Fonterra Co-operative Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fonterra Co-operative Group Bundle

Fonterra's powerful brand and global reach are undeniable strengths, but evolving consumer preferences and intense competition present significant challenges. Understanding these dynamics is crucial for navigating the dairy giant's future.

Want the full story behind Fonterra's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fonterra's strategic pivot towards high-value channels, particularly Ingredients and Foodservice, is a significant strength. This focus, reinforced in 2024, aims to capture higher margins and capitalize on growth opportunities. These two segments were the bedrock of the co-op's performance, contributing a substantial 85% to earnings in FY24.

Fonterra's financial performance in fiscal year 2024 was notably robust, with a profit after tax from continuing operations reaching NZ$1.168 billion. This result, coupled with an 11.3% return on capital, surpassed the co-operative's own target range, underscoring its operational efficiency and market strength.

The co-operative demonstrated a strong commitment to its shareholders by declaring a total dividend of 55 cents per share. This represents the second-largest dividend payout in Fonterra's history, directly reflecting its healthy earnings and dedication to delivering value back to its farmer-owners.

Fonterra boasts an impressive global market presence, operating and distributing its dairy products in over 100 countries. This expansive reach allows for the sale of everything from bulk dairy ingredients to well-recognized consumer brands, ensuring a diverse revenue stream.

This extensive network significantly diversifies Fonterra's market exposure, mitigating the risk associated with over-reliance on any single geographic region. For instance, in the fiscal year ending July 31, 2023, Fonterra's revenue from its Ingredients business, which often serves global markets, remained robust, demonstrating the strength of its international distribution capabilities.

Integrated Supply Chain and Operational Efficiency

Fonterra's farmer-owned co-operative structure is a cornerstone of its integrated supply chain, providing direct control from milk collection to global distribution. This integration fosters significant operational efficiencies. For instance, in the fiscal year ending July 31, 2023, Fonterra reported a normalized earnings before interest and taxes (EBIT) of NZ$1.1 billion, reflecting the benefits of its streamlined operations.

The co-operative consistently invests in optimizing its manufacturing and supply chain network. This strategic focus enables flexibility in allocating milk to products and channels that offer the highest returns. This agility is crucial in navigating volatile global dairy markets, allowing Fonterra to adapt quickly to demand shifts and capitalize on emerging opportunities.

- Farmer-Owned Integration: Direct control over milk sourcing and processing enhances efficiency.

- Supply Chain Optimization: Ongoing investment in manufacturing and logistics networks.

- Product Allocation Flexibility: Ability to shift milk to highest-returning products and channels.

- Operational Efficiency Gains: Demonstrated by strong EBIT figures, such as NZ$1.1 billion in FY23.

Strong Sustainability Commitments and Credentials

Fonterra's robust sustainability commitments are a significant strength, underscored by ambitious targets. The co-operative aims for a 50% reduction in Scope 1 and 2 emissions and a 30% decrease in Scope 3 (on-farm) greenhouse gas emissions by fiscal year 2030, using fiscal year 2018 as a baseline. This commitment extends to an aspiration for net-zero emissions by 2050.

These targets are not just aspirations; they are validated by the Science Based Targets initiative (SBTi). This validation lends significant credibility to Fonterra's environmental stewardship. It positions the co-operative favorably with an increasing number of global customers who prioritize suppliers with strong environmental, social, and governance (ESG) credentials.

- Science-Based Targets: Validated by SBTi, aiming for a 50% reduction in Scope 1 & 2 emissions and a 30% reduction in Scope 3 (on-farm) GHG emissions by FY2030 (from FY2018 base).

- Net Zero Ambition: A clear long-term goal to achieve net-zero emissions by 2050, demonstrating forward-thinking environmental strategy.

- Customer Demand: Aligns with growing customer preference for environmentally responsible partners, enhancing market appeal and potential for premium pricing or contracts.

- Reputational Capital: Strong sustainability credentials build significant reputational capital, crucial for brand loyalty and attracting investment in an ESG-conscious market.

Fonterra's strategic focus on high-value Ingredients and Foodservice segments is a key strength, driving profitability and growth. These segments accounted for a significant 85% of the co-op's earnings in FY24.

