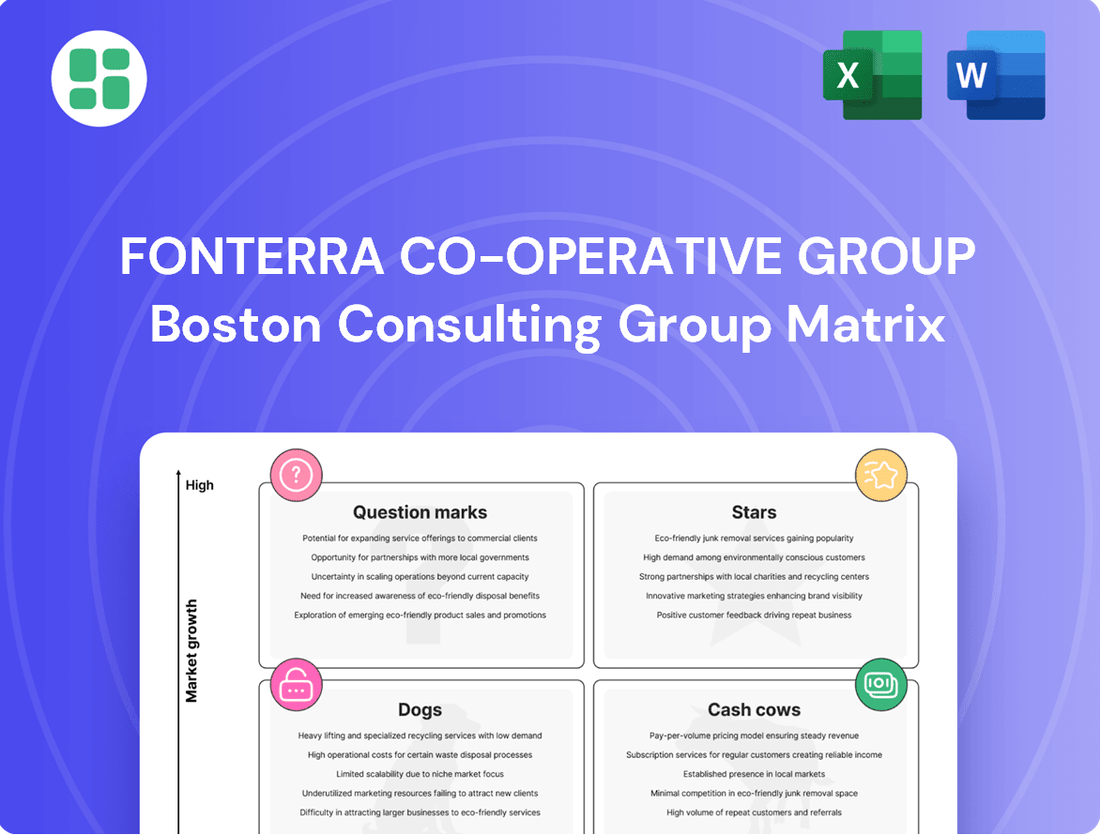

Fonterra Co-operative Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fonterra Co-operative Group Bundle

Curious about Fonterra's product portfolio performance? This preview offers a glimpse into their strategic positioning, hinting at where their dairy giants might be thriving and where new ventures might be emerging.

To truly understand Fonterra's competitive edge and unlock actionable strategies, dive into the complete BCG Matrix. Gain a clear view of their Stars, Cash Cows, Dogs, and Question Marks, and discover the data-backed insights needed to make informed investment decisions. Purchase the full report now for a comprehensive breakdown and a roadmap to optimizing Fonterra's market presence.

Stars

Fonterra's specialized dairy ingredients, like advanced proteins and nutritional components, are a major growth engine. This is fueled by the rising global appetite for healthier food options. The market for these ingredients is expected to expand robustly, and Fonterra is a frontrunner, consistently boosting its capacity for these profitable products.

Fonterra's Foodservice division is a powerhouse, especially in Asia's booming markets like China and Southeast Asia. This segment is characterized by its high growth and profitability, driven by increasing consumer demand for convenient and quality food options.

