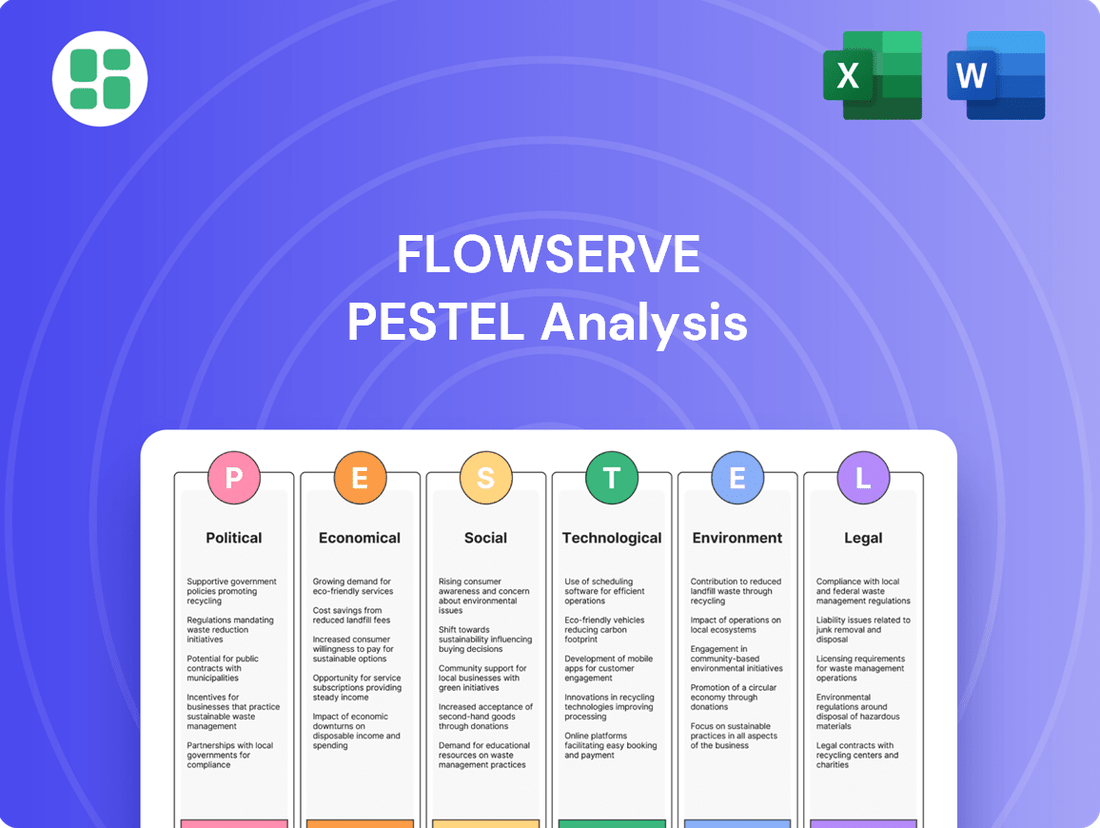

Flowserve PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flowserve Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Flowserve's strategic landscape. Our expert-crafted PESTLE analysis delivers actionable intelligence, empowering you to anticipate market shifts and identify opportunities. Download the full version now and gain a decisive advantage in your strategic planning.

Political factors

Government investments in critical infrastructure, like water treatment plants and power grids, are a major driver for Flowserve. These public spending initiatives directly translate into demand for Flowserve's pumps, valves, and seals. For instance, the US government's Infrastructure Investment and Jobs Act, enacted in 2021, allocated over $1.2 trillion towards infrastructure upgrades, with a significant portion earmarked for water and energy systems through 2026, providing substantial opportunities for companies like Flowserve.

Global trade policies, including tariffs and import/export regulations, significantly influence Flowserve's manufacturing costs and overall competitiveness. For instance, anticipated tariffs in Q1 2025, such as a potential 145% tariff on goods from China, a 25% tariff from Canada and Mexico, and a 10% tariff from the EU, could directly increase the cost of essential raw materials and components.

These increased costs can impact Flowserve's profitability and necessitate adjustments to pricing strategies for its industrial pump and valve solutions. The company actively monitors these evolving trade landscapes to implement proactive measures and mitigate potential financial repercussions.

