Focusrite Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Focusrite Bundle

Focusrite navigates a dynamic audio technology landscape, facing moderate buyer power from discerning musicians and content creators. The threat of new entrants is significant, given the accessibility of audio software and the potential for innovative hardware designs.

The complete report reveals the real forces shaping Focusrite’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Focusrite's supplier power is significantly shaped by the concentration of manufacturers for specialized electronic components. Critical parts like Digital-to-Analog Converters (DACs) and Analog-to-Analog Converters (ADCs) are vital for their audio interfaces. If a limited number of suppliers can provide these high-quality, specialized components, they gain considerable leverage. This leverage can translate into higher prices and less favorable supply terms, directly impacting Focusrite's production expenses and profit margins.

Focusrite faces moderate switching costs when dealing with its suppliers. For highly specialized or custom-engineered components, the process of finding a new supplier, validating their parts, and re-certifying them can be a substantial undertaking, impacting production timelines and costs.

This complexity can foster a degree of reliance on established suppliers, particularly for key components in their audio interfaces and digital mixing consoles. For example, the integration of proprietary digital signal processing chips or unique analog-to-digital converters might necessitate lengthy and costly re-development if a supplier relationship were to change.

In 2024, Focusrite reported that its cost of goods sold was £130.7 million. While specific supplier switching costs aren't broken out, the need for rigorous testing and potential re-engineering for critical components suggests that these costs are a material consideration in supplier relationships.

The uniqueness of inputs is a key factor influencing supplier bargaining power. If a supplier offers proprietary chipsets or specialized audio processing technologies that are difficult for others to replicate, they gain significant leverage. For instance, if a critical component is only available from a single source, Focusrite's ability to negotiate favorable terms diminishes.

When suppliers provide unique or highly advanced components that are hard to substitute, Focusrite has less negotiation power. This reliance on specialized inputs can drive up costs and limit flexibility. For example, in 2024, the global semiconductor shortage highlighted how dependence on unique chips can empower suppliers, impacting production timelines and pricing for many electronics manufacturers, including those in the audio industry.

However, Focusrite's own investment in research and development, particularly in proprietary audio processing algorithms and intellectual property, can help to mitigate this supplier power. By developing in-house expertise and unique technologies, Focusrite can reduce its dependence on external suppliers for critical differentiation, thereby strengthening its own position in the value chain.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into audio product manufacturing, essentially competing directly with Focusrite, is generally minimal. This is because establishing a strong brand, building extensive distribution channels, and providing robust customer service demand substantial investment, areas where Focusrite has already cultivated significant strength and recognition.

While large technology corporations that supply essential components could theoretically venture into this space, such a move is less probable for specialized pro-audio components. These niche markets often lack the scale to attract major component manufacturers seeking broader market penetration.

- Supplier Forward Integration Threat: Generally low for Focusrite due to high barriers to entry in brand building and distribution.

- Niche Market Defense: Specialized pro-audio components are less likely targets for large technology conglomerates.

- Focusrite's Established Position: The company's existing brand equity and distribution networks act as a significant deterrent.

Importance of Focusrite to Suppliers

Focusrite's position as a customer significantly influences the bargaining power of its suppliers. If Focusrite constitutes a large percentage of a supplier's total sales, that supplier is likely to offer more favorable pricing and prioritize Focusrite's orders to maintain a valuable business relationship. For instance, if a key component supplier, like a manufacturer of high-quality audio converters, derives 20% of its annual revenue from Focusrite, they have a strong incentive to keep Focusrite satisfied.

Conversely, if Focusrite represents a minor portion of a supplier's business, the supplier can afford to be less accommodating. In such scenarios, the supplier may have less motivation to negotiate on price or delivery schedules, thereby increasing their bargaining power. This dynamic is common when dealing with suppliers of more commoditized electronic components where Focusrite might be one of many clients.

- Revenue Dependence: Suppliers heavily reliant on Focusrite's business are more likely to offer competitive terms.

- Client Size: Focusrite's importance as a customer directly correlates to its leverage with suppliers.

