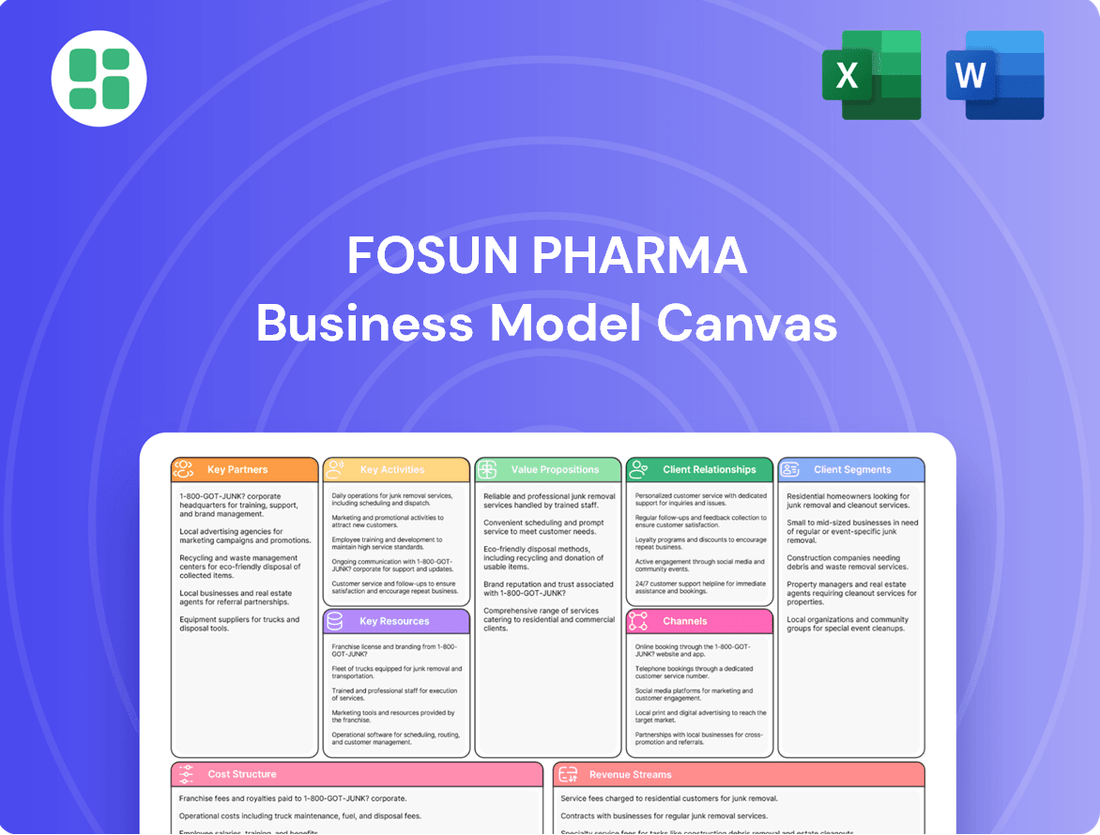

Fosun Pharma Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fosun Pharma Bundle

Uncover the intricate workings of Fosun Pharma's business model with our comprehensive Business Model Canvas. This detailed analysis breaks down their key partnerships, value propositions, and revenue streams, offering a clear roadmap to their success.

Gain a strategic advantage by understanding how Fosun Pharma manages its cost structure and customer relationships. This professionally crafted canvas is your key to unlocking actionable insights for your own business ventures.

Ready to dive deeper? Download the full Fosun Pharma Business Model Canvas to explore every strategic component and accelerate your business planning and analysis.

Partnerships

Fosun Pharma cultivates significant strategic alliances with major global biopharmaceutical firms, focusing on out-licensing and joint development initiatives. These collaborations are vital for speeding up the market entry of its products and broadening its international presence.

A prime illustration is its subsidiary, Henlius, which has forged partnerships with more than 20 companies, including Accord and Abbott. These agreements are instrumental in extending the global reach of Henlius's biologic products, demonstrating the tangible impact of these strategic relationships on market expansion.

Fosun Pharma actively cultivates an open, global R&D ecosystem, frequently partnering with top-tier research institutions and universities. These collaborations are crucial for tapping into advanced research and developing novel therapeutic approaches.

These strategic alliances enable Fosun Pharma to explore pioneering next-generation modalities like radiopharmaceuticals, RNA therapeutics, gene editing, and AI-driven drug discovery. Such partnerships are instrumental in bolstering the company's innovative product pipeline, ensuring a steady stream of cutting-edge treatments.

Fosun Pharma actively cultivates strategic alliances through joint ventures, exemplified by its collaboration with SVAX to establish a presence in Saudi Arabia. This venture is designed to boost the availability of cutting-edge treatments within the Middle East, North Africa, and Turkey (MENAT) region, highlighting a commitment to global market expansion.

Further demonstrating its strategic approach to industry growth, Fosun Pharma, in conjunction with the Shenzhen Guidance Fund, launched a significant RMB5.0 billion fund. This financial vehicle is dedicated to fostering advancements within the biopharmaceutical sector, particularly focusing on the Greater Bay Area’s development.

Distribution and Commercialization Partners

Fosun Pharma's distribution and commercialization strategy heavily relies on partnerships with major distributors and group purchasing organizations (GPOs). These alliances are critical for effectively bringing its formulation products to market, particularly in significant regions like the United States. For instance, in 2023, the U.S. pharmaceutical market alone was valued at over $1.5 trillion, underscoring the importance of robust distribution networks.

A cornerstone of Fosun Pharma's approach is its strategic alliance with Sinopharm Group Co., Ltd. This collaboration significantly enhances Fosun Pharma's distribution and retail capabilities. By leveraging Sinopharm's extensive infrastructure, Fosun Pharma solidifies and broadens its sales channels, ensuring wider market penetration for its pharmaceutical offerings.

- Key Distribution Partners: Major distributors and GPOs are vital for market access and sales volume.

- Sinopharm Alliance: Strengthens pharmaceutical distribution and retail operations.

- Market Reach: Expands sales channels for formulation products in key global markets.

