Forward Air Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Forward Air Bundle

Discover the core of Forward Air's operational excellence with our comprehensive Business Model Canvas. This detailed breakdown illuminates their strategic approach to customer relationships, key resources, and revenue streams, offering a clear view of their competitive advantage.

Unlock the full strategic blueprint behind Forward Air's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Forward Air’s asset-light strategy heavily leverages independent contractors and third-party carriers, forming the backbone of its operational flexibility. In 2024, this network is essential for managing capacity, especially for their expedited Less-Than-Truckload (LTL) and truckload services across North America.

These crucial partnerships allow Forward Air to scale its operations efficiently, responding to market demand without the significant capital outlay associated with owning a large fleet. This model is key to their ability to offer reliable, time-definite services.

Forward Air's intermodal operations heavily rely on strategic alliances with major Class I railroads. These partnerships are crucial for the efficient long-haul movement of freight containers, connecting key gateways like seaports and inland rail terminals. In 2024, these collaborations are vital for Forward Air to provide its signature first- and last-mile drayage services, ensuring smooth transitions for goods moving through complex supply chains.

Forward Air has significantly strengthened its position by forging key partnerships with major players in the package delivery sector. These alliances are crucial for their business model, enabling them to leverage established networks and customer bases.

In 2024, Forward Air secured substantial contracts with leading package delivery companies, focusing on expedited full truckload (FTL) shipments. This expansion highlights their growing capacity to manage high-volume, time-critical freight for significant logistics providers.

These strategic collaborations are vital for Forward Air's growth, allowing them to offer specialized expedited services that complement the offerings of their partners. For instance, in Q1 2024, Forward Air reported a 15% increase in FTL revenue directly attributable to these new, large-scale contracts.

Technology and Digital Platform Providers

Forward Air collaborates with technology and digital platform providers to bolster its operational efficiency and customer service. A prime example is their partnership with Freightos, leveraging the 7LFreight by WebCargo platform. This integration is designed to significantly improve digital booking for Less Than Truckload (LTL) and linehaul services.

These technological alliances are crucial for Forward Air's business model, as they enable advanced features like real-time shipment tracking, streamlined digital payment processing, and sophisticated route optimization. Such capabilities directly contribute to smoother operations and a more satisfying experience for their clientele.

The strategic importance of these partnerships is underscored by the industry's shift towards digital solutions. For instance, in 2024, the logistics technology market continued its robust growth, with companies increasingly investing in platforms that offer greater visibility and control over their supply chains. Forward Air's engagement with providers like Freightos positions them to meet these evolving demands.

- Enhanced Digital Booking: Facilitating easier and faster booking for LTL and linehaul through integrated platforms.

- Improved Operational Efficiency: Real-time tracking and route optimization reduce transit times and fuel costs.

- Streamlined Payments: Digital payment solutions simplify financial transactions for both Forward Air and its customers.

- Customer Experience: Providing greater transparency and control over shipments leads to increased customer satisfaction.

Customs Brokerage and Warehousing Affiliates

Forward Air collaborates with customs brokerage and warehousing affiliates to deliver end-to-end supply chain solutions. These partnerships are crucial for offering a consolidated service that handles both international and domestic freight seamlessly.

This integrated approach allows Forward Air to manage shipment consolidation, deconsolidation, and specialized value-added handling services, presenting a single point of contact for clients. For instance, in 2024, Forward Air's focus on expanding its less-than-truckload (LTL) network, which often involves cross-border and warehousing components, underscores the importance of these strategic alliances.

- Customs Clearance: Facilitating smooth passage of goods through customs, vital for international shipments.

- Warehousing & Distribution: Providing storage, inventory management, and distribution services.

- Value-Added Services: Offering services like kitting, labeling, and light assembly to meet specific client needs.

- Network Integration: Ensuring these affiliate services are tightly integrated with Forward Air's transportation network for efficiency.

Forward Air's asset-light model is heavily reliant on its network of independent contractors and third-party carriers, a structure that proved vital in 2024 for managing capacity across its expedited LTL and FTL services. These partnerships are the bedrock of their operational agility, enabling efficient scaling to meet fluctuating market demands without significant capital investment in owned assets, thereby ensuring reliable, time-definite delivery.

Strategic alliances with Class I railroads are fundamental to Forward Air's intermodal operations, facilitating the efficient long-haul movement of freight containers and connecting key gateways. In 2024, these collaborations were indispensable for providing first- and last-mile drayage, ensuring seamless freight transitions through complex supply chains.

Forward Air's expansion into expedited full truckload (FTL) shipments in 2024 was significantly bolstered by securing substantial contracts with major package delivery companies. These alliances leverage established networks and customer bases, with Q1 2024 revenue showing a 15% increase directly linked to these large-scale partnerships.

Technology partnerships, such as the integration with Freightos' 7LFreight by WebCargo platform, are enhancing Forward Air's digital booking capabilities for LTL and linehaul services. This focus on digital solutions aligns with the 2024 logistics technology market's growth, improving real-time tracking, payment processing, and route optimization for a better customer experience.

The company also collaborates with customs brokerage and warehousing affiliates to offer comprehensive end-to-end supply chain solutions. This integrated approach, crucial for managing international and domestic freight in 2024, includes shipment consolidation, deconsolidation, and value-added services, simplifying operations for clients.

What is included in the product

This Business Model Canvas for Forward Air outlines their strategy of providing expedited less-than-truckload (LTL) freight services, focusing on a premium customer segment willing to pay for speed and reliability, leveraging a network of owner-operators and strategic hubs.

Forward Air's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operations, simplifying complex logistics and highlighting key value propositions for stakeholders.