- Supplier Market Share: If Focusrite is a significant buyer for a specific supplier, that supplier's power is diminished.

- Component Importance: The criticality of the supplied component also plays a role; unique or specialized components grant suppliers more leverage.

The bargaining power of suppliers for Focusrite is influenced by the concentration of specialized component manufacturers and the switching costs involved. If a few suppliers dominate the market for critical parts like high-quality converters, they can command higher prices and dictate terms, impacting Focusrite's production costs.

Focusrite's reliance on unique or proprietary components, such as specialized audio processing chips, further strengthens supplier leverage. The cost and time required to find and integrate alternative suppliers for these specialized inputs can be substantial, limiting Focusrite's negotiation flexibility.

In 2024, Focusrite's cost of goods sold reached £130.7 million, highlighting the financial impact of supplier relationships. While specific switching costs are not detailed, the need for rigorous testing and potential re-engineering for critical components suggests these are significant factors influencing supplier power.

| Factor | Impact on Focusrite | Supporting Data/Example |

| Supplier Concentration | High for specialized components | Limited number of manufacturers for high-quality DACs/ADCs |

| Switching Costs | Moderate to High for critical parts | Re-certification and potential re-engineering needed for new suppliers |

| Uniqueness of Inputs | Increases supplier power | Proprietary chipsets or unique audio technologies |

| Focusrite's Customer Importance | Variable | Depends on Focusrite's share of a supplier's revenue |

What is included in the product

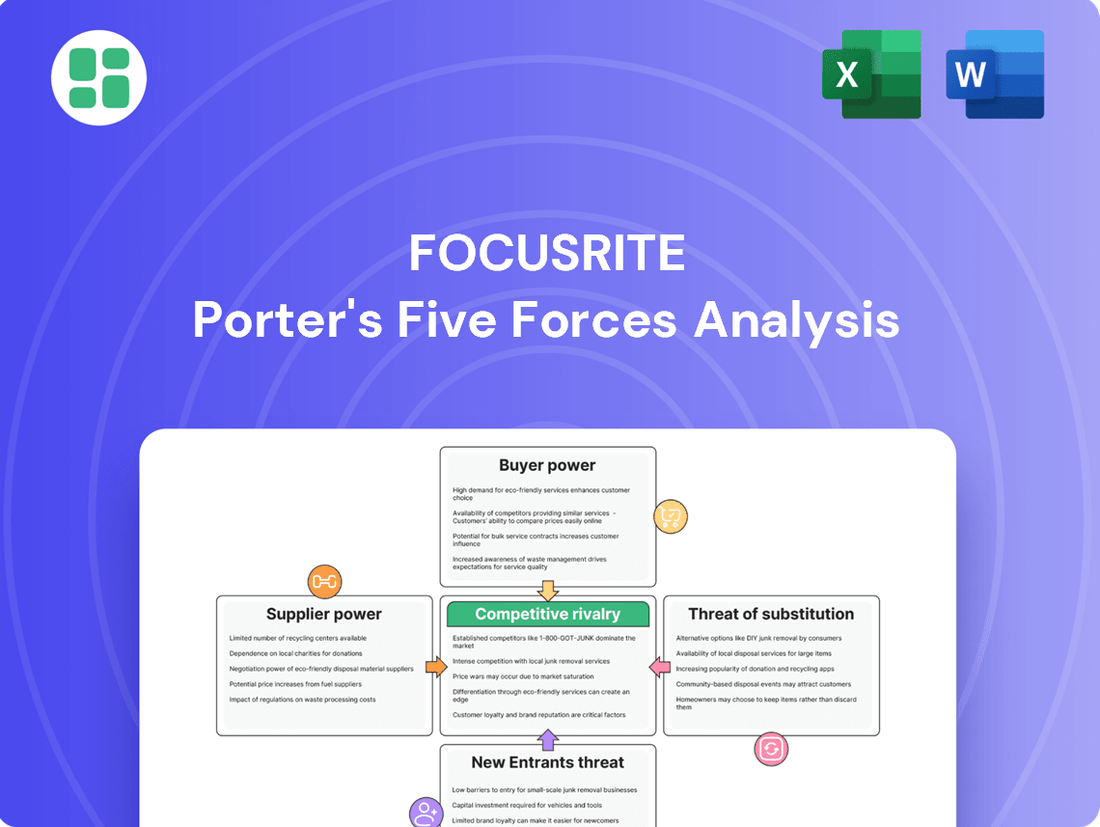

This analysis dissects the competitive forces impacting Focusrite, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the audio equipment market.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, allowing for rapid assessment of market dynamics and strategic positioning.

