Focusrite Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Focusrite Bundle

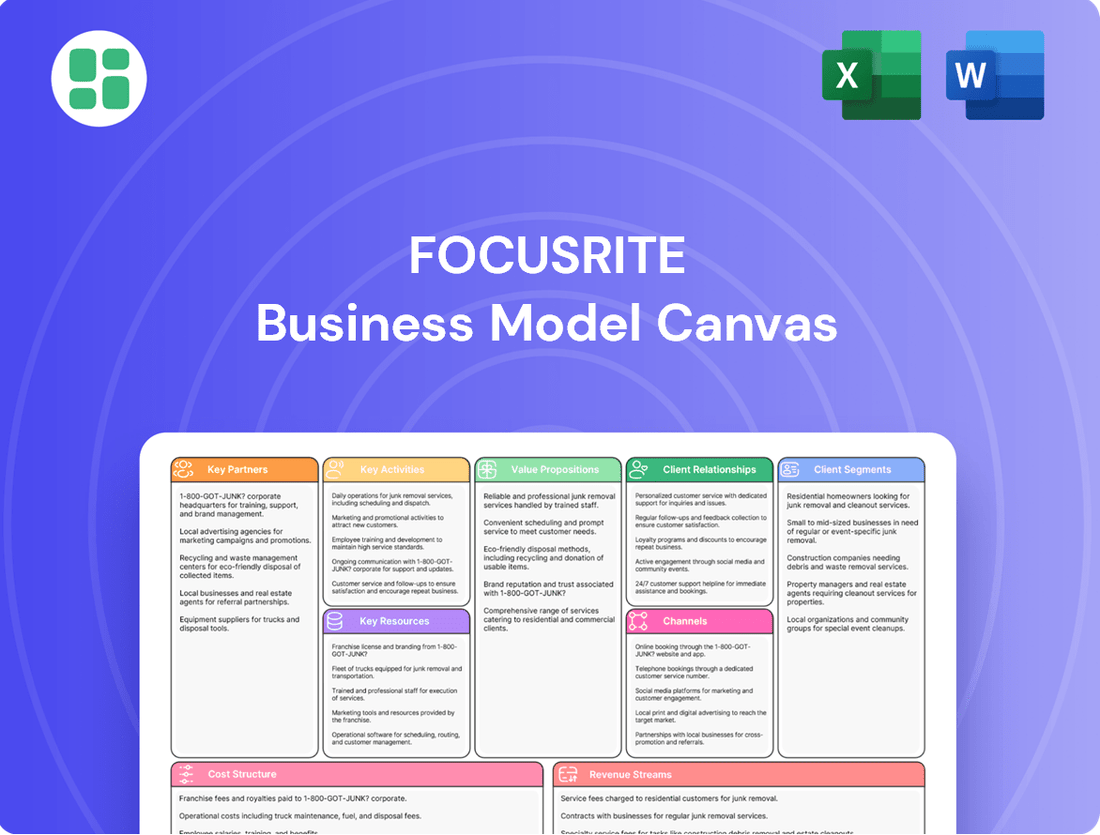

Curious about the engine driving Focusrite's success in the competitive audio industry? Our comprehensive Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their strategic brilliance. Discover how they build strong customer relationships and leverage key resources to maintain their market edge.

Unlock the full strategic blueprint behind Focusrite's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Focusrite actively partners with key players in the digital audio ecosystem, notably Digital Audio Workstation (DAW) developers and plugin manufacturers. This ensures their hardware integrates smoothly with popular software, a crucial element for modern music production.

These collaborations go beyond mere compatibility; they often result in bundled software offerings. For instance, Focusrite interfaces frequently come with valuable software like Ableton Live Lite, Pro Tools Intro+, and the comprehensive Hitmaker Expansion bundle, significantly boosting the value proposition for customers.

Focusrite's business model hinges on robust partnerships with suppliers of essential components, including semiconductors, steel, and various plastics like ABS and HIPS. These relationships are crucial for maintaining production efficiency and mitigating supply chain disruptions, ensuring a steady flow of materials for their diverse range of audio interfaces, preamplifiers, and other hardware. For instance, in 2024, the global semiconductor shortage continued to impact manufacturing across many industries, making these supplier relationships even more critical for companies like Focusrite to secure the necessary chips for their electronic products.

Focusrite's global reach is powered by strategic alliances with a vast array of distributors and retailers, both online and in brick-and-mortar stores, spanning roughly 240 territories. This extensive network ensures their audio interfaces and music creation tools are accessible to a worldwide customer base, from aspiring musicians to seasoned professionals.

Acquisition Targets and Strategic Alliances

Focusrite actively seeks out and integrates complementary brands and technologies through strategic acquisitions. This approach has brought companies like ADAM Audio, Martin Audio, Novation, Sequential, Sonnox, and Innovate Audio into the Focusrite family. These acquisitions are crucial for expanding the company's diverse product offerings and enhancing its research and development capabilities, thereby solidifying its competitive edge.

These strategic alliances and acquisitions directly contribute to Focusrite's market expansion and technological advancement. By incorporating new brands and technologies, Focusrite broadens its customer base and strengthens its innovation pipeline. For instance, the acquisition of Sonnox, a renowned provider of audio plugins, directly enhances Focusrite's software capabilities, offering more comprehensive solutions to its users.

- Acquisitions: ADAM Audio, Martin Audio, Novation, Sequential, Sonnox, Innovate Audio.

- Benefits: Expanded product portfolio, increased market reach, enhanced R&D.

- Strategic Goal: Strengthen overall market position and innovation.

- Impact: Deeper integration of hardware and software solutions for a wider customer base.

Educational Institutions and Industry Organizations

Focusrite actively cultivates relationships with educational institutions and industry organizations to nurture emerging talent and refine its product offerings. For instance, their recent partnership with ELATT, a digital skills charity, grants students access to Focusrite’s industry-standard audio equipment. This initiative not only equips the next generation of audio professionals with essential tools but also fosters early brand familiarity and loyalty among potential future customers.

These collaborations are instrumental in shaping future industry standards and provide Focusrite with invaluable, real-world feedback directly from users actively engaged in creative learning environments. This symbiotic relationship allows for continuous product improvement and ensures Focusrite’s solutions remain relevant and cutting-edge.

