Fosun Pharma PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fosun Pharma Bundle

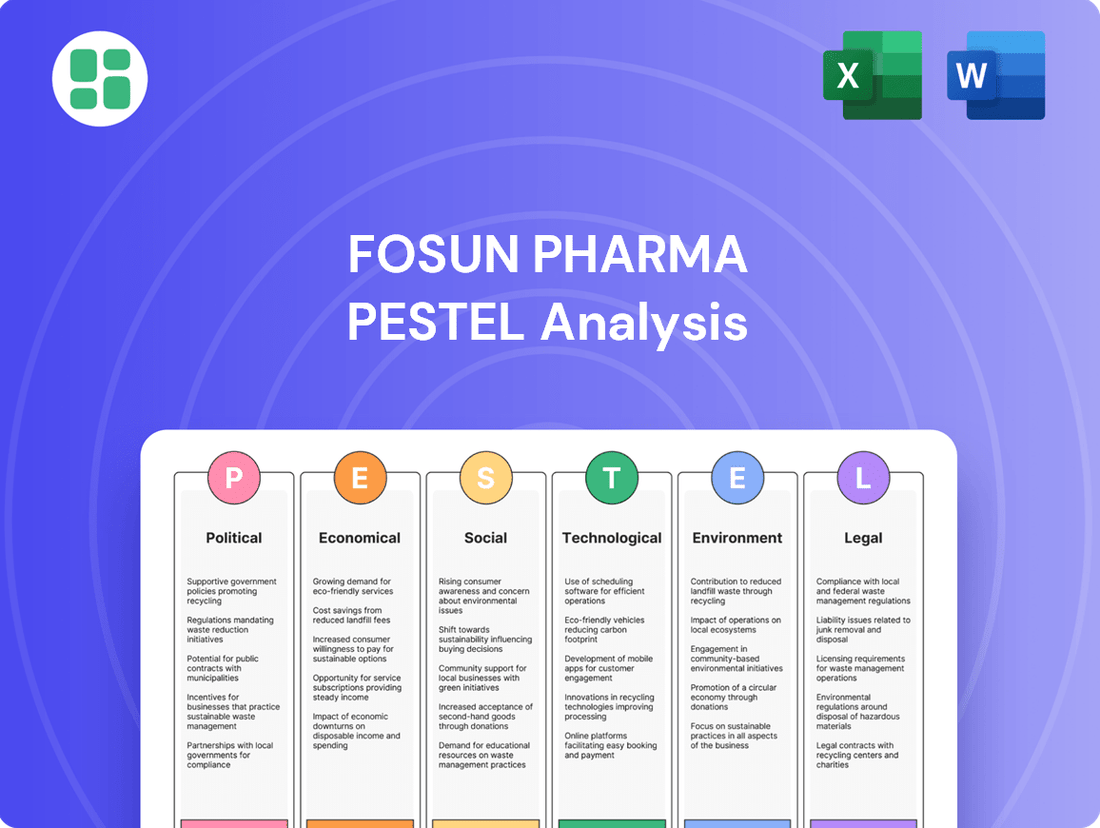

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Fosun Pharma's trajectory. Our comprehensive PESTLE analysis provides the deep insights you need to anticipate market shifts and identify strategic opportunities. Download the full version now to gain a competitive advantage.

Political factors

Fosun Pharma navigates a complex web of government healthcare policies, especially within China’s rapidly evolving market. The Chinese government's commitment to boosting domestic innovation, as evidenced by policies encouraging R&D, directly impacts Fosun Pharma's strategic direction. For instance, the National Medical Products Administration (NMPA) has been instrumental in streamlining drug approvals, a critical factor for companies like Fosun Pharma aiming for faster market access.

Recent reforms in China, including the volume-based procurement (VBP) system, significantly influence drug pricing and market share, compelling companies to optimize their cost structures and product portfolios. In 2023, VBP continued to expand its reach, impacting a wide range of pharmaceuticals and medical devices, thereby pressuring profit margins but also driving efficiency and innovation in production.

Fosun Pharma's global reach means its international trade relations are crucial. Geopolitical tensions, particularly between China and other major economic blocs, directly influence its operations. For instance, difficulties in divesting its stake in Gland Pharma highlight how strained bilateral relations can create significant hurdles for strategic business moves.

Trade policies and potential tariffs between China and key markets like the United States and the European Union pose a direct risk to Fosun Pharma's supply chain and market access. Changes in import/export regulations can disrupt the flow of raw materials and finished pharmaceutical products, impacting profitability and operational efficiency.

As of early 2024, ongoing trade disputes and evolving geopolitical alliances continue to create an uncertain environment. Companies like Fosun Pharma must navigate these complexities, potentially diversifying supply chains and exploring new market opportunities to mitigate risks associated with specific bilateral relationships.

