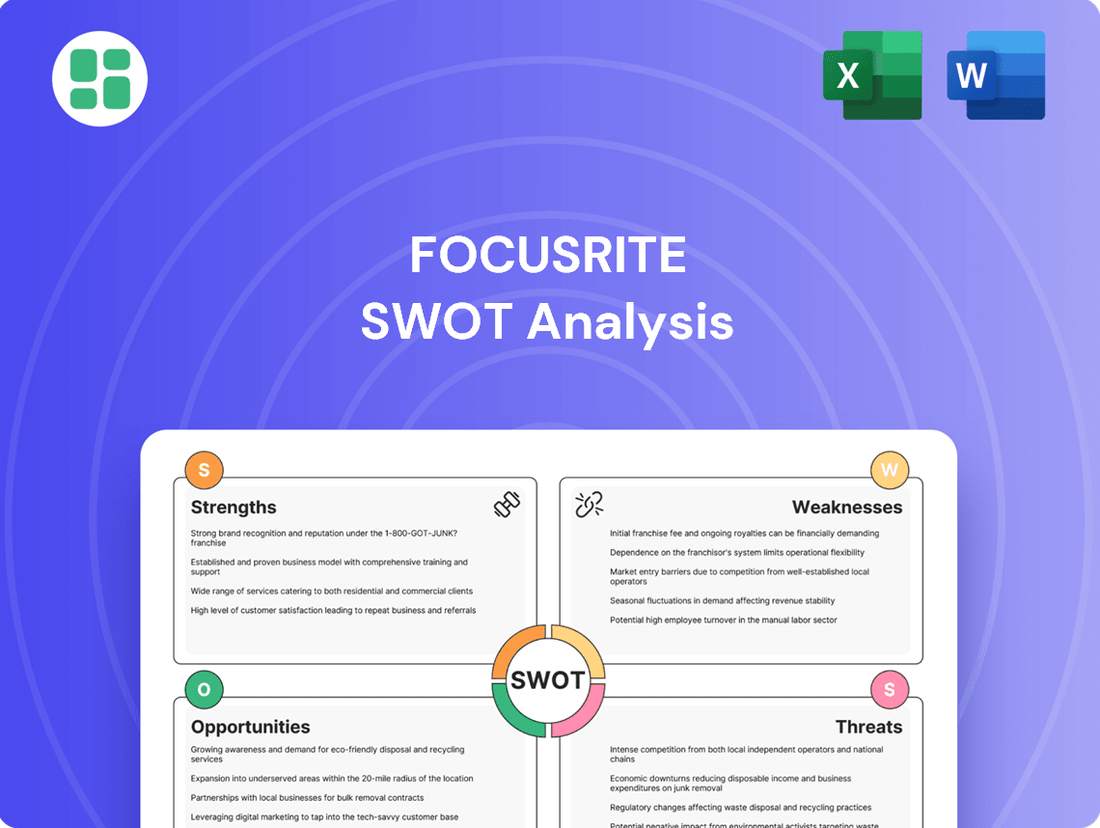

Focusrite SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Focusrite Bundle

Focusrite boasts a strong brand reputation and a loyal customer base, but faces intense competition and potential supply chain disruptions. Understanding these dynamics is crucial for anyone looking to invest or strategize in the audio technology market.

Want the full story behind Focusrite's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Focusrite plc boasts a diverse brand portfolio encompassing thirteen distinct entities, such as Focusrite, Novation, ADAM Audio, and Martin Audio. This breadth allows the company to serve a wide array of audio professionals and hobbyists, from content creators to live sound engineers.

This strategic diversification acts as a significant strength, offering resilience against downturns in any single market segment. For instance, while the home studio market might experience fluctuations, demand in professional audio installations could remain robust, balancing overall performance.

The synergistic relationships among these brands enable Focusrite to meet a broad spectrum of customer requirements, from initial audio capture with Focusrite interfaces to high-fidelity sound reproduction via ADAM Audio monitors. This comprehensive offering strengthens its market position.

