Forward Air Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Forward Air Bundle

Forward Air faces moderate competitive rivalry, with established players vying for market share in the expedited freight sector. The threat of new entrants is somewhat limited by capital requirements and established networks, but potential disruption from technology remains a consideration.

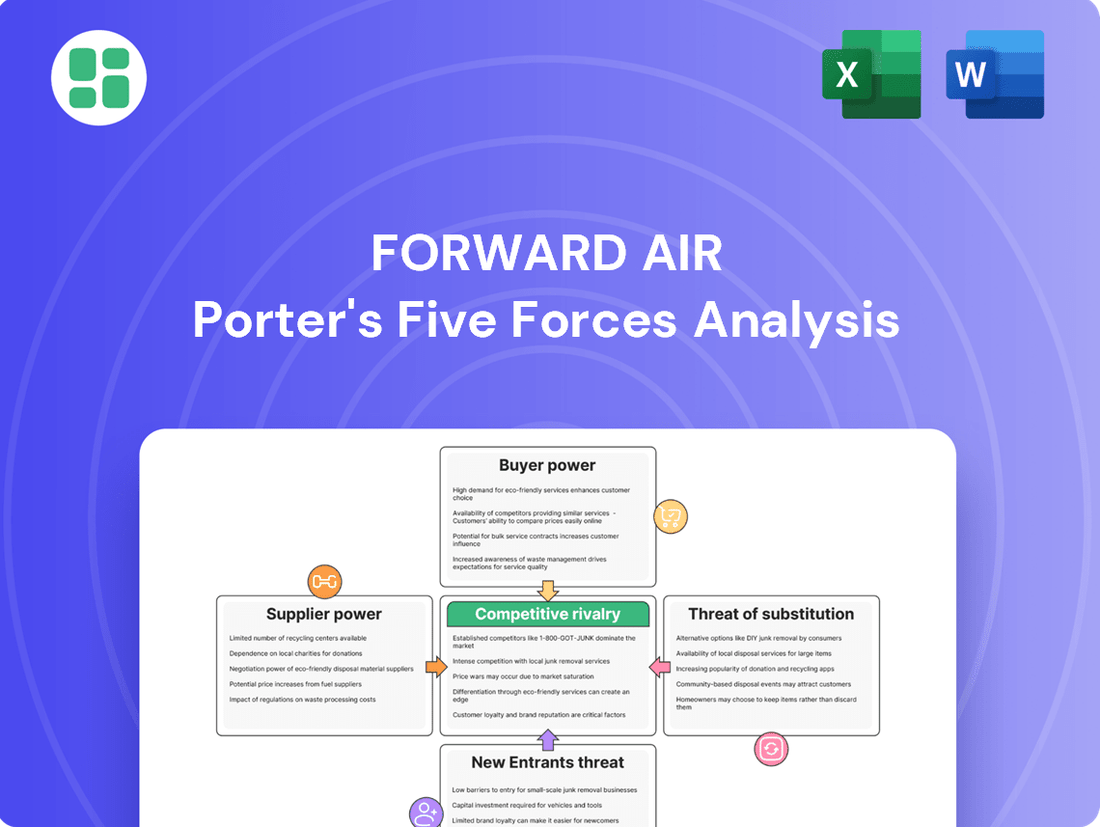

The full Porter's Five Forces Analysis reveals the real forces shaping Forward Air’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Forward Air, operating as an asset-light logistics company, depends significantly on independent owner-operators for its trucking services. This widespread network of individual drivers and small fleets typically dilutes the bargaining power of any single supplier, as Forward Air can readily find alternatives.

While the sheer number of available drivers works in Forward Air's favor, industry-wide challenges can shift the balance. For instance, persistent driver shortages, a notable trend in the trucking sector throughout 2024, can empower these fragmented suppliers collectively, leading to increased leverage in contract negotiations.

Fuel represents a substantial portion of Forward Air's operating expenses, making the company susceptible to fluctuations in energy markets. The inherent volatility of fuel prices grants suppliers significant leverage, particularly if Forward Air faces challenges in fully transferring these increased costs to its customer base. For instance, in early 2024, diesel prices saw notable swings, directly impacting carriers' margins.

To counter this supplier power, Forward Air relies on robust fuel surcharge mechanisms and sophisticated hedging strategies. These tools are essential for managing the financial impact of unpredictable fuel cost increases and maintaining profitability in a dynamic transportation landscape.