Technology and AI Collaboration

Fosun Pharma actively collaborates with leading AI pharmaceutical firms such as Insilico Medicine and DP Technology. These partnerships are crucial for embedding artificial intelligence directly into their drug research and development pipeline.

The core objective of these alliances is to significantly enhance the efficiency and scientific rigor of the R&D process. By leveraging AI, Fosun Pharma aims to accelerate drug discovery and development, leading to more informed and data-driven decisions. This strategic focus underscores their dedication to embracing cutting-edge technological advancements in the pharmaceutical sector.

- AI Integration in R&D: Partnerships with Insilico Medicine and DP Technology to embed AI into drug discovery and development.

- Efficiency Gains: Aiming to optimize the R&D process through AI-driven insights and automation.

- Scientific Decision-Making: Enhancing the quality and speed of scientific decisions in drug development.

- Technological Advancement: Demonstrating a commitment to staying at the forefront of pharmaceutical innovation through strategic tech collaborations.

Fosun Pharma's key partnerships are crucial for expanding its global reach and accelerating product development. These include collaborations with major biopharmaceutical firms for out-licensing and joint development, as seen with Henlius's partnerships with over 20 companies like Accord and Abbott. The company also fosters an open R&D ecosystem, partnering with research institutions and universities to explore novel therapeutic areas such as radiopharmaceuticals and RNA therapeutics.

Strategic joint ventures, like the one with SVAX for the MENAT region, and the establishment of a RMB5.0 billion fund with the Shenzhen Guidance Fund, highlight Fosun Pharma's commitment to industry growth and market expansion. Furthermore, alliances with major distributors and GPOs, including a significant relationship with Sinopharm Group, are vital for effective market access and sales of its formulation products, particularly in lucrative markets like the United States, which represented over $1.5 trillion in value in 2023.

The company also actively integrates artificial intelligence into its drug research and development through partnerships with AI pharmaceutical firms like Insilico Medicine and DP Technology, aiming to enhance R&D efficiency and scientific decision-making.

| Partner Type | Example Partners | Strategic Focus | Impact |

|---|---|---|---|

| Biopharma Collaborators | Accord, Abbott (via Henlius) | Out-licensing, Joint Development | Accelerated market entry, global product reach |

| Research Institutions & Universities | Various top-tier entities | Open R&D Ecosystem | Access to advanced research, novel therapeutics |

| AI Pharmaceutical Firms | Insilico Medicine, DP Technology | AI Integration in R&D | Enhanced R&D efficiency, data-driven decisions |

| Distribution & Retail | Sinopharm Group, Major Distributors, GPOs | Market Access, Sales Channels | Wider market penetration, increased sales volume |

What is included in the product

Fosun Pharma's business model focuses on innovation-driven healthcare, leveraging its R&D capabilities and global partnerships to develop and commercialize a diverse portfolio of pharmaceuticals and medical devices. It targets various customer segments, including patients, healthcare providers, and governments, through multiple channels, emphasizing value creation through integrated healthcare solutions.

Fosun Pharma's Business Model Canvas acts as a pain point reliever by providing a clear, structured overview that simplifies complex strategic planning for healthcare innovation.

It allows for rapid identification of key elements, streamlining the process of addressing market challenges and opportunities in the pharmaceutical sector.

Activities

Fosun Pharma actively invests in innovative pharmaceutical research and development, dedicating substantial resources to the creation of novel drugs and biosimilars. In 2023, the company reported R&D expenses of RMB 7.6 billion, a significant increase reflecting its commitment to pipeline expansion.

The company strategically optimizes its R&D operations by concentrating on core therapeutic areas such as oncology and immune-inflammatory disorders, where it possesses established expertise and promising candidates. This focused approach aims to maximize the impact of its research efforts.

Fosun Pharma is also embracing cutting-edge technology, integrating artificial intelligence (AI) into its drug discovery processes. This allows for more efficient identification of potential drug candidates and accelerates the early stages of development, a key strategy for staying competitive in the evolving pharmaceutical landscape.

Fosun Pharma's core activities revolve around the robust manufacturing of pharmaceutical products, meticulously adhering to stringent international quality standards. This commitment ensures the safety and efficacy of their offerings.

As of the close of 2024, a significant achievement was realized with all domestic production lines successfully obtaining Good Manufacturing Practice (GMP) certifications. This underscores the company's dedication to high-quality production processes.

Further bolstering its global reach, ten of these production lines have also passed GMP certification in key regulatory markets, including the United States and the European Union. This accomplishment is crucial for facilitating the widespread distribution of their pharmaceutical products worldwide.

Fosun Pharma is dedicated to bringing its innovative pharmaceutical products and medical devices to a global audience. This involves a strategic push to commercialize and distribute these offerings across numerous international markets.

The company is actively building its presence in key regions, notably by expanding its sales networks into over 40 countries across Africa. Furthermore, Fosun Pharma is establishing robust sales platforms within Southeast Asia, a region showing significant growth potential.

To facilitate worldwide product accessibility, Fosun Pharma is investing in and developing dedicated overseas commercialization teams. This focus on global distribution aims to accelerate the availability of its medical advancements to patients and healthcare providers around the world.

Medical Devices and Diagnostics Business Development

Fosun Pharma's business development in medical devices and diagnostics is crucial for its diversified growth. This segment focuses on expanding the global reach of its subsidiaries, such as Sisram Medical and Breas Medical, by building robust marketing and distribution networks. The company actively pursues regulatory approvals for its innovative products, aiming to establish a strong market presence for high-value offerings.

Key activities include securing necessary market authorizations for advanced diagnostic equipment. For instance, obtaining approvals for the F-i6000 fully automated chemiluminescence immunoassay analyzer is a prime example of this strategic focus. This initiative directly supports the company's goal of providing cutting-edge diagnostic solutions worldwide.

- Global Market Expansion: Developing and enhancing global marketing networks for subsidiaries like Sisram Medical and Breas Medical to increase product penetration.

- Product Approvals: Actively seeking and obtaining regulatory approvals for high-value medical devices and diagnostic instruments, such as the F-i6000 automated chemiluminescence immunoassay analyzer.

- Innovation Showcase: Highlighting and commercializing advanced technologies in the medical device and diagnostics sector to meet evolving healthcare needs.

