for specialized storage and handling equipment tailored to specific materials, or the integration of proprietary technologies that are optimized for particular feedstocks.

If Formosa Petrochemical must undertake substantial retooling or lengthy qualification processes to switch to alternative suppliers, their bargaining power with existing suppliers diminishes. For instance, in 2023, global oil prices saw considerable volatility, making reliable, long-term feedstock agreements crucial for stable operations. Any disruption in securing these essential inputs could lead to production halts, impacting revenue and market share.

The availability of substitute inputs significantly impacts supplier bargaining power. If Formosa Petrochemical Corporation (FPCC) can readily source alternative raw materials or adopt different production technologies, its reliance on any single supplier diminishes. For instance, FPCC's ability to switch between various grades of crude oil or utilize feedstocks like LPG, based on prevailing price differences, directly weakens the leverage of individual crude oil suppliers. This flexibility is crucial in maintaining cost competitiveness and operational stability.

Threat of Forward Integration by Suppliers

Suppliers' potential to move into Formosa Petrochemical's refining and petrochemical production operations significantly boosts their bargaining power. This threat of forward integration means suppliers could directly compete with Formosa, giving them leverage in negotiations for raw materials.

For instance, a major crude oil producer that also has refining capabilities could choose to process its own oil instead of selling it to Formosa, thereby capturing more of the value chain. This capability can lead to more favorable pricing and contract terms for the supplier when dealing with Formosa.

- Threat of Forward Integration: Suppliers can gain leverage by threatening to enter Formosa Petrochemical's core business.

- Increased Bargaining Power: This threat allows suppliers to dictate better pricing and terms for their raw materials.

- Value Chain Capture: Suppliers with existing downstream operations can bypass Formosa and capture more profit.

- Competitive Pressure: Formosa faces increased competition if suppliers decide to integrate forward.

Uniqueness of Supplier Offerings

The uniqueness of Formosa Petrochemical's supplier offerings significantly impacts supplier bargaining power. When suppliers provide highly specialized or patented inputs, like proprietary catalysts crucial for specific refining processes or unique crude oil blends tailored to Formosa's needs, their leverage increases. These differentiated inputs often have few, if any, readily available substitutes, forcing Formosa Petrochemical to accept supplier terms.

For instance, in 2024, the market for advanced petrochemical catalysts saw continued consolidation, with a few key players dominating production of high-efficiency catalysts. These specialized catalysts can reduce energy consumption and improve yield, making them indispensable for Formosa. If Formosa Petrochemical relies on such specialized inputs, suppliers can command higher prices or dictate more favorable contract terms, thereby strengthening their bargaining position.

Consider the sourcing of specific grades of crude oil. While many crude varieties exist, Formosa Petrochemical's refining infrastructure might be optimized for particular types. Suppliers of these preferred crude blends, especially if they are scarce or geographically concentrated, gain considerable bargaining power. In the first half of 2024, global supply disruptions, particularly affecting certain light sweet crude grades, led to price premiums for those specific products, illustrating this dynamic.

- Unique Inputs: Formosa Petrochemical's reliance on patented catalysts or specialized crude oil blends, which have limited alternatives, grants suppliers greater bargaining power.

- Supplier Leverage: If Formosa Petrochemical requires high-performance inputs with few substitutes, suppliers can influence pricing and contract conditions.

- Market Concentration: In 2024, the market for advanced petrochemical catalysts experienced consolidation, empowering dominant suppliers of essential components.

The bargaining power of suppliers for Formosa Petrochemical is significant, primarily due to the concentrated nature of crude oil production and the critical role of specialized feedstocks and catalysts. In 2024, global oil markets, heavily influenced by OPEC+ decisions, continued to dictate pricing and availability, giving major oil producers substantial leverage. Furthermore, the necessity of unique, high-performance catalysts for advanced petrochemical processes, with limited alternatives available as seen with market consolidation in 2024, allows these specialized suppliers to command higher prices and more favorable contract terms.