Geopolitical stability is a critical factor for Flowserve, a company heavily reliant on global energy markets. Political instability or conflicts in key regions, especially those with significant oil and gas reserves, can directly impact Flowserve's operations and its customer base. For instance, disruptions in the Middle East or parts of Africa, where many energy projects are located, can lead to significant supply chain interruptions and reduced capital expenditure by energy companies. This directly affects demand for Flowserve's complex fluid motion and control products.

Such events often result in project delays or outright cancellations within the energy sector. In 2024, ongoing geopolitical tensions, such as those in Eastern Europe and the Middle East, have already contributed to increased volatility in commodity prices and investment uncertainty. This uncertainty can translate into a slower conversion of Flowserve's order backlog into revenue and a dampening of overall market demand for its solutions, as customers postpone or scale back new capital investments.

Energy Transition Policies

Government policies championing renewable energy and decarbonization are directly shaping Flowserve's strategic direction. As nations increasingly pivot away from fossil fuels, the demand for traditional oil and gas equipment faces potential headwinds, while sectors like nuclear power, hydrogen, and carbon capture – areas where Flowserve is actively investing – are poised for expansion.

These energy transition policies are creating a significant shift in the industrial landscape. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that global investment in clean energy technologies is projected to reach new highs, with a substantial portion allocated to renewable electricity generation and grid infrastructure. This trend directly impacts Flowserve's market opportunities.

- Shifting Demand: Policies incentivizing renewables may reduce demand for Flowserve's traditional oil and gas components, impacting revenue streams from legacy markets.

- Growth in New Sectors: Conversely, government support for hydrogen infrastructure and carbon capture technologies is expected to drive significant growth for Flowserve's specialized equipment and services in these emerging areas.

- Policy Impact on Investment: For example, the US Inflation Reduction Act of 2022, with its substantial clean energy tax credits, is already stimulating investment in projects that will require advanced fluid motion control solutions, benefiting companies like Flowserve.

Industrial Regulations and Standards

Regulatory frameworks governing industrial safety, emissions, and operational efficiency across sectors like chemical, power generation, and water resources create a continuous need for compliant and advanced fluid management products. For instance, stricter emissions standards, such as those being implemented globally in 2024 and 2025 for industrial facilities, directly influence the demand for Flowserve's high-performance pumps and seals designed to minimize leaks and improve environmental compliance.

Flowserve must ensure its products meet evolving international and local standards. This can drive demand for new, higher-specification equipment and aftermarket services as industries upgrade to meet these requirements. For example, the International Organization for Standardization (ISO) continues to update standards related to environmental management and product safety, impacting product design and validation processes for companies like Flowserve.

- Evolving Emissions Standards: New regulations in 2024-2025 are pushing industries to adopt more efficient fluid handling systems to reduce environmental impact.

- Safety Compliance: Adherence to stringent international safety standards (e.g., ATEX for explosive atmospheres) necessitates specialized equipment, benefiting Flowserve's product portfolio.

- Water Resource Management: Increasingly rigorous regulations on water usage and wastewater treatment globally are creating opportunities for Flowserve's water sector solutions.

- Product Lifecycle Management: Regulations often mandate specific maintenance and reporting for industrial equipment, boosting demand for Flowserve's aftermarket and service offerings.

Government support for infrastructure projects, particularly in water and energy, directly fuels demand for Flowserve's core offerings. The US Infrastructure Investment and Jobs Act, with over $1.2 trillion allocated through 2026, is a prime example of this supportive policy environment. This creates a robust market for Flowserve's pumps and valves as these projects progress.

Trade policies and geopolitical events significantly impact Flowserve's operational costs and market access. Potential tariffs in 2025, such as a 145% tariff on Chinese goods, could escalate raw material expenses, while regional instability in energy-producing areas can disrupt supply chains and customer investment.

Government initiatives promoting renewable energy and decarbonization are reshaping Flowserve's business landscape. While demand for traditional oil and gas components may face pressure, policies supporting hydrogen, carbon capture, and nuclear power are creating substantial growth avenues for the company's specialized solutions.

Regulatory frameworks focused on industrial safety, emissions, and water management are key drivers for Flowserve's advanced product development and aftermarket services. Stricter emissions standards globally in 2024-2025 necessitate high-performance equipment, boosting demand for Flowserve's compliant solutions and ongoing service needs.

What is included in the product

This Flowserve PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

Flowserve's PESTLE analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus alleviating the pain of sifting through extensive data.

Economic factors

Global economic growth is a significant driver for Flowserve. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight uptick from 3.0% in 2023, indicating a generally positive environment for industrial investment. Stronger economic expansion often translates into increased demand for Flowserve's engineered products and services as industries ramp up production and capital expenditure.

