Forward Air Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Forward Air Bundle

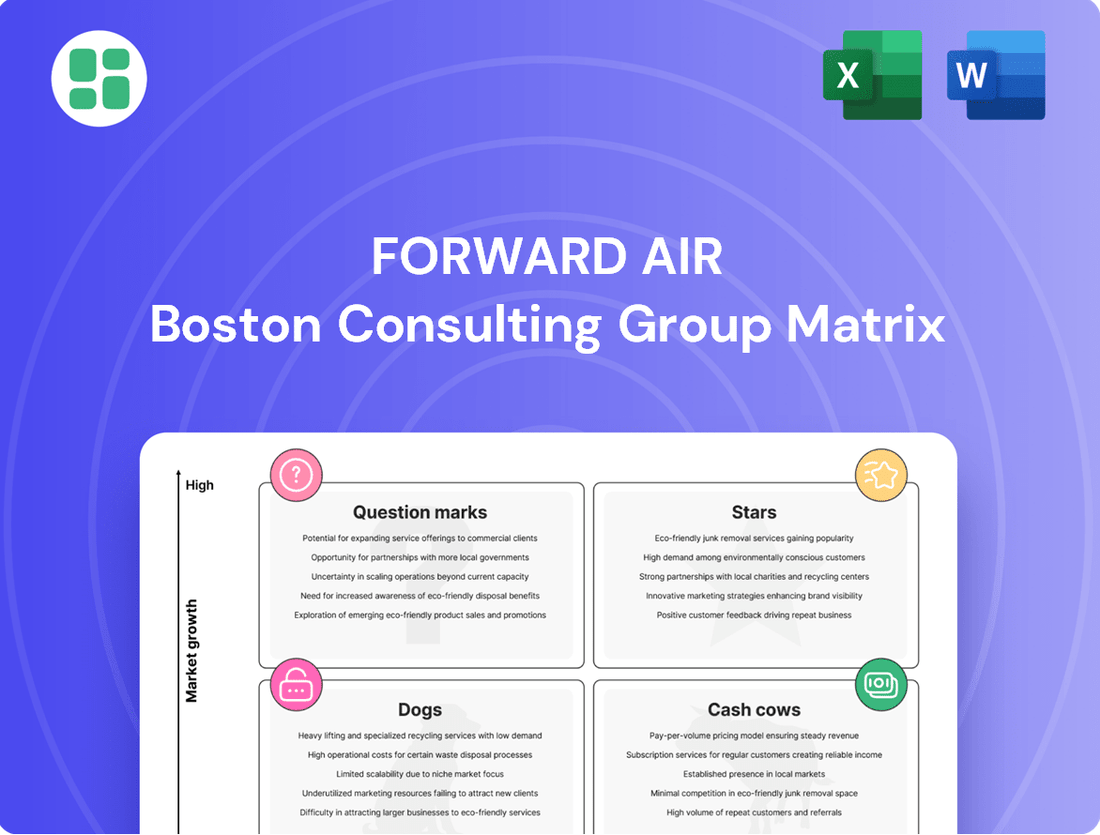

Curious about Forward Air's strategic positioning? This glimpse into their BCG Matrix reveals where their services might be Stars, Cash Cows, Dogs, or Question Marks, offering a vital snapshot of their market performance. To truly unlock actionable insights and understand the full strategic implications for investment and growth, dive into the complete BCG Matrix report.

Stars

Forward Air's acquisition of Omni Logistics in early 2024 has been a game-changer, significantly boosting its revenue and global footprint. This move highlights Omni Logistics' position as a high-growth star within Forward Air's portfolio, tapping into the expansive logistics market.

The integration has already yielded impressive results, generating over $100 million in annualized synergies, surpassing initial projections. This financial success underscores the strategic value of Omni Logistics and its contribution to Forward Air's path toward enhanced profitability.