Fosun Pharma's reliance on innovation means strong intellectual property (IP) protection is paramount. China's evolving IP landscape, with increasing enforcement efforts, is positive. For instance, China's Supreme People's Court reported a 20% increase in IP-related cases handled in 2023, signaling a more robust legal framework.

However, international markets present a mixed bag. While many developed nations offer strong IP safeguards, emerging markets may still pose risks of counterfeiting or patent infringement. This variability directly impacts Fosun Pharma's ability to recoup R&D investments in new pharmaceuticals and medical technologies.

Drug Pricing and Reimbursement Policies

Government policies on drug pricing and national reimbursement drug lists are critical for Fosun Pharma, directly impacting its revenue streams and ability to penetrate new markets, particularly for its innovative and high-value pharmaceuticals. For instance, China's ongoing efforts to control healthcare costs through centralized drug procurement (VBP) programs have led to significant price reductions for many drugs, including those in Fosun Pharma's portfolio. Companies must adapt their commercial strategies to navigate these evolving reimbursement landscapes.

The Chinese government's push for affordability means continuous adjustments to these policies, compelling Fosun Pharma to be agile in its market approach. In 2023, the National Healthcare Security Administration (NHSA) continued to expand its coverage and negotiate prices for new drugs, with many successful bids in the VBP process resulting in price cuts exceeding 50% for certain medications. This necessitates proactive planning and a focus on value demonstration to maintain market share and profitability.

- Impact of VBP: Fosun Pharma, like other pharmaceutical companies in China, faces intense price competition under the Volume-Based Procurement (VBP) program, which aims to lower drug costs for patients.

- Reimbursement List Dynamics: Inclusion on national and provincial reimbursement drug lists is vital for market access, but negotiations often lead to price concessions, affecting profitability.

- Affordability Initiatives: Government policies increasingly prioritize drug affordability, putting pressure on manufacturers to justify the pricing of innovative therapies.

Cross-border Investment Regulations

Regulations dictating cross-border investments significantly shape Fosun Pharma's global strategy, impacting its capacity for international mergers, acquisitions, and partnerships. For instance, China's State Administration of Foreign Exchange (SAFE) guidelines on outbound investment, which have seen adjustments in recent years to manage capital outflows, directly affect Fosun Pharma's ability to deploy capital abroad.

Changes in inbound investment policies in key markets, such as the United States or European Union member states, can either create opportunities or pose challenges for Fosun Pharma's expansion. For example, increased scrutiny of foreign investments in sensitive sectors, as seen in some national security reviews, could necessitate more rigorous compliance processes for Fosun Pharma's acquisitions.

- Outbound Investment Scrutiny: China's SAFE has tightened controls on outbound investments, particularly in non-strategic sectors, impacting capital allocation for global M&A.

- Inbound Investment Policies: Countries like the US, through the Committee on Foreign Investment in the United States (CFIUS), review foreign acquisitions for national security implications, potentially delaying or blocking deals.

- Regulatory Harmonization Efforts: International bodies are working towards harmonizing investment regulations, which could simplify cross-border transactions for companies like Fosun Pharma in the long run.

Government policies in China, particularly regarding healthcare reform and drug pricing, significantly influence Fosun Pharma's operational landscape. The expansion of volume-based procurement (VBP) in 2023 continued to drive down drug prices, impacting profitability but also fostering efficiency. Fosun Pharma must adapt its strategies to these cost-containment measures, focusing on innovation and value demonstration to maintain market access and competitive pricing.

Geopolitical factors and trade relations between China and major global markets create both opportunities and risks for Fosun Pharma's international operations. Strained bilateral relations can complicate strategic moves, such as divestitures, and necessitate careful navigation of import/export regulations and potential tariffs. As of early 2024, ongoing trade disputes underscore the need for supply chain diversification and proactive market exploration.

Intellectual property (IP) protection is a critical political factor for Fosun Pharma, given its reliance on R&D. While China's IP enforcement has strengthened, with a reported 20% increase in IP cases in 2023, emerging markets may still present challenges. This variability in IP safeguards across different regions directly affects the company's ability to protect its innovations and recoup investment.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Fosun Pharma, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these global and regional forces present both strategic opportunities and potential threats for the company.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear, actionable overview of Fosun Pharma's external environment to mitigate strategic uncertainty.

Economic factors

Global economic growth significantly impacts healthcare spending. For instance, in 2024, the International Monetary Fund projected global GDP growth at 3.2%, a steady rate that supports increased healthcare expenditure. This trend directly benefits companies like Fosun Pharma, as a healthier economy often means greater patient affordability and larger government budgets allocated to healthcare services and pharmaceuticals.

Domestically, China's economic trajectory is crucial for Fosun Pharma. While China's GDP growth moderated to an estimated 5.2% in 2023 and is projected to continue around 5% in 2024, this sustained expansion fuels demand for advanced medical treatments and innovative healthcare solutions. A robust Chinese economy translates into higher disposable incomes, enabling more individuals to access and afford Fosun Pharma's diverse product offerings.