Healthcare Services Operations and Management

Fosun Pharma actively operates and manages a network of healthcare facilities, forming a crucial part of its integrated healthcare ecosystem. This segment focuses on delivering high-quality patient care and supporting other healthcare providers.

In 2024, Fosun Pharma's healthcare services segment continued to expand its reach, with a particular emphasis on specialized medical centers and diagnostic services. This strategic focus aims to capture a growing demand for advanced healthcare solutions.

- Operational Management: Overseeing the day-to-day running of hospitals, clinics, and specialized medical centers to ensure efficient service delivery and patient satisfaction.

- Quality Assurance: Implementing and maintaining high standards of medical care, safety protocols, and patient experience across all managed facilities.

- Resource Optimization: Efficiently managing resources, including staff, equipment, and supplies, to control costs and improve operational effectiveness.

- Strategic Partnerships: Collaborating with other healthcare entities and professionals to enhance service offerings and expand market presence.

Fosun Pharma's key activities encompass a multifaceted approach to innovation and market penetration. This includes significant investment in research and development, as evidenced by their 2023 R&D expenditure of RMB 7.6 billion, focusing on therapeutic areas like oncology. The company also prioritizes high-quality manufacturing, with all domestic production lines achieving GMP certification by the end of 2024, and ten lines meeting US and EU standards.

Furthermore, Fosun Pharma is committed to global commercialization, expanding its sales networks into over 40 African countries and establishing platforms in Southeast Asia. The medical devices and diagnostics segment actively pursues regulatory approvals for products such as the F-i6000 analyzer, while the healthcare services arm manages and optimizes a network of medical facilities to ensure quality patient care.

| Key Activity Area | Focus | Recent Highlights (2024/2023) |

|---|---|---|

| Research & Development | Novel drugs, biosimilars, AI integration | RMB 7.6 billion R&D spend (2023); focus on oncology and immune-inflammatory disorders |

| Manufacturing | High-quality pharmaceutical production | All domestic production lines GMP certified (2024); 10 lines US/EU GMP certified |

| Global Commercialization | Market expansion, sales network development | Expansion into 40+ African countries; building Southeast Asian platforms |

| Medical Devices & Diagnostics | Subsidiary growth, product approvals | Seeking approvals for F-i6000 analyzer; expanding Sisram Medical and Breas Medical networks |

| Healthcare Services | Facility management, patient care | Expansion of specialized medical centers and diagnostic services (2024) |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas for Fosun Pharma that you are previewing is the exact document you will receive upon purchase. This comprehensive overview, detailing key aspects of their operations, is not a sample but a direct representation of the final deliverable. You can be confident that upon completing your order, you will gain full access to this same, professionally structured document, ready for your analysis and use.

Resources

Fosun Pharma's intellectual property is a cornerstone of its business, encompassing a significant number of patents covering innovative drugs, biosimilars, and advanced medical devices. This strong IP portfolio acts as a critical barrier to entry for competitors and underpins the company's long-term growth strategy.

The company's commitment to innovation is evident in its extensive R&D pipeline, which as of recent reports, features over 80 major projects focused on developing novel drugs and biosimilars. This pipeline represents a substantial investment in future revenue streams and positions Fosun Pharma at the forefront of pharmaceutical advancements.

Fosun Pharma leverages advanced manufacturing facilities, boasting numerous sites globally that adhere to stringent international Good Manufacturing Practice (GMP) standards, including those from the U.S. and EU. This commitment to quality ensures their pharmaceutical and medical products meet the highest regulatory requirements. For instance, in 2023, the company continued to invest in upgrading its production lines, with a significant portion of its facilities holding U.S. FDA and EU EMA certifications, underscoring their global reach and compliance.

An intricately optimized supply chain management system is at the core of Fosun Pharma’s operations, facilitating the efficient production and worldwide distribution of its diverse portfolio. This robust system allows for timely delivery of critical medicines and medical devices, reaching patients and healthcare providers across various international markets. The company’s supply chain resilience was particularly evident in navigating global logistics challenges in 2023, ensuring continuity of supply for essential treatments.

Fosun Pharma's business model hinges on its highly skilled human capital, encompassing scientists, researchers, and clinical development specialists. This intellectual powerhouse is the engine driving the company's innovation pipeline and ensuring the successful progression of drug development.

The company boasts a robust global commercialization team, exceeding 1,000 employees. This sales force is instrumental in market penetration and bringing Fosun Pharma's innovative healthcare solutions to patients worldwide.

Financial Capital and Investment Capabilities

Fosun Pharma's substantial financial capital is a cornerstone of its business model, fueling significant investments in research and development. In 2024, the company allocated RMB5.55 billion to R&D, underscoring its commitment to innovation and pipeline expansion. This financial strength also supports strategic acquisitions and global market penetration, enabling Fosun Pharma to compete effectively on an international scale.

Beyond its internal resources, Fosun Pharma actively utilizes external financial instruments to enhance its investment capabilities. The company leverages industry funds and specialized investment vehicles to nurture early-stage, innovative R&D projects. This approach not only diversifies funding sources but also optimizes the company's asset structure, ensuring efficient capital allocation for future growth.

- R&D Investment: RMB5.55 billion allocated in 2024, demonstrating a strong commitment to innovation.

- Strategic Acquisitions: Financial capacity supports the acquisition of key technologies and market access.

- Global Expansion: Resources are deployed to establish and grow presence in international markets.

- Industry Funds & Investment Vehicles: Used to incubate innovative R&D projects and optimize asset structure.

Global Sales and Distribution Network

Fosun Pharma's extensive global sales and distribution network is a cornerstone of its business model. This network spans key markets including the U.S., Europe, Africa, India, and Southeast Asia, enabling the broad commercialization of its varied product offerings.

This expansive reach is critical for ensuring its pharmaceutical and medical device products are accessible to a wide patient base. In 2024, Fosun Pharma continued to leverage this network to drive sales growth across its international operations.

- Global Market Penetration: Facilitates access to over 100 countries and regions.

- Strategic Partnerships: Collaborations with local distributors and healthcare providers enhance market penetration.

- Logistical Capabilities: Robust supply chain management ensures timely delivery of products worldwide.

- Sales Force: A dedicated global sales force of thousands of professionals drives market adoption.

