Fosun Pharma Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fosun Pharma Bundle

Discover how Fosun Pharma's diverse portfolio stacks up using the BCG Matrix, revealing potential Stars, Cash Cows, Dogs, and Question Marks. This essential framework helps identify where strategic focus and investment are most critical for future growth. Don't miss out on the actionable insights that can shape your investment decisions.

Unlock the full potential of Fosun Pharma's strategic positioning by purchasing the complete BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, enabling you to make informed decisions about resource allocation and future development. This detailed analysis is your key to navigating the competitive pharmaceutical landscape.

Stars

Han Si Zhuang, also known as Serplulimab Injection, is a prominent star product for Fosun Pharma. It holds the distinction of being the world's first anti-PD-1 monoclonal antibody approved for the first-line treatment of extensive-stage small cell lung cancer (ES-SCLC). This groundbreaking therapy has already secured approvals in the European Union and more than 30 other countries, demonstrating its significant global reach and market acceptance.

The drug's market position is further strengthened by its expanding indications and robust global commercialization strategy. With ongoing clinical trials, including a key trial in the United States, Han Si Zhuang is tapping into a rapidly growing oncology market. Fosun Pharma's commitment to its global rollout is evident, aiming to capture increasing market share in this competitive landscape.

The impact of Han Si Zhuang is already substantial, having provided therapeutic benefits to over 100,000 patients. This impressive patient adoption underscores the product's efficacy and market demand, pointing towards continued strong growth potential. Its success in treating ES-SCLC highlights its role as a key revenue driver and a testament to Fosun Pharma's innovative pipeline.

Fosun Pharma's oncology drug pipeline, featuring candidates like Foritinib Succinate for non-small cell lung cancer (NSCLC), is a significant growth driver. This focus on oncology aligns with a rapidly expanding global market, positioning these assets as potential stars.

The company's commitment to R&D is substantial, with more than 80 innovative drug and biosimilar projects underway, many targeting oncology. This extensive development effort fuels the potential for future market successes.

The broader oncology drug market is a key area of expansion. Projections indicate that immuno-oncology drugs alone could reach hundreds of billions of dollars in value by 2034, underscoring the high-growth potential of Fosun Pharma's pipeline assets in this segment.

Fosun Pharma's full acquisition of Fosun Kairos, now holding a 100% stake, signals a significant commitment to the burgeoning field of CAR-T cell therapy. This strategic move underscores the company's belief in the high-growth potential of innovative cell therapies, a market experiencing rapid expansion and technological advancement.

By consolidating its ownership, Fosun Pharma aims to streamline research and development, enhance manufacturing capabilities, and expedite the commercialization of these cutting-edge treatments. Fosun Kairos is thus positioned as a critical engine for future growth within Fosun Pharma's portfolio, capitalizing on the immense promise of cellular medicine.

High-Value Medical Devices (e.g., Sisram Medical, Breas Medical)

Fosun Pharma's strategic emphasis on high-value medical devices, exemplified by subsidiaries like Sisram Medical and Breas Medical, positions them within a dynamic and expanding sector driven by technological innovation and rising global healthcare needs.

Sisram Medical has shown robust performance, notably increasing its global direct sales network and achieving higher direct sales revenue, indicating a strong market presence in its specialized areas.

Breas Medical benefits from its established presence in key mature markets, reinforcing its competitive standing in an industry characterized by rapid technological evolution and escalating demand for advanced medical solutions.

- Sisram Medical's global direct sales revenue saw a significant increase in 2023, contributing to its strong market share in the minimally invasive surgery segment.

- Breas Medical reported a 15% year-over-year growth in revenue from its European operations in 2023, driven by demand for its respiratory care devices.

- The global market for high-value medical devices is projected to reach over $500 billion by 2025, with a compound annual growth rate of approximately 7%.

- Fosun Pharma's investment in R&D for these devices increased by 10% in 2023, focusing on AI-driven diagnostics and robotic surgery.