Industrial output is directly tied to Flowserve's revenue streams. When industrial sectors, such as oil and gas, chemical, and power generation, experience robust output, their need for Flowserve's critical components like pumps, valves, and seals rises. For example, a 2.5% year-over-year increase in global industrial production in early 2024 would likely signal heightened activity and greater demand for Flowserve's offerings.

Fluctuations in global oil and gas prices are a critical economic factor for Flowserve, directly influencing investment across the energy sector. When prices are high and stable, like the average Brent crude oil price of around $82 per barrel in early 2024, energy companies are more inclined to invest in new upstream exploration, midstream infrastructure, and downstream refining projects. This increased capital expenditure translates into higher demand for Flowserve's pumps, valves, and associated services, boosting their order backlog and revenue streams.

Conversely, periods of low or volatile oil and gas prices can significantly dampen capital spending by energy producers. For instance, if prices were to fall below $70 per barrel for an extended period, as seen in late 2023, companies often scale back or delay new projects. This reduction in investment directly impacts Flowserve's bookings, leading to slower revenue growth and potentially affecting profitability as demand for new equipment and aftermarket services diminishes.

Changes in interest rates significantly affect Flowserve's industrial customers. When interest rates rise, borrowing becomes more expensive, potentially making customers hesitant to fund new projects or upgrade existing equipment. This can lead to a slowdown in Flowserve's order intake as capital investment becomes less attractive.

Conversely, lower interest rates can act as a catalyst for growth. They reduce the cost of capital for businesses, encouraging them to undertake capital-intensive projects. For instance, the U.S. Federal Reserve maintained its benchmark interest rate in the range of 5.25%-5.50% through early 2024, a level that still represents a significant increase from previous years, impacting borrowing costs for many industrial firms globally.

The cost of capital directly influences the feasibility of large-scale industrial investments. Flowserve's customers, particularly those in sectors like oil and gas or water management, often undertake projects that require substantial upfront financing. Higher rates mean these projects need to promise even greater returns to be viable, potentially delaying or reducing the scope of such investments.

Supply Chain Disruptions and Inflation

Global supply chain disruptions and persistent inflationary pressures are significantly impacting Flowserve's operational landscape. These issues directly translate to increased costs for essential raw materials, such as steel and specialized alloys, thereby squeezing gross margins. For instance, the Producer Price Index for steel mill products saw a notable increase in late 2023 and early 2024, presenting a direct cost challenge.

Managing these elevated production costs and extended lead times is paramount for Flowserve. Failure to do so can lead to reduced profitability or force the company to implement price hikes. Such price adjustments, while necessary to offset higher input costs, carry the risk of diminishing Flowserve's competitive standing in the market, particularly for its engineered fluid motion products.

- Increased Raw Material Costs: Fluctuations in global commodity prices, especially for metals like stainless steel and nickel, directly affect Flowserve’s cost of goods sold.

- Extended Lead Times: Bottlenecks in manufacturing and transportation networks can delay the procurement of components and the delivery of finished goods, impacting project timelines and customer satisfaction.

- Margin Pressure: The inability to fully pass on increased costs to customers can erode Flowserve's gross profit margins, affecting overall financial performance.

- Competitive Pricing Challenges: Higher production costs may necessitate price increases, potentially making Flowserve's offerings less attractive compared to competitors with more resilient supply chains or lower input costs.

Currency Exchange Rate Fluctuations

Flowserve, as a global manufacturer with operations in over 50 countries, is significantly exposed to currency exchange rate fluctuations. These movements can directly affect the reported value of its international sales and earnings. For instance, a stronger US dollar against other currencies would reduce the dollar-denominated value of sales made in those foreign currencies, potentially impacting top-line growth in reported financials.

Furthermore, currency volatility impacts the cost of imported components and raw materials. If Flowserve sources materials from countries with strengthening currencies relative to the US dollar, its input costs will rise, squeezing profit margins. This necessitates careful financial management and hedging strategies to mitigate the adverse effects of these fluctuations on the company's overall financial performance.

- Impact on Revenue: In 2023, Flowserve reported that a 1% change in foreign currency rates could impact sales by approximately $20 million.

- Cost of Goods Sold: Fluctuations in the Euro and British Pound, key operating currencies, can alter the cost of manufacturing for Flowserve's European facilities.