Products like IQF Mozzarella and UHT cream are seeing exceptional demand, prompting Fonterra to invest heavily in expanding production capacity. For instance, in fiscal year 2023, Fonterra announced significant capital expenditure plans to bolster its foodservice capabilities in the region, aiming to meet the escalating needs of its customers and capitalize on market opportunities.

This strategic focus on foodservice in Asia is a key driver of Fonterra's overall financial performance. The business consistently delivers strong operating profits and impressive sales volume increases, underscoring its importance as a high-value channel for the co-operative. In the first half of FY24, Fonterra reported that its Foodservice segment delivered a gross profit of NZ$375 million, up 11% on the prior period, reflecting the strong underlying demand.

The market for specialized dairy proteins, particularly those for sports nutrition and health products, is experiencing robust growth, driven by increasing global health awareness. Fonterra is making significant investments to boost its production of these high-value protein ingredients, with facilities like Studholme being central to this expansion. These specialized ingredients offer better profit margins and are a critical strategic focus for Fonterra.

New Zealand Milk Supply for B2B

The consistent and increasing supply of high-quality New Zealand milk is a cornerstone of Fonterra's B2B operations, effectively acting as a Star in the BCG matrix. Fonterra's efficient processing capabilities transform this raw milk into valuable ingredients and foodservice solutions for business clients.

Fonterra's dominance in the New Zealand milk supply chain is critical. Despite minor shifts in overall milk pool market share among New Zealand dairy farmers, Fonterra consistently maintains high collection volumes. This allows them to strategically allocate milk to their high-growth B2B segments, reinforcing their position.

- Fonterra's New Zealand milk collection for the 2023-24 season was approximately 1.5 billion kgMS (kilograms of milk solids).

- The company aims to increase the proportion of milk solids directed towards value-added ingredients and foodservice, which are key B2B offerings.

- New Zealand's reputation for high-quality, grass-fed dairy production directly supports the premium positioning of Fonterra's B2B ingredients.

Innovation in Dairy Applications

Fonterra's dedication to innovation is evident in its substantial investments, fostering collaborations to pioneer new dairy applications and ingredients. This strategic focus solidifies its standing in advanced dairy science. For instance, their partnership with Nourish Ingredients to develop novel fats like Creamilux™ for both dairy and plant-based products highlights a drive towards creating lucrative, emerging product categories.

This commitment to continuous innovation is key to Fonterra's strategy for unlocking new market potentials and sustaining a competitive edge. In 2024, Fonterra continued to emphasize R&D, with a significant portion of its capital expenditure directed towards innovation and sustainability initiatives, aiming to capture value in high-growth segments.

- Dairy Innovation: Fonterra actively invests in research and development to create novel dairy applications and ingredients.

- Strategic Partnerships: Collaborations, such as with Nourish Ingredients, drive the development of new product lines like Creamilux™.

- Market Leadership: These efforts position Fonterra as a leader in emerging dairy science and high-growth product segments.

- Competitive Advantage: Continuous innovation is crucial for maintaining and expanding Fonterra's market share in evolving global markets.

Fonterra's specialized dairy ingredients, particularly proteins for sports nutrition and health, represent a significant Star in its BCG matrix. These high-value products benefit from growing global health consciousness and are a key focus for Fonterra's investment in R&D and production capacity, such as at its Studholme facility.

The Foodservice division, especially its presence in booming Asian markets, also functions as a Star. Driven by demand for convenient, quality food, this segment consistently delivers strong profits and sales growth. Fonterra's investment in expanding its foodservice capabilities, including IQF Mozzarella and UHT cream production, underscores its strategic importance.

Fonterra's core strength in collecting and processing high-quality New Zealand milk positions its B2B ingredient and foodservice offerings as Stars. The co-operative's efficient supply chain and ability to allocate milk solids to value-added segments solidify its market leadership and competitive advantage.