The co-operative's financial health is robust, evidenced by a NZ$1.168 billion profit after tax from continuing operations in FY24 and an 11.3% return on capital, exceeding targets.

Fonterra's global reach, operating in over 100 countries, diversifies revenue streams from bulk ingredients to consumer brands, mitigating geographic risk.

Its farmer-owned co-operative structure ensures integrated supply chain control, fostering operational efficiencies, as shown by a normalized EBIT of NZ$1.1 billion in FY23.

Fonterra's commitment to sustainability, with validated Science Based Targets for emission reductions and a net-zero ambition by 2050, enhances its appeal to environmentally conscious customers and investors.

| Metric | FY23 Data | FY24 Data | Significance |

|---|---|---|---|

| Profit After Tax (Continuing Operations) | NZ$1.09 billion | NZ$1.168 billion | Demonstrates strong and growing profitability. |

| Return on Capital | 10.4% | 11.3% | Exceeds targets, indicating efficient capital utilization. |

| Total Dividend Per Share | 50 cents | 55 cents | Second-largest payout historically, rewarding shareholders. |

| Scope 1 & 2 Emissions Reduction Target | 40% by FY2030 (from FY2018) | 50% by FY2030 (from FY2018) | Strengthened environmental commitment. |

| Scope 3 (On-Farm) Emissions Reduction Target | 20% by FY2030 (from FY2018) | 30% by FY2030 (from FY2018) | Ambitious on-farm sustainability goal. |

What is included in the product

Delivers a strategic overview of Fonterra Co-operative Group’s internal and external business factors, highlighting its strong brand and farmer relationships alongside challenges in market volatility and innovation.

Uncovers critical vulnerabilities and opportunities within Fonterra's market position, enabling proactive risk mitigation and strategic advantage.

Weaknesses

Fonterra's dominance in the New Zealand milk supply has noticeably eroded, with its share dropping to 78.1% in the latest dairy season. This represents a substantial decrease from the 95% it held in 2001, a trend driven by the rise of competing independent processors.

This declining share of the milk pool poses a significant challenge for Fonterra. It directly impacts the co-operative's capacity to secure the volume needed to maintain its market standing and effectively generate value for its farmer-owners.

While Fonterra has bolstered its value-added product lines, a substantial part of its operations still grapples with the unpredictable nature of global dairy commodity prices. For instance, the average Global Dairy Trade (GDT) Price Index experienced significant swings throughout 2023 and into early 2024, directly impacting Fonterra's revenue streams and the payments made to its farmer-owners.

These price fluctuations, driven by factors like international trade policies, weather patterns affecting milk production, and shifts in consumer demand, create an element of financial uncertainty. This exposure means Fonterra's profitability and its ability to offer stable, attractive milk prices to its suppliers can be significantly challenged by external market forces beyond its direct control.

Fonterra's exploration of divesting its global Consumer business, along with integrated operations in Oceania and Sri Lanka, introduces significant complexity. This strategic review, ongoing through 2024, means managing intricate legal, financial, and operational carve-outs, which can be time-consuming and resource-intensive.

The potential impact of this divestment process on Fonterra's overall structure and financial performance requires careful navigation. While the goal is to simplify the co-operative and unlock value, the actual realization of optimal value depends heavily on the execution of these complex transactions, which could face market volatility or buyer interest fluctuations.

Reliance on a Single Sourcing Geography

Fonterra's significant dependence on its New Zealand farmer-owners for milk supply, while ensuring premium product quality, creates a vulnerability to regional disruptions. Adverse weather, environmental shifts, or localized policy changes within New Zealand can directly affect milk collection volumes and Fonterra's overall production capacity, impacting its global supply chain stability.

This concentration risk was evident in recent years. For instance, during the 2022-23 New Zealand dairy season, Fonterra's milk collection was impacted by weather events, highlighting the sensitivity of its operations to regional agricultural conditions. The co-operative's reliance on a single geographic source for its primary input makes it susceptible to fluctuations that can ripple through its financial performance and market position.

- Geographic Concentration: Over 90% of Fonterra's milk supply originates from New Zealand.

- Climate Sensitivity: Dairy production is highly susceptible to drought, floods, and temperature variations, all of which are increasingly prevalent due to climate change.