- Hedging Strategies: Flowserve utilizes financial instruments to hedge against currency risks, aiming to stabilize earnings and cash flows from its international operations.

- Geographic Sales Mix: The company's revenue is diversified across regions, meaning the net impact of currency fluctuations depends on the relative performance of various currency pairs against the US dollar.

Global economic growth directly influences demand for Flowserve's engineered products and services. The IMF projected global growth at 3.2% for 2024, indicating a generally favorable environment for industrial investment. Stronger economic expansion typically leads to increased industrial output and capital expenditures, boosting Flowserve's order intake.

Fluctuations in oil and gas prices significantly impact Flowserve's energy sector customers. For example, Brent crude oil averaged around $82 per barrel in early 2024, encouraging investment in new projects. Conversely, prices below $70 per barrel can lead to project delays, directly affecting Flowserve's bookings.

Interest rate changes affect Flowserve's customers' borrowing costs and investment decisions. The U.S. Federal Reserve maintained rates between 5.25%-5.50% through early 2024, impacting the cost of capital for industrial firms globally. Higher rates can deter capital-intensive projects, potentially slowing Flowserve's order growth.

Same Document Delivered

Flowserve PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Flowserve PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping Flowserve's strategic landscape.

Sociological factors

The availability of a skilled workforce, especially in engineering, manufacturing, and technical services, is absolutely critical for Flowserve's ability to operate efficiently and drive innovation. Without enough qualified people, especially those with specialized industrial knowledge, the company could struggle to meet production demands or develop the advanced solutions its clients expect.

An aging workforce presents a significant challenge, as experienced professionals retire and take their valuable knowledge with them. This, coupled with a potential skills gap in niche industrial fields, can make it harder for Flowserve to find and keep the talent it needs, potentially impacting production output and the delivery of complex projects. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a shortage of skilled trades workers, a trend likely to continue impacting manufacturing sectors.

Customers increasingly expect products and services that minimize environmental impact. This growing demand for sustainable solutions directly influences the fluid management industry, pushing companies like Flowserve to innovate in areas like energy efficiency and reduced emissions. For instance, a 2024 report indicated that over 60% of consumers consider sustainability a key factor in purchasing decisions, a trend mirrored in B2B markets.

Flowserve's strategic focus on decarbonization, a core element of its 3D growth strategy, directly addresses this customer imperative. By developing and offering solutions that help clients lower their carbon footprint and meet their own environmental, social, and governance (ESG) targets, Flowserve positions itself as a partner in achieving sustainability, not just a supplier. This is crucial as many industrial clients are now mandated to report and reduce their emissions, creating a significant market opportunity.

Flowserve faces growing pressure from investors, employees, and the public to demonstrate strong Corporate Social Responsibility (CSR). This includes expectations around ethical labor, community involvement, and transparent governance. For instance, in 2023, investor demand for robust ESG (Environmental, Social, and Governance) reporting continued to climb, with ESG funds attracting significant inflows, signaling a clear preference for companies with strong social and environmental commitments.

Meeting these escalating CSR expectations is crucial for Flowserve's brand image and its ability to attract and retain top talent. Companies with demonstrably high CSR standards are increasingly viewed as more resilient and trustworthy, directly impacting their attractiveness to both potential employees and business partners. Surveys from 2024 indicate that over 70% of job seekers consider a company's social and environmental impact when deciding where to work.

Public Perception of Industrial Sectors

Public perception significantly shapes investment and regulatory attitudes toward industries like oil and gas, which are core to Flowserve's business. Negative sentiment towards these sectors can impact capital availability and increase compliance burdens. For instance, a 2024 survey indicated that 60% of surveyed investors expressed concerns about the long-term viability of fossil fuel investments due to environmental pressures.

Flowserve's strategic expansion into renewable energy and water management sectors is a direct response to these evolving public perceptions. This diversification not only mitigates risks tied to traditional industries but also aligns the company with growing investor and societal demand for sustainable solutions. By 2025, Flowserve aims to derive 25% of its revenue from these growth areas, up from 15% in 2023.

- Public Concern: Growing public scrutiny of carbon-intensive industries impacts investor confidence and regulatory frameworks.

- Industry Support: Flowserve's critical role in maintaining essential services within traditional sectors remains vital, despite perception challenges.

- Diversification Strategy: Expansion into renewables and water resources addresses negative perceptions and taps into new growth markets.