Formosa Petrochemical faces considerable switching costs when dealing with its primary suppliers of crude oil and essential petrochemical feedstocks. These costs can include the need for specialized infrastructure, long-term contractual obligations, and the integration of proprietary technologies optimized for specific materials. In 2023, global feedstock price volatility underscored the importance of securing stable, long-term supply agreements, which in turn can diminish Formosa's ability to negotiate aggressively with its current suppliers.

The threat of forward integration by suppliers poses a considerable challenge to Formosa Petrochemical. If suppliers, particularly major oil producers, possess their own refining or petrochemical capabilities, they can choose to process their raw materials internally rather than selling them to Formosa. This potential to capture more of the value chain allows these suppliers to exert greater influence over pricing and contract negotiations for raw materials supplied to Formosa.

| Factor | Impact on Formosa Petrochemical | 2024/2023 Relevance |

|---|---|---|

| Concentration of Crude Oil Supply | High supplier leverage due to limited major producers | OPEC+ influence on global oil supply and pricing |

| Switching Costs | Reduces Formosa's negotiation power | Volatility in feedstock prices in 2023 emphasized stable contracts |

| Uniqueness of Inputs (e.g., Catalysts) | Increases supplier power for specialized components | Consolidation in advanced catalyst markets in 2024 |

| Threat of Forward Integration | Suppliers can bypass Formosa and capture more value | Potential for oil producers with refining assets to compete |

What is included in the product

This analysis details the competitive landscape for Formosa Petrochemical, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the petrochemical industry.

Instantly visualize competitive pressures with a dynamic Formosa Petrochemical Porter's Five Forces analysis, allowing for rapid identification of key threats and opportunities.

Customers Bargaining Power

The bargaining power of Formosa Petrochemical's customers is significantly shaped by how concentrated its customer base is and how much each customer buys. For instance, major industrial purchasers of key products like olefins or plastics, especially those with substantial buying clout, can leverage their position to negotiate for reduced prices or more favorable contract terms. In 2023, Formosa Petrochemical reported that its top ten customers accounted for approximately 45% of its total sales revenue, highlighting a degree of customer concentration that can amplify their bargaining influence.

Customer switching costs are quite low in the petrochemical industry, especially for products that are essentially commodities, like basic plastics or fuels. This means buyers can easily switch to another supplier if they find a better deal, which puts pressure on companies like Formosa Petrochemical.

When customers can switch suppliers without much hassle, like avoiding costly redesigns or significant disruptions, they have more power. This ease of switching intensifies price competition, as Formosa Petrochemical must remain competitive on price to retain its customer base.

For example, in 2024, the global petrochemical market saw significant price volatility. Companies that could offer even slightly lower prices for comparable products, due to lower overhead or more efficient production, could easily attract customers away from competitors like Formosa Petrochemical, highlighting the impact of low switching costs.

Customers' ability to produce their own petroleum or petrochemicals themselves significantly boosts their negotiation strength. For instance, a large automotive manufacturer with substantial capital and engineering expertise could consider building its own refining capacity, thereby reducing its reliance on suppliers like Formosa Petrochemical and demanding better pricing.

This threat of backward integration is particularly potent for major industrial consumers who possess the financial resources and technical acumen to operate such complex facilities. In 2024, the global petrochemical industry saw significant investment in new capacity, with major players like Saudi Aramco expanding their downstream operations, signaling a trend that could empower large customers to explore similar vertical integration strategies.

Product Differentiation and Importance to Customer

The bargaining power of customers is significantly influenced by how differentiated Formosa Petrochemical's products are and how crucial they are to the customer's final output. When products are highly commoditized, like basic olefins, customers have substantial power because they can easily switch suppliers without impacting their own production significantly. For instance, in 2024, the global market for ethylene, a key commodity petrochemical, saw intense price competition, giving buyers more leverage.