Fonterra's commitment to innovation, including partnerships for novel dairy applications like Creamilux™, further cements its Star status. These R&D efforts aim to capture value in emerging, high-growth product categories, ensuring a sustained competitive edge in the global market.

| Fonterra Business Segment | BCG Matrix Category | Key Drivers | FY24 Performance Indicators |

| Specialized Dairy Ingredients (Proteins) | Star | Global health & wellness trend, demand for sports nutrition | Strong growth in high-margin ingredients, capacity expansion |

| Foodservice (Asia) | Star | Demand for convenience, growing Asian middle class | 11% gross profit increase in H1 FY24, strong sales volume |

| B2B Ingredients & Solutions (Leveraging NZ Milk) | Star | High-quality NZ milk reputation, efficient processing | Consistent milk collection (~1.5 billion kgMS in 23-24), strategic milk allocation |

| Innovation & New Product Development | Star | R&D investment, strategic partnerships | Focus on emerging dairy science, development of novel fats |

What is included in the product

Fonterra's BCG Matrix analysis identifies key product units to invest in, hold, or divest based on market share and growth.

A Fonterra BCG Matrix overview clarifies which business units require investment (Stars), generate cash (Cash Cows), need careful management (Question Marks), or should be divested (Dogs), thus easing strategic decision-making.

Cash Cows

Fonterra's commodity dairy powders, like Whole Milk Powder (WMP) and Skim Milk Powder (SMP), are its bedrock cash cows. Their consistent global demand and Fonterra's commanding market position ensure reliable, high-volume sales, making them a crucial source of stable cash flow. For instance, in the fiscal year ending July 2023, Fonterra's total milk collection reached 15.1 billion litres, with a significant portion processed into these core powder products, underpinning its financial strength.

Fonterra's established foodservice products in mature Western markets, like bulk butter and cheese, are vital cash cows. These offerings leverage Fonterra's strong brand and distribution, ensuring consistent revenue streams despite slower market growth. For instance, in the fiscal year ending July 31, 2023, Fonterra's Ingredients business, which includes many of these traditional foodservice products, saw its earnings before interest and taxes (EBIT) reach NZ$1.1 billion, demonstrating their significant contribution to overall profitability.

Bulk dairy fats and proteins are foundational to Fonterra's business, acting as reliable cash cows. Their widespread use in food manufacturing ensures consistent demand, underpinning stable revenue streams. Fonterra's robust production capabilities and extensive global supply network solidify its significant market share in these vital ingredients.

These commodity-like products require minimal promotional spending, contributing to their profitability and reinforcing the financial bedrock of the Ingredients division. For the fiscal year ending July 31, 2023, Fonterra reported strong performance in its Ingredients and Specialised Nutrition segment, with earnings before interest and taxes (EBIT) of NZ$1.4 billion, reflecting the consistent contribution of these bulk products.

New Zealand Domestic Market Presence

Fonterra's New Zealand domestic market presence is a cornerstone of its operations, functioning as a classic Cash Cow. The co-operative holds a commanding position in its home market, with a significant share across a broad range of dairy products. This deep penetration ensures a steady and predictable stream of revenue, underpinning the group's financial stability.

While the New Zealand dairy market is mature, with growth prospects being modest, Fonterra's established distribution networks and strong brand loyalty among consumers translate into consistent sales volumes. This segment requires relatively low capital expenditure to maintain its market share, freeing up capital for investment in other areas of the business.

- Market Share: Fonterra holds over 80% of the New Zealand liquid milk market.

- Revenue Contribution: The domestic market consistently contributes a substantial portion to Fonterra's overall earnings, providing reliable cash flow.

- Brand Loyalty: Strong consumer recognition and trust in brands like Anchor and Mainland dairy products ensure sustained demand.

- Investment Needs: Minimal reinvestment is required to sustain the existing market share and operational efficiency in this mature segment.

Existing Manufacturing and Supply Chain Network

Fonterra’s established manufacturing and supply chain network is a cornerstone of its operations, acting as a robust cash cow. This extensive infrastructure, honed over many years, enables the efficient and cost-effective processing and distribution of vast quantities of dairy products.

The sheer scale of this network translates into significant operational efficiencies, driving down costs and boosting profit margins across Fonterra’s diverse product portfolio. This well-oiled machine is a critical competitive advantage, consistently delivering substantial value.

- Scale of Operations: Fonterra operates over 100 manufacturing sites globally, processing billions of liters of milk annually.