Suppliers of specialized transportation equipment and advanced logistics technology generally hold moderate bargaining power over Forward Air. While the market for standard trucks and trailers might be competitive, providers of proprietary or highly specialized systems, like advanced telematics or AI-powered route optimization software, can exert more influence. This is because switching to a different provider for such critical technologies can involve significant costs and operational disruption, potentially impacting Forward Air's efficiency and capital investment decisions.

Labor Market Dynamics (Non-Driver)

Beyond direct driver availability, Forward Air's operational costs are significantly influenced by the labor market for essential roles like warehousing, terminal management, and overall logistics coordination. A scarcity of skilled personnel in these areas can empower employees, potentially driving up wages and impacting profitability.

The logistics sector has seen persistent trends of tight labor markets and wage inflation. For instance, in 2024, the U.S. Bureau of Labor Statistics reported continued growth in logistics and warehousing employment, but also noted persistent wage pressures. This environment can increase the bargaining power of employees, forcing companies like Forward Air to absorb higher labor costs if not strategically managed.

- Skilled Labor Availability: Shortages in warehousing and terminal operations staff can elevate employee leverage.

- Wage Inflation: Rising wages in the logistics sector directly increase operational expenses for companies.

- Impact on Costs: Unmanaged labor market pressures can lead to higher overall operating costs for Forward Air.

Intermodal and Drayage Partners

Forward Air's reliance on intermodal and drayage partners means it's directly impacted by the bargaining power of rail carriers and local trucking firms. This power isn't uniform; it fluctuates based on geographic location and specific shipping routes.

In areas where a few large rail companies dominate, like major East-West corridors, their concentrated market share can translate into greater leverage over pricing and service terms. For instance, as of early 2024, Class I railroads in the US, which handle a significant portion of intermodal freight, have shown pricing power through contract renewals and accessorial charges.

Conversely, drayage services in highly competitive local markets, where numerous smaller operators vie for business, typically exhibit less supplier power. This competition can allow companies like Forward Air to negotiate more favorable rates or switch providers more readily if terms become unfavorable.

- Intermodal Dependence: Forward Air uses rail for long-haul segments and drayage for first/last mile, making these suppliers critical.

- Regional Power Dynamics: Supplier power is higher where rail networks are concentrated and lower in markets with abundant drayage providers.

- Market Leverage: In 2023, the transportation sector saw continued inflationary pressures, impacting contract negotiations with carriers, including drayage providers.

- Service Level Agreements: The terms of contracts with these partners, including transit times and reliability, directly influence Forward Air's operational efficiency and customer satisfaction.

Forward Air's bargaining power with its owner-operator drivers is generally low due to the fragmented nature of this supplier base. However, industry-wide driver shortages, a persistent issue in 2024, can collectively increase driver leverage, leading to demands for higher rates.

Fuel suppliers wield significant power, as fuel costs are a major expense for Forward Air. Volatile diesel prices, as seen with fluctuations in early 2024, can pressure margins if these costs cannot be fully passed on to customers.

Specialized technology providers, such as those offering advanced logistics software, can have moderate bargaining power due to the high switching costs and potential operational disruption involved.

Labor availability for essential roles like warehousing and terminal operations also impacts bargaining power. In 2024, tight labor markets and wage inflation in the logistics sector, as reported by the Bureau of Labor Statistics, empower employees and increase operational expenses.

Intermodal and drayage partners, especially dominant rail carriers on key routes, possess considerable bargaining power. Conversely, drayage providers in competitive local markets have less influence.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power (2024 Context) | Impact on Forward Air |

|---|---|---|---|

| Owner-Operators | Low to Moderate | Fragmented base, but driver shortages can increase leverage. | Potential for higher per-mile rates, increased operational costs. |

| Fuel Suppliers | High | Volatile fuel prices, essential commodity. | Direct impact on operating expenses, margin pressure if costs aren't passed on. |

| Specialized Tech Providers | Moderate | Proprietary systems, high switching costs, operational integration. | Influence on technology adoption decisions, potential for higher software/service fees. |

| Warehouse/Terminal Labor | Moderate | Tight labor markets, wage inflation, need for skilled personnel. | Increased labor costs, potential for service disruptions if staffing is insufficient. |

| Intermodal/Rail Carriers | Moderate to High | Concentrated market on key routes, pricing power in contract renewals. | Higher freight rates, potential for service level impacts. |

What is included in the product

This analysis unpacks the competitive landscape for Forward Air by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute services.

Instantly visualize competitive pressures across all five forces with a dynamic, interactive dashboard.