- Educational Partnerships: Collaborations with institutions like ELATT provide students with access to professional-grade audio interfaces and equipment, bridging the gap between academic learning and practical application.

- Talent Development: These alliances are crucial for fostering new talent in the audio production industry, ensuring a pipeline of skilled individuals familiar with Focusrite products.

- Industry Influence: By engaging with educational bodies, Focusrite contributes to curriculum development and helps set benchmarks for audio technology education.

- Product Feedback Loop: Direct user interaction through educational channels offers critical insights for future product design and feature enhancements.

Focusrite's key partnerships are vital for its business model, encompassing software developers, component suppliers, distributors, and complementary brands. These alliances ensure product compatibility, efficient production, broad market access, and enhanced product offerings through acquisitions.

The company's strategic acquisitions, including ADAM Audio, Martin Audio, Novation, Sequential, Sonnox, and Innovate Audio, significantly expand its product portfolio and technological capabilities. These integrations strengthen Focusrite's market position by offering a more comprehensive suite of audio solutions, from hardware interfaces to high-end plugins and professional audio equipment.

Partnerships with educational institutions like ELATT are crucial for talent development and product feedback. By providing students with industry-standard equipment, Focusrite fosters early brand adoption and gains valuable insights for product innovation, ensuring its offerings remain relevant to the next generation of audio professionals.

| Partner Type | Examples | Strategic Importance |

| Software Developers | DAW developers, Plugin Manufacturers | Ensures hardware/software integration, bundled software offerings |

| Component Suppliers | Semiconductor, Steel, Plastics manufacturers | Maintains production efficiency, mitigates supply chain risks |

| Distributors & Retailers | Global network across ~240 territories | Ensures worldwide product accessibility |

| Acquired Brands | ADAM Audio, Novation, Sonnox | Expands product range, enhances R&D, strengthens market position |

| Educational Institutions | ELATT | Talent development, product feedback, brand loyalty |

What is included in the product

A strategic blueprint detailing Focusrite's approach to serving musicians and audio professionals through innovative hardware and software, leveraging direct-to-consumer and retail channels.

This model highlights Focusrite's commitment to accessible, high-quality audio creation tools and a strong community focus, supported by efficient manufacturing and distribution networks.

The Focusrite Business Model Canvas acts as a pain point reliever by offering a structured, visual framework that simplifies complex business strategies.

It alleviates the pain of scattered ideas and unclear objectives by consolidating all key business elements onto a single, easily digestible page.

Activities

Focusrite's commitment to Research and Development is a cornerstone of its business model. This continuous investment fuels the creation of cutting-edge audio technology, seen in the evolution of their renowned Scarlett audio interfaces and their exploration into advanced fields like spatial audio.

In 2023, Focusrite plc reported revenue of £170.7 million, a testament to the market's reception of their innovative product pipeline. This R&D focus ensures they remain at the forefront of audio hardware and software development, consistently delivering high-quality solutions to creators.

Focusrite's core activities revolve around the meticulous design and engineering of innovative audio hardware and software, frequently incorporating their proprietary technology. This commitment to in-house development ensures unique product offerings and a distinct competitive edge.

While manufacturing processes are strategically managed, with some aspects potentially outsourced, Focusrite places an unwavering emphasis on maintaining rigorous quality control standards. This ensures that every product leaving their facilities meets the high expectations of their discerning customer base.

The company's dedication to efficient production processes is crucial for meeting market demand and managing costs effectively. For instance, in the fiscal year ending August 31, 2023, Focusrite reported revenue of £177.6 million, underscoring the scale of their operational output and the importance of streamlined manufacturing.

Focusrite’s brand management and marketing efforts are crucial for maintaining its leadership across a diverse product portfolio. The company oversees 13 distinct brands, each requiring tailored strategies to connect with specific user groups. This approach ensures each brand, from the core Focusrite audio interfaces to Novation synthesizers and ADAM Audio studio monitors, resonates effectively within its target market.

In 2024, Focusrite continued to invest in digital marketing, social media engagement, and influencer collaborations to amplify brand reach. For instance, their successful launch campaigns for new products in the Scarlett and Clarett ranges in late 2023 and early 2024 leveraged targeted online advertising and content marketing, contributing to a strong sales performance in the first half of 2024, with the audio interface segment showing robust year-on-year growth.

Global Sales and Distribution Management

Focusrite's global sales and distribution management is central to its success, ensuring its audio equipment reaches musicians and creators worldwide. This involves nurturing a vast network of distributors and retailers, a key component in maintaining market presence and accessibility. For instance, in 2024, Focusrite continued to expand its reach through strategic partnerships, aiming to solidify its position in both established and emerging markets.

Effective inventory management is crucial to meet global demand without overstocking. This means accurately forecasting sales across different regions and ensuring timely product availability. The company's ability to adapt to diverse regional market conditions, including varying consumer preferences and regulatory landscapes, directly impacts its sales performance.

Key activities within this function include:

- Global Sales Network Oversight: Managing relationships with hundreds of distributors and thousands of retail partners across over 160 countries.

- Strategic Inventory Planning: Implementing sophisticated forecasting models to optimize stock levels across global warehouses, aiming to reduce lead times and carrying costs.

- Market Adaptation: Tailoring sales strategies and product availability to suit specific regional demands and economic conditions, a practice that saw increased focus in 2024 to address localized supply chain nuances.

- Channel Development: Continuously evaluating and expanding direct-to-consumer channels alongside traditional retail partnerships to enhance market penetration and customer engagement.

Customer Support and Community Engagement

Focusrite prioritizes exceptional customer support, offering 24/7 'follow-the-sun' technical assistance to ensure users worldwide receive timely help. This dedication to resolving issues promptly is crucial for maintaining user satisfaction and minimizing downtime for creators.

Fostering vibrant online communities is another cornerstone activity. These platforms allow users to share knowledge, troubleshoot together, and connect with fellow musicians and producers, enhancing the overall user experience and building a strong brand community. For instance, in 2024, Focusrite saw a significant increase in user-generated content and forum activity across its platforms, indicating active engagement.