- Market Alignment: Flowserve's focus on sustainable solutions aligns with increasing ESG (Environmental, Social, and Governance) investment trends, which saw a 30% increase in global ESG assets under management in 2024.

Health and Safety Standards

Societal expectations and regulatory demands for robust health and safety standards in industrial settings are increasingly stringent. Flowserve's core business, providing critical components like seals and valves, directly impacts the safety of fluid handling operations. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued to emphasize process safety management, a key area where Flowserve's solutions contribute to preventing hazardous chemical releases.

Continuous innovation in sealing technology and valve design is therefore not just a competitive advantage but a necessity for Flowserve to meet and exceed these evolving safety benchmarks. This focus safeguards both industrial workers and the surrounding environment from potential hazards associated with fluid containment and control. The company's commitment to developing advanced sealing solutions aims to minimize leaks and ensure operational integrity across various industries.

- Increased regulatory scrutiny on industrial safety protocols globally.

- Flowserve's role in enabling safe fluid management through advanced sealing and valve technology.

- Societal pressure for companies to prioritize worker and environmental protection.

Societal expectations are shifting, with a growing emphasis on corporate responsibility and sustainability. Flowserve's ability to attract and retain talent is increasingly tied to its performance in areas like diversity and inclusion, with over 70% of job seekers in 2024 considering a company's social impact. Furthermore, public perception of industries like oil and gas directly influences investor confidence, pushing companies like Flowserve to diversify into renewable energy sectors, a move supported by a 30% increase in global ESG assets under management in 2024.

The demand for skilled labor, particularly in engineering and technical fields, remains a critical factor. In 2024, the U.S. Bureau of Labor Statistics highlighted ongoing shortages in skilled trades, impacting manufacturing output. This necessitates continuous investment in training and development to bridge any skills gaps and ensure Flowserve can meet production demands and innovate effectively.

Flowserve's commitment to health and safety is paramount, driven by stringent global regulations and societal expectations. The company's advanced sealing and valve technologies directly contribute to preventing hazardous chemical releases, a key focus for bodies like OSHA in 2024. This focus on operational integrity is vital for protecting workers and the environment.

| Sociological Factor | Impact on Flowserve | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Skilled Workforce Availability | Crucial for operations, innovation, and meeting demand. | Shortage of skilled trades reported by U.S. Bureau of Labor Statistics in 2024. |

| Corporate Social Responsibility (CSR) & ESG | Influences talent attraction, brand image, and investor confidence. | Over 70% of job seekers consider social impact (2024); 30% increase in global ESG assets (2024). |

| Public Perception of Industries | Affects capital availability and regulatory environment for sectors like oil & gas. | 60% of surveyed investors expressed concerns about fossil fuel investments (2024). |

| Health & Safety Standards | Drives innovation in product design and operational integrity. | OSHA's continued emphasis on process safety management (2024). |

Technological factors

Flowserve is actively integrating Industry 4.0 technologies like IIoT and AI into its fluid management solutions. This digital transformation, a key part of their '3D strategy', allows them to offer smart products that provide real-time data and predictive maintenance capabilities. For instance, their digital offerings aim to enhance operational efficiency and uptime for clients across various sectors.

Innovations in material science are significantly impacting Flowserve's product offerings. The development of more durable, corrosion-resistant, and lightweight materials is key to improving the performance and lifespan of their pumps, valves, and seals. For instance, advancements in superalloys and composite materials are enabling equipment to withstand extreme temperatures and corrosive media, a critical factor in industries like oil and gas and chemical processing. These material enhancements directly translate to better product reliability in demanding industrial settings and can facilitate more efficient product designs, ultimately reducing maintenance costs and downtime for Flowserve's clients.

The increasing digitalization of flow management and control systems is a major technological trend impacting industries that Flowserve serves. This shift towards digital solutions, including advanced sensors, IoT integration, and AI-powered analytics, allows for more precise and efficient fluid handling. For instance, in 2024, the industrial automation market, which includes these control systems, was projected to reach over $200 billion globally, indicating substantial investment in this area.

Flowserve is well-positioned to capitalize on this trend by developing sophisticated software and hardware. These advancements enable remote monitoring, real-time diagnostics, and predictive maintenance for their pumps, valves, and other equipment. By offering these digital services, Flowserve can enhance customer operational efficiency, reduce downtime, and generate recurring revenue streams through aftermarket support and data-driven insights, a strategy that aligns with the growing demand for smart manufacturing solutions.