Customers Bargaining Power

Forward Air's customer base is quite varied, encompassing freight forwarders, logistics providers, retailers, e-commerce businesses, and manufacturers. These clients all need reliable, time-sensitive shipping services. In 2023, Forward Air reported that its top ten customers accounted for approximately 41% of its total revenue, indicating that while the base is diverse, a significant portion of business still comes from larger clients.

Customers shipping high-value and time-sensitive freight often place a premium on reliability and speed, which inherently lessens their leverage to negotiate lower prices. Forward Air's strategic focus on these expedited services directly addresses this market need, enabling the company to command higher rates than those typically seen in standard freight operations.

The availability of alternative providers significantly boosts customer bargaining power in the expedited freight market. Forward Air faces competition from numerous carriers offering similar Less-Than-Truckload (LTL), truckload, and intermodal solutions. This abundance of choice means customers can readily switch providers if they aren't satisfied with pricing or service, forcing Forward Air to remain competitive.

In 2024, the transportation and logistics sector saw continued emphasis on carrier reliability and cost-effectiveness. Customers, particularly those with high-volume shipping needs, actively leverage the competitive landscape to negotiate favorable rates and service level agreements. Forward Air's ability to differentiate itself through its specialized network, particularly for temperature-controlled and hazmat freight, becomes crucial in mitigating this customer power.

Customer Sophistication and Logistics Expertise

Forward Air's customer base includes sophisticated players like large manufacturers and third-party logistics providers (3PLs). These entities possess significant expertise in logistics and procurement, enabling them to understand market dynamics thoroughly.

This deep knowledge allows them to negotiate pricing and service terms with considerable leverage. They actively seek competitive rates and demand rigorous adherence to service level agreements, directly impacting Forward Air's profitability and operational flexibility.

- Sophisticated Customer Base: Forward Air serves large manufacturers and 3PLs with advanced logistics knowledge.

- Negotiating Power: Customers leverage their market rate understanding to negotiate aggressively.

- Service Demands: High expectations for competitive pricing and stringent service level agreements are common.

- Impact on Forward Air: This sophistication directly influences Forward Air's pricing strategies and contract terms.

Impact of Omni Logistics Acquisition

Forward Air's acquisition of Omni Logistics, a freight forwarder, has created a dynamic shift in customer relationships. Initially, existing freight forwarder customers of Forward Air expressed apprehension, viewing the move as a potential move by Forward Air to become a direct competitor. This concern could empower these customers, leading them to explore other carriers to mitigate perceived conflicts of interest.

The bargaining power of customers in the freight forwarding industry is influenced by several factors, including the availability of alternatives and the cost of switching. With Forward Air's expanded service offerings post-acquisition, customers now have a broader range of options to consider, potentially increasing their leverage in negotiations.

- Customer Concerns: Freight forwarder customers of Forward Air voiced worries about the company potentially competing directly with them after acquiring Omni Logistics.

- Increased Leverage: This situation could enhance customer bargaining power, as they may seek alternative providers to avoid potential conflicts of interest.

- Market Dynamics: The acquisition reshapes competitive landscapes, potentially leading to price adjustments or service modifications to retain customer loyalty.

Forward Air's customer base, including large manufacturers and 3PLs, possesses significant logistics expertise, enabling them to negotiate pricing and service terms effectively. In 2024, the competitive transportation landscape pressured carriers to offer cost-effectiveness, with high-volume shippers leveraging this to secure favorable agreements. Forward Air's differentiation through specialized services like temperature-controlled freight is key to mitigating this customer power.

| Customer Segment | Key Negotiation Factors | Impact on Forward Air |

|---|---|---|

| Large Manufacturers | Logistics expertise, volume discounts | Price pressure, demand for strict SLAs |

| 3PLs | Market rate knowledge, switching costs | Negotiating leverage, potential provider shifts |

| Freight Forwarders (Post-Acquisition) | Perceived competition, service diversification | Risk of customer loss, need for relationship management |

Same Document Delivered

Forward Air Porter's Five Forces Analysis

This preview showcases the complete Forward Air Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive instantly after purchase, ensuring no surprises or missing sections. This detailed report provides actionable insights into industry rivalry, supplier and buyer power, threat of new entrants, and the threat of substitutes, all ready for immediate use.

Rivalry Among Competitors

The expedited freight sector is a battlefield, teeming with a diverse array of competitors. Forward Air contends not only with other Less-Than-Truckload (LTL) carriers but also with full truckload providers and comprehensive logistics firms. This crowded landscape means everyone is fighting for those crucial, time-sensitive, and high-value shipments.