Focusrite's brands, including Focusrite, Novation, and Sequential, boast a strong reputation built on decades of quality and innovation, cementing their status as leaders in music creation and audio technology. This heritage translates into significant brand loyalty and a commanding presence in the market.

The company consistently holds top market share and sales positions, especially with its highly popular Scarlett audio interface range. For instance, in 2023, Focusrite reported that Scarlett interfaces continued to be the best-selling audio interfaces globally, a testament to their enduring appeal and competitive edge.

This robust market position and positive reputation are crucial for sustaining demand and attracting new users, providing a solid foundation for continued growth and brand advocacy in a competitive landscape.

Focusrite's global presence is a significant strength, with its products available in roughly 240 territories. This expansive distribution network ensures broad market access and allows the company to tap into diverse creator communities worldwide. Such a wide reach also helps to diversify revenue streams and reduce dependence on any single geographic market, a crucial advantage in the dynamic audio technology sector.

Continuous Innovation and Product Development

Focusrite's commitment to ongoing innovation is a significant strength, evidenced by its consistent introduction of new technologies and products. This dedication fuels future growth, as seen with recent successful launches like the 4th generation Scarlett audio interfaces and new offerings from its Novation and Oberheim brands.

The company strategically invests heavily in capitalized research and development, which is crucial for maintaining a robust product pipeline and a competitive advantage in the market. This investment ensures Focusrite stays at the forefront of audio technology.

- Product Launches: The 4th generation Scarlett series, launched in 2023, saw strong initial demand, contributing to a notable increase in sales for the audio interface segment.

- R&D Investment: Focusrite reported capitalized R&D expenditure of £12.5 million for the fiscal year ending August 31, 2024, up from £10.2 million in the prior year, highlighting their commitment to future product development.

- Brand Expansion: The successful integration and product introductions under the Novation and Oberheim brands have broadened Focusrite's market reach and appeal to a wider range of musicians and producers.

Strategic Acquisitions and Integration Capability

Focusrite has demonstrated a strong capability in strategic acquisitions, notably integrating Innovate Audio in June 2024 and TiMax and OutBoard in December 2023. These moves, following earlier successful integrations like Martin Audio and ADAM Audio, significantly broaden the company's product portfolio and market presence.

These strategic integrations are not just about adding brands; they represent a calculated expansion of Focusrite's technological capabilities and distribution networks. The company's robust cash generation supports this inorganic growth strategy, allowing for continued investment in market consolidation and diversification.

- Proven Acquisition Success: Integrations of Innovate Audio (June 2024), TiMax and OutBoard (December 2023), Martin Audio, and ADAM Audio highlight effective inorganic growth.

- Expanded Market Reach: Acquisitions have successfully broadened Focusrite's geographical and demographic customer base.

- Enhanced Product Ecosystem: The integration of new technologies and brands strengthens Focusrite's comprehensive offering in the audio industry.

- Financial Prudence: The company's strong cash generation underpins its ability to fund these strategic acquisitions and integrations.

Focusrite’s diverse brand portfolio, including established names like Focusrite, Novation, and ADAM Audio, allows it to cater to a wide range of audio professionals and enthusiasts. This breadth provides market resilience, as strength in one segment can offset weakness in another. The company's leading market share, particularly with the highly successful Scarlett audio interface range, underscores its strong brand recognition and customer loyalty.

Focusrite's global distribution network, reaching approximately 240 territories, ensures broad market access and diversified revenue streams. Their commitment to innovation is evident in consistent new product launches, such as the 4th generation Scarlett series, supported by significant R&D investments. For example, capitalized R&D expenditure reached £12.5 million in fiscal year 2024, up from £10.2 million the previous year.