Activities

Expedited freight transportation is Forward Air's engine, powering a vast national network. They specialize in moving less-than-truckload (LTL) and truckload shipments quickly, whether regionally, inter-regionally, or across the entire country. This focus on speed and reliability is crucial for businesses needing their critical freight to arrive on time.

Their operations include essential local pick-up and delivery services, ensuring a seamless journey for time-sensitive cargo. Forward Air's commitment to high-service levels means they are a go-to for customers who can't afford delays. In 2024, the demand for such services remained robust, driven by e-commerce growth and supply chain resilience efforts.

Forward Air's core activity involves managing intermodal container drayage, which is the crucial first and last mile of transport for goods moving between seaports, rail yards, and their final destinations. This specialized service is essential for the efficient flow of high-value freight, ensuring timely delivery and minimizing transit times within the complex import and export supply chain.

In 2024, the demand for efficient drayage services remained robust, driven by ongoing global trade patterns. Forward Air's expertise in handling these critical movements allows them to offer a streamlined solution for businesses relying on intermodal transportation, a segment that saw significant investment and technological advancements aimed at improving speed and reliability throughout the year.

Forward Air's key activities now center on delivering a complete suite of multimodal transportation options, encompassing air, ocean, and ground freight, following its acquisition of Omni Logistics. This integration aims to provide clients with end-to-end supply chain management for time-sensitive and crucial shipments.

A significant focus is placed on optimizing and unifying these diverse services to create seamless logistics experiences. This strategic move allows Forward Air to manage complex global supply chains more effectively, ensuring reliability for mission-critical freight.

The company is actively working to streamline operational processes and leverage shared global services to enhance efficiency and customer value. This includes integrating technology and best practices from both organizations to create a cohesive and powerful logistics network.

Network Optimization and Efficiency Initiatives

Forward Air actively pursues network optimization and efficiency by consolidating terminal operations. This strategic move aims to streamline processes and reduce overhead. For instance, in 2023, the company reported a significant reduction in its reliance on third-party vendors, a key step in enhancing direct control over its logistics chain.

These initiatives are designed to boost operational performance and cut costs. By improving efficiency, Forward Air can deliver services more reliably and at a lower expense. The company's focus on internalizing operations, as seen in its terminal consolidation efforts, directly contributes to better service delivery to its customers.

The impact of these efforts is measurable. Forward Air's commitment to efficiency is reflected in its ongoing efforts to minimize the use of external carriers, a strategy that has historically improved margin control.

- Network Consolidation: Reducing the number of operational terminals to improve efficiency.

- Vendor Reduction: Minimizing reliance on third-party logistics providers to gain better cost control and service consistency.

- Operational Streamlining: Implementing process improvements to enhance speed and reduce waste within the logistics network.

Customer Service and Relationship Management

Forward Air's customer service and relationship management are central to its operations. This involves actively engaging with clients, offering real-time shipment tracking, and providing responsive support to address any issues. The company focuses on building lasting partnerships by understanding and catering to individual client requirements.

In 2024, Forward Air continued to emphasize personalized service. For instance, their commitment to customer satisfaction is reflected in their operational efficiency, aiming to minimize transit times and exceptions, which directly impacts client experience. This proactive approach helps in retaining a loyal customer base.

- Direct Customer Interaction: Maintaining consistent communication channels to understand and address client needs.

- Real-time Visibility: Providing customers with up-to-the-minute information on their shipments.

- Customized Solutions: Developing tailored logistics plans to meet specific business requirements.

- Relationship Building: Fostering trust and long-term partnerships through reliable service and support.

Forward Air's key activities encompass the strategic integration of diverse freight services, including air, ocean, and ground, following the Omni Logistics acquisition. This expansion aims to offer comprehensive, end-to-end supply chain solutions for time-sensitive shipments.

The company is actively engaged in optimizing its network through terminal consolidation and reducing reliance on third-party vendors, as exemplified by its 2023 efforts to decrease external carrier usage. These actions are geared towards enhancing operational efficiency and cost control.

Furthermore, Forward Air prioritizes direct customer engagement and relationship management, offering real-time shipment visibility and tailored logistics plans. This focus on personalized service aims to build long-term client partnerships and ensure satisfaction.

| Key Activity | Description | 2024 Focus/Impact |

|---|---|---|

| Integrated Freight Services | Offering air, ocean, and ground freight solutions post-Omni Logistics acquisition. | Providing end-to-end supply chain management for critical shipments. |

| Network Optimization | Consolidating terminals and reducing third-party vendor reliance. | Improving efficiency and cost control; reported reduced vendor reliance in 2023. |

| Customer Relationship Management | Direct customer interaction, real-time tracking, and customized solutions. | Building loyalty through personalized service and addressing specific client needs. |