- Regulatory Exposure: Changes in New Zealand's environmental regulations or agricultural policies could directly impact farming practices and milk availability.

- Supply Chain Risk: A disruption in New Zealand, whether natural or political, poses a significant threat to Fonterra's ability to meet global demand.

Increased Operating and Capital Investment Requirements

Fonterra's strategic push into high-value ingredients and expanding foodservice capabilities, alongside significant investments in sustainability and digital transformation, has naturally led to higher capital expenditure needs. These ambitious growth plans, while promising long-term returns, require substantial upfront investment.

Furthermore, the co-operative has seen an increase in its cash operating expenses per kilogram of milk solids (kgMS). This rise is directly attributable to ongoing investments in crucial areas like information technology and various digital transformation projects aimed at improving efficiency and data analytics.

- Increased Capital Expenditure: Investments in value-added ingredients, foodservice, sustainability, and digital infrastructure are driving up capital requirements.

- Rising Operating Costs: Cash operating expenses per kgMS have climbed due to necessary spending on IT systems and digital transformation initiatives.

Fonterra's reliance on New Zealand for over 90% of its milk supply creates a significant geographic concentration risk, making it vulnerable to regional disruptions like adverse weather or policy changes. This was evident during the 2022-23 season when weather events impacted milk collection, highlighting the sensitivity of its operations to local agricultural conditions.

The co-operative faces increasing capital expenditure demands due to its strategic investments in value-added ingredients, foodservice, sustainability, and digital transformation. Concurrently, cash operating expenses per kilogram of milk solids (kgMS) have risen, driven by necessary spending on IT and digital initiatives aimed at enhancing efficiency.