Forward Air's asset-light strategy means it faces intense competition from both traditional asset-heavy carriers and other asset-light logistics providers. Asset-heavy competitors, like major trucking firms, can leverage their owned fleets for greater control over capacity and service quality, potentially offering a stable, predictable service.

Conversely, other asset-light brokers and carriers compete fiercely on price and network optimization, often utilizing independent contractors or leased capacity. This dynamic intensifies rivalry as Forward Air must balance its flexibility with the need to offer competitive pricing and efficient service delivery against a broad range of players. For instance, in 2023, the US trucking industry saw freight volumes fluctuate, with spot rates often under pressure, highlighting the price sensitivity in this competitive landscape.

Even though Forward Air targets premium, high-service freight, the broader freight market can face overcapacity and declining rates, a situation observed in 2024. This softening market intensifies competition, forcing carriers to lower prices to secure business, which directly impacts Forward Air's profit margins.

The average spot rate for dry van loads in the U.S. saw a notable decrease in early 2024 compared to previous years, with some reports indicating drops of over 20% year-over-year for certain lanes. This price pressure makes it harder for specialized carriers like Forward Air to maintain their pricing power, even with superior service offerings.

Service Differentiators and Network Density

Competitive rivalry in the expedited less-than-truckload (LTL) sector is intense, with companies like Forward Air differentiating themselves through crucial service elements. These include a strong emphasis on on-time delivery performance, sophisticated real-time shipment visibility, and specialized handling for sensitive or high-value freight.

Forward Air's extensive network spanning North America, coupled with its integrated service offerings—particularly following the Omni acquisition—provides a significant competitive edge. However, rivals are not standing still; they are consistently investing in their own networks and technological capabilities to either match or surpass Forward Air’s service levels.

- Service Differentiators: On-time delivery, real-time visibility, and specialized handling are key competitive drivers.

- Network Density: Forward Air's comprehensive North American network is a core advantage.

- Integrated Solutions: Post-Omni acquisition, integrated service offerings enhance competitive positioning.

- Rival Investment: Competitors are actively investing to match or exceed Forward Air's network and service capabilities.

Strategic Acquisitions and Consolidation

The logistics industry is a hotbed of consolidation, with companies actively pursuing strategic acquisitions to bolster their service portfolios and geographic footprints. Forward Air's significant acquisition of Omni Logistics in 2023, valued at $2.1 billion, exemplifies this trend, aiming to broaden its multimodal capabilities and create a more comprehensive freight network. This move, however, places Forward Air in direct competition with rivals who are also engaging in similar consolidation strategies to gain market share and operational efficiencies.

This intense M&A activity reshapes the competitive landscape, forcing players to constantly adapt and innovate. Companies are not just acquiring to grow, but to integrate new technologies, expand into specialized markets, and achieve economies of scale. For instance, many competitors are investing heavily in last-mile delivery solutions and international freight forwarding, areas where Omni Logistics already had a strong presence, thus intensifying rivalry in these specific segments.

- Industry Consolidation: The logistics sector is witnessing a surge in mergers and acquisitions as companies seek to strengthen their market positions.

- Forward Air's Strategy: Forward Air's acquisition of Omni Logistics for approximately $2.1 billion in 2023 was a key move to expand its multimodal service offerings.

- Competitive Response: Rivals are also pursuing similar acquisition strategies, leading to a more consolidated and competitive market environment.

- Market Reshaping: These strategic plays are actively reshaping the competitive dynamics, pushing companies to enhance capabilities and expand their reach to remain competitive.

Competitive rivalry is fierce in the expedited freight sector, with Forward Air facing pressure from LTL carriers, full truckload providers, and comprehensive logistics firms, all vying for time-sensitive, high-value shipments. The market experienced fluctuating freight volumes and declining spot rates in 2024, with some lanes seeing over a 20% year-over-year drop in average spot rates for dry van loads, impacting pricing power.

| Competitor Type | Key Differentiators | 2024 Market Trend Impact |

|---|---|---|

| LTL Carriers | On-time delivery, real-time visibility, specialized handling | Intensified price competition due to market softening |

| Full Truckload Providers | Fleet control, predictable service | Pressure to offer competitive rates amidst overcapacity |

| Asset-Light Providers | Price, network optimization, independent contractors | Aggressive pricing strategies challenge premium service providers |

SSubstitutes Threaten

Large shippers increasingly consider bringing their logistics in-house, a significant threat to third-party providers like Forward Air. This trend is fueled by a desire for greater control over their supply chains and potential cost savings on high-volume shipments. For instance, many Fortune 500 companies now operate extensive private fleets, which can offer specialized handling for sensitive goods and predictable delivery schedules.