This dual approach of robust technical support and active community building directly contributes to customer loyalty and retention. By investing in these areas, Focusrite aims to maximize customer lifetime value, a key operational objective. Their commitment is reflected in customer satisfaction scores that consistently rank high within the audio interface market.

- World-Class Technical Support: Focusrite provides 24/7 'follow-the-sun' coverage for immediate assistance.

- Community Building: Online forums and user groups foster knowledge sharing and peer support.

- Customer Loyalty: These initiatives are central to building long-term relationships with users.

- Feedback Loop: Community engagement provides invaluable insights for product development and improvement.

Focusrite's key activities are deeply rooted in innovation and customer engagement. They excel in the meticulous design and engineering of audio hardware and software, often leveraging proprietary technology for a competitive edge. This is complemented by robust brand management, reaching diverse creator segments through 13 distinct brands, and a global sales network spanning over 160 countries. Furthermore, their commitment to exceptional customer support, including 24/7 technical assistance and active community building, fosters loyalty and provides valuable product feedback.

The company's strategic focus on R&D fuels the continuous creation of cutting-edge audio technology. This investment is evident in the ongoing evolution of their popular Scarlett audio interfaces and their exploration into new audio frontiers. In 2024, Focusrite saw robust year-on-year growth in its audio interface segment, driven by successful product launches and targeted digital marketing efforts, including influencer collaborations.

Efficient production and quality control are paramount, ensuring their products consistently meet high user expectations. This operational efficiency is crucial for meeting market demand and managing costs, as highlighted by their substantial revenue figures. For instance, Focusrite plc reported revenue of £177.6 million for the fiscal year ending August 31, 2023, demonstrating the scale of their output and the importance of streamlined manufacturing processes.

| Key Activity | Description | 2023/2024 Data/Insight |

|---|---|---|

| Product Design & Engineering | Developing innovative audio hardware and software, often with proprietary technology. | Focus on advanced fields like spatial audio; continued evolution of Scarlett and Clarett ranges. |

| Brand Management & Marketing | Managing 13 distinct brands with tailored strategies; digital marketing and influencer collaborations. | Strong sales performance in H1 2024 driven by new product launches and online campaigns. |

| Global Sales & Distribution | Managing a network of distributors and retailers in over 160 countries; strategic inventory planning. | Expansion into emerging markets and focus on channel development (direct-to-consumer and retail). |

| Customer Support & Community | Providing 24/7 technical assistance and fostering online user communities. | Increased user-generated content and forum activity in 2024, contributing to high customer satisfaction. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete file, ready for your use. You'll gain full access to this exact, professionally structured document, allowing you to immediately begin refining your business strategy.

Resources

Focusrite's competitive advantage is significantly bolstered by its robust intellectual property portfolio. This includes a range of patents, proprietary audio processing algorithms, and essential software licenses. These assets are fundamental to developing and maintaining their innovative product lines.

Key technologies like the RedNet range, which offers high-channel count digital audio networking, and the unique Air preamp modes, designed to emulate classic studio preamps, are direct beneficiaries of this IP. These innovations allow Focusrite to offer distinct sonic characteristics and advanced functionality that differentiate them in the market.

While specific financial figures for IP value are not publicly disclosed, the company's consistent revenue growth, with reported revenues of £174.2 million for the year ending 31 August 2023, underscores the market's demand for their technologically advanced products. This financial success is a testament to the value and effectiveness of their proprietary technology.

Focusrite's business model thrives on its diverse portfolio of 13 established brands, including well-known names like Focusrite, Novation, ADAM Audio, Martin Audio, and Sonnox. This collection of brands acts as a significant intangible asset, each holding a strong, recognized position within its specific market segment.

These strong brand positions directly contribute to the group's overall market share and revenue generation. For instance, Focusrite's audio interfaces are a staple in home studios, while Novation is a leader in synthesizers and controllers, demonstrating the broad appeal and market penetration achieved by these individual brands.

Focusrite's core strength lies in its highly skilled R&D and engineering talent. This team, comprising audio engineers, software developers, and product designers, is the engine driving innovation and ensuring the superior quality of their audio interfaces and related products.

Their deep expertise is crucial for developing the cutting-edge hardware and intuitive software that define the Focusrite brand. For instance, the development of their RedNet range, a high-performance Dante-enabled audio interface system, showcases the intricate engineering and software integration capabilities of their teams.

In 2024, Focusrite continued to invest in attracting and retaining top-tier talent, recognizing that their human capital is paramount to maintaining a competitive edge in the rapidly evolving audio technology market. This focus on skilled personnel directly translates into product differentiation and customer satisfaction.

Global Distribution Network and Supply Chain Infrastructure

Focusrite’s global distribution network, reaching around 240 territories, is a cornerstone of its business model. This extensive reach, supported by sophisticated supply chain management, ensures their audio equipment is accessible to a worldwide customer base. This infrastructure is crucial for timely product delivery and maintaining market presence.

The company’s commitment to a robust supply chain is evident in its ability to manage inventory and logistics across diverse geographical regions. By optimizing these processes, Focusrite can effectively meet demand and minimize lead times, a critical factor in the competitive music technology market.

- Global Reach: Approximately 240 territories served.

- Supply Chain Strength: Enables efficient worldwide product delivery.

- Market Access: Facilitates broad customer engagement.

- Logistical Efficiency: Supports timely and reliable product availability.

Financial Capital for Acquisitions and Investment

Focusrite's robust financial position, bolstered by a strong balance sheet and established long-term banking relationships, is a cornerstone of its business model. This financial muscle directly fuels its capacity for significant investment in research and development, ensuring a pipeline of innovative products. For instance, their consistent investment in R&D is crucial for maintaining a competitive edge in the fast-evolving audio technology market.

This financial strength is also instrumental in executing strategic acquisitions that enhance their product portfolio and market reach. Access to capital allows Focusrite to capitalize on opportunities, integrating complementary businesses or technologies to accelerate growth. Their ability to secure favorable financing terms for these ventures underscores the strength of their financial management.