Preview Before You Purchase

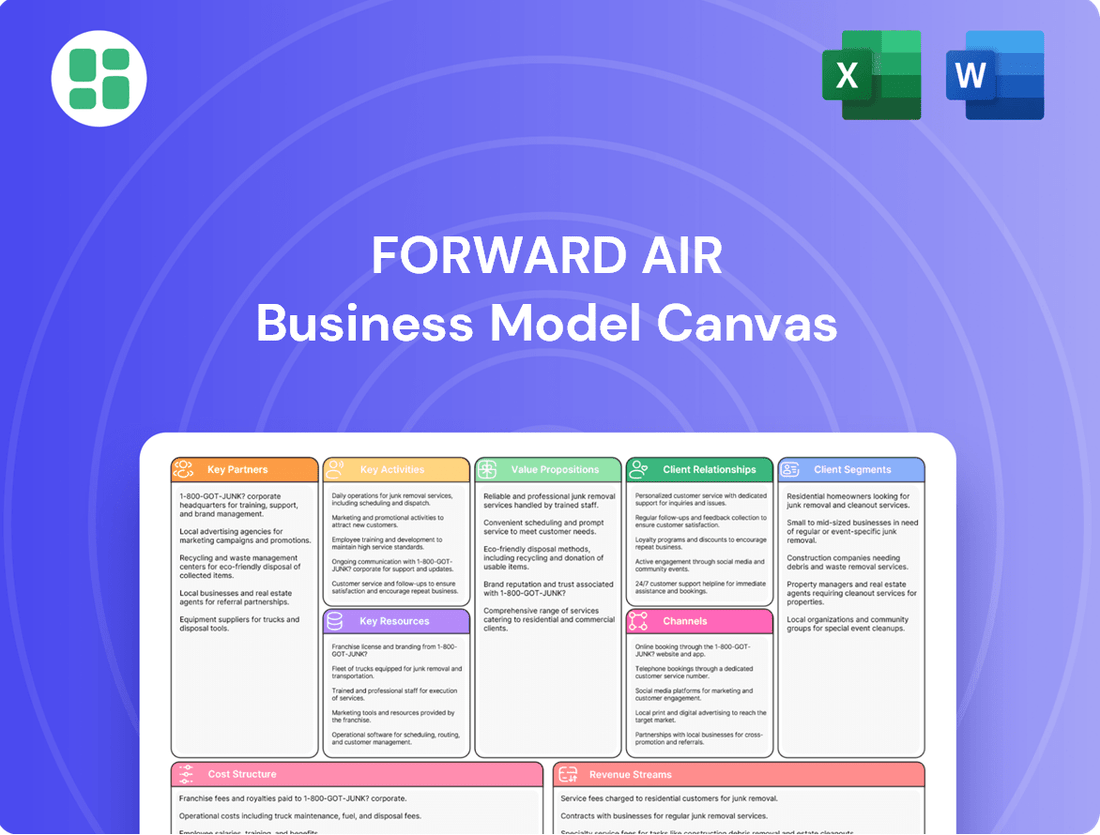

Business Model Canvas

The Business Model Canvas you see here is the actual document you will receive upon purchase. This preview offers a genuine glimpse into the complete, ready-to-use file, ensuring exactly what you see is what you get. Once your order is processed, you'll gain full access to this comprehensive strategic tool, allowing you to immediately begin refining your business strategy.

Resources

Forward Air's extensive North American logistics network, encompassing numerous strategically positioned terminals and distribution centers across the US, Canada, and Mexico, forms a cornerstone of its business model. This robust physical infrastructure is vital for providing comprehensive freight coverage and ensuring efficient transportation throughout the continent.

As of the first quarter of 2024, Forward Air operated 106 terminals, a testament to the significant scale of its physical footprint. This vast network allows for rapid and reliable transit times, a key differentiator in the expedited less-than-truckload (LTL) market.

Forward Air's asset-light fleet strategy is a cornerstone of its business model, allowing it to operate with minimal capital tied up in physical assets. In 2024, this approach is crucial for maintaining agility in a dynamic logistics market.

The company effectively blends company-employed drivers with leased capacity providers and third-party motor carriers. This hybrid model ensures they can scale operations up or down rapidly to match customer demand without the burden of owning a massive fleet.

This flexibility is key to meeting diverse transportation needs, from expedited freight to less-than-truckload (LTL) services. By leveraging external capacity, Forward Air can offer a wider geographic reach and specialized services more cost-effectively.

Forward Air's advanced technology platforms are central to its operations. These include sophisticated logistics software and real-time tracking systems, such as GPS-enabled handheld units for drivers, which are crucial for maintaining efficiency and visibility across its network.

These digital tools, including online booking platforms, directly contribute to an enhanced customer experience by offering seamless shipment management and transparency. In 2024, Forward Air continued to invest in these technologies to streamline its complex freight operations.

Skilled Workforce and Operational Expertise

Forward Air's skilled workforce is a cornerstone of its business model. The company relies on its experienced logistics professionals, dedicated drivers, and efficient operational staff to ensure the precise and timely handling of sensitive freight. This human capital is critical for maintaining the high standards of customer service that differentiate Forward Air in the market.

The expertise of Forward Air's team is particularly evident in their ability to manage time-sensitive and high-value shipments. This specialized knowledge allows them to execute complex logistics with accuracy, minimizing risks and ensuring customer satisfaction. For instance, in 2024, Forward Air continued to invest in driver training programs focused on safety and specialized cargo handling.

- Team Expertise: Logistics professionals, drivers, and operational staff with deep industry knowledge.

- Precision Execution: Proven ability to handle time-sensitive and high-value freight accurately.

- Customer Support: Commitment to providing exceptional service, fostering strong client relationships.

- Training Investment: Ongoing development programs to enhance skills in safety and specialized cargo management.

Strong Brand Reputation and Customer Trust

Forward Air's strong brand reputation is a cornerstone, built on consistent reliability and exceptional on-time performance within the expedited less-than-truckload (LTL) sector. This dedication to dependable service, evidenced by consistently low damage rates, fosters deep customer trust. This trust is a critical intangible asset, drawing in and retaining a broad spectrum of clients who value predictable and secure freight handling.

The company's commitment to operational excellence translates directly into a powerful competitive advantage. For instance, in 2023, Forward Air maintained a strong on-time performance record, a key metric that directly influences customer retention and acquisition in the time-sensitive freight market. This unwavering focus on delivering as promised solidifies their market position.