Same Document Delivered

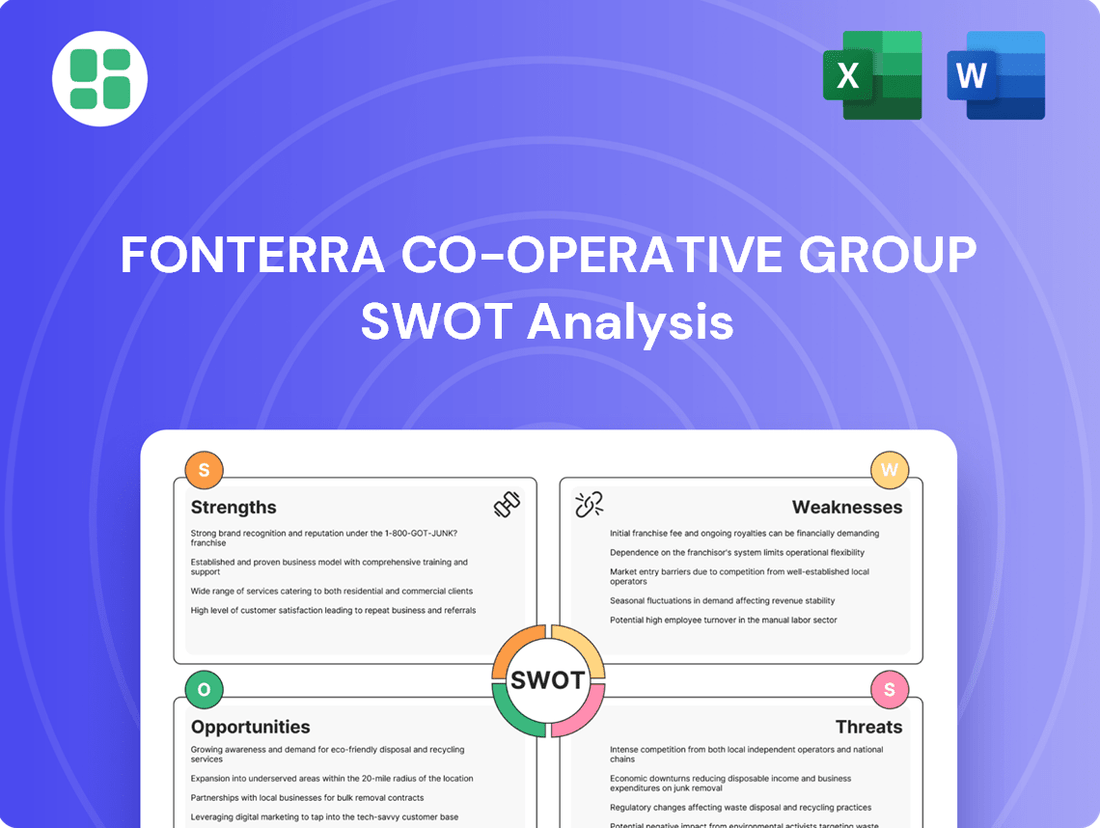

Fonterra Co-operative Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Fonterra's Strengths, Weaknesses, Opportunities, and Threats to provide a comprehensive strategic overview.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into Fonterra's competitive landscape and future potential.

Opportunities

Emerging markets, especially in Asia, are seeing significant economic expansion and higher incomes, which directly fuels a greater appetite for dairy. This is particularly true for premium dairy items and specialized ingredients used in food services.

Fonterra is strategically positioned to benefit from this surge, aiming to grow its footprint and customize offerings for these rapidly expanding areas. The company has already observed a positive demand recovery in Greater China, a key indicator of this trend.

Fonterra has a substantial opportunity in developing and marketing specialized dairy products like protein concentrates and lactoferrin, catering to growing health and wellness demands. This focus on high-value ingredients can significantly boost profit margins.

By investing in research and development, particularly in areas like functional foods, Fonterra can tap into new revenue streams. For instance, the global functional foods market was valued at approximately USD 270 billion in 2023 and is projected to grow, offering a fertile ground for Fonterra's dairy expertise.

Fonterra's robust commitment to sustainability, evidenced by its validated Scope 1 and 2 emissions reduction targets and active participation in no-deforestation initiatives, presents a significant market advantage. This strong environmental stewardship is increasingly valued by both consumers and business partners.

By highlighting these credentials, Fonterra can solidify relationships with customers who prioritize environmentally responsible sourcing, thereby opening doors to new market segments and strengthening its competitive position. For instance, Fonterra's 2023 Sustainability Report detailed progress towards its 2030 emissions reduction goals, a key factor for B2B clients seeking to meet their own ESG targets.

Strategic Investments in Capacity and Efficiency

Fonterra's strategic investments in capacity and efficiency are poised to significantly boost its market position. The cooperative has outlined plans for substantial capital expenditure, including increasing production capacity for high-value protein ingredients and constructing a new UHT cream plant. These initiatives are directly aimed at capitalizing on escalating demand in key growth segments, ensuring Fonterra can meet market needs effectively.

Further strengthening its operational backbone, Fonterra is also investing in its supply chain network. A prime example is the development of a new cool store, a move designed to enhance logistical efficiency and bolster the resilience of its operations. These investments are crucial for maintaining product quality and ensuring reliable delivery to customers worldwide.

- Capacity Expansion: Investments in high-value protein ingredients and a new UHT cream plant to meet rising demand.

- Supply Chain Enhancement: Development of a new cool store to improve efficiency and resilience.

- Focus on Efficiency: Streamlining operations to reduce costs and improve product flow.

- Meeting Market Demand: Aligning production capabilities with projected growth in key Fonterra segments.

Diversification Beyond Traditional Dairy Offerings

Fonterra is well-positioned to capitalize on the growing alternative protein market, a significant long-term opportunity beyond its core dairy business. While its current strategy emphasizes dairy, the global plant-based food market is projected to reach $162 billion by 2030, according to Bloomberg Intelligence. This presents a clear avenue for future diversification.

Exploring hybrid dairy-alternative products or fully plant-based options could significantly future-proof Fonterra against evolving consumer tastes and demand for sustainable protein sources. For instance, the global dairy alternatives market alone was valued at approximately $20.3 billion in 2023 and is expected to grow considerably.

- Market Growth: The alternative protein sector is experiencing robust growth, offering Fonterra a chance to expand its revenue streams.

- Consumer Trends: Shifting consumer preferences towards plant-based and flexitarian diets create a demand for diversified protein offerings.

- Innovation Potential: Fonterra can leverage its expertise in protein extraction and processing to develop innovative hybrid or plant-based products.