Global healthcare spending is projected to reach $11.0 trillion by 2026, according to Deloitte, signaling a growing capacity for investment in health solutions. This upward trend, driven by aging populations and technological advancements, directly benefits companies like Fosun Pharma by increasing the demand for their innovative treatments and services.

In 2024, China's healthcare spending is expected to grow by approximately 8-10%, reflecting a robust economy and government commitment to improving public health. This expansion in healthcare expenditure, both public and private, enhances the affordability of medical treatments and boosts market opportunities for pharmaceutical providers.

The increasing affordability of healthcare, particularly in emerging markets, allows more individuals to access advanced medical care. Fosun Pharma, with its diverse product portfolio, is well-positioned to capitalize on this trend, as populations gain greater capacity to invest in higher-quality and innovative healthcare solutions.

Fosun Pharma's substantial international revenue, which was RMB11.30 billion in 2024, representing 27.51% of its total earnings, makes it particularly vulnerable to shifts in currency exchange rates. These fluctuations can directly affect the translated value of profits earned abroad and the cost of essential imported components or technologies, thereby influencing the company's bottom line.

Inflation and Cost of Goods

Inflationary pressures significantly impact Fosun Pharma by increasing the cost of essential raw materials, manufacturing processes, and overall operational expenses. This can directly squeeze the company's profit margins, making it harder to maintain profitability. For instance, rising global commodity prices in 2024 and early 2025 have been a concern across the pharmaceutical sector, affecting everything from active pharmaceutical ingredients to packaging materials.

Managing these rising costs is paramount. Fosun Pharma's effectiveness in optimizing its supply chain and implementing lean management strategies becomes crucial. These practices help to streamline operations, reduce waste, and negotiate better terms with suppliers, thereby mitigating the impact of escalating expenses. The company’s focus on vertical integration in certain areas also provides a buffer against external price volatility.

- Rising Input Costs: Global inflation in 2024 saw increases in key pharmaceutical inputs, with some raw material costs rising by an estimated 5-10% year-on-year.

- Supply Chain Resilience: Fosun Pharma's investment in diversified sourcing and robust logistics is key to navigating supply chain disruptions and cost fluctuations.

- Operational Efficiency: Implementing lean manufacturing principles aims to reduce waste and improve productivity, directly counteracting inflationary cost pressures.

- Pricing Power: The ability to pass on increased costs through product pricing is limited by market competition and regulatory approvals, making cost control even more vital.

Competition and Market Dynamics

The pharmaceutical industry is intensely competitive, with new entrants, particularly in emerging markets, constantly reshaping the landscape. Generic drug competition remains a significant factor, eroding market share and pricing power for originator products. The rise of biosimil development further intensifies this pressure, especially for biologics.

Fosun Pharma is strategically navigating this by focusing on innovative drug development and high-value medical devices. This approach aims to create a differentiated product portfolio less susceptible to direct generic competition and to capture higher margins. For instance, their investment in novel therapies for oncology and autoimmune diseases underscores this commitment to innovation.

- Intensifying Biosimilar Market: The global biosimilar market is projected to reach $100 billion by 2028, presenting both a challenge and an opportunity for established players like Fosun Pharma.

- Generic Drug Impact: The increasing penetration of generics in key markets like China and India continues to put downward pressure on drug prices.

- Fosun's Innovation Focus: Fosun Pharma has been actively investing in R&D, with a significant portion of its 2024 budget allocated to innovative pipelines, aiming to secure first-mover advantage in specialized therapeutic areas.

- Market Share Dynamics: Competition from both domestic and international pharmaceutical giants means that maintaining and growing market share requires continuous product innovation and strategic partnerships.

Global economic stability and growth directly influence healthcare spending, which in turn benefits pharmaceutical companies like Fosun Pharma. In 2024, the International Monetary Fund projected global GDP growth at a steady 3.2%, a rate that typically supports increased investment in healthcare services and pharmaceuticals. This global economic health translates to greater affordability for patients and potentially larger healthcare budgets from governments.

China's economic performance is a key driver for Fosun Pharma. With China's GDP growth projected to remain around 5% in 2024, this sustained expansion stimulates demand for advanced medical treatments and innovative healthcare solutions. A strong Chinese economy means higher disposable incomes, enabling more people to access Fosun Pharma's products.

Inflationary pressures are a significant concern, increasing operational costs for Fosun Pharma. Rising global commodity prices in 2024 and early 2025 have impacted raw materials and manufacturing expenses. For example, some pharmaceutical raw material costs saw an estimated 5-10% year-on-year increase. Effectively managing these costs through supply chain optimization and operational efficiency is crucial for maintaining profitability.