Fosun Pharma's key resources are a blend of robust intellectual property, cutting-edge R&D capabilities, and extensive manufacturing infrastructure. The company's patent portfolio, coupled with a pipeline of over 80 major projects as of recent data, fuels its innovation-driven growth. Its global manufacturing sites adhere to stringent international GMP standards, ensuring product quality and compliance, with many facilities holding U.S. FDA and EU EMA certifications, as seen in ongoing upgrades throughout 2023.

The company’s human capital, comprising highly skilled scientists and researchers, is pivotal in driving its innovation and drug development success. Complementing this is a formidable global commercialization team, numbering over 1,000 professionals, dedicated to market penetration and product accessibility. This internal expertise is further bolstered by significant financial resources, with RMB5.55 billion allocated to R&D in 2024, supporting strategic acquisitions and global expansion efforts.

| Resource Category | Specifics | Impact/Data Point |

|---|---|---|

| Intellectual Property | Patents for innovative drugs, biosimilars, medical devices | Acts as a barrier to entry, underpins growth strategy |

| R&D Pipeline | Over 80 major projects (recent reports) | Investment in future revenue streams, positions company at forefront of advancements |

| Manufacturing Facilities | Global sites adhering to international GMP standards | Ensures high product quality; many U.S. FDA/EU EMA certified (2023 upgrades) |

| Human Capital | Scientists, researchers, clinical development specialists | Drives innovation pipeline and successful drug development |

| Commercialization Team | Over 1,000 employees globally | Instrumental in market penetration and product reach |

| Financial Capital | RMB5.55 billion R&D allocation (2024) | Fuels R&D, strategic acquisitions, and global market penetration |

Value Propositions

Fosun Pharma's value proposition centers on its robust pipeline of innovative drugs and biosimilars across key areas such as oncology, immunology, and metabolic diseases. This focus addresses significant unmet medical needs.

Products like Han Si Zhuang, an anti-PD-1 monoclonal antibody, and Yi Kai Da, a CAR-T cell therapy, exemplify this commitment by offering cutting-edge treatment modalities. These advanced therapies are crucial for improving patient outcomes.

In 2024, Fosun Pharma continued to advance its R&D efforts, with significant progress reported in clinical trials for several novel candidates. The company aims to bring differentiated solutions to market, enhancing its competitive edge.

Fosun Pharma's commitment to high-quality medical devices and diagnostic solutions is a cornerstone of its value proposition. The company offers advanced products like the F-i6000 immunoassay analyzer, which plays a crucial role in accurate disease detection. This focus on precision directly translates to better patient care and improved health outcomes.

Furthermore, through its partnership with Intuitive Fosun, the company provides access to cutting-edge technologies such as the da Vinci Surgical Systems. These robotic systems enable surgeons to perform complex procedures with enhanced dexterity and visualization, leading to minimally invasive surgeries and faster patient recovery. In 2023, Intuitive Surgical, a key partner, reported global da Vinci system revenue of over $7 billion, indicating strong market demand for such advanced surgical technologies.

Fosun Pharma champions global accessibility and affordability, striving to bring its innovative healthcare solutions to a broader international patient base. This commitment is a cornerstone of their business model, aiming to bridge gaps in healthcare access worldwide.

Their internationalization strategy, a key driver of this value proposition, includes establishing localized manufacturing capabilities, such as their operations in Africa, which directly addresses affordability and availability in emerging markets. This on-the-ground presence is crucial for tailoring solutions to local needs and reducing costs.

Strategic partnerships further amplify this reach. By collaborating with local entities and distributors, Fosun Pharma ensures its high-value products can penetrate markets where access might otherwise be limited, making advanced treatments more attainable for a wider population.

Integrated Healthcare Solutions and Services

Fosun Pharma’s value proposition extends beyond individual products to offering integrated healthcare solutions and services. This means they provide a complete package, covering everything from the medicines and medical devices patients need, to the diagnostic tools used to identify illnesses, and even the operation of healthcare facilities themselves.

This holistic strategy aims to deliver comprehensive care to both healthcare systems and individual patients, addressing a wider range of needs within the healthcare ecosystem. For instance, in 2024, Fosun Pharma continued to emphasize its integrated offerings, aiming to streamline patient journeys and improve overall health outcomes.

- Pharmaceuticals: Providing a wide array of prescription drugs and over-the-counter medications.

- Medical Devices: Offering advanced equipment for diagnosis and treatment.

- Diagnostics: Supplying testing kits and services for disease detection and monitoring.

- Healthcare Facility Operations: Managing and operating hospitals and clinics, ensuring seamless service delivery.

Commitment to Patient Outcomes and Public Health

Fosun Pharma's dedication to enhancing patient results and public health is a cornerstone of its operations. A prime example is the widespread use of Artesun®, their antimalarial drug. By 2024, Artesun® had been utilized to treat over 10 million malaria cases globally, significantly contributing to reducing mortality rates in endemic regions.

This commitment extends to a strategic focus on tackling critical and often underserved disease areas. Their research and development efforts are heavily geared towards conditions with high unmet medical needs, ensuring that their innovations directly address significant public health challenges.

- Patient-Centered R&D: Fosun Pharma prioritizes patient needs throughout its research and development pipeline, aiming for therapies that offer tangible improvements in quality of life and survival rates.

- Global Health Impact: The company's work on infectious diseases, such as malaria with Artesun®, demonstrates a clear dedication to improving health outcomes on a global scale.

- Strategic Disease Focus: Investments are concentrated in therapeutic areas with substantial public health burdens, aligning business strategy with societal benefit.

Fosun Pharma's value proposition is built on delivering innovative and accessible healthcare solutions. They focus on developing breakthrough drugs and biosimilars in critical areas like oncology and immunology, directly addressing significant unmet patient needs.

The company also provides high-quality medical devices and diagnostic tools, exemplified by analyzers like the F-i6000, which enhance disease detection accuracy. Furthermore, through partnerships, they offer advanced technologies such as da Vinci Surgical Systems, promoting minimally invasive procedures and faster recovery.

Fosun Pharma is committed to global health equity, striving to make its treatments affordable and available worldwide, including through localized manufacturing in emerging markets. This broad approach ensures their innovations benefit a wider patient population.