Conversely, if Formosa Petrochemical offers specialized petrochemicals that are essential inputs with few viable substitutes, their ability to command better pricing increases, thus reducing customer power. This is particularly true for advanced polymers or specialty chemicals used in high-tech manufacturing or pharmaceuticals. The company's investment in research and development for proprietary formulations can create such critical dependencies.

- Product Commoditization: Formosa Petrochemical's exposure to commodity products like ethylene and propylene means customers for these items possess higher bargaining power.

- Specialty Products: The company's development of differentiated products, such as specific grades of polypropylene or engineered plastics, can reduce customer power by offering unique performance characteristics.

- Customer Dependence: The criticality of Formosa Petrochemical's inputs to a customer's manufacturing process or final product performance directly impacts the customer's ability to negotiate prices.

- Market Share in Niches: A dominant market share in specific niche petrochemical markets can further solidify Formosa Petrochemical's pricing power against its customers.

Customer Price Sensitivity

Customer price sensitivity is a key driver of their bargaining power. When Formosa Petrochemical's products represent a significant portion of a customer's overall costs, or when customers themselves operate with thin profit margins, they become acutely aware of price fluctuations. This heightened sensitivity compels them to seek lower prices for raw materials, directly impacting Formosa Petrochemical's pricing flexibility.

For example, in the automotive sector, where component costs are critical to overall vehicle profitability, car manufacturers will exert considerable pressure on petrochemical suppliers like Formosa for competitive pricing. In 2023, the average profit margin for automotive manufacturers globally hovered around 8-10%, making them highly susceptible to input cost changes.

- Customer Price Sensitivity: Impacts bargaining power based on product cost as a proportion of customer's total cost and customer's profitability.

- Impact on Formosa Petrochemical: High price sensitivity among customers can lead to increased pressure for lower raw material prices.

- Industry Example: Automotive manufacturers, with tight margins (around 8-10% in 2023), are particularly sensitive to petrochemical input costs.

- Consequence: This sensitivity can limit Formosa Petrochemical's ability to dictate prices and enhance their own profit margins.

The bargaining power of Formosa Petrochemical's customers is amplified by the low switching costs prevalent in the petrochemical industry, especially for commoditized products. This ease of transition pressures Formosa to maintain competitive pricing, as seen in 2024's volatile global petrochemical market where even minor price differences could sway buyers. Furthermore, the threat of backward integration by large customers, such as automotive manufacturers exploring their own refining capacities, adds another layer of customer leverage, a trend supported by significant downstream investments by major industry players in 2024.

| Factor | Impact on Formosa Petrochemical | 2024 Market Context |

|---|---|---|

| Low Switching Costs | Increases customer power, forcing competitive pricing. | Price volatility favored buyers who could switch easily. |

| Backward Integration Threat | Customers with capital and expertise may produce inputs themselves. | Increased downstream investment by majors like Saudi Aramco signaled potential for customer vertical integration. |

| Product Commoditization | Gives customers more power as substitutes are readily available. | Intense price competition for key commodities like ethylene. |

| Customer Price Sensitivity | Heightens pressure for lower prices when petrochemicals are a large cost component. | Automotive sector, with ~8-10% profit margins in 2023, is highly sensitive to input costs. |

What You See Is What You Get

Formosa Petrochemical Porter's Five Forces Analysis

This preview showcases the complete Formosa Petrochemical Porter's Five Forces Analysis, offering a detailed examination of industry competition, buyer and supplier power, the threat of new entrants, and substitute products. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ready for your strategic decision-making.

Rivalry Among Competitors

The petrochemical and refining sector is a battleground featuring a blend of massive, globally integrated companies and more localized competitors, fueling fierce rivalry. Formosa Petrochemical navigates a landscape with substantial production capacity, where many firms aggressively pursue market share, particularly within the dynamic Asian market.

The petrochemical industry is experiencing a slowdown in growth, coupled with persistent overcapacity. This situation intensifies competition as companies vie for a limited pool of demand. For instance, in 2023, global petrochemical operating rates hovered around 80%, a notable dip from previous years, signaling an oversupplied market.