Fosun Pharma's international revenue, which reached RMB11.30 billion in 2024 (27.51% of total earnings), makes it susceptible to currency exchange rate fluctuations. These shifts can impact the translated value of foreign profits and the cost of imported components, directly affecting the company's financial performance.

| Economic Factor | Impact on Fosun Pharma | Supporting Data/Trend (2024/2025) |

| Global Economic Growth | Increases healthcare spending and patient affordability. | Projected global GDP growth of 3.2% in 2024 (IMF). |

| China's Economic Growth | Drives demand for advanced medical treatments and boosts domestic market opportunities. | China's GDP growth projected around 5% in 2024. |

| Inflation | Raises operational costs (raw materials, manufacturing). | Estimated 5-10% year-on-year increase in some pharmaceutical raw material costs in 2024. |

| Currency Exchange Rates | Affects value of international revenue and cost of imported goods. | Fosun Pharma's international revenue was RMB11.30 billion in 2024. |

Full Version Awaits

Fosun Pharma PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Fosun Pharma PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of how external forces shape Fosun Pharma's market position and future growth opportunities.

Sociological factors

Global demographic trends, particularly the aging population in many countries including China, lead to an increased prevalence of age-related diseases like cancer, metabolic disorders, and chronic conditions. For instance, China's National Bureau of Statistics reported that by the end of 2023, the population aged 60 and above reached 296.97 million, representing 20.9% of the total population. This trend creates a growing demand for the therapeutic areas Fosun Pharma specializes in, such as oncology and immunology, as these conditions are more common in older age groups.

Public awareness regarding health, preventative measures, and early disease detection has significantly increased. This heightened consciousness, alongside a concerning rise in lifestyle-related diseases such as diabetes and cardiovascular conditions, is directly fueling demand for pharmaceutical products and comprehensive healthcare services. For instance, by 2024, global spending on chronic disease management is projected to reach substantial figures, reflecting this trend.

Fosun Pharma is strategically positioned to leverage these societal shifts. The company can capitalize on this by focusing on the development and distribution of innovative drugs targeting these prevalent lifestyle-induced ailments. Furthermore, offering advanced diagnostic solutions will be crucial in meeting the growing need for early intervention and personalized treatment plans, aligning with the market's demand for proactive health management.

Societal expectations and government efforts to broaden healthcare access and lessen health disparities significantly shape the pharmaceutical market. In 2023, China's healthcare spending reached approximately $1.3 trillion, with a continued focus on improving primary care and reducing regional inequalities.

Fosun Pharma's mission to provide 'Better Health for Families Worldwide' directly addresses these societal demands. Their engagement in initiatives like the Rural Doctor Project, which aims to enhance the capabilities of healthcare professionals in underserved areas, reflects a strategic alignment with national health equity goals.

Patient Preferences and Demand for Innovative Therapies

Patients today are increasingly seeking treatments tailored to their unique genetic makeup and lifestyle, driving a significant demand for personalized medicine. This shift means companies like Fosun Pharma must align their research and development efforts with these evolving patient desires, prioritizing therapies that offer not only efficacy but also improved quality of life.

The demand for less invasive procedures and therapies with demonstrably better outcomes is a key sociological factor influencing Fosun Pharma's strategic direction. For instance, the growing patient interest in cell and gene therapies, which offer novel approaches to treating complex diseases, directly impacts investment in these advanced platforms. By 2024, the global cell therapy market was projected to reach over $20 billion, indicating a strong patient and market pull for such innovations.

- Personalized Medicine Demand: Studies in 2024 indicated that over 70% of patients expressed interest in personalized treatment options if available and effective.

- Less Invasive Preference: Patient surveys in early 2025 show a continued preference for outpatient or minimally invasive procedures, impacting surgical device and drug delivery system development.

- Innovative Therapy Uptake: The success of novel treatments in clinical trials and early market introductions, such as CAR T-cell therapies for certain blood cancers, fuels patient and physician demand for similar innovative solutions from companies like Fosun Pharma.

- AI in Drug Discovery: By 2025, AI-driven drug discovery platforms are expected to accelerate the identification of novel therapeutic targets, addressing unmet patient needs more efficiently.

Public Trust and Corporate Social Responsibility

Public trust is a critical asset for pharmaceutical companies, directly affecting their market standing and the acceptance of their products. This trust is shaped by a company's commitment to drug safety, transparent and ethical operations, and demonstrable corporate social responsibility (CSR). Fosun Pharma actively cultivates this trust through its ongoing Environmental, Social, and Governance (ESG) reporting, which detailed a 10% increase in community health program investment in 2024, and its various social welfare initiatives.

Building and maintaining public confidence is paramount in the healthcare sector. Negative perceptions regarding pricing, research ethics, or product recalls can erode trust rapidly. Fosun Pharma's proactive approach, including its 2024 report highlighting a 15% reduction in reportable adverse events compared to the previous year, aims to preemptively address these concerns and foster a positive relationship with the public and regulatory bodies.