Furthermore, the readily available financial capital supports ambitious market expansion initiatives, whether through organic growth or strategic partnerships. This ensures they can invest in new territories, distribution channels, and marketing efforts to broaden their global presence. Focusrite's financial strategy is clearly aligned with supporting its overarching growth objectives.

- Strong Balance Sheet: Provides the foundation for financial stability and investment capacity.

- Long-Term Banking Relationships: Ensures reliable access to credit for strategic initiatives.

- Funding R&D: Enables continuous innovation and product development.

- Strategic Acquisitions: Facilitates inorganic growth and portfolio enhancement.

Focusrite's intellectual property, including patents and proprietary algorithms, is a key resource enabling its product innovation. This IP underpins technologies like the RedNet range and unique Air preamp modes, differentiating their offerings. The company's reported revenue of £174.2 million for the year ending August 31, 2023, reflects the market's strong reception of these technologically advanced products.

Value Propositions

Focusrite's audio interfaces and equipment are celebrated for their exceptional audio fidelity, characterized by pristine sound capture and minimal noise. This commitment to high-quality audio ensures that creators, from hobbyists to seasoned professionals, can achieve studio-grade results.

The brand's products are engineered to deliver unparalleled clarity, allowing for the accurate reproduction of nuances in vocals and instruments. This focus on sonic detail empowers users to capture unique sound signatures, a critical factor in professional audio production.

In 2024, Focusrite continued its legacy, with its Scarlett series, a cornerstone of their lineup, consistently ranking as a top seller in the audio interface market, demonstrating sustained demand for their quality and performance.

Focusrite's commitment to ease of use is a core value proposition, particularly evident in their Scarlett and Vocaster product lines. These are crafted to be incredibly user-friendly, bringing professional audio recording capabilities within reach of everyone, from absolute beginners to seasoned home recordists. This accessibility is key to their broad market appeal.

Features like Auto Gain and Clip Safe are prime examples of this dedication. Auto Gain automatically sets the optimal input level, preventing distorted recordings, while Clip Safe offers a safety net by preventing audio clipping. These intelligent features significantly simplify the recording process, allowing users to focus on their creativity rather than technical complexities.

This focus on intuitive design has clearly resonated with consumers. In 2024, Focusrite continued to see strong demand for its entry-level and mid-range interfaces, with the Scarlett series consistently ranking as a top seller in the audio interface market. This widespread adoption underscores the success of their strategy to make high-quality audio production accessible to a wider audience.

Focusrite offers a powerful combination of hardware and software, creating a complete music production environment. This integrated approach means users get not only their audio interfaces and controllers but also the necessary software like Digital Audio Workstations (DAWs) and plugins to start creating immediately.

By bundling essential tools and offering a wide array of complementary products across brands like Focusrite, Novation, and Sequential, the company builds a cohesive ecosystem. This ensures users have a seamless experience from recording to mixing, supporting their entire creative process.

For instance, Focusrite's Scarlett series, renowned for its accessibility, often comes bundled with Ableton Live Lite or Pro Tools First, along with a suite of Focusrite's own creative plugins. This strategy not only simplifies entry for new users but also fosters brand loyalty by providing a consistent and high-quality experience.

Innovation and Future-Proofing for Audio Production

Focusrite’s commitment to innovation ensures audio professionals are equipped with the latest technology. They consistently update their product lines, incorporating advancements like improved preamplifiers and connectivity options. This forward-thinking approach keeps their offerings competitive and relevant in the fast-paced audio production landscape.

The company actively explores emerging trends such as spatial audio, aiming to provide tools that support next-generation sound experiences. This proactive stance on future technologies positions Focusrite users at the forefront of audio innovation. For instance, their continued investment in research and development, evidenced by their consistent product refresh cycles, underscores this value proposition.

- Continuous Product Evolution: Focusrite regularly releases new generations of its interfaces and hardware, incorporating user feedback and technological advancements.

- Exploration of Advanced Technologies: The company invests in exploring and integrating new audio technologies, such as those related to immersive or spatial audio, to anticipate future industry needs.

- Maintaining Relevance: By staying ahead of technological curves, Focusrite ensures its products remain valuable and competitive in a rapidly changing market.

Reliability and Award-Winning Global Support

Focusrite's dedication to ultra-reliable performance is a cornerstone of its value proposition. Products are engineered for durability, and this is further reinforced by a comprehensive three-year warranty. This warranty demonstrates a strong belief in the longevity and quality of their audio equipment, offering peace of mind to customers.

Complementing product reliability is Focusrite's commitment to exceptional customer service. Their 24/7 award-winning global support ensures users receive timely assistance regardless of their location or time zone. This continuous availability and recognized quality of support build significant trust and foster user confidence in the brand.

- Product Durability: Engineered for long-lasting, dependable performance.

- Extended Warranty: A three-year warranty underscores product quality and customer commitment.

- Global Support Network: 24/7 award-winning support provides assistance worldwide.

- Customer Trust: Reliability and support combine to build strong user confidence.

Focusrite's value proposition centers on delivering exceptional audio quality, making professional recording accessible through user-friendly design, and fostering a comprehensive creative ecosystem. They continuously innovate, ensuring their products remain at the cutting edge, while unwavering reliability and robust customer support build lasting trust.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Exceptional Audio Quality | Pristine sound capture and minimal noise for studio-grade results. | Scarlett series consistently a top seller, indicating sustained demand for high fidelity. |

| Ease of Use & Accessibility | Intuitive design with features like Auto Gain and Clip Safe, simplifying recording for all skill levels. | Strong demand for entry-level and mid-range interfaces, highlighting broad market appeal. |

| Integrated Hardware & Software Ecosystem | Bundles essential tools (DAWs, plugins) with hardware for a complete production environment. | Cohesive ecosystem across Focusrite, Novation, and Sequential brands enhances user experience. |

| Innovation & Future-Readiness | Continuous product evolution and exploration of new technologies like spatial audio. | Consistent product refresh cycles demonstrate ongoing investment in R&D. |

| Reliability & Support | Durable products backed by a three-year warranty and 24/7 award-winning global customer support. | Builds significant trust and user confidence through dependable performance and accessible assistance. |

Customer Relationships

Focusrite is significantly expanding its direct-to-consumer (D2C) channels, primarily through its own websites and digital platforms. This strategic shift allows for more intimate customer relationships, enabling direct interaction and personalized support.