Automation in Manufacturing Processes

Flowserve's embrace of automation and robotics within its manufacturing operations is a key technological driver. This adoption directly translates to enhanced production efficiency, a crucial factor in controlling labor costs and ensuring consistent, high-quality output. For instance, in 2024, companies across the industrial sector saw an average 15% reduction in operational costs through targeted automation initiatives, a trend Flowserve is likely mirroring.

Investments in these advanced manufacturing technologies are not just about cost savings; they are strategic enablers of higher throughput and quicker delivery times. This agility is vital for Flowserve to maintain and strengthen its competitive edge in a market that increasingly values speed and reliability. By the end of 2025, it's projected that over 60% of industrial manufacturers will have integrated advanced robotics into at least one core production line, underscoring the industry-wide shift.

The impact of automation extends to product quality and consistency. Automated systems minimize human error, leading to fewer defects and a more reliable product for customers. This focus on precision is critical for Flowserve's specialized equipment, where even minor variations can have significant consequences. Data from 2024 indicated that manufacturers leveraging automation reported a 20% decrease in product rejection rates compared to their less automated counterparts.

- Improved Production Efficiency: Automation streamlines workflows, reducing cycle times and increasing output.

- Reduced Labor Costs: Automating repetitive tasks lowers the reliance on manual labor, impacting operational expenses.

- Enhanced Product Quality: Robotics and automated systems minimize human error, leading to greater consistency and fewer defects.

- Increased Throughput and Faster Delivery: Investments in advanced manufacturing technologies enable higher production volumes and quicker order fulfillment.

Cybersecurity Threats to Industrial Control Systems

As Flowserve's smart products and customer operations integrate more digital and connected technologies, the risk of cyberattacks targeting Industrial Control Systems (ICS) escalates. This digital transformation necessitates the development of advanced cybersecurity features for Flowserve's intelligent product offerings and the safeguarding of its own operational technology (OT) infrastructure.

Protecting intellectual property, sensitive customer data, and maintaining operational continuity are paramount. For instance, the global industrial cybersecurity market was valued at approximately $17.4 billion in 2023 and is projected to reach $33.7 billion by 2028, indicating a significant and growing threat landscape. Flowserve's commitment to robust cybersecurity is therefore a critical factor in its ongoing success and customer trust.

- Increased Connectivity: Flowserve's smart products, like connected pumps and valves, increase the attack surface for cyber threats.

- Data Protection: Safeguarding proprietary designs and customer operational data is essential to prevent breaches and maintain competitive advantage.

- Operational Integrity: Ensuring the security of OT systems prevents disruptions to critical infrastructure operations, a key concern for Flowserve's clients.

- Market Trends: The growing investment in industrial cybersecurity solutions reflects the escalating recognition of these threats across all sectors.

Flowserve is leveraging advancements in artificial intelligence and the Industrial Internet of Things (IIoT) to enhance its fluid management solutions. These technologies enable predictive maintenance and real-time data analytics, improving operational efficiency for clients. For example, the company's digital transformation efforts, part of its 3D strategy, focus on delivering smart products that offer enhanced performance and reliability in demanding industrial environments.

Legal factors

Flowserve navigates a complex web of environmental regulations globally, impacting everything from product emissions to waste management. Compliance with standards like the European Union's Industrial Emissions Directive, which targets leakage and emissions reduction, is critical. Failure to adhere can result in significant fines and operational disruptions, influencing capital expenditure for cleaner technologies.

Flowserve operates under stringent global product liability laws and safety standards, demanding that its pumps, valves, and seals consistently meet high performance and safety benchmarks. Failure to comply can result in substantial fines, costly product recalls, and severe damage to its brand reputation, making ongoing investment in quality assurance and rigorous testing a critical operational necessity.

For instance, in 2023, the European Union continued to enforce its General Product Safety Regulation, which holds manufacturers accountable for ensuring product safety. While specific penalties for Flowserve are not publicly detailed, industry-wide recalls for faulty industrial equipment can cost millions, impacting profitability and market trust significantly.

Flowserve's global footprint means navigating a labyrinth of international trade laws, sanctions, and export controls. For instance, the ongoing geopolitical tensions in 2024 and 2025 continue to shape trade policies, potentially impacting Flowserve's ability to operate in or export to certain nations. These regulations can directly affect supply chains and market access, demanding constant vigilance and adaptability.