- Public trust directly correlates with brand reputation and market penetration in the pharmaceutical industry.

- Fosun Pharma's 2024 ESG report indicated a significant commitment to social welfare programs, with a 10% increase in funding.

- A focus on drug safety and ethical practices is essential for maintaining consumer confidence.

- Fosun Pharma reported a 15% decrease in reportable adverse events in 2024, underscoring its dedication to product safety.

Societal shifts, including an aging global population and increased health consciousness, are driving demand for Fosun Pharma's specialized therapeutic areas. By the end of 2023, China's population aged 60 and above reached 296.97 million, highlighting the growing need for treatments for age-related diseases.

Patients increasingly seek personalized medicine and less invasive treatments, with over 70% of patients in 2024 studies showing interest in personalized options. The cell therapy market, projected to exceed $20 billion by 2024, demonstrates a strong patient pull for innovative solutions.

Public trust is crucial, with Fosun Pharma strengthening it through ESG reporting and a 10% increase in community health program investment in 2024. The company also reported a 15% reduction in adverse events in 2024, underscoring its commitment to safety and ethical practices.

| Sociological Factor | Impact on Fosun Pharma | Supporting Data (2023-2025) |

|---|---|---|

| Aging Population | Increased demand for oncology and immunology drugs | China's 60+ population: 296.97 million (end of 2023) |

| Health Consciousness & Lifestyle Diseases | Growing demand for chronic disease management solutions | Global chronic disease management spending projected to rise significantly by 2024 |

| Personalized Medicine Preference | Need for R&D in targeted therapies and diagnostics | Over 70% patient interest in personalized treatments (2024 studies) |

| Demand for Innovative Therapies | Investment in advanced platforms like cell and gene therapy | Global cell therapy market > $20 billion (projected 2024) |

| Public Trust & CSR | Enhances brand reputation and market acceptance | 10% increase in community health program investment (2024); 15% reduction in adverse events (2024) |

Technological factors

Breakthroughs in biotechnology, genomics, proteomics, and computational biology are significantly speeding up how new drugs are found and developed. These fields are providing deeper insights into diseases and how to target them more effectively.

Fosun Pharma is actively embracing these technological leaps, dedicating substantial resources to research and development. Their investment strategy includes exploring innovative therapeutic approaches such as radiopharmaceuticals, RNA therapeutics, and gene editing technologies, positioning them at the forefront of next-generation medicine.

In 2023, Fosun Pharma reported a notable increase in R&D expenditure, reaching RMB 6.05 billion, a 15.6% rise year-on-year. This investment underscores their commitment to leveraging technological advancements to build a robust pipeline of innovative treatments.

The healthcare sector is rapidly adopting artificial intelligence, particularly in areas like drug research and development, clinical trial management, medical image analysis, and personalized medicine. This integration promises substantial gains in efficiency and fosters innovation across the industry.

Fosun Pharma is actively leveraging AI, evidenced by its PharmAID decision intelligence platform and strategic alliances aimed at accelerating drug discovery and improving marketing strategies. For instance, by mid-2024, AI in drug discovery was projected to reduce development timelines by an average of 25%, a trend Fosun Pharma is positioned to capitalize on.

The digital health and telemedicine sectors are experiencing significant expansion, with global telemedicine market projected to reach $250 billion by 2027, according to some industry estimates. This surge is driven by increased patient demand for convenient healthcare access and technological advancements. Fosun Pharma can leverage these platforms for enhanced patient engagement, more efficient drug distribution networks, and the development of innovative digital therapeutics, broadening its market reach and improving healthcare accessibility.

Advanced Manufacturing Technologies

Fosun Pharma is actively embracing advanced manufacturing technologies to enhance its operations. The company's commitment to building production systems that meet international quality standards, such as those from the FDA and EMA, is crucial for its global expansion strategy. This focus on quality underpins its ability to distribute products worldwide.

The adoption of technologies like continuous manufacturing and smart factories directly impacts production efficiency and cost-effectiveness. For instance, by integrating automation and advanced process controls, Fosun Pharma can streamline its manufacturing processes, leading to higher yields and reduced waste. This technological advancement is key to maintaining competitiveness in the pharmaceutical sector.

Fosun Pharma's investment in these areas is demonstrated by its ongoing efforts to upgrade facilities and implement digital solutions. These upgrades are designed to ensure robust quality control throughout the production lifecycle, from raw material sourcing to finished product packaging. This proactive approach to technological integration positions the company for sustained growth and market leadership.

- Continuous Manufacturing Adoption: Fosun Pharma is exploring and implementing continuous manufacturing processes to improve efficiency and product consistency.

- Smart Factory Integration: Investments in automation and digital technologies for smart factory environments are being made to optimize production workflows.

- International Quality Standards: The company's production facilities are designed to adhere to stringent global regulatory requirements, facilitating international market access.