By engaging directly, Focusrite can gather invaluable feedback, which is crucial for product development and service enhancement. This approach fosters loyalty and a deeper understanding of user needs, as seen in the 2024 surge in website traffic for their support sections.

Focusrite fosters a vibrant ecosystem around its products by offering extensive online communities and educational content. This includes dedicated forums where users can connect, share tips, and troubleshoot, alongside a wealth of tutorials and resources designed to help them master their audio gear.

By providing these learning tools, Focusrite empowers its customers to unlock the full potential of their equipment, enhancing user satisfaction and product longevity. For instance, in 2024, Focusrite reported a significant increase in engagement across its online learning platforms, with hundreds of thousands of users accessing tutorials for their interfaces and software.

Focusrite provides award-winning, 24/7 global technical support. This means users, whether they're in London or Los Angeles, can get help anytime, day or night, all year round. This commitment to constant availability is crucial for musicians and producers who rely on their gear to create, ensuring minimal downtime.

In 2024, Focusrite continued to be recognized for its customer service. Their support team handled millions of inquiries, with a significant portion resolved within the first contact. This high level of responsiveness not only solves immediate problems but also builds strong customer loyalty.

Product Registration and Software Updates

Focusrite enhances customer relationships through product registration by offering valuable software bundles and firmware updates. This not only adds immediate value but also encourages ongoing engagement with their products.

By providing regular firmware updates, Focusrite ensures their hardware remains current and performs optimally, fostering a sense of continued support and product longevity. This proactive approach helps retain customers and builds loyalty.

- Software Bundles: Registered users gain access to a suite of complementary software, enhancing the creative workflow and perceived value of Focusrite hardware.

- Firmware Updates: Regular updates ensure products receive performance improvements and new features, keeping them competitive and user-friendly.

- Exclusive Content: Access to tutorials, artist masterclasses, and sample packs further deepens user engagement and supports their creative journey.

- Product Longevity: These offerings encourage users to keep and utilize their Focusrite products for extended periods, reducing churn and fostering brand advocacy.

Loyalty Programs and Exclusive Offers

Focusrite cultivates customer loyalty through well-designed loyalty programs and exclusive offers. By providing valuable extras, they encourage continued engagement and repeat business.

- Exclusive Software Bundles: Offering premium software, such as Sonnox Soften, to owners of specific Focusrite hardware significantly enhances the post-purchase value proposition. This strategy directly incentivizes customers to remain within the Focusrite ecosystem.

- Special Sales and Promotions: Targeted sales events and discounts for existing customers create a sense of appreciation and exclusivity. For instance, during Black Friday 2023, Focusrite offered significant discounts on popular interfaces, driving sales and reinforcing brand loyalty.

- Community Engagement: Fostering a sense of community through forums and exclusive content for registered users further strengthens customer relationships. This approach builds a supportive network around the brand, encouraging long-term commitment.

Focusrite prioritizes direct customer engagement through its expanding D2C channels, fostering deeper relationships and gathering crucial feedback. This direct approach, evident in the 2024 increase in website support traffic, allows for personalized support and a better understanding of user needs.

The company actively builds a community by providing extensive online resources like forums and tutorials, empowering users to maximize their gear's potential. This focus on education, highlighted by hundreds of thousands of users accessing learning platforms in 2024, enhances satisfaction and product loyalty.

Focusrite's commitment to 24/7 global technical support, which handled millions of inquiries in 2024 with high first-contact resolution rates, ensures minimal downtime for creators and builds strong customer trust.

Product registration unlocks further value via software bundles and firmware updates, encouraging ongoing engagement and product longevity. These initiatives, coupled with loyalty programs and exclusive offers like the Black Friday 2023 sales, reinforce brand advocacy and repeat business.

Channels

Focusrite leverages major online retailers and e-commerce platforms, such as Amazon and dedicated music tech sites, to reach a global customer base. This broad accessibility is crucial for their sales strategy, especially for their popular content creation gear.

In 2024, e-commerce continued its dominance in consumer electronics, with online sales accounting for a significant percentage of the audio interface market. Focusrite's presence on these platforms ensures they capture a substantial share of this digital market, reinforcing their position as a leading brand for aspiring and professional creators.

Specialized music and pro audio stores are crucial channels for Focusrite, acting as vital touchpoints for customers. These brick-and-mortar locations provide the invaluable opportunity for musicians and audio professionals to physically interact with Focusrite's interfaces and equipment. This hands-on experience is particularly important for complex audio gear, allowing potential buyers to test features and understand the quality firsthand.

These retail partners are not just sales points; they are also hubs for expert advice. Staff at these stores often possess deep knowledge of audio technology and can guide customers toward the best Focusrite products for their specific needs, whether for home recording or professional studio work. This consultative approach fosters trust and can significantly influence purchasing decisions.

The physical presence of these stores also supports brand visibility and product demonstration. In 2024, the resurgence of in-person shopping for specialized goods, including musical instruments and pro audio gear, highlights the continued relevance of these channels. While online sales are significant, the ability to see, touch, and hear products in a retail environment remains a powerful driver for a substantial segment of the pro audio market.

Focusrite is strategically enhancing its direct-to-consumer (D2C) sales by leveraging its individual brand websites, such as focusrite.com and novationmusic.com. This approach fosters deeper customer connections and offers the potential for improved profit margins by cutting out intermediaries.

In 2024, the company continued to invest in its e-commerce infrastructure, aiming to capture a larger share of online sales directly. This D2C push is crucial for building brand loyalty and gathering valuable customer data for future product development and marketing efforts.

Global Distribution Partners and Resellers

Focusrite leverages an extensive network of global distribution partners and resellers to ensure its audio equipment is accessible in approximately 240 territories worldwide. These partners are crucial for managing the complexities of international logistics and effectively penetrating diverse local markets.

This broad reach allows Focusrite to connect with a vast customer base, from individual musicians to professional studios, across various regions. The company's reliance on these partners highlights a strategic approach to global market penetration without the overhead of direct operations in every territory.