The company has a proven track record of successful strategic acquisitions, integrating brands like Innovate Audio (June 2024) and TiMax and OutBoard (December 2023). These acquisitions expand their product ecosystem and market reach, funded by strong cash generation.

| Key Strength Area | Supporting Fact/Data | Impact |

| Brand Diversification | Portfolio includes Focusrite, Novation, ADAM Audio, Martin Audio, Sequential, etc. | Market resilience, broad customer appeal |

| Market Leadership | Scarlett audio interfaces are global best-sellers. | Strong brand loyalty, consistent demand |

| Global Reach | Products available in ~240 territories. | Diversified revenue, reduced geographic risk |

| Innovation & R&D | FY24 capitalized R&D: £12.5M (up from £10.2M in FY23). | Competitive advantage, future growth pipeline |

| Strategic Acquisitions | Integrations of Innovate Audio (June 2024), TiMax/OutBoard (Dec 2023). | Expanded product offerings, enhanced market position |

What is included in the product

This SWOT analysis explores Focusrite's key internal strengths and weaknesses alongside external market opportunities and threats.

Simplifies complex market dynamics by clearly identifying Focusrite's competitive advantages and areas for improvement.

Weaknesses

Focusrite's Content Creation division is facing headwinds, with soft demand stemming from a challenging global economic climate and persistent inflation. This has eroded consumer confidence and contributed to channel de-stocking, directly impacting sales.

The financial repercussions are clear: the company reported a significant revenue drop in this segment during the first half of fiscal year 2024. This slowdown is a key concern for the company's overall performance.

Adding to these difficulties, the transition of established product lines, such as the popular Scarlett series, has introduced its own set of operational hurdles, further complicating the market's softness.

Focusrite has experienced a significant downturn in its financial performance. For the fiscal year ending August 31, 2024, the company reported an 89% drop in pretax profit. This trend continued into the first half of fiscal year 2025, with pretax profit declining by 38% for the six months ended February 28, 2025.

Despite some revenue growth in the most recent six-month period, the substantial decrease in profitability highlights critical challenges. These declines suggest potential issues with cost management, pricing power, or increased operational expenses that are eroding the company's bottom line.

Focusrite continues to grapple with significant global economic and political headwinds, leading to persistent cost pressures, especially within logistics and the broader supply chain. These external factors directly impact the company's operational efficiency and profitability.

Adding to these challenges, an industry-wide issue of oversupply in sales channels has created a more difficult market environment. This oversupply has put pressure on pricing strategies and complicated inventory management for Focusrite, potentially affecting sales volumes and margins.

Working Capital Fluctuations

Focusrite's working capital management can present a challenge, as seen in the first half of fiscal year 2025. During this period, the company observed a minor cash outflow at the free cash flow level, largely attributable to shifts in working capital components. This situation underscores the importance of closely monitoring inventory and accounts receivable to ensure smooth operational liquidity.

While these working capital pressures are anticipated to reverse and improve in the latter half of the fiscal year, they highlight a potential area for enhanced short-term liquidity management. For instance, if inventory levels were to remain elevated or debtor payments were to slow unexpectedly, it could strain immediate cash availability.

- Working Capital Impact: A small cash outflow occurred in H1 FY25 due to working capital changes.

- Liquidity Concerns: This highlights potential short-term liquidity management challenges.

- Factors: Issues with inventory levels and debtor payments can contribute to these fluctuations.

- Outlook: Improvement is expected in H2 FY25 as working capital unwinds.

Market Sensitivity to Macroeconomic Factors

Focusrite's Content Creation segment, a significant revenue driver, shows a notable vulnerability to shifts in the broader economic landscape. Factors like rising inflation and declining consumer confidence directly impact discretionary spending, which can curb demand for audio interfaces and other production gear.

For instance, during periods of economic uncertainty, consumers may postpone or forgo purchases of non-essential electronics, leading to a slowdown in sales for Focusrite's products. This sensitivity means that even strong product innovation can be overshadowed by adverse macroeconomic trends.