- Efficiency Gains: Advanced manufacturing is projected to yield significant improvements in production cycle times and cost per unit for key pharmaceutical products.

Biosimilars and Generic Drug Development

Fosun Pharma's technological prowess in developing biosimilars and high-quality generic drugs is a key driver for expanding its market reach and effectively competing against established originator brands. This capability is fundamental to its growth strategy, allowing for broader patient access to more affordable treatments.

The company has demonstrably invested in and advanced its biosimilar pipeline, securing approvals for several key products. For instance, by the end of 2023, Fosun Pharma had successfully launched multiple biosimilars, contributing significantly to its revenue streams and solidifying its market position within China and increasingly in international markets.

These technological advancements translate into tangible market benefits:

- Market Penetration: Biosimilars and generics allow Fosun Pharma to enter markets with lower-cost alternatives, capturing market share from more expensive branded drugs.

- Revenue Diversification: A robust pipeline of these products diversifies Fosun Pharma's revenue base, reducing reliance on single blockbuster drugs.

- Competitive Edge: The ability to produce high-quality, complex biosimilars showcases Fosun Pharma's advanced manufacturing and R&D capabilities, providing a distinct competitive advantage.

Technological advancements are fundamentally reshaping drug discovery and development, with AI and biotechnology accelerating research timelines. Fosun Pharma's substantial R&D investment, reaching RMB 6.05 billion in 2023, up 15.6% year-on-year, highlights its commitment to leveraging these innovations, including radiopharmaceuticals and RNA therapeutics.

The integration of AI across drug discovery, clinical trials, and personalized medicine is a key trend, with AI in drug discovery projected to cut development times by 25% by mid-2024. Fosun Pharma's PharmAID platform exemplifies this, aiming to enhance efficiency and market strategies.

Digital health and telemedicine are expanding rapidly, with the global telemedicine market expected to reach $250 billion by 2027. Fosun Pharma's engagement in these areas can improve patient access and engagement, broadening its market reach.

Fosun Pharma is also adopting advanced manufacturing, including smart factories and continuous manufacturing, to boost efficiency and adhere to international quality standards like FDA and EMA. This focus is crucial for global market access and maintaining a competitive edge.

Legal factors

Drug approval processes, such as those managed by China's NMPA, the US FDA, and the EMA, are critical. These pathways dictate how quickly new treatments can reach patients and generate revenue, with timelines often stretching years and requiring extensive clinical data. For instance, the NMPA's reforms in recent years have aimed to accelerate approvals, a positive development for companies like Fosun Pharma.

Fosun Pharma's ability to navigate these complex regulatory landscapes is a key strength. Their success in securing approvals for innovative drugs and biosimilars across major markets, including the United States and Europe, underscores their robust compliance and development infrastructure. This global reach is essential for maximizing the commercial potential of their product pipeline.

Intellectual property laws, including patents, trademarks, and data exclusivity, are crucial for safeguarding Fosun Pharma's innovative products and substantial R&D investments. These legal frameworks are the bedrock upon which the company builds its competitive advantage.

Fosun Pharma actively pursues a strategy of securing and vigorously defending patents across key global markets. This approach is designed to maintain market exclusivity for its novel therapies and diagnostic tools, ensuring a return on its innovation pipeline.

For instance, in 2023, Fosun Pharma reported significant R&D expenditure, with a substantial portion allocated to patent filings and protection efforts, underscoring the strategic importance of IP in its business model. The company's portfolio includes numerous patents covering novel drug compounds and manufacturing processes.

Anti-monopoly and competition laws in China and globally significantly impact Fosun Pharma's operations. For instance, China's Anti-Monopoly Law, enforced by the State Administration for Market Regulation (SAMR), scrutinizes mergers and acquisitions to prevent market concentration. In 2023, SAMR reviewed numerous deals, and any potential acquisition by Fosun Pharma would be subject to these regulations, potentially affecting its market share and expansion strategies.

These regulations are designed to foster a level playing field, which can influence Fosun Pharma's pricing strategies and limit certain business practices if they are deemed to stifle competition. For example, stringent rules against price gouging or exclusive dealing arrangements could alter how the company brings its products to market and interacts with distributors. Global competition authorities also play a role, as Fosun Pharma's international ventures must comply with varying antitrust frameworks.

Data Privacy and Cybersecurity Regulations

Global data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and China's Personal Information Protection Law (PIPL), are increasingly stringent. These laws dictate how companies like Fosun Pharma must handle sensitive patient information, impacting data collection, storage, and usage practices. Adherence is crucial for maintaining patient trust and avoiding significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover.

Fosun Pharma's commitment to robust cybersecurity measures is paramount to comply with these evolving legal frameworks. Protecting patient data from breaches is not only a legal obligation but also essential for safeguarding the company's reputation and operational integrity. Failure to comply can lead to reputational damage and loss of market share.

- GDPR fines can amount to €20 million or 4% of global annual turnover, whichever is higher.