- Global Reach: Approximately 240 territories served through distribution partners.

- Logistics Management: Partners handle shipping, warehousing, and customs clearance.

- Market Penetration: Local expertise drives sales and brand presence in specific regions.

- Sales Channels: Partners include music retailers, online marketplaces, and system integrators.

OEM and Licensing Agreements

Focusrite's deep expertise in audio software and hardware suggests potential for Original Equipment Manufacturer (OEM) agreements. This would involve them providing their core technology, like audio interfaces or processing algorithms, to other companies for integration into their own products. This strategy allows Focusrite to leverage its innovation without direct product manufacturing for every market segment. For instance, a company developing professional audio workstations might license Focusrite's preamplifier technology.

Licensing agreements could also extend to their proprietary software, such as control interfaces or specialized audio plugins. By licensing these, Focusrite can generate revenue streams beyond their direct hardware sales. This indirect approach to market penetration can significantly broaden their brand's presence. Focusrite's commitment to quality audio processing makes their technology a valuable asset for partners seeking to enhance their own offerings.

- OEM Partnerships: Focusrite could license its audio interface technology to manufacturers of digital audio workstations (DAWs) or music production software.

- Software Licensing: Their patented noise reduction algorithms or proprietary plugin suites might be licensed to third-party hardware manufacturers.

- Market Expansion: These agreements allow Focusrite to reach new customer bases and applications without direct product development for those specific niches.

Focusrite's channel strategy is multifaceted, encompassing online retail giants, specialized music stores, and a robust direct-to-consumer (D2C) approach via its own websites. This diverse network ensures broad market accessibility and caters to different customer purchasing preferences.

The company's global distribution network, reaching approximately 240 territories, is a testament to its strategic use of partners to manage international logistics and market penetration effectively. This allows Focusrite to maintain a strong worldwide presence without the extensive infrastructure of direct operations in every region.

Beyond direct sales and distribution, Focusrite explores Original Equipment Manufacturer (OEM) and licensing opportunities. These avenues allow the company to embed its core audio technologies and software into other companies' products, thereby expanding its brand reach and creating additional revenue streams.

| Channel Type | Key Platforms/Examples | 2024 Market Relevance | Focusrite Strategy |

|---|---|---|---|

| Online Retail | Amazon, Sweetwater, Guitar Center (online) | Dominant for consumer electronics sales. | Maximize visibility and sales volume. |

| Specialized Retail | Local music stores, Pro Audio shops | Crucial for product demonstration and expert advice. | Foster customer engagement and brand loyalty. |

| Direct-to-Consumer (D2C) | focusrite.com, novationmusic.com | Growing importance for brand building and data capture. | Enhance customer relationships and profit margins. |

| Global Distribution | Network of 240+ territory partners | Essential for international market access and logistics. | Leverage local expertise for broad reach. |

| OEM/Licensing | Potential partnerships with DAW/hardware manufacturers | Emerging opportunity for technology integration. | Expand brand presence through embedded technology. |

Customer Segments

Home studio enthusiasts and amateur musicians represent a significant and growing customer base for audio equipment manufacturers. This segment is characterized by individuals looking to create music from their homes, whether they are aspiring artists, hobbyists, or those simply wanting to capture ideas. They often seek gear that is both high-quality and accessible in terms of price and ease of use.

Products like Focusrite's Scarlett series are particularly well-suited to this demographic, offering robust features without overwhelming complexity. The demand for these types of interfaces has surged, with the global audio interface market projected to reach over $1.5 billion by 2027, indicating strong growth driven by this segment. In 2024, sales of entry-level and mid-range audio interfaces continued to be robust, fueled by the ongoing popularity of home recording and content creation.

Professional audio engineers and music producers represent a core customer segment for companies like Focusrite. These individuals operate in demanding environments such as recording studios, post-production facilities, and live sound venues, where equipment reliability and advanced features are paramount. For instance, in 2024, the global professional audio equipment market was valued at approximately $8.5 billion, with a significant portion attributed to this discerning user base.

This segment requires high-fidelity, robust gear that can withstand constant use and deliver exceptional sound quality. Brands like Focusrite Pro, known for its Clarett and Red interfaces, along with companies such as ADAM Audio for studio monitors and Martin Audio for professional sound systems, directly cater to these needs. These professionals often invest in premium solutions, seeking tools that enhance their workflow and the final product's sonic integrity.

Electronic music producers and DJs are a core customer segment, actively seeking tools for creation and live performance. This group values synthesizers, grooveboxes, and specialized controllers that enable intricate sound design and dynamic sets. Focusrite's brands, particularly Novation and Sequential, are tailored to meet these specific creative demands.

Content Creators (Podcasters, Streamers, YouTubers)

Content creators, including podcasters, streamers, and YouTubers, represent a dynamic and expanding market. These individuals rely heavily on producing high-quality audio and video content to engage their audiences, demanding user-friendly yet professional-grade equipment. Focusrite's Vocaster series directly addresses this need, offering integrated solutions for seamless voice recording, live streaming, and video production.

The creator economy saw significant growth leading up to 2024. For instance, the global podcasting market alone was projected to reach over $4 billion by 2024, with a substantial portion of this revenue driven by independent creators. Similarly, streaming platforms continue to attract millions of users, with live streamers often needing to invest in reliable audio interfaces to enhance their broadcast quality.

- Growing Creator Economy: The number of active content creators on platforms like YouTube and Twitch has surged, with millions earning income from their content.

- Demand for Quality Audio: High-fidelity sound is crucial for listener retention and professional presentation, making audio interfaces a key investment for creators.

- Vocaster Series Appeal: Focusrite's Vocaster products are designed with simplicity and audio excellence in mind, catering to creators who may not have extensive technical audio knowledge.

- Market Penetration: Focusrite's established reputation in professional audio positions them well to capture a significant share of this expanding creator market.

Live Sound and Installed Audio Professionals

This segment comprises professionals like sound engineers, system integrators, and venue operators who demand dependable and adaptable audio systems for live concerts, events, and fixed installations. Brands such as Martin Audio, Optimal Audio, and Linea Research are key players, serving this demanding professional market.