- Cost Efficiency: Optimized logistics and processing capabilities contribute to lower per-unit costs, enhancing profitability.

- Market Reach: The robust supply chain ensures Fonterra can reliably serve diverse international markets, maximizing sales volume.

- Asset Utilization: High utilization rates across its manufacturing assets generate consistent returns on investment.

Fonterra's commodity dairy powders, such as Whole Milk Powder (WMP) and Skim Milk Powder (SMP), represent its primary cash cows. These products benefit from consistent global demand and Fonterra's significant market share, ensuring high-volume sales and a stable cash flow. For the fiscal year ending July 2023, Fonterra processed 15.1 billion litres of milk, a large portion of which became these essential powders, solidifying their role in the co-operative's financial stability.

Fonterra's established foodservice products, including bulk butter and cheese sold in mature Western markets, also function as key cash cows. These items leverage Fonterra's strong brand recognition and extensive distribution network, generating reliable revenue streams even with slower market growth. The Ingredients segment, encompassing many of these traditional foodservice offerings, reported earnings before interest and taxes (EBIT) of NZ$1.1 billion for the fiscal year ending July 31, 2023, highlighting their substantial profit contribution.

Bulk dairy fats and proteins are foundational to Fonterra's business, acting as consistent cash cows due to their widespread use in food manufacturing. This ensures steady demand and underpins stable revenue streams. Fonterra's robust production capabilities and extensive global supply network solidify its significant market share in these vital ingredients.

These commodity-like products require minimal promotional spending, contributing to their profitability and reinforcing the financial bedrock of the Ingredients division. For the fiscal year ending July 31, 2023, Fonterra reported strong performance in its Ingredients and Specialised Nutrition segment, with earnings before interest and taxes (EBIT) of NZ$1.4 billion, reflecting the consistent contribution of these bulk products.

| Product Category | Market Position | Revenue Driver | FY23 EBIT Contribution (NZ$) | Key Characteristic |

| Commodity Dairy Powders (WMP, SMP) | Market Leader | High Volume, Stable Demand | Part of NZ$1.4bn Ingredients & Specialised Nutrition | Global staple, low marketing cost |

| Foodservice Butter & Cheese | Strong Brand Loyalty | Consistent Sales in Mature Markets | Part of NZ$1.1bn Ingredients | Leverages established distribution |

| Bulk Dairy Fats & Proteins | Significant Market Share | Broad Industrial Use | Part of NZ$1.4bn Ingredients & Specialised Nutrition | Essential food manufacturing inputs |

What You’re Viewing Is Included

Fonterra Co-operative Group BCG Matrix

The Fonterra Co-operative Group BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, offers a clear strategic overview of Fonterra's product portfolio, categorizing each into Stars, Cash Cows, Question Marks, and Dogs. The insights provided are ready for immediate integration into your business planning, enabling informed decision-making for resource allocation and future growth strategies.

Dogs

Fonterra's global consumer brands, including Anchor and Mainland, are earmarked for divestment, placing them squarely in the 'Dog' category of the BCG Matrix. While these brands have shown some profit improvement, the co-operative's strategy is to exit these lower-growth, lower-margin consumer markets. This move is designed to unlock capital for reinvestment in more promising B2B areas.

Fonterra's integrated businesses in Oceania (Australia and New Zealand consumer, foodservice, and ingredients) and Sri Lanka are positioned as potential divestments within the BCG Matrix. This strategic move indicates they may be classified as Question Marks or potentially Dogs, depending on their specific growth rates and market shares within their respective sectors.

The decision to explore divestment for these integrated units, despite containing elements that might fit other quadrants, signals they are not deemed core to Fonterra's future B2B focused strategy. This suggests they may be struggling to achieve the growth or market dominance the co-operative expects, potentially hindering overall group performance.

Fonterra's 'Simply Milk', once branded as 'Carbon Zero Milk', is a clear example of a product that landed in the Dogs quadrant of the BCG Matrix. This product struggled with a low market share within a niche market, failing to gain significant traction.

The initiative was ultimately abandoned because it couldn't meet its ambitious environmental targets, specifically its emissions reduction goals. This failure meant resources were invested without the expected market penetration or the fulfillment of its sustainability promise.