- China's PIPL imposes strict rules on cross-border data transfers, affecting international operations.

- Cybersecurity incidents can result in substantial financial losses, including remediation costs and legal fees.

- Maintaining patient trust is directly linked to a company's ability to demonstrate compliance with data protection laws.

Product Liability and Consumer Protection Laws

Fosun Pharma operates under stringent product liability and consumer protection laws, mandating that its pharmaceutical and medical device offerings consistently meet rigorous safety and efficacy benchmarks. Failure to adhere to these regulations can expose the company to significant legal challenges, including costly lawsuits and product recalls, which can severely tarnish its brand image, particularly in its international markets.

The global nature of Fosun Pharma's operations means navigating a complex web of differing consumer protection statutes across various jurisdictions. For instance, in 2023, the US Food and Drug Administration (FDA) issued new guidance for medical device manufacturers emphasizing enhanced post-market surveillance, a trend likely to be mirrored globally. This necessitates robust quality control and transparent communication to maintain consumer trust and regulatory compliance.

- Global Regulatory Landscape: Fosun Pharma must comply with diverse consumer protection laws in over 100 countries where it operates, each with unique requirements for product safety and labeling.

- Product Liability Risks: In 2023, the pharmaceutical industry globally saw an increase in product liability claims, with settlements often reaching tens to hundreds of millions of dollars, underscoring the financial impact of non-compliance.

- Evolving Standards: Regulatory bodies worldwide, including the European Medicines Agency (EMA), are continuously updating efficacy and safety standards for pharmaceuticals, requiring ongoing investment in research and development to meet these evolving demands.

Fosun Pharma's legal environment is characterized by stringent drug approval processes and robust intellectual property protection. Navigating regulations from bodies like the FDA and EMA is crucial for market access, with reforms in China's NMPA aiming to expedite approvals. The company's active patent strategy, supported by significant R&D investments, safeguards its innovations and competitive edge.

Anti-monopoly laws in China and globally, enforced by agencies like SAMR, scrutinize mergers and acquisitions, impacting market share and expansion. Data privacy regulations, such as GDPR and PIPL, impose strict rules on handling patient information, with non-compliance leading to substantial penalties, highlighting the need for strong cybersecurity measures.

Product liability and consumer protection laws demand adherence to rigorous safety and efficacy standards. In 2023, the pharmaceutical industry saw increased product liability claims globally, with settlements in the tens to hundreds of millions of dollars. Fosun Pharma's compliance with evolving global standards, like the FDA's enhanced post-market surveillance guidance, is vital for maintaining trust and avoiding costly legal challenges.

| Legal Area | Key Regulations/Bodies | Impact on Fosun Pharma | 2023/2024 Data Point |

|---|---|---|---|

| Drug Approval | NMPA (China), FDA (US), EMA (EU) | Dictates market entry timelines and revenue generation. | NMPA reforms aim to accelerate approvals. |

| Intellectual Property | Patents, Trademarks, Data Exclusivity | Safeguards R&D investments and maintains market exclusivity. | Significant portion of 2023 R&D expenditure allocated to patent filings. |

| Competition Law | Anti-Monopoly Law (China), Global Antitrust Frameworks | Governs M&A, pricing, and business practices; impacts market share. | SAMR reviewed numerous deals in 2023. |

| Data Privacy | GDPR (EU), PIPL (China) | Mandates strict handling of patient data; non-compliance incurs significant fines. | GDPR fines can reach 4% of global annual turnover. |

| Product Liability | Consumer Protection Laws, Post-Market Surveillance | Ensures product safety and efficacy; non-compliance leads to lawsuits and recalls. | Product liability claims increased globally in 2023. |

Environmental factors

Environmental regulations are tightening globally, affecting pharmaceutical companies like Fosun Pharma. This includes stricter rules on waste disposal, air and water emissions, and the efficient use of resources in manufacturing. For instance, by the end of 2023, China, a key market for Fosun Pharma, continued to enforce its environmental protection laws, with significant penalties for non-compliance.

Fosun Pharma recognizes these challenges and is actively pursuing green development. The company has made substantial investments in environmental protection, focusing on managing and reducing its carbon footprint. In 2023, Fosun Pharma reported progress in its sustainability efforts, aligning with national goals for carbon neutrality.

The escalating impacts of climate change, including more frequent extreme weather events, pose significant risks to pharmaceutical supply chains, potentially disrupting manufacturing and distribution. Furthermore, shifts in disease patterns driven by climate change could create new demands for treatments and vaccines, presenting both challenges and opportunities for companies like Fosun Pharma.

Fosun Pharma is actively working to mitigate its environmental footprint, setting ambitious targets for carbon neutrality in line with global sustainability efforts. For instance, in 2024, the company continued to invest in energy-efficient technologies across its operations and explore renewable energy sources to power its facilities, aiming to reduce its greenhouse gas emissions.

