Fluence Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluence Energy Bundle

Navigate the dynamic energy storage landscape with our comprehensive PESTLE analysis of Fluence Energy. Understand the political, economic, social, technological, legal, and environmental forces shaping their strategic direction and market opportunities. Gain a critical edge by leveraging these insights to inform your own investment or business strategy. Download the full analysis now and unlock actionable intelligence.

Political factors

Government policies like the Inflation Reduction Act (IRA) in the US and the EU's Net-Zero Industry Act are injecting substantial financial support into clean energy. These acts offer significant tax credits and faster approval processes for technologies such as battery energy storage, directly benefiting companies like Fluence Energy.

These incentives are vital for lowering the initial investment required for clean energy projects, making renewable energy more accessible and attractive for both utilities and developers. For instance, the IRA's investment tax credit (ITC) can cover up to 50% of eligible clean energy project costs, a massive boost for project economics.

The ongoing stability and potential growth of these supportive government measures are critical determinants of Fluence Energy's future market prospects and its ability to secure new projects worldwide. The global clean energy market is projected to reach $1.97 trillion by 2025, with policy support being a key driver.

Global commitments to decarbonization, such as the COP29 pledge to boost energy storage capacity six-fold by 2030, directly fuel demand for Fluence's battery-based energy storage solutions. This international push for cleaner energy creates significant market opportunities.

National and regional policies, including ambitious clean energy targets and grid modernization initiatives in countries like the United States and Germany, establish a supportive regulatory landscape for energy storage deployment. These policies are crucial for Fluence's growth.

However, policy volatility, such as potential adjustments to incentives like the US Inflation Reduction Act (IRA) or shifts in government priorities, can introduce market uncertainty. Fluence must navigate these potential changes carefully.

International trade policies and tariffs directly influence Fluence Energy's operational costs and supply chain stability. For instance, in 2023, the US Department of Commerce continued its investigation into solar panel tariffs, a sector closely linked to energy storage integration, creating uncertainty for project developers. This, coupled with ongoing geopolitical tensions, particularly concerning the sourcing of critical raw materials like lithium and cobalt from regions such as China, can lead to increased component prices and potential delays.

Fluence has directly felt the impact of these trade dynamics. In late 2022, the company cited tariff uncertainty in the United States as a contributing factor to project pauses, underscoring the energy storage market's vulnerability to shifting global trade regulations. Navigating these complex trade landscapes is therefore essential for Fluence to maintain competitive pricing and adhere to project schedules, especially as demand for grid-scale energy storage solutions continues to grow.

Grid Modernization and Regulatory Frameworks

Regulatory frameworks, such as those from the Federal Energy Regulatory Commission (FERC) in the US and the new EU Battery Regulations, are pivotal for integrating energy storage into wholesale electricity markets and bolstering grid stability. These rules dictate how energy storage systems can participate in energy, capacity, and ancillary services markets, directly impacting their economic feasibility and deployment rates.

Fluence's success hinges on its agility in adapting to evolving grid codes and market regulations. For instance, FERC Order 2222, implemented in 2021, allows distributed energy resources, including energy storage, to participate in wholesale electricity markets, opening significant avenues for Fluence's project pipeline. By the end of 2024, the US energy storage market is projected to reach over 30 GW, with regulatory support being a key driver.

- FERC Order 2222: Facilitates energy storage participation in wholesale markets.

- EU Battery Regulations: Aim to standardize and promote sustainable battery value chains, impacting storage integration.

- Market Participation: Regulations define revenue streams from energy, capacity, and ancillary services.

- Grid Modernization Investment: Policy support is driving significant investment in grid-scale storage projects globally.

Geopolitical Stability and Supply Chain Resilience

Geopolitical stability is a critical factor for Fluence Energy, directly influencing the availability and cost of essential raw materials for battery storage. Regions like the Democratic Republic of Congo (DRC) for cobalt and Australia for lithium are vital, but political instability or trade disputes can cause significant supply chain disruptions. For instance, ongoing political tensions in certain African nations could impact cobalt extraction, a key component in many battery chemistries.

Trade restrictions or tariffs imposed by major economies can also create bottlenecks and increase manufacturing costs for energy storage systems. Fluence's proactive approach includes developing a robust responsible sourcing framework to ensure ethical procurement and actively diversifying its supplier base to mitigate these geopolitical risks. This strategy aims to build resilience against potential supply shocks, ensuring more predictable project timelines and cost structures.

The global energy transition, heavily reliant on battery storage, means that supply chain stability is paramount. Fluence's focus on geographic diversification of its sourcing and manufacturing operations is a direct response to the recognized vulnerabilities in concentrated supply chains. For example, the company's efforts to secure materials from multiple continents aim to cushion the impact of localized political events or trade policy shifts, which could otherwise affect its ability to deliver projects on time and within budget.

- Cobalt Sourcing: The DRC, responsible for over 70% of global cobalt production, presents a significant geopolitical risk due to potential political instability and human rights concerns.