Forward Air's Expedited Full Truckload (EFT) shipments are a prime example of a Stars category within the BCG Matrix. The company recently secured a significant contract to handle over 15,000 expedited full truckload shipments annually for a major package delivery services leader. This substantial award directly translates to a projected significant increase in revenue year-over-year, highlighting a high-growth, high-market-share position in their core expedited services segment.

Forward Air's focus on high-value, time-sensitive freight is a significant driver of its growth, reflecting a market trend where businesses value speed and accuracy for essential deliveries. This specialization positions them favorably as the demand for urgent shipping solutions escalates, fueled by the increasing financial impact of operational delays.

The market for expedited shipping continues to expand, with companies recognizing the substantial cost of downtime. Forward Air's established expertise in handling these critical shipments solidifies its leadership in this lucrative segment, where reliability and punctuality are paramount.

Cross-Border Logistics Expansion

Forward Air's strategic expansion into cross-border logistics, significantly bolstered by the acquisition of Omni Logistics, positions it to capitalize on robust North American trade. This move directly addresses the increasing freight volumes between the United States, Canada, and Mexico.

The company is well-placed to capture a greater share of this expanding market. For instance, North American transborder freight saw a notable 8.4% increase in March 2025 when compared to the same month in 2024, highlighting the opportune timing of this expansion.

Key aspects of this cross-border logistics expansion include:

- Enhanced Network: Integration of Omni Logistics' capabilities strengthens Forward Air's reach across U.S., Canadian, and Mexican trade lanes.

- Market Capture: The company aims to secure a larger portion of the growing transborder freight market.

- Trade Volume Growth: Leveraging the 8.4% year-over-year increase in North American transborder freight observed in March 2025.

- Synergistic Opportunities: Cross-selling services and optimizing routes for greater efficiency and profitability.

Strategic Technology & Digitalization

Forward Air's investment in technology, focusing on simplification, rationalization, and digitalization, is a key driver within its strategic framework. This includes exploring AI for supply chain management, aiming to boost efficiency and adapt to market shifts. For instance, in 2024, Forward Air continued to invest in its technology infrastructure, with a significant portion of its capital expenditures allocated to enhancing its operating systems and digital capabilities. This strategic push positions the company for potential future growth in high-demand service areas.

While specific new product launches stemming directly from these tech investments aren't explicitly detailed, the underlying strategy points towards the development of offerings that will capture significant market share. The focus on digitalization and AI suggests a move towards more automated, data-driven services that can offer superior speed and reliability. This is crucial in the competitive logistics landscape where technological advancement often dictates market leadership.

- Technology Investment: Forward Air is prioritizing investments in system simplification, rationalization, and digitalization.

- AI Integration: The company is exploring AI-driven supply chain management to enhance operational efficiency.

- Market Responsiveness: These technological advancements are designed to help Forward Air meet evolving market demands.

- Future Growth Potential: Strategic emphasis on technology indicates a pathway for future high-growth, high-market-share offerings.

Forward Air's Expedited Full Truckload (EFT) business is a clear Star in their BCG Matrix. This segment benefits from high demand for time-sensitive freight, a market where Forward Air has established strong market share. The company’s recent contract wins, like handling over 15,000 expedited truckloads annually for a major package delivery firm, directly support its Star status by driving significant year-over-year revenue growth.

The acquisition of Omni Logistics in early 2024 has also bolstered Forward Air's position, particularly in cross-border logistics, a high-growth area. This strategic move leverages increasing North American trade volumes, with transborder freight between the US, Canada, and Mexico showing robust growth, evidenced by an 8.4% increase in March 2025 compared to the previous year. This expansion into cross-border services, integrating Omni's capabilities, positions Forward Air to capture a larger market share in this expanding segment.