Fonterra can leverage its expertise in dairy innovation to tap into the burgeoning market for specialized nutritional ingredients. The global market for functional foods, which includes products with added health benefits, was valued at approximately USD 270 billion in 2023 and is projected for continued expansion, offering a significant opportunity for Fonterra to develop high-value protein concentrates and lactoferrin for health-conscious consumers.

The company's commitment to sustainability is a key differentiator, aligning with increasing consumer and business demand for environmentally responsible products. Fonterra's 2023 Sustainability Report highlighted progress towards its 2030 emissions reduction goals, a factor that strengthens its appeal to B2B clients seeking to meet their own ESG targets and can open doors to new market segments.

Fonterra's strategic capital investments, including capacity expansion for high-value protein ingredients and a new UHT cream plant, are designed to meet escalating demand in key growth areas. These investments, alongside supply chain enhancements like a new cool store, aim to improve efficiency and ensure reliable product delivery, positioning Fonterra to capitalize on market opportunities effectively.

The cooperative is also poised to explore the rapidly growing alternative protein market, a sector projected to reach $162 billion by 2030. By potentially developing hybrid or plant-based products, Fonterra can diversify its offerings and cater to evolving consumer preferences for sustainable protein sources, leveraging its existing processing expertise.

Threats

Fonterra is experiencing intensified competition for milk supply within New Zealand, with independent processors actively seeking to secure greater volumes. This rivalry has led to a discernible reduction in Fonterra's proportion of the national milk pool. For instance, in the 2023-24 season, Fonterra's share of the milk supply saw a decline, though specific percentage figures are still being finalized by industry bodies.

This escalating competition poses a direct threat to Fonterra's operational capacity. A diminished milk supply could hinder its ability to meet the demands of its global processing and export activities, potentially impacting production volumes and market presence. Furthermore, the increased demand for raw milk is likely to drive up sourcing costs, squeezing profit margins.

Global dairy commodity prices are inherently volatile, with factors like weather patterns and geopolitical events constantly shifting supply and demand. For instance, in early 2024, the Global Dairy Trade (GDT) Price Index experienced fluctuations, impacting the revenue streams of major players like Fonterra. This ongoing price instability directly threatens Fonterra's profitability, making consistent financial performance a challenge.

Furthermore, Fonterra, as a significant exporter, is highly susceptible to foreign exchange rate volatility. A strengthening New Zealand dollar against key trading partners' currencies can significantly reduce the value of its export earnings when converted back. This currency risk can erode margins and negatively affect the company's overall financial health, as seen in periods of rapid currency appreciation impacting export-oriented businesses.

Fonterra, like many in the global dairy sector, faces mounting pressure from escalating production expenses. Feed, fertilizer, energy, and labor costs have all seen significant upticks across major dairy-producing nations, including its home base of New Zealand. This inflationary environment directly impacts Fonterra's operational expenditures.

For instance, during the 2023-24 season, New Zealand dairy farmers experienced a notable increase in input costs, with feed prices alone rising by an estimated 10-15%. These widespread cost increases can squeeze Fonterra's profit margins and potentially affect its ability to maintain competitive pricing for its products, impacting overall profitability.

Shifting Consumer Preferences and Alternative Protein Trends

The global shift towards plant-based diets and alternative proteins presents a significant threat to traditional dairy producers like Fonterra. This trend, driven by health, environmental, and ethical concerns, is expected to continue growing. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach over $70 billion by 2030, indicating a substantial potential impact on dairy demand.

Fonterra must actively innovate and adapt to this evolving consumer landscape to maintain its market share. Failure to do so could lead to a decline in long-term demand for its core dairy products. Staying ahead requires investment in research and development for dairy-based innovations that cater to changing preferences, as well as exploring opportunities within the alternative protein space itself.

- Growing Plant-Based Market: The global plant-based food market is experiencing rapid expansion, with projections indicating significant growth through 2030.

- Consumer Demand Shift: Increasing consumer interest in veganism and flexitarianism directly impacts the demand for traditional dairy items.

- Need for Innovation: Fonterra faces pressure to continuously innovate its product offerings to align with shifting consumer preferences and remain competitive.

- Market Adaptation: Adapting to these trends is crucial for Fonterra's long-term relevance and financial performance in the global food industry.