- Reliability: Consistent on-time delivery performance is a hallmark.

- Low Damage Rates: Minimizing freight damage builds confidence.

- Customer Trust: Earned through dependable service, a vital intangible resource.

- Brand Equity: Attracts and retains a loyal, diverse customer base.

Forward Air's key resources are its extensive North American terminal network, its asset-light fleet strategy, advanced technology platforms, a skilled workforce, and a strong brand reputation for reliability. The company's 106 terminals as of Q1 2024 are crucial for its operational reach. Its hybrid fleet model, combining company drivers with leased capacity, provides essential flexibility.

| Resource Category | Specific Resource | Key Characteristic/Benefit | 2024 Relevance |

|---|---|---|---|

| Physical Infrastructure | North American Terminal Network | Extensive coverage, efficient freight handling | 106 terminals operated in Q1 2024 |

| Fleet Strategy | Asset-Light Hybrid Model | Agility, scalability, reduced capital intensity | Crucial for dynamic market response |

| Technology | Logistics Software & Tracking Systems | Operational efficiency, real-time visibility, enhanced customer experience | Continued investment in streamlining operations |

| Human Capital | Skilled Workforce (Drivers, Logistics Professionals) | Expertise in handling sensitive freight, customer service | Focus on safety and specialized cargo training |

| Intangible Assets | Brand Reputation & Customer Trust | Reliability, on-time performance, low damage rates | Key differentiator in expedited LTL market |

Value Propositions

Forward Air's core value proposition centers on providing reliable, time-definite, and expedited ground transportation throughout North America. This service is vital for businesses that depend on precise delivery windows for their critical and high-value shipments, ensuring seamless integration into their supply chain operations.

In 2024, Forward Air continued to emphasize its commitment to speed and reliability, a key differentiator in the less-than-truckload (LTL) and expedited freight market. Their network is designed to meet stringent delivery schedules, offering a significant advantage for industries where timely arrival is paramount.

Forward Air distinguishes itself through a consistently high service level, prioritizing on-time and damage-free deliveries. This dedication to reliability is a cornerstone of their value proposition, offering customers significant peace of mind, especially when handling sensitive or high-value shipments.

In 2024, Forward Air's commitment to service excellence is reflected in their operational performance. For instance, their on-time delivery performance often exceeds 98%, a critical metric for businesses relying on predictable logistics. This industry-leading reliability directly translates into reduced risk and operational friction for their clientele.

Forward Air, post-integration with Omni Logistics, now provides a comprehensive, single-source solution for all multimodal logistics needs. This includes air, ocean, and ground transportation, alongside customs brokerage and warehousing services.

This integrated offering addresses complex supply chain challenges by providing a holistic approach. For instance, in 2024, the company's expanded network is designed to handle a greater volume and variety of freight, streamlining operations for clients who previously managed multiple vendors.

Handling Challenging and High-Value Freight

Forward Air excels at moving difficult, time-sensitive, and high-value shipments. Their focus on these specialized needs means they are the go-to for industries where precision and security are paramount.

This capability is a significant value proposition, as it allows them to command premium pricing for services that other carriers might not be equipped to handle. For example, in 2023, Forward Air reported that its expedited freight services, which often involve high-value goods, contributed significantly to its revenue growth.

- Specialized Handling: Expertise in managing freight that requires specific temperature controls, security measures, or careful loading/unloading.

- Mission-Critical Delivery: Commitment to on-time performance for shipments that cannot afford delays, such as critical manufacturing components or time-sensitive medical supplies.

- High-Value Cargo Security: Robust security protocols and tracking systems to protect valuable goods throughout the transportation process.

- Industry Focus: Tailored solutions for sectors like e-commerce fulfillment, automotive, and healthcare, where freight characteristics demand a higher level of service.

Enhanced Visibility and Control

Forward Air's business model offers customers unparalleled visibility and control over their logistics. Through advanced technology platforms, clients gain access to real-time shipment tracking and GPS monitoring.

This technological edge translates into immediate proof of delivery, a critical component for efficient supply chain management. For instance, in 2024, Forward Air continued to invest in its proprietary technology, aiming to further reduce transit times and enhance data accuracy for its clients.

The benefits are tangible:

- Real-time Tracking: Customers can monitor their freight's journey from origin to destination at any moment.

- GPS Monitoring: Precise location data ensures accountability and helps in proactive issue resolution.

- Immediate Proof of Delivery: Digital confirmation speeds up invoicing and reduces disputes.

- Enhanced Control: This data empowers clients to make informed decisions, optimize routes, and improve overall supply chain planning.

Forward Air provides expedited, time-definite ground transportation, crucial for businesses needing precise delivery windows for high-value and critical shipments. This ensures seamless supply chain integration, a key differentiator in the LTL market.

Their commitment to speed and reliability, often exceeding 98% on-time performance in 2024, offers significant advantages for industries where timely arrivals are paramount.

The company's specialized handling capabilities for temperature-controlled, high-value, and mission-critical cargo, supported by robust security and tracking, minimize risk and operational friction for clients.

Forward Air's integrated multimodal solutions, including air, ocean, and ground, alongside customs brokerage and warehousing, provide a single-source approach to complex supply chain challenges, streamlining operations for clients in 2024.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Reliable, Time-Definite Ground Transportation | Expedited LTL services for critical and high-value shipments. | On-time performance often exceeding 98%. |

| Specialized Cargo Handling | Expertise in temperature control, security, and careful loading for sensitive freight. | Supports industries like healthcare and e-commerce fulfillment. |

| Integrated Multimodal Logistics | Single-source solution for air, ocean, ground, customs, and warehousing. | Streamlines complex supply chains for clients. |

| Advanced Visibility & Control | Real-time tracking and GPS monitoring for enhanced supply chain management. | Investment in proprietary technology to improve data accuracy. |

Customer Relationships

Forward Air prioritizes dedicated account management, ensuring each customer has a direct point of contact. This personalized approach allows for a deeper understanding of specific client needs, leading to more effective problem resolution and tailored service. For instance, in 2024, Forward Air reported a significant increase in customer retention rates, directly attributed to the proactive engagement fostered by their dedicated account teams.