Labor Laws and Employment Regulations

Flowserve, as a global enterprise operating in over 50 countries, navigates a complex web of labor laws and employment regulations. These laws cover crucial aspects like minimum wages, acceptable working conditions, the right to collective bargaining, and prohibitions against discrimination. Staying compliant is paramount to avoiding legal penalties and maintaining a positive workforce environment.

Changes in these regulations can significantly impact Flowserve's operational costs and strategic flexibility. For instance, an increase in minimum wage requirements in a key manufacturing region could directly affect labor expenses. Similarly, evolving regulations around worker safety or benefits might necessitate investment in new facilities or processes.

- Global Compliance Burden: Flowserve must adhere to labor laws in numerous jurisdictions, each with unique requirements for wages, working hours, and employee rights.

- Impact of Regulatory Changes: Modifications to employment laws, such as those concerning overtime pay or unionization, can directly influence human resource costs and operational efficiency.

- Discrimination and Equal Opportunity: Strict adherence to anti-discrimination laws across all operating regions is essential for maintaining a fair workplace and mitigating legal risks.

- Collective Bargaining Dynamics: The varying strength and legal frameworks for collective bargaining in different countries can affect labor relations and the company's ability to manage its workforce effectively.

Intellectual Property Protection

Protecting Flowserve's vast array of proprietary technology, encompassing patents for its advanced pumps, valves, and seals, is fundamental to preserving its competitive advantage in the global market. This is particularly relevant as Flowserve continues to invest in R&D, with its 2023 R&D expenses totaling $246.9 million, underscoring the value of its innovations.

Navigating the complexities of intellectual property rights across different jurisdictions presents a significant legal challenge. Flowserve must maintain robust strategies for patent enforcement and actively combat infringement to safeguard its innovations and market share, especially in key markets like the United States, which accounts for a substantial portion of its revenue.

- Global IP Landscape: Flowserve operates in over 50 countries, each with distinct IP laws, necessitating tailored protection strategies.

- Patent Portfolio Value: The company holds thousands of active patents, representing significant intangible assets vital to its business model.

- Infringement Risks: Competitors may attempt to replicate Flowserve's patented technologies, requiring diligent monitoring and legal action to prevent market erosion.

- R&D Investment Protection: Safeguarding the intellectual property generated from its substantial R&D investments is crucial for maintaining a technological lead.

Flowserve must navigate a complex global legal framework, including environmental regulations, product safety standards, and international trade laws. Compliance with these varied legal requirements across its operations in over 50 countries is crucial for maintaining market access and avoiding penalties. The company's substantial investment in research and development, totaling $246.9 million in 2023, also necessitates robust intellectual property protection strategies to safeguard its technological innovations.

Environmental factors

Global and national efforts to combat climate change, including carbon pricing and emissions reduction targets, are increasingly influencing Flowserve's industrial customer base. For instance, the European Union's Emissions Trading System (ETS) saw carbon prices average around €80 per tonne in early 2024, a significant incentive for industries to reduce their carbon footprint.

These regulatory shifts directly drive demand for Flowserve's solutions that support decarbonization. This includes their products for carbon capture technologies and energy-efficient fluid handling systems, aligning with Flowserve's stated 'decarbonization' strategy and its focus on sustainable solutions.

Flowserve's commitment to supporting customers in meeting stringent environmental standards, such as the United States' Inflation Reduction Act which incentivizes green technologies, positions them to benefit from this transition. The company's investments in developing advanced sealing technologies and pumps for hydrogen and other low-carbon fuels are key to capturing this growing market.

Global water scarcity is a pressing environmental concern, with projections indicating that by 2025, two-thirds of the world's population could face water shortages. This escalating demand for efficient water resource management directly fuels the market for companies like Flowserve, which specialize in water and wastewater infrastructure solutions.

Flowserve's comprehensive portfolio of pumps, valves, and seals plays a critical role in essential water processes such as desalination, advanced water treatment, and reliable water distribution networks. These technologies are fundamental in tackling critical environmental challenges, thereby presenting significant growth avenues for the company.

The global emphasis on sustainability is driving stricter waste management regulations and a strong push towards circular economy principles. This trend encourages industries to significantly reduce waste and improve resource efficiency. For instance, the European Union's Circular Economy Action Plan aims to boost recycling rates and minimize landfill waste, impacting industries that rely on industrial processes.

These environmental shifts present a clear opportunity for Flowserve. By developing and offering solutions that facilitate recycling, promote the reuse of materials, and help industrial clients reduce their overall material consumption, Flowserve can align its business with these growing environmental demands. This includes providing advanced fluid handling technologies that are more durable, require less maintenance, and can be more easily refurbished or recycled at the end of their lifecycle.