Customers Bargaining Power

Customer price sensitivity in the music and audio products market is a key factor for Focusrite. Home recording enthusiasts, often on tighter budgets, tend to be more price-sensitive. This segment looks for good value and may opt for more affordable alternatives if prices are too high.

However, professional studios and seasoned musicians often prioritize performance, sound quality, and reliability over sheer cost. These customers are less sensitive to price, especially for high-end equipment where brand reputation and advanced features justify a higher investment. This allows Focusrite to differentiate and potentially command premium pricing for its professional-grade interfaces and equipment. For instance, in 2024, the average price for a professional audio interface from a leading brand could range from $300 to over $1000, reflecting this tiered sensitivity.

The growing accessibility of free or inexpensive music creation software, alongside integrated audio capabilities in computers and mobile devices, presents customers with viable alternatives. This is particularly true for individuals just starting out in music production, who may find these options sufficient, thereby enhancing their bargaining power.

However, for those pursuing professional-level audio recording and production, the specialized features and superior quality delivered by Focusrite's hardware and software significantly diminish the attractiveness of these more basic substitutes. This differentiation is key to maintaining Focusrite's market position.

Focusrite's diverse customer base, spanning roughly 240 territories and encompassing individual musicians, professional studios, and educational bodies, significantly dilutes individual buyer power. This wide distribution means no single customer or small cluster of customers can exert substantial influence over Focusrite's pricing or terms.

Switching Costs for Customers

Switching costs for customers in the audio interface market, particularly for professional users, can be a significant factor. These users often invest heavily in a specific ecosystem, integrating hardware and software that forms the backbone of their established workflows. For instance, a studio relying on a particular brand's drivers and control software might face considerable disruption and expense if they were to switch to a competitor. This integration means that simply changing the audio interface might necessitate updating or replacing other compatible components, adding to the overall cost and complexity of a transition.

Compatibility issues are a major hurdle. New hardware might not seamlessly integrate with existing plugins, digital audio workstations (DAWs), or even operating system versions that have been optimized for the current setup. Furthermore, the learning curve associated with mastering a new interface's features, routing options, and bundled software can be time-consuming and potentially impact productivity, especially for busy professionals. These factors collectively reduce the bargaining power of customers by making it less appealing or more costly to switch brands.

- High Integration: Professional audio setups often involve deep integration of hardware and software from a single manufacturer, creating a sticky ecosystem.

- Learning Curves: Acquiring proficiency with new interfaces and their associated software requires time and effort, which can be a deterrent.

- Cost of Replacement: Beyond the interface itself, customers may need to replace other compatible gear or software licenses, increasing the financial burden of switching.

- Workflow Disruption: Changing brands can disrupt established production workflows, potentially impacting project timelines and creative output.

Buyer Information Availability

Buyer information availability significantly bolsters customer bargaining power in the audio equipment market. With readily accessible online reviews, detailed product comparisons, and active user forums, customers are more empowered than ever to research and understand the features, pricing, and performance of various audio interfaces and related products. This increased transparency allows them to make highly informed purchasing decisions, directly influencing their expectations and demands for value.

For instance, the proliferation of tech review sites and YouTube channels dedicated to audio gear means that a new Focusrite Scarlett 2i2, a popular audio interface, can be compared feature-by-feature with competitors like the PreSonus AudioBox or the Universal Audio Volt. This ease of access to detailed information, often including real-world performance tests and user feedback, shifts power towards the buyer. They can easily identify the best price-to-performance ratio, pushing manufacturers to offer competitive pricing and superior product development to stand out.