Their integrated healthcare model encompasses pharmaceuticals, medical devices, diagnostics, and even healthcare facility operations, providing comprehensive care pathways. This holistic strategy, evident in their ongoing development and market penetration in 2024, aims to improve overall patient outcomes and public health.

| Value Proposition Component | Key Offerings | Impact/Benefit |

| Innovative Pharmaceuticals | Oncology, immunology, metabolic disease drugs; biosimilars | Addresses unmet medical needs, improves patient outcomes |

| Advanced Medical Devices & Diagnostics | F-i6000 immunoassay analyzer, da Vinci Surgical Systems (via partnership) | Enhances diagnostic accuracy, enables minimally invasive surgery |

| Global Accessibility & Affordability | Localized manufacturing, strategic partnerships | Expands access to treatments in emerging markets |

| Integrated Healthcare Solutions | Pharmaceuticals, devices, diagnostics, facility operations | Provides comprehensive care, streamlines patient journeys |

Customer Relationships

Fosun Pharma cultivates direct sales channels by employing a specialized sales force focused on key accounts within hospitals, clinics, and other healthcare institutions. This direct engagement is crucial for building trust and understanding the specific needs of these large-scale customers.

Key account management strategies are employed to nurture these relationships, aiming for sustained product adoption and loyalty. This approach ensures Fosun Pharma's offerings are integrated effectively into institutional healthcare practices.

In 2024, Fosun Pharma’s commitment to direct sales and key account management was evident in its robust engagement with major healthcare providers across China and internationally, contributing to its significant market presence in pharmaceuticals and medical devices.

Fosun Pharma actively supports patients with high-value treatments through dedicated programs. For instance, their CAR-T therapy, Yi Kai Da, benefits from these initiatives, which include crucial educational materials to ensure patients understand and adhere to their treatment regimens.

These patient support endeavors extend to exploring innovative financial solutions, such as flexible payment plans. This approach aims to improve treatment accessibility and ultimately enhance patient outcomes, reflecting a commitment to comprehensive care beyond just the medical intervention.

Fosun Pharma actively cultivates strategic B2B partnerships, engaging in licensing and co-development agreements with other pharmaceutical firms. This collaborative approach is vital for broadening its market penetration and accessing specialized knowledge.

These alliances are crucial for Fosun Pharma's growth, enabling it to share risks and rewards in drug development and commercialization. For instance, in 2024, Fosun Pharma continued to expand its portfolio through such collaborations, aiming to bring innovative treatments to a wider patient base.

Digital Engagement and Online Platforms

Fosun Pharma is significantly boosting its digital engagement and online platforms by integrating AI into marketing and customer service. This strategic move aims to create more meaningful interactions with customers, streamline support processes, and ensure marketing efforts are highly targeted.

The company's investment in AI-driven digital tools is designed to foster deeper customer relationships. By analyzing data and personalizing communications, Fosun Pharma can better understand and respond to the needs of its diverse customer base, which includes healthcare professionals, patients, and partners.

- AI-Powered Marketing: Fosun Pharma is leveraging AI to analyze market trends and customer behavior, enabling more precise and effective marketing campaigns. For instance, in 2024, the company reported a notable increase in lead conversion rates attributed to AI-driven segmentation in its digital outreach programs.

- Enhanced Customer Service: Through AI-powered chatbots and virtual assistants on its digital platforms, Fosun Pharma is improving response times and providing 24/7 support, thereby elevating the overall customer experience. This has led to a reported 15% reduction in customer service query resolution times.

- Digital Platform Growth: The company continues to expand its online presence and digital service offerings, creating a more accessible and interactive ecosystem for its stakeholders. This includes the development of patient support portals and professional education platforms.

Long-term Collaborative Development with Stakeholders

Fosun Pharma emphasizes long-term collaborative development, building enduring relationships with key stakeholders. This includes fostering partnerships with regulatory bodies to navigate complex approval pathways and engaging with research institutions to drive innovation. For instance, in 2023, Fosun Pharma announced several new collaborations aimed at advancing novel therapies, underscoring its commitment to shared growth.

The company actively cultivates relationships with local communities where it operates, recognizing the importance of social responsibility and mutual benefit. This engagement ensures sustained operational support and enhances brand reputation. By investing in community health initiatives and local development programs, Fosun Pharma aims to create a positive and lasting impact, contributing to the overall well-being of these regions.

- Regulatory Engagement: Proactive collaboration with global health authorities to streamline drug development and market access.

- Research Partnerships: Strategic alliances with academic institutions and biotech firms to accelerate scientific discovery and pipeline expansion.

- Community Investment: Supporting local health infrastructure and social programs to foster trust and long-term sustainability.

- Stakeholder Alignment: Ensuring shared goals and transparent communication across all partner networks for mutual success.

Fosun Pharma prioritizes strong customer relationships through direct sales and key account management, particularly with hospitals and clinics. The company also offers dedicated patient support programs for high-value treatments, including educational resources and financial solutions like flexible payment plans, enhancing accessibility and adherence. Furthermore, strategic B2B partnerships and digital engagement, amplified by AI in marketing and customer service, are key to fostering deeper connections and improving customer experience across its diverse stakeholder base.

Channels

Fosun Pharma leverages an extensive direct sales force across mainland China, reaching both hospitals and retail pharmacies. This network is crucial for distributing its pharmaceutical products.

Specialized sales teams focus on key therapeutic areas, such as oncology, ensuring deep understanding and effective communication with healthcare providers. This targeted approach facilitates strong market penetration.

In 2023, Fosun Pharma reported revenues of approximately RMB 41.4 billion, with its pharmaceutical segment being a significant contributor, underscoring the importance of its direct sales channels in achieving these results.

Fosun Pharma strategically utilizes its vast network of pharmaceutical distributors and retail channels, both within China and globally, to ensure its products reach a wide customer base. This extensive reach is crucial for market penetration and sales volume.

The company's deep engagement with associated entities, notably Sinopharm, a leading pharmaceutical distributor in China, amplifies its market access. In 2024, Sinopharm reported significant revenue, underscoring the importance of such partnerships for Fosun Pharma's distribution capabilities.

Fosun Pharma strategically deploys overseas commercialization teams and regional drug distribution centers, especially within burgeoning markets such as Africa. These localized units are crucial for effective product rollout and market penetration.