Underperforming Regional Niche Products

Fonterra's portfolio includes several underperforming regional niche products. These are typically specialized consumer goods or regional dairy variants that operate in slow-growth markets with limited penetration. For example, certain artisanal cheese lines or specific regional milk formulations might fall into this category. These products often require significant marketing and distribution resources relative to their modest revenue contribution.

The financial performance of these niche products in 2024 reflects this challenge. While Fonterra's overall revenue for the fiscal year ending July 31, 2024, is projected to be robust, these specific niche items are expected to represent a small fraction of that. For instance, if a niche product line generates only NZ$5 million in revenue against a total group revenue of NZ$20 billion, its contribution is negligible. The cost of maintaining these products, including specialized production and targeted marketing, can outweigh the returns, making them prime candidates for review.

- Niche Product Performance: Specific regional dairy products showing minimal sales growth in 2024.

- Market Saturation: Operating in low-growth markets with limited potential for increased penetration.

- Resource Allocation: Disproportionate marketing and distribution costs relative to revenue generated.

- Strategic Review: Potential candidates for discontinuation or reduced investment to optimize the portfolio.

Obsolete or Low-Demand Ingredient Formulations

Fonterra's legacy dairy ingredient formulations, those replaced by newer, more sought-after options or serving niche, shrinking food manufacturing sectors, would fall into the Dogs category. These products typically hold a small market share in a market that is contracting.

Such formulations would generate very little cash flow for the co-operative. Furthermore, they might occupy valuable manufacturing space that could be better allocated to produce higher-margin, more in-demand ingredients, impacting overall operational efficiency.

For example, if Fonterra had a specific whey protein isolate formulation popular in the early 2010s but now superseded by advanced hydrolysates, it might be classified as a Dog. In 2024, the global market for specialized protein ingredients continues to grow, making these older formulations less competitive.

- Low Market Share: These ingredients would represent a minimal portion of Fonterra's overall sales.

- Declining Market: The demand for these specific formulations is shrinking.

- Minimal Cash Flow: They contribute little to the co-operative's profits.

- Capacity Tie-up: Manufacturing capacity used for these could be repurposed for more profitable products.

Fonterra's divestment of certain consumer brands, like Anchor and Mainland, places them in the 'Dog' category of the BCG Matrix. These brands, while showing some profit improvement, are being exited due to their lower growth and margin potential in consumer markets. This strategic move aims to free up capital for investment in more promising business-to-business (B2B) segments.

Fonterra's portfolio includes underperforming regional niche products, such as artisanal cheese lines, which operate in slow-growth markets with limited penetration. In the fiscal year ending July 31, 2024, these niche items are expected to contribute a small fraction to Fonterra's projected robust revenue of NZ$20 billion, with their revenue potentially around NZ$5 million. The costs associated with maintaining these products can exceed their returns, making them candidates for review.

| Product Category | BCG Quadrant | 2024 Market Share (Est.) | 2024 Revenue Contribution (Est.) | Strategic Rationale |

|---|---|---|---|---|

| Global Consumer Brands (e.g., Anchor, Mainland) | Dogs | Low | Minor | Divestment to unlock capital for B2B growth |

| Underperforming Regional Niche Products | Dogs | Very Low | Negligible (<0.1% of total) | Potential discontinuation due to low ROI |

| Legacy Dairy Ingredient Formulations | Dogs | Minimal | Low | Repurposing manufacturing capacity |

Question Marks

Fonterra's ventures into precision fermentation, exemplified by its work with Nourish Ingredients on Creamilux™, place its dairy alternative fats firmly in the Question Mark quadrant of the BCG Matrix. This sector is experiencing rapid expansion, driven by consumer demand for sustainable and novel food ingredients.

While the market for precision fermentation dairy alternatives is projected for substantial growth, Fonterra's current market share in this nascent area is likely minimal. Significant investment is being channeled into research and development, alongside efforts to build consumer acceptance and establish distribution channels.

Fonterra's Nutiani brand is venturing into AI-driven personalized nutrition and GLP-1 focused foods, signaling a strategic move into a high-growth area. This innovation leverages artificial intelligence to tailor dietary recommendations, a significant shift in how consumers approach health and wellness.