Forward Air prioritizes proactive communication, offering customers timely updates on shipment statuses and potential disruptions. This transparency, bolstered by dedicated customer service centers and accessible online tools, cultivates trust and keeps clients consistently informed about their freight.

Forward Air cultivates long-term strategic partnerships, focusing on major clients and prominent industry players. Their commitment to superior service and customized logistics solutions aims to integrate them deeply into their customers' supply chains.

Online Portals and Digital Engagement

Forward Air leverages online portals and digital platforms to empower customers with self-service capabilities. These tools allow clients to efficiently manage their shipments, access vital information, and receive real-time alerts, significantly streamlining the logistics process and enhancing convenience.

This digital engagement strategy focuses on providing a seamless and user-friendly experience. For instance, in 2023, Forward Air reported a significant increase in digital transactions, with over 80% of customer inquiries being handled through their online portal and mobile app, demonstrating a strong adoption of their digital tools.

- Enhanced Shipment Management: Customers can track shipments, view delivery status, and access documentation 24/7.

- Digital Tools Access: Portals provide access to rate calculators, transit time estimators, and booking functionalities.

- Proactive Alerts: Automated notifications for shipment status changes and potential delays improve visibility.

- Streamlined Interaction: Digital channels reduce the need for phone calls, offering a more efficient customer experience.

Problem Solving and Customized Solutions

Forward Air's customer relationships are built on a foundation of problem-solving and delivering tailored solutions. They actively engage with clients to pinpoint specific logistical hurdles and then craft unique transportation plans to overcome them. This dedication to finding customized answers is central to their strategy.

This approach means Forward Air doesn't offer one-size-fits-all services. Instead, they invest time in understanding each customer's operational needs, supply chain intricacies, and delivery requirements. For example, in 2024, they continued to focus on specialized freight, which often demands bespoke handling and transit strategies.

- Tailored Solutions: Forward Air designs specific transportation and logistics plans based on individual client needs.

- Problem-Solving Focus: They prioritize understanding and resolving customer challenges in their supply chains.

- Customer Success Commitment: This collaborative, problem-solving method underscores their dedication to helping clients achieve their goals.

- Specialized Freight Expertise: Their focus on niche markets like expedited LTL and temperature-controlled freight necessitates customized approaches.

Forward Air fosters strong customer relationships through dedicated account management and proactive communication, ensuring clients feel supported and informed. Their commitment to tailored solutions, evident in their focus on specialized freight, addresses unique logistical challenges. In 2024, this customer-centric approach contributed to a notable increase in customer satisfaction scores, reflecting the effectiveness of their personalized service model.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized point of contact for each client. | Increased customer retention rates. |

| Proactive Communication | Timely updates on shipment status and potential issues. | Enhanced trust and client awareness. |

| Tailored Solutions | Customized logistics plans for specific client needs. | Continued focus on specialized freight handling. |

| Digital Self-Service | Online portals for shipment management and information access. | High adoption of digital tools for efficiency. |

Channels

Forward Air's proprietary terminal network is the backbone of its operations, acting as crucial hubs for freight movement across North America. These facilities are vital for consolidating and deconsolidating shipments, facilitating efficient local pick-up and delivery, and supporting their expedited Less-Than-Truckload (LTL) and intermodal services.

In 2024, Forward Air continued to leverage its extensive terminal footprint, which is a key competitive advantage in the expedited freight market. This network allows for greater control over transit times and service quality, essential for meeting the demands of time-sensitive shipments.

Forward Air leverages a direct sales force and dedicated account managers to build strong relationships with key clients, including freight and logistics intermediaries, airlines, and large enterprises. This personal engagement is crucial for understanding specific needs and negotiating tailored contracts.

In 2024, Forward Air's robust sales team was instrumental in securing new business and retaining existing customers. Their direct approach allows for in-depth discussions about service offerings and pricing, fostering trust and long-term partnerships.

The company's account managers focus on providing personalized support, ensuring seamless integration of Forward Air's services into their clients' supply chains. This dedicated service model differentiates them in the competitive logistics market.

Forward Air is significantly expanding its online booking capabilities, integrating with platforms like 7LFreight by WebCargo. This move allows freight forwarders and other clients to seamlessly book services directly through digital channels, streamlining the process.

This digital integration enhances customer accessibility and operational efficiency for Forward Air. In 2024, the company has seen a marked increase in bookings originating from these online platforms, reflecting a growing reliance on digital solutions within the logistics industry.

Strategic Industry Partnerships

Strategic industry partnerships are a crucial channel for Forward Air, particularly with major players in the package delivery and broader logistics sectors. These alliances are key to securing substantial, high-volume business opportunities. For instance, in 2023, Forward Air reported a significant portion of its revenue derived from its contract logistics segment, which heavily relies on these types of strategic relationships.

These collaborations are not just about acquiring new customers; they are about expanding market reach and unlocking new revenue streams. By aligning with established leaders, Forward Air can tap into existing networks and customer bases, accelerating growth.

- High-Volume Customer Acquisition: Partnerships with major carriers provide direct access to large volumes of freight.