Forward Air's commitment to technology, including AI for supply chain management, is another key factor contributing to its Star potential. By investing in digitalization and system enhancements, the company aims to improve efficiency and responsiveness. This strategic focus on technology is designed to create future offerings that can achieve high growth and market leadership in the competitive logistics landscape.

| BCG Category | Key Business Segment | Growth Rate | Market Share | Strategic Rationale |

| Stars | Expedited Full Truckload (EFT) | High | High | Strong demand for time-sensitive freight, significant contract wins driving revenue. |

| Stars | Cross-Border Logistics (post-Omni acquisition) | High | Growing | Capitalizing on increasing North American trade volumes, leveraging expanded network. |

| Potential Stars | Technology-Enabled Services (AI, Digitalization) | High (projected) | Emerging | Investment in AI and digitalization to enhance efficiency and develop future high-demand offerings. |

What is included in the product

Strategic overview of Forward Air's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

The Forward Air BCG Matrix offers a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

Forward Air's core expedited Less-Than-Truckload (LTL) services, though experiencing a slight revenue dip in Q1 2025, continues to be a dominant force with significant market share. This established segment, a cornerstone of their operations, is now the focus of strategic pricing adjustments initiated in early 2025. These actions are designed to bolster profitability, effectively treating this mature business as a reliable generator of consistent cash flow.

Forward Air's established intermodal drayage operations are a prime example of a Cash Cow within their business portfolio. This segment consistently generates substantial revenue and profit, a testament to their nearly four decades of expertise in container drayage.

Even amidst broader market volatility, the intermodal division showed robust growth in the first quarter of 2025. This resilience underscores its position as a dependable source of cash flow for the company.

Forward Air's comprehensive national terminal network is a prime example of a Cash Cow within the BCG Matrix. This extensive infrastructure, spanning North America, is a significant asset that drives consistent operational efficiency and market penetration.

The robust network underpins many of Forward Air's core services, enabling steady cash generation. As of the first quarter of 2024, Forward Air reported a revenue of $395.9 million, a testament to the ongoing demand for their logistics solutions facilitated by this established network.

Warehousing and Consolidation Services

Forward Air's warehousing and consolidation/deconsolidation services represent a stable, mature segment within its broader supply chain solutions. These offerings are designed to support the company's primary transportation operations by providing essential logistics functions for a reliable customer base.

These services are characterized by consistent demand, contributing to predictable and stable revenue streams for Forward Air. They act as a foundational element, enhancing the efficiency and attractiveness of the company's core freight services.

- Mature Offering: Warehousing and consolidation are established services with a consistent demand profile.

- Revenue Stability: These services contribute to predictable and stable revenue streams for Forward Air.

- Supportive Function: They directly support and enhance the company's core transportation business.

- Customer Base: These operations cater to a loyal and consistent customer segment, ensuring ongoing business.

Dedicated Contract Services

Forward Air's Dedicated Contract Services, encompassing dedicated fleet services and Container Freight Station (CFS) warehouse and handling, are key components of their operations. These services are designed for long-term, high-value client relationships.

These contracts are crucial for generating predictable revenue and ensuring stable operational performance, aligning with the characteristics of a cash cow business unit within the BCG matrix. For example, in 2024, Forward Air reported that its Dedicated Contract Services segment continued to be a significant contributor to overall revenue, demonstrating its stability. The company's focus on these long-term agreements provides a solid foundation for consistent financial results.

- Revenue Stability: Long-term contracts offer a predictable income stream.

- Operational Efficiency: Dedicated resources lead to optimized logistics.

- Client Retention: High-value relationships foster loyalty and repeat business.

- Market Position: Established presence in dedicated services supports consistent demand.

Forward Air's expedited Less-Than-Truckload (LTL) services, despite a slight dip in Q1 2025 revenue, remain a dominant force with substantial market share. These strategic pricing adjustments, implemented in early 2025, aim to boost profitability, solidifying this mature business as a consistent cash generator.

The company's intermodal drayage operations, backed by nearly four decades of expertise, consistently deliver strong revenue and profit, proving to be a reliable cash cow. This segment demonstrated robust growth in Q1 2025, underscoring its stability.