This oversupply directly translates into aggressive price competition. Companies are often forced to lower their prices to move inventory, squeezing profit margins across the board. Reports from early 2024 suggest this trend continues, with benchmark prices for key petrochemicals like ethylene and propylene remaining under pressure due to ample supply.

Many of Formosa Petrochemical's core products, such as basic olefins and aromatics, are essentially commodities. This means they are largely indistinguishable from those offered by competitors, intensifying price-based rivalry. For instance, the global market for ethylene, a key building block, often sees prices fluctuate significantly based on supply and demand, forcing producers to compete fiercely on cost.

This product homogeneity compels Formosa Petrochemical to maintain rigorous cost control and operational efficiency. In 2024, the average cost of producing a ton of ethylene globally remained a critical benchmark for profitability. Companies that can achieve lower production costs, perhaps through scale or advanced technology, gain a significant competitive edge in this environment.

High Fixed Costs and Exit Barriers

The refining and petrochemical sector is characterized by immense capital outlays for plants and equipment, leading to substantial fixed operating costs. These high fixed costs compel companies like Formosa Petrochemical to operate at high capacity utilization rates, even when market demand is sluggish, to spread these costs over a larger output. This creates a competitive environment where maintaining production volume is paramount, intensifying rivalry.

Exit barriers in this industry are notably high. Specialized, large-scale assets are difficult to repurpose or sell, and the costs associated with decommissioning and environmental remediation can be prohibitive. For instance, the construction of a new integrated refinery and petrochemical complex can easily run into billions of dollars, making a premature exit financially ruinous for most players.

- High Capital Intensity: Building a new petrochemical plant can cost upwards of $5 billion, a significant barrier to entry and a major fixed cost for existing operators.

- Specialized Assets: Equipment like cracking units and polymerization reactors are highly specific to petrochemical production, limiting resale options and increasing exit costs.

- Decommissioning Costs: Environmental regulations and the sheer scale of facilities mean that closing a plant can incur millions in demolition and site cleanup expenses.

- Industry Consolidation: The high costs often lead to consolidation, with fewer, larger players dominating the market, further intensifying the rivalry among those remaining.

Strategic Objectives and Diversification of Competitors

Competitors' strategic aims, whether prioritizing market share, profitability, or broad diversification, significantly shape the competitive rivalry within the petrochemical sector. For instance, global entities might employ aggressive pricing tactics to capture a larger slice of the market, directly impacting Formosa Petrochemical's pricing power.

Diversified conglomerates often possess the financial flexibility to cross-subsidize their petrochemical operations. This means they can absorb temporary losses or invest heavily in specific segments, even if those segments aren't immediately profitable, to maintain or grow their overall market presence. This can create a challenging environment for less diversified players.

- Market Share Focus: Companies like Sinopec and Saudi Aramco have historically pursued market share expansion, often through large-scale capacity additions and competitive pricing, as seen in their significant global production volumes in 2024.

- Profitability Drive: Other players, perhaps those with higher cost structures or more specialized product lines, might focus on maximizing profitability per unit, leading to different competitive strategies.

- Diversification Strategies: Conglomerates such as Dow or BASF leverage their broad portfolios, potentially shifting investment and resources between petrochemicals and other chemical or materials segments based on market conditions, offering them resilience.

- Impact on Formosa Petrochemical: These varied strategic objectives create a complex competitive landscape for Formosa Petrochemical, requiring agile responses to pricing pressures and strategic investments from rivals.