- Informed Decision-Making: Customers can easily compare specifications, pricing, and user reviews for audio interfaces like Focusrite Scarlett models against competitors.

- Price Transparency: Online marketplaces and comparison tools make it simple for buyers to find the lowest prices and identify deals, increasing pressure on sellers to be competitive.

- Feature Comparison: Detailed online resources allow consumers to evaluate technical specifications, software bundles, and connectivity options, leading to more discerning purchases.

- Demand for Value: Enhanced buyer knowledge translates into a greater demand for products that offer superior performance, features, and customer support at a competitive price point.

Focusrite faces moderate bargaining power from its customers, largely influenced by price sensitivity and the availability of information. While professional users may exhibit lower price sensitivity due to a focus on quality and workflow integration, the broader market, especially home recordists, actively seeks value. The increasing availability of detailed online comparisons and reviews in 2024 empowers these buyers to make informed decisions, putting pressure on manufacturers to offer competitive pricing and robust features.

Full Version Awaits

Focusrite Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Focusrite Porter's Five Forces Analysis, detailing competitive rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes, is precisely what you will receive upon purchase, offering immediate strategic insights.

Rivalry Among Competitors

The music and audio products market is quite crowded, with many companies vying for attention. You'll find big electronics players alongside niche manufacturers focusing specifically on professional audio gear. This means there's a wide variety of companies to consider when looking at competition.

Some of the key players you'll see include Universal Audio, known for its high-end interfaces and plugins, and PreSonus, which offers a broad range of audio equipment from interfaces to studio monitors. Behringer is another significant competitor, often recognized for its more budget-friendly options, while RME is respected for its robust driver stability and high-quality converters. Arturia brings a blend of hardware synths and audio interfaces, and Audient provides professional-grade recording consoles and interfaces. Yamaha, a giant in the musical instrument and electronics world, also has a strong presence in the audio interface and recording equipment market.

The music production software market is quite robust, with forecasts suggesting a compound annual growth rate (CAGR) between 6.5% and 8.36% for the period spanning 2024 to 2025. Similarly, the professional audio equipment sector is also demonstrating consistent expansion, reflecting a healthy overall demand for tools used in music creation.

However, this broad market strength doesn't tell the whole story for every player. Focusrite, for instance, experienced a downturn in its Content Creation division during fiscal year 2024. This was characterized by market weakness and significant de-stocking efforts, highlighting that even within a growing industry, specific segments or product lines can encounter considerable headwinds.

Focusrite's competitive strength is amplified by its portfolio of 13 distinct brands, including well-respected names like Focusrite, Novation, and ADAM Audio. These brands carry a strong reputation for quality and a deep history, which cultivates significant brand loyalty among their user base.

The company actively differentiates its products through continuous innovation, delivering superior audio quality, and seamless integration with user-friendly software. This strategic approach helps Focusrite maintain a distinct advantage over its competitors in the market.

High Fixed Costs and Exit Barriers

The audio hardware and software sector often demands substantial upfront investment. Companies face significant fixed costs for research and development, sophisticated manufacturing plants, and establishing widespread distribution channels. For instance, developing a new flagship audio interface can cost millions in R&D alone.

These high fixed costs, coupled with considerable exit barriers like specialized machinery and substantial brand equity built over years, can amplify competitive rivalry. Companies are incentivized to maintain high production volumes to spread these costs, leading to intense competition for market share and capacity utilization.

- Significant R&D Investment: Companies like Focusrite invest heavily in R&D to stay competitive, with annual R&D spending often representing a notable percentage of revenue.

- Manufacturing Scale: Achieving economies of scale in manufacturing audio equipment is crucial for cost competitiveness, making it difficult for new entrants without substantial capital.

- Brand Loyalty and Reputation: Established brands have built trust and loyalty, creating a barrier for new players attempting to capture market share.

- Specialized Assets: The need for specialized manufacturing equipment and testing facilities represents a significant capital commitment, increasing exit barriers.