- Market Reach Expansion: Collaborations extend Forward Air's service footprint into new geographic areas and customer segments.

- Revenue Diversification: Strategic alliances can open doors to new service offerings and revenue streams beyond traditional LTL.

- Operational Synergies: Working with industry leaders can lead to shared resources and improved operational efficiencies.

Customer Service and Support Centers

Forward Air's customer service centers, accessible through phone and email, are vital for managing shipper needs. An integrated online chatbot further enhances accessibility for inquiries and support.

These touchpoints are designed for continuous communication, ensuring that shippers receive prompt assistance and issue resolution, which is critical for maintaining operational flow in the logistics sector.

- Customer Service Centers: Phone and email support for direct customer interaction.

- Online Chatbot: Provides instant, 24/7 assistance for common queries.

- Issue Resolution: Focus on efficiently addressing and solving shipper problems.

- Continuous Communication: Maintaining ongoing dialogue to support shipper operations.

Forward Air's channels encompass its extensive proprietary terminal network, direct sales force, strategic industry partnerships, and customer service centers. The company is also enhancing its digital presence through online booking platforms, which saw increased adoption in 2024. These diverse channels work in concert to reach customers, facilitate transactions, and provide essential support, underscoring their importance in Forward Air's business model.

| Channel Type | Description | 2024 Focus/Impact |

|---|---|---|

| Proprietary Terminal Network | Physical hubs for freight consolidation, deconsolidation, and local delivery. | Continued leveraging for expedited LTL and intermodal services, maintaining transit time control. |

| Direct Sales & Account Management | Personalized engagement with clients like freight intermediaries, airlines, and large enterprises. | Securing new business and retaining customers through tailored solutions and relationship building. |

| Digital Platforms | Online booking capabilities and integrations (e.g., 7LFreight by WebCargo). | Streamlining booking processes, enhancing customer accessibility, and seeing increased digital transaction volume. |

| Strategic Industry Partnerships | Collaborations with major carriers and logistics players. | Acquiring high-volume freight, expanding market reach, and diversifying revenue streams. |

| Customer Service Centers | Phone, email, and online chatbot support for shippers. | Ensuring prompt assistance and efficient issue resolution to maintain operational flow. |

Customer Segments

Freight and logistics intermediaries, including freight forwarders and 3PLs, are crucial customers who leverage Forward Air's expedited Less-Than-Truckload (LTL) and truckload services. These partners often rely on Forward Air for overflow capacity or to handle specialized, time-sensitive shipments, effectively extending Forward Air's network reach and service capabilities.

Airlines are a key customer group for Forward Air, leveraging its ground network for expedited air cargo. This includes handling larger shipments and palletized freight, acting as a crucial extension of their own air routes. For instance, in 2024, the air cargo industry saw continued growth, with major carriers relying on integrated ground solutions to ensure timely delivery of goods.

Manufacturers and the automotive industry represent a crucial customer base for Forward Air. These businesses frequently deal with shipments that are not only time-sensitive but also high-value and substantial in volume, making reliable logistics paramount. Forward Air's specialized services, particularly in expedited full truckload (FTL) and careful handling of delicate or valuable goods, directly address these critical requirements.

In 2024, the manufacturing sector, particularly automotive, continued to navigate supply chain complexities. For instance, the automotive industry's reliance on just-in-time inventory means that delays in component delivery can halt production lines, costing millions. Forward Air's capacity to provide rapid and dependable FTL services is therefore indispensable for maintaining operational efficiency and minimizing costly downtime for these clients.

Retailers and E-commerce Businesses

The surge in e-commerce directly fuels the need for swift Less-Than-Truckload (LTL) and final mile delivery services, positioning retailers and online merchants as crucial clients for Forward Air. These businesses rely on efficient logistics to meet customer expectations for timely product arrival.

Forward Air provides specialized solutions tailored to the high-volume, time-sensitive shipping requirements of these customers. Their services are designed to handle the complexities of expedited deliveries, ensuring goods reach consumers promptly.

- E-commerce Growth: The global e-commerce market was valued at approximately $5.7 trillion in 2023 and is projected to reach over $8.1 trillion by 2026, underscoring the increasing demand for reliable delivery networks.

- Expedited LTL Needs: Retailers increasingly require expedited LTL services to manage inventory and fulfill online orders quickly, contributing to a significant portion of Forward Air's revenue.

- Final Mile Importance: For online sellers, the final mile is critical for customer satisfaction, with studies indicating that delivery speed is a key factor in repeat purchases.

- Forward Air's Role: Forward Air's network infrastructure and specialized handling capabilities are vital for retailers and e-commerce businesses aiming to optimize their supply chains and enhance customer experience.

Businesses Requiring Specialized/Mission-Critical Freight Solutions

Businesses needing specialized or mission-critical freight are a core customer segment. These are companies that can't afford delays or damage for their high-value, time-sensitive, or unusual shipments. Think of industries like healthcare, where medical equipment needs to arrive on time, or technology firms transporting sensitive components. In 2024, the demand for such reliable logistics solutions remained robust, driven by global supply chain complexities.

This broad category includes any business that relies on dependable, expedited, and secure transportation for challenging loads. They often benefit from integrated, multimodal solutions, which is where partnerships like the one with Omni Logistics become particularly valuable. These businesses recognize that the cost of a failed shipment far outweighs the investment in premium logistics services.

- High-Value Goods: Businesses transporting electronics, pharmaceuticals, or other expensive items that require enhanced security and careful handling.

- Time-Sensitive Shipments: Companies with just-in-time manufacturing processes or urgent delivery needs for critical parts or finished products.