Competitive rivalry in the petrochemical sector is intense, driven by a large number of players, high fixed costs, and significant exit barriers. Formosa Petrochemical operates in a market where overcapacity, as evidenced by global operating rates around 80% in 2023, forces aggressive price competition. The commodity nature of many petrochemical products, like ethylene, means differentiation is difficult, making cost efficiency and scale crucial for survival.

| Key Petrochemical Product | Global Average Production Cost (Estimated 2024) | Major Competitors (Examples) |

|---|---|---|

| Ethylene | $800 - $1200 per ton | Sinopec, Saudi Aramco, Dow, LyondellBasell |

| Propylene | $900 - $1300 per ton | ExxonMobil, SABIC, INEOS |

| Benzene | $700 - $1000 per ton | TotalEnergies, Reliance Industries, UOP |

SSubstitutes Threaten

The growing adoption of electric vehicles (EVs) presents a significant threat to Formosa Petrochemical's core business. By the end of 2023, global EV sales surpassed 13.6 million units, a nearly 35% increase from the previous year, signaling a clear shift away from traditional internal combustion engine vehicles that rely on gasoline and diesel. This trend directly impacts the demand for refined petroleum products.

The rise of bio-based plastics and advanced recycling technologies poses a significant threat of substitution for Formosa Petrochemical's traditional offerings. For instance, the global bioplastics market was valued at approximately USD 11.5 billion in 2023 and is projected to grow substantially, indicating a clear shift in consumer and industrial preference. These alternatives directly compete with petrochemical-derived plastics across various applications, from packaging to consumer goods.

Shifts in how consumers and industries use materials pose a significant threat. As people and businesses focus more on reducing waste, using lighter materials, and embracing circular economy ideas, the demand for new petrochemicals can drop. For example, advancements in electric vehicles often incorporate lighter plastics and composites, potentially reducing the need for traditional automotive plastics derived from petrochemicals.

Efficiency gains in manufacturing and product design also play a role. Industries that can make their products with less material or use recycled content instead of virgin petrochemicals directly impact companies like Formosa Petrochemical. In 2024, many sectors are actively pursuing these efficiencies to cut costs and meet sustainability goals, which could lead to a decrease in the overall volume of petrochemicals required by downstream manufacturers.

Technological Advancements in End-User Industries

Technological advancements in industries that rely on Formosa Petrochemical's products can significantly alter demand. For example, innovations in packaging might reduce the amount of plastic needed per item, directly impacting sales volumes for Formosa. By mid-2024, the push for sustainable packaging solutions is accelerating, with many consumer goods companies setting ambitious targets for recycled content and material reduction.

Furthermore, the development of entirely new materials or manufacturing processes can create potent substitutes. Consider the automotive sector, where advancements in lightweight composites or bio-based materials could lessen the reliance on traditional petrochemical-derived plastics. In 2024, the automotive industry is heavily investing in R&D for these alternative materials, aiming to meet stricter environmental regulations and consumer preferences.

- Shift to advanced composites in automotive: Many automakers are increasing their use of carbon fiber and other advanced composites to improve fuel efficiency, with some targeting over 20% composite content by 2025.

- Growth of bio-plastics: The global bioplastics market is projected to reach significant growth, with some estimates suggesting a market size exceeding $10 billion by 2027, driven by demand for sustainable alternatives.

- Digitalization impacting material usage: Advances in 3D printing and digital manufacturing allow for more efficient use of raw materials, potentially reducing overall consumption of traditional plastics and polymers.

Regulatory and Environmental Pressures

Increasing global regulations, such as the European Union's Carbon Border Adjustment Mechanism (CBAM) which came into effect in October 2023, are directly impacting the petrochemical industry. These measures, alongside rising carbon taxes and environmental policies focused on reducing fossil fuel dependency and plastic waste, actively encourage the adoption of substitute materials. For instance, by 2026, the EU aims to reduce greenhouse gas emissions by at least 55% compared to 1990 levels, creating a significant incentive for alternatives to petrochemicals.

These mounting pressures can significantly alter market demand for traditional petrochemical products, making them less attractive as companies and consumers seek more sustainable options. The International Energy Agency (IEA) reported in its 2024 outlook that while petrochemical demand is projected to grow, the pace of this growth is increasingly influenced by policy shifts and the availability of viable substitutes, particularly in packaging and textiles.

- Global Regulations: The EU's CBAM and similar initiatives worldwide are increasing the cost of carbon-intensive products.