Strategic Stakes and Acquisitions

Companies in the audio technology sector frequently pursue strategic acquisitions to broaden their product ranges and increase their market presence. This trend is clearly visible with Focusrite's recent strategic moves. For instance, their acquisitions of Innovate Audio and OutBoard/TiMax significantly enhanced their capabilities in immersive audio technologies.

This active mergers and acquisitions (M&A) landscape underscores the high strategic stakes involved for players in this market. Such consolidation and diversification efforts can intensify competitive rivalry as firms grow their market share and technological portfolios.

- Focusrite's Acquisitions: Innovate Audio and OutBoard/TiMax were acquired to strengthen immersive audio capabilities.

- Market Expansion: M&A activity aims to expand product portfolios and overall market reach.

- Heightened Rivalry: Consolidation and diversification through acquisitions can lead to increased competition.

- Strategic Importance: The high level of M&A activity indicates significant strategic importance for market leadership.

Competitive rivalry in the music and audio products market is intense, driven by numerous players from large electronics conglomerates to specialized audio manufacturers. Focusrite itself competes with established brands like Universal Audio, PreSonus, Behringer, RME, Arturia, Yamaha, and others, each offering distinct product lines and market positioning.

The market is characterized by high fixed costs in R&D and manufacturing, encouraging companies to pursue high volumes and leading to aggressive competition for market share. This is further fueled by strategic acquisitions aimed at expanding product portfolios and market reach, as seen with Focusrite's acquisitions of Innovate Audio and OutBoard/TiMax.

Despite overall market growth, specific segments can face challenges, as evidenced by Focusrite's Content Creation division experiencing weakness and de-stocking in fiscal year 2024. This highlights the dynamic nature of competition, where innovation, brand loyalty, and cost-effectiveness are crucial for sustained success.

| Key Competitor | Product Focus | Market Strategy Example |

|---|---|---|

| Universal Audio | High-end interfaces, plugins | Premium pricing, focus on professional studio quality |

| PreSonus | Interfaces, monitors, software | Broad product range, catering to various user levels |

| Behringer | Budget-friendly audio gear | Cost leadership, high volume production |

| RME | High-quality converters, stable drivers | Technical excellence, reliability for demanding users |

| Arturia | Synths, audio interfaces | Innovation in analog emulation and hybrid hardware/software solutions |

| Yamaha | Instruments, electronics, audio gear | Leveraging brand recognition and diverse product ecosystem |

SSubstitutes Threaten

The threat of substitutes is growing due to the increasing capability of built-in audio solutions found in computers and mobile devices, alongside the availability of generic audio recording tools. These alternatives, while adequate for casual use, often fall short in delivering the specialized features, superior audio fidelity, and minimal latency that dedicated hardware like Focusrite's audio interfaces provide. For instance, while many smartphones now offer decent microphones, they cannot match the professional-grade preamps and digital-to-analog converters found in a Focusrite Scarlett 2i2, which is crucial for studio-quality recordings.

The increasing availability of high-quality, free music production software presents a significant threat of substitutes for companies like Focusrite. These platforms are rapidly evolving, offering features once exclusive to paid software, thereby lowering the barrier to entry for aspiring musicians and content creators. For instance, by mid-2024, many free Digital Audio Workstations (DAWs) were already incorporating advanced virtual instruments and effects, directly competing with the functionality of entry-level audio interfaces and controllers that Focusrite offers.

The rise of cloud-based and AI-powered audio tools presents a significant threat of substitution for Focusrite. Platforms offering smart composition, auto-mastering, and real-time sound modulation are increasingly accessible, potentially lessening the need for dedicated hardware interfaces and complex software setups that have been Focusrite's core offerings.

For instance, by mid-2024, the global market for AI in music production was projected to see substantial growth, with many new entrants offering software-based solutions that bypass traditional hardware requirements. This trend indicates a shift where creative workflows might increasingly rely on these digital alternatives, impacting demand for physical audio interfaces.