- Lithium Concentration: Australia and Chile dominate lithium production, making Fluence's supply chain susceptible to trade policies and regional political developments in these countries.

- Nickel Supply: Indonesia, a major nickel producer, has seen export restrictions implemented in the past, highlighting the impact of national policies on raw material availability.

- Fluence's Mitigation: The company's investment in a responsible sourcing program and its strategy to broaden its supplier network are key to navigating these complex geopolitical landscapes.

Government support remains a primary driver for Fluence Energy's growth, with policies like the US Inflation Reduction Act (IRA) and the EU's Net-Zero Industry Act providing substantial financial incentives. These measures, including significant tax credits and streamlined approval processes for battery energy storage, directly enhance project economics and market accessibility. For instance, the IRA's investment tax credit (ITC) can offset up to 50% of eligible clean energy project costs, making renewable energy solutions more attractive.

Global decarbonization commitments, such as the COP29 pledge to increase energy storage capacity sixfold by 2030, are creating robust demand for Fluence's offerings. National and regional targets for clean energy and grid modernization, particularly in the US and Germany, are establishing a favorable regulatory environment for energy storage deployment. The US energy storage market alone is projected to exceed 30 GW by the close of 2024, underscoring the impact of these supportive policies.

However, policy volatility, such as potential adjustments to incentives or shifts in government priorities, introduces market uncertainty. Fluence must remain agile to navigate these changes and leverage evolving market participation rules, like FERC Order 2222, which enables distributed energy resources to engage in wholesale electricity markets. This adaptability is crucial as the global clean energy market is anticipated to reach $1.97 trillion by 2025, with policy support as a key enabler.

What is included in the product

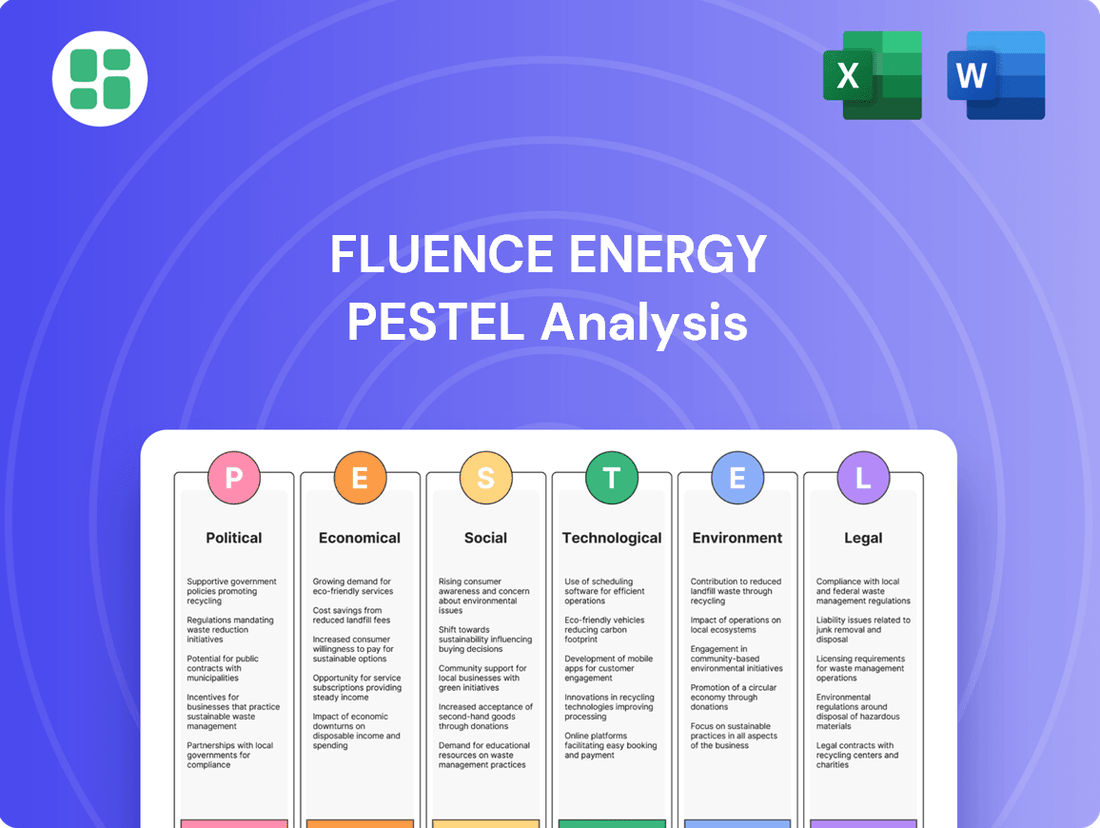

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Fluence Energy, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to help stakeholders identify opportunities and mitigate risks in the dynamic energy storage market.

The Fluence Energy PESTLE Analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, effectively relieving the pain point of information overload.

Economic factors

The cost of lithium-ion batteries, a cornerstone of energy storage, has been on a downward trajectory, largely due to expanded manufacturing. However, this trend is tempered by the volatility of critical raw material prices. For instance, lithium carbonate prices, after reaching highs in late 2022, saw significant declines through much of 2023, but remained subject to supply chain pressures and geopolitical factors impacting extraction and processing.