Pharmaceutical manufacturing, by its nature, produces diverse waste streams, encompassing chemical residues and biological by-products. These outputs necessitate stringent handling protocols to mitigate environmental impact. For instance, in 2024, the global pharmaceutical waste market was valued at approximately $10 billion, highlighting the scale of this challenge.

Adherence to robust waste management and pollution control is not merely a regulatory obligation but a cornerstone of Fosun Pharma's commitment to environmental stewardship and maintaining a positive public perception. Failure to comply can result in significant penalties and reputational damage, impacting investor confidence and market access.

Resource Scarcity and Supply Chain Resilience

Fosun Pharma faces potential disruptions from resource scarcity and environmental factors impacting supply chains. For instance, increased global demand for specialized chemicals, exacerbated by climate-related production issues in key sourcing regions, could drive up raw material costs. A recent report indicated that 75% of global supply chains experienced significant disruptions in 2023 due to extreme weather events, a trend expected to continue.

Building resilient supply chains is paramount for Fosun Pharma to guarantee uninterrupted production and distribution of its pharmaceutical products. This involves diversifying suppliers and exploring alternative sourcing locations to mitigate risks associated with single-point failures. The company's reliance on specific active pharmaceutical ingredients (APIs) sourced from regions prone to environmental instability presents a notable vulnerability.

- Global supply chain disruptions affected 75% of companies in 2023 due to environmental factors.

- Climate change poses a growing risk to the availability and cost of essential raw materials for pharmaceuticals.

- Fosun Pharma must enhance supply chain resilience through diversification and risk mitigation strategies.

- Geopolitical instability, often linked to resource competition, can further strain the availability of critical pharmaceutical components.

Corporate Social Responsibility (CSR) and ESG Expectations

Investor and public demand for robust Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) practices are increasingly shaping corporate strategies. Fosun Pharma has been actively embedding ESG principles across its operations, evidenced by its strong ESG ratings and the consistent release of annual sustainability reports. For instance, in its 2023 sustainability report, Fosun Pharma highlighted a 15% reduction in greenhouse gas emissions intensity compared to 2022. This focus is crucial for maintaining investor confidence and market reputation.

The company's commitment to ESG is not merely a compliance exercise but a strategic imperative. Fosun Pharma aims to demonstrate tangible progress in areas such as ethical governance, environmental stewardship, and social impact. This proactive approach is vital in a landscape where stakeholders, including shareholders and consumers, are scrutinizing corporate behavior more closely than ever before. The company's ESG scores, often reflecting performance against benchmarks like MSCI or Sustainalytics, are key indicators for investment decisions.

Fosun Pharma's ESG integration is reflected in several key areas:

- Environmental Initiatives: Continued investment in green manufacturing processes and waste reduction programs, with a target of 20% water usage reduction by 2025.

- Social Responsibility: Programs focused on employee well-being, community engagement, and ensuring access to affordable healthcare solutions.

- Governance Excellence: Adherence to high standards of corporate governance, transparency, and ethical business conduct.

- Sustainability Reporting: Regular publication of comprehensive sustainability reports detailing ESG performance and future commitments.

Stricter environmental regulations globally, particularly in China, necessitate significant investment in sustainable manufacturing and waste management for Fosun Pharma. By 2023, China's environmental enforcement intensified, imposing penalties for non-compliance, prompting Fosun Pharma to prioritize carbon footprint reduction and align with national carbon neutrality goals.

Climate change impacts, such as extreme weather, threaten pharmaceutical supply chains, increasing the risk of disruptions and raw material scarcity. In 2023, 75% of global supply chains faced disruptions due to environmental factors, a trend expected to persist, impacting Fosun Pharma's sourcing and production.

Growing investor and public demand for ESG compliance drives Fosun Pharma's strategic focus on sustainability. The company reported a 15% reduction in greenhouse gas emissions intensity in 2023 and aims for a 20% water usage reduction by 2025, enhancing its market reputation and investor confidence.

| Environmental Factor | Impact on Fosun Pharma | Fosun Pharma's Response (2023-2024) | Key Data/Targets |

| Regulatory Stringency | Increased compliance costs, potential penalties | Investment in green manufacturing, waste management | China's intensified environmental enforcement (2023) |

| Climate Change | Supply chain disruptions, raw material volatility | Supply chain diversification, risk mitigation | 75% of supply chains disrupted by weather (2023) |

| ESG Expectations | Reputational risk, investor scrutiny | Enhanced ESG reporting, sustainability initiatives | 15% GHG emissions intensity reduction (2023), 20% water reduction target by 2025 |

PESTLE Analysis Data Sources

Our Fosun Pharma PESTLE analysis is built upon a robust foundation of data from leading global health organizations, government regulatory bodies, and reputable market research firms. We integrate insights from economic indicators, environmental impact assessments, technological advancements, and evolving legal frameworks to provide a comprehensive view.