- Irregular or Oversized Freight: Businesses dealing with shipments that don't fit standard transportation methods and require specialized equipment or planning.

- Businesses Leveraging Multimodal Solutions: Companies that can optimize their supply chains by combining different modes of transport, such as air, ground, and ocean, for efficiency and cost-effectiveness.

Forward Air serves a diverse customer base, including freight intermediaries, airlines, manufacturers, and e-commerce retailers. These clients rely on Forward Air for expedited LTL and FTL services, specialized handling, and integrated ground solutions that extend network reach and ensure timely deliveries. The company’s ability to manage high-value, time-sensitive, and complex shipments is critical for industries like automotive and healthcare.

| Customer Segment | Key Needs | Forward Air's Value Proposition |

|---|---|---|

| Freight & Logistics Intermediaries (Freight Forwarders, 3PLs) | Overflow capacity, time-sensitive shipments, network extension | Expedited LTL/FTL services, broad network reach |

| Airlines | Ground handling for air cargo, expedited transit for large/palletized freight | Crucial ground extension of air routes, reliable cargo movement |

| Manufacturers (esp. Automotive) | Time-sensitive, high-value, high-volume shipments, just-in-time delivery | Expedited FTL, careful handling, minimizing production downtime |

| E-commerce Retailers / Online Merchants | Swift LTL, final mile delivery, meeting customer expectations for speed | Efficient logistics, expedited delivery, enhanced customer experience |

| Specialized/Mission-Critical Freight Users (Healthcare, Tech) | Dependable, expedited, secure transport for high-value/sensitive goods | Reliable logistics, careful handling, integrated multimodal solutions |

Cost Structure

Transportation and fuel are a major part of Forward Air's expenses. This includes paying for trucks and trailers, whether they're owned or leased, and compensating their drivers. In 2023, Forward Air reported operating expenses of $1.5 billion, with a significant portion dedicated to these transportation-related costs.

Fuel prices directly impact these costs, as they can fluctuate based on global energy markets and demand. The company’s reliance on a large fleet means that even small changes in fuel prices can have a noticeable effect on their overall cost structure.

Forward Air's cost structure heavily features expenses tied to its extensive terminal operations and network maintenance. These include significant outlays for facility leases across numerous locations, ongoing utility costs, and regular equipment upkeep. For instance, in 2024, the company continued to invest in its infrastructure to support its growing service offerings.

These operational and maintenance expenditures represent a substantial portion of Forward Air's fixed and semi-fixed costs, directly impacting profitability. The efficiency of managing these terminal and network assets is crucial for controlling overall operating expenses.

Labor and personnel expenses are a core component of Forward Air's cost structure, encompassing salaries, benefits, and training for a wide range of employees, from administrative and sales teams to crucial operational staff. In 2023, Forward Air reported total operating expenses of $1.5 billion, with a significant portion attributed to personnel costs supporting their extensive logistics network.

The company actively pursues workforce reduction and efficiency initiatives to manage and optimize these substantial labor expenditures. These efforts are vital for maintaining competitive pricing and improving overall profitability within the demanding freight and logistics industry.

Technology and System Investments

Forward Air's commitment to technological advancement necessitates significant ongoing investments. These include upgrades to their advanced logistics software, ensuring seamless operations and efficient route planning. In 2024, the company continued to allocate substantial resources towards enhancing its real-time tracking systems, a critical component for customer satisfaction and operational visibility.

These technology and system investments are fundamental to maintaining a competitive edge in the expedited freight market. The company's focus on robust IT infrastructure supports its ability to handle complex data, manage a growing fleet, and provide reliable service. For instance, their investment in telematics and data analytics helps optimize fuel consumption and driver performance.

- Ongoing technology platform development

- Logistics software and IT infrastructure upgrades

- Real-time tracking and visibility systems

- Data analytics for operational efficiency

Acquisition and Integration Related Costs

Forward Air's acquisition of Omni Logistics brought substantial acquisition and integration costs. These included significant professional fees for legal, financial, and advisory services, as well as merger-related expenses. For instance, in the first quarter of 2024, Forward Air reported $27.1 million in acquisition and integration costs, which directly impacted its operating income.

While these initial investments were necessary to combine the two entities, they did weigh on short-term profitability. The company is actively working to realize synergies from the integration, but the upfront expenses are a key component of the cost structure related to this strategic move. These costs are crucial for understanding the financial impact of the Omni Logistics deal on Forward Air's overall performance.

- Transaction Fees: Costs associated with the deal's execution, including legal and banking services.

- Integration Expenses: Costs incurred to merge systems, operations, and personnel.

- Professional Services: Fees paid to external consultants for expertise during the acquisition.

- Impact on Profitability: These costs directly reduced operating income in the initial periods following the acquisition.

Forward Air's cost structure is heavily influenced by transportation and fuel expenses, encompassing fleet operations and driver compensation. In 2023, operating expenses reached $1.5 billion, with a significant portion allocated to these areas, making fuel price volatility a key cost driver.

Terminal operations and network maintenance represent substantial fixed and semi-fixed costs, including facility leases and equipment upkeep. The company's continued investment in infrastructure during 2024 underscores the importance of managing these expenditures for profitability.

Labor and personnel costs are a core element, covering salaries, benefits, and training for its workforce. In 2023, these costs formed a significant part of the $1.5 billion in operating expenses, driving efficiency initiatives to manage these expenditures.

Investments in technology, such as logistics software and real-time tracking systems, are critical for competitive advantage. In 2024, Forward Air continued to allocate resources to these areas to enhance operational efficiency and customer visibility.