Mobile Device as a Production Hub

The growing trend of mobile music production presents a significant threat of substitution for Focusrite. As mobile applications become more sophisticated, they empower creators to produce music directly on smartphones and tablets, diminishing the reliance on dedicated hardware for casual or on-the-go recording. This shift could impact Focusrite's portable interface sales.

For instance, apps like GarageBand on iOS, which comes pre-installed on millions of devices, and other advanced DAWs (Digital Audio Workstations) such as FL Studio Mobile and BandLab, offer robust features for songwriting, recording, and mixing. This accessibility means that for many aspiring musicians or those creating content casually, a mobile device can serve as a complete production hub, bypassing the need for external audio interfaces.

- Mobile DAWs: Applications like BandLab reported over 60 million users by early 2024, showcasing the widespread adoption of mobile music creation.

- Hardware Bypass: For many users, the built-in microphones and line-in capabilities of smartphones and tablets are sufficient for initial idea capture and basic production, reducing the perceived need for specialized interfaces.

- Cost-Effectiveness: Mobile production offers a significantly lower barrier to entry compared to purchasing dedicated hardware, making it an attractive alternative for budget-conscious creators.

DIY and Open-Source Alternatives

The rise of DIY audio solutions and open-source software presents a tangible threat of substitutes for Focusrite's products. Technically adept users can now assemble their own recording interfaces and software setups, often at a significantly lower cost. For instance, projects leveraging Raspberry Pi and open-source audio drivers can replicate basic interface functionalities.

These alternatives, while demanding greater technical skill, cater to hobbyists and budget-conscious creators who may not require the full feature set or polish of professional-grade equipment. The availability of free digital audio workstations (DAWs) and plugins further lowers the barrier to entry for creating music and audio content without specialized hardware.

- DIY Interface Projects: Online communities showcase projects using readily available components, offering basic audio input/output capabilities.

- Open-Source Software: Free DAWs like Audacity and Ardour, along with numerous open-source plugins, provide core recording and mixing functionalities.

- Cost Savings: For users with technical aptitude, building a functional setup can cost a fraction of purchasing a dedicated audio interface.

- Hobbyist Appeal: These alternatives appeal to individuals exploring audio production as a hobby, prioritizing learning and experimentation over professional-grade performance.

The threat of substitutes for Focusrite is amplified by the increasing sophistication and accessibility of mobile music production tools and free software alternatives. While these may not match the professional quality of Focusrite's interfaces, they cater to a growing segment of creators, particularly those starting out or working on the go.

By mid-2024, the landscape saw numerous free DAWs and mobile apps offering robust features, significantly lowering the barrier to entry for music creation. This trend means that for many, the need for dedicated hardware interfaces is diminishing, especially for casual use or initial idea generation.

The global market for AI in music production was projected for substantial growth by mid-2024, with many new software-based solutions bypassing traditional hardware requirements, further intensifying substitution threats.

| Substitute Category | Key Characteristics | Impact on Focusrite | User Base Example | Mid-2024 Market Trend |

|---|---|---|---|---|

| Mobile DAWs & Built-in Device Audio | High accessibility, low cost, portability | Reduces demand for entry-level interfaces for casual use | Aspiring musicians, content creators on the go | Over 60 million users for apps like BandLab by early 2024 |

| Free/Open-Source Software | Cost-effective, customizable, broad functionality | Competes with paid software bundles and basic interface features | Hobbyists, DIY enthusiasts, budget-conscious producers | Widespread adoption of Audacity, Ardour, and free plugins |

| AI-Powered Audio Tools | Automated processes, novel creative workflows | Potential to reduce reliance on complex hardware setups | Producers seeking efficiency, experimental artists | Projected substantial growth in AI for music production |

Entrants Threaten

Entering the professional audio hardware market demands substantial capital for research and development, specialized manufacturing facilities, and rigorous quality control to match established players like Focusrite. For instance, developing a new high-fidelity audio interface can involve millions in R&D before a single unit is produced.

These high upfront expenditures create a formidable barrier, particularly for companies aiming to produce complex, high-performance audio equipment. The need for sophisticated engineering and precision manufacturing means new entrants must be prepared for significant financial commitment to even begin competing.