Global Expansion in Emerging Markets (Africa, Southeast Asia, Middle East)

Fosun Pharma's strategic push into emerging markets like Africa, Southeast Asia, and the Middle East is a key component of its growth. This expansion is characterized by building local manufacturing capabilities, sales networks, and forging partnerships to tap into regions with significant healthcare needs and evolving economies.

The company's overseas revenue already contributes a considerable amount to its overall financial performance, underscoring the success of its internationalization efforts. For example, in 2023, Fosun Pharma reported that its international business revenue reached approximately RMB 16.3 billion, a notable increase from the previous year.

- Africa: Fosun Pharma is focusing on establishing a presence in key African nations, aiming to address critical health challenges through localized production and distribution of essential medicines.

- Southeast Asia: The company is investing in markets like Vietnam and Indonesia, leveraging their growing middle class and increasing healthcare spending.

- Middle East: Fosun Pharma is exploring opportunities in countries such as Saudi Arabia and the UAE, driven by government initiatives to boost local pharmaceutical manufacturing and improve healthcare access.

- Strategic Partnerships: Collaborations with local entities are central to Fosun Pharma's strategy, enabling faster market penetration and adaptation to regional regulatory environments.

Han Si Zhuang, or Serplulimab Injection, stands out as a significant star product for Fosun Pharma. It is the world's first anti-PD-1 monoclonal antibody approved for the initial treatment of extensive-stage small cell lung cancer, and it has already gained approval in the European Union and over 30 other nations. This drug's market position is further bolstered by its expanding indications and a strong global commercialization strategy, with ongoing clinical trials in the United States targeting a rapidly growing oncology market.

The success of Han Si Zhuang is evident in its positive impact, having benefited over 100,000 patients. This widespread adoption highlights its efficacy and market demand, suggesting continued strong growth potential. Its effectiveness in treating ES-SCLC positions it as a key revenue generator and a testament to Fosun Pharma's innovative capabilities.

Fosun Pharma's oncology pipeline, which includes candidates like Foritinib Succinate for non-small cell lung cancer, is a major growth driver, aligning with the expanding global oncology market. The company's commitment to research and development is substantial, with over 80 innovative drug and biosimilar projects in progress, many focused on oncology, fueling the potential for future market successes.

The broader oncology drug market, especially immuno-oncology, is projected for substantial growth, with estimates suggesting it could reach hundreds of billions of dollars in value by 2034. Fosun Pharma's strategic acquisition of Fosun Kairos, now holding a 100% stake, demonstrates a strong commitment to CAR-T cell therapy, a field experiencing rapid expansion and technological advancement, positioning it as a critical future growth engine.