The economics of in-house logistics become particularly attractive when a company's shipping needs are substantial and consistent. By owning and managing their transportation assets, these large entities can amortize costs over their operational lifespan, potentially achieving a lower per-unit cost than outsourcing. This strategic shift directly substitutes the need for external freight and logistics services, impacting the market share of companies in Forward Air's segment.

For freight that isn't time-critical, customers can opt for standard Less-than-Truckload (LTL) or full Truckload (TL) services. These alternatives are generally more budget-friendly than expedited shipping, posing an ongoing threat as clients might switch to slower, cheaper options when speed isn't a priority.

While Forward Air excels in expedited ground transport, air cargo presents a significant substitute for extremely urgent or high-value shipments, especially for international routes where speed is paramount. For instance, in 2024, the global air cargo market was valued at over $150 billion, demonstrating its substantial scale and appeal for time-sensitive deliveries.

Parcel and Courier Services

For smaller, lighter, and highly time-sensitive packages, specialized parcel and courier services present a significant substitute threat to Forward Air. While Forward Air primarily operates in the less-than-truckload (LTL) and truckload (TL) freight segments, the burgeoning e-commerce sector and the increasing demand for expedited delivery are blurring the lines between traditional freight and parcel services.

This trend is particularly relevant for certain shipment profiles that might otherwise be handled by Forward Air. For instance, the rise of same-day and next-day delivery expectations in e-commerce means that even moderately sized items could be routed through parcel networks if they offer a faster or more cost-effective solution for that specific delivery window. In 2024, the global parcel delivery market was projected to reach over $570 billion, highlighting the sheer scale and competitive nature of this segment.

- Evolving E-commerce Demands: Increased consumer expectation for rapid delivery, even for business-to-business (B2B) shipments, pushes more volume towards express parcel carriers.

- Technological Advancements: Innovations in logistics technology and last-mile delivery solutions by parcel carriers enhance their ability to compete for a wider range of shipments.

- Cost-Effectiveness for Lighter Shipments: For shipments falling within parcel weight and size limits, these services often provide a more economical alternative than LTL freight.

Emerging Technologies and Digital Freight Platforms

The increasing prevalence of digital freight platforms presents a significant threat of substitution for Forward Air. These platforms, like Convoy or Uber Freight, are streamlining the process of connecting shippers directly with carriers, potentially cutting out traditional intermediaries. In 2024, the digital freight brokerage market continued its expansion, with many platforms reporting substantial growth in freight volume processed.

These technologies enhance market transparency and efficiency, allowing shippers to find capacity more readily and often at competitive rates. This can diminish the perceived value of asset-light providers like Forward Air, who historically offered a bridge between shippers and a fragmented carrier base. For instance, by 2024, many digital platforms had integrated real-time tracking and automated payment systems, features that traditional logistics providers are still developing.

The threat is amplified as these platforms mature and gain wider adoption. They can offer a more agile and potentially cost-effective solution for certain freight needs, directly substituting the services Forward Air provides.

- Digital Freight Platforms: Facilitate direct shipper-carrier connections.

- Increased Transparency: Lower barriers for shippers to find capacity.

- Efficiency Gains: Streamlined booking, tracking, and payment processes.

- Cost Competitiveness: Potential for reduced overall logistics spend for shippers.

The threat of substitutes for Forward Air is multifaceted, encompassing both direct and indirect alternatives. Large shippers bringing logistics in-house, the availability of standard LTL/TL services for non-urgent freight, and the robust global air cargo market all represent significant competitive pressures. Furthermore, the rapidly expanding parcel delivery sector, driven by e-commerce, and the rise of digital freight platforms that disintermediate traditional providers, further dilute Forward Air's market position.

| Substitute Category | Description | 2024 Market Relevance (Illustrative) |

|---|---|---|

| In-house Logistics | Large shippers managing their own fleets. | Significant for high-volume, consistent needs. |

| Standard LTL/TL | Slower, more economical freight options. | Appeals to cost-sensitive shippers prioritizing price over speed. |

| Air Cargo | Expedited global transport for urgent/high-value goods. | Global market valued over $150 billion in 2024. |

| Parcel & Courier Services | Specialized for smaller, time-sensitive packages. | Global market projected over $570 billion in 2024. |

| Digital Freight Platforms | Direct shipper-carrier connections, increased transparency. | Continued expansion and growth in freight volume processed. |