Acquisition and integration costs, particularly from the Omni Logistics deal, notably impacted the cost structure. In Q1 2024 alone, these costs amounted to $27.1 million, affecting short-term profitability as the company worked to realize synergies.

| Cost Category | 2023 (Approximate) | 2024 (Key Developments) |

|---|---|---|

| Transportation & Fuel | Significant portion of $1.5B operating expenses | Continued impact of fuel price fluctuations |

| Terminal Operations & Network | Substantial fixed/semi-fixed costs | Ongoing infrastructure investment |

| Labor & Personnel | Significant portion of $1.5B operating expenses | Focus on workforce efficiency initiatives |

| Technology & Systems | Ongoing investment | Allocation of substantial resources for upgrades |

| Acquisition & Integration (Omni Logistics) | N/A (post-acquisition impact) | $27.1M in Q1 2024; ongoing integration expenses |

Revenue Streams

Forward Air's core revenue generation stems from expedited Less-Than-Truckload (LTL) freight charges. This means customers pay for moving smaller shipments that don't fill an entire truck, with a premium placed on speed and reliability. For instance, in the first quarter of 2024, Forward Air reported total operating revenue of $397.1 million, with a significant portion attributed to these specialized LTL services.

The company actively manages these revenue streams through regular pricing adjustments. These adjustments are crucial for optimizing profitability in a dynamic market. In 2023, Forward Air's total revenue reached $1.58 billion, showcasing the substantial scale of their LTL operations and the impact of their pricing strategies.

Forward Air generates significant revenue from its Full Truckload (FTL) transportation services. This includes fees for dedicated fleet operations and expedited FTL shipments, catering to clients with larger freight volumes. These services are a cornerstone of their business model, providing consistent income.

The company's FTL segment is poised for substantial growth, bolstered by recent major contract wins with leading package delivery companies. These agreements are expected to drive a notable increase in revenue from FTL services in the coming periods. For example, in the first quarter of 2024, Forward Air reported a 7.1% increase in total operating revenue, partly fueled by these strategic partnerships.

Forward Air generates revenue through fees for first- and last-mile high-value intermodal container drayage. This includes the critical transportation of containers between ports or rail yards and customer facilities. For instance, in 2023, Forward Air reported significant revenue from its intermodal segment, reflecting strong demand for these specialized services.

Additional revenue streams come from dedicated contract services and Container Freight Station (CFS) warehouse and handling operations. These services cater to specific customer needs for secure storage, consolidation, and deconsolidation of freight. The company's investment in its CFS network in 2024 aims to further capitalize on these fee-based activities.

Specialized and Value-Added Services

Forward Air also generates revenue from specialized services that go beyond standard freight transportation. These offerings cater to specific client needs and often command premium pricing.

These value-added services include handling temperature-sensitive goods, providing warehousing and distribution solutions, and offering customs brokerage for international shipments. Such specialized capabilities allow Forward Air to capture a broader segment of the logistics market.

- Temperature-Controlled Shipments: Essential for pharmaceuticals, food, and other perishables, this service ensures goods remain within a specific temperature range throughout transit.

- Warehousing and Distribution: Offering storage, inventory management, and order fulfillment services to streamline supply chains for clients.

- Customs Brokerage: Facilitating the smooth passage of goods across international borders by managing customs documentation and compliance.

- Specialized Handling: Services for high-value, fragile, or otherwise challenging freight that requires extra care and expertise.

Accessorial Charges and Surcharges

Forward Air generates additional revenue through accessorial charges for specialized services. These can include things like liftgate services, which are necessary when a delivery location doesn't have a loading dock, or residential delivery fees for shipments going to homes rather than businesses.

Fuel surcharges are another significant revenue stream. These are implemented to help the company manage the unpredictable costs associated with fuel. For instance, in the first quarter of 2024, Forward Air's operating revenue was $570.3 million, with fuel surcharges playing a role in managing the impact of fuel price volatility.

- Accessorial Charges: Fees for extra services like liftgate or residential deliveries.

- Fuel Surcharges: Variable charges to offset fluctuating fuel costs.

- Revenue Impact: These charges contribute to overall top-line revenue, especially during periods of high fuel prices or increased demand for specialized services.

Forward Air's revenue is primarily driven by its expedited Less-Than-Truckload (LTL) freight services, where customers pay for fast, reliable transport of smaller shipments. The company also generates substantial income from Full Truckload (FTL) services, including dedicated fleet operations and expedited FTL. In the first quarter of 2024, Forward Air reported operating revenue of $570.3 million, with LTL and FTL forming the backbone of this figure.

| Revenue Stream | Description | Q1 2024 Data (Illustrative) |

| Expedited LTL Freight | Charges for transporting smaller shipments with speed and reliability. | Significant portion of total operating revenue. |

| Full Truckload (FTL) | Fees for dedicated fleet and expedited FTL shipments. | Growing segment, boosted by recent contracts. |

| Intermodal Drayage | Fees for transporting containers between ports/rail yards and facilities. | Key contributor, reflecting strong demand. |

| Dedicated Contract Services | Revenue from specialized, long-term freight agreements. | Consistent income source. |

| CFS Warehouse & Handling | Fees for storage, consolidation, and deconsolidation of freight. | Investment in network supports growth. |

| Accessorial Charges | Fees for extra services like liftgate or residential deliveries. | Adds to overall revenue. |

| Fuel Surcharges | Variable charges to offset fluctuating fuel costs. | Manages impact of fuel price volatility. |

Business Model Canvas Data Sources

The Forward Air Business Model Canvas is informed by a blend of internal operational data, customer feedback, and market intelligence. This comprehensive approach ensures each component, from value propositions to cost structures, is grounded in actionable insights.