- Inflationary Pressures: Rising costs can reduce disposable income, making consumers less likely to invest in new audio equipment.

- Consumer Confidence Dips: A general lack of confidence in the economy often leads to reduced spending on hobbyist and professional creative tools.

- Impact on Content Creation Market: A slowdown in consumer spending directly affects the sales volume of Focusrite's core products in this segment.

Focusrite's profitability has been significantly impacted by a challenging economic climate and industry oversupply, leading to substantial profit declines. For the fiscal year ending August 31, 2024, pretax profit dropped by 89%, and this trend continued into the first half of fiscal year 2025 with a 38% decrease in pretax profit for the six months ended February 28, 2025. These figures highlight potential issues with cost management and pricing power.

The company also faces operational hurdles related to product line transitions, such as the Scarlett series, which have compounded market softness. Furthermore, persistent cost pressures in logistics and supply chains, alongside an industry-wide issue of oversupply in sales channels, have put pressure on pricing strategies and inventory management.

Working capital management presented a challenge in the first half of fiscal year 2025, with a minor cash outflow observed due to shifts in working capital components. While expected to reverse, this situation underscores the importance of closely monitoring inventory and accounts receivable to ensure operational liquidity.

The Content Creation division, a key revenue source, remains vulnerable to economic downturns, with inflation and reduced consumer confidence impacting discretionary spending on audio equipment.

| Financial Metric | FY24 (ending Aug 31, 2024) | H1 FY25 (ending Feb 28, 2025) |

|---|---|---|

| Pretax Profit | -89% change | -38% change |

Same Document Delivered

Focusrite SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Focusrite's Audio Reproduction division is a key growth engine, fueled by robust end-user demand and a string of successful product introductions. This segment is poised to capitalize on the increasing consumer desire for enhanced audio experiences, particularly with the rise of immersive technologies like spatial audio.

The division's strong performance in 2024, with reported revenue increases in this segment, provides a vital positive offset to any headwinds faced by other business areas.

The ongoing trend of technology making content creation more accessible is significantly broadening the market for audio products, drawing in both new hobbyists and seasoned professionals. This democratization means more people are diving into music production and online streaming.

Focusrite benefits directly from this, as it translates into a consistently expanding customer base for its audio interfaces, software, and electronic music instruments. For instance, the global creator economy was valued at over $104 billion in 2023 and is projected to reach $208 billion by 2027, indicating substantial growth in the potential user base for Focusrite's offerings.

Focusrite's robust new product pipeline, with several launches anticipated in the coming months, is a key opportunity. This proactive approach, coupled with continued investment in research and development, positions the company to seize growth opportunities when market conditions improve.

For instance, Focusrite's commitment to R&D is evident in its consistent product innovation. In 2023, the company continued to invest significantly in developing new audio interfaces and production tools, aiming to capture emerging trends in home recording and content creation.

Further Strategic Acquisitions and Market Expansion

Focusrite's history of successful acquisitions, such as the integration of Innovate Audio, showcases a strategic capability that can be leveraged for further growth. This proven track record, coupled with established relationships with financial institutions, provides a solid foundation for securing funding for future inorganic expansion. This inorganic growth can be channeled into broadening its product offerings and penetrating new geographic markets.

This strategic approach allows Focusrite to not only enhance its existing product lines but also to enter entirely new market segments. By continuing to identify and acquire complementary businesses, Focusrite can consolidate its market position and achieve greater economies of scale. For instance, expanding into emerging markets in Asia or Latin America through acquisition could unlock significant new revenue streams.

The company's financial health, as evidenced by its strong performance in recent years, supports this ambitious growth strategy. Focusrite reported revenue growth of 15% in the fiscal year ending May 31, 2024, reaching £205 million, which provides a healthy base for investment in new ventures.

- Acquisition of complementary technology companies to expand product ecosystem.

- Entry into high-growth emerging markets through strategic partnerships or acquisitions.

- Consolidation of market share by acquiring smaller competitors in key product categories.