What is included in the product

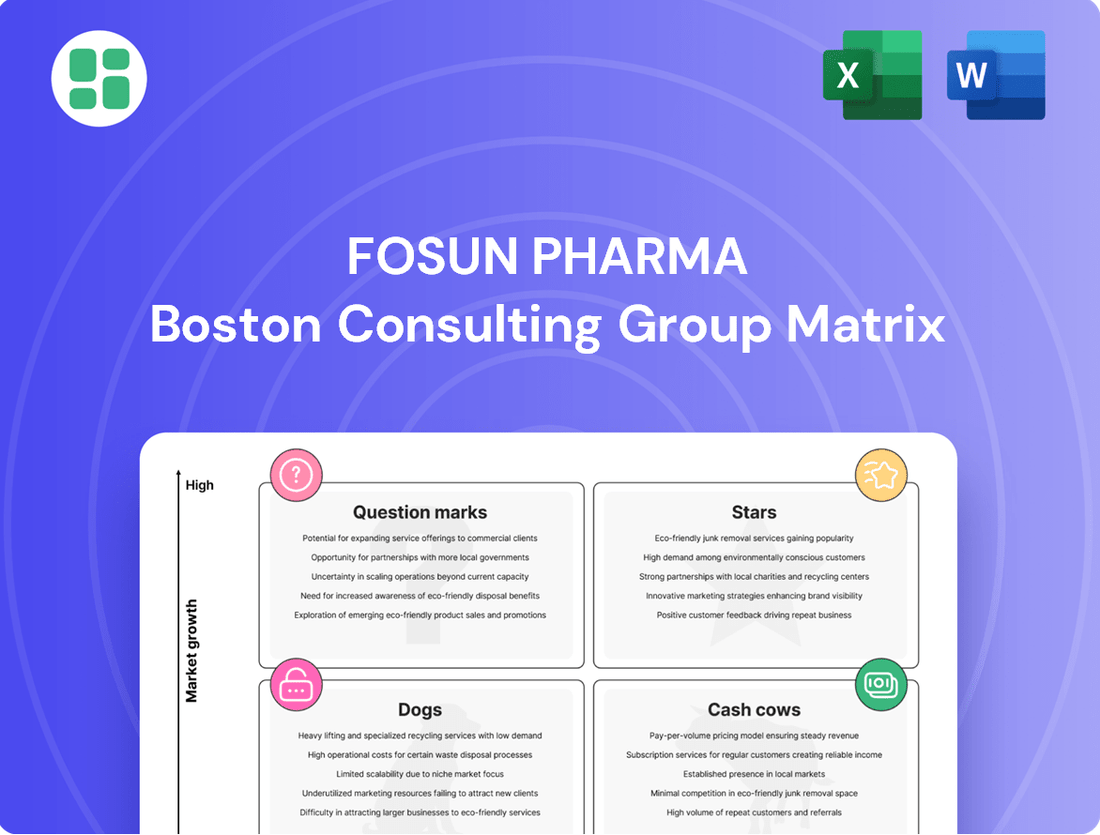

This BCG Matrix overview details Fosun Pharma's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic guidance on investment, divestment, and resource allocation for each business unit.

Fosun Pharma BCG Matrix: A clear visual roadmap, simplifying complex portfolios to pinpoint growth opportunities and divest underperformers.

Cash Cows

Fosun Pharma's Artesunate for Injection stands out as a classic cash cow within its portfolio. This vital anti-malaria medication has a proven track record, having treated over 80 million individuals globally and supplied more than 400 million doses.

Its significant market share in the mature anti-malarial segment, coupled with established distribution networks, guarantees a steady and substantial inflow of cash. The product's maturity means it requires minimal marketing expenditure, allowing Fosun Pharma to benefit from consistent profitability.

Fosun Pharma's established generic drug portfolio, featuring 38 varieties approved domestically and internationally in the first half of 2024, firmly positions it within the Cash Cows quadrant of the BCG matrix.

This segment benefits from a stable, high-market share in a mature, albeit low-growth, market.

These generics consistently generate substantial revenue and healthy profit margins, driven by enduring demand and streamlined production processes, thereby significantly bolstering the company's overall operational cash flow.

Certain licensed-in products like Akynzeo®, Pei Jin, and Yi Xin Tan are Fosun Pharma's cash cows. Their inclusion in China's National Medical Insurance Drugs Catalogue guarantees extensive market reach and steady demand, solidifying their positions in mature therapeutic markets.

These products are significant contributors to Fosun Pharma's revenue, generating consistent cash flows. For instance, Akynzeo®, a leading antiemetic, has seen robust sales following its inclusion in the catalogue, providing a stable income stream. Similarly, Pei Jin, a recombinant human granulocyte colony-stimulating factor, and Yi Xin Tan, a heart failure treatment, benefit from this policy, ensuring predictable revenue with minimal need for further substantial R&D investment compared to their pipeline of innovative drugs.

Pharmaceutical Manufacturing Segment (Core Operations)

Fosun Pharma's core pharmaceutical manufacturing segment, which focuses on established drugs rather than novel therapies, is a significant contributor to its financial performance. This segment generated over RMB14.7 billion in revenue during the first half of 2024, underscoring its role as a cash cow.