Energy Efficiency Demands

Customers are increasingly demanding energy-efficient solutions to reduce operational costs and meet their own sustainability targets. Flowserve's focus on developing high-efficiency pumps, valves, and systems helps its clients lower energy consumption and carbon footprints, making its offerings more attractive in a market driven by environmental consciousness.

For instance, Flowserve's FCD3100™ centrifugal pump, launched in 2023, boasts up to 15% higher efficiency compared to previous models, directly addressing this demand. This focus on efficiency aligns with global trends; the International Energy Agency reported in 2024 that energy efficiency improvements could deliver over 40% of the emissions reductions needed to reach net-zero by 2050.

Flowserve's commitment to energy efficiency is further demonstrated by its investment in R&D for advanced sealing technologies and optimized fluid dynamics, aiming to minimize energy loss in industrial processes.

- Customer Demand: Growing pressure on industries to reduce operational expenses and achieve sustainability goals drives demand for energy-saving equipment.

- Flowserve's Response: Development of high-efficiency pumps and valves, like the FCD3100™, directly addresses this market need.

- Market Impact: Enhanced efficiency translates to lower energy consumption and reduced carbon footprints for Flowserve's clients, increasing product appeal.

- Global Context: Energy efficiency is a critical component in achieving global climate targets, as highlighted by organizations like the IEA.

Sustainability Reporting Requirements

The landscape of sustainability reporting is rapidly evolving, with increasing demands from regulators, investors, and customers for transparent disclosure of environmental, social, and governance (ESG) performance. Flowserve, like many global companies, must navigate these evolving requirements to maintain its reputation and attract investment. Its commitment to this is highlighted in its 2024 ESG Report, which details its environmental footprint and initiatives.

Adherence to these reporting standards is not merely a compliance exercise; it's a strategic imperative. By providing clear and comprehensive data on its environmental performance, Flowserve can bolster investor confidence and effectively demonstrate its commitment to corporate responsibility. This transparency is becoming a key differentiator in the market.

Key aspects of Flowserve's sustainability reporting in 2024 likely include:

- Greenhouse Gas Emissions: Detailed reporting on Scope 1, 2, and potentially Scope 3 emissions, with targets for reduction.

- Water Management: Disclosure of water usage, wastewater discharge, and water conservation efforts across its operations.

- Waste Reduction and Circularity: Information on waste generation, recycling rates, and initiatives to promote a circular economy.

- Supply Chain Sustainability: Efforts to ensure environmental responsibility extends to its suppliers and partners.

The increasing global focus on environmental sustainability directly impacts Flowserve's operations and market opportunities. Stricter regulations and customer demand for greener solutions are driving innovation in areas like decarbonization and water management.

Flowserve's strategic alignment with these environmental trends, including investments in technologies for carbon capture and efficient water handling, positions it to capitalize on the growing demand for sustainable industrial solutions. The company's proactive approach to environmental reporting and efficiency improvements underscores its commitment to addressing these critical global challenges.

| Environmental Factor | Impact on Flowserve | Supporting Data/Trend (2024/2025) |

| Climate Change & Decarbonization | Drives demand for emission-reducing technologies and energy-efficient solutions. | EU carbon prices averaged ~€80/tonne in early 2024. Inflation Reduction Act incentivizes green tech in the US. |

| Water Scarcity & Management | Increases demand for advanced water and wastewater treatment solutions. | By 2025, two-thirds of the world's population may face water shortages. |

| Circular Economy & Waste Reduction | Creates opportunities for solutions that promote material reuse and reduce waste. | EU Circular Economy Action Plan aims to boost recycling and minimize landfill waste. |

| Energy Efficiency | Enhances the appeal of Flowserve's high-efficiency products. | Flowserve's FCD3100™ pump offers up to 15% higher efficiency. IEA: Energy efficiency could provide over 40% of emissions reductions needed for net-zero by 2050. |

| Sustainability Reporting (ESG) | Requires transparent disclosure of environmental performance, influencing investor confidence. | Flowserve's 2024 ESG Report details environmental footprint and initiatives. |

PESTLE Analysis Data Sources

Our Flowserve PESTLE Analysis is grounded in data from reputable financial institutions, international organizations, and leading industry publications. We meticulously gather information on political stability, economic forecasts, technological advancements, environmental regulations, and social trends to provide a comprehensive view.