Forward Air's extensive national terminal network is a significant asset, driving operational efficiency and market penetration, thus contributing to steady cash generation. In Q1 2024, the company reported $395.9 million in revenue, reflecting the ongoing demand for services supported by this network.

Warehousing and consolidation/deconsolidation services provide stable, predictable revenue streams, acting as a foundational element that enhances Forward Air's core freight services. These mature offerings cater to a consistent customer base, ensuring ongoing business.

Dedicated Contract Services, including dedicated fleet and CFS operations, are crucial for generating predictable revenue and stable performance. In 2024, this segment continued to be a significant revenue contributor, highlighting the stability derived from long-term client agreements.

| Business Segment | BCG Category | Key Characteristics | 2024 Data Point |

|---|---|---|---|

| Expedited LTL Services | Cash Cow | Dominant market share, mature, focus on profitability | Revenue dip in Q1 2025, strategic pricing adjustments |

| Intermodal Drayage | Cash Cow | Consistent revenue/profit, long-standing expertise | Robust growth in Q1 2025 |

| National Terminal Network | Cash Cow | Drives efficiency, market penetration, steady cash generation | Supported $395.9M revenue in Q1 2024 |

| Warehousing & Consolidation | Cash Cow | Stable demand, predictable revenue, supports core services | Caters to a consistent customer segment |

| Dedicated Contract Services | Cash Cow | Predictable revenue, stable performance via long-term contracts | Significant contributor to overall revenue in 2024 |

Full Transparency, Always

Forward Air BCG Matrix

The Forward Air BCG Matrix preview you are currently viewing is the identical, fully realized document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, professionally formatted strategic analysis ready for your immediate use. You can confidently assess the depth and quality of our market insights, knowing the final deliverable will mirror this preview precisely, offering actionable intelligence for your business planning.

Dogs

Within Forward Air's Expedited Freight segment, certain legacy routes or services might be struggling to maintain profitability. These could be older operational lanes or specific service offerings that haven't kept pace with market demands or cost efficiencies.

The company's emphasis on "corrective pricing actions" and "eliminating previously unidentified redundancies" strongly indicates that there are segments within their operations that are not performing as expected. This suggests a need for significant operational adjustments or even potential exits from these underperforming areas.

For instance, if a particular legacy route consistently shows lower freight volumes and higher operational costs compared to newer, more efficient routes, it would fall into this category. Forward Air's Q1 2024 results, for example, showed a 1.4% decrease in total operating revenue year-over-year, hinting at potential pressure points in specific service areas that require attention.

Forward Air's truckload operations have specific segments grappling with persistent excess capacity. These areas are particularly vulnerable to industry-wide overcapacity and the resulting soft freight rates, making it difficult to achieve better utilization or profitability.

These struggling segments may find it challenging to generate meaningful returns on investment. In fact, as of the first quarter of 2024, the company reported a revenue decline of 10.5% year-over-year, partly attributed to these capacity challenges in certain freight lanes.

Such segments often require significant, disproportionate investment to maintain viability, potentially diverting resources from more promising areas of the business. This situation can strain overall financial performance and strategic focus.

Forward Air's divestiture of its Final Mile business in late 2023 for approximately $262 million exemplifies a strategic move to streamline operations. This action clearly places the divested unit in the Dogs quadrant of the BCG matrix, as it was no longer contributing to the company's core objectives or desired profitability levels.

Inefficient Operational Overlaps Post-Acquisition

Following Forward Air's acquisition of Omni Logistics, certain operational overlaps are proving more challenging to integrate than anticipated. These inefficiencies, particularly in areas like redundant route networks and overlapping terminal operations, are hindering the full realization of expected synergies, potentially impacting profitability in the near term.

While Forward Air has highlighted significant synergy targets, the integration of Omni Logistics' extensive network, especially in less dense regions, presents ongoing optimization hurdles. For instance, the company reported in its Q1 2024 earnings that while total synergies are on track, specific cost-saving initiatives related to network rationalization are taking longer to implement, leading to a slight drag on operating margins in those specific segments.