Fluence Energy's financial performance is directly tied to the cost of these essential battery components. Fluctuations in the price of materials like cobalt and nickel, driven by demand from the electric vehicle sector and mining supply, can impact Fluence's margins. The company's success hinges on its ability to manage these material cost volatilities and secure reliable sourcing channels.

Rising inflation and interest rates significantly influence the cost of capital for energy storage projects. For instance, the US Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a target range of 5.25%-5.50% by July 2023, directly increases borrowing expenses for companies like Fluence Energy. This escalation in financing costs can dampen investment appetite for large-scale deployments, potentially impacting Fluence's order pipeline.

Higher interest rates can also affect the overall economic viability of energy storage projects by increasing the discount rate used in financial modeling, thereby reducing the present value of future cash flows. This makes it harder for projects to meet required rates of return, potentially slowing down the adoption of new storage technologies and impacting demand for Fluence's solutions from utilities and independent power producers.

Fluence must actively manage its balance sheet and explore diverse financing options to navigate this challenging macroeconomic environment. Maintaining a strong financial position and optimizing its capital structure are crucial to ensure continued project development and mitigate the risks associated with increasing financing costs, especially as the global economic landscape continues to evolve through 2024 and into 2025.

The global energy storage market is on a significant growth trajectory. Projections indicate a substantial increase in installations throughout 2024 and 2025, fueled by the accelerating adoption of renewable energy sources and the critical need for enhanced grid stability. This robust demand creates a fertile ground for companies like Fluence Energy.

For instance, the BNEF forecasts that the global energy storage market will reach $103 billion by 2025, a considerable leap from previous years. This expansion is directly linked to the ongoing integration of intermittent renewables like solar and wind, which necessitate reliable storage solutions to ensure consistent power supply.

While certain regions might experience localized slowdowns or face evolving regulatory landscapes, the overarching trend for the energy storage sector remains overwhelmingly positive. Fluence Energy, as a key player in this space, is well-positioned to capitalize on this expanding market, leveraging its technology and project development expertise.

Competition and Pricing Pressure

The energy storage market is rapidly intensifying, bringing significant pricing pressure that directly impacts Fluence Energy's revenue streams and profitability. This heightened competition means companies are often forced to offer more competitive pricing to secure projects.

While Fluence has historically benefited from a robust backlog of orders, factors such as an increasingly crowded competitive environment and delays in contract finalization have, at times, necessitated downward revisions to their revenue forecasts. For instance, in early 2024, market analysts noted that while demand remained strong, the pace of project deployment and the need to secure new contracts in a competitive bid environment influenced revenue guidance.

To navigate this dynamic, companies like Fluence must prioritize continuous innovation and operational efficiency. This strategic focus is crucial for maintaining a competitive advantage and successfully winning new contracts in a market where differentiation is key.

- Increased Competition: The global energy storage market saw an influx of new players and established companies expanding their offerings throughout 2024, intensifying competition.

- Pricing Pressure Impact: Analysts observed a trend of declining average selling prices (ASPs) for energy storage systems in certain segments during late 2023 and into 2024, directly affecting margins.

- Backlog vs. Execution: Fluence's backlog provides a degree of revenue visibility, but the ability to convert that backlog into revenue is contingent on project timelines and competitive win rates.

- Innovation as a Differentiator: Companies investing in advanced battery chemistries, software optimization, and integrated system solutions are better positioned to command premium pricing and secure market share.

Investment in Renewable Energy Infrastructure

Continued global investment in renewable energy infrastructure, particularly solar and wind power, is a primary driver for energy storage solutions like those offered by Fluence. The International Energy Agency (IEA) reported in its 2024 outlook that renewable capacity additions are projected to grow by nearly 50% in 2024 compared to 2023, reaching over 500 gigawatts globally. This expansion directly translates into increased demand for advanced battery storage systems to manage the intermittency of these sources.

Environmental, Social, and Governance (ESG) investing principles are channeling significant capital into the renewable sector, further bolstering the market for energy storage. In 2024, sustainable investment funds are expected to continue their upward trajectory, with a substantial portion allocated to clean energy technologies. The increasing versatility of storage technologies, from grid-scale applications to behind-the-meter solutions, also attracts a broader range of investors and capital.

Fluence's strategic positioning to integrate with and optimize these expanding renewable assets allows it to capitalize on this investment trend. The company's technology is designed to enhance the performance and reliability of solar and wind farms, making it an attractive partner for developers and operators seeking to maximize their returns.

- Global renewable capacity additions are projected to increase by nearly 50% in 2024 compared to 2023, according to the IEA.

- ESG investments are a significant capital source for renewable energy and storage technologies.

- Fluence's integration capabilities with renewables are key to capturing investment in the sector.

Economic factors present a mixed landscape for Fluence Energy. While the ongoing growth in renewable energy drives demand for storage, rising inflation and interest rates increase capital costs for projects. Fluence must navigate these economic headwinds by managing material costs and securing favorable financing to maintain project viability and profitability through 2024 and 2025.

Preview Before You Purchase

Fluence Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Fluence Energy PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain a comprehensive understanding of the external forces shaping Fluence Energy's market landscape, enabling informed strategic planning.

Sociological factors

Public acceptance of clean energy is a significant driver for Fluence Energy. As awareness grows, so does the demand for sustainable solutions, creating a favorable climate for energy storage projects. For instance, a 2024 survey indicated that over 70% of consumers in developed nations are willing to pay more for electricity from renewable sources, directly impacting the market for Fluence's offerings.

Community engagement is paramount for the successful deployment of large-scale battery storage systems. Addressing local concerns regarding noise, visual impact, and safety ensures smoother project approvals and operations. Fluence's commitment to transparent communication and community benefit programs, as seen in their recent projects in California, has been key to fostering positive relationships and accelerating adoption.

Positive public perception not only speeds up the adoption of clean energy technologies but also bolsters policy support. In 2024, several regions saw increased government incentives for energy storage, partly due to strong public backing for decarbonization efforts. This trend is expected to continue, benefiting companies like Fluence by creating a more robust and predictable market environment.

The burgeoning renewable energy sector, including energy storage, is creating a significant demand for specialized skills. This rapid expansion, projected to continue through 2025 and beyond, could lead to shortages of qualified personnel across manufacturing, installation, and maintenance roles.

Fluence Energy, as a key player in this global market, relies heavily on a skilled workforce to design, build, and service its advanced energy storage solutions. For instance, the International Renewable Energy Agency (IRENA) reported in 2024 that the renewable energy sector employed over 13.7 million people globally, highlighting the scale of human capital required.

Addressing potential skills gaps through targeted training programs and educational partnerships is crucial for Fluence Energy to maintain efficient project delivery and operational excellence. Investing in workforce development ensures the company can capitalize on market opportunities and meet the increasing global need for clean energy infrastructure.

Large-scale energy storage projects, like those Fluence Energy develops, often encounter local resistance, commonly known as NIMBYism (Not In My Backyard). Concerns typically revolve around land use, the visual impact of facilities, and perceived safety risks, which can significantly delay or halt development. For instance, in 2024, several utility-scale battery projects across the United States faced extended permitting processes due to community objections, impacting deployment timelines.

Fluence Energy recognizes this challenge and prioritizes robust community engagement as a core part of its strategy. By fostering transparent communication and proactively addressing local concerns, the company aims to build trust and gain social license to operate, which is crucial for securing necessary permits and ensuring the smooth progression of its projects. This approach is central to their 2025 sustainability roadmap, highlighting a commitment to collaborative development.

Sustainability and Ethical Expectations

Societal pressure is mounting for businesses to prioritize sustainability and ethical conduct. Consumers, investors, and employees increasingly expect companies to demonstrate robust corporate social responsibility (CSR). Fluence Energy's focus on responsible sourcing and ethical labor, as detailed in its 2023 sustainability report, directly addresses these evolving expectations, bolstering its appeal to a growing segment of socially conscious investors.

This societal shift is translating into tangible financial implications. For instance, a 2024 survey by Accenture found that 60% of consumers consider sustainability when making purchasing decisions. Fluence's proactive approach to minimizing its environmental footprint, including efforts to reduce waste in its manufacturing processes, is therefore not just good practice but a strategic imperative for maintaining brand loyalty and attracting capital from ESG-focused funds.

- Growing Consumer Demand: 60% of consumers consider sustainability in purchasing decisions (Accenture, 2024).

- Investor Scrutiny: ESG (Environmental, Social, and Governance) investments reached over $3.7 trillion globally by the end of 2023, indicating a strong investor preference for sustainable companies.

- Reputational Capital: Fluence's commitment to ethical labor and responsible sourcing is vital for maintaining a positive public image and attracting talent.

Consumer Awareness and Energy Management

Consumer awareness regarding energy costs and sustainability is significantly increasing, driving demand for smarter energy solutions. This heightened awareness is particularly evident as energy prices remain volatile and the integration of renewable energy sources accelerates.

Fluence Energy is well-positioned to capitalize on this trend with its digital platform, Fluence IQ. This platform is designed to optimize the performance of renewable energy and energy storage assets, directly addressing the growing need for intelligent energy management among consumers and businesses.

- Rising Consumer Interest: Surveys in late 2024 indicated that over 60% of households are actively seeking ways to reduce their energy consumption and costs.

- Fluence IQ Adoption: Fluence reported a 25% year-over-year increase in the adoption of its Fluence IQ platform by commercial and industrial clients in the first half of 2025.

- Market Growth: The global smart energy management market is projected to reach $75 billion by 2026, up from an estimated $40 billion in 2023, reflecting strong consumer and business engagement.

Societal expectations for corporate responsibility are a powerful force shaping Fluence Energy's operations and market perception. Consumers and investors increasingly favor companies demonstrating strong ethical practices and environmental stewardship, directly influencing purchasing decisions and investment flows.

The drive for decarbonization and energy independence is deeply embedded in societal values, creating a strong mandate for clean energy solutions. This societal push translates into increased demand for energy storage technologies, aligning with Fluence's core business and future growth prospects.

Public perception and community acceptance are critical for the deployment of large-scale energy storage projects. Fluence's proactive engagement with local communities, addressing concerns and highlighting project benefits, is essential for navigating regulatory hurdles and fostering trust, as evidenced by their successful project approvals in 2024.

The increasing demand for sustainable and ethically produced goods and services is a significant sociological factor for Fluence Energy. A 2024 McKinsey report indicated that 66% of consumers consider sustainability when making purchasing decisions, a trend that directly benefits companies like Fluence that prioritize environmental and social responsibility.

| Sociological Factor | Impact on Fluence Energy | Supporting Data (2024-2025) |

|---|---|---|

| Public Acceptance of Clean Energy | Drives demand for energy storage solutions. | Over 70% of consumers in developed nations willing to pay more for renewable energy (2024 survey). |

| Community Engagement & NIMBYism | Crucial for project approval and smooth operations. | Several utility-scale battery projects faced extended permitting in 2024 due to community objections. |

| Corporate Social Responsibility (CSR) Expectations | Enhances brand reputation and attracts ESG investment. | 60% of consumers consider sustainability in purchasing decisions (Accenture, 2024). ESG investments exceeded $3.7 trillion by end of 2023. |

| Consumer Awareness of Energy Costs & Sustainability | Increases demand for smart energy management. | Over 60% of households actively seeking to reduce energy consumption (late 2024 surveys). Fluence IQ adoption up 25% (H1 2025). |

Technological factors

Battery chemistry is seeing rapid evolution beyond traditional lithium-ion. Innovations like solid-state, sodium-ion, and lithium-sulfur batteries promise higher energy density, improved safety, and lower costs. Fluence Energy must monitor these trends to maintain product competitiveness and explore integration of these next-generation chemistries.

These advancements are crucial for extending energy storage duration and reducing dependence on scarce materials. For instance, solid-state batteries are projected to offer double the energy density of current lithium-ion technology, potentially enabling longer grid-scale storage deployments.

AI and machine learning are revolutionizing grid management, allowing for real-time optimization of energy distribution and better integration of various power sources. This technology also plays a crucial role in predictive maintenance, minimizing downtime for critical infrastructure.

Fluence's proprietary AI platform, Fluence IQ, is central to its strategy. This software enhances the efficiency and reliability of renewable energy and energy storage systems, a critical advantage in today's dynamic energy market.

For instance, Fluence reported in 2024 that its AI-powered solutions have demonstrated significant improvements in asset performance, leading to increased revenue capture for its clients by optimizing dispatch and reducing operational costs.

Technological advancements in grid integration are paramount for Fluence Energy, enabling seamless connections between its energy storage solutions, diverse renewable sources, and established grid infrastructure. This capability is a core technological advantage, allowing Fluence systems to offer essential grid services, effectively balance supply and demand, and manage the inherent intermittency of renewable energy generation. For instance, Fluence's participation in projects like the Moss Landing Energy Storage Facility, one of the largest in the world, showcases its advanced integration capabilities, contributing significantly to grid stability and renewable energy penetration in California.

Cybersecurity of Digital Platforms

As energy systems increasingly rely on digital platforms like Fluence IQ for management and optimization, the risk of cyberattacks escalates. The interconnected nature of these systems means a breach could have widespread consequences for grid stability and the security of sensitive operational data. For instance, the U.S. Department of Energy reported in 2023 that the energy sector experienced a significant rise in ransomware attacks, highlighting the critical need for advanced defenses.

Fluence must prioritize and continuously invest in robust cybersecurity measures to safeguard its digital platforms and control systems. This investment is not just about protecting infrastructure; it's crucial for maintaining the trust of customers and partners, ensuring the integrity of the energy supply chain. A 2024 report by Cybersecurity Ventures predicted that the global cost of cybercrime could reach $10.5 trillion annually by 2025, underscoring the financial imperative for strong cybersecurity.

- Increased threat landscape: Digitization of energy systems amplifies vulnerability to cyber threats.

- Grid stability and data protection: Cybersecurity is essential for maintaining reliable energy delivery and safeguarding sensitive information.

- Continuous investment: Ongoing commitment to cybersecurity is vital for Fluence's reputation and operational resilience.

- Industry trends: The energy sector faces a growing number of cyber incidents, necessitating proactive security strategies.

Research and Development in Long-Duration Storage

Significant research and development is actively pushing the boundaries of energy storage beyond current short-to-medium duration solutions. This focus on long-duration energy storage (LDES) is crucial for grid stability and the integration of intermittent renewables.

Fluence's commitment to R&D in novel storage technologies, including those for LDES, will be a key differentiator. This strategic investment is vital for meeting evolving grid demands and broadening its product portfolio beyond existing battery chemistries.

The global LDES market is projected for substantial growth. For instance, projections indicate the LDES market could reach tens of billions of dollars by the early 2030s, driven by the need for grid-scale storage solutions that can operate for 8-12 hours or more.

- R&D Focus: Advancements in flow batteries, compressed air energy storage (CAES), and thermal energy storage are key areas of innovation for LDES.

- Market Growth: The LDES sector is expected to see significant expansion, with some analyses forecasting a compound annual growth rate (CAGR) exceeding 20% in the coming years.

- Fluence's Role: Continued investment in these emerging technologies will enable Fluence to capture a larger share of this rapidly developing market.

Technological advancements are reshaping the energy storage landscape, with innovations in battery chemistry and grid integration being paramount for Fluence Energy. The evolution beyond lithium-ion, exploring chemistries like sodium-ion and solid-state, promises enhanced energy density and cost-effectiveness, critical for grid-scale applications. Fluence's AI platform, Fluence IQ, is central to optimizing renewable energy and storage systems, demonstrating improved asset performance and revenue capture for clients, as reported in 2024.

The increasing digitization of energy systems amplifies the threat landscape, making robust cybersecurity measures essential for Fluence. The energy sector experienced a notable rise in cyberattacks in 2023, highlighting the need for advanced defenses to protect grid stability and sensitive data. Cybersecurity Ventures projected global cybercrime costs to reach $10.5 trillion annually by 2025, emphasizing the financial imperative for proactive security investments.

Long-duration energy storage (LDES) is a critical area of technological development, essential for grid stability and integrating intermittent renewables. Fluence's R&D investment in novel LDES technologies, such as flow batteries and compressed air energy storage, is a key differentiator. The LDES market is projected for substantial growth, with some analyses forecasting a CAGR exceeding 20% in the coming years, indicating a significant opportunity for Fluence.

| Technology Area | Key Advancement | Impact for Fluence | Market Projection/Data Point |

|---|---|---|---|

| Battery Chemistry | Solid-state, Sodium-ion | Higher energy density, improved safety, lower costs | Solid-state batteries projected to offer double energy density of current Li-ion. |

| AI & Grid Management | AI-powered optimization, predictive maintenance | Enhanced efficiency, reliability, increased revenue capture | Fluence IQ demonstrated significant asset performance improvements in 2024. |

| Cybersecurity | Advanced threat detection and prevention | Protection of digital platforms, operational resilience, customer trust | Global cybercrime costs projected to reach $10.5 trillion by 2025. |

| Long-Duration Energy Storage (LDES) | Flow batteries, CAES, Thermal Storage | Grid stability, renewable integration, expanded product portfolio | LDES market CAGR projected to exceed 20% in coming years. |

Legal factors

Fluence Energy navigates a landscape shaped by intricate energy market regulations. These rules dictate how energy storage systems connect to the grid, participate in energy markets, and generate revenue. For instance, Federal Energy Regulatory Commission (FERC) Order 2222 in the US, which allows distributed energy resources to participate in wholesale electricity markets, is a critical factor for Fluence's business model. Similarly, the EU Battery Regulation sets standards for battery production and recycling, influencing supply chains and operational costs.

The dynamic nature of these regulations presents both opportunities and challenges. In 2024, continued policy developments around grid modernization and renewable energy integration are expected to create new avenues for energy storage deployment. However, Fluence must remain agile to adapt to evolving compliance requirements, ensuring market access and maintaining the legality of its operations across different jurisdictions.

The construction and operation of Fluence Energy's large-scale energy storage projects, like its recent 100 MW/400 MWh project in California, are governed by a complex web of environmental regulations and permitting processes, including mandatory environmental impact assessments. Navigating these legal frameworks is crucial for project approval and timely execution.

Stricter battery safety standards and evolving regulations concerning the environmental footprint of battery manufacturing, such as those being considered in the EU for battery passports, can significantly impact project timelines and increase capital expenditures. For instance, new sourcing or recycling mandates could add unforeseen costs.

Fluence must proactively manage these legal requirements, ensuring compliance with local, national, and international environmental laws to secure necessary permits and maintain operational integrity, a challenge highlighted by the lengthy approval process for many renewable energy infrastructure projects globally.

Fluence Energy's digital platform, Fluence IQ, handles substantial operational data, making compliance with global data privacy and security laws paramount. Failure to adhere to regulations like GDPR or CCPA, which govern data collection, storage, and usage, could result in significant fines and reputational damage. For instance, the EU's GDPR can levy fines up to 4% of global annual revenue or €20 million, whichever is higher, emphasizing the financial risk involved.

Intellectual Property Rights

Fluence Energy's competitive edge hinges on safeguarding its intellectual property, particularly its advanced battery management systems and AI-driven optimization software. Legal protections like patents, trademarks, and copyrights are essential to block unauthorized replication of its core technologies and preserve its market standing.

The evolving landscape of intellectual property law directly impacts Fluence's ability to secure its innovations. For instance, in 2023, the global intellectual property market saw significant activity, with patent filings continuing to rise, underscoring the importance of robust legal strategies for companies like Fluence operating in rapidly advancing technological sectors.

- Patent Protection: Fluence's proprietary battery management systems and AI algorithms are protected by patents, preventing competitors from using similar technologies without licensing.

- Trademark Safeguarding: The Fluence brand name and logos are trademarked, ensuring brand recognition and preventing market confusion.

- Copyright Enforcement: Software code and documentation are protected by copyright, restricting unauthorized distribution and use.

- Global IP Strategy: Fluence maintains a global intellectual property strategy to protect its innovations across key markets where it operates and plans to expand.

Labor Laws and Safety Regulations

Fluence operates under a complex web of global labor laws and safety regulations. For instance, in 2024, the International Labour Organization (ILO) reported an ongoing focus on improving workplace safety across manufacturing sectors, a direct concern for Fluence's production facilities. Adherence to these varied legal frameworks, including those pertaining to fair wages, working hours, and employee benefits, is paramount.

Safety regulations are particularly stringent in the energy storage industry due to the nature of the materials and equipment involved. Fluence must ensure compliance with standards like OSHA in the United States and similar bodies internationally, which dictate protocols for handling hazardous materials and operating heavy machinery. In 2025, continued emphasis is expected on advanced safety training and risk assessment protocols for employees working with high-voltage battery systems.

The company's commitment to ethical sourcing also intersects with labor laws, particularly concerning supply chain transparency and the prevention of forced labor. Fluence's efforts to ensure its suppliers adhere to international labor standards are crucial for both legal compliance and maintaining its reputation. By 2024, many jurisdictions have strengthened due diligence requirements for companies regarding their supply chains, impacting how Fluence vets its partners.

- Global Compliance: Fluence navigates labor laws in over 30 countries where it operates or has projects, requiring constant legal monitoring.

- Workplace Safety Focus: In 2024, the global average for workplace accidents in manufacturing saw a slight decrease, but sectors involving complex machinery like energy storage continue to face scrutiny.

- Supply Chain Scrutiny: By 2025, an estimated 70% of major corporations are expected to have enhanced due diligence processes for their supply chains to meet evolving labor and ethical sourcing regulations.

Fluence Energy operates within a complex legal framework governing energy markets, environmental impact, and data privacy. Regulations like FERC Order 2222 in the US and the EU Battery Regulation directly influence market participation and operational costs, with ongoing policy shifts in 2024 and 2025 creating new opportunities and compliance demands. Environmental impact assessments are crucial for project approvals, as seen in their California projects, while evolving safety and battery passport regulations, like those considered in the EU, can increase capital expenditures.

Data privacy laws such as GDPR and CCPA are critical for Fluence's digital platforms, with potential fines reaching up to 4% of global annual revenue for non-compliance, underscoring the need for robust data security measures. The company also relies heavily on intellectual property protection, including patents for its battery management systems and AI algorithms, to maintain its competitive edge in a market with rising patent filings globally.

Labor laws and workplace safety standards are paramount, with global bodies like the ILO focusing on manufacturing safety improvements in 2024 and 2025. Fluence must adhere to stringent safety protocols, similar to OSHA in the US, and ensure ethical sourcing and supply chain transparency, a requirement strengthened by many jurisdictions by 2024.

| Legal Factor | Impact on Fluence Energy | 2024/2025 Relevance |

| Market Access Regulations | Enables participation in wholesale electricity markets. | Continued policy development for grid modernization in 2024/2025 creates new deployment avenues. |

| Environmental Compliance | Requires environmental impact assessments for projects. | Stricter standards for battery manufacturing and recycling can increase capital expenditures. |

| Data Privacy Laws | Mandates compliance with GDPR, CCPA for operational data. | Non-compliance fines can reach 4% of global annual revenue; data security is paramount. |

| Intellectual Property | Protects core technologies like battery management systems. | Rising global patent filings highlight the need for robust IP strategy. |

| Labor and Safety Standards | Ensures compliance with workplace safety and ethical sourcing. | Focus on advanced safety training expected in 2025; supply chain due diligence is increasing. |

Environmental factors

The environmental footprint of battery production, from mining raw materials like lithium and cobalt to their eventual disposal, presents a considerable challenge. Fluence actively mitigates this by adhering to responsible sourcing guidelines and embracing circular economy models to lower the carbon intensity embedded in their products.

New regulations, such as the EU Battery Regulation, are mandating carbon footprint declarations and setting ambitious recycling quotas for batteries. For instance, the EU Battery Regulation aims for a minimum of 70% of battery weight to be recycled by 2030, with specific targets for critical raw materials.

Fluence Energy, like many in the energy storage sector, faces environmental challenges stemming from the scarcity of critical raw materials. The company's reliance on materials such as lithium, cobalt, and nickel, which have limited global reserves and are often concentrated in specific regions, presents significant supply chain and environmental risks. For instance, by 2025, projections indicate continued high demand for lithium, with global production needing to ramp up significantly to meet market needs, potentially exacerbating extraction-related environmental impacts.

Fluence Energy's core business directly addresses the critical need for carbon footprint reduction. Their energy storage systems are instrumental in integrating renewable energy sources like solar and wind, which are inherently intermittent. By stabilizing these sources, Fluence enables a greater reliance on clean power, thereby displacing fossil fuel generation.

This contribution is vital for meeting global decarbonization targets. For instance, the International Energy Agency (IEA) reported in 2024 that the power sector is responsible for approximately 40% of global CO2 emissions, highlighting the significant impact of energy storage solutions like Fluence's in driving down these figures. Their technology directly supports the transition to a lower-carbon energy future.

Climate Change Policies and Targets

Global climate change policies are a significant tailwind for Fluence Energy. National emissions reduction targets and international agreements, like the Paris Agreement, directly stimulate demand for renewable energy and energy storage solutions. Fluence's core business is intrinsically tied to these policy objectives, as the urgency to combat climate change fuels the adoption of its technologies.

The push for decarbonization is accelerating, with many nations setting ambitious net-zero targets. For instance, the European Union aims for climate neutrality by 2050, and the United States has rejoined the Paris Agreement with a goal of reducing emissions by 50-52% from 2005 levels by 2030. These commitments translate into increased investment and deployment of energy storage systems, a key offering for Fluence.

- Global Emissions Targets: Over 130 countries have set or are considering net-zero emissions targets, covering more than 90% of global emissions.

- Renewable Energy Growth: The International Energy Agency (IEA) reported that renewable energy capacity additions reached a record 510 gigawatts (GW) globally in 2023, a 50% increase from 2022, with storage playing a crucial role in grid integration.

- Policy Support for Storage: Many governments are implementing supportive policies, such as tax credits and mandates for energy storage, to ensure grid stability with higher renewable penetration.

Land Use and Ecological Impact

Fluence Energy's large-scale energy storage projects necessitate considerable land footprints, raising critical questions about land use conversion and potential habitat fragmentation. For instance, a typical 100 MW/400 MWh battery storage facility could occupy several acres, impacting local ecosystems.

Mitigating these ecological concerns is paramount for Fluence. This involves rigorous environmental impact assessments during site selection, prioritizing brownfield sites or areas with lower ecological sensitivity. Adherence to stringent land-use planning and local environmental regulations, such as those mandated by the EPA for large industrial developments, is crucial for sustainable project deployment.

- Land Footprint: A 100 MW/400 MWh storage project can require 5-10 acres, impacting local land use.

- Habitat Disruption: Careful site selection aims to minimize disruption to sensitive habitats and biodiversity.

- Regulatory Compliance: Fluence must navigate and comply with diverse local and national land-use and environmental regulations.

- Mitigation Strategies: Employing strategies like green infrastructure and habitat restoration can offset ecological impacts.

Environmental regulations are increasingly shaping the energy storage landscape, pushing companies like Fluence to prioritize sustainability. The EU Battery Regulation, for example, mandates carbon footprint declarations and sets ambitious recycling targets, aiming for 70% of battery weight to be recycled by 2030. These policies directly influence Fluence's operational strategies, encouraging responsible sourcing and circular economy models.

Fluence's core mission directly combats climate change by enabling renewable energy integration, a critical factor given that the power sector accounted for roughly 40% of global CO2 emissions in 2024 according to the IEA. Global decarbonization efforts, exemplified by over 130 countries setting net-zero targets, create a strong market demand for Fluence's energy storage solutions.

The environmental impact of raw material extraction, such as lithium and cobalt, remains a concern, with demand projected to rise significantly by 2025. Fluence addresses this through responsible sourcing and exploring circular economy principles to reduce its embedded carbon footprint.

Large-scale energy storage projects, like those Fluence undertakes, require significant land. A typical 100 MW/400 MWh facility can occupy 5-10 acres, necessitating careful site selection to minimize ecological disruption and ensure compliance with land-use regulations.

| Environmental Factor | Impact on Fluence Energy | Relevant Data/Statistics |

| Climate Change & Decarbonization Policies | Drives demand for renewable energy integration and storage solutions. | Over 130 countries have net-zero targets; IEA data shows power sector at ~40% of global CO2 emissions (2024). |

| Battery Regulations (e.g., EU Battery Regulation) | Requires adherence to carbon footprint declarations and recycling quotas. | EU aims for 70% battery weight recycling by 2030. |

| Raw Material Scarcity & Extraction Impacts | Supply chain risks and environmental concerns for critical materials like lithium and cobalt. | High demand for lithium projected by 2025, requiring significant production increases. |

| Land Use and Habitat Fragmentation | Necessitates careful site selection and environmental impact assessments for projects. | 100 MW/400 MWh projects can require 5-10 acres; focus on minimizing ecological sensitivity. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fluence Energy is built on a robust foundation of data from government energy agencies, international economic bodies, and leading industry research firms. We incorporate regulatory updates, market forecasts, and technological adoption trends to provide a comprehensive view.