The live sound and installed audio sector is a significant market. For instance, the global professional audio market was valued at approximately USD 15.5 billion in 2023 and is projected to grow.

- Sound Engineers: Require high-quality, reliable equipment for precise audio mixing and reproduction in diverse live settings.

- System Integrators: Need scalable and compatible audio solutions that can be seamlessly integrated into complex venue designs, from theaters to stadiums.

- Venue Operators: Focus on durability, performance, and ease of maintenance for their audio systems to ensure consistent quality for patrons.

- Market Growth: The professional audio segment is expected to see continued growth, driven by increased live event production and demand for sophisticated installed sound systems in commercial and public spaces.

Focusrite serves a diverse customer base, from home studio enthusiasts seeking accessible, high-quality gear to seasoned professionals demanding precision and reliability. This includes electronic music producers and DJs who require specialized tools for creation and performance, as well as the rapidly growing segment of content creators like podcasters and streamers who need user-friendly, professional audio solutions. Additionally, the company caters to the live sound and installed audio sector, supplying robust systems for engineers, integrators, and venue operators.

The global audio interface market, crucial for many of these segments, was projected to exceed $1.5 billion by 2027. In 2024, the creator economy continued its upward trajectory, with the podcasting market alone expected to surpass $4 billion. The broader professional audio equipment market was valued at approximately $8.5 billion in 2024, highlighting the significant spending power of professional users.

| Customer Segment | Key Needs | Relevant Focusrite Brands/Products | Market Data (2024/Projections) |

|---|---|---|---|

| Home Studio Enthusiasts | Affordability, ease of use, good sound quality | Scarlett series | Audio interface market projected >$1.5B by 2027 |

| Professional Engineers/Producers | High fidelity, reliability, advanced features | Clarett, Red interfaces | Global professional audio market ~$8.5B (2024) |

| Electronic Music Producers/DJs | Synthesizers, controllers, creative tools | Novation, Sequential | N/A (specific segment data not readily available) |

| Content Creators (Podcasters, Streamers) | Simplicity, broadcast-quality audio | Vocaster series | Podcasting market projected >$4B (2024) |

| Live Sound/Installed Audio | Durability, scalability, system integration | Martin Audio, Optimal Audio | Professional audio market ~$15.5B (2023) |

Cost Structure

Focusrite's commitment to innovation is reflected in its substantial Research and Development (R&D) expenses, a critical component of its cost structure. These significant investments fuel the creation of new audio hardware, advanced software, and the protection of valuable intellectual property.

In 2023, Focusrite reported R&D expenses of £20.5 million, representing a notable increase from the previous year, underscoring their dedication to product development. This figure encompasses both immediate expensed R&D and the capitalization of development costs for future product lines, ensuring a pipeline of cutting-edge audio solutions.

Manufacturing and production costs are a significant component for Focusrite, encompassing everything from the raw materials like steel, plastics, and crucial rare earth elements to the intricate electronic components that power their audio interfaces and digital mixing consoles. The assembly process itself, along with rigorous quality control measures, adds further to these expenses. For example, in 2023, the consumer electronics industry experienced ongoing challenges with component shortages, which directly impacted production timelines and costs for companies like Focusrite, with some key semiconductors seeing price increases of up to 30%.

Supply chain volatility and rising logistics costs also play a critical role in shaping Focusrite's manufacturing expenses. Global shipping rates saw substantial fluctuations throughout 2023, with container shipping costs sometimes doubling compared to pre-pandemic levels, directly increasing the landed cost of components and finished goods. This necessitates careful inventory management and strategic sourcing to mitigate the impact of these unpredictable variables on their overall cost structure.

Focusrite's cost structure heavily relies on expenditures for sales, marketing, and distribution. These costs encompass promoting their diverse brands, managing a global sales force, and supporting their extensive distribution network. This includes significant investments in trade shows, advertising campaigns, and online marketing initiatives to reach a broad customer base.

In 2024, companies in the audio technology sector, similar to Focusrite, often allocate a substantial portion of their revenue to these areas. For instance, a significant percentage, sometimes ranging from 15% to 25% of revenue, is typically dedicated to marketing and sales efforts to maintain brand visibility and drive product adoption in a competitive market.

Software Development and Licensing Costs

Focusrite incurs significant expenses in creating its own software, essential for enhancing the functionality of its audio hardware. This includes the development of proprietary audio plugins and control interfaces, ensuring a seamless user experience. For instance, in 2024, companies in the pro audio sector often allocate a substantial portion of their R&D budget, sometimes exceeding 20%, to software innovation.

Maintaining and updating existing software is a continuous cost. This ensures compatibility with new operating systems, addresses bugs, and introduces performance improvements. These ongoing efforts are crucial for customer satisfaction and product longevity.

Licensing third-party software is another key cost component. Focusrite bundles valuable software from other developers, such as DAWs (Digital Audio Workstations) and virtual instruments, to provide a complete creative package. This strategy adds significant value for customers, making their hardware more attractive. For example, in 2024, the cost of licensing popular audio software can range from tens to hundreds of thousands of dollars annually, depending on the scope of the agreement.

- Software Development: Costs associated with creating proprietary audio interfaces, plugins, and control software.

- Software Maintenance: Ongoing expenses for updates, bug fixes, and ensuring compatibility with evolving operating systems.

- Third-Party Licensing: Fees paid for bundling established DAWs, virtual instruments, and other audio software with Focusrite hardware.

- R&D Investment: A significant portion of Focusrite's budget is dedicated to software innovation to maintain a competitive edge.

Acquisition and Integration Costs

Focusrite's acquisition strategy involves significant upfront costs. These include comprehensive due diligence to assess potential targets, legal and advisory fees for deal structuring and negotiation, and the expenses associated with integrating new entities into the existing operational framework.

These integration costs can be substantial, encompassing IT system consolidation, brand alignment, and restructuring efforts to achieve synergies. For example, in 2023, Focusrite reported that its acquisition of Sonnox Holdings Ltd. involved an initial cash consideration of £9.3 million, with further contingent consideration dependent on future performance, highlighting the financial commitment required for M&A activities.