Increasing Environmental Regulations and Climate Change Impacts

Fonterra faces growing pressure from stricter environmental regulations in New Zealand and key export markets. These rules, focusing on agricultural emissions, water quality, and land use, could significantly raise compliance costs and operational challenges for the co-operative. For instance, New Zealand's proposed agricultural emissions pricing scheme, aiming for significant reductions by 2030, presents a direct financial impact on Fonterra's farmer suppliers.

Climate change also presents a tangible threat to Fonterra's core business: milk production. Increased frequency and intensity of extreme weather events, such as droughts and floods, directly impact pasture availability and cow health, leading to reduced milk yields. For example, the severe drought conditions experienced in parts of New Zealand during early 2024 led to concerns about milk supply stability for the season.

- Increased Compliance Costs: New environmental standards may necessitate investments in new technologies and practices, impacting profitability.

- Operational Complexity: Adapting to diverse and evolving regulations across different operating regions adds significant management overhead.

- Supply Chain Vulnerability: Climate-related disruptions can lead to volatile milk collection volumes and affect processing schedules.

- Reputational Risk: Failure to adequately address environmental concerns could damage Fonterra's brand image and consumer trust.

Fonterra's competitive landscape is intensifying, with a notable increase in competition for milk supply within New Zealand from independent processors, leading to a reduction in Fonterra's share of the national milk pool. This heightened rivalry directly threatens Fonterra's operational capacity and could increase sourcing costs, impacting profit margins.

Global dairy commodity price volatility, influenced by factors like weather and geopolitical events, poses a continuous threat to Fonterra's profitability. For instance, fluctuations in the Global Dairy Trade (GDT) Price Index in early 2024 have demonstrated this instability. Additionally, foreign exchange rate volatility, particularly a strengthening New Zealand dollar, can significantly diminish the value of export earnings.

Escalating production expenses, including feed, fertilizer, energy, and labor, are squeezing Fonterra's profit margins. Dairy farmers in New Zealand, for example, saw input costs rise significantly in the 2023-24 season, with feed prices alone increasing by an estimated 10-15%. This inflationary pressure impacts operational expenditures and potentially competitive pricing.

The growing plant-based market, valued at approximately $29.7 billion in 2023 and projected to exceed $70 billion by 2030, presents a substantial threat to traditional dairy demand. Fonterra must innovate to adapt to shifting consumer preferences, driven by health, environmental, and ethical concerns, to maintain market share and long-term relevance.

Stricter environmental regulations in New Zealand and key export markets are increasing compliance costs and operational challenges. For example, New Zealand's proposed agricultural emissions pricing scheme by 2030 directly impacts farmer suppliers. Furthermore, climate change-induced extreme weather events, such as droughts in early 2024, threaten milk production stability and yields.

| Threat Category | Specific Threat | Impact on Fonterra | Example/Data Point (2023-2025) |

|---|---|---|---|

| Competition | Intensified Milk Supply Competition | Reduced milk pool share, increased sourcing costs | Decline in Fonterra's share of national milk supply in 2023-24 season. |

| Market Dynamics | Dairy Commodity Price Volatility | Eroded profitability, inconsistent financial performance | Fluctuations in GDT Price Index in early 2024. |

| Economic Factors | Foreign Exchange Rate Volatility | Reduced export earnings value | Impact of strengthening NZD on export-oriented businesses. |

| Cost Pressures | Rising Production Expenses | Squeezed profit margins, potential pricing challenges | 10-15% increase in feed prices for NZ dairy farmers in 2023-24. |

| Consumer Trends | Growth of Plant-Based Alternatives | Decreased demand for dairy products, need for innovation | Global plant-based market projected to grow from $29.7B (2023) to over $70B by 2030. |

| Regulatory & Environmental | Stricter Environmental Regulations | Increased compliance costs, operational complexity | NZ's proposed agricultural emissions pricing scheme by 2030. |

| Climate Change | Extreme Weather Events | Reduced milk yields, supply instability | Drought conditions impacting milk supply stability in early 2024. |

SWOT Analysis Data Sources

This Fonterra Co-operative Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence reports, and expert analyses of the global dairy industry to ensure a robust and accurate strategic assessment.