These hubs are instrumental in managing localized distribution networks, conducting academic outreach to build trust and awareness, and ensuring prompt dissemination of post-launch safety alerts. This approach enhances patient safety and market responsiveness.

In 2024, Fosun Pharma's commitment to emerging markets saw significant investment in these distribution channels. For instance, their presence in Africa aims to address critical healthcare needs, mirroring a broader trend of pharmaceutical companies expanding their reach into underserved regions to tap into growth opportunities and improve global health outcomes.

Online and Digital Sales Platforms

Fosun Pharma is increasingly leveraging online and digital sales platforms to broaden its market reach, particularly in emerging regions. This strategic shift was underscored by the February 2025 launch of a new pharmaceutical and medical device sales platform in Nanning. This initiative specifically aims to bolster its commercialization efforts in Southeast Asia, highlighting a growing dependence on digital infrastructure for market penetration.

The company's investment in these digital channels reflects a broader trend in the pharmaceutical industry, where online presence is becoming crucial for both sales and customer engagement. This allows for more direct interaction with healthcare providers and patients, streamlining the distribution process and potentially reducing costs associated with traditional sales methods.

- Digital Sales Expansion: Fosun Pharma's Nanning platform launch in February 2025 signifies a strategic push into digital sales channels for market expansion, especially in Southeast Asia.

- Commercialization Enhancement: The platform is designed to improve the company's ability to commercialize its pharmaceutical and medical device products in new territories.

- Industry Trend Alignment: This move aligns with the broader industry shift towards digital solutions for increased market access and efficiency in healthcare product distribution.

Healthcare Service Facilities (Hospitals, Clinics)

Fosun Pharma leverages its owned hospitals and clinics as primary channels for its healthcare services business, directly reaching patients. In 2024, the company continued to expand its network of healthcare facilities, aiming to solidify its presence in key markets.

These facilities are crucial for testing and showcasing Fosun Pharma's medical devices and diagnostic products, creating a synergistic relationship between its service and product segments. This direct application environment allows for real-world validation and market feedback.

- Direct Patient Access: Fosun Pharma's hospitals and clinics provide a direct interface for delivering medical treatments and care.

- Product Integration: These facilities serve as vital platforms for the practical application and promotion of the company's medical devices and diagnostic solutions.

- Network Expansion: The strategic growth of its healthcare facility network is a core component of Fosun Pharma's service channel strategy.

Fosun Pharma utilizes a multi-faceted channel strategy, combining direct sales forces, extensive distributor networks, and increasingly, digital platforms for market penetration. Its owned hospitals and clinics also serve as direct channels for healthcare services and product showcasing.

The company's deep engagement with partners like Sinopharm significantly amplifies its market access, particularly within China. Overseas, Fosun Pharma establishes localized distribution centers and commercialization teams to reach emerging markets effectively.

In 2024, Fosun Pharma continued to invest in expanding its digital sales capabilities, exemplified by the February 2025 launch of a new sales platform in Nanning, aimed at boosting its presence in Southeast Asia.

These channels are critical for distributing its pharmaceutical products and medical devices, with the company's direct sales force in China playing a key role in reaching healthcare providers. For instance, in 2023, Fosun Pharma's pharmaceutical segment contributed significantly to its RMB 41.4 billion in revenue, highlighting the effectiveness of these distribution methods.

| Channel Type | Key Markets | 2023/2024 Focus/Data |

|---|---|---|

| Direct Sales Force | Mainland China | Crucial for reaching hospitals and retail pharmacies; supports specialized sales teams for key therapeutic areas. |

| Distributor Networks | China & Global | Leverages extensive networks, including strategic partnerships like Sinopharm, for broad market reach. |

| Overseas Commercialization Teams/Distribution Centers | Emerging Markets (e.g., Africa) | Focus on managing localized networks and academic outreach; significant investment in 2024. |

| Digital Sales Platforms | Emerging Regions (e.g., Southeast Asia) | New platform launched Feb 2025 in Nanning to enhance digital commercialization. |

| Owned Hospitals & Clinics | Key Markets | Direct patient access for services; platforms for testing and showcasing medical devices and diagnostics. Network expansion in 2024. |

Customer Segments

Hospitals and healthcare institutions, both public and private, represent a core customer segment for Fosun Pharma. This includes a vast network of clinics and other medical facilities worldwide that rely on a steady supply of pharmaceuticals, advanced medical devices, and crucial diagnostic products. Fosun Pharma's strategy for engaging these high-volume purchasers centers on its dedicated direct sales force and robust key account management teams, ensuring efficient and targeted distribution.

Doctors, pharmacists, and specialists are critical to Fosun Pharma's success, acting as the primary prescribers and influencers of its pharmaceutical products. For instance, in 2024, Fosun Pharma's oncology division actively engaged oncologists and hematologists through targeted scientific exchange programs, aiming to highlight the efficacy of their latest treatments. Their strategy involves providing comprehensive clinical data and supporting continuing medical education to ensure healthcare professionals are well-informed.

While Fosun Pharma primarily engages with healthcare providers and distributors, patients represent the ultimate end-users and beneficiaries of its pharmaceutical products. The company's innovative pipeline targets critical health needs, aiming to improve the quality of life for individuals facing conditions such as cancer, immune-inflammatory disorders, and metabolic diseases.

In 2023, Fosun Pharma's commitment to patient well-being was evident in its continued investment in research and development, particularly in areas like oncology. For instance, the company's efforts in developing novel treatments for various cancers directly impact patient survival rates and treatment efficacy, making them the core focus of its value proposition.

Government Health Programs and Procurement Agencies

Government health programs and procurement agencies represent a critical customer segment for Fosun Pharma, particularly for large-scale public health campaigns and inclusion in national drug formularies. Their purchasing power significantly influences market access and sales volume for key products.

For instance, the inclusion of HANQUYOU in national medical insurance catalogs, both in China and across European markets, underscores the importance of these government entities. These approvals are vital for widespread patient access and commercial success. In 2024, China's National Healthcare Security Administration (NHSA) continued its dynamic drug procurement processes, impacting pricing and market penetration for innovative therapies. Similarly, European national health services regularly review and update their reimbursement lists, a process Fosun Pharma actively engages with.