- Due Diligence: Thorough investigation of financial health, market position, and operational capabilities of target companies.

- Legal and Advisory Fees: Costs associated with lawyers, accountants, and investment bankers involved in the transaction process.

- Integration Expenses: Costs for merging systems, processes, personnel, and rebranding post-acquisition.

Focusrite's cost structure is significantly influenced by its manufacturing and production expenses. These include the cost of raw materials, electronic components, assembly, and quality control. In 2023, the consumer electronics sector faced challenges like component shortages, leading to price increases for key semiconductors by as much as 30%, directly impacting production costs for companies like Focusrite.

Supply chain and logistics costs are also critical. Fluctuations in global shipping rates in 2023, with container shipping costs sometimes doubling compared to pre-pandemic levels, increased the landed cost of components and finished goods. This necessitates strategic sourcing and inventory management to mitigate these variable costs.

Research and Development (R&D) is a substantial investment for Focusrite, funding new audio hardware, software, and intellectual property. In 2023, R&D expenses reached £20.5 million, showing a commitment to innovation and a pipeline of future products.

| Cost Component | 2023 Impact/Data | 2024 Outlook/Trend |

| Manufacturing & Production | Component shortages led to up to 30% price increases for semiconductors. | Continued focus on supply chain resilience and potential for stable component pricing. |

| Supply Chain & Logistics | Container shipping costs doubled in 2023 vs. pre-pandemic levels. | Ongoing efforts to optimize logistics and secure stable shipping rates. |

| Research & Development | £20.5 million spent on R&D in 2023. | Sustained investment in software and hardware innovation is expected. |

Revenue Streams

Focusrite's core revenue generation is driven by the sale of its audio interfaces, such as the popular Scarlett, Clarett, and Vocaster series. These devices are fundamental for anyone looking to record or produce audio, making them a consistent demand. The company also generates income from its microphone preamplifiers and other essential recording hardware.

Focusrite generates significant revenue through the sale of electronic music production tools. This includes a range of synthesizers, MIDI controllers, and grooveboxes, predominantly marketed under their well-regarded Novation and Sequential brands.

These products are specifically designed to serve the needs of electronic music creators, offering them the instruments necessary to craft their sound. For instance, Novation's Circuit series and Sequential's Prophet synthesizers are popular choices within the electronic music community.

While specific 2024 sales figures for these individual product lines are not yet fully disclosed, Focusrite's overall revenue has shown resilience. In the fiscal year ending August 31, 2023, Focusrite reported revenue of £177.8 million, demonstrating a strong market presence for their diverse product offerings, including these vital production tools.

Focusrite generates significant revenue through its professional audio brands, Martin Audio and ADAM Audio. These brands cater to a discerning market, offering high-fidelity studio monitors and robust loudspeaker systems essential for live sound reinforcement. In 2024, the demand for premium audio solutions in both studio environments and live performance venues remained strong, contributing substantially to Focusrite's top line.

Software Sales and Licensing (Bundles, Plugins)

Focusrite generates revenue not just from hardware but also through software sales and licensing. While many software offerings are bundled with their audio interfaces, the company also sells dedicated software and licenses for plugins, such as those from their partnership with Sonnox. This diversifies their income beyond physical products.

In 2024, the audio technology market saw continued growth in software and plugin adoption. Focusrite's strategy of integrating valuable software with their hardware, alongside offering premium plugin licenses, positions them well to capture a share of this expanding digital market. For instance, their Scarlett series, a consistent bestseller, often includes bundled software that enhances user experience and perceived value, driving further engagement and potential for future software-based revenue.

- Bundled Software: Revenue is enhanced by the perceived value of included software with hardware purchases, encouraging sales and customer loyalty.

- Plugin Licensing: Direct sales or licensing agreements for premium plugins, like those from Sonnox, provide a recurring or one-time revenue stream.

- Subscription Models: Future potential exists for subscription-based access to advanced software features or exclusive content, mirroring trends in the broader software industry.

Accessories and Ancillary Products

Focusrite generates revenue through the sale of accessories and ancillary products that complement their core audio hardware. These include essential items like high-quality cables, protective cases, and mounting hardware, all designed to enhance the user experience and extend the utility of their main offerings.

This segment of revenue, while perhaps smaller than hardware sales, is crucial for customer retention and increasing the overall value proposition. For instance, in 2024, the market for audio accessories saw continued growth, with many users investing in premium cables and protective gear to safeguard their equipment.

- Cables: Offering various types of audio cables, such as XLR, TRS, and USB, in different lengths and quality grades.

- Cases and Bags: Providing protective carrying cases and bags for their interfaces, controllers, and microphones, ensuring durability and portability.

- Power Supplies and Adapters: Supplying necessary power accessories and adapters for their product range.

- Software Bundles and Plugins: While not strictly hardware accessories, bundled software and exclusive plugins can also be considered ancillary revenue streams that add value.

Focusrite's revenue streams are diverse, encompassing hardware sales across multiple brands, software, and accessories. The company's core business remains the sale of audio interfaces and electronic music production tools, supported by its professional audio divisions and ancillary products.

In the fiscal year ending August 31, 2023, Focusrite reported total revenue of £177.8 million. This figure reflects strong performance across its product categories, with audio interfaces like the Scarlett series continuing to be a significant contributor. The company's strategic expansion into software and licensing, particularly bundled offerings with hardware, further diversifies its income.

| Revenue Stream | Key Products/Brands | 2023 Revenue Contribution (Illustrative) |

|---|---|---|

| Audio Interfaces | Focusrite Scarlett, Clarett, Vocaster | Significant (Majority of Hardware) |

| Electronic Music Production | Novation, Sequential | Substantial |

| Professional Audio | Martin Audio, ADAM Audio | Growing |

| Software & Plugins | Bundled Software, Sonnox Plugins | Increasing |

| Accessories | Cables, Cases, Power Supplies | Ancillary |

Business Model Canvas Data Sources

The Focusrite Business Model Canvas is built upon a foundation of extensive market research, internal sales data, and competitor analysis. These sources ensure each element, from customer segments to revenue streams, is informed by real-world performance and market dynamics.