- Carbon Taxes: Many countries are implementing or increasing carbon taxes, making fossil fuel-based production more expensive.

- Environmental Policies: Stricter rules on plastic waste and emissions directly push for the use of biodegradable or recyclable alternatives.

- Market Demand Shift: These factors collectively steer consumer and industrial demand away from traditional petrochemicals.

The threat of substitutes for Formosa Petrochemical is substantial, driven by evolving technologies and increasing environmental consciousness. The burgeoning electric vehicle market, which saw global sales exceed 13.6 million units by the end of 2023, directly reduces demand for gasoline and diesel. Similarly, the growing bioplastics market, valued at approximately USD 11.5 billion in 2023, offers a direct alternative to petrochemical-derived plastics. These shifts, coupled with efficiency gains in manufacturing and new material development, are actively reshaping demand for traditional petrochemical products.

| Substitute Category | Key Drivers | Impact on Petrochemicals | 2023/2024 Data Point |

|---|---|---|---|

| Electric Vehicles (EVs) | Environmental concerns, government incentives, technological advancements | Reduced demand for gasoline and diesel | Global EV sales surpassed 13.6 million units in 2023 (up ~35% YoY) |

| Bioplastics & Bio-based Materials | Sustainability initiatives, consumer preference, regulatory support | Direct competition with petrochemical plastics | Global bioplastics market valued at ~USD 11.5 billion in 2023 |

| Advanced Composites & Lightweight Materials | Fuel efficiency targets, performance enhancement | Reduced use of traditional plastics in automotive and aerospace | Automotive sector targeting over 20% composite content by 2025 |

| Recycling Technologies & Circular Economy | Waste reduction goals, resource efficiency | Decreased demand for virgin petrochemicals | Increasing investment in advanced recycling infrastructure globally |

Entrants Threaten

The sheer scale of investment needed to build and operate an oil refinery or petrochemical plant presents a formidable barrier to entry. For instance, constructing a new, large-scale refinery can easily cost billions of dollars, encompassing land acquisition, complex machinery, environmental compliance, and skilled labor. This immense capital requirement effectively deters many potential new players from even considering entering the market.

Established companies like Formosa Petrochemical benefit significantly from economies of scale. Their vast, integrated facilities allow for lower per-unit production costs due to efficient operations and bulk purchasing power. A new entrant would find it incredibly challenging to match these cost efficiencies, making it difficult to compete on price with incumbents who have already amortized much of their initial investment.

In 2024, the global petrochemical industry continues to see massive capital expenditures, with projects often exceeding $10 billion. Companies like Formosa Petrochemical, with their existing infrastructure and operational expertise, are well-positioned to leverage these scale advantages. New entrants would face the dual challenge of raising substantial capital and then operating at a scale that can rival the cost-effectiveness of industry leaders.

Newcomers face significant hurdles in securing reliable and cost-effective access to crude oil and other essential feedstocks, a critical input for petrochemical production. Establishing extensive distribution networks for refined and petrochemical products also presents a formidable challenge, requiring substantial investment in infrastructure and logistics. Formosa Petrochemical, for instance, benefits from its established supply chain relationships and existing logistics infrastructure, giving it a distinct advantage over potential new entrants. In 2024, the global refining capacity stood at approximately 102 million barrels per day, highlighting the scale of operations required to compete effectively.

The petrochemical industry faces significant barriers to entry due to extensive regulatory frameworks and rigorous environmental compliance requirements. New companies must navigate a complex web of permits, licenses, and adherence to strict environmental standards, a process that is both time-consuming and financially demanding. For instance, the ongoing scrutiny and opposition surrounding major projects, such as Formosa's proposed Sunshine Bend complex in Louisiana, highlight how environmental concerns can significantly impede new entrants, adding substantial risk and cost to market entry.