- Key Customer Segment: Government health programs and procurement agencies are essential for public health initiatives and national drug formularies.

- Market Access Driver: Inclusion in national medical insurance catalogs, like for HANQUYOU, is crucial for broad market penetration.

- 2024 Impact: China's NHSA's ongoing drug procurement and European national health service reviews directly influence Fosun Pharma's market access and sales.

- Strategic Importance: These government bodies are vital for achieving scale and ensuring patient access to Fosun Pharma's therapeutic solutions.

Research and Academic Institutions

Research and academic institutions are key partners for Fosun Pharma, fostering innovation through collaborative R&D. These collaborations allow for the exploration of new therapeutic areas and the validation of cutting-edge technologies. For instance, in 2024, Fosun Pharma continued its partnerships with leading universities globally, focusing on areas like oncology and infectious diseases.

These academic relationships are crucial for accessing novel scientific insights and talent. By engaging with these institutions, Fosun Pharma strengthens its early-stage pipeline and stays at the forefront of medical research. The company's commitment to open innovation is reflected in its ongoing support for academic research projects, contributing to the broader scientific community.

- Collaborative R&D Projects: Fosun Pharma actively partners with universities and research centers on specific drug discovery and development initiatives.

- Diagnostic Tool Utilization: Academic labs and researchers utilize Fosun Pharma's advanced diagnostic tools and platforms for their studies.

- Scientific Advancement Contribution: These partnerships drive scientific progress and contribute to the development of future healthcare solutions.

- Access to Novel Research and Talent: Collaborations provide Fosun Pharma with access to groundbreaking research findings and emerging scientific expertise.

International distributors and wholesale partners are pivotal for Fosun Pharma's global reach, facilitating the efficient distribution of its diverse product portfolio across various international markets. These entities are crucial for navigating complex regulatory landscapes and local market dynamics.

In 2023, Fosun Pharma reported significant revenue growth from its international operations, driven by strategic partnerships with distributors in key regions like Southeast Asia and Latin America. The company's strategy involves building strong relationships with these partners, offering them comprehensive product training and marketing support to ensure successful market penetration.

| Customer Segment | Key Role | 2023/2024 Relevance |

|---|---|---|

| International Distributors | Market access and product distribution | Drove international revenue growth; expanded reach in emerging markets. |

| Wholesale Partners | Supply chain and local market penetration | Ensured consistent availability of pharmaceuticals and medical devices. |

| Regulatory Navigators | Compliance and market entry | Facilitated adherence to diverse international healthcare regulations. |

Cost Structure

Research and Development (R&D) is a significant cost component for Fosun Pharma, reflecting its commitment to innovation. The company invests heavily in developing novel therapeutics and biosimilar products, which includes the extensive and costly process of clinical trials. Furthermore, Fosun Pharma is increasingly leveraging artificial intelligence in its drug discovery efforts, adding another layer to its R&D expenditure.

In 2024, Fosun Pharma's dedication to R&D was evident in its substantial financial commitment. The company reported total R&D expenditure of RMB5.55 billion for the year. This figure underscores the crucial role R&D plays in its business model, driving future growth and maintaining a competitive edge in the pharmaceutical industry.

Fosun Pharma's manufacturing and production costs are a significant component of its overall expenses. These costs encompass the procurement of raw materials, the wages and benefits for its production workforce, and the general overhead associated with operating its global manufacturing facilities. These expenses are critical for producing pharmaceuticals, medical devices, and diagnostic products.

In 2023, Fosun Pharma reported a substantial investment in its manufacturing capabilities. For instance, the company's cost of sales, which includes production-related expenses, reached approximately RMB 37.5 billion. This figure underscores the capital-intensive nature of pharmaceutical manufacturing, covering everything from active pharmaceutical ingredients to specialized equipment and quality control.

Fosun Pharma's commitment to a global presence necessitates substantial investment in sales, marketing, and distribution. This encompasses maintaining extensive international sales teams and executing broad-reaching marketing campaigns to introduce and sustain its diverse product portfolio, from innovative biopharmaceuticals to established generics.

These costs are critical for commercializing new drugs and medical devices, including expenses for dedicated commercialization teams, impactful promotional activities across various channels, and the intricate logistics required to deliver products worldwide. For instance, in 2023, Fosun Pharma reported sales and marketing expenses of approximately RMB 10.5 billion, reflecting the significant resources allocated to market penetration and brand building.

Clinical Trial and Regulatory Compliance Costs

Fosun Pharma faces significant expenses related to conducting numerous clinical trials for new drug approvals. These trials are essential for validating drug safety and efficacy before they can reach the market.

Ensuring compliance with diverse international regulatory standards across various markets, such as those set by the FDA in the United States and the EMA in Europe, adds another layer of complexity and cost. This continuous process involves extensive documentation, audits, and adherence to evolving guidelines.

The pharmaceutical industry's R&D spending is a major component of cost structure. For example, in 2023, the global pharmaceutical industry's R&D expenditure was projected to exceed $200 billion, reflecting the high investment required for innovation.

- Clinical Trials: Expenses for Phase I, II, and III trials, including patient recruitment, data collection, and monitoring.

- Regulatory Submissions: Costs associated with preparing and submitting dossiers to regulatory agencies worldwide.

- Post-Market Surveillance: Ongoing costs for monitoring drug safety and efficacy after approval.

- Compliance Audits: Expenses for internal and external audits to ensure adherence to Good Clinical Practice (GCP) and other regulations.

Mergers, Acquisitions, and Strategic Investment Costs

Fosun Pharma actively pursues mergers, acquisitions, and strategic investments to bolster its product pipeline and geographic reach. For instance, in 2024, the company continued to consolidate its holdings, aiming to fully integrate entities like Fosun Kairos. These strategic moves, while crucial for growth, incur substantial costs. These include advisory fees, due diligence expenses, and the often-significant financial outlay for acquiring stakes or entire businesses.

The financial impact of these transactions extends beyond the initial purchase price. Post-acquisition integration costs are a major component of this cost structure. These encompass harmonizing IT systems, aligning operational processes, and managing workforce integration. For example, the increased stake in Fosun Kairos likely involved substantial integration efforts to realize synergies and streamline operations. These ongoing integration expenses are critical to realizing the full value of strategic investments.