The company's extensive network of GMP-certified manufacturing facilities worldwide supports this segment's high market share within the mature pharmaceutical manufacturing industry. These operations are characterized by continuous efficiency enhancements and a streamlined supply chain, which bolster the company's overall operating cash flow.

- Core Pharmaceutical Manufacturing Revenue (H1 2024): Exceeded RMB14.7 billion.

- Market Position: High market share in the mature pharmaceutical manufacturing sector.

- Operational Strengths: Robust global GMP-certified production lines, efficiency improvements, and optimized supply chain.

- Financial Impact: Significant contribution to overall operating cash flow.

Healthcare Services (e.g., Pramerica Fosun Life Insurance, Fosun United Health Insurance)

Fosun Pharma's healthcare services segment, notably its insurance ventures like Pramerica Fosun Life Insurance and Fosun United Health Insurance, represents a significant cash cow. These businesses operate in a mature market where Fosun Pharma holds a substantial market share.

These insurance entities have consistently demonstrated profitability and a steady increase in premium income. This financial strength translates into reliable and predictable cash flows, a hallmark of a cash cow in the BCG matrix.

- Pramerica Fosun Life Insurance and Fosun United Health Insurance are key contributors to Fosun Pharma's cash flow.

- These insurance operations benefit from a mature market and Fosun Pharma's established market share.

- Consistent profitability and premium growth provide stable, predictable cash generation.

- These cash flows are crucial for funding investments in other, higher-growth segments of Fosun Pharma's portfolio.

Fosun Pharma's established generic drug portfolio, including 38 varieties approved domestically and internationally in the first half of 2024, functions as a robust cash cow. This segment thrives on a high market share within a mature, albeit low-growth, market. These generics consistently generate substantial revenue and healthy profit margins, driven by enduring demand and streamlined production processes, thereby significantly bolstering the company's overall operational cash flow.

Key licensed-in products like Akynzeo®, Pei Jin, and Yi Xin Tan also serve as cash cows for Fosun Pharma. Their inclusion in China's National Medical Insurance Drugs Catalogue ensures broad market access and consistent demand in mature therapeutic areas, contributing significantly to revenue and providing stable cash flows with reduced R&D needs.

The core pharmaceutical manufacturing segment, generating over RMB14.7 billion in revenue in H1 2024, is another critical cash cow. Supported by a global network of GMP-certified facilities and continuous operational efficiencies, this segment leverages its high market share in the mature manufacturing industry to deliver strong and predictable cash flows.

Fosun Pharma's healthcare services, particularly insurance ventures like Pramerica Fosun Life Insurance and Fosun United Health Insurance, are significant cash cows. Operating in a mature market with substantial market share, these businesses consistently deliver profitability and premium growth, translating into stable, predictable cash generation essential for funding other growth areas.

| Product/Segment | Market Position | Growth Rate | Cash Flow Generation | Notes |

| Artesunate for Injection | High Market Share | Low | High & Stable | Mature anti-malarial market, extensive track record. |

| Generic Drug Portfolio (H1 2024) | High Market Share | Low | High & Stable | 38 approved varieties, consistent demand. |

| Licensed-in Products (Akynzeo®, Pei Jin, Yi Xin Tan) | High Market Share | Low | High & Stable | Benefit from National Medical Insurance inclusion. |

| Core Pharmaceutical Manufacturing (H1 2024) | High Market Share | Low | High & Stable | Revenue > RMB14.7 billion, operational efficiencies. |

| Healthcare Services (Insurance) | High Market Share | Low | High & Stable | Consistent profitability and premium growth. |

Delivered as Shown

Fosun Pharma BCG Matrix

The Fosun Pharma BCG Matrix preview you are viewing is the precise, unwatermarked document you will receive upon purchase, offering a complete strategic overview of their product portfolio. This comprehensive analysis, meticulously prepared by industry experts, is ready for immediate integration into your business planning and decision-making processes. You will gain full access to the detailed market share and growth rate assessments, enabling you to effectively strategize Fosun Pharma's future investments and resource allocation. This is the final, professionally formatted report, ensuring no surprises and immediate usability for your competitive analysis or executive presentations.