Proprietary Technology and Expertise

The threat of new entrants for Formosa Petrochemical is significantly mitigated by the substantial proprietary technology and expertise held by existing players. Companies like Formosa have invested heavily in developing and refining their complex refining and petrochemical processes, creating a high barrier to entry.

This deep operational knowledge translates into tangible advantages. For instance, Formosa Petrochemical's integrated production facilities, a result of years of technological advancement and optimization, allow for greater efficiency and cost control. In 2023, the company reported a net profit of NT$27.8 billion (approximately US$860 million), reflecting its operational effectiveness.

- Proprietary Technology: Incumbents possess unique, patented processes that are costly and time-consuming for newcomers to develop or license.

- Operational Expertise: Years of experience in managing complex petrochemical operations lead to optimized yields and lower waste, giving established firms a cost advantage.

- Capital Intensity: Building new, state-of-the-art petrochemical facilities requires billions of dollars in investment, a significant hurdle for potential entrants.

- Economies of Scale: Existing large-scale operations benefit from lower per-unit production costs, making it difficult for smaller, new facilities to compete on price.

Brand Loyalty and Established Customer Relationships

While many petrochemical products are essentially commodities, companies like Formosa Petrochemical have cultivated deep-seated relationships with crucial industrial clients. This history fosters significant customer loyalty, making it challenging for newcomers to disrupt existing supply chains and secure market share. Formosa Petrochemical’s established presence means new entrants must invest heavily in building trust and demonstrating superior value to even begin competing.

Brand recognition, even in commodity markets, can be a powerful barrier. Formosa Petrochemical benefits from a reputation built over years of consistent supply and quality. New competitors face the uphill battle of not only matching product specifications but also overcoming the ingrained preference customers have for familiar and trusted suppliers. For instance, in 2023, Formosa Petrochemical reported consolidated revenues of approximately NT$1.1 trillion (around US$35 billion), underscoring its significant market footprint and the scale of loyalty it commands.

- Customer Loyalty: Established firms like Formosa Petrochemical benefit from long-standing relationships with industrial customers.

- Brand Recognition: A recognized brand, even in commodity sectors, can deter new entrants by fostering customer preference.

- Switching Costs: For buyers, switching petrochemical suppliers can involve costs related to qualification, testing, and potential disruptions, reinforcing loyalty to incumbents.

- Market Share Defense: Formosa Petrochemical's substantial market share, evidenced by its significant revenue figures, makes it harder for new players to gain initial traction.

The threat of new entrants for Formosa Petrochemical is significantly low due to immense capital requirements, estimated in the billions for new facilities, and the established economies of scale enjoyed by incumbents. New players also struggle with securing feedstock and building distribution networks, while navigating complex regulations adds further hurdles.

Proprietary technology and deep operational expertise are critical advantages for existing companies like Formosa Petrochemical, making it difficult for newcomers to match efficiency and cost-effectiveness. Customer loyalty and brand recognition further solidify the position of established players, as switching suppliers can involve significant costs for buyers.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/2023) |

|---|---|---|---|

| Capital Intensity | High cost of building new petrochemical plants. | Deters most potential entrants. | New refinery projects often exceed $10 billion. |

| Economies of Scale | Lower per-unit costs for large-scale producers. | Makes it hard to compete on price. | Formosa Petrochemical's integrated facilities. |

| Feedstock Access & Distribution | Securing raw materials and product delivery. | Requires significant infrastructure investment. | Global refining capacity ~102 million bpd (2024). |

| Proprietary Technology & Expertise | Unique processes and operational knowledge. | Creates a knowledge and efficiency gap. | Formosa Petrochemical's operational effectiveness (NT$27.8 billion net profit in 2023). |

| Customer Loyalty & Brand | Established relationships and market recognition. | Difficult to gain market share. | Formosa Petrochemical's revenue ~NT$1.1 trillion (2023). |

Porter's Five Forces Analysis Data Sources

Our Formosa Petrochemical Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Formosa's annual reports, industry-specific market research from firms like IHS Markit, and publicly available regulatory filings from Taiwan's SEC equivalent.