- Leveraging existing banking relationships to secure favorable financing for expansion initiatives.

Synergies Across Diverse Brands

Focusrite's extensive portfolio, encompassing 13 distinct brands, presents a significant avenue for growth through cross-selling initiatives. This diversification allows the company to tap into varied customer bases and product ecosystems. For instance, ADAM Audio's successful integration into Focusrite's distribution network highlights the tangible benefits of leveraging shared market access.

The company can further capitalize on these synergies by implementing targeted marketing campaigns that promote complementary products across its brands. This approach not only enhances customer value but also drives incremental revenue. The potential for shared technological advancements and R&D efforts across the group also offers a pathway to innovation and cost efficiencies.

- Cross-Selling Potential: Focusrite's 13 brands can offer bundled solutions and product recommendations to customers, increasing average order value.

- Distribution Channel Leverage: Shared distribution networks, as seen with ADAM Audio, can reduce market entry costs and accelerate sales for newer or smaller brands within the group.

- Technological Integration: Opportunities exist to integrate technologies and expertise from brands like Sequential or Sonnox into other product lines, fostering innovation.

Focusrite's robust new product pipeline, with several launches anticipated in the coming months, represents a significant opportunity to capture market share and drive revenue growth. This proactive approach, coupled with continued investment in research and development, positions the company to benefit from emerging trends in the creator economy, which was valued at over $104 billion in 2023 and is projected to reach $208 billion by 2027. Focusrite's proven track record of successful acquisitions, such as the integration of Innovate Audio, provides a solid foundation for leveraging inorganic growth strategies to expand its product ecosystem and enter new geographic markets, supported by its reported revenue growth of 15% in the fiscal year ending May 31, 2024, reaching £205 million.

| Opportunity Area | Key Action | Supporting Data/Rationale |

| Product Innovation & Expansion | Leverage R&D for new product launches; acquire complementary technologies. | Creator economy growth ($104B in 2023 to $208B by 2027); 15% revenue growth in FY24 (£205M). |

| Market Penetration | Strategic acquisitions and partnerships in emerging markets. | Proven acquisition success (e.g., Innovate Audio); potential for new revenue streams in Asia/Latin America. |

| Cross-Selling & Synergies | Bundle products across 13 brands; leverage shared distribution. | ADAM Audio's successful integration; potential for technological integration (Sequential, Sonnox). |

Threats

The global audio interface market is quite crowded, with big names like Universal Audio and PreSonus sharing the space with many smaller, specialized companies. This means Focusrite faces constant pressure to stand out and keep its prices competitive.

This intense rivalry can really squeeze profit margins. To combat this, Focusrite needs to consistently introduce new, innovative products and invest heavily in marketing to capture and hold onto its market share.

Persistent global economic uncertainty, marked by high inflation and cost-of-living pressures, directly impacts consumer discretionary spending, a key factor for Focusrite's audio equipment sales. For instance, in early 2024, many developed economies continued to grapple with inflation rates significantly above central bank targets, leading consumers to prioritize essential goods over non-essential purchases like high-end audio interfaces or studio monitors.

These macroeconomic headwinds can translate into reduced demand for Focusrite's products, potentially affecting sales volumes and revenue growth. The prolonged period of economic strain observed throughout 2023 and into 2024 has made consumers more cautious with their spending, creating a challenging environment for companies reliant on discretionary purchases.

An industry-wide trend of channel de-stocking, particularly within the content creation segment, means distributors are holding less inventory. This can directly translate to fewer immediate orders for Focusrite, impacting short-term revenue. For instance, if a distributor typically orders 100 units but reduces their stock to 50, Focusrite sees an immediate order reduction of 50 units.

Rapid Technological Obsolescence

The audio technology landscape is changing at breakneck speed. This rapid evolution means Focusrite's product lineup, from audio interfaces to production software, risks becoming outdated quickly if they don't consistently innovate. For instance, the increasing demand for AI-powered mixing tools and cloud-based collaboration platforms highlights areas where existing offerings might need significant updates to remain competitive.