- Network Integration Challenges: Overlapping service areas and redundant routes from Omni Logistics require careful consolidation, a process that can be complex and time-consuming, impacting cost efficiencies.

- Terminal Consolidation Delays: Integrating and optimizing terminal footprints inherited from Omni Logistics has encountered some delays, leading to higher-than-expected operating expenses in the initial integration phase.

- Synergy Realization Pace: While progress is being made, the full financial benefits from eliminating duplicate functions and streamlining processes are not yet fully reflected in the bottom line, indicating a slower-than-ideal synergy capture.

Services Highly Vulnerable to Economic Downturns

Forward Air's less differentiated services, particularly those tied to discretionary consumer spending or general manufacturing output, are highly vulnerable during economic downturns. These segments often struggle to maintain profitability when broader economic headwinds like reduced consumer spending or manufacturing contraction take hold. Without strong market share or unique value propositions, these services may consistently operate at break-even or even incur losses during challenging economic periods.

For instance, services reliant on non-essential goods shipments or general freight that can be easily substituted by other carriers would fall into this category. In 2024, a significant slowdown in retail sales, which declined by approximately 1.5% year-over-year in the first half of the year according to preliminary data, directly impacts the demand for such services.

- Exposure to Discretionary Spending: Services supporting the transport of non-essential consumer goods are directly hit by reduced household budgets.

- Commodity Freight Sensitivity: General freight services, lacking specialized handling or unique routes, are susceptible to price wars and volume drops during slowdowns.

- Limited Pricing Power: In these segments, Forward Air may have less ability to pass on increased costs or maintain margins when demand softens.

- Increased Competition: The lower barriers to entry in these less specialized areas mean more intense competition, especially when volumes shrink.

Segments within Forward Air's operations that exhibit low market share and low growth potential are classified as Dogs. These are typically legacy services or specific routes that are not generating significant revenue or profit and require substantial investment to maintain.

Forward Air's Q1 2024 results, showing a 1.4% decrease in total operating revenue, hint at these underperforming areas. The divestiture of the Final Mile business in late 2023 for $262 million also exemplifies a strategic move away from a Dog-like segment.

Challenges in integrating Omni Logistics, such as network overlaps and terminal consolidation delays, are creating inefficiencies that could push certain combined operations into the Dogs quadrant if not addressed. These segments are vulnerable to economic downturns and intense competition, with limited pricing power.

Question Marks

Within Forward Air's broader Omni Logistics segment, which generally performs as a Star, newer service lines like international air and ocean freight are likely positioned as Question Marks. These emerging offerings tap into the growing global trade landscape, with the air cargo market alone projected to grow significantly. For instance, the International Air Transport Association (IATA) reported a robust increase in air cargo demand throughout 2023 and into early 2024, indicating high potential.

These newer Omni Logistics ventures face a dynamic and competitive international freight market. While the overall growth trajectory is promising, achieving substantial market share requires significant investment in infrastructure, partnerships, and technology. Forward Air's strategic focus on these areas suggests a belief in their future success, but their current market penetration and profitability may still be developing, characteristic of a Question Mark in the BCG matrix.

Forward Air's ambition to be a global logistics leader naturally points towards expansion into new geographic markets. These ventures would represent potential Stars or Question Marks in the BCG matrix, characterized by low current market share but significant anticipated growth.

In 2024, Forward Air has been actively exploring opportunities to broaden its reach, including potential entries into specialized domestic markets that offer high growth ceilings. This strategy aligns with their goal of enhancing synergistic service offerings on an international scale.

Forward Air's investment in advanced technologies like AI and automation for logistics is a key consideration for its position. While the company is simplifying and digitalizing its systems, indicating an interest in these high-growth areas, its market leadership in specific AI-driven solutions for supply chain optimization is still likely in its early stages of development. For instance, the global logistics technology market was valued at approximately $45 billion in 2023 and is projected to grow significantly, but Forward Air's specific share or leadership within the AI segment of this market needs further assessment.