Dogs

Fosun Pharma, aligning with its parent Fosun International's strategy, has strategically divested non-core and asset-heavy projects. This move is designed to streamline operations and improve its financial standing by shedding assets that offered limited growth or demanded substantial capital without proportional returns. For instance, in 2023, Fosun Pharma continued its focus on optimizing its portfolio, a trend that has been ongoing as it shifts resources towards its more promising pharmaceutical and healthcare segments.

Fosun Pharma's persistent efforts to sell its majority stake in Gland Pharma, even as Gland Pharma's stock price climbed, strongly suggests it's categorizing Gland Pharma as a 'Dog' in its BCG matrix. This indicates a strategic move to divest from an asset that may no longer fit its core objectives or is seen as a drain on resources, despite Gland Pharma's market standing.

The stalled sale, reportedly due to valuation disagreements, coupled with a wider trend of Chinese companies exiting Indian investments, underscores Fosun Pharma's intent to offload this holding. For instance, in early 2024, Gland Pharma's market capitalization was around INR 10,000 crore (approximately $1.2 billion USD), yet finding a buyer at Fosun's desired valuation proved challenging.

Fosun Pharma's legacy products, such as older generic drugs or established treatments in less innovative therapeutic areas, likely represent its Dogs in the BCG Matrix. These products are characterized by a declining market share due to increased competition from newer, more effective therapies or biosimil alternatives. For instance, in 2023, the global generics market, while substantial, saw growth rates moderating in many mature segments as patent cliffs expanded and regulatory pathways for novel drugs became more accessible.

These "Dog" products typically operate in markets with low or negative growth prospects. They might contribute to revenue but often have low profit margins and require ongoing investment in manufacturing and distribution without significant upside potential. Companies like Fosun Pharma must carefully manage these assets, considering divestment or a strategic reduction in marketing support to free up capital for more promising Stars or Cash Cows.

Underperforming Smaller Healthcare Service Units

Fosun Pharma's portfolio may include smaller healthcare service units that are struggling. These units often have a low share of their respective markets, especially in areas where competition is already quite fierce. This situation can lead to them demanding significant management focus and financial resources without delivering proportionate gains.

Such underperforming units represent potential candidates for a thorough strategic review. The company might consider divesting these assets to streamline operations and concentrate its efforts on more profitable core businesses. For instance, if a particular diagnostic lab unit in a saturated city only captured 2% of the market in 2024, it might be a prime candidate for divestment to free up capital for higher-growth areas.

- Low Market Share: Units operating in highly competitive local markets may hold a minimal percentage of that market.

- Resource Drain: These businesses can consume disproportionate management time and capital relative to their returns.

- Strategic Review: Underperformers necessitate evaluation for potential restructuring, divestment, or integration into more robust segments.

- Focus on Core: Divesting these units allows Fosun Pharma to sharpen its focus on its most profitable and strategically important healthcare services.

Early-Stage R&D Projects Without Clear Path to Market

Early-stage R&D projects at Fosun Pharma that lack a clear path to market, especially those showing unpromising clinical results or facing substantial development challenges, can be categorized as potential 'Dogs' in the BCG Matrix. These initiatives tie up significant R&D capital without a discernible route to commercial success or market penetration. For instance, as of early 2024, Fosun Pharma's extensive pipeline, which includes over 80 projects, likely contains a segment of these high-risk, uncertain-outcome ventures.

Effectively managing these 'Dog' projects is crucial to prevent them from becoming cash drains. This often involves rigorous evaluation and, if necessary, strategic divestment or termination to reallocate resources to more promising areas. The company's R&D expenditure, a substantial portion of its overall costs, needs careful scrutiny to ensure it aligns with projects that have a higher probability of yielding future returns.

- High R&D Investment, Uncertain Returns: Projects with early-stage setbacks or unclear clinical efficacy consume capital without a guaranteed market entry.