While this segment holds immense future potential, Fonterra's current market share in AI-driven nutrition is likely nascent. Significant investment will be crucial for R&D, technology infrastructure, and consumer outreach to establish a strong foothold and achieve scalability in this emerging market.

Fonterra is strategically focusing on emerging foodservice markets beyond China, employing a capital-light strategy to accelerate growth. These markets, while offering significant expansion opportunities, currently represent a smaller share for Fonterra as they build brand recognition and tailor offerings. For instance, in Southeast Asia, a region projected to see substantial foodservice growth, Fonterra is investing in local partnerships and product development to capture market share.

New High-Value Protein & Nutrition Products (Initial Launch Phase)

Fonterra's new high-value protein and nutrition products, currently in their initial launch phase, represent potential stars in the BCG matrix. These products target fast-growing segments aligned with Fonterra's strategic direction, but their market share is still developing. For example, in the fiscal year ending July 2024, Fonterra reported increased investment in its Ingredients and New Zealand Milk Products division, which includes these advanced nutrition offerings, aiming to capture emerging consumer trends.

These innovative products necessitate significant investment in marketing and distribution to accelerate market penetration and achieve economies of scale. While the long-term outlook is promising, immediate returns remain uncertain, characteristic of a question mark in the BCG framework. Fonterra's focus on innovation, as highlighted in their 2024 investor updates, signals a commitment to nurturing these nascent ventures into future market leaders.

- Product Stage: Initial market adoption, requiring significant investment.

- Market Potential: Targeting high-growth segments in protein and advanced nutrition.

- Investment Needs: Heavy spending on marketing and distribution to drive adoption.

- Return Uncertainty: Immediate returns are not guaranteed, reflecting a question mark position.

Sustainability-Focused Dairy Innovations

Fonterra's commitment to sustainability, including significant investments in decarbonisation and lower emissions milk initiatives, positions its sustainability-focused dairy innovations as potential Stars or Question Marks in the BCG Matrix. These efforts are geared towards developing new product lines and certifications that resonate with environmentally conscious consumers and markets.

For instance, Fonterra's 2024 investment of NZ$100 million into its new Emissions Reduction Fund, alongside ongoing efforts in areas like methane reduction, directly supports these innovative ventures. This financial backing fuels research and development into novel dairy products with a demonstrably lower environmental footprint.

- Fonterra's Decarbonisation Investments: NZ$100 million allocated to Emissions Reduction Fund in 2024, supporting projects aimed at reducing greenhouse gas emissions in dairy farming.

- Lower Emissions Milk Funding: Continued investment in research and development for technologies and practices that reduce methane and other emissions from milk production.

- Potential New Product Lines: Innovations could include certified low-emission dairy products, plant-based alternatives, or specialized nutritional ingredients derived from sustainable farming practices.

- Market Appeal: These initiatives aim to capture growing consumer demand for ethically and environmentally produced food, potentially leading to premium pricing and increased market share.

Fonterra's ventures into precision fermentation and AI-driven personalized nutrition represent significant question marks within its business portfolio. These areas are characterized by high growth potential but also substantial investment requirements and uncertain market capture.

The company is actively investing in research and development for these nascent technologies, aiming to build market share in rapidly evolving sectors. Fonterra's strategic focus on these emerging areas, as evidenced by its 2024 investments and innovation pipeline, underscores their potential to become future stars.

However, the current market share in these segments is minimal, necessitating considerable capital for scaling, marketing, and consumer education. The success of these question mark ventures hinges on Fonterra's ability to navigate technological advancements and shifting consumer preferences effectively.

Fonterra's investment in its Nutiani brand, targeting personalized nutrition and GLP-1 focused foods, highlights its commitment to high-growth, albeit uncertain, markets. In fiscal year 2024, Fonterra continued to allocate resources towards innovation, signaling a long-term strategy to develop these ventures.

BCG Matrix Data Sources

Our Fonterra BCG Matrix leverages comprehensive data from Fonterra's annual reports, global dairy market research, and competitor analysis to accurately position its business units.