Entrants Threaten

The high capital investment needed to build a comparable expedited ground transportation network presents a significant hurdle for new players. Forward Air's extensive network of terminals, sortation facilities, and a substantial fleet, even when leveraging owner-operators, demands considerable upfront funding. For instance, in 2023, the company reported capital expenditures of $133.9 million, reflecting ongoing investment in its infrastructure and operational capabilities. This substantial financial commitment acts as a formidable barrier, deterring many potential entrants from challenging established players like Forward Air.

The transportation sector faces significant regulatory barriers, including extensive licensing and permit requirements. For instance, in 2024, the Federal Motor Carrier Safety Administration (FMCSA) continued to enforce stringent safety regulations, impacting operational costs for all carriers. These compliance demands, covering everything from emissions standards to driver hours, create substantial upfront investment and ongoing expenses that can discourage new entrants.

Established players like Forward Air leverage significant economies of scale in purchasing, operations, and technology, giving them a cost advantage. For instance, in 2023, Forward Air reported operating revenues of $1.9 billion, reflecting their substantial operational footprint. New entrants would find it difficult to match these efficiencies and the broad service offerings that come with scale, making it challenging to compete on price or service breadth.

Brand Recognition and Customer Relationships

Forward Air has cultivated a strong brand identity centered on dependable, time-sensitive delivery, which translates into deeply entrenched customer loyalty. Newcomers must overcome the significant hurdle of establishing trust and recognition in a sector where consistent, high-quality service for valuable freight is non-negotiable.

Building these robust customer relationships, a key differentiator for Forward Air, requires substantial time and investment for any new competitor aiming to gain traction. The company's established network and reputation for reliability, exemplified by their consistent performance metrics, present a formidable barrier to entry for emerging players.

- Brand Equity: Forward Air's established reputation for reliability is a significant deterrent to new entrants.

- Customer Loyalty: Long-standing relationships built on trust are difficult and costly for new companies to replicate.

- Service Differentiation: The emphasis on time-definite, high-value freight services creates a specialized market that requires proven operational excellence.

Access to Driver Pool and Skilled Labor

The persistent shortage of qualified truck drivers and skilled logistics professionals presents a substantial hurdle for new entrants. Attracting and retaining a competent workforce, particularly owner-operators vital for an asset-light strategy, would be difficult when competing with established firms that have pre-existing relationships and attractive compensation packages.

In 2024, the American Trucking Associations reported a shortage of over 78,000 drivers, a figure projected to grow. This scarcity directly impacts a new company's ability to scale operations and meet service demands efficiently.

- Driver Shortage Impact: The estimated 78,000+ driver deficit in 2024 makes it hard for new logistics companies to build capacity.

- Owner-Operator Reliance: New entrants often depend on owner-operators, who are in high demand and less likely to join unproven ventures.

- Established Relationships: Incumbents benefit from established networks and loyalty programs that are difficult for newcomers to replicate quickly.

- Compensation and Retention: Competing with the established pay scales and benefits offered by larger, more stable companies is a significant challenge for new entrants seeking to attract and retain talent.

The threat of new entrants for Forward Air is moderate, primarily due to significant capital requirements and established brand loyalty. New companies face substantial costs in building a comparable expedited ground transportation network, as evidenced by Forward Air's 2023 capital expenditures of $133.9 million. Furthermore, the sector's stringent regulatory landscape, including FMCSA compliance, adds to the financial and operational burden for newcomers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | Building a robust network requires significant upfront funding. | High barrier; discourages many potential entrants. |

| Regulatory Compliance | Adherence to safety and emissions standards demands investment. | Moderate to high barrier; increases operational costs. |

| Economies of Scale | Established players have cost advantages from large operations. | High barrier; difficult to compete on price. |

| Brand Equity & Loyalty | Trust and consistent service are hard for new firms to replicate. | High barrier; requires time and investment to build. |

| Talent Acquisition | Driver shortages make it hard to secure essential workforce. | Moderate barrier; impacts ability to scale. |

Porter's Five Forces Analysis Data Sources

Our Forward Air Porter's Five Forces analysis is built upon a foundation of industry-specific data, including freight volume statistics, carrier pricing trends, and economic indicators. We also leverage company financial reports and market intelligence from logistics associations to understand competitive dynamics.