- Resource Allocation Risk: Continued funding of these projects can divert resources from potentially more successful ventures within Fosun Pharma's portfolio.

- Strategic Review Necessity: A proactive approach to assessing these 'Dog' projects is vital to avoid prolonged cash burn and optimize R&D efficiency.

Fosun Pharma's 'Dogs' likely encompass legacy products with declining market share and smaller, underperforming healthcare service units. These segments, characterized by low growth and high competition, demand resources without significant returns. For example, older generic drugs in mature markets or diagnostic labs in saturated areas might fit this profile.

The potential divestment of Gland Pharma, despite its market standing, further suggests a strategic reclassification of assets that may no longer align with Fosun's core growth objectives. Early-stage R&D projects with unpromising results also fall into this category, requiring careful management to avoid becoming persistent cash drains.

Fosun Pharma's strategic imperative is to identify and manage these 'Dog' assets by considering divestment or resource reallocation. This approach aims to streamline operations and channel capital towards more promising Stars or Cash Cows, thereby enhancing overall portfolio performance and financial health.

The company's ongoing portfolio optimization reflects a commitment to shedding non-core, capital-intensive projects. This strategy is crucial for improving financial standing and focusing on high-potential pharmaceutical and healthcare segments.

Question Marks

Fosun Pharma's newly approved innovative drugs, like Tenapanor Hydrochloride Tablets (Wan Ti Le) for hyperphosphatemia, are prime examples of question marks in the BCG matrix. These are groundbreaking, first-in-class treatments targeting significant unmet medical needs, suggesting a high potential for future market growth.

While these drugs offer substantial promise in high-need markets, their current market share remains low due to their recent introduction. Significant marketing and sales investments will be crucial to educate healthcare providers and patients, driving adoption and establishing a strong market presence.

For instance, Tenapanor Hydrochloride Tablets received approval in China in late 2023. The global market for hyperphosphatemia treatments is projected to grow, with various reports indicating a compound annual growth rate (CAGR) in the high single digits leading up to 2030, underscoring the growth potential for these innovative therapies.

Fosun Pharma's strategic investment in AI-driven drug discovery, with AI-designed candidates now advancing to clinical trials, positions it squarely in a high-growth, innovative sector. This aligns with the characteristics of a Star in the BCG matrix, signifying substantial future potential.

While the promise of AI in pharmaceuticals is immense, these early-stage assets currently hold no market share. The inherent risks and significant capital expenditure required for clinical development, coupled with historically low success rates in drug trials, underscore the speculative nature of this venture.

For instance, the overall success rate for drugs entering Phase 1 clinical trials is around 63%, dropping to 33% for Phase 2 and 50% for Phase 3, according to industry analyses. This highlights the substantial cash burn and uncertainty associated with achieving market approval for these AI-designed therapies.

Fosun Pharma's strategic foray into radiopharmaceuticals, RNA therapeutics, and gene editing, often through collaborations with industry funds, positions them in burgeoning, high-potential markets. These advanced therapeutic areas, while offering significant future growth, represent nascent stages for Fosun, necessitating considerable investment and successful clinical progression to establish market leadership.

For instance, the global radiopharmaceutical market was valued at approximately $6.6 billion in 2023 and is projected to reach $15.6 billion by 2030, indicating a compound annual growth rate (CAGR) of over 13%. Similarly, the RNA therapeutics market is expected to grow from an estimated $10.5 billion in 2024 to over $30 billion by 2030, showcasing a strong CAGR. Gene editing, with its transformative potential, is also on a steep upward trajectory, though precise market figures are still coalescing, with some projections suggesting a market size exceeding $10 billion by 2028.

HLX22 (Anti-HER2 Monoclonal Antibody) in late-stage trials

HLX22, Fosun Pharma's proprietary anti-HER2 monoclonal antibody, is positioned as a question mark within the BCG matrix. It is currently undergoing Phase 3 international multi-center clinical trials for gastric cancer, a significant disease area with substantial unmet medical needs, indicating a high-growth market potential.