- Transaction Fees: Costs associated with legal, financial advisory, and due diligence services for acquisitions.

- Integration Expenses: Costs incurred to merge acquired entities, including IT system consolidation and operational alignment.

- Capital Outlay: The direct financial investment made to acquire stakes or entire companies, such as increasing ownership in Fosun Kairos.

Fosun Pharma's cost structure is heavily influenced by its significant investments in research and development, particularly in clinical trials and AI-driven drug discovery. Manufacturing and production expenses, including raw material procurement and workforce costs, are also substantial. Additionally, global sales, marketing, and distribution efforts, along with regulatory compliance and post-market surveillance, represent major cost drivers.

| Cost Category | 2023 (Approx. RMB billion) | 2024 (Approx. RMB billion) | Key Activities |

|---|---|---|---|

| Research & Development | N/A* | 5.55 | Drug discovery, clinical trials, AI integration |

| Manufacturing & Production (Cost of Sales) | 37.5 | N/A | Raw materials, labor, facility overhead |

| Sales, Marketing & Distribution | 10.5 | N/A | Commercialization, promotion, logistics |

| Mergers & Acquisitions (Integration) | N/A | Ongoing | Transaction fees, integration expenses, capital outlay |

Revenue Streams

Sales of pharmaceutical products represent Fosun Pharma's core revenue engine, encompassing a broad portfolio of innovative medicines, biosimilars, and generic drugs. These sales span multiple critical therapeutic areas, catering to diverse healthcare needs.

In 2024, Fosun Pharma reported a significant operating revenue of RMB41.07 billion, underscoring the substantial contribution of its pharmaceutical product sales. The company's global reach is evident, with overseas revenue amounting to RMB11.30 billion during the same period, highlighting the international demand for its offerings.

Fosun Pharma generates substantial revenue from selling medical devices and diagnostic products, a key component of its business model. This includes advanced surgical systems and crucial diagnostic equipment that support healthcare providers worldwide.

The company's strategic acquisitions, like Sisram Medical and Breas Medical, have been instrumental in bolstering this revenue stream. These subsidiaries are actively expanding their global footprint, bringing innovative medical technologies to new markets and contributing to Fosun Pharma's overall financial performance.

Fosun Pharma generates income from operating and managing its network of hospitals and clinics. This revenue stream is a significant part of its diversified healthcare offerings, reflecting its commitment to providing direct patient care.

In 2023, Fosun Pharma reported that its healthcare segment, which includes its hospital operations, contributed substantially to its overall revenue. For instance, its hospital management business saw continued growth, demonstrating the demand for its healthcare services.

Licensing and Collaboration Agreements

Fosun Pharma generates revenue by licensing its innovative products and technologies to other pharmaceutical firms across different geographical markets. These agreements often include upfront payments, milestone payments tied to development progress, and ongoing royalties on sales of the licensed products. For example, in 2023, Fosun Pharma continued to leverage its R&D pipeline through such partnerships, contributing to its diverse revenue streams.

These collaborations are crucial for expanding the reach of Fosun Pharma's innovations and accessing new markets without the need for direct investment in manufacturing or distribution in those regions. The financial terms are structured to provide immediate income through milestone payments and sustained revenue as the licensed products gain market traction.

- Out-licensing of proprietary products and technologies.

- Receipt of milestone payments upon achievement of development and regulatory goals.

- Earnings from royalties based on sales performance of licensed products.

- Strategic collaborations to share risk and reward in product development and commercialization.

Research and Development Service Fees / Contract Manufacturing

Fosun Pharma, given its substantial investment in research and development and its robust manufacturing infrastructure, likely generates revenue by offering contract research and manufacturing services (CRAMS) to other pharmaceutical companies. This is a common practice for large players in the industry, allowing them to monetize their specialized capabilities and advanced facilities.

While not always explicitly highlighted as a standalone revenue stream, these services are crucial for companies like Fosun Pharma to optimize asset utilization and expand their market reach. For instance, in 2023, the global pharmaceutical contract manufacturing market was valued at approximately $160 billion and is projected to grow significantly, indicating a strong demand for such services.

- Contract Research: Providing specialized R&D services, such as preclinical testing, clinical trial management, and regulatory affairs support, to biotech and pharmaceutical firms.

- Contract Manufacturing: Offering manufacturing services for active pharmaceutical ingredients (APIs) and finished drug products, leveraging Fosun Pharma's production capacity and quality standards.

- Technology Transfer: Facilitating the transfer of manufacturing technology and processes for drugs developed by other companies.

- Strategic Partnerships: Engaging in co-development or co-commercialization agreements where R&D or manufacturing capabilities are a key component.

Fosun Pharma's revenue streams are multifaceted, extending beyond direct drug sales to encompass medical devices, hospital operations, and strategic licensing. In 2024, the company's total operating revenue reached RMB41.07 billion, with international sales contributing RMB11.30 billion, showcasing a strong global presence.

The company also leverages its R&D capabilities through out-licensing, securing milestone payments and royalties. Additionally, Fosun Pharma offers contract research and manufacturing services (CRAMS), tapping into a global market valued at approximately $160 billion in 2023.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Pharmaceutical Products | Sales of innovative, biosimilar, and generic drugs across various therapeutic areas. | RMB 41.07 billion total operating revenue. |

| Medical Devices & Diagnostics | Sales of surgical systems and diagnostic equipment. | Bolstered by acquisitions like Sisram Medical and Breas Medical. |

| Hospital Operations | Revenue from operating and managing hospitals and clinics. | Segment showed continued growth in 2023. |

| Licensing & Collaborations | Income from licensing proprietary products and technologies. | Includes upfront payments, milestone payments, and royalties. |

| CRAMS | Contract research and manufacturing services for other pharmaceutical firms. | Leverages R&D and manufacturing infrastructure; global CRAMS market strong. |

Business Model Canvas Data Sources

The Fosun Pharma Business Model Canvas is constructed using a blend of internal financial disclosures, extensive market research reports, and strategic analyses of the pharmaceutical industry. These diverse data sources ensure a comprehensive and accurate representation of the company's strategic framework.