Focusrite has cultivated significant brand recognition and customer loyalty through its portfolio of 13 established brands. This deep-seated trust makes it challenging for new entrants to establish credibility in a market where audio quality and reliability are critical purchasing factors. For instance, Focusrite's Scarlett range, a cornerstone of their product line, has consistently received high praise and user adoption, setting a high bar for newcomers to match.

Focusrite's extensive global distribution network, reaching around 240 territories, presents a significant barrier for new entrants. Replicating this reach requires substantial investment in logistics, partnerships, and market access, making it difficult for newcomers to establish a foothold.

New companies face challenges securing shelf space in established retail outlets, prominent online marketplaces, and specialized professional audio suppliers. These existing channels are vital for reaching target customers, and gaining access often necessitates strong brand recognition and proven sales history, which new entrants lack.

Proprietary Technology and Patents

Focusrite's robust portfolio of proprietary hardware and software solutions, backed by significant investment in research and development, presents a substantial hurdle for potential new entrants. The company's extensive patent portfolio covering audio processing technologies, unique circuit designs, and sophisticated software algorithms acts as a strong deterrent. These intellectual property rights make it difficult and costly for newcomers to develop competing products without risking infringement, effectively raising the barrier to entry.

For instance, Focusrite's commitment to innovation is evident in its consistent product development. While specific R&D spending figures fluctuate, the company has historically allocated a notable portion of its revenue to engineering and product innovation, ensuring a pipeline of advanced technologies. This ongoing investment, coupled with existing patents, solidifies Focusrite's technological advantage and discourages new players from entering the market.

- Proprietary Technology: Focusrite's hardware and software are protected by intellectual property.

- Patent Portfolio: Extensive patents on audio processing, circuit design, and software algorithms.

- R&D Investment: Significant and ongoing investment in research and development to maintain technological leadership.

- Barrier to Entry: High costs and legal risks associated with replicating Focusrite's patented technologies deter new competitors.

Economies of Scale and Experience Curve

Established companies like Focusrite leverage significant economies of scale. This means they can produce goods at a lower cost per unit due to high-volume operations in manufacturing, purchasing raw materials, and marketing efforts. For instance, in 2023, Focusrite reported revenue of £164.5 million, indicating substantial production volumes that likely translate into cost efficiencies.

The experience curve also presents a barrier. Over time, companies develop expertise in product design, efficient production processes, and understanding customer needs. This accumulated knowledge makes it difficult for new entrants to match the cost-effectiveness or product quality that seasoned players, with years of market presence and refinement, can offer from the outset.

- Economies of Scale: Lower per-unit costs in manufacturing, procurement, and marketing for established players.

- Experience Curve: Accumulated expertise in product development and market understanding creates a competitive advantage.

- Cost Competition: New entrants face challenges competing on price due to the cost efficiencies of incumbents.

- Market Entry Barrier: Significant upfront investment and learning curve required for new companies to achieve comparable efficiency.

The threat of new entrants into the professional audio hardware market is moderate, primarily due to high capital requirements for R&D and manufacturing, coupled with strong brand loyalty and established distribution networks. Focusrite's significant investment in proprietary technology and its extensive patent portfolio also erects substantial barriers.

New companies must overcome significant upfront costs for product development and marketing to compete effectively against established players like Focusrite, which benefits from economies of scale and an experienced production process. For example, Focusrite's 2023 revenue of £164.5 million underscores its operational scale.

Securing access to established distribution channels and building brand credibility are critical challenges for newcomers. Focusrite's global reach, serving approximately 240 territories, highlights the logistical and partnership investments required to match its market penetration.

The need to replicate Focusrite's technological advancements, protected by a robust patent portfolio, adds complexity and legal risk for potential entrants, demanding substantial investment in innovation to gain a competitive edge.

Porter's Five Forces Analysis Data Sources

Our Focusrite Porter's Five Forces analysis is built upon a foundation of comprehensive data, drawing from Focusrite's official investor relations reports, industry-specific market research from firms like Statista and IBISWorld, and competitor financial disclosures.