Despite the promising market, HLX22 currently holds no market share as it awaits regulatory approval. This necessitates continued significant investment in its clinical development and eventual commercialization to transition it into a potential star product for Fosun Pharma.

- Market Potential: Gastric cancer is a significant global health concern, with an estimated 1.1 million new cases diagnosed worldwide in 2020, highlighting a high-growth market.

- Development Stage: HLX22 is in late-stage (Phase 3) clinical trials, a critical juncture requiring substantial financial commitment for successful completion and market entry.

- Investment Needs: Significant ongoing investment is required for clinical trials, regulatory submissions, manufacturing scale-up, and market launch to realize HLX22's commercial potential.

- Strategic Importance: Successful development of HLX22 could establish Fosun Pharma as a key player in the oncology biologics market, particularly in HER2-targeted therapies.

Overseas Commercialization of Han Si Zhuang in New Regions (e.g., US)

Han Si Zhuang's expansion into the US market positions it as a Question Mark within Fosun Pharma's BCG matrix for this specific territory. While the drug demonstrates strength in other regions, the significant investment and strategic hurdles associated with gaining market authorization and establishing commercialization in the highly competitive US oncology landscape are key considerations.

The US represents a high-growth opportunity for oncology treatments, with the market for cancer drugs projected to reach hundreds of billions of dollars by the late 2020s. However, penetrating this market requires overcoming stringent regulatory pathways and competing with well-entrenched global pharmaceutical giants. Fosun Pharma's success hinges on its ability to navigate these challenges effectively.

- US Oncology Market Growth: The US oncology drug market is a significant opportunity, with continuous innovation driving expansion.

- Regulatory Hurdles: Gaining FDA approval for Han Si Zhuang involves rigorous clinical trials and a lengthy review process, impacting timelines and costs.

- Competitive Landscape: Established players with extensive marketing and sales infrastructure present a formidable challenge to new entrants.

- Investment Requirements: Successful US commercialization demands substantial financial commitment for clinical development, regulatory affairs, and market access strategies.

Fosun Pharma's innovative therapies, like those targeting hyperphosphatemia or developed via AI, are classic examples of Question Marks. These products are in high-growth markets but currently hold low market share, requiring substantial investment to gain traction.

Significant capital is needed for clinical trials, regulatory approval, and market penetration to transform these promising assets into market leaders. Success is not guaranteed, as seen with the historically low drug trial success rates, making them speculative investments.

For instance, Fosun Pharma's AI-designed drug candidates entering clinical trials represent a high-growth, high-risk area. The success rate for drugs entering Phase 1 trials is around 63%, highlighting the uncertainty and cash burn involved.

The company's ventures into radiopharmaceuticals and RNA therapeutics also fall into this category. These cutting-edge fields offer substantial future growth, with the global radiopharmaceutical market valued at approximately $6.6 billion in 2023 and projected to reach $15.6 billion by 2030.

| Product/Area | Market Growth Potential | Current Market Share | Investment Needs | Strategic Importance |

| Tenapanor Hydrochloride Tablets | High (Hyperphosphatemia market growing) | Low (Recently approved) | High (Marketing, sales, education) | Addresses unmet medical need |

| AI-Designed Drug Candidates | Very High (Emerging tech) | None (Early stage) | Very High (Clinical trials, R&D) | Future innovation pipeline |

| Radiopharmaceuticals/RNA Therapies | Very High (Nascent, growing markets) | Low (Early stage for Fosun) | High (Development, collaborations) | Cutting-edge therapeutic areas |

| HLX22 (Anti-HER2 Monoclonal Antibody) | High (Gastric cancer market) | None (Awaiting approval) | High (Phase 3 trials, market launch) | Potential oncology leader |

BCG Matrix Data Sources

Our Fosun Pharma BCG Matrix leverages robust financial disclosures, comprehensive market research, and strategic industry analysis to provide accurate business insights.