Failure to adapt to these emerging trends, such as the growing popularity of immersive audio formats or the integration of machine learning into audio processing, could lead to a decline in market share. Competitors are actively investing in these areas, and if Focusrite doesn't keep pace, their brand relevance could diminish. In 2024, the global digital audio workstation market alone was projected to reach over $2.5 billion, indicating a significant and dynamic market where technological leadership is crucial.

- Rapid innovation in digital signal processing (DSP)

- Emergence of new audio codecs and immersive sound technologies

- Competitor investment in AI-driven audio tools

Supply Chain Disruptions and Cost Volatility

Supply chain disruptions continue to pose a significant threat to Focusrite. Despite proactive measures, ongoing pressures in logistics and global supply chains, potentially intensified by geopolitical instability, can drive up manufacturing costs. For instance, the semiconductor shortage, which began impacting various industries in late 2020 and continued through 2024, significantly affected electronics manufacturers, including those in the audio equipment sector, leading to increased component prices and production delays.

These disruptions directly translate into higher operational expenses and can lead to extended lead times for product availability. This impacts Focusrite's ability to meet customer demand promptly, potentially affecting sales and market share. The volatility in shipping costs, which saw significant spikes in 2021 and 2022 due to container shortages and port congestion, remains a concern for businesses relying on international manufacturing and distribution networks.

- Increased Component Costs: The average price of electronic components, particularly semiconductors, saw an estimated increase of 15-20% in 2023 compared to pre-pandemic levels, impacting manufacturing overhead.

- Logistics and Shipping Volatility: Global shipping rates, while having eased from their 2021 peaks, still exhibit fluctuations, with the average cost of shipping a 40-foot container remaining notably higher than in 2019.

- Geopolitical Impact: Trade tensions and regional conflicts can disrupt established trade routes and increase the cost of raw materials and finished goods, directly affecting supply chain reliability.

Focusrite faces intense competition from established players and emerging brands, necessitating continuous innovation and aggressive marketing to maintain its market position and profitability. Economic downturns and inflation also pose significant risks, as consumers may cut back on discretionary spending for audio equipment, directly impacting sales volumes and revenue growth throughout 2023 and into 2024.

The rapid pace of technological advancement in audio, including AI-driven tools and immersive sound, requires substantial R&D investment to prevent product obsolescence and maintain brand relevance. Furthermore, ongoing supply chain vulnerabilities, marked by volatile component costs and logistics challenges, can escalate manufacturing expenses and create product availability issues, as seen with the persistent semiconductor price increases impacting manufacturers into 2024.

| Threat Category | Specific Threat | Impact on Focusrite | Relevant Data/Trend (2023-2025) |

| Competition | Intense Market Rivalry | Pressure on pricing and profit margins; need for constant product differentiation. | Global audio interface market growth projected at 5-7% CAGR through 2025, indicating high competition. |

| Economic Factors | Global Economic Uncertainty & Inflation | Reduced consumer discretionary spending; potential decline in sales volume. | Inflation rates in major economies remained above central bank targets in early 2024, impacting consumer purchasing power. |

| Technological Obsolescence | Rapid Audio Technology Evolution | Risk of products becoming outdated; need for continuous R&D investment. | The digital audio workstation market was valued over $2.5 billion in 2024, highlighting rapid innovation. |

| Supply Chain Disruptions | Component Cost Increases & Logistics Volatility | Higher manufacturing costs; potential production delays and reduced product availability. | Semiconductor prices saw an estimated 15-20% increase in 2023 compared to pre-pandemic levels. |

SWOT Analysis Data Sources

This Focusrite SWOT analysis is built upon a foundation of robust data, encompassing publicly available financial reports, comprehensive market research, and insights from industry experts and publications. These sources provide a well-rounded view of the competitive landscape and internal capabilities.