Developing Specialized Last-Mile Solutions

While Forward Air divested a final-mile unit in 2023, the broader logistics sector is experiencing significant expansion in specialized last-mile delivery, especially for e-commerce and valuable items. This trend highlights opportunities for growth, with the global last-mile delivery market projected to reach $300 billion by 2027, up from $177.7 billion in 2022.

If Forward Air is indeed developing new, distinct last-mile solutions, potentially leveraging capabilities from Omni Logistics, these initiatives could be strategically positioned to capture a larger market share. Such specialized services often command premium pricing due to their complexity and the specific handling requirements of goods like furniture or electronics.

- E-commerce Growth: Online retail sales in the U.S. are expected to increase by 8.5% in 2024, driving demand for efficient last-mile operations.

- Specialized Handling: Demand for white-glove delivery services for high-value or fragile items is on the rise, indicating a market for differentiated solutions.

- Technology Integration: Advanced route optimization and real-time tracking are becoming standard expectations, pushing providers to innovate.

- Market Expansion: Companies focusing on niche last-mile segments, such as oversized items or temperature-controlled goods, are seeing substantial revenue growth.

Strategic Partnerships for Niche Markets

Forward Air's strategic partnerships are crucial for tapping into niche markets. For instance, an expanded collaboration with a major package delivery service, moving beyond their traditional expedited truckload focus, allows Forward Air to access specialized segments. This type of alliance aims to capture high-growth opportunities in specific areas where the company is actively increasing its market share.

These evolving alliances are designed to penetrate markets with significant growth potential. By leveraging these partnerships, Forward Air can build a stronger presence and gain a competitive edge in these specialized sectors. For example, in 2024, the logistics sector saw significant investment in last-mile delivery solutions, a key area for niche market expansion.

- Expanded Partnerships: Collaborations with package delivery leaders beyond core services.

- Niche Market Focus: Targeting specific, high-growth segments.

- Market Share Growth: Building presence and capturing share in specialized areas.

- 2024 Trends: Increased investment in last-mile solutions supports niche market strategies.

Newer service lines within Forward Air's Omni Logistics, such as international air and ocean freight, are likely positioned as Question Marks. These ventures operate in a growing global trade landscape, with air cargo demand showing strong increases through 2023 and into early 2024, according to IATA. However, achieving significant market share requires substantial investment in infrastructure and technology, characteristic of their current developmental stage.

Forward Air's strategic expansion into new geographic markets and specialized domestic areas with high growth potential also places these initiatives in the Question Mark category. While the company is actively exploring these avenues in 2024, their market penetration and profitability in these nascent segments are still developing, reflecting the inherent uncertainty and investment needs of Question Marks.

The company's investment in AI and automation for logistics, while targeting a high-growth market valued around $45 billion in 2023, also represents a Question Mark. Forward Air's progress in deploying specific AI-driven supply chain solutions is likely in its early stages, requiring further development and market adoption to solidify its position.

| Forward Air Business Area | BCG Matrix Position | Rationale |

|---|---|---|

| International Air & Ocean Freight | Question Mark | Emerging service lines in a growing global trade market, requiring significant investment and facing competitive pressures. |

| New Geographic Market Expansion | Question Mark | Strategic focus on growth potential with currently low market share, necessitating investment to build presence. |

| Specialized Domestic Market Entry | Question Mark | Targeting high-growth segments with developing market share and synergistic potential. |

| AI & Automation in Logistics | Question Mark | Operating in a high-growth technology market, with early-stage development of specific AI solutions for supply chain optimization. |

BCG Matrix Data Sources

Our Forward Air BCG Matrix is built on a foundation of robust data, integrating financial disclosures, market growth analytics, and industry expert insights to provide a clear strategic view.