Fluence Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluence Energy Bundle

Fluence Energy's position in the market is dynamic, and understanding its BCG Matrix is crucial for strategic growth. This preview offers a glimpse into how its offerings might be categorized, but to truly unlock actionable insights, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Fluence's grid-scale Battery Energy Storage Systems (BESS) in North America are a clear Star in the BCG matrix. The North American market for energy storage is experiencing robust growth, with the U.S. alone projected to install over 10 GW of new battery capacity in 2024, a substantial increase from previous years.

This rapid expansion is significantly fueled by supportive policies like the Inflation Reduction Act (IRA), which incentivizes domestic manufacturing and content. Fluence's strategic focus on meeting these domestic content requirements positions them favorably to capitalize on this burgeoning demand, giving them a distinct competitive advantage in a high-growth, high-share segment.

Fluence's advanced product portfolio, featuring innovations like the SmartStack™ Edge modular storage system, firmly places it at the forefront of the rapidly expanding energy storage sector. This focus on cutting-edge solutions is designed to boost operational efficiency and offer distinct competitive advantages, paving the way for increased market share.

The company's commitment to ongoing technological development is a critical factor in sustaining its leading position within this fast-evolving industry. For instance, Fluence reported a significant increase in its project pipeline in 2024, reflecting strong market demand for its advanced battery energy storage systems (BESS).

Fluence Energy's global project backlog is a significant indicator of its market position and future growth potential. As of December 31, 2024, the company reported a contracted backlog of approximately $5.1 billion. This substantial figure underscores strong demand for Fluence's energy storage solutions and provides considerable revenue visibility for the coming years.

This expanding backlog highlights Fluence's success in securing a high market share within the rapidly growing global energy storage sector. It demonstrates the company's ability to translate market opportunities into confirmed business, laying a solid foundation for continued expansion and profitability in a dynamic industry.

Strategic Partnerships and Market Leadership

Fluence's strategic alliances with industry giants like Siemens and AES are foundational to its market dominance. These collaborations not only inject substantial capital but also provide invaluable engineering prowess and expansive global market access, solidifying Fluence's standing as a leader in energy storage solutions. For instance, Siemens’ involvement offers advanced digital and automation technologies, while AES contributes deep utility operational experience.

Fluence consistently earns accolades as a premier Battery Energy Storage System (BESS) integrator, reflecting its substantial market share within the rapidly expanding energy storage industry. In 2023, the company reported a significant increase in deployed storage capacity, further cementing its leadership position. These strategic partnerships directly fuel Fluence's ability to invest heavily in research and development and achieve broad market penetration.

- Market Share: Fluence is recognized as one of the top BESS integrators globally, holding a significant share in a market projected to reach over $100 billion by 2030.

- Partnership Value: Backing from Siemens and AES translates into enhanced technological capabilities and greater financial stability, enabling larger project deployments.

- Investment Capacity: These alliances facilitate substantial capital infusion, allowing Fluence to scale operations and outpace competitors in market penetration.

- Global Reach: The combined networks of its partners extend Fluence's operational footprint, enabling it to secure and execute projects across diverse international markets.

Integrated Solutions for Renewable Energy Integration

Fluence's integrated solutions are pivotal for incorporating renewable energy, a sector experiencing rapid growth. Their energy storage systems bolster grid stability and improve the efficiency of renewable assets, positioning them as key contributors to the energy transition. This vital function guarantees continued strong demand for their products.

The company's technology is crucial for overcoming the intermittency of renewables like solar and wind. In 2023, renewable energy sources accounted for approximately 23% of the U.S. electricity generation, a figure projected to rise significantly. Fluence's storage solutions enable a higher penetration of these variable sources by providing grid services such as frequency regulation and peak shaving.

- Grid Stability: Fluence's systems help maintain grid frequency and voltage, essential for integrating large amounts of intermittent renewable power.

- Renewable Asset Optimization: They enhance the economic viability of renewable projects by allowing energy to be stored when abundant and dispatched when demand is high.

- Market Growth: The global energy storage market is expected to grow substantially, with projections indicating it could reach over $300 billion by 2030, driven by renewable integration needs.

Fluence's position as a market leader in Battery Energy Storage Systems (BESS) firmly places it in the Star quadrant of the BCG matrix. The company commands a significant market share in the rapidly expanding global energy storage sector, evidenced by its substantial contracted backlog of approximately $5.1 billion as of December 31, 2024. This strong market presence is bolstered by strategic alliances with industry leaders like Siemens and AES, which provide crucial capital, engineering expertise, and global market access, enabling Fluence to outpace competitors and secure large-scale projects. Furthermore, Fluence's integrated solutions are vital for the increasing adoption of renewable energy, addressing the intermittency of sources like solar and wind and ensuring grid stability.

| Metric | Value | Significance |

|---|---|---|

| Contracted Backlog (as of Dec 31, 2024) | $5.1 billion | Indicates strong demand and revenue visibility, reinforcing market leadership. |

| US New Battery Capacity (2024 Projection) | Over 10 GW | Highlights the robust growth of the North American market, a key region for Fluence. |

| Renewable Energy Share in US Generation (2023) | Approx. 23% | Demonstrates the growing need for energy storage to integrate variable renewable sources. |

What is included in the product

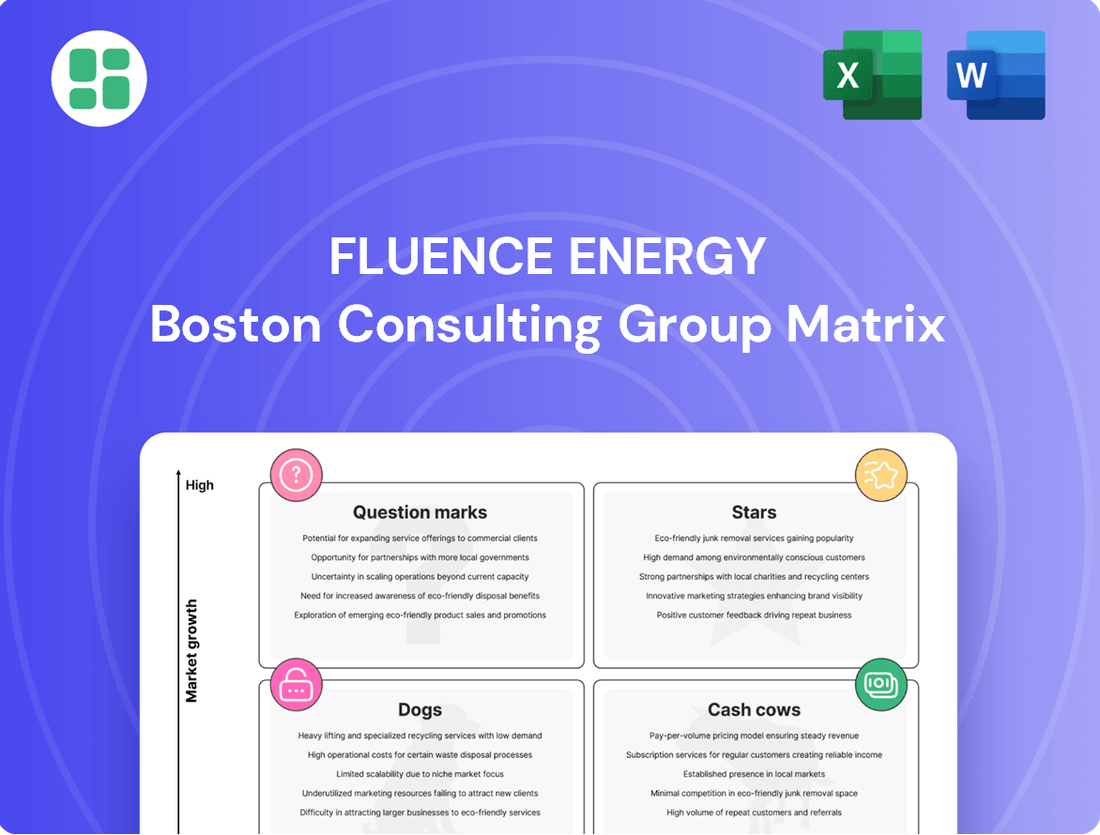

This BCG Matrix overview analyzes Fluence Energy's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

Fluence Energy's BCG Matrix provides a clear, visual roadmap, alleviating the pain of strategic uncertainty by pinpointing growth opportunities.

Cash Cows

Fluence Energy's operational services and long-term maintenance contracts are a clear Cash Cow. These offerings generate predictable, recurring revenue with healthy profit margins, often exceeding those from initial hardware sales. This stability is a significant advantage.

By tapping into its existing customer base and installed energy storage systems, Fluence can generate consistent cash flow with minimal need for substantial new investment. This strategy allows for efficient capital deployment.

For fiscal year 2024, Fluence has projected annual recurring revenue (ARR) growth, underscoring the robust and expanding nature of these service contracts. This financial guidance directly supports their classification as a Cash Cow within the BCG matrix.

Established utility-scale BESS deployments represent Fluence Energy's cash cows. These operational projects consistently generate healthy profits and reliable cash flow, having already absorbed initial development expenses. Their strong performance and existing service agreements ensure a steady income stream.

Fluence Energy's standardized BESS product platforms, like its Fluence Gridstack, represent mature offerings with a proven track record. These systems have achieved significant market penetration, reducing the need for substantial new R&D investment. For instance, Fluence reported a significant increase in deployed capacity in their fiscal year 2023, underscoring the maturity and reliability of their established product lines.

These established products benefit from economies of scale in manufacturing and deployment, leading to consistent profitability. This allows Fluence to generate steady cash flow without requiring heavy reinvestment for market expansion, a hallmark of a cash cow in the BCG matrix. The company's focus on optimizing these platforms ensures continued cost-effectiveness and market competitiveness.

Efficient Global Supply Chain and Manufacturing

Fluence Energy's focus on an efficient global supply chain and manufacturing is a key driver of its cash cow status. By optimizing logistics and production processes, the company has seen a positive impact on its profitability. This operational efficiency allows Fluence to extract maximum value from its established market positions.

These efforts directly translate into stronger gross profit margins, which are crucial for generating substantial cash. For instance, in the fiscal year ending September 30, 2023, Fluence reported a gross profit of $222.3 million, a significant increase from the previous year, reflecting improved cost management and operational leverage. This ability to control costs across its worldwide operations enables Fluence to effectively 'milk' its existing market share.

- Improved Gross Profit Margins: Fluence's operational efficiencies have bolstered its gross profit, a direct contributor to cash generation.

- Cost Management: Effective cost control across global operations allows for more profitable utilization of existing market share.

- Strong Cash Generation: Operational excellence underpins the company's robust cash-generating capabilities, characteristic of a cash cow.

- Fiscal Year 2023 Performance: The company reported a gross profit of $222.3 million for FY23, demonstrating the financial benefits of their supply chain and manufacturing optimization.

Strategic Financial Backing and Capital Structure

Fluence Energy benefits from significant strategic financial backing, primarily from its parent companies, Siemens and AES. This robust foundation allows for substantial investments in growth and operational stability.

The company has also successfully raised capital through instruments like convertible senior notes, further solidifying its financial position. For instance, in February 2024, Fluence announced a $250 million offering of convertible senior notes due 2029, demonstrating continued investor confidence.

This access to capital enables Fluence to effectively manage its working capital needs and fund ambitious growth initiatives. It means the company isn't solely dependent on its operating cash flow, allowing it to leverage its strong market presence.

- Siemens and AES provide substantial financial backing.

- Successful capital raises, like the $250 million convertible senior notes in Feb 2024, enhance financial stability.

- This backing supports working capital management and growth funding.

- Fluence can leverage its market position without sole reliance on operating cash flow.

Fluence Energy's established utility-scale battery energy storage systems (BESS) and their associated long-term service agreements are prime examples of cash cows. These operational projects have already covered their initial development costs and now consistently generate reliable cash flow with healthy profit margins. This stability is further enhanced by economies of scale in manufacturing and deployment, allowing Fluence to maintain profitability without significant new investment. For fiscal year 2023, Fluence reported a gross profit of $222.3 million, a testament to the financial strength of these mature offerings.

| Business Segment | BCG Matrix Category | Key Characteristics | Supporting Data (FY23) |

|---|---|---|---|

| Operational Services & Maintenance Contracts | Cash Cow | Predictable recurring revenue, high profit margins, minimal new investment needed. | Strong Annual Recurring Revenue (ARR) growth projected for FY24. |

| Standardized BESS Product Platforms (e.g., Gridstack) | Cash Cow | Mature offerings, proven track record, market penetration, economies of scale. | Significant increase in deployed capacity reported in FY23. |

| Optimized Global Supply Chain & Manufacturing | Supports Cash Cow Status | Improved cost management, increased gross profit margins. | Gross profit of $222.3 million in FY23. |

Full Transparency, Always

Fluence Energy BCG Matrix

The Fluence Energy BCG Matrix preview you're examining is the definitive, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be delivered to you in its entirety, ready for immediate application in your business planning and decision-making processes.

Dogs

Certain U.S. projects for Fluence Energy have been put on hold due to the unpredictable nature of trade tariff policies. These projects, though situated in a market with significant growth potential, are currently yielding minimal or even negative returns. This situation clearly places them in the 'Dog' category of the BCG Matrix.

The direct consequence of these project delays has been a noticeable impact on Fluence's revenue forecasts and overall profitability. Capital is effectively tied up in these deferred projects, preventing it from generating the immediate returns that would bolster the company's financial performance.

For instance, in 2024, Fluence reported that tariff-related uncertainties contributed to a backlog of projects facing extended timelines. This situation highlights the financial drag of these 'Dog' assets, as they demand ongoing investment without a clear or timely path to positive cash flow, affecting the company's ability to reinvest in more promising ventures.

Fluence Energy's energy storage solutions, particularly in segments where price is the primary differentiator, face significant pressure from Chinese competitors. These markets often lack robust domestic content requirements, allowing lower-cost Chinese manufacturers to gain a foothold. For instance, in markets prioritizing upfront cost over long-term value, Fluence may find it challenging to compete directly on price.

This intense price competition directly impacts Fluence's profitability. In 2024, reports indicated that the average selling price for battery energy storage systems (BESS) in some Asian markets saw a notable decline, partly due to the influx of aggressively priced Chinese products. This trend puts considerable pressure on Fluence's margins and can lead to a loss of market share in these price-sensitive segments, potentially impacting their overall revenue growth trajectory.

Underperforming legacy or niche solutions in Fluence Energy's portfolio might include older, highly specialized energy storage systems that struggle to compete in today's fast-paced market. These products, often custom-built, may not align with Fluence's current strategy focused on scalable, standardized offerings. As of early 2024, the energy storage market is heavily influenced by cost reductions and technological advancements, making it challenging for older, less efficient systems to maintain relevance.

Such solutions are likely experiencing stagnant or declining market share, with maintenance costs potentially outweighing the revenue they generate. For instance, if a legacy system requires proprietary parts or specialized labor that is becoming scarce or expensive, its profitability would be significantly impacted. This category represents a drain on resources that could otherwise be invested in Fluence's more promising product lines.

Geographic Markets with Limited Traction

Geographic markets where Fluence Energy currently has limited traction can be viewed as potential Dogs in a BCG Matrix analysis. These are regions where the company's market share is low, and the market growth rate is also not substantial, suggesting limited future potential. For instance, while Fluence has a presence in various global markets, specific developing economies might present significant hurdles such as regulatory complexities, underdeveloped grid infrastructure, or intense competition from established local players. These markets, despite potential long-term demand, might not be yielding significant revenue or profit for Fluence in the near to medium term.

These underperforming regions often require substantial investment in sales, marketing, and localized operational setup without a commensurate return. In 2023, for example, while Fluence reported strong growth in established markets like Australia and Europe, certain emerging markets in Southeast Asia or parts of Africa, where regulatory frameworks for energy storage are still nascent, represented a smaller portion of their overall revenue. This can lead to a situation where resources are allocated to these areas with minimal impact on the company's top-line growth or profitability.

- Low Market Share: Fluence's presence in certain developing nations, particularly those with nascent renewable energy policies, results in a minimal market share, often in the low single digits.

- Intense Local Competition: Established local energy providers or companies with deep-rooted relationships in these markets create significant barriers to entry for international players like Fluence.

- Resource Drain: Continued investment in these markets without substantial revenue generation can divert capital and management attention from more promising opportunities, impacting overall financial performance.

- Limited Growth Prospects: The slow pace of renewable energy adoption and storage market development in these specific geographies limits the near-term growth potential for Fluence's offerings.

Unsuccessful Exploratory Ventures

Unsuccessful exploratory ventures within Fluence Energy's portfolio, categorized as Dogs in the BCG matrix, represent past or current experimental projects that haven't achieved significant market adoption or a clear route to profitability. These initiatives, while potentially innovative, have become drains on resources, yielding minimal returns and diverting capital from more successful endeavors.

For instance, consider Fluence's early-stage development of a novel, grid-scale energy storage solution utilizing a different battery chemistry that, despite initial promise, faced unforeseen manufacturing challenges and higher-than-anticipated operational costs. By mid-2024, the project had consumed an estimated $25 million in R&D and pilot funding with no commercial contracts secured. This venture, like others in the Dog category, highlights the inherent risks in pioneering new technologies and the necessity of rigorous performance evaluation to identify and divest from underperforming assets.

- Sunk Costs: These ventures represent significant capital investment with little to no prospect of future returns.

- Resource Diversion: Funds and management attention are drawn away from high-potential Stars and Question Marks.

- Market Traction Failure: Projects have failed to gain sufficient customer interest or competitive advantage.

- Profitability Concerns: The path to generating profit has proven elusive or economically unviable.

Projects in markets with unpredictable trade policies, like certain U.S. initiatives for Fluence Energy, are currently yielding minimal returns, placing them in the Dog category of the BCG Matrix. These delayed projects tie up capital, impacting revenue forecasts and profitability. For example, in 2024, tariff uncertainties caused project backlogs, creating a financial drag as they required ongoing investment without a clear path to positive cash flow.

Fluence faces intense price competition from Chinese manufacturers in segments where cost is paramount, particularly in markets lacking robust domestic content requirements. This pressure on average selling prices, evident in 2024 market reports showing declines in some Asian markets, directly impacts Fluence's margins and potential market share loss.

Underperforming legacy or niche energy storage solutions, often custom-built and struggling to compete with newer, cost-effective technologies, also fall into the Dog category. As of early 2024, the market's focus on cost reduction makes older, less efficient systems less relevant. These solutions may experience stagnant market share, with maintenance costs potentially exceeding revenue, diverting resources from more promising product lines.

| Category | Description | Fluence Energy Example | 2024 Financial Impact | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low market share and low market growth. Require significant investment but offer minimal returns. | U.S. projects impacted by trade tariffs; price-sensitive Asian markets facing Chinese competition; underperforming legacy systems; nascent geographic markets. | Tied-up capital, reduced profit margins, potential revenue stagnation in specific segments. | Divestment, cost reduction, or strategic repositioning to free up resources for more promising ventures. |

Question Marks

Fluence IQ, Fluence Energy's AI-powered platform for optimizing renewable and storage assets, is positioned as a Question Mark within the BCG matrix. This classification stems from its operation in the burgeoning digital energy management sector, a market experiencing rapid expansion.

Despite the high-growth nature of its market, Fluence IQ's current market share is still establishing itself when compared to the wider software landscape. The company is investing heavily in research and development, alongside efforts to drive market adoption, reflecting the significant resources required for this nascent product.

The future trajectory of Fluence IQ hinges on its ability to gain widespread acceptance and integration within the energy sector. Should it achieve substantial market penetration and solidify its position, it has the potential to transition from a Question Mark to a Star, signifying a leading presence in a high-growth market.

Fluence's strategic push into emerging international markets, like those in the Middle East and Africa, positions it squarely in the "Question Marks" category of the BCG matrix. These regions represent nascent but rapidly expanding energy storage landscapes, offering significant long-term growth prospects.

While the potential is high, Fluence is likely entering these markets with a comparatively modest market share. This necessitates considerable investment to build brand recognition, develop local partnerships, and establish operational infrastructure, characteristic of managing Question Mark assets effectively.

Investments in next-generation long-duration energy storage technologies, moving beyond traditional lithium-ion, hold significant future promise but are currently in their nascent stages. These advanced technologies, such as flow batteries, compressed air energy storage, and thermal storage, are still working towards widespread commercialization. Their market share remains low, reflecting the early phase of their adoption cycle.

Significant capital investment is essential for the development and scaling of these innovative storage solutions. For example, companies developing advanced battery chemistries or novel mechanical storage systems often require substantial funding for research, pilot projects, and manufacturing facility build-outs. This capital intensity is a key factor in their current position within the BCG matrix, demanding careful strategic consideration for Fluence Energy.

Specific Advanced Grid Services Pilots

Fluence Energy is actively involved in developing and piloting advanced grid services. These specialized services, like sophisticated frequency regulation and black start capabilities, are designed to meet evolving grid requirements. They are experiencing rapid growth in demand but are still in the initial stages of adoption, necessitating substantial investment for wider market penetration and significant market share gains.

These advanced services are crucial for grid stability and resilience, particularly as renewable energy sources become more prevalent. For instance, advanced frequency regulation helps maintain grid balance by rapidly responding to changes in electricity supply and demand. Black start capabilities are essential for restoring power after a widespread outage.

- Advanced Frequency Regulation: Pilots focus on faster response times and higher accuracy to support grid stability with intermittent renewables.

- Black Start Capabilities: Projects are demonstrating the ability of energy storage systems to initiate power restoration without relying on the main grid.

- Demand Response Optimization: Fluence is piloting services that intelligently manage customer load to provide grid flexibility.

- Grid Inertia Emulation: Research and development are underway to simulate the inertia provided by traditional generators, enhancing grid stability.

Modular and Standardized Product Rollouts in New Segments

Fluence Energy's strategy involves introducing modular and standardized products, such as the SmartStack™ Edge, into new customer segments or applications where their market presence is not yet established. This approach positions these offerings as Question Marks within the BCG Matrix.

While the underlying technology might be considered a Star due to its innovation and potential, its deployment in nascent or unproven markets introduces uncertainty. Success hinges on achieving significant market adoption and demonstrating a clear competitive advantage in these new territories.

- SmartStack™ Edge Rollout: Targeting new market segments for Fluence’s modular battery energy storage products.

- Market Penetration Goal: Achieving substantial market share in these new, less-established areas is key to moving this product from Question Mark to Star.

- Investment Consideration: Significant investment is likely required to build brand awareness and customer trust in these new segments.

- 2024 Market Data: The global energy storage market continued its robust growth in 2024, with new segments like distributed generation and microgrids showing particular promise for modular solutions.

Fluence Energy's AI platform, Fluence IQ, is a Question Mark due to its operation in the rapidly expanding digital energy management sector, yet it still needs to establish a significant market share against broader software competitors.

The company's strategic expansion into emerging international markets like the Middle East and Africa also places its endeavors in the Question Mark category, as these regions offer high growth potential but require substantial investment to build presence and market share.

Investments in next-generation long-duration energy storage technologies, such as flow batteries, are also considered Question Marks, reflecting their early commercialization stages and the considerable capital required for their development and scaling.

Fluence's advanced grid services, including frequency regulation and black start capabilities, are in high demand but still in early adoption phases, necessitating significant investment for wider market penetration and market share gains.

| Category | Market Growth | Market Share | Investment Needs | Strategic Outlook |

| Fluence IQ (AI Platform) | High (Digital Energy Management) | Low/Establishing | High (R&D, Adoption) | Potential Star if market share grows |

| Emerging Markets (MEA) | High (Energy Storage) | Low | High (Brand, Ops) | High potential with strategic investment |

| Long-Duration Storage Tech | High (Emerging) | Very Low | Very High (Development, Scale) | Future growth dependent on commercialization |

| Advanced Grid Services | High (Grid Modernization) | Low/Early Adoption | High (Penetration) | Crucial for grid stability, needs wider adoption |

BCG Matrix Data Sources

Our Fluence Energy BCG Matrix is built on robust market data, encompassing financial disclosures, industry growth forecasts, and competitor performance